Retail store credit lawsuit defense in Texas means responding fast when a store card or retail account lawsuit is filed, forcing the creditor or lender to prove the debt, and using Texas consumer protection laws and strategic debt relief options to avoid default judgment. A Texas debt defense attorney at Warren & Migliaccio defends your income, bank accounts, and credit.

Why You Need a Texas Debt Defense Lawyer Right Now

Quick Answer

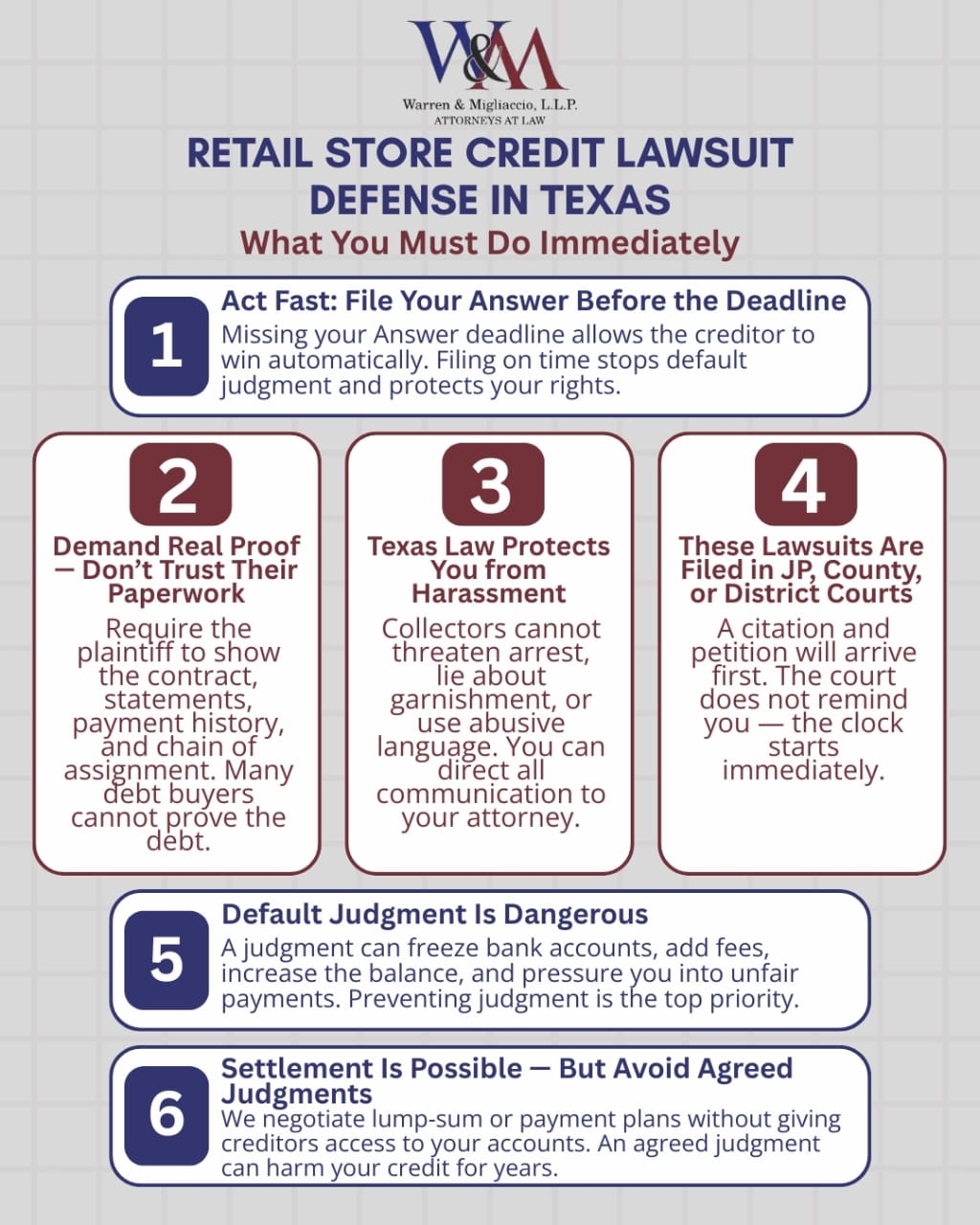

If you are sued on a Texas retail store card, act quickly: file an Answer, demand proof, and use a debt defense lawyer to protect accounts and credit.

- File a formal Answer by the deadline so the creditor cannot get default judgment.

- Demand documents proving the debt, balance, and chain of assignment from any debt buyer.

- Contact a Texas debt defense attorney to stop harassment, track deadlines, and protect bank accounts.

Getting sued on a retail store credit card or other retail account is frightening. Many Texas consumers ignore the lawsuit because they feel overwhelmed or assume it is a mistake. Under Texas law, if you do not file a formal response (called an “Answer”) by the deadline, the court can enter a default judgment against you, which may lead to repossession of certain non‑exempt property.

A default judgment lets the creditor:

- Freeze or garnish your bank accounts through bank levies

- Record judgment liens against non‑exempt property

- Add court costs, attorney’s fees, and post‑judgment interest

- Pressure you into paying more than you actually owe

A default judgment gives creditors powerful collection tools, including the ability to freeze bank accounts and place liens on property.

These cases show up in:

- Justice of the Peace (“JP” or peace court) – Texas small claims courts

- County and district courts – for higher balance claims and more complex lawsuits

Once the petition is filed and you are sued, the clock is ticking. The court will not call to remind you. You must file an Answer on time, or the plaintiff gets a huge advantage. In Texas, you typically have 20 days to respond to a debt lawsuit to avoid a default judgment. Texas law requires proper notification of lawsuits, and defective service can invalidate default judgments.

At Warren & Migliaccio, our Texas debt defense attorneys regularly defend clients against retail store credit lawsuit defense in Texas and Texas credit card lawsuits across the state. We step in to:

- Stop direct contact from debt collectors using abusive language

- Track every deadline and handle the court process for you

- Push creditors and debt buyers to prove the underlying debt

- Protect your credit report and long‑term financial future

We are Lead Counsel Verified Texas debt defense attorneys with nearly 20 years defending Texas consumers in debt lawsuits, including clients in Houston. Call us at phone number (888) 584-9614 for a free consultation with a Texas debt defense attorney to review your lawsuit and legal options.

Core Content – What, Why, and How of Retail Store Credit Lawsuit Defense

What Is a Retail Store Credit or Retail Account Lawsuit in Texas?

How Retail Store Credit Accounts Work

Retail store credit, sometimes called “store cards,” “private‑label cards,” or “retail accounts,” are credit lines tied to a specific retailer. You might have a card for a clothing store, electronics store, or big‑box retailer.

These accounts work like other credit card debt or personal loans, with interest, late fees, and penalties that can increase the balance:

- You make purchases on credit

- Interest, late fees, and penalties can grow the balance

- “Special financing” or promotional offers can create confusion about what you truly owe

Retail store credit is different from:

- General‑purpose credit cards (like Visa or Mastercard issued by a bank)

- Installment loans, which have fixed payments over a set time

When payments stop, the account may be “charged off,” then sold to a debt buyer or placed with a collection agency. That is often when debt collection lawsuits begin.

Who Can Sue You: Original Creditor, Debt Buyer, or Collection Agency

In Texas courts, the plaintiff can be:

- The original creditor (the bank or retailer that first issued the card)

- A debt buyer, such as Portfolio Recovery, that purchased a bundle of old accounts for pennies on the dollar can file a lawsuit.

- A collection law firm or credit card companies filing on behalf of a creditor or debt buyer

To win, the plaintiff must:

- Show you are the right defendant

- Show there is a valid contract or agreement

- Prove the balance with account statements and payment history

- Prove any assignment or sale of the account if a debt buyer is suing

You have the right to demand proof and proper validation of the debt, not just take their word for it.

Where Texas Credit Card Lawsuits Are Filed

Retail store credit and credit card lawsuits in Texas are civil cases. They may be filed in:

- Justice of the Peace (JP) / small claims courts – usually for lower balances

- County courts – mid‑range balances and appeals

- District courts – larger money damages claims

You will receive a citation and petition. The petition lists the plaintiff’s claims and the amount they say you owe. You must file an Answer—a formal response—by the deadline in that court, or risk default judgment. These cases are part of civil litigation, which means evidence, hearings, and sometimes a trial.

Why Retail Store Credit Lawsuits Threaten Your Financial Future

Credit Report, Credit Score, and Negative Reporting

Late repayments, charge‑offs, and collections can damage your credit report even before a lawsuit. If a judgment is entered, it may show up as negative reporting and harm your credit score for years. You have the right to dispute inaccuracies on your credit report, and creditors must conduct a reasonable investigation if you do so.

This can affect:

- Mortgage and car loan approvals

- Apartment or rental applications

- Insurance rates and sometimes employment screening

You have rights under federal and Texas law to dispute errors. After a dismissal or fair settlement, we can often help you challenge incorrect negative reporting so your credit can begin to heal.

Creditor Harassment and Protection

Before and during a lawsuit, debt collectors may call, text, email, or send letters. Some cross the line into creditor harassment with:

- Abusive language

- False threats about arrest or criminal charges

- Misleading statements about their right to garnish wages

Texas law and federal law limit these tactics. You can:

- Tell collectors to stop calling you at work

- Demand that communication go through your attorney

- Keep records of all calls and letters for your case

When we step in, we deal with the collector or collection agency so you do not have to. Responding to a debt lawsuit allows you to negotiate settlements that fit your budget.

How to Defend a Retail Store Credit or Credit Card Lawsuit in Texas

Step One – Do Not Ignore the Lawsuit (File an Answer on Time)

The single biggest mistake in collection lawsuits is doing nothing. In Texas:

- JP courts, county courts, and district courts all have strict Answer deadlines

- Missing the deadline can lead to immediate default judgment

Your Answer is a formal response that denies or responds to the claims and may raise defenses. Generic forms from the internet may not fit Texas law or your specific court. Our firm prepares tailored Answers that protect your rights and preserve possible defenses.

Forcing the Creditor to Prove the Underlying Debt

We use a “demand proof” strategy to force the plaintiff to:

- Produce required documentation, such as:

- Application or cardmember agreement

- Monthly statements and payment history

- Documents showing the sale or assignment of the account

- Show a clear chain of title if a debt buyer is suing

- Explain how they calculated the balance, interest, and fees

If they cannot prove the underlying debt with real documents, we may seek dismissal or a better settlement. Debt collectors often lack the necessary documentation to prove their case, which can lead to favorable outcomes for defendants.

Key Affirmative Defenses in Texas Credit Card and Retail Lawsuits

In many cases we raise one or more affirmative defenses, including:

- Statute of limitations – Texas generally has a four‑year limitations period for suits on most credit card and retail accounts; old claims may be barred

- Identity theft or mistaken identity – the account is not yours

- Wrong amount – fees or interest added in violation of contract or Texas law

- Prior settlement or payment plan not properly credited

In Texas, most debt lawsuits must be filed within four years from the date of default.

- Statute of limitations – Texas generally has a four‑year limitations period for suits on most credit card and retail accounts; old claims may be barred

- Identity theft or mistaken identity – the account is not yours

- Wrong amount – fees or interest added in violation of contract or Texas law

- Prior settlement or payment plan not properly credited

- Lack of standing, mistaken identity, or a bankruptcy discharge are also common defenses to Texas retail credit lawsuits.

Affirmative defenses must usually be raised in the Answer. If they are not raised, they may be lost.

Using Debt Collection Laws to Stop Creditor Harassment

Texas and federal law give you tools to stop abusive language and threats:

- Texas Debt Collection Act – limits unfair or deceptive collection practices

- Federal Fair Debt Collection Practices Act (FDCPA) – sets national rules for debt collectors

We help you:

- Document harassment

- Send cease‑and‑desist letters where appropriate

- Use violations as leverage in negotiations when the law allows

Settlement Options, Payment Plans, and When to Avoid an Agreed Judgment

Not every case goes to trial. In many cases we resolve Texas credit card lawsuits with:

- Lump‑sum settlement for less than the claimed amount

- Structured payment plans that fit your budget

However, signing an agreed judgment without advice can be dangerous. An agreed judgment:

- Creates a public judgment record

- Can allow bank levies and liens if you later miss payments

- May hurt your credit long after the case

It is important to get any settlement agreement in writing to avoid future disputes.

- Creates a public judgment record

- Can allow bank levies and liens if you later miss payments

- May hurt your credit long after the case

We negotiate for solutions that protect bank accounts and assets and aim for the best possible outcome in your situation.

When Bankruptcy or Other Debt Solutions May Be Better

Sometimes a single lawsuit is only one piece of a bigger picture of credit card debt, medical bills, and other debt lawsuits. If you face multiple suits or cannot realistically pay even a reduced amount, it may be time to talk with our bankruptcy attorney team about a fresh financial start.

We can review whether Chapter 7 or Chapter 13 is a better path and how that interacts with your pending lawsuits.

Case Study: Defending an $8,000 Texas Retail Store Credit Lawsuit in JP Court

Problem: A North Texas consumer was sued in a Justice of the Peace court by a national debt buyer on a charged-off retail store account for nearly $8,000 plus court costs and fees. She was worried about a default judgment, frozen bank accounts, and long-term damage to her credit, and she had no idea whether the balance the plaintiff claimed was even accurate.

Legal Action: We filed a timely Answer in the JP court to stop default judgment and raised key defenses under Texas law. Then we used discovery to demand proof of the underlying debt, including the card agreement, monthly statements, payment history, and a clear chain of assignment from the original retailer to the debt buyer. As we prepared for trial, we pressed every gap and inconsistency in the plaintiff’s documents.

Result: Before trial, the debt buyer agreed to dismiss the lawsuit. No judgment was entered, her bank accounts were protected from levy, and her risk of additional negative credit reporting dropped sharply.

Takeaway: In Texas retail store credit and credit card lawsuits, responding on time and demanding proof can change everything. When a Texas debt defense attorney who understands JP court rules and documentation requirements gets involved early, debt buyers often cannot meet their burden—and that leverage can help you protect your income, assets, and financial future.

Strategic Process – How Our Texas Debt Defense Attorneys Handle a Retail Store Credit Lawsuit

| Step | Phase | What We Do |

|---|---|---|

| 1 | Free Consultation & Lawsuit Triage | Review the petition, court, deadlines, and any prior debt collection history so you understand where the case stands. |

| 2 | Collect Documents & Credit Report | Gather statements, letters, texts, and emails, and review your credit report for negative reporting tied to the account. |

| 3 | File a Timely Answer | Prepare and file your Answer in the correct Texas court (JP, county, or district) to avoid default judgment and preserve defenses. |

| 4 | Analyze Defenses & Limitations | Identify affirmative defense issues such as statute of limitations, identity theft, payment history problems, or prior settlements. |

| 5 | Demand Proof of the Debt | Use discovery and motions to make the creditor or debt buyer produce required documentation and prove their claims. |

| 6 | Negotiate Settlement or Payment Plan | Evaluate lump-sum settlements and structured payment plans with an eye on tax impact, credit impact, and your overall financial future. |

| 7 | Prepare for Trial | When necessary, prepare witnesses and exhibits and build a trial strategy that highlights weaknesses in the plaintiff’s case. |

| 8 | Post-Result Support | After dismissal or resolution, help with credit reporting issues, other collection lawsuits, and long-term planning, including coordination with other practice areas when needed. |

For a comprehensive step-by-step guide on how to handle a debt collection lawsuit in Texas, click here.

Texas Statutes & Case Law That Shape Retail Store Credit Lawsuit Defense

Texas debt defense is not just about common sense; it is about knowing the statutes and rules that Texas courts apply. Key authorities include:

- Tex. Civ. Prac. & Rem. Code § 16.004 – sets a four‑year statute of limitations for most suits on written and open accounts, including many retail and credit card debts.

- Tex. Fin. Code ch. 392 (Texas Debt Collection Act) – limits threats, misrepresentations, and other unfair debt collection practices.

- Texas Rules of Civil Procedure 500–510 – govern practice in Justice of the Peace courts, including Answer deadlines and small claims procedures.

- Federal FDCPA – regulates third‑party debt collectors nationwide.

- Federal FCRA – governs accuracy and correction of credit report information, including after a case is resolved.

Texas appellate courts have also made clear that debt buyers must show a clear chain of assignment and reliable account records before they can win a judgment. We track these decisions and use them to strengthen your debt defense strategy.

The Insider Advantage – What General Blogs Miss About Retail Store Credit Lawsuits in Texas

Here is what most generic articles never explain:

- Retail accounts are messy. Store‑specific promotions, returns, and reward credits often create gaps in the records. Those gaps can be powerful legal defenses.

- Mass‑filed lawsuits rely on thin proof. Big debt buyers file thousands of cases at once, often with automated affidavits and limited backup. We know how to attack that.

- Local court practices matter. Different JP, county, and district courts—and even different judges—handle collection lawsuits differently. Knowing the local rules and habits helps us plan the right approach.

- Numbers tell a story. Our managing partner’s accountancy background helps us read interest, fees, and payments line by line and spot errors that others miss.

This practitioner‑level insight is what lets Warren & Migliaccio see defenses that general online advice will never catch.

Common Mistakes Texas Consumers Make in Retail Store Credit and Credit Card Lawsuits

Avoid these common traps:

- Ignoring the lawsuit and letting a default judgment happen. Our team can file an Answer on your behalf to prevent this.

- Calling the debt collector to “work it out,” but never filing anything in court.

- Admitting you “owe the debt” on a recorded call before you see any proof.

- Signing an agreed judgment or one‑sided payment plan without understanding bank levy and credit consequences.

- Making small “good faith” payments that restart the limitations period without legal advice.

- Thinking wages are safe, so a judgment “can’t hurt,” and forgetting about bank accounts and liens.

- Using do‑it‑yourself forms that do not match Texas procedures or the specific court (JP vs. county vs. district court).

- Waiting too long to contact a Texas attorney who focuses on debt defense.

Frequently Asked Questions

Judgment & Account Issues

Can a Texas retail store credit judgment let a creditor take money from my bank accounts?

Yes. While Texas generally protects wages from garnishment for most private credit card and retail debts, a judgment creditor can seek a writ to freeze and garnish bank accounts and may place liens on certain non-exempt property. That is why avoiding judgment is so important. Texas law prohibits wage garnishment for most consumer debts, allowing it only for child support, student loans, taxes, and court-ordered restitution.

Defense & Identity Theft

What should I do if a retail credit lawsuit is based on identity theft or an account that isn’t mine?

Raise this early. We can help you dispute the debt, raise identity theft as a defense, demand proof, and guide you through filing police reports and credit bureau disputes. Do not ignore a lawsuit, even if you believe it is clearly not your account.

Costs & Timeline

How much does it cost to hire Warren & Migliaccio to defend a retail store credit or credit card lawsuit in Texas?

We offer a free consultation to review your case and explain fees. In many matters, we use flat fee structures for debt defense, so you know the cost up front and can weigh that against the risk of a judgment and long-term financial damage.

How long do Texas retail store credit and credit card lawsuits usually take?

Timing depends on the court and the parties. Some JP cases resolve in a few months; county and district court cases can take longer, especially if there is discovery and a trial setting. Along the way, we look for early opportunities for dismissal or fair settlement.

Representation Scope

Do you defend retail store credit and credit card lawsuits in Justice of the Peace, county, and district courts throughout Texas and surrounding counties?

Yes. We defend Texas consumers statewide in JP, county, and district courts, including Dallas, Collin, Denton, Tarrant, Austin, and surrounding counties. Most work can be handled remotely, and we appear in person when required.

Credit Impact & Alternatives

Can resolving a retail store credit lawsuit help improve my credit report or credit score over time?

A good outcome—such as a dismissal or fair settlement—can reduce or remove some negative reporting. After the case ends, we can help you understand how to dispute incorrect entries and start rebuilding your credit score.

When does it make sense to consider bankruptcy instead of fighting multiple Texas debt lawsuits one by one?

If you are facing several debt lawsuits, large balances, or serious risk to your home or other assets, it may be time to review broader options with our bankruptcy attorney team. Sometimes a single bankruptcy filing provides a cleaner, more affordable path forward than fighting each case alone.

Conclusion About Retail Store Credit Lawsuit Defense in Texas

Facing a retail store credit or credit card lawsuit in Texas can be stressful, but timely action makes all the difference. Filing a formal Answer, demanding proof of the debt, and working with an experienced Texas debt defense attorney can stop default judgments, protect your bank accounts, and preserve your credit. With the right legal strategy, you can challenge inaccurate claims, negotiate fair settlements, and safeguard your financial future.

For answers about your specific lawsuit and legal options, schedule a free consultation with Warren & Migliaccio at (888) 584-9614 or contact us online. Our team of lawsuit defense attorneys defend Texas consumers in retail store credit and credit card debt cases across the state.

Legal Authorities (Endnotes)

- Tex. Civ. Prac. & Rem. Code § 16.004 (four‑year limitations period on certain debts), available at https://statutes.capitol.texas.gov

- Tex. Fin. Code ch. 392 (Texas Debt Collection Act) and 15 U.S.C. § 1692 et seq. (FDCPA)

- Tex. R. Civ. P. 500–510 (Justice Court Rules)

- 15 U.S.C. § 1681 et seq. (Fair Credit Reporting Act)

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Reading it does not create an attorney‑client relationship. Legal outcomes depend on the facts of each case and the law at the time. This is attorney advertising.