Is Autovest LLC suing you for debt collection in Texas? If so, you may be stressed and confused. What is Autovest, and why is it suing you if you have never taken out a loan with it? Autovest LLC is a debt buyer that pursues unpaid auto loans. It might be suing you for an old debt purchased from an original creditor.

Our Texas debt collection defense attorneys have put together a resource guide about Autovest to help you navigate this situation. In the sections below, we cover what to know about Autovest, LLC, why it might be suing you, and steps you can take to address and resolve the lawsuit.

You can also schedule a free consultation with us to discuss your case. We represent and defend Texans against debt collectors across the state. During a free consultation, we can review the claims against you and help you understand your best legal options for moving forward.

What Is Autovest LLC?

Autovest, LLC is a debt buyer based in Southfield, Michigan. According to its website, Autovest “acquires consumer loan portfolios direct from Fortune 500 banks and automobile finance companies.” This means that Autovest purchases charged off auto loans from banks and auto lenders at a fraction of their face value.

After Autovest buys these debts, it pursues collection actions like lawsuits against the consumers who have defaulted on their auto loans. Its goal is to collect the full amount of debt the borrower owes, in addition to accrued interest, legal fees, and court costs. Since Autovest bought the debt for much less, any money they collect above the purchase price is profit.

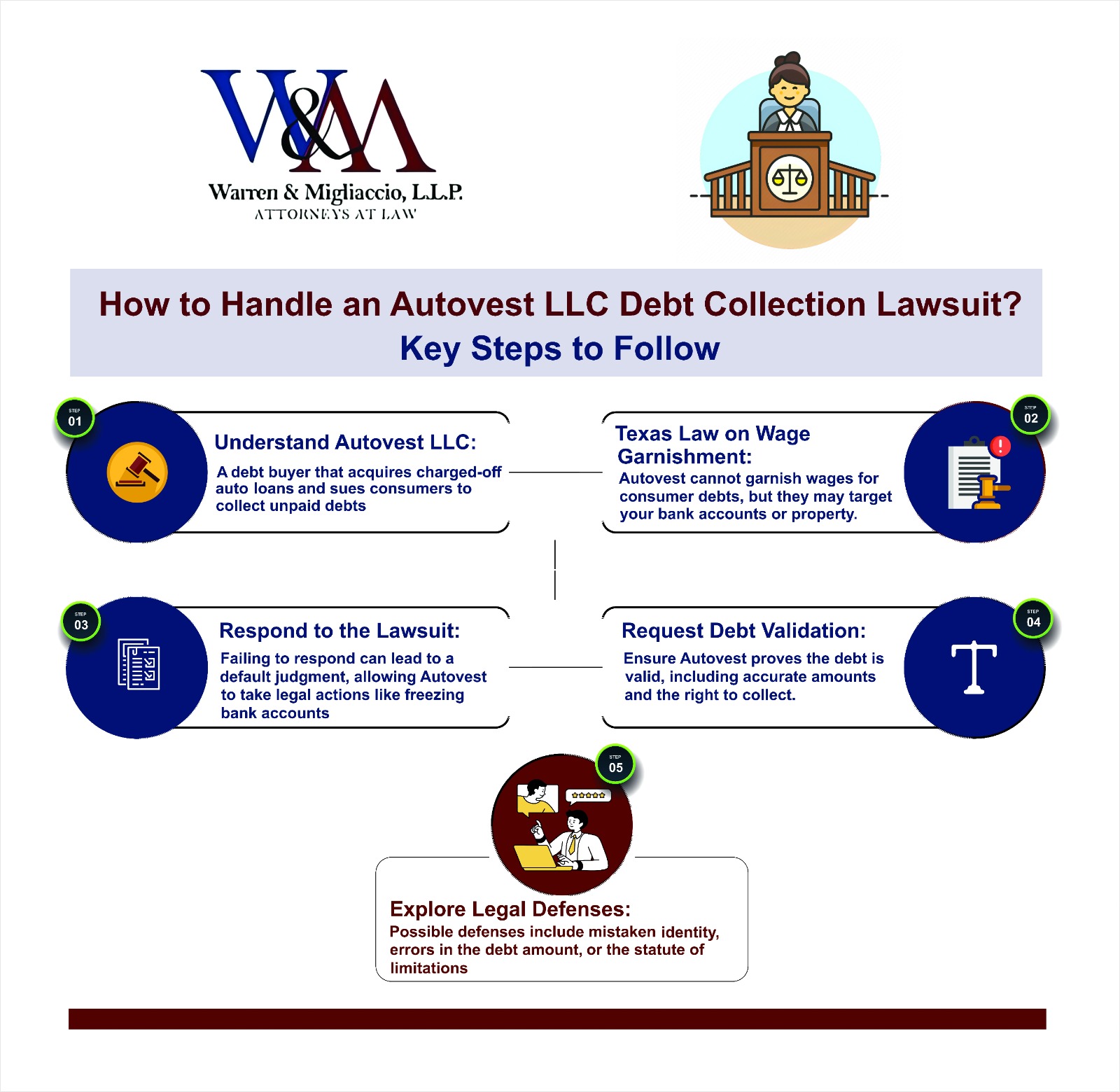

Arm yourself with knowledge to tackle an Autovest LLC debt collection lawsuit. This infographic guides you through crucial steps, from understanding Texas garnishment laws to exploring vital legal defenses, helping you protect your assets and rights effectively.

Why Is Autovest Suing Me?

If you are facing a lawsuit from Autovest LLC, it is likely because they have purchased a debt you allegedly owe. Autovest, LLC buys portfolios of charged-off auto loans from banks and lenders. A lender may charge off a debt when its collection efforts have failed, and it believes it is unlikely to collect the debt through normal means. To recover some of the money it lost, lenders sell these charged-off debts to buyers like Autovest at a significantly discounted rate.

Now, Autovest may be suing you to recover not only the amount it paid to buy your alleged debt but also the total amount of debt itself, plus any accumulated interest and fees. Autovest uses lawsuits as a tool to try to collect the debt when other methods have failed.

Typically, Autovest, LLC hires debt collection law firms to handle its lawsuits. In Texas, it often works with the law firm Jenkins & Young, P.C. to bring lawsuits against consumers.

Can Autovest Garnish Your Wages in Texas?

No, wage garnishment is not allowed in Texas to pay off consumer debts. Texas only permits wage garnishment for specific types of debts, such as child support, back taxes, or defaulted student loans. Even if Autovest wins the lawsuit against you, it cannot take money directly from your paycheck.

However, even though wage garnishment is not an option, Autovest has other legal actions it can take. For example, if it gets a judgment against you, Autovest may be able to pursue:

-

- Bank garnishment. Autovest can seek a court order to freeze and seize money from your bank accounts to satisfy the debt. Your paycheck would be at risk once deposited into your bank account.

-

- Property liens. Autovest may place a lien on your property, such as your home or land. You could run into problems if you try to sell your property, as Autovest may have a claim on the proceeds.

-

- Property seizure. In some cases, Autovest may seek to have your non-exempt property seized and sold to pay off the debt.

How to Beat Autovest LLC in a Texas Debt Collection Lawsuit

If sued by Autovest LLC for debt collection, we recommend contacting our experienced Texas debt defense lawyers about your situation. We deal with creditors and debt collectors daily to help our clients obtain the best possible results for their cases and put debt collection lawsuits in the past.

Beyond working with an experienced Texas debt collection defense lawyer, a few steps for improving your chances of a favorable case resolution include:

1. Respond to the Autovest LLC Lawsuit

We strongly recommend that you do not ignore a lawsuit from Autovest. If you do not respond to the lawsuit, Autovest will likely win by default. This means the court will rule in favor of Autovest, which can lead to legal actions like bank garnishment.

By responding to the lawsuit, you protect yourself from a default judgment and allow yourself to explore your legal options and decide how to handle the lawsuit. You may have a strong defense to get the case dismissed, negotiate a favorable settlement, or fight it in court and win.

2. Demand Debt Validation

Demanding debt validation requires Autovest to prove that you owe the debt, that the claimed debt is accurate, and that it has the right to collect the debt. Because Autovest purchased the debt from the original creditor, it may not have enough evidence to back up its claims.

3. Assess Your Legal Defenses

When facing a lawsuit from Autovest, you should assess your legal defenses. This assessment will help determine the best strategy for moving forward with your case. For example, a few potential defenses to consider may include, but are not limited to:

-

- Mistaken identity. If you do not recognize the debt, then it may be a case of mistaken identity or even identity theft. Proving that you are not the debtor can lead to the dismissal of the case.

-

- Errors in debt amount. The amount Autovest claims you owe might be inaccurate for several reasons. If it is incorrect, it hurts the validity of Autovest’s claim against you.

-

- Statute of limitations. The statute of limitations is the time limit that a creditor or debt collector can legally sue you to collect a debt. In Texas, this period is generally four years. If the debt is too old for legal action, you can get the case dismissed.

-

- Illegal collection practices. Debt collectors must follow the Fair Debt Collection Practices Act (FDCPA) in their collection practices. If Autovest, LLC, or its attorney violated any of these rules, it can be a defense to get the case dismissed. You may also be able to counter-sue for damages.

4. Explore Your Legal Options

After you evaluate the strengths and weaknesses of Autovest’s case and assess your potential legal defenses, you can determine the best course of action for your situation. Generally, your legal options may include one of the following:

-

- Negotiating a settlement. Settling can be a quick way to resolve the lawsuit without the added time, costs, and risks associated with going to court. Additionally, if Autovest has a strong case against you, settling may be in your best interest. In many cases, you may be able to negotiate a number less than the claimed amount or a manageable payment plan.

-

- Challenge the lawsuit. If you believe Autovest’s claims are weak or have strong defenses to the lawsuit, challenging it in court may lead to a favorable outcome. For example, you may be able to get the case dismissed, set yourself up for a favorable settlement, or win the case in court.

-

- Seek other debt relief options. If your financial situation is dire, you should consider alternative debt relief options like debt consolidation or bankruptcy to manage or eliminate your debts. For example, you may be able to discharge or restructure multiple debts, including those from Autovest, through bankruptcy.

Are you unsure about the best course of action for your situation? If so, do not hesitate to schedule a free consultation with our law firm. We have significant experience and success in helping Texans resolve debt collection lawsuits. We are happy to help you determine the best path forward based on your unique situation.

Schedule a Free Consultation With Our Texas Debt Collection Defense Lawyers

At Warren & Migliaccio, we have a proven track record of successfully defending Texans against debt collection lawsuits. Contact us today to schedule a free consultation about your Autovest LLC lawsuit. During your consultation, we can review Autovest’s claims, answer your legal questions, and help you understand your best options for moving forward. Call us at (888) 670-3593 or contact us online, and we will reach out to you soon.