A common question many Texans have is, can a trust be changed after it’s established? It’s a question that often pops up, especially when life throws those curveballs we never see coming. Whether it’s marriage, divorce, the birth of a child, or any significant life change, those events often have us rethinking our financial strategies. And, when it comes to estate planning, that question of, can a trust be changed, becomes even more critical.

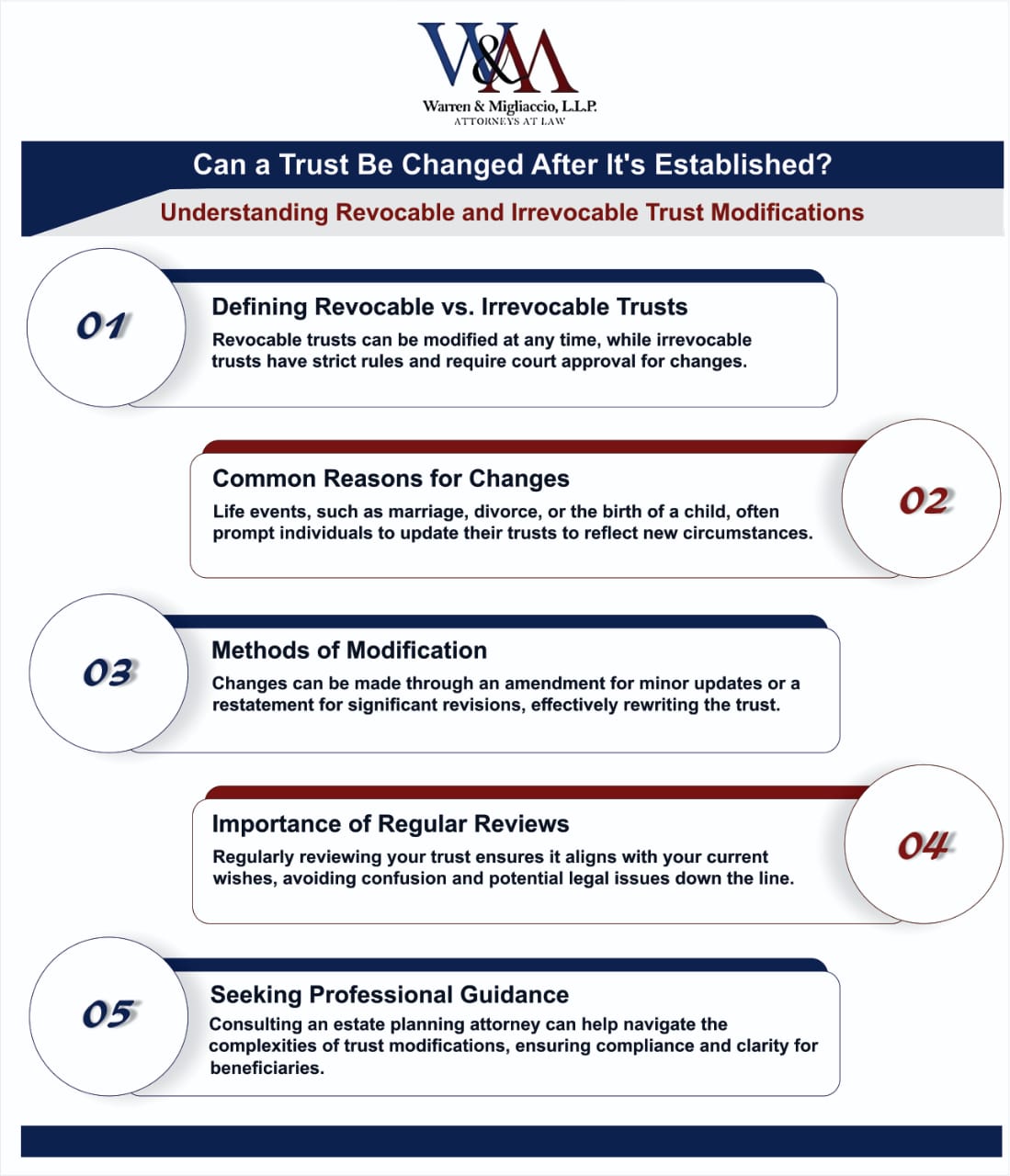

In Texas, the flexibility you have with your trust depends on the type you choose: revocable or irrevocable. Let’s delve deeper into the world of revocable living trusts to answer your questions.

Understanding Revocable Living Trusts

The beauty of a revocable living trust in Texas lies in its flexibility. As long as you’re alive and mentally capable, you can make changes as you see fit. It’s your roadmap, and you hold the pen to make any adjustments along the way.

That means you can add or remove beneficiaries, update the way assets are distributed, or even dissolve the trust altogether if you need to. It’s all about aligning your trust with your current wishes and circumstances.

Common Reasons for Changing a Revocable Trust in Texas

Life is full of changes, so it’s no wonder people often need to tweak their revocable trusts along the way. Let’s explore common reasons why individuals in Texas choose to update their trust documents:

Regular reviews help your trust align with your wishes and prevent future issues. Reassess as your circumstances change. Consider resources like Quicken WillMaker & Trust for additional information.

How Can a Trust Be Changed?

Generally, as the grantor of a revocable living trust, you have two primary ways to make changes: an amendment or a restatement. A trust amendment allows you to change specific sections of the trust document, much like changing trust beneficiaries.

You might modify beneficiaries or adjust distribution timelines. If many updates are needed, a trust restatement overhauls the entire document. The trust itself persists, but you substitute a completely revised version. This would effectively achieve the goal of those seeking to learn if a trust can be completely altered after it’s established.

Amending Your Trust

Making simple changes to a trust is often easy, especially with an online trust. But more complex adjustments, like those involving real estate, need detailed paperwork and filing. While changing trust documents might seem straightforward, legal procedures add complexity. For example, some states require court approval for changes involving a successor trustee. Knowing your state’s legal steps for amending trust terms is essential.

An estate planning attorney is invaluable. They ensure all legal requirements are met and that the document reflects your wishes. Some states have strict rules for trust amendments, making professional help important.

Restating Your Trust

Think of a trust restatement as completely rewriting your trust while incorporating all changes at once. This allows for updating multiple trust terms simultaneously. While this is a bigger undertaking than an amendment, it’s still the same trust – just a newer, updated version. You’re simply restating the original trust agreement with modifications.

Working with Professionals

As the grantor, trustee, and sole beneficiary of a revocable trust, you have strong control over its terms. Consulting an estate planning lawyer or a financial advisor is key when making any changes. They help ensure your wishes are clear and legally sound. An attorney can also guide you on appointing a trust protector, which adds oversight for irrevocable trusts.

They can explain amendment options, give advice on how to make changes, or even end the trust if needed. Having professionally drafted trust documents can help manage tax impacts on beneficiaries—an important point to address. It’s also crucial to discuss who will be the successor trustee, especially in California, since they handle the transfer of trust assets.

Case Study

A family wanted to move their trust from California to Delaware, following Phipps v. Palm Beach Trust Co. Their goal was better asset protection and tax efficiency, showing how trust location matters.

Frequently Asked Questions

Can a Trust Ever Be Changed?

Yes, especially revocable living trusts. During your lifetime, you can adjust a revocable trust to reflect changing circumstances.Irrevocable trusts are far more challenging to change. They often need court approval or specific legal approaches, such as appointing a trust protector.

Can a Trustee Change Beneficiaries?

In a revocable trust, the grantor maintains control over beneficiary changes. After the grantor’s death, a trustee usually cannot alter beneficiaries unless given that power in the trust document.In an irrevocable living trust, a successor trustee’s power to adjust beneficiaries depends on the trust’s language. This often clarifies how assets are transferred to beneficiaries.

Can the Beneficiaries of an Irrevocable Trust Be Changed?

Modifying beneficiaries in an irrevocable trust is complex. Once established, an irrevocable trust is generally fixed. Specific legal mechanisms may allow adjustments in certain situations.For example, amendments might be made due to beneficiary hardship, changes in tax laws. Also, adjustments may be needed if a trustee or other fiduciary must attend to responsibilities due to the death of an original trustee.

Can an Executor Remove a Beneficiary from a Trust?

An executor oversees wills, not trusts. A trustee cannot remove a beneficiary from an irrevocable trust without explicit permission. But, in rare cases, removal may be justified, such as when fiduciary misconduct arises.

Can a Trust Protect My Assets?

One benefit of a trust, whether a testamentary trust or a living trust, over a will is asset protection, no matter the size of your estate. Understanding how a trust safeguards your assets is important. It’s also essential to know if a trustee can sell trust property without getting approval from all beneficiaries.

Conclusion

Can a trust be changed? Yes, especially revocable living trusts. Understanding the different types and procedures for modification is essential. As family dynamics change, a revocable trust can be a valuable tool.

Working with skilled estate planning attorneys can enhance compliance. It maximizes the benefits of your trust, bringing greater clarity to your beneficiaries. This expert guidance minimizes uncertainty, especially in handling complex issues. Our Texas-based attorneys are ready to help you create an estate plan that meets your needs. Call us at (888) 584-9614 or reach out online to explore how we can support your estate planning goals.