Picture this: After years of paying off your mortgage and filling your house with memories, you suddenly need nursing home care. Then you hear rumors that the state might take your home to pay for that care. Is that actually possible in Texas? Medicaid Estate Recovery Programs are mandatory in all states following the death of Medicaid recipients aged 55 or older.

I’ve sat with plenty of Texas families who have this exact fear. The thing is, with decent planning and a clear understanding of the rules, you can usually protect your home. So, let’s dig into when and how Medicaid might claim a Texas home—and what you can do to keep your property in the family.

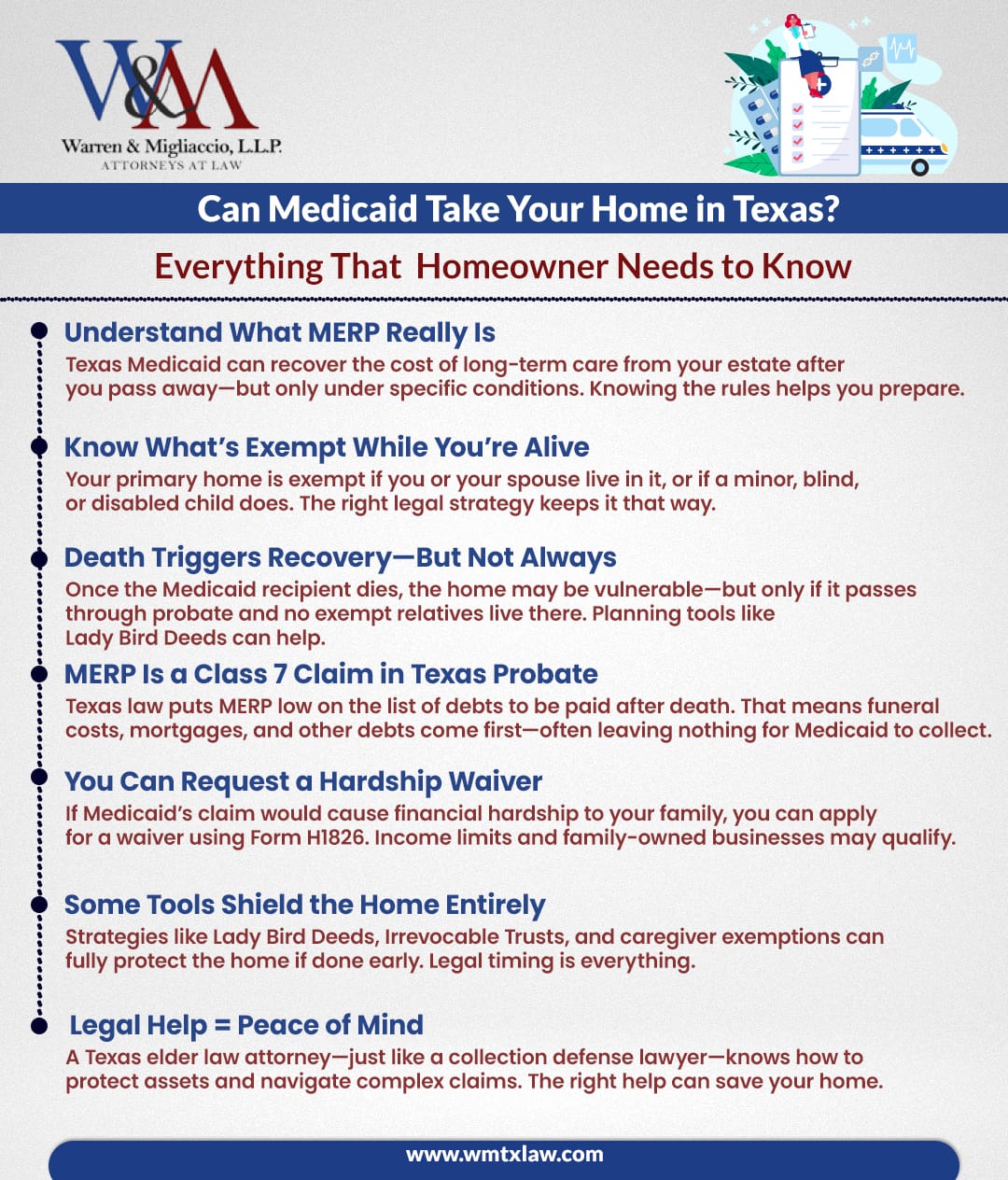

Need-to-Know Highlights for This Article

- Medicaid cannot take your home while you are alive; recovery only happens after death from your probate estate.

- Your home is protected if your spouse, minor child, or disabled child lives there, even after you pass away.

- Tools like a Lady Bird Deed let your home bypass probate, protecting it from the state’s recovery claim.

- Start planning at least five years before needing care to avoid penalties from Texas’s 5-year look-back rule.

This comes from my own experience in Texas estate planning and elder law, plus current state statutes, guidance from Texas Health & Human Services (HHSC), and federal Medicaid Estate Recovery Program rules. Medicaid is administered by each state’s medicaid program under federal law, which requires real estate recovery in certain situations.

Medicaid Estate Recovery in Texas: What Homeowners Must Know

What Is the Medicaid Estate Recovery Program (MERP)?

The Medicaid Estate Recovery Program is a federal rule that lets states recover costs from the estates of certain Medicaid recipients after they die. MERP applies to Medicaid beneficiaries who received long-term care services, and the state may collect reimbursement for those costs from their estate. Basically, it’s the government trying to get reimbursed for long-term health care benefits they provided. Medicaid can recover costs from the estate of recipients who were permanently institutionalized or 55 and older at the time of receiving benefits.

In Texas, MERP can go after costs for:

- Nursing facility services

- Home and community-based services

- Hospital services tied to nursing facility care

- Prescription drug services

Texas-Specific MERP Rules vs. Federal Baseline

Texas has its own spin on the federal guidelines. Estate recovery rules are determined by state laws, which can differ from federal requirements and vary from state to state. What stands out here?

- Recovery only happens after the recipient dies

- The state files a claim against the probate estate

- Texas limits recovery to probate assets (not everything you own)

- There are exemptions for certain surviving family members, such as a surviving spouse, a minor child under 21 years old, or a disabled or blind child of any age.

One client I worked with had a mother on Medicaid for three years. Because we set up her assets the right way, the state couldn’t touch the family home after she passed.

How Medicaid Recovery Differs From Medicare

People mix up Medicare and Medicaid recovery all the time. Here’s the main thing:

- Medicare: Doesn’t do estate recovery

- Medicaid: Can recover costs through MERP

Medicare is something you pay into through taxes. Medicaid is needs-based, so that’s why recovery rules exist. The federal government requires states to implement Medicaid estate recovery, but does not require it for Medicare.

Can the State’s Medicaid Take Your Home? Myth vs. Reality

When a Primary Residence Is Exempt While You’re Alive

Here’s the critical part: Texas Medicaid can’t take your home while you’re alive. Your primary residence is exempt from Medicaid’s asset limits if:

- You live there

- Your spouse lives there

- Your minor child (under 21) lives there

- Your disabled child of any age lives there

Submitting a home statement, such as an ‘Intent to Return Home’ declaration, can help protect your home ownership status and ensure the residence remains exempt from Medicaid asset calculations.

The home stays protected as long as you intend to return, even if you’re in a nursing facility.

Triggers That Turn Your Home Into a Recoverable Asset at Death

Your home can become vulnerable to MERP when:

- You pass away

- No exempt person is living in the home

- The home goes through probate

- You received Medicaid benefits after age 55

- Medicaid has a limited timeframe to file for estate recovery after the death of a Medicaid recipient. In Texas, MERP generally files a claim within 70 days after receiving actual notice of death, and can file a claim at any time before the estate is closed or within 4 months of receiving notice from the estate administrator. However, Medicaid typically has a one-year limit to file for estate recovery after the recipient’s death.

If the home is sold after the Medicaid recipient’s death, the proceeds from the sale become a countable asset of the estate and may be used to satisfy MERP claims.

Real-World Examples: Nursing Home vs. In-Home Care Outcomes

Let me give you two quick stories:

Case 1: Mrs. Johnson got nursing home care for five years. She owned a $300,000 home. When she died, MERP filed a $280,000 claim against her estate, and her kids had to sell the house. After the death of a Medicaid recipient, the state will attempt estate recovery and seek reimbursement for the cost of long-term care through the sale of the home.

Case 2: Mr. Garcia got home-based care. We helped him use a Lady Bird Deed before he applied for Medicaid. When he passed, the home avoided probate, so MERP couldn’t touch it.

Case Study: MERP Claims as Class 7 Probate Claims in Texas

Under Texas Estates Code § 355.102, Medicaid Estate Recovery Program (MERP) claims are classified as Class 7 claims in probate. This means they are paid only after six other classes of claims get paid first. These priority claims include secured debts like mortgages and funeral expenses. The probate process determines how real property and other assets are distributed and which claims are paid first.

In practice, this classification limits MERP’s ability to recover money from estates that already have debts. For example:

- Secured creditors must be paid before MERP.

- Funeral expenses get priority payment.

According to Texas Health and Human Services data, the largest single MERP recovery in 2023 was about $424,000 from an estate in Travis County. However, many estates valued below $10,000 are considered not cost-effective for MERP to pursue.

Why does this matter? Because even when MERP files a valid claim:

- Secured creditors and other priority claims must be paid first.

- Often, little or no money is left for Medicaid recovery.

This is especially important for families trying to keep modest inheritances safe.

Medicaid Eligibility, Asset Limits & Home Equity for 2025

Texas Asset Limit, Look-Back Period & Penalty Period Explained

For 2025, Texas Medicaid has some tough financial rules:

Asset Limits:

- Individual: $2,000

- Married couple (both applying): $3,000

- Community spouse resource allowance: Up to $$157,920.

- The asset limit for a single individual applying for nursing home Medicaid is generally set at $2,000.

Exceeding these asset limits can make you ineligible for Medicaid until your assets are spent down or otherwise protected.

Look-Back Period:

- 5 years for all asset transfers

- Gifts or below-market transfers can trigger penalties

Penalty Period Calculation:

- Total transferred amount ÷ Average monthly nursing home cost = Months of ineligibility

Home Equity Interest Caps ($730k–$1.097M) and How They Apply

Texas uses the federal minimum home equity limit. For 2025:

- The home equity limit is $730,000 for a single applicant

- If your home equity exceeds $730,000, you cannot qualify for Medicaid unless:

- Your spouse lives in the home (no equity limit applies)

- Your child under 21 lives in the home

- Your blind or disabled child lives in the home; in this case, the home is considered an exempt asset and does not count against Medicaid’s asset limit

- Home equity is calculated as the home’s value minus any outstanding mortgage or debt

- This limit applies to nursing home Medicaid and Home and Community-Based Services (HCBS) waiver programs. The home equity interest limit for Medicaid is generally between $730,000 and $1,097,000 depending on the state in 2025.

Effect of Nursing Home Care and Other Long-Term Care Costs on Eligibility

Texas nursing home care averages $6,000–$8,000 a month. These costs matter for eligibility because:

- You must spend down assets to qualify (often referred to as a Medicaid spend down)

- Your income goes toward care costs

- Only $75 a month is set aside for personal needs

Exemptions & Undue Hardship Rules That Protect the Home

Surviving Spouse, Minor or Disabled Child, and “Family Member Caregiver” Exemptions

Texas MERP can’t recover if these folks live in the home:

- Surviving spouse (permanent protection)

- Child under 21 (protected until age 21)

- Disabled child (permanent protection)

- Sibling with equity interest who lived there at least a year before institutionalization (this is known as the sibling exemption)

- Adult children caregivers who lived there two years or more and delayed your institutionalization

- If a Medicaid recipient has a disabled child, the home is exempt from Medicaid estate recovery. Homes occupied by disabled or blind adult children are completely exempt from Medicaid estate recovery. Additionally, the Caregiver Child Exemption allows a parent to transfer their home to an adult child without violating Medicaid’s Look-Back Rule under certain conditions.

The “Return Home” & Community Spouse Protections

Your home stays exempt if:

- You intend to return home (a doctor’s note helps)

- Your spouse keeps living there (sometimes called the non applicant spouse)

- It’s still your primary residence

How to Request a Texas MERP Hardship Waiver (Forms, Deadlines, Evidence)

You can ask for a hardship waiver by:

- Filing within 60 days of the MERP notice

- Using HHSC Form H1826

- Providing evidence like:

- Income below 100% of the federal poverty level

- Disability documentation

- Proof it’s the primary residence

- Evidence of a family farm or business

Thus, obtaining a hardship waiver can help families maintain financial security during difficult times.

Asset Protection & Estate Planning Strategies That Work

Medicaid Planning with a Texas Elder Law Attorney

Good planning should start early. We usually: Working with experienced elder law attorneys and engaging in careful planning can help protect your home from Medicaid estate recovery.

- Firstly, inventory all assets and their values

- Also, check home equity against Medicaid limits

- Additionally, estimate care costs based on health

- Create a timeline for protection strategies

- Planning with a qualified Medicaid attorney can help implement effective strategies to protect homes from Medicaid estate recovery. The timing of asset transfers to an irrevocable trust is crucial to avoid penalties from Medicaid’s Look-Back Rule.

- Inventory all assets and their values

- Check home equity against Medicaid limits

- Likewise, estimate care costs based on health

- Finally, create a timeline for protection strategies

Deed & Trust Tools

Here are the main tools we use in Texas:

Lady Bird Deed (Enhanced Life Estate)

- Pros: Keeps control, avoids probate, protects from MERP

- Cons: Needs to be done before Medicaid application

Standard Life Estate

- Pros: Removes home from estate

- Cons: Can trigger a gift penalty, you lose control

- Establishing a life estate can protect a home from Medicaid estate recovery by retaining ownership for the individual until death. Creating a life estate deed is a common estate planning tool that allows the property owner to keep certain rights during their lifetime while ensuring the home transfers automatically after death, avoiding probate and Medicaid recovery.

- Pros: Removes home from estate

- Cons: Can trigger a gift penalty, you lose control

Irrevocable Trusts

- Pros: Strong asset protection

- Cons: Five-year look-back, permanent loss of control

- Establishing an irrevocable trust can protect one’s home from Medicaid claims, as it ensures the individual no longer holds ownership of the home. Irrevocable trusts are often used in Medicaid planning to safeguard assets like homes from Medicaid estate recovery, but must comply with transfer rules and timing requirements. An irrevocable trust must retain the home until the death of the individual to fully avoid Medicaid recovery issues.

- Pros: Strong asset protection

- Cons: Five-year look-back, permanent loss of control

Leveraging Long-Term Care Insurance, Annuities & Community-Based Services

Other strategies can include:

- Long-term care insurance: Pays for care so you don’t need Medicaid

- Medicaid-compliant annuities: Turn assets into an income stream

- Community-based options: PACE programs, adult day care, and so on

Hence, protecting other assets, such as bank accounts, is also important in Medicaid planning to help safeguard your financial resources from estate recovery.

Navigating MERP Notices, Probate & Appeals

Timeline: From Recipient’s Death to MERP Claim Filing

The MERP process usually goes like this:

- Medicaid recipient’s death occurs

- 30–90 days: Family notifies HHSC

- 4–6 months: MERP reviews the case

- 6–12 months: Claim filed in probate

- 13 months: MERP claim deadline

Probate vs. Non-Probate Estate—Why Titling Matters

Texas MERP can only recover from probate assets. This really matters:

Probate Assets (at risk for MERP):

- Property in your name only

- Assets without beneficiary designations

Non-Probate Assets (protected from MERP):

- Joint accounts with survivorship

- Assets with beneficiary designations

- Property in trusts

- Lady Bird Deed property

Thus, if just one spouse is applying for Medicaid, transferring the home to the non-applicant spouse or placing it in certain trusts can help protect the home from MERP.

Step-by-Step Appeal Strategy if You Believe MERP Is Wrong

If you get a MERP claim you think is off-base:

- Firstly, review the claim amount versus actual benefits received

- Secondly, check the dates—only benefits after age 55 count

- Also, double-check exemptions weren’t missed

- Additionally, file a written objection within 30 days

- Request an administrative hearing if needed

- Finally, send in your supporting documents

Step-by-Step Checklist: Safeguarding a Texas Home Before & After Medicaid

Here’s a checklist to keep your home safe:

5+ Years Before Needing Care:

- Meet with an elder law attorney

- Review your property deeds

- Think about a Lady Bird Deed

- Update estate planning documents

When Applying for Medicaid:

- Make sure your home equity is under the limit

- Verify if exemptions apply

- Gather all financial records

- Document your intent to return home

After Death:

- Notify HHSC quickly

- Respond to MERP notices right away

- Understand that the state may seek recovery because the state paid for long-term care services through Medicaid

- Check if you qualify for a hardship waiver

- File appeals on time if needed

- Keep all documentation

When to Seek Professional Help

Selecting the Right Texas Elder Law Attorney & Estate Planning Attorney

Before you look for attorneys who: consider how to choose the right attorney to ensure you select the best fit for your needs.

- Firstly, specialize in elder law and Medicaid planning

- Likewise, know Texas MERP rules inside and out

- Understand your county’s quirks

- Also, offer full-service planning

Coordinating With Financial Planners, Care Facilities & Insurance Advisors

Your team should include:

- Firstly, an elder law attorney (as the main coordinator)

- Secondly, a financial planner who gets Medicaid

- Thirdly, a health insurance advisor for long-term care options

- Your care facility administrator

- Likewise, consulting with a Medicaid planner or elder law attorney can help ensure that strategies are correctly implemented to protect the home from Medicaid recovery processes.

Documenting Advice for Future Probate & MERP Review—E-A-T Best Practice

Always keep records of:

- Firstly, attorney meetings and advice

- Additionally, asset values and transfers

- Doctor’s statements about returning home

- Also, caregiver arrangements

Conclusion

Medicaid Estate Recovery in Texas is complex—but with the right knowledge and proactive planning, your family home doesn’t have to be at risk. By understanding how MERP works, which assets are protected, and what steps to take before and after Medicaid enrollment, you can make informed choices that protect your legacy and your loved ones’ future.

If you’re navigating long-term care planning or worried about preserving your home from estate recovery, it’s not too early—or too late—to get legal guidance. Our Texas-based estate planning attorneys are here to help you understand your options and craft a plan tailored to your family’s needs. Call us at (888) 584-9614 or reach out online to schedule your FREE consultation today.

Frequently Asked Questions

Estate Planning Tools & Protections

Can a Lady Bird Deed bypass MERP in Texas?

Yes. If you set up a Lady Bird Deed before applying for Medicaid, your home transfers outside probate. Texas MERP only recovers probate assets, so your house is safe. You still keep full control—you can sell or refinance if you want.

How does the caregiver child exemption work for MERP?

If your adult child lived with you for at least two years before you needed nursing home care and helped delay that move, the home is exempt from MERP. Be sure to document their residency and the care they provided.

Can Medicaid take jointly owned property in Texas?

Only if your share of the property goes through probate. If the property has survivorship rights, it passes directly to the co-owner and avoids MERP recovery.

What assets are exempt from Texas MERP?

Non-probate assets are exempt. That includes:

- Property transferred with a Lady Bird Deed

- Retirement accounts with named beneficiaries

- Joint accounts with rights of survivorship

- Life insurance policies with named beneficiaries

Medicaid Recovery & Liens

Can Medicaid take your house after death in Texas?

Yes, through the Medicaid estate recovery program, Texas can recover costs from probate assets if there aren’t any exemptions (like a surviving spouse, minor, or disabled child). But if your home passes outside probate—like with a Lady Bird Deed or joint ownership with survivorship—it’s protected.

Does Medicaid put a lien on your home while you’re alive?

No, Texas doesn’t allow pre-death Medicaid liens on your primary home. There’s a rare exception—a TEFRA lien—if you’re permanently in a nursing facility and not planning to return home.

Spouse & Family Considerations

What happens to my home if my spouse lives there?

Your home stays protected. As long as your spouse lives in the house, it’s exempt from Medicaid asset limits and MERP recovery, even after you pass away.

However, when the surviving spouse dies, the home may become subject to Medicaid estate recovery unless another exemption applies.

Planning & Eligibility

How far back does Texas Medicaid review asset transfers?

Texas Medicaid looks at asset transfers made within five years of your application. If you gave away assets or sold them below market value during that time, you’ll face a penalty period that delays eligibility.

Are retirement accounts safe from MERP?

Yes, as long as your retirement accounts (like IRAs or 401(k)s) have named beneficiaries, they bypass probate and are safe from MERP. But if the account pays out to your estate, it’s at risk for recovery.

What’s the home equity limit for Texas Medicaid in 2025?

The home equity limit is $730,000 for 2025. If your spouse, minor child, or disabled child lives in the home, there’s no equity limit. If your equity is over $730,000 and no exemption applies, you won’t qualify.

How soon should I start Medicaid planning to protect my home?

Ideally, start at least five years before you might need long-term care. That way, you can transfer assets without penalty. Even if it’s last minute, options like Lady Bird Deeds or exempt transfers can still help.

What are the estate value thresholds for Texas MERP claims?

Texas usually doesn’t pursue MERP claims if the estate is worth less than $10,000 or if Medicaid costs were under $3,000. These rules help protect smaller estates from recovery.

How do I apply for a MERP hardship waiver in Texas?

To apply, you’ll need to file Form H1826 within 60 days after you get a MERP claim notice. Make sure to include documents that show hardship—think proof of income below the federal poverty level, documentation of disability, or evidence that the home is where family members live or supports a family farm or business.

Christopher Migliaccio is an attorney with Warren & Migliaccio, L.L.P. He serves families all across Texas with estate planning and elder law issues. This article is just for informational purposes and isn’t legal advice. If you want guidance for your own situation, give our office a call at (888) 584-9614.