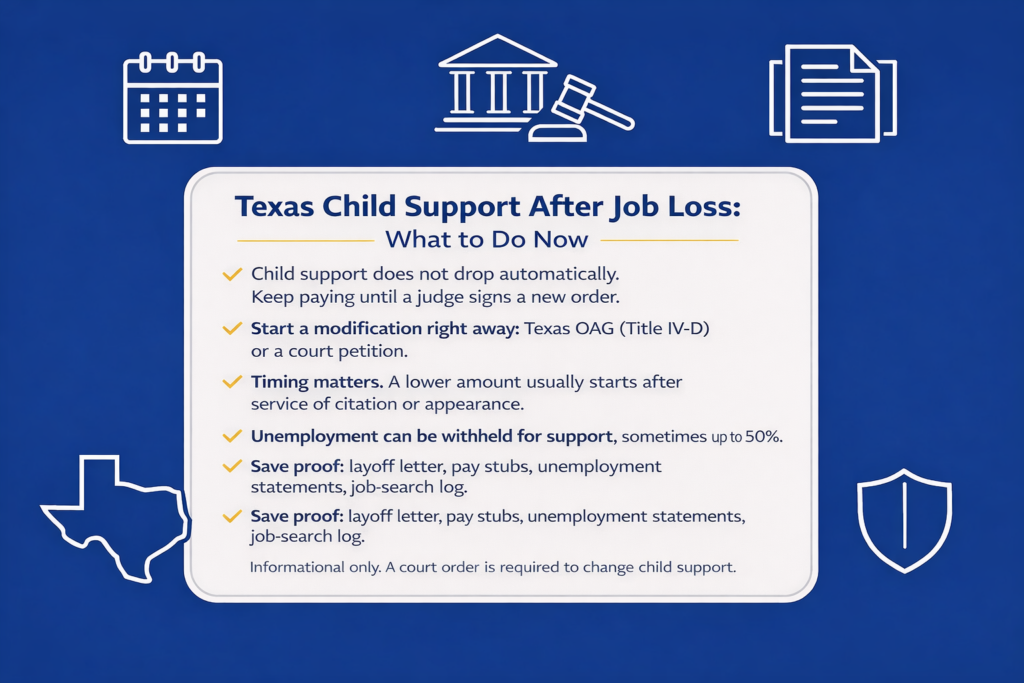

If you lose your job in Texas, your child support does not automatically change. You must keep paying under the current child support order until a judge signs a new one. Act quickly: request a review through the Texas Office of the Attorney General (OAG) or file a modification petition in court. Delays can create arrears and enforcement risk.

Key Takeaways

Losing a job doesn’t pause Texas child support—but quick action can reduce future payments once a new order is signed.

-

Support doesn’t drop automatically—you owe the ordered amount until a judge changes it.

-

You can seek changes through the OAG (Title IV-D) or a court modification case.

-

A new amount usually starts only after service of citation or appearance.

-

Unemployment benefits can be withheld for support—sometimes up to 50%.

-

OAG reviews often take 6+ months, so track payments and job-search proof.

Key Facts About Child Support and Job Loss in Texas

| Factor | Rule / Answer |

|---|---|

| Who this applies to | Paying parent (obligor) and receiving parent (obligee) when income changes |

| Does job loss automatically reduce support? | No—your child support obligation remains until a court changes it |

| Two ways to pursue a change | OAG review/modification process (Title IV-D cases) or court petition to modify |

| When can changes take effect? | Generally only for obligations after service of citation or appearance in the modification case |

| Can support come from unemployment? | Yes—child support can be withheld from unemployment benefits; up to 50% may be withheld for current monthly obligations |

| How long does OAG modification take regarding child support in Texas? | OAG notes many modifications can take at least 6 months |

Quick Definitions:

- Arrears: Unpaid child support debt that keeps growing if you underpay or miss payments.

- Material and substantial change: A significant life or income change that may justify modifying your child support amount.

- Imputed income: The court may calculate child support based on your earning ability—not just your current “$0 income.”

Can I Stop Paying Child Support If I Lose My Job in Texas?

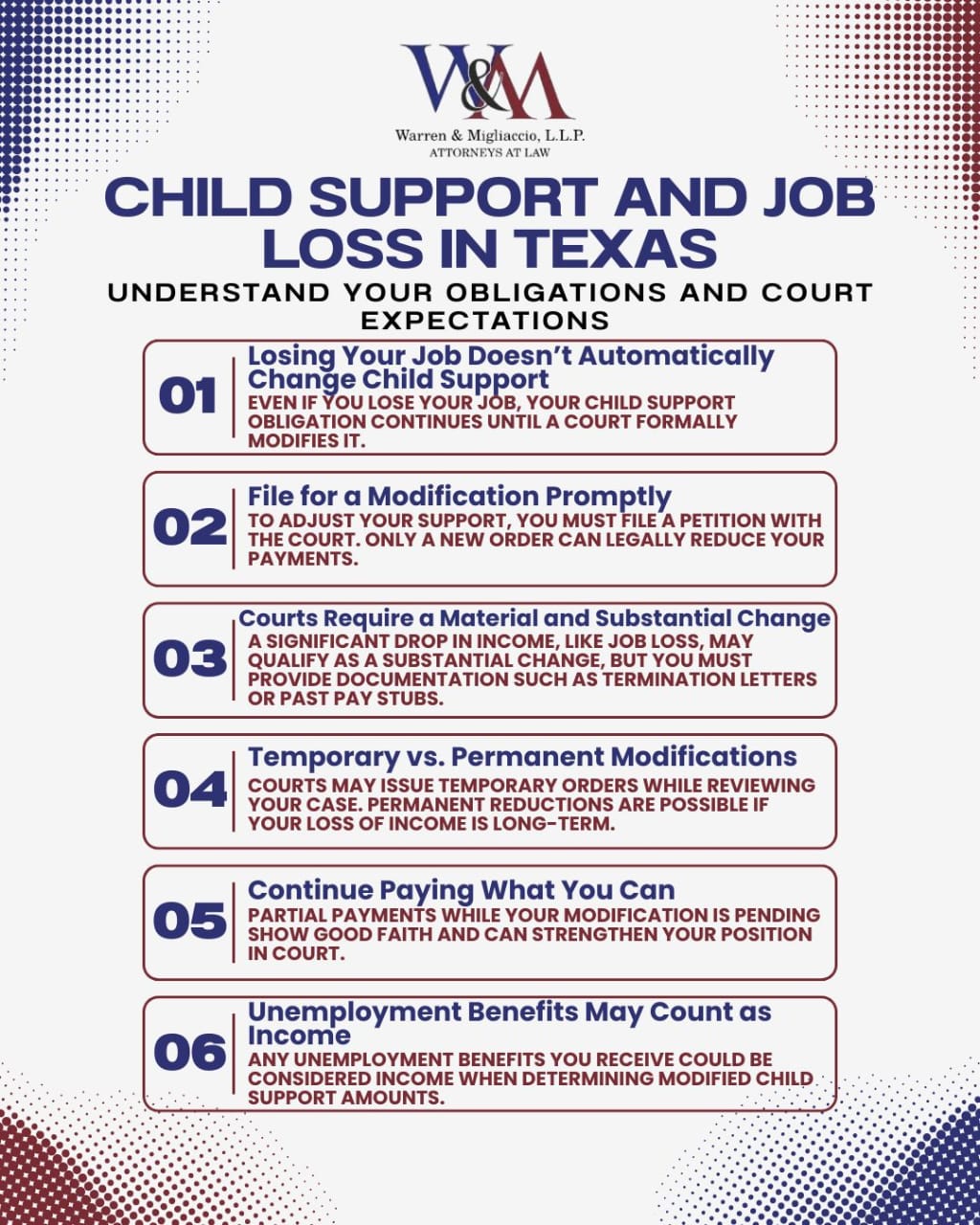

No—loss of income/job does not automatically change or cancel your child support obligation. Many parents worry about this exact question. The answer is clear under Texas law: only a court order changes your monthly child support payments.

Your existing child support order stays in effect until a judge signs a new one. This means you must keep paying—even if you’re struggling financially. We know that sounds harsh when you’ve just lost your job. But here’s why waiting hurts:

- Arrears grow fast. Every month you underpay, that unpaid child support becomes a debt you still owe.

- Enforcement actions can follow. The Texas Attorney General’s Office can take steps like wage garnishment, license suspension, or even jail time for non-payment.

- Your current income/financial circumstances don’t automatically matter. Courts look at what your order says, not what your bank account shows—until you get that order changed.

Bottom line: Pay as much as you can while pursuing a child support modification. Don’t just stop paying and hope things work out, because there are serious consequences to not paying.

If I’m Receiving Unemployment, How Does That Affect Child Support?

Child support can be withheld directly from your unemployment benefits. Texas law allows the OAG to collect support this way—and they do.

Here’s what you need to know:

- Up to 50% of your unemployment benefits may be withheld for current monthly child support obligations.

- Withholding may not cover your full support amount. If your unemployment check is smaller than your old paycheck, the withholding might not match your order.

- Arrears can still grow. Even with automatic withholding, you may fall short of your child support obligation each month.

This surprises many parents. They assume that if money is being taken from unemployment, they’re in the clear. That’s not always true. Track your payments carefully and check if you’re falling behind.

What Qualifies to Modify Child Support After Job Loss in Texas?

Texas Family Code §156.401 sets two paths to modify child support:

- Material and substantial change in circumstances — This includes involuntary job loss that causes a significant decrease in your income.

- Three-year rule — If it’s been at least 3 years since your last order and the guideline amount would differ by 20% or $100, you may qualify.

What courts look at when deciding your request of modification of child support:

- Was the job loss involuntary, or did you quit or get fired for cause?

- What’s your employment history and ability to work?

- Are you actively seeking new employment?

- Could you earn more than you’re claiming? (This is the imputed income risk.)

What Texas Courts Consider When You Have “No Income”

Courts may not accept “$0” as your long-term earning picture. If you report zero income, the court can set child support based on:

- Your past employment and earning history

- Your ability to work (education, skills, health)

- Federal minimum wage as a baseline

This matters because if you quit your job, aren’t job searching, or appear voluntarily underemployed, the court may impute income based on what you could earn—not what you’re actually making. Document your job search efforts carefully.

If you are self-employed, courts often look past what you “pay yourself.” They may review profit and loss statements, bank deposits, invoices, and tax returns to understand your real financial situation. Also, a new spouse’s income is usually not counted as your income for child support, but shared household expenses can still come up when a judge evaluates your financial statements.

How Do I Modify Child Support When My Income Changes? Two Lanes You Can Take

You have two main options to pursue a child support modification in Texas: the OAG review process or filing a court petition directly.

Comparison Table: OAG Review vs. Court Petition

| Factor | OAG Review | Court Petition |

|---|---|---|

| Best for | Title IV-D cases already in the OAG system | Cases needing faster action or more control |

| Who runs it | Texas Attorney General’s Office | You (with or without an attorney) |

| What you file | Modification request through OAG | Petition to Modify in the court with continuing jurisdiction |

| Speed & control | Can take 6+ months; less control over timeline | Can be faster if you push it; court sets hearing dates |

| Temporary orders | Uncommon in OAG-processed cases | Available if you request them |

| Common friction points | Needs both parties’ info; delays if information is missing | Court costs; may need an experienced attorney for complex cases |

Key timing rule: Under Texas Family Code §156.401(b), child support generally can only be modified for obligations after service of citation or your appearance in the case. This means the sooner you file, the sooner your “effective window” can begin.

Timeline: What to Do and When

TODAY:

- Document your layoff (save termination letter, last pay stub)

- Keep paying what you can—the order hasn’t changed yet

- Decide: OAG review or court petition?

THIS WEEK:

- File your modification request or court petition

- Apply for unemployment benefits

- Start tracking your job search efforts

NEXT 30–60 DAYS:

- Gather updated financial statements (bank records, budget)

- Prepare for negotiation or court hearing

- Plan for wage withholding at your next job

Track A — If You’re Paying Support and Just Lost Your Job

- Keep paying as much as possible until the court changes your order.

- Gather proof: termination letter, severance details, last pay stubs, unemployment benefit statements, job search log.

- Avoid “quiet quitting” strategies. If it looks like you’re not trying to find work, the court may impute income based on minimum wage or your past earnings.

- File fast. Changes generally only apply after service or appearance—waiting costs you money.

Track B — If You’re Receiving Support and the Other Parent Lost a Job

- Keep records of all payments and communication with the other parent.

- Respond quickly if a review or modification starts. The OAG process depends on info from both parties.

- Don’t rely on informal agreements. You still need a new court order to officially change the child support amount.

- Consider your options: Is enforcement appropriate, or would a structured temporary plan while modification is pending make more sense? (No guarantees either way.)

Related Guide: What to Do When Your Ex Stops Paying Child Support in Texas

Documentation Checklist

Use this list when preparing your modification request:

- ☐ Termination or layoff notice

- ☐ Pay stubs (before and after job loss)

- ☐ Unemployment benefit award letters and weekly statements

- ☐ Job applications and interview records (job search efforts)

- ☐ Monthly budget (housing, transportation, medical expenses)

- ☐ Tax returns (last 2 years)

- ☐ If self-employed: profit and loss statements, invoices, bank statements

A Personal Story from Attorney Migliaccio

I remember sitting across from a father who had just been laid off after 12 years at the same company. He was terrified. Not about finding a new job—he knew he’d land on his feet eventually. He was scared about his kids.

“I don’t want them to think I’m a deadbeat,” he told me. “But I can’t pay $1,800 a month on unemployment.”

We got his modification filed that same week. We documented everything: his layoff letter, his job search spreadsheet, his unemployment award. Six weeks later, he had a new job at lower pay. Two months after that, we had a new order that reflected his current financial reality.

He never missed a single payment to his kids. He just needed someone to show him the path forward.

That’s what we do at Warren & Migliaccio. Call us at (888) 584-9614 if you’re in that same spot.

Case Study: Filing Quickly After Job Loss to Lower Child Support

Problem: A North Texas dad was laid off, but his child support order was based on an $85,000 salary. Six weeks later he found work at $58,000 and felt overwhelmed because he was slipping into arrears.

Action: We filed a petition to modify within days and moved quickly on service, since support usually cannot be reduced for payments due before service or appearance. We gathered a layoff letter, unemployment statements, and a job-search log, then presented updated income figures and a workable budget.

Result: The court signed a new order reducing his monthly support by about 30% and set a manageable arrears repayment plan. Filing early meant the effective date started sooner, limiting how much unpaid support accumulated.

Takeaway: Takeaway: In Texas, child support does not change automatically after job loss/financial hardships. Keep paying what you can, document the change, and file fast to protect your financial future and your relationship with your kids.

What to Do in the First 48 Hours, First Week, and First 60 Days

Action Plan: First 48 Hours, First Week, First 60 Days

Use this checklist to stay organized while you pursue a modification.

First 48 Hours

- Step 1Keep paying what you can right now. Your child support order remains in effect. Paying something—even if it’s less than the full amount—shows good faith and slows arrears growth.

- Step 2Document the job loss immediately. Save your termination letter, final pay stub, and any severance information. You’ll need these for your modification request.

- Step 3Apply for unemployment and expect withholding. Child support can be withheld from unemployment benefits—up to 50% of your payment. This helps, but may not cover your full financial obligation.

First Week

-

Step 4Choose your lane.

- OAG review if your case is already in the Title IV-D system.

- Court petition if you need more control or faster action.

- Step 5File or request review fast. Don’t wait until you have a new job. Modification generally applies only after service or appearance—every week you delay is a week of higher obligations.

- Step 6Respond quickly to requests for information. The OAG contacts both parties within 30 days and needs responses to proceed. Delays hurt everyone.

First 60 Days

- Step 7Prepare for “imputed income” questions. Show your job search efforts. Explain any limitations on your ability to work. Avoid looking voluntarily underemployed.

- Step 8After the new order—confirm everything. When you’re re-employed, make sure wage withholding is set up correctly. Verify payments are posting to your account.

If you’re the receiving parent and payments stop

Texas Statutes & Case Law – What the Law Says and Why It Matters

Understanding the legal process helps you make smarter decisions. Here’s how Texas law applies to your situation:

Texas Family Code §156.401 — Grounds to Modify This statute sets the “eligibility doorway.” You can request modification based on a material and substantial change in circumstances or if 3 years have passed and the guideline amount differs by 20% or $100.

Why it matters to you: If you’ve had a significant income reduction, you likely qualify. But you have to file to find out.

Texas Family Code §156.401(b) — Timing Rule Support amounts generally can only be modified for obligations after service of citation or appearance in the modification case.

Why it matters to you: Waiting costs money. Every month you delay filing is a month where your old (higher) support amount applies.

Texas OAG Guidance — Real-World Administration The OAG confirms that only a court order changes your monthly amount. You must keep paying while your request is processed.

Why it matters to you: Even if you’ve asked for a review, you’re still on the hook for the old amount until a judge signs a new order.

Common Mistakes – Correcting Bad Internet Advice We See All the Time

Myth 1: “If I’m laid off, my child support automatically drops.” Reality: No—your child support order doesn’t change automatically. You must file for modification and get a new court order.

Myth 2: “I’ll wait until I’m back on my feet before filing.” Reality: This is one of the most expensive mistakes we see. Changes generally apply only after service or appearance. Waiting = more arrears.

Myth 3: “A handshake deal with my co-parent is enough.” Reality: Informal agreements don’t change your legal obligation. You still need a new court order for the amount to officially change.

Myth 4: “Unemployment benefits can’t be touched for child support.” Reality: The OAG can withhold child support from unemployment—up to 50% of your benefit.

Myth 5: “If I show $0 income, my support must be $0.” Reality: Courts may use your ability to work and minimum wage concepts to calculate support even when you report zero income.

Frequently Asked Questions

Child Support Modification Timing and Process

▶▼

I just lost my job—when can a Texas court actually lower child support?

Usually, the lower amount can’t start until after the other parent is served with your modification case (or appears in the case). That’s why filing quickly matters.

Texas Family Code §156.401(b) generally limits a change to support only for payments that come due after the earlier of (1) service of citation or (2) an appearance in the suit to modify. In plain English: you usually can’t “erase” months of old payments just because you were laid off, so delays can mean more arrears.

If your case runs through the Texas OAG child support review process, the OAG notes many modifications can take at least six months. While the case is pending, pay what you can and keep proof of the change (termination notice, recent pay stubs, unemployment benefit statements, and a job-search log). Modifications still must fit the best interests of the child.

▶▼

Can we agree to a temporary child support reduction without going to court?

You can agree informally, but it won’t legally change the order until a judge signs a new order. Any unpaid amount can still become arrears.

The OAG is clear that the court-ordered amount changes only through a court order—even if both parents agree. Informal deals can create surprise arrears, and unpaid support can accrue 6% interest in Texas.

A safer approach:

- Put any temporary agreement in writing for clarity.

- Start the OAG review process or file a modification case and ask the court to sign an agreed order.

- Keep paying what you can while the legal process is pending.

Unemployment Withholding, Arrears, and Enforcement

▶▼

If child support is being withheld from unemployment, can I still fall behind?

Yes. Withholding from unemployment benefits may not cover your full court-ordered amount, so you can still build arrears.

Texas OAG guidance explains that child support can be taken from unemployment benefits through withholding, and up to 50% can be withheld for current monthly obligations. That helps, but it doesn’t automatically lower your ordered support amount if your prior order was based on higher income.

Practical steps:

- Compare what’s being withheld to what your order requires each month.

- If you can, pay any difference so you don’t build arrears (which carry 6% simple interest in Texas).

- Keep your unemployment award letters and weekly statements in case the court or OAG requests them.

- Check your payment ledger so you’re not guessing about whether you’re short.

▶▼

What happens if I stop paying child support while I’m unemployed?

Stopping payments without court approval can trigger enforcement because your existing order stays in effect. Arrears can grow every month even while you’re unemployed.

Texas courts can enforce child support orders through the contempt of court, and the OAG can use multiple collection tools. One common consequence is license suspension: overdue support of about three months (and failure to follow a repayment schedule) can put you at risk. Enforcement tools can include:

- Income withholding when you return to work (and sometimes during unemployment)

- Liens and money judgments for arrears

- Interest on delinquent amounts at 6% simple interest per year

Imputed Income and Job Change Issues

▶▼

If I have “no income,” will the judge impute income anyway?

Yes, the court can base support on your earning potential if it believes you are intentionally unemployed or underemployed. Reporting zero income is not always the end of the analysis.

Texas Family Code §154.066 allows a court to apply guideline support to earning potential when actual income is lower due to intentional unemployment or underemployment. OAG guidance also notes that courts may consider work history, ability to work, and minimum-wage concepts in some situations.

To reduce imputation risk, bring proof such as:

- Job search efforts (applications, interviews, rejection emails)

- Medical limitations, if health affects your ability to work

- Recent pay stubs, severance information, and unemployment benefit statements

▶▼

Does quitting (or being fired) hurt my child support modification request?

It can. If the court views the job change as avoidable, it may treat it as voluntary underemployment and impute income instead of lowering support.

Under Texas Family Code §154.066, if your income is significantly lower because of intentional unemployment or underemployment, the court can apply the guidelines to what you could earn. So quitting without a strong reason, stopping your job search, or being fired for misconduct can make a modification harder.

Helpful documentation includes:

- Proof the change was involuntary (layoff notice, termination paperwork, reduced-hours memo)

- Evidence of an active job search (applications, interviews, updated résumé)

- Proof your financial circumstances are real (pay stubs, unemployment statements, budget)

The court still must make a decision that fits the child’s best interest.

Bankruptcy and Child Support

▶▼

Will bankruptcy wipe out child support arrears after a layoff?

No. Bankruptcy typically does not wipe out child support arrears or end your duty to pay ongoing support.

Child support is treated as a domestic support obligation under federal law, so it generally survives a bankruptcy discharge. Even if bankruptcy affects collection activity for other debts, it does not change your court-ordered child support amount.

What this means in practice:

- If your income dropped, the “fix” is a modification request in family court (or through the OAG process), not bankruptcy court.

- Staying current matters because arrears can create additional legal and financial consequences.

Texas Guideline Cap Update Effective September 1, 2025

▶▼

Does the September 1, 2025 child support cap change affect my modification after job loss?

It might, especially if your income is high enough to reach the cap. After September 1, 2025, Texas applies guideline percentages up to $11,700 in monthly net resources (up from $9,200).

The OAG’s Texas Register notice announces the updated cap, which is the maximum monthly net resources to which guideline percentages automatically apply.

How it plays out:

- If your net resources are at or below the cap, the guidelines are the standard starting point.

- If your net resources are above the cap, amounts over the cap aren’t automatically included; additional support generally depends on proof of the child’s needs.

- Even after a job loss, you still need to file for modification so the court can sign a new order.

Remember the timing rule: support usually changes only for amounts that come due after service or appearance in the modification case.

Need Help Modifying Child Support After Job Loss in North Texas?

Losing a job can put you in an impossible spot. You still want to support your kids, but your current order may be based on income you no longer have. Because the order does not change until a judge signs a new one, acting quickly can help limit avoidable arrears. Since 2006, our attorneys at Warren & Migliaccio have helped North Texas parents pursue child support modifications the right way and present the documentation courts and the Texas OAG typically expect.

If you live in Dallas, Collin, Denton, or Tarrant County, call our law firm at (888) 584-9614 to schedule your free consultation. You can also contact us online to schedule your free consultation. We’re here to help you find a path forward.

Legal Authorities (Endnotes)

Texas Office of the Attorney General: Employment Changes & Child Support Modification (including job loss guidance, imputed income/minimum wage concepts, unemployment withholding, and modification timeline information)

Texas Family Code, Chapter 156 (Modification of Prior Orders

Texas Family Code §156.401 (Grounds for Modification; Timing/Retroactivity Rule)

TexasLawHelp.org: Legal Standards in Child Custody and Support Modification Cases

Disclaimer: This article is for informational purposes only and does not create an attorney-client relationship. Every situation is different. For advice about your specific circumstances, please consult with a qualified Texas family law attorney.