If you’re served in Texas by Velocity Investments, the citation (summons) requires a prompt written Answer to avoid a default judgment. Consult with a Texas debt-defense lawyer. After you answer, ask for account documents (original creditor, chain of title, itemized balance), evaluate defenses, and only then consider settlement options.

Have you recently received notice that Velocity Investments, LLC is suing you for debt collection? Our North Texas debt-collection defense lawyers understand you may feel confused and stressed.

You may not have heard of Velocity Investments and wonder if it’s a scam. If it’s legitimate, how do you defend yourself—and beat Velocity Investments?

Warren & Migliaccio has significant success helping Texans resolve debt-collection cases. Below, we explain what to know about Velocity Investments and what to do if it sues you.

Quick Answer: What should I do first if Velocity Investments sues me in Texas?

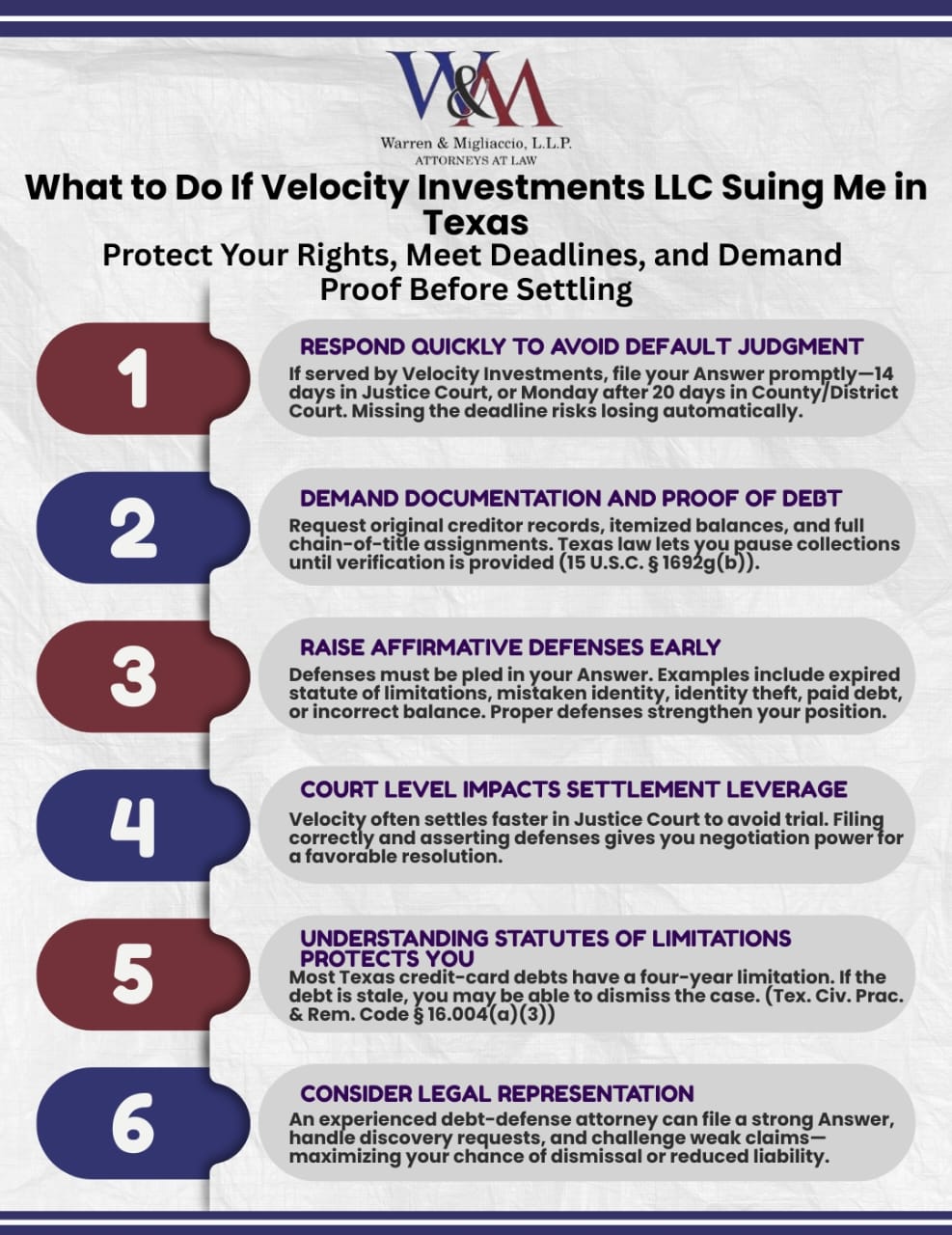

Act fast: file your Answer by the Texas deadline (14 days in Justice; 10:00 a.m. Monday after 20 days in County/District), then demand proof and assert defenses to avoid default.

- File your Answer before the court deadline

- Demand validation and account documents

- Raise defenses and consider counsel

Is Velocity Investments, LLC a Scam?

It’s common to wonder if Velocity Investments is a scam. It isn’t—Velocity is a legitimate debt buyer. However, Velocity Investments is a real company, and you should not ignore the lawsuit. The lawsuit is likely legitimate, and you may only have a short timeframe to contest it.

Need-to-Know Highlights

- Answer deadline: 14 days (Justice) or Monday after 20 (County/District).

- Demand proof: original creditor, itemized balance, chain of title.

- Four-year statute of limitations may bar stale claims.

- Texas protects current wages; non-exempt bank funds can be garnished post-judgment.

- Consider settlement only after reviewing documentation.

What Is Velocity Investments, LLC?

Since Velocity Investments, LLC is not a lender or original creditor, many people haven’t heard of it. Also called Velocity Recoveries, Velocity is a Wall Township, New Jersey–based debt buyer and collection company operating since 2002.

It purchases portfolios of defaulted consumer accounts—often for a fraction of face value—and then seeks to collect the stated balance to earn a profit.

Velocity Investments also provides third-party debt collection services for financial companies, pursuing debts on behalf of its clients.

Why Is Velocity Investments, LLC Suing Me?

When a creditor cannot recover debt on its own, it may hire a third-party collection company or law firm to try to collect the debt. It may also sell the debt to a debt buyer to recover some of its losses.

Why would a company you have never heard of sue you for a debt? Since Velocity buys delinquent or charged-off debt from creditors, it is possible it bought your defaulted account from your original creditor.

Who Represents Velocity Investments?

Velocity Recoveries works with debt collection law firms across the United States. These law firms handle litigation on Velocity’s behalf. In Texas, Velocity Investments often hires Rausch Sturm LLP, Javitch Block LLC, Noack Law Firm, PLLC, or Couch Lambert, LLC, to handle its collection cases.

What to Do if Velocity Investments Files a Debt Collection Lawsuit Against You

Companies like Velocity buy thousands of defaulted accounts at a time. Without doing due diligence on the accounts to verify the debts or debt owners, they file thousands of lawsuits and hope consumers ignore them. Unfortunately, many consumers ignore these suits, and Velocity often wins default judgments—gaining the legal right to collect even when the claim could be disputed.

Whether you owe the debt or believe Velocity Investments has sued you by mistake, you must respond to the lawsuit to protect yourself from a default judgment. Pay attention to which Texas court is overseeing your case.

Texas Answer deadlines: 14 days in Justice Court (Tex. R. Civ. P. 502.5(a)) and 10:00 a.m. on the Monday after 20 days in County/District Court (Tex. R. Civ. P. 99(b)). Because of this, it is essential to move quickly.

Our North Texas debt resolution attorneys always tell potential clients that they likely have more legal options than they think to deal with a debt collection lawsuit. Even if you recognize the debt, collection lawsuits generally have weaknesses.

For example, Velocity may not have enough evidence to prove its case. However, the only way to initially put pressure on Velocity is to respond to the lawsuit within the appropriate time frame. After you answer, you can use discovery to demand account records, assignments, and calculations. Tex. R. Civ. P 192, Page 115

Your response should address Velocity’s allegations against you with an acceptance or denial. It should also state your affirmative defenses. Texas rules require that affirmative defenses be specifically pleaded. Tex. R. Civ. P 94, Page 56.

Affirmative defenses are defenses you can prove with evidence. A few examples of affirmative defenses include but are not limited to:

- Expired statute of limitations

- Mistaken identity

- Identity theft

- The debt has been paid

- The debt amount is incorrect

The Answer you provide should also demand proof of debt validation from Velocity. You also have a 30-day right to dispute and request validation after the initial collection notice, and collection must pause until verification is mailed. 15 U.S.C. § 1692g(b).

What Is the Statute of Limitations for a Texas Debt Collection Lawsuit?

Texas, like every state, has a statute of limitations, or SOL, for how long a creditor or collection company can file a lawsuit to pursue a delinquent debt. A statute of limitations is a deadline. Once the deadline passes, a creditor can no longer use litigation to seek the debt. In Texas, most suits to collect credit-card and other debt are subject to a four-year limitations period. Tex. Civ. Prac. & Rem. Code § 16.004(a)(3).

Do I Need an Attorney for a Velocity Investments LLC Lawsuit?

Having an attorney represent you in a debt collection lawsuit is not required. However, we recommend having one on your side. You have a better chance of getting a favorable result if an experienced debt defense attorney defends you against Velocity.

Preparing and filing an Answer—and then navigating court procedures when you’re representing yourself—can be complex. Small mistakes with deadlines or filings can cost you the case.

An experienced debt defense attorney can ensure you file a comprehensive Answer before the deadline. Your attorney will ensure you follow all appropriate legal procedures. Your attorney can also investigate Velocity’s claims to determine weaknesses, defense strategies, and the best way forward.

Case Study: Forcing Strict Proof Turned a Velocity Lawsuit Into a Dismissal

When Marcus, a Dallas father, sat down in my office, he looked exhausted—Velocity Investments had sued him on a card he didn’t recognize, and he worried about the account he uses for rent and daycare. I filed a timely Answer to block a default and keep leverage.

Then I went on offense: I served targeted discovery demanding the original creditor’s records, a clean chain of title, and itemized statements showing how the balance was calculated. The production came back thin—generic bills of sale that didn’t identify Marcus’s account, missing assignment dates, and math that wouldn’t reconcile.

I set a hearing and walked the court through each gap, line by line. Facing holes they couldn’t fix, Velocity agreed to dismiss the case with prejudice. Marcus kept his paycheck and his peace of mind.

The Takeaway: act fast, file your Answer, and make the collector prove every element with real documents.

At Warren & Migliaccio, we help our clients reach case resolution in the following ways:

- Case dismissal

- Litigation defense

- Settlement negotiations

- Alternative debt resolution options, such as bankruptcy

Frequently Asked Questions

FAQs About Immediate Concerns (Deadlines, Garnishment, Legitimacy)

What is the deadline to answer a Velocity Investments lawsuit in Texas?

You must file an Answer by the Texas court deadline. In Justice Court, you generally have 14 days; in County/District Court, it’s 10:00 a.m. on the Monday after 20 days. Missing the deadline risks a default judgment and quick enforcement steps.

Can Velocity Investments garnish my wages or freeze my bank account in Texas?

Texas bans garnishment of current wages for most consumer debts. Tex. Const. art. XVI, § 28. However, after a judgment, non-exempt funds in a bank account can be frozen and taken by writ of garnishment. Exemptions apply, so timing and account sources matter.

Is Velocity Investments, LLC legitimate or a scam?

Velocity Investments is a real debt buyer/collector. Lawsuits from Velocity are typically legitimate and should not be ignored. Treat any citation seriously: file an Answer, demand proof, and evaluate defenses before discussing settlement.

FAQs About Defenses, Proof & Validation

What defenses work against a Velocity Investments lawsuit in Texas?

- Gaps in chain of title/assignment

- Incorrect amount or accounting errors

- Identity theft or mistaken identity

- Time-barred (statute of limitations) claims

- FDCPA or Texas debt-law violations

How do I make Velocity Investments prove the debt?

Dispute in writing within 30 days for validation, and use discovery in court to demand: original creditor and account records, complete chain of title/assignments, and itemized statements and balance calculations.

FAQs About Time Limits & Ignoring Suits

What is the statute of limitations on credit card debt in Texas?

Most credit-card suits are subject to a four-year statute of limitations from default or last qualifying activity. If the period ran, raise a limitations defense to seek dismissal and stop collection through the courts.

What happens if I ignore a Velocity Investments lawsuit?

Ignoring the suit usually results in a default judgment. With a judgment, the creditor can pursue non-exempt assets (e.g., post-judgment bank garnishment and turnover). Answering on time keeps defenses alive and preserves leverage.

FAQs About Settlement & Arbitration

Can I settle with Velocity Investments—and when?

Yes. File your Answer first, then request documentation and evaluate defenses. Negotiate only after you understand the claim. Put the deal in writing and ensure a dismissal with prejudice once terms are satisfied.

Can I force arbitration in a Velocity Investments case?

If your account agreement includes an arbitration clause, you can move to compel arbitration. This tactic can shift costs and leverage. Locate the governing card agreement and act promptly to avoid waiving the right.

FAQs About Exemptions & Protected Property

What Texas exemptions can protect my property after a judgment?

Common protections include the homestead, personal property under Chapter 42, and current wages. Some income sources are exempt, and tracing matters if funds are commingled. A lawyer can align exemptions with your specific facts.

Discuss Your Potential Legal Options With Our North Texas Debt Collection Defense Attorneys

If Velocity Investments is suing you for a defaulted debt, you do not have to face it alone. The debt defense lawyers of Warren & Migliaccio represent individuals in collection lawsuits filed by debt buyers, collection companies, and creditors. We encourage you to contact our office to discuss how we can help you.

We can review your case during a confidential consultation and help you determine your potential legal options. Call us or submit our online contact formto schedule a case review.