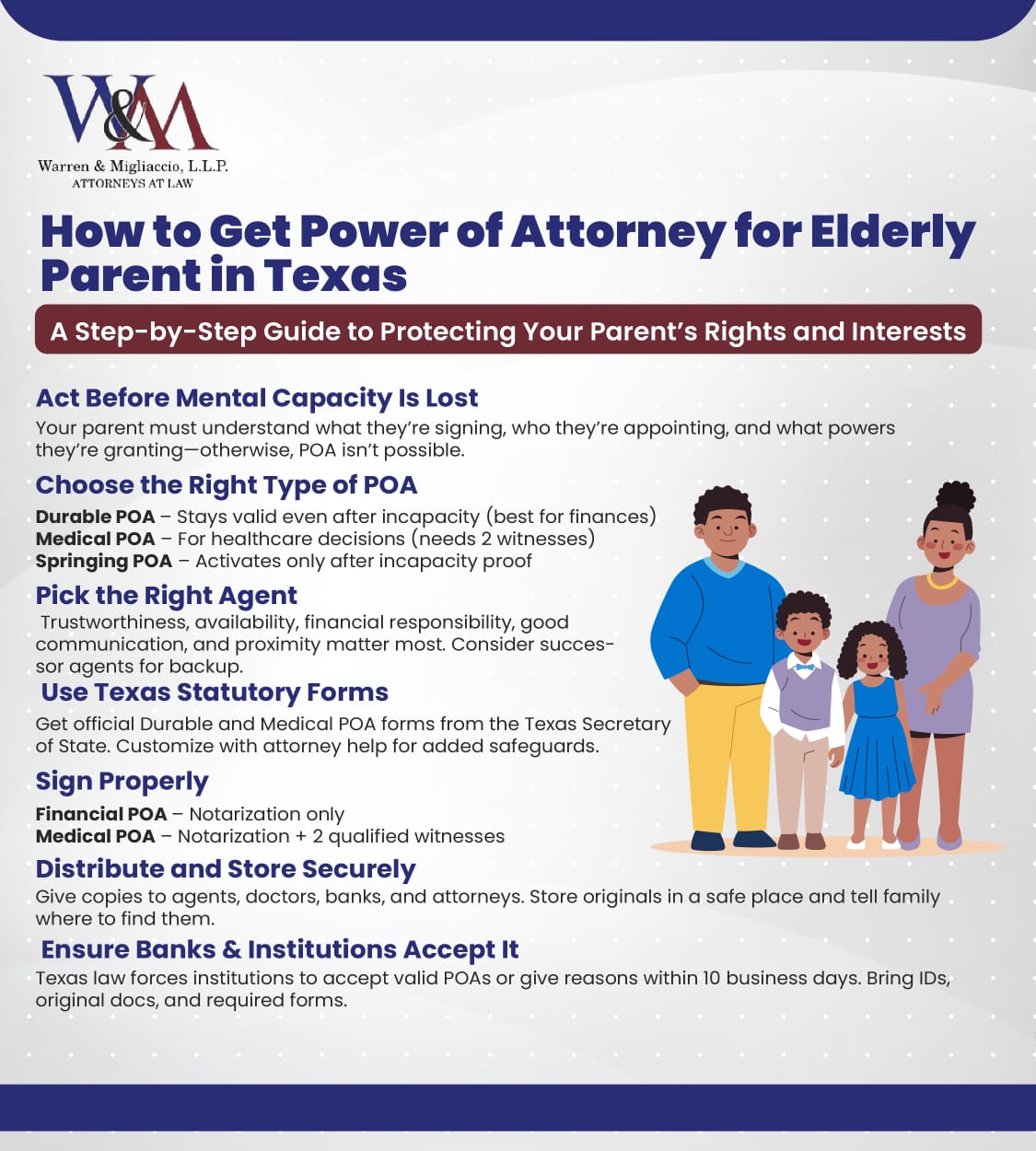

In Texas, you secure power of attorney for an elderly parent by having them, while still mentally competent, sign the state’s durable and medical POA forms before a notary (plus two witnesses for medical), then distribute certified copies to agents, banks, and healthcare providers.

Quick Answer: How do you get power of attorney for an elderly parent in Texas?

Have your mentally-competent parent sign Texas statutory durable and medical POA forms before a notary (plus two witnesses for medical) and give certified copies to banks, doctors, and agents.

- Discuss wishes, choose agent early.

- Complete Texas statutory durable and medical POA forms.

- Sign before notary (two witnesses medical) and circulate copies.

Essential Points

- Act before capacity is lost to avoid guardianship costs.

- Pair durable financial and medical POAs for complete coverage.

- Select trustworthy, available agents and name successors.

- Notarize, witness, then distribute certified copies promptly.

Introduction

Worried a sudden illness could leave Mom’s bills unpaid or Dad unable to make important medical decisions? You are not alone. Every day, many Texas families face this concern as their parents get older.

The good news is that with proper planning, you can protect your parent’s interests before a crisis happens. Setting up a power of attorney before it is needed helps avoid complicated legal processes later.

Since 2006, our Texas estate planning attorneys have helped Texas families with these important decisions. Managing attorney Morgan Gill has guided countless families through the power of attorney process with care and skill.

This guide will walk you through everything you need to know about how to get power of attorney for an elderly parent in Texas. We cover:

- Different types of power of attorney

- How to make sure banks and hospitals accept your documents

- Steps to protect your family’s future

Key Takeaway: You must act before your parent loses mental capacity. Once mental capacity is lost, you can no longer get power of attorney. Also, an adult child cannot create a power of attorney for a parent without the parent’s permission.

If you have questions about your situation, we offer free consultations. Call us at (888) 584-9614 to speak with our team today.

Understanding Power of Attorney Under Texas Law

Power of attorney is a legal document that allows one person (the principal) to give another person (the agent) the authority to make decisions on their behalf. The person appointed to act on behalf of the principal is called the attorney in fact. In simple terms, it’s like giving someone permission to act in your place when you can’t or don’t want to handle certain matters yourself. Creating a power of attorney generally requires the principal to voluntarily initiate the process.

Texas law recognizes several key areas where an agent can act:

- Financial decisions: Managing bank accounts, paying bills, handling investments, filing tax returns

- Medical care: Making healthcare decisions, choosing treatments, accessing medical records, communicating with healthcare providers

- Legal matters: Signing contracts, filing paperwork, representing interests in court, managing litigation, signing documents on behalf of the principal

- Property management: Buying, selling, or managing real estate, handling rental properties, maintaining assets

The agent’s authority is defined by the specific language in the power of attorney document, which sets the scope and limitations of what the agent can do.

The Texas Estates Code §§ 751.001–.002 provides the legal framework for these arrangements. These statutes require the use of formal legal forms that must be properly completed to establish authority. This ensures that power of attorney documents meet specific requirements to protect both the principal and third parties who rely on the agent’s authority.

Why Capacity Matters Before You Sign

Mental capacity is the foundation of any valid power of attorney. Your parent must have a “sound mind” when signing the document. This legal standard means they understand:

- What they’re signing – The nature and purpose of the power of attorney document

- Who they’re choosing as their agent – The identity and relationship of the person they’re appointing

- What powers they’re giving away – The specific authorities being granted

- The consequences of their decision – How this affects their autonomy and control

The principal’s capacity is assessed by both legal and medical professionals to ensure the individual is mentally capable of making these decisions. Courts may require evidence of the principal’s capacity to validate or challenge a power of attorney, especially to prevent elder abuse or undue influence.

If your parent shows signs of dementia or other cognitive decline, time becomes critical. A dementia diagnosis can be a critical factor in determining capacity for granting POA, as legal professionals often rely on such a diagnosis to assess whether your parent can consent to legal documents. Once mental capacity is lost, it’s too late for a simple power of attorney. The family would then need to pursue guardianship through the courts, which typically costs $5,000-$15,000 and takes 60-120 days.

Key Takeaway: A physician’s evaluation can help establish capacity even in early-stage dementia. Don’t assume it’s too late without professional assessment.

We offer free 30-minute consultations to help evaluate your parent’s situation and determine the best path forward. Don’t wait until it’s too late to protect your family’s interests.

Choosing the Right Agent to Protect Your Parent’s Interests

Selecting the right person to serve as your parent’s agent is one of the most important decisions in the power of attorney process. This person will have significant authority over your parent’s life, so careful consideration is essential. The agent must always act in the principal’s best interest, especially when making healthcare or financial decisions.

When considering who to appoint as an agent, it is important to involve children in the process and document their roles to ensure clarity and preparedness for future scenarios.

It is advisable to have a secondary holder of the power of attorney named in case the primary, or original agent, is unavailable. Specifying successor agents helps ensure smooth decision-making if the original agent cannot serve.

Our 5-Point Checklist for Choosing an Agent:

- Trustworthiness: The agent must act in your parent’s best interests, not their own—look for someone with a proven track record of integrity

- Availability: They should be accessible when decisions need to be made, whether for routine matters or emergencies

- Financial responsibility: Understanding of money management and experience working with financial institutions

- Communication skills: Ability to work with healthcare providers, family members, financial advisors, and legal professionals

- Geographic proximity: Close enough to handle urgent matters when needed, though remote management is increasingly viable

Many families also consider naming:

- Co-agents who must act together (provides checks and balances but can slow decision-making)

- Successor agents who step in if the first choice becomes unable to serve (ensures continuity). Having multiple agents named on a power of attorney typically requires strong communication among agents.

The best agent is often an adult child, but it could be a trusted friend, family member, or professional fiduciary. The key is choosing someone who will honor your parent’s wishes and protect their interests above all else.

A Personal Story from Attorney Migliaccio

I once worked with a family where the eldest daughter assumed she’d be her mother’s agent. She lived nearby, handled most family updates, and had a history of being “the responsible one.” But during our meeting, something surprising came up.

The mother hesitated over financial decisions. Her younger son, who lived in Houston, had the stronger financial skills. He was a CPA with a flexible schedule. The daughter admitted she felt swamped by paperwork. She was also recovering from a stressful divorce, which limited her time.

We found a simple solution—divide the roles. This meant naming two agents in the power of attorney. Each would handle the tasks they were best at. The son became the financial agent, managing investments, taxes, and property. The daughter became the medical agent, using her closeness and empathy to make care decisions.

Six months later, the mother had a stroke. The son handled insurance and bills from Houston using online tools. The daughter worked with doctors at her mother’s bedside in Dallas. They stayed in sync and played to their strengths.

The lesson was clear: the “obvious” choice isn’t always the best one. Parents should look beyond assumptions and choose based on skills. And yes—splitting duties can be the smartest move.

Types of Power of Attorney in Texas and When Each Fits

Texas law provides several types of power of attorney, each designed for different circumstances. One common type is the limited power of attorney, which grants specific, restricted authority to an agent for particular actions or responsibilities as detailed in the legal document. Understanding these options helps you choose the right legal instrument for your parent’s specific needs.

| Type | Stays Valid if Incapacitated? | Common Use | Key Considerations |

|---|---|---|---|

| General POA | No | Short-term real estate closing, temporary absence | Automatically void upon incapacity |

| Durable POA | Yes | Ongoing financial control, property management | Most crucial for elderly parents |

| Medical POA | N/A | Healthcare decisions when parent cannot communicate | Requires 2 witnesses + notary |

| Springing POA | Yes (on trigger) | Future incapacity planning | Can create delays in acceptance |

Understanding Each Type:

Types of Power of Attorney

- General Power of Attorney gives broad authority but becomes invalid if your parent loses mental capacity. This type works well for temporary situations, like when your parent travels abroad or needs help with a specific transaction. However, it fails exactly when elderly parents need it most.

- Durable Power of Attorney remains valid even if your parent becomes incapacitated. The word “durable” is crucial—it means the document survives mental decline, making it the most useful tool for aging parents. This type handles financial affairs, legal matters, and property management even after capacity is lost.

- Medical Power of Attorney focuses specifically on healthcare decisions. Your parent can authorize someone to make medical choices, communicate with healthcare providers, and access medical records. This document requires two witnesses in addition to notarization under Texas law.

- Springing Power of Attorney only becomes effective when a specific trigger occurs, usually when a physician certifies your parent has become incapacitated. While this preserves your parent’s autonomy longer, it can create delays when the agent needs to prove the triggering event has occurred. Banks and healthcare providers often require extensive documentation.

Step-by-Step Guide: Creating a Valid Texas POA

Creating a power of attorney for your elderly parent involves several important steps. Establishing a POA can provide clarity for families by clearly outlining decision-making roles and minimizing misunderstandings. Following the proper process ensures the document will be legally valid and accepted by third parties when needed, helping to avoid future complications related to legal or financial matters.

Step 1: Discuss Wishes with Parent and Family Members

Start with an honest conversation about your parent’s wishes and concerns. Include other family members to avoid conflicts later. Creating a power of attorney should include discussions with family members to avoid tensions later. Topics to cover include:

- Which powers to grant (financial, medical, or both)

- Who should serve as agent(s)

- Specific instructions or limitations

- End-of-life preferences for medical decisions

- How to handle potential family disagreements

- Ensuring the POA aligns with the principal’s wishes

Key Considerations When Creating a Power of Attorney

- Which powers to grant (financial, medical, or both)

- Who should serve as agent(s)

- Specific instructions or limitations

- End-of-life preferences for medical decisions

- How to handle potential family disagreements

- Ensuring the POA aligns with the principal’s wishes

Pro Tip

Consider recording this conversation (with permission) to document your parent’s wishes and mental clarity.

Step 2: Select the Appropriate Form

Texas provides statutory forms that meet legal requirements. The Texas Statutory Durable Power of Attorney form is available through the Texas Secretary of State’s office. For medical decisions, use the Texas Medical Power of Attorney form.

You can customize these forms to add specific instructions or limitations. However, major changes may require attorney guidance to ensure validity.

Step 3: Draft or Customize with Attorney Guidance

While Texas forms are legally sufficient, many families benefit from attorney review. Establishing a power of attorney (POA) and other essential estate planning documents often requires significant attorney work, including paperwork and legal proceedings. An experienced estate planning attorney can:

- Explain complex provisions in understandable terms and demonstrate how an attorney works to ensure the POA is properly drafted and implemented

- Add custom instructions tailored to your family

- Ensure the document fits your parent’s specific circumstances and complies with state requirements, which is why consulting a lawyer is important for legal validity

- Coordinate with other estate planning documents

- Prevent common mistakes that cause rejection

When seeking professional help, consider lawyers who specialize in elder law and estate planning.

Step 4: Sign Before a Notary

Financial power of attorney requires only notarization. Your parent must sign the document in the presence of a notary public who verifies their identity and mental capacity. The signed power of attorney documents must be notarized to be legally valid in many jurisdictions, including Texas. It is also important to ensure that the signed and notarized documents are properly filed and securely stored for future reference.

Medical power of attorney requires both notarization and two witnesses. The witnesses cannot be:

- Related to your parent by blood or marriage

- Named as agents in the document

- Entitled to any part of your parent’s estate

- The attending physician or healthcare provider employee

Step 5: Distribute and Store Properly

Make copies for:

- The designated agent(s)

- Primary healthcare providers

- Financial institutions

- Family members who need to know

- Your parent’s attorney

The agent should understand their financial responsibilities, including ensuring that bills are paid and all financial obligations are met on time.

Store the original document in a fireproof safe or safe deposit box. Keep digital copies accessible for emergencies. Tell trusted family members where to find the documents when needed.

Key Takeaway: Proper execution and distribution are just as important as drafting. A perfectly written POA is useless if no one can find it when needed. Naming a successor agent offers an extra layer of protection for the principal.

Related Guide: How to Create a Power of Attorney

After Execution—Getting Banks and Third Parties to Honor Your POA

Even with a valid power of attorney, banks and other institutions may be slow to accept it. Ensuring the POA meets legal requirements and is ready for use is key to protecting the principal’s interests. While Texas law offers support, advance preparation makes the process far smoother.

Texas Legal Protections

The 2017 changes to Texas Estates Code §751.201–.208 require institutions to either accept a valid power of attorney or provide written reasons for refusal within 10 business days. This gives families legal recourse if institutions unreasonably refuse valid documents. They can face penalties including court costs and attorney fees.

Documents Banks Often Request:

- Firstly, original or certified copy of the power of attorney

- Also, valid government-issued ID for the agent

- Physician letter (for springing power of attorney)

- Death certificate if successor agent is acting

- Additionally, affidavit confirming the document remains in effect

- Finally, bank’s internal POA acceptance forms

Strategies for Smooth Acceptance:

When using a springing power of attorney, include a doctor’s letter confirming your parent’s incapacity. This medical proof shows the triggering event has happened.

Some banks or institutions may ask the agent to sign their own forms or provide extra documents. It can feel frustrating, but meeting reasonable requests helps build the working relationship your parent’s agent will need.

Pro Tip: Visit banks with your parent while they’re still capable. Introduce the agent and finish any needed paperwork ahead of time.

Guardianship vs. Power of Attorney: Last-Resort Options

When power of attorney isn’t possible or enough, guardianship is the alternative. A power of attorney lets someone plan for their affairs to be handled as they wish if they become incapacitated. Knowing the differences helps families make informed choices to protect an elderly parent’s interests.

The Guardianship Process in Texas

Guardianship is needed when someone can’t make their own decisions and has no valid power of attorney. In that case, the court appoints a guardian to act for the incapacitated person, called the ward.

In Dallas County Probate Court, the process usually includes:

- Firstly, filing fees of $1,000-$2,000

- Also, attorney fees of $5,000-$15,000

- Additionally, a timeline of 60-90 days minimum

- Ongoing annual reporting to the court

- Finally, court approval for major decisions

Comparing Your Options:

Pros of Power of Attorney:

- Private family decision

- Less expensive to create ($350-$750)

- Immediate effectiveness

- Maintains parent’s dignity

- Flexible and adaptable

- No ongoing court supervision

Cons of Power of Attorney:

- Requires mental capacity to create

- Potential for abuse without oversight

- May be challenged by family members

- Some institutions reluctant to accept

Pros of Guardianship:

- Court oversight protects against abuse

- Comprehensive authority over all decisions

- Clear legal framework for disputes

- Strong third-party acceptance

Cons of Guardianship:

- Expensive and time-consuming

- Public court proceedings

- Ongoing court supervision

- Limited flexibility for the ward

- Loss of personal autonomy

- Annual accounting requirements

Key Takeaway: Power of attorney is almost always preferable when your parent still has mental capacity. Guardianship serves as the safety net when planning didn’t happen in time, but it should remain the absolute last resort.

Safeguards Against Elder Financial Abuse

Because power of attorney grants broad authority, safeguards are vital to prevent financial abuse. First, an elder law attorney can ensure documents are accurate and tailored. Next, while Texas law offers safeguards, families must stay alert. Finally, strong documentation and legal oversight help protect an elderly parent’s long-term care.

Legal Protections and Penalties

Agents have fiduciary duties under Texas law, meaning they must act solely in your parent’s best interests. Violating these duties can result in criminal penalties under Texas Penal Code §32.45, including potential felony charges for financial exploitation of the elderly.

Family Oversight Strategies:

- Require annual accountings of all financial transactions

- Set up dual signature requirements for large expenditures (over $5,000)

- Schedule regular family meetings to review finances quarterly

- Use separate agents for medical and financial decisions

- Consider professional oversight through annual CPA reviews

- Create transparency through shared online banking view-only access

Warning Signs of Potential Abuse:

- Unexplained changes in financial accounts or spending patterns

- Missing valuable items or sudden property transfers

- Agent living beyond their apparent means

- Isolation of the elderly parent from other family members

- Refusal to provide financial records or explanations

- Unusual changes to estate planning documents

If you suspect financial abuse, document everything and seek legal help immediately. Time is critical in recovering assets and protecting your parent from further harm. We offer free consultations to families dealing with suspected elder abuse situations.

Case Study: In re Estate of Kuykendall, 206 S.W.3d 766 – A Texas Warning

The Facts That Shocked Texas Courts

In In re Estate of Kuykendall, 206 S.W.3d 766 (Tex. App.—Texarkana 2006, no pet.), a daughter used her durable power of attorney to transfer her mother’s valuable ranch property—worth hundreds of thousands of dollars—to herself for just one dollar. The daughter claimed this was a “gift” her mother intended to make.

The Court’s Powerful Response

When other family members challenged this blatant self-dealing, the Texas Court of Appeals delivered a decisive ruling that continues to protect elderly Texans today:

- Voided the deed completely, returning the property to the mother’s estate

- Removed the daughter as agent immediately

- Established clear precedent that agents cannot enrich themselves

- Emphasized fiduciary duties are sacred and enforceable

Why This Case Matters for Your Family

The Kuykendall ruling demonstrates that Texas courts will actively intervene when agents abuse their power. The court stated that agents must act with the “utmost good faith” and cannot use their position for personal gain—even if they believe the principal would have approved.

This case provides three critical lessons for Texas families:

- Document everything – The daughter’s lack of documentation about her mother’s supposed “gift” intent proved fatal to her claim

- Avoid even the appearance of self-dealing – Agents should never transfer assets to themselves without independent documentation

- Courts will protect the vulnerable – Texas judges take elder financial abuse seriously and will reverse improper transactions

Key Takeaway: Detailed instructions in your POA document and honest record-keeping protect both your parent and the agent from legal challenges. Consider requiring independent approval for any transfers to family members.

[Source: Texas Court of Appeals, Texarkana – Public Record]

Keeping Your POA Current and Effective

A power of attorney isn’t a “set it and forget it” document. Regular review ensures it continues to meet your parent’s needs and complies with current Texas law.

Critical Review Triggers:

Review your parent’s POA annually and immediately after:

- Moving to a different county or state

- Death or incapacity of the named agent

- Major changes in family relationships (divorce, marriage, estrangement)

- Significant changes in Texas estate planning laws

- Major health changes affecting your parent’s needs

- Changes in financial situation or assets

Annual Review Checklist:

- Agent Assessment: Is the current agent still willing, able, and the best choice?

- Powers Review: Do the granted powers still match your parent’s current needs?

- Document Access: Are all copies current, accessible, and properly stored?

- Institution Updates: Do banks and healthcare providers have current contact information?

- Coordination Check: Do POA documents align with other estate planning documents?

- Legal Compliance: Have any Texas law changes affected your documents?

Best Practice Implementation:

We recommend families conduct this review each year around the same time, such as:

- Your parent’s birthday

- The anniversary of signing the original document

- During annual tax preparation

- At yearly medical checkups

This creates a routine that helps ensure nothing falls through the cracks and provides natural opportunities to discuss any needed changes with your parent while they still have capacity.

Our office provides a complimentary annual review worksheet to help families stay organized. This practical tool walks through key questions and helps identify when professional review might be beneficial.

Frequently Asked Questions

Basics & Process

How do you get power of attorney for an elderly parent in Texas?

Your parent signs Texas statutory forms while mentally competent, with proper notarization. The complete process takes 2-3 weeks.

Five essential steps:

Discuss wishes and select trusted agents

Choose durable power of attorney (POA) forms

Complete statutory forms with custom provisions

Sign before notary (add two witnesses for medical)

Distribute copies to agents, banks, healthcare providers

How much does it cost to set up a power of attorney in Texas?

Power of attorney costs range from $15 for DIY forms to $1,500 for attorney-drafted packages. Most families spend $350-$750 per document.

DIY statutory forms: $15-30 (notary only)

Attorney-reviewed POA: $350-$750

Complete estate package: $1,000-$1,500

Guardianship if too late: $5,000-$15,000+

Can you obtain power of attorney if a parent has dementia?

Yes, if your parent understands the document during a lucid moment. A doctor’s capacity evaluation during signing strengthens validity.

Your parent must comprehend:

What they’re signing

Who becomes their agent

Powers being granted

Consequences of the decision

What type of power of attorney is best for elderly parents?

Most Texas families need both durable financial POA and medical POA. These paired documents cover all major decisions after incapacity.

Durable Financial POA: Banking, property, taxes, bills

Medical POA: Treatment decisions, healthcare access

Avoid General POA: Becomes invalid at incapacity

Timing & Consequences

How long does it take to get power of attorney in Texas?

Form completion and notarization happen in one day. Full implementation typically finishes within 2-3 weeks.

Document drafting: 3-7 days

Signing/notarization: Same day

Bank acceptance: 10 business days per Texas law

Does power of attorney end at death in Texas?

Yes, all . Only the executor or court-appointed administrator can manage the estate afterward.

The agent loses all authority immediately. Banks freeze accounts once notified, requiring estate administration documents instead.

What happens if no POA exists when a parent becomes incapacitated?

Families must petition for court-ordered guardianship—an expensive, public process taking 60-120 days minimum.

Guardianship consequences:

Filing and attorney fees: $5,000-$15,000

Ongoing court supervision

Annual accounting requirements

Public loss of autonomy

Banks, Overrides & Challenges

Do Texas banks have to accept my parent’s power of attorney?

Yes, Texas Estates Code §751.201 requires banks to accept valid statutory POAs or provide written refusal within 10 business days.

Banks may request:

Original POA document

Agent’s government ID

Doctor’s letter for springing POAs

Who can override a power of attorney in Texas?

Only three parties can override POA: the principal while competent, Texas courts via guardianship proceedings, or successor agents if designated. A power of attorney can be revoked by the principal as long as they have the mental capacity to do so.

When a principal revokes a power of attorney, they must follow proper legal procedures, such as providing written notice to the agent and any relevant institutions, to ensure the revocation is effective and documented. Failure to properly document when a principal revokes a POA can lead to legal challenges or disputes regarding the agent’s authority.

Family members cannot unilaterally revoke valid POA. Courts require proof of incapacity at signing, undue influence, or agent misconduct.

Can siblings challenge power of attorney in Texas?

Yes, siblings can petition probate court alleging incapacity, undue influence, or agent abuse. Success requires substantial evidence.

Courts examine:

Unexplained asset transfers

Parent isolation from family

Missing financial records

Decisions against known wishes

Conclusion: Your Path Forward Starts Today

Getting power of attorney for an elderly parent isn’t only about legal form. It’s about protecting what matters most to your family. The process takes planning, honest talks, and careful attention to detail. Yet the peace of mind it brings is worth every step.

Remember These Critical Points:

- Time is your enemy – Mental capacity can disappear suddenly

- Choose agents wisely – Trust and competence matter more than family hierarchy

- Use durable POA – General POA fails when you need it most

- Follow Texas requirements exactly – Small mistakes can invalidate documents

- Plan for oversight – Protect against potential abuse with transparency

At Warren & Migliaccio, we believe in putting families first. Since 2006, our statewide estate planning practice has helped thousands of Texas families navigate difficult decisions with dignity and care. Over the years, we’ve seen how challenging it can be to watch a parent age, and that’s why we’re here to guide you through the legal steps that protect their interests.

Whether you live in Dallas, Houston, Austin, or anywhere else in Texas, we can help your family create the right power of attorney documents for your situation. In every case, our experienced attorneys take time to understand your parent’s wishes and your family’s dynamics. This ensures the documents we prepare truly reflect your loved one’s best interests.

Most importantly, don’t wait until a crisis forces tough decisions. Mental capacity can be lost in an instant—through stroke, accident, or sudden cognitive decline. By acting now, you can create documents that may save your family thousands of dollars and countless hours of stress later.

Take Action Now:

Schedule your free consultation today to discuss your family’s estate planning needs. Our experienced Texas estate planning attorneys can help you protect your parent’s future.

Call us at (888) 584-9614 or visit our website to book an appointment online anytime. We have offices in Richardson, Dallas, and Prosper. Likewise, we offer virtual consultations statewide through our Texas network.

We’re here to help you protect what matters most.

This article offers general information about Texas law. It is not specific legal advice for your situation. Estate planning laws can be complex, and every family’s needs are different. For advice tailored to your parent’s estate planning, speak with an experienced Texas estate planning attorney.