If Atlas Credit is suing you in Texas, file a timely Answer to avoid a default judgment and require Atlas Credit to prove the debt. Your deadline depends on the court listed on your citation. After you respond, you can evaluate options like settlement, bankruptcy, or another resolution based on your goals. Texas debt lawsuit defense.

Quick Answer: What should I do if Atlas Credit is suing me in Texas?

Respond fast by filing an Answer to avoid default judgment, then choose the best next step based on your situation.

-

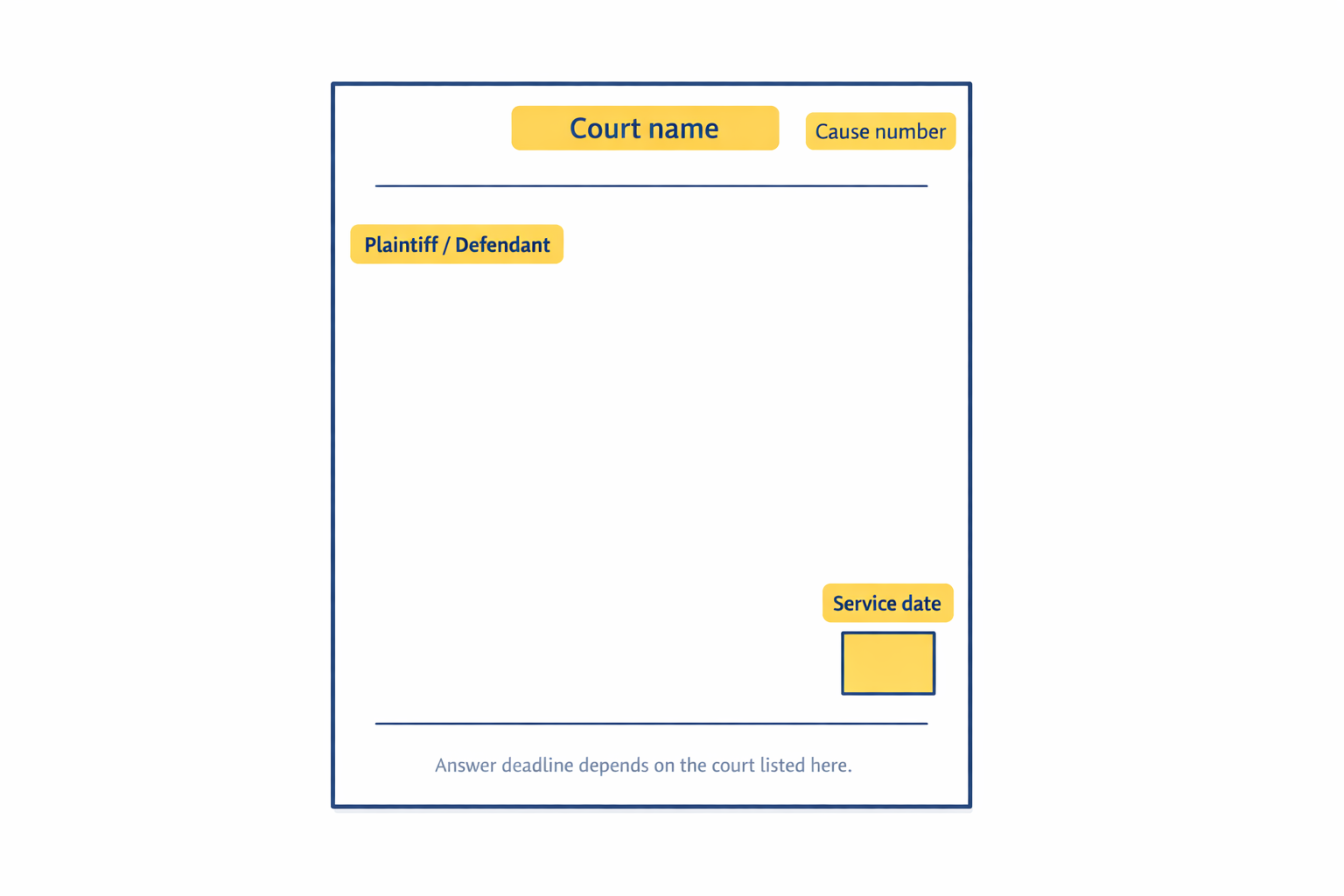

Confirm the court and deadline on your citation.

-

File an Answer and send a copy to Atlas Credit’s attorney (if listed) or to Atlas Credit. Tex. R. Civ. P. 21; Tex. R. Civ. P. 501.4.

-

Evaluate options like settlement, bankruptcy, or another resolution.

Find Your Deadline & Next Steps

Answer 2-3 quick questions to see exactly what applies to your Atlas Credit case.

Check the top of your paperwork—the court name is usually in the header.

Texas Justice Courts handle claims up to $20,000. Larger amounts go to County or District Court.

By filing an Answer, you’ve required Atlas Credit to prove its case. Now it’s time to evaluate your options.

No problem—Atlas Credit lawsuits can be confusing. A quick call can help us identify your court, deadline, and options.

What Do I Do if Atlas Credit Is Suing Me?

We understand you may have reasons for wanting to ignore the lawsuit and avoid talking to a lawyer. However, if there is one thing to take away from this article, it is not to ignore a collection lawsuit against you.

If Atlas Credit is suing you, we recommend taking two steps right away: consult an experienced debt resolution attorney and file an appropriate response to the lawsuit.

Step 1: Discuss Your Situation With an Attorney

We recommend talking to a debt collection defense lawyer as soon as possible. An attorney who handles debt collection defense cases can help you understand your best legal options based on your situation. However, before building a legal strategy, your attorney’s first priority is helping you avoid a default judgment by filing a timely response to the lawsuit.

If Atlas Credit gets a judgment, it may try post-judgment collection tools such as a writ of garnishment against certain bank funds, a judgment lien through an abstract of judgment, or execution against non-exempt property under Texas procedure. (Tex. Civ. Prac. & Rem. Code ch. 63; Tex. Prop. Code § 52.001; Tex. Civ. Prac. & Rem. Code ch. 34).

After a Judgment: What These Collection Tools Can Do

If a creditor gets a judgment, different collection tools may become available. This table explains what each tool usually targets and why timing matters.

| Tool | What it usually targets | What people miss | Practical takeaway |

|---|---|---|---|

| Writ of garnishment (often bank accounts) |

Funds held by a third party (often your bank). | Some funds may be protected by exemption laws, but you often have to act quickly to claim exemptions or challenge the garnishment. | If you get notice of a garnishment or a frozen account, do not ignore it. Deadlines move fast. |

| Judgment lien (abstract of judgment) |

Can attach to certain non-exempt real property in the county where the abstract is recorded. | Homestead protections can limit forced sale, but a lien can still create problems when you refinance or sell. | Even if you are not losing property tomorrow, liens can become a long-term headache. |

| Execution (non-exempt property) |

Non-exempt personal property, depending on what you own and what exemptions apply. | The real risk depends on your assets and how the judgment is pursued, because many common items are protected. | Asset type matters. Early defense reduces the chance you ever get here. |

Bottom line: These tools are far more likely after a judgment. That is why an on-time Answer matters so much.

In Texas, lenders generally cannot garnish your current wages or take money from your paycheck to pay consumer debt. (Tex. Const. art. XVI, § 28)

Working with an attorney also gives you a better chance of obtaining an outcome that benefits you. We discuss how a lawyer can help you in further detail below.

Step 2: File an Answer With the Court Handling Your Case

You must act quickly to file a response to the lawsuit in order to protect yourself from a default judgment in court. We recommend working with an attorney to prepare and file your response to avoid mistakes and missing important deadlines.

| Comparison Point | County/District Court | Justice Court (many debt claims) |

|---|---|---|

| Answer deadline timing (as stated) | By 10:00 a.m. on the Monday next after 20 days from service | Generally due by the end of the 14th day after service |

| Weekend/holiday note (as stated) | Not specified in the article | With weekend/holiday adjustments |

| Rule cited in the article | Tex. R. Civ. P. 99(b) | Tex. R. Civ. P. 502.5 |

| Rule source link (as used in the article) | TRCP 99(b) source | TexasLawHelp / SLL guide |

What We Consistently See in Texas Debt Lawsuits

In our Texas debt lawsuit defense work, we see the same issue again and again: people assume every court has the same Answer deadline. They feel rushed, confused, and sometimes freeze because the paperwork looks unfamiliar.

Our first move is simple but critical: we identify the court listed on the citation, then calculate the deadline using the correct Texas rule. That one step helps prevent a default judgment and keeps the case in a defendable posture, where the plaintiff still has to prove the debt and the amount.

The Takeaway: Do not guess your deadline. Confirm the court and file your Answer on time.

You must file this response, called an Answer, with the court and send a copy to the plaintiff so they know you responded.

Filing an Answer is critical to your case for a couple of reasons:

Two Paths: What Happens Next Depends on Your Response

If You DON’T Respond

- Court can enter default judgment

- Atlas Credit wins without proving anything

- Bank garnishment becomes possible

- Judgment liens can attach to property

- Judgment stays on record for years

If You File an Answer

- No default judgment

- Atlas Credit must prove the debt

- You can raise defenses

- Settlement negotiation possible

- Bankruptcy may be an option

- It protects you from a default judgment. If you ignore the suit and do not file an Answer by the deadline, the court can enter a default judgment in Atlas Credit’s favor. Tex. R. Civ. P. 239; Tex. R. Civ. P. 503.1; Tex. R. Civ. P. 508.3.

- It puts the burden of proof on Atlas Credit. Once you respond to the lawsuit, Atlas Credit—as the plaintiff—must prove you owe the debt. In your Answer, you can deny allegations you can’t verify and require Atlas Credit to prove its claim in court. Separately, if a third-party debt collector is involved, federal law may give you a limited window to request debt validation after initial collection contact. (15 U.S.C. § 1692g(a)). In some cases, the lender may not have enough evidence to prove you owe it money.

What “Prove the Debt” Usually Means in Plain English

If you file an Answer, the plaintiff generally has to back up its claim with evidence. Here is a practical checklist of what that usually looks like.

| Evidence | What it should answer | Common red flags |

|---|---|---|

| Loan agreement | What the deal was (amount, terms, interest, fees). | Missing terms, unclear fee language, or paperwork that does not match what you remember signing. |

| Payment history | How the balance changed over time. | Gaps in statements, missing credits, or payments not applied. |

| Balance breakdown | How the final number was calculated (principal, interest, fees). | Round numbers with no math, unexplained add-ons, or totals that do not match the statements. |

| Right defendant | That they sued the correct person. | Name mix-ups, old addresses, or identity confusion. |

| If a third party is collecting | Who owns the debt and why they have the right to sue. | Missing ownership proof, unclear account transfers, or vague “assignment” statements. |

How Can a Lawyer Help Me in a Debt Collection Lawsuit?

A dedicated debt defense attorney can alleviate the stress and confusion of dealing with a lawsuit by handling it on your behalf. From an initial confidential consultation through the resolution of your case, your attorney can assist you in many ways.

Case Study: How We Stopped a Default Judgment and Forced Proof

Roger (not his real name) came to us embarrassed and rattled after being served with an Atlas Credit lawsuit. He’d been juggling bills, working long hours, and the court papers made him feel like he’d already lost. He was tempted to ignore it just to make the stress go away.

We reviewed the paperwork immediately and focused on the biggest risk: missing the Answer deadline and getting a default judgment. We made sure to file Roger’s Answer on time, denied anything he couldn’t confirm, and required Atlas Credit to prove the contract, the balance, and how the total was calculated. When their paperwork didn’t fully match the numbers they claimed, we used those gaps as leverage.

Because we prevented a default judgment, Roger kept his chance to defend himself and pursue a better outcome.

The takeaway: In Texas, a timely Answer can shift the case from panic to control—because it forces the lender to prove its claim instead of winning by silence.

Quick Self-Check: Default Judgment Risk

Check these off. If any item is still unchecked, your safest next step is to confirm the court and deadline and file an Answer on time.

In addition to helping you avoid a default judgment, your attorney can investigate the validity of Atlas Credit’s claims. By identifying the strengths and weaknesses of the plaintiff’s evidence, your attorney can determine the best defense strategy for your situation.

If the lender has a strong case, your lawyer can explore resolution options. For example, negotiating a settlement with Atlas Credit may be the right option. Or, if you are dealing with severe financial hardship, bankruptcy may be an option to discharge qualifying debts.

At Warren & Migliaccio, we take the time to understand your unique situation and the case you are facing. We are dedicated to helping our clients find the best way forward that aligns with their best interests and put collection lawsuits behind them.

More Context: Who Atlas Credit Is and What This Lawsuit Usually Means

Now that you know the steps that protect you right away, it helps to understand who Atlas Credit is and how these personal-loan lawsuits are typically framed in Texas. This background can make the paperwork easier to interpret and can help you spot issues like missing proof, the wrong amount, or the wrong party bringing the claim.

Who Is Atlas Credit Co. Inc.?

Atlas Credit Co. Inc., also known as Atlas Credit, is a consumer loan company. In Texas, regulated consumer lenders are primarily governed by Chapter 342 of the Texas Finance Code and are overseen by the Texas Office of Consumer Credit Commissioner (OCCC). According to its website, Atlas Credit provides personal loans from about $100 up to $1,800, with terms of five to 12 months (amounts and terms can vary by location and borrower).

Atlas Credit states it was established in Tyler, Texas, in 1968. The company reports it has locations across Texas and additional locations in Oklahoma and Virginia.

Can Atlas Credit Sue You for a Personal Loan?

Atlas Credit may file lawsuits to collect on personal loans it alleges are in default. If Atlas Credit is suing you, it claims you owe money on a personal loan it provided.

Depending on the circumstances of your case, Atlas Credit may have a viable claim to collect the debt. However, it may also have a weak case. We recommend having an experienced debt defense attorney review the lawsuit. We can investigate the validity and strength of Atlas Credit’s claims against you.

Need-to-Know Highlights

- Do not ignore the lawsuit—missing the deadline can lead to default judgment.

- File an Answer to force Atlas Credit to prove the debt and the amount.

- Texas lenders generally cannot garnish wages for consumer debt.

- After judgment, bank garnishment and liens may become possible.

- A debt defense attorney can evaluate defenses, settlement, or bankruptcy options.

Who Represents Atlas Credit in Debt Collection Lawsuits?

Rather than hire third-party debt collectors or law firms, Atlas Credit appears to use an in-house team to pursue its collection lawsuits. Many lawsuits brought by Atlas Credit list the name Brenda Nunez who likely works for Atlas Credit.

The lawsuit paperwork should identify whether Atlas Credit is represented by an attorney or a company representative; review the petition/citation for the listed name and contact information.

Frequently Asked Questions

FAQs About Deadlines and Responding to the Lawsuit

How long do I have to answer an Atlas Credit lawsuit in Texas?

Your deadline depends on the court listed on your citation. In county or district court, the Answer is due by 10:00 a.m. on the Monday next after 20 days from service. In many justice court cases, the Answer is generally due by the end of the 14th day after service (with weekend/holiday adjustments).

What should I include in my Answer to an Atlas Credit lawsuit?

Your Answer should be a clear lawsuit response that prevents default and requires Atlas Credit to prove its claims. Keep it simple and accurate:

- Admit only what you know is true

- Deny allegations you can’t verify

- Assert defenses that may apply

- Demand proof of the debt and the amount claimed

How do I know which Texas court my Atlas Credit case is in?

Check the court name on your citation/petition and the filing information at the top of the paperwork. Many consumer cases are filed in justice court, but some are filed in county/district court—and your response deadline can differ. If you’re unsure, you can look up the case on the court’s docket or contact the clerk.

FAQs About Wage and Bank Garnishment

Can Atlas Credit garnish my wages in Texas?

For most consumer debt (including many personal loans), Texas generally does not allow wage garnishment from your paycheck. Common exceptions include child support, spousal support, and certain federal debts. However, once wages are deposited into a bank account, different collection tools may apply after a judgment.

Can Atlas Credit freeze or garnish my bank account after a judgment?

Yes. After a judgment, Atlas Credit may pursue bank garnishment to freeze funds held by a third party (often your bank). This is a key reason to respond on time. If your account is frozen, you may need to act quickly to challenge the garnishment or claim exemptions.

FAQs About Defenses and Proof

What defenses are common in Texas personal loan debt lawsuits?

Defenses depend on the facts, but these are common in Texas debt collection defense:

- Wrong amount or unsupported fees/interest

- Payment, settlement, or credits not applied

- Statute of limitations (time-barred debt)

- Lack of proof of the contract or account history

- Improper service or wrong defendant

What if the Atlas Credit debt is past the statute of limitations in Texas?

Texas generally gives creditors 4 years to sue on many debt claims. If the claim is time-barred, the statute of limitations can be a strong defense—but you usually must raise it properly in court. Because the timeline can be fact-specific, it helps to confirm dates and whether anything restarted the clock.

Does Atlas Credit have to prove the debt—and what evidence matters?

Yes. If you file an Answer, Atlas Credit generally must prove you owe the debt and the amount claimed. Evidence often includes the loan agreement or contract, a clear payment history, and an accurate balance calculation. Gaps or inconsistencies in documentation can weaken a collection case.

FAQs About Resolution Options

Can I negotiate a settlement with Atlas Credit after the lawsuit is filed?

Often, yes. Negotiating a settlement is common in Texas debt collection lawsuits, especially if you want certainty and to control the outcome. Get terms in writing, confirm the total amount and due dates, and confirm how the case will be resolved after payment.

Can bankruptcy stop an Atlas Credit lawsuit?

Usually, yes. Filing bankruptcy typically triggers an automatic stay that can pause collection activity, including lawsuits. Bankruptcy may be an option when you’re facing broader financial hardship, but the best chapter and timing depend on your full financial picture and goals.

FAQs About Legal Help and Property Risk

Should I hire a lawyer for an Atlas Credit lawsuit—or can I represent myself?

You can represent yourself, but a debt collection attorney can reduce risk with deadlines, defenses, and evidence. Even a limited consultation can help you avoid mistakes that lead to default judgment and identify leverage for dismissal, settlement, or a stronger defense strategy.

Can Atlas Credit put a lien on my property in Texas?

A creditor generally must first obtain a judgment. After that, a judgment lien may be possible under Texas procedures, and the impact can depend on the property type and exemptions (including homestead protections). Defending early helps you avoid default and reduces the risk of judgment-based collection tools.

| Comparison Point | Wage Garnishment (Paycheck) | Bank Garnishment (Bank Account) |

|---|---|---|

| General rule stated in the article | For most consumer debt (including many personal loans), Texas generally does not allow wage garnishment from your paycheck. | After a judgment, Atlas Credit may pursue bank garnishment to freeze funds held by a third party (often your bank). |

| Exceptions mentioned in the article | Child support, spousal support, and certain federal debts | Not specified in the article |

| Key nuance stated in the article | Once wages are deposited into a bank account, different collection tools may apply after a judgment. | If your account is frozen, you may need to act quickly to challenge the garnishment or claim exemptions. |

Schedule a Consultation to Discuss Your Legal Options for Fighting an Atlas Credit Lawsuit

Warren & Migliaccio has significant experience and success in helping individuals facing debt collection lawsuits reach favorable resolutions. We handle debt collection defense cases across Texas and have offices conveniently located in Richardson and Dallas.

You should not face an Atlas Credit lawsuit alone. Our credit card lawsuit defense attorneys provide affordable legal services to help our clients get through these difficult situations. During a confidential, no-obligation consultation, we can review your case and discuss your legal options.

Call our office at (888) 584-9614 or contact us online to request a consultation with us today.