Creating a will lets you decide how your estate will be handled when you pass away. A will is an important part of end-of-life planning. But many Americans die without a will. In fact, about 60% of people in the U.S. do not have a valid will.

A valid will is a legal document. It stays effective even after you have passed away. It explains how you want your assets to be distributed. This is a big deal because dying without a will can cause problems.

Our law firm’s Texas estate planning lawyers explain what happens if you die without a will in Texas.

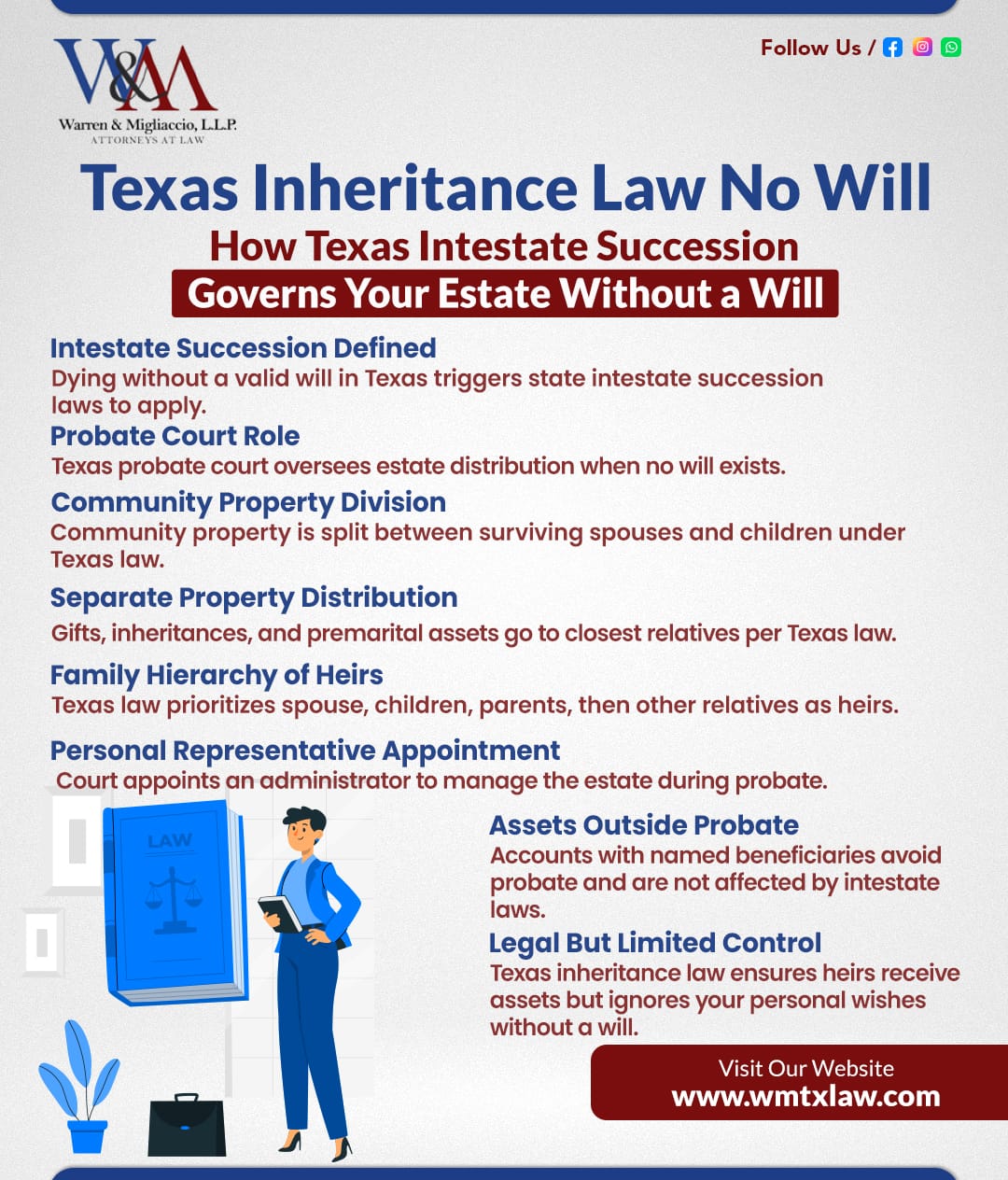

Dying without a will in Texas is known as dying intestate. If you died intestate, you do not have control over what happens to your entire estate after your death. Your specific wishes for your estate will not be considered.

When a person dies without a will, their estate will likely go through the probate process. Only assets that are subject to probate, such as those solely owned by the deceased, are affected by intestate succession laws. The court will oversee the distribution of the decedent’s estate, and a judge will apply Texas intestate succession laws to determine how to distribute your assets and who will act as your estate’s executor. The estate passes to your legal heirs, and the court determines who inherits property based on Texas laws.

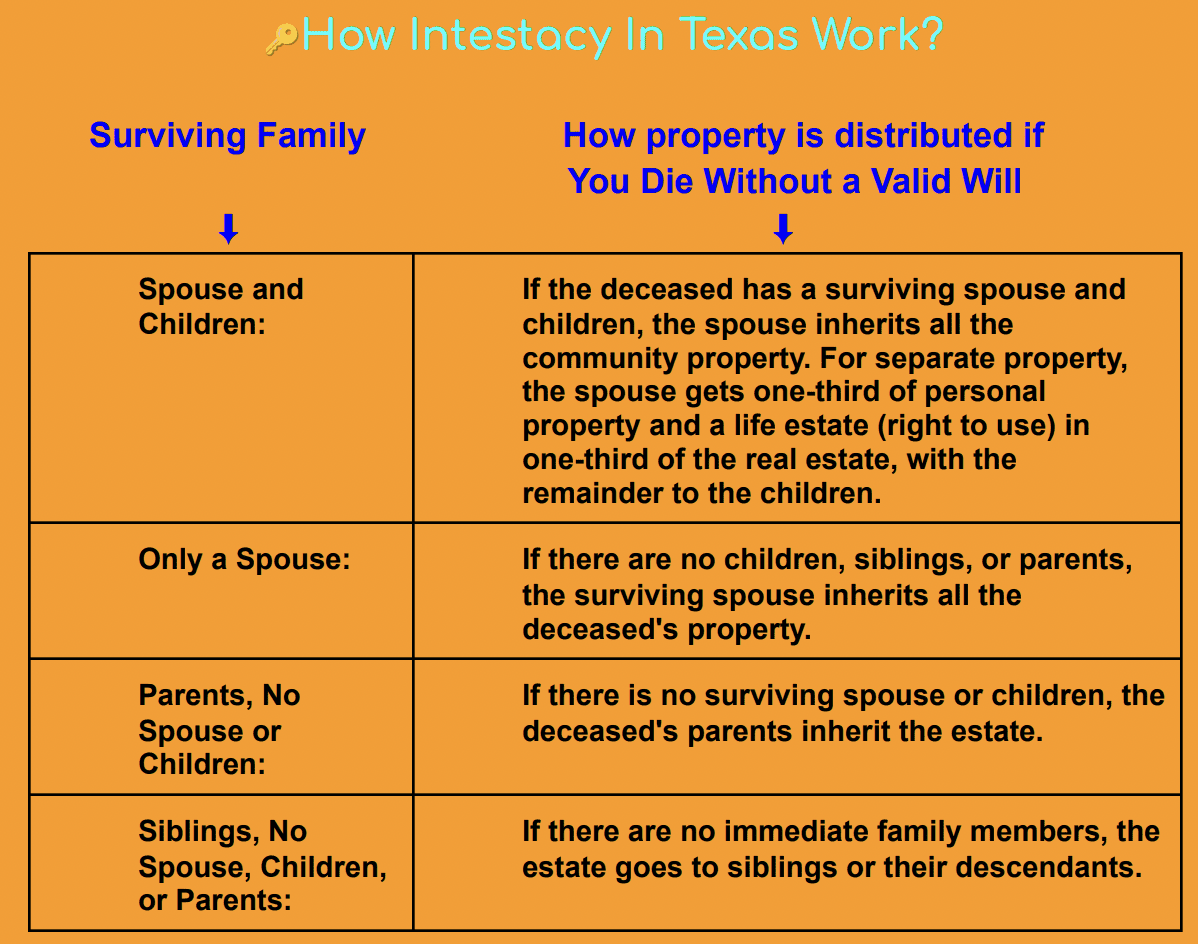

How Intestacy Laws in Texas Work

Intestacy laws in Texas focus on immediate family members when dividing the deceased person’s estate and assets. Close friends or distant relatives usually do not receive anything under these laws. Since state intestacy laws can differ, it is important to know the specific rules in Texas to avoid unwanted distribution of assets. Blended families often face unique challenges when it comes to dividing a deceased person’s estate under Texas laws.

If you die without a will, Texas probate courts use a family hierarchy to decide who inherits your property. This hierarchy usually starts with the surviving spouse, followed by children, parents, and other descendants. Biological children have strong inheritance rights under Texas law. Property is shared among all children, including those from previous relationships or blended families.

The court also ensures all legal requirements are met during probate and intestate succession. The graphic below shows who may inherit your property if you do not have a will in Texas:

Understanding Texas Intestate Succession Laws and Why Estate Planning Matters

In Texas, community property is usually divided so that your surviving spouse gets half, and the other half goes to your descendants. Community property generally includes anything acquired during your marriage and paid for with marital earnings or income.

Separate property, which is property acquired before marriage or by gift or inheritance, is usually distributed to your closest relatives after your death.

Under Texas law:

- If there are surviving children, the surviving spouse may receive one third of certain personal property.

- The remaining property is divided among the children.

Property passes to heirs according to Texas intestate succession laws. The court makes sure the distribution follows the legal rules.

It’s important to know that financial accounts, life insurance policies with named beneficiaries, and tools like transfer on death deeds are not subject to probate. These assets pass directly to the named beneficiary.

Not all of the deceased person’s assets go through probate. Only assets without a named beneficiary or that are not jointly owned are included in the probate estate.

Proper estate planning helps ensure that the decedent’s assets are managed and distributed according to your wishes.

Introduction to Estate Planning in Texas

Estate planning involves more than just writing a will. It ensures you carry out your wishes and protect your loved ones after your death.

In Texas, estate planning requires you to understand state laws, including the Texas Estates Code. These laws determine how others distribute your assets if you die without a valid will.

You must follow specific formalities and requirements to create valid and enforceable estate planning documents. Without a clear estate plan, the law may distribute your property through intestacy rules—which might not reflect your intentions.

When you work with an experienced estate planning attorney, you gain guidance and legal protection. Establishing an attorney-client relationship keeps your communications confidential and safeguards your interests throughout the estate planning process.

An attorney can create a comprehensive plan that covers:

- Your will

- Powers of attorney

- Healthcare directives

- Other important documents

An attorney will assess your estate planning needs. This ensures all parts of your unique situation are covered.

By planning ahead, you can make sure your estate is handled smoothly. Your family will avoid unnecessary stress and confusion.

Understanding Probate and Intestate Succession in Texas Without a Will

If you die without a will in Texas, your estate may need to go through probate. Probate is a court-supervised process that settles a deceased person’s estate and distributes their assets according to Texas law.

During probate, the court will:

- Locate and value all of the decedent’s assets

- Pay any outstanding debts, estate tax, or other taxes

The probate process can take a long time and be complex, which is why many families choose to work with a probate attorney to navigate the legal steps involved. It may also be more complicated if the decedent had adopted children or foster children. This is because the distribution of assets can change based on family dynamics and state-specific rules.

One of the first steps a probate court will take is to appoint an administrator or executor for your estate. In Texas probate proceedings, this person is also known as the personal representative. A judge will appoint someone to fill this role if you die without a will. The probate court is responsible for managing the distribution of a decedent’s assets to heirs and creditors. This person will have a tremendous amount of responsibility, including:

- Identifying and collecting your assets

- Settling any debts or claims against your estate

- Paying taxes and fees

- Petitioning the court to determine heirs according to state law

- Distributing assets to heirs

- Managing the decedent’s assets and ensuring proper distribution

For smaller estates, heirs may be able to use a small estate affidavit to transfer property without going through the full probate process.

Community Property and Inheritance in Texas

Texas is a community property state. This means most property gained during a marriage belongs to both spouses equally.

When one spouse dies, the way property is passed on depends on the family’s situation. Usually, the surviving spouse gets the deceased spouse’s share of the community property. But if there are minor children from another relationship, the rules may be different.

In many cases, the surviving spouse can still use or control some property. This often includes separate property, depending on inheritance laws in Texas. However, not all assets are treated the same. What happens to them depends on the type of property and how it was owned.

Separate property is different. It includes things a spouse owned before marriage. It also includes gifts or inheritances received during the marriage. These stay the personal property of the person who received them.

If there is no will, separate personal property—like cash, cars, or investments—is divided under Texas inheritance laws.

Knowing the difference between community and separate property is important. It helps families understand how assets will be divided after a death. It also shows who may inherit what under Texas law.

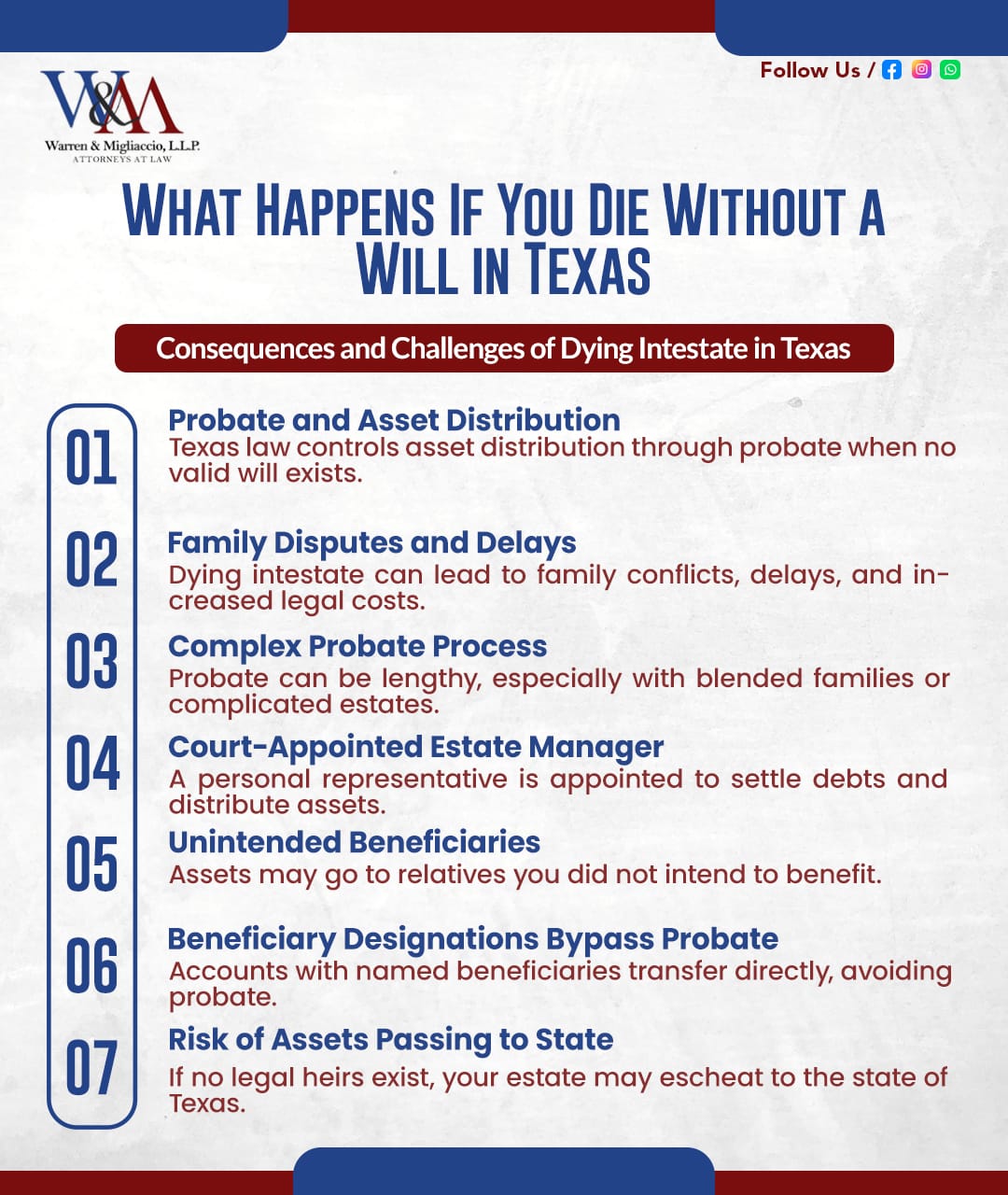

Consequences of Dying Without a Will in Texas

Dying without a will in Texas can create major problems for your family. If you pass away without a valid will, your estate must follow Texas intestacy laws. These laws decide who gets your property, even if it’s not who you would have chosen.

Your assets might go to relatives you never planned to benefit. If no legal heirs are found, your property could even go to the state.

The probate process without a will can be long and expensive. It may involve court hearings, legal fees, and emotional stress. These issues are often avoidable with proper estate planning.

Without a will, your loved ones may have to wait to access money. They might argue over who gets what. And no one will be sure of your final wishes.

Things can get even harder when a single person dies without a will. If there are no children or close relatives, it becomes tricky to find the right heirs.

Creating a will helps prevent these problems. Working with an estate planning attorney lets you decide how your assets will be shared. It also gives your family peace of mind and clear guidance during a difficult time.

What Happens if I Die With a Valid Will in Texas?

Many people think that settling debts and dividing assets will be easy for their loved ones. But this is not always true. When a person dies without a valid will, called dying intestate, state laws decide how their assets are handled. This can make the process more complicated.

Grief makes it hard to make clear decisions or deal with tough situations. Sadly, disputes often happen during probate, even in close families.

The best way to avoid these problems is to create a last will and testament. Sometimes, a revocable living trust can also help, depending on your situation. While most estates still go through probate, having a will or estate plan makes things easier for your family after you pass.

When you have a valid will, you decide how to share your property. Without one, Texas law divides your assets equally among heirs.

A will lets you choose your estate executor. The court will not pick someone for you. Probate and succession laws cannot consider your family’s unique dynamics.

More importantly, a will lets you control your legacy. You decide who gets what — including your personal belongings.

Case Study: When Intestate Succession Would Have Been More Generous

In the case of In re Estate of McDaniel, 935 S.W.2d 827 (Tex. App.—Texarkana 1996), a father left a $4.5 million estate. The will, signed just five days before the father died, granted his son only a $158,000 life estate.

If the father had died without a will, Texas law would have divided the estate equally between his two children. This means the son would have received about $2.25 million.

The court ruled that the son could not challenge the will after accepting the benefits it provided. This case shows that Texas intestacy laws can sometimes give more generous shares than a hastily made will.

It highlights why proper estate planning is important. Having a well-planned will can prevent family disputes and make sure your true wishes are followed.

FAQs on What Happens When You Die Without A Will In Texas

Who inherits in Texas if no will?

Texas intestate succession laws prioritize spouse and children first, followed by parents, siblings, and other relatives in a specific order.

In Texas, if someone dies without a will, their estate is distributed according to intestate succession laws. These laws prioritize the deceased’s closest relatives, starting with the spouse and children.

The inheritance hierarchy follows this order:

Married with children: If you have separate property (many spouses mix everything together and don’t have any separate property), your spouse will inherit all or part of it. Community property usually goes to the surviving spouse if all children are from both spouses. If there are children from previous relationships, the spouse keeps their half of the community property. The deceased’s half goes to their children.

Married without children: The surviving spouse inherits all community property and all separate personal property. Separate real property is divided equally between the surviving spouse and the deceased’s parents, siblings, or siblings’ descendants, in that order.

Single with children: Children inherit everything equally. This includes biological and legally adopted children. If a child died before the parent, that child’s share goes to their children (the grandchildren).

Single without children: If your parents are alive, they each get half of your property. If only one parent is alive and you have no siblings, that parent inherits the whole estate. If you have siblings, they share the estate with the surviving parent.

What happens to bank account when someone dies without a will in Texas?

Bank accounts with beneficiaries transfer directly to the named person. Without beneficiaries, accounts go through probate and are distributed according to intestate succession laws.

When someone dies without a will in Texas, what happens to their bank account depends on how the account is titled. If the account is jointly owned or has a designated beneficiary (such as a payable-on-death designation), it bypasses probate and transfers directly to the co-owner or beneficiary.

Financial accounts with a named beneficiary are not subject to probate and automatically pass to the designated individual, regardless of the existence of a will.

If there is no such designation, the account will become part of the deceased’s estate and be subject to probate. Funds distribution will be the court’s call, governed by the law of intestate succession.

Delaying access to funds can spell trouble for families in need of financial support. Imagine having to miss a payment or going without necessities while waiting for the money to come through.

How do I avoid probate without a will in Texas?

You can avoid probate in Texas by planning ahead. Use beneficiary designations on accounts. Create payable-on-death (POD) accounts. Establish joint ownership. Or use a small estate affidavit for estates under $75,000.

Naming trusted people to inherit your bank accounts, retirement funds, and life insurance is a smart move. For example, life insurance policies with named beneficiaries pass directly to those people without probate.

POD and transfer-on-death (TOD) accounts also let assets pass straight to beneficiaries. This avoids the probate process.

For smaller estates, Texas allows a small estate affidavit. This tool lets heirs transfer property without full probate, making things easier.

Joint tenancy is another option. When you share ownership, the property automatically goes to the surviving owner.

Probate court can be stressful. To avoid it, you can transfer assets to a trust. The trust then handles dividing and distributing your property according to its rules.

Each method has its own rules and risks. To avoid mistakes, talk to an attorney who knows Texas estate laws well.

How long does probate take in Texas without a will?

Probate without a will typically takes 6-15 months, longer than the 3-6 months with a will, due to the court’s need to determine heirs and oversee distribution.

Probate without a will often demands a more extended period due to increased court oversight. The process, termed “determination of heirship,” ranges from five weeks to potentially over 9 months.

The timeline varies based on several factors:

1. Simple estates: 6-9 months for straightforward cases

2. Complex estates: 9 and 15 months, or even longer if members of the family cannot agree or if the court requires a dependent administration

3. Heirship determination: Requires appointing an attorney to locate all family members, adding significant time

Key steps that extend the timeline:

1. 10-14 day waiting period for initial hearing

2. Court must determine and locate all legal heirs

3. Creditors have up to 6 months to file claims

This long process involves appointing an additional lawyer to locate all of the family members, proving their legal right to inherit, and attending multiple hearings.

For comparison, probate with a will typically takes 3-6 months, while muniment of title, which you may be eligible for if your loved one had a will and there are no unpaid creditor claims on the estate and no property held in other states.

Does the oldest child inherit everything?

No, Texas law divides estates equally among all children regardless of birth order when someone dies without a will.

Contrary to popular belief, the oldest child does not automatically inherit everything. In most states, inheritance laws treat all children equally and do not give preference to the oldest. If there is no will, intestate succession laws divide the estate equally among all the children. For example, if a decedent leaves behind two children, each child receives half of the estate. If the decedent has three children, each one gets a third. If one of the two children has died but left behind children (the decedent’s grandchildren), those grandchildren inherit their parent’s share. The same rule applies when one of three children has died—their descendants inherit that child’s portion.

Surprisingly, even the most straightforward situations can get bogged down by family power struggles and byzantine legal arrangements. For example, if a parent specifically names the oldest child as the primary beneficiary in their will, that child could inherit a larger portion of the estate. Without a will, the court will decide based on state laws, which often prioritize fairness among siblings.

Do I automatically inherit my parents’ house?

You don’t automatically inherit the house unless you’re the only heir. If others also have a right to inherit, Texas intestate succession laws divide the ownership among all eligible heirs.

Whether you inherit your parents’ house automatically depends on their estate plan and Texas law. If your parents created a will, their instructions in the will determine who receives the house. If they didn’t leave a will, intestate succession laws decide who inherits the property.

Under Texas law, real property includes land and anything attached to it, such as a house. A spouse owns separate real property if they acquired it before marriage or received it as a gift or inheritance. When a parent dies without a will, the law distributes the separate real property between the surviving spouse and the surviving children. If children survive the parent, they inherit a share of the separate real property. The surviving spouse receives a different portion, depending on the specific family situation.

Even as the legal heir, inherited assets can come with a web of issues, including unsettled debts, pending mortgages, and family feuds that demand attention. It is essential to check whether your parents had any liens or debts tied to the property, as these could complicate the inheritance process.

What is a small estate affidavit in Texas?

A small estate affidavit is a simplified legal process in Texas that allows heirs to claim assets from an estate valued at $75,000 or less without going through formal probate, but only when the person died without a will.

To qualify for a small estate affidavit:

The deceased must have died intestate (without a valid will)

The estate value cannot exceed $75,000 (excluding homestead and exempt property)

At least 30 days must pass after death before filing

All heirs must agree and sign the affidavit

The estate’s assets must exceed its debts

No petition for a personal representative can be pending

You start the process by filing the affidavit with the probate court in the county where the deceased lived, along with a certified death certificate and detailed lists of assets and debts. Once the judge approves the affidavit, you can use it to collect bank accounts, transfer property titles, and access other assets—without going through the time and expense of full probate proceedings.

Can stepchildren inherit in Texas without a will?

No, Texas intestate succession laws do not give stepchildren inheritance rights unless the deceased stepparent legally adopted them.

Texas law only recognizes biological and legally adopted children as heirs when someone dies without a will. This means:

Stepchildren have no inheritance rights unless formally adopted

Foster children who were never adopted cannot inherit

Only biological children and those adopted through legal proceedingsreceive an intestate share

However, stepchildren can inherit if:

The stepparent legally adopted them before death.

Likewise, the stepparent named them as beneficiaries on specific accounts, such as life insurance policies, retirement accounts, or payable-on-death (POD) bank accounts.

The stepparent created a valid will and included them as beneficiaries.

For blended families, this distinction makes estate planning crucial. Without a will, your stepchildren will receive nothing while your biological children inherit everything, regardless of your relationships or intentions.

Do bank accounts with beneficiaries have to go through probate in Texas?

No, bank accounts with designated beneficiaries bypass probate entirely and transfer directly to the named beneficiary upon death.

Bank accounts with properly designated beneficiaries bypass probate entirely in Texas and transfer directly to the named beneficiary upon the account owner’s death.

These probate-avoiding accounts include:

Payable-on-death (POD) accounts

Transfer-on-death (TOD) accounts

Joint accounts with right of survivorship

Retirement accounts (IRAs, 401(k)s) with named beneficiaries

Life insurance policies with designated beneficiaries

To claim these accounts, beneficiaries typically need only:

A certified copy of the death certificate

Valid identification

The bank’s beneficiary claim form

What happens if you die without a will and have no family in Texas?

Your property “escheats” to the State of Texas, but only after an exhaustive search finds no relatives, including distant cousins.

If you die without a will in Texas and have no surviving family members who can inherit under intestate succession laws, your property “escheats” to the State of Texas.

However, this rarely happens because Texas intestacy laws cast a wide net to find relatives:

First, the law looks for immediate family (spouse, children, parents, siblings)

Then extends to grandparents, aunts, uncles, and cousins

The search includes relatives on both maternal and paternal sides

Even distant cousins can inherit before the state

The state initiates the escheat process only when it cannot find any relatives, including:

No surviving spouse or descendants

Likewise, no parents, siblings, or their descendants

No grandparents or their descendants

And, no relatives on either side of the family tree

If your estate does escheat to Texas, the state becomes the owner of all your property, including real estate, bank accounts, and personal belongings. This underscores the importance of creating a will to ensure your assets go to chosen beneficiaries, friends, or charities rather than the state.

Importance of Understanding Intestacy Laws in Texas

If you want to protect your legacy and provide for your loved ones, you need to understand Texas intestacy laws. The Texas Estates Code outlines how to distribute property when someone dies without a will. It explains who inherits probate assets and how to divide shares among surviving spouses, children, parents, and other relatives.

Not all assets go through probate. For example, retirement accounts, life insurance policies, and other non-probate assets with named beneficiaries follow different rules. These assets pass outside the probate process and transfer directly to the named beneficiaries.

By understanding how intestacy laws and non-probate assets work together, you can create a better estate plan. This ensures you carry out your wishes and take care of your family.

Working with an estate planning attorney can guide you through these details. They can help you avoid problems if you die without a will.

Prepare Your Texas Will Online Using an Estate Planning Attorney and Estate Plan Express

At , we make creating a valid will convenient, cost-effective, and straightforward. Estate Plan Express is our online will service. Check it out to see what our Estate Plan Express can do.

From the comfort of your home, you can access our estate planning portal and fill out our guided estate planning questionnaire. Then, our experienced Texas estate planning lawyer will prepare and send you your will documents. All you have to do is get your will legally executed at your convenience.

We also offer six months of free revisions, excluding converting to a different plan, to ensure that your will continues to meet your needs. If you have any questions or need legal advice, do not hesitate to contact us online for a free consultation by calling us at 888-584-9614.