When a major creditor like Barclays Bank files a lawsuit against you, you may feel overwhelmed and powerless. You may be unsure about your legal rights or the steps you should take to defend yourself. It is important to understand that you have legal options if you act quickly. In the article below, our Texas debt collection defense lawyers explain what happens when sued by Barclays and what to do if facing a Barclays debt collection lawsuit.

What Is Barclays Bank?

Barclays Bank is a global financial services company that originated in London, United Kingdom. It has a significant presence in the United States. According to U.S. News & World Report, Barclays was the 50th largest bank in the United States as of December 31, 2023. Barclays provides a wide range of financial services, including traditional banking, credit card options, and personal loan options.

Does Barclays Sue?

Barclays Bank may sue consumers after their accounts, such as a credit card or loan account, become delinquent. The bank generally will not pursue litigation until other collection efforts, like phone calls, emails, or letters, fail to result in payment.

For example, if you default on a Barclays credit card, or fail to make the minimum payments, the bank will likely try to collect the debt through phone calls or letters first. If those efforts fail, Barclays may file a lawsuit to seek a judgment against you.

Barclays Bank generally hires debt collection law firms when it resorts to litigation for its delinquent accounts. In Texas, it often works with the following law firms to handle its debt collection:

- Couch Lambert, LLC (formerly Couch, Conville & Blitt, LLC)

- Scott & Associates, P.C.

- Suttell and Hammer, P.S.

You can expect Barclays to seek a court judgment for the alleged amount owed, plus interest, late fees, court costs, and attorney’s fees. If you receive a lawsuit from Barclays Bank, it is essential not to ignore it. If you ignore the lawsuit, the court will likely rule in favor of Barclays Bank, meaning you automatically lose the case, even if you have a strong defense.

Ignoring a Barclays Lawsuit May Hand Them an Easy Win

Failing to respond promptly can result in a default judgment, even if you had valid defenses. Act quickly to protect your rights and finances.

Once Barclays has a court judgment against you, it can pursue bank garnishment, property liens, or property seizure to obtain the money. In Texas, Barclays Bank cannot pursue wage garnishment.

What Happens if Barclays Bank Sues You for Debt?

If sued by Barclays Bank for debt collection, you must be served with the lawsuit papers in accordance with Texas law. Generally, you will receive the paperwork by hand from a process server, sheriff, or another person authorized under the law or by mail. When you receive these documents, carefully review them. They should include the following:

- Complaint. The complaint explains why Barclays Bank is suing you. It will consist of Barclays Bank’s legal claims against you, such as breach of contract, and details about the debt account. It will also include the relief that Barclay is requesting from the court.

- Summons. The summons is the official notice of the lawsuit. It will provide information about the court where the lawsuit was filed and your case number. Additionally, the summons will include information about the deadline to respond to the lawsuit and the consequences of ignoring it.

After being served, it is now your turn to take action. You should act quickly to protect yourself from a default judgment. If you do nothing, you may lose the opportunity to defend yourself and favorably resolve the lawsuit. Below, our Texas debt collection defense lawyers discuss what to do if sued by Barclays Bank.

What to Do if Sued by Barclays for Debt Collection in Texas

Interactive Timeline: Barclays Lawsuit Process

-

Barclays typically begins collection attempts once your account is past due. Expect calls, emails, or letters demanding payment.

-

If delinquency continues, Barclays intensifies collection efforts. Failure to respond or negotiate can lead to a lawsuit filing.

-

Barclays may hire outside debt collection law firms. A formal complaint is filed, and the court issues a summons naming you as defendant.

-

You’re served the lawsuit paperwork (complaint and summons). Read it carefully—the summons specifies your response deadline (often 14–20 days in Texas).

-

If you do not file a formal Answer in time, Barclays can request a default judgment. That makes you automatically liable for the alleged debt.

-

Barclays may obtain a court judgment, enabling bank garnishment, property liens, or seizure. In Texas, wage garnishment is not typically permitted for consumer debt, but other assets remain at risk if a judgment is issued.

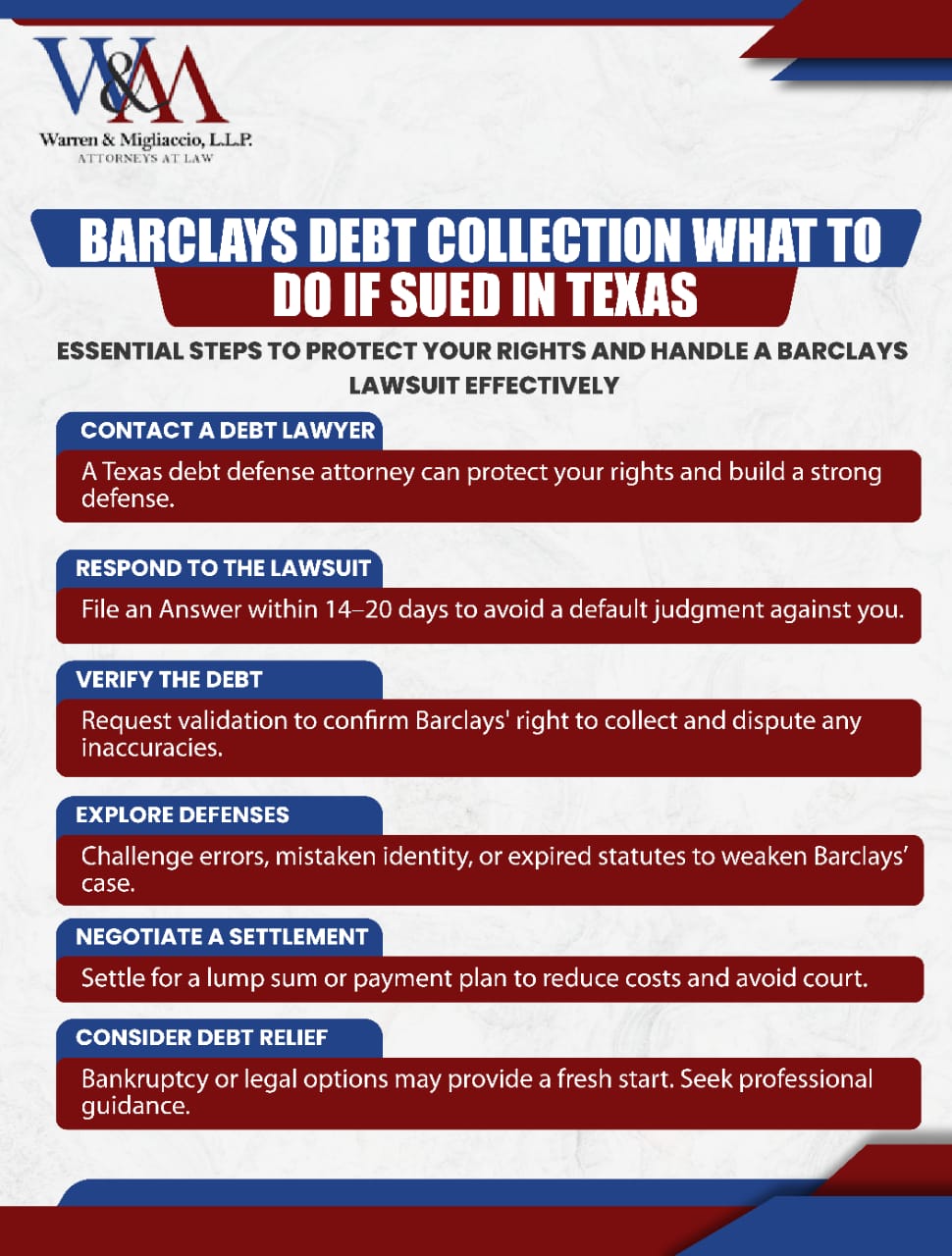

Are you being sued by Barclays Bank for debt collection? If so, we recommend taking the following steps:

Step 1: Contact an Experienced Texas Debt Defense Lawyer

If you are being sued for debt collection, we recommend scheduling a free, no-obligation consultation with an experienced Texas debt defense attorney from our firm. During a free consultation, we can review the claims against you and help you understand your situation. We can also discuss your potential legal options based on your unique situation.

At Warren & Migliaccio, our attorneys have significant experience and success defending Texans against creditor and debt collection lawsuits. When you choose to work with us, we will defend and represent you throughout the legal process, working toward the best possible outcome for your case. Do not hesitate to learn more about how we can help you with your case during a free consultation.

Step 2: Respond to the Lawsuit

Time Is Short—Don’t Let Barclays Win By Default

In many Texas courts, you may have as few as 14 days to respond after being served. Missing that window hands Barclays an easy judgment against you.

You should formally respond to the lawsuit, which is called an Answer. In your Answer, you should address each claim Barclays Bank has made against you. You can also raise any defenses you may have. When you choose us to help you with your case, we will draft and file your Answer for you.

Generally, depending on the court overseeing your case, you have 14 to 20 days to respond from the date you are served. You must not miss the deadline because it could result in a default judgment against you, which means Barclays automatically wins the case.

By filing a response to the lawsuit, called an Answer, you protect yourself from a default judgment. More so, it gives you time to evaluate your legal options and execute a legal strategy to reach a favorable case outcome.

Step 3: Verify the Debt

You have the legal right to request debt validation from Barclays Bank. It must be able to prove that you owe the debt, the amount it claims you owe is accurate, and it has the right to collect it.

With Barclays being an original creditor, you should review all your records relating to the alleged debt. Check your statements, payment history, and any correspondence with the bank. Note any inaccuracies in the debt amount or any other details claimed by Barclays Bank. Any discrepancies can be used to help your defense.

Step 4: Assess Your Legal Options

When facing a Barclays lawsuit, you have several potential legal options:

- Challenging the lawsuit. Common defenses to debt collection lawsuits include an expired statute of limitations, mistaken identity, and weaknesses or errors in the creditor or debt collector’s case. If you have a strong defense, you may be able to seek case dismissal or fight the lawsuit in court.

- Negotiating a settlement. Barclays Bank may be open to a settlement to avoid the resources and uncertainty of going to court. You may be able to negotiate a lower lump-sum payment or a manageable payment plan.

- Seeking alternative debt relief. Do you feel overwhelmed by debt beyond the Barclays lawsuit? If so, you may consider seeking alternative options like bankruptcy. By seeking bankruptcy, you may be able to discharge your unsecured debt or restructure your debt to help you get back on the road to financial recovery.

The best legal strategy for your case depends on your unique financial situation and the strength of Barclays’ case against you. One of our experienced debt collection defense lawyers can help you assess and determine the best path forward for your case.

Schedule a Free Consultation With Our Texas Debt Collection Defense Attorneys

At Warren & Migliaccio, we help Texans like you reach favorable case outcomes in creditor and debt collection lawsuits. If you are facing a Barclays debt collection lawsuit, then do not hesitate to reach out to us for a free consultation.

During a free consultation, we can review the claims against you and help you understand your situation. We can also discuss your legal options and how we can help you resolve the lawsuit. Call us at (888) 670-3593 or contact us online, and we will contact you soon to schedule a free consultation.