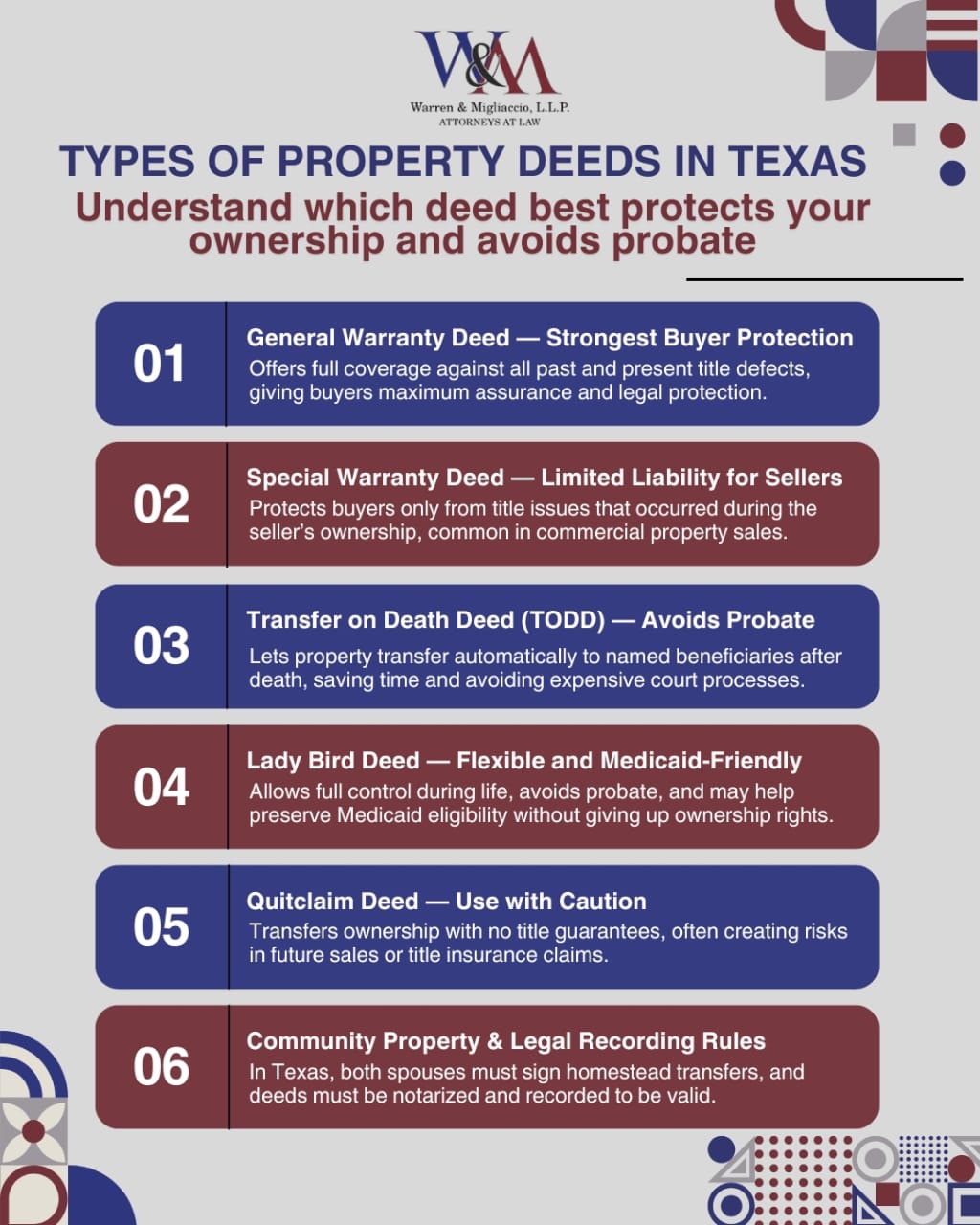

Quick Answer: Texas has several types of property deeds. The most common are general warranty deeds, special warranty deeds, and transfer on death deeds. General warranty deeds give full protection to the buyer. Special warranty deeds give limited protection. Transfer on death deeds let property go to heirs without probate. The deed you choose affects ownership of the property, probate, and legal protection. Since 2021, changes to Texas law for quitclaim deeds make picking the right deed even more important.

Key Takeaways

- Texas has several deed types for estate planning. Transfer on Death Deeds (TODD) and Enhanced Life Estate Deeds (Lady Bird Deeds) are the best for avoiding probate.

- General Warranty Deeds give stronger protection when funding Revocable Living Trusts than Special Warranty Deeds. Hence, ensuring beneficiaries get full property title.

- 2021 Texas law changed Quitclaim Deed rules. After four years on record, they no longer block later bona fide buyers, but title companies still act cautiously.

- Quitclaim Deeds are high-risk DIY options. They often cause costly legal problems and should be avoided without professional help.

- Using the wrong deed type can cause probate, loss of homestead exemptions, and serious financial issues for heirs.

- Professional legal help is essential when choosing and preparing deeds. DIY approaches can lead to mistakes that cost families thousands.

Understanding Texas Property Deeds for Estate Planning

Your family home is more than real estate—it is your legacy. Choosing the wrong property deed can cost your family thousands and lead to lengthy probate proceedings. We know these decisions can feel overwhelming, especially when you want to protect what matters most.

In Texas, property deeds are the legal documents that transfer ownership from one person to another. The type of deed you choose affects asset protection, probate avoidance, and the security of future ownership. A title shows who legally owns the property and the legal right to use, rent, or sell it. A deed is the document that actually transfers that ownership.

Deeds determine not only how property changes hands but also the protections your beneficiaries receive. The right deed can safeguard your family home and ensure assets pass smoothly without costly court involvement. Many families do not realize that deed choice also affects homestead exemptions and property tax benefits. Choosing the wrong deed can even trigger the probate you hoped to avoid.

Properly executed real estate deeds play a key role in avoiding probate and reducing estate administration costs. The right deed can transfer ownership automatically at death. Hence, bypassing the time-consuming and expensive probate process. This can save families months in court and thousands in legal fees.

Need help selecting the right deed? Our Texas estate planning attorneys have guided families through property transfers for 20 years. Call us today at (888) 584-9614 for a free consultation. We’ll review your situation and recommend the best deed type—no pressure, no obligation.

Primary Deed Types for Asset Protection and Estate Planning

Texas recognizes several types of property deeds, each serving a specific role in estate planning. Knowing the differences helps you make smart decisions about protecting and transferring property.

The most common deeds in Texas offer different levels of protection and flexibility. Each affects probate avoidance and asset protection in unique ways. Choosing the right deed is essential to meeting your estate planning goals.

When deciding which deed to use, consider your needs. Do you want to keep control during your lifetime? Are you focused on creditor protection? Do you need to qualify for Medicaid benefits? Different deeds provide the best protection for family homes or investment properties depending on your answers.

General Warranty Deed vs. Special Warranty Deed for Trust Funding

Choosing between a general warranty deed and special warranty deed is important when transferring property into a revocable living trust. Knowing the differences protects your beneficiaries and ensures the trust works correctly.

General Warranty Deed: Maximum Protection

A General Warranty Deed gives full protection by covering the entire chain of title from the sovereign forward. The Texas Land Title Association says these deeds offer the broadest protection for Texas buyers.

The seller promises they own the property, can transfer it, and that no hidden claims exist. If any title problems appear—even from previous owners—the seller must fix them.

Key protections include:

- Full title protection against past and future claims

- Seller responsibility for any title issues

- Legal recourse if ownership problems appear

- Maximum confidence for buyers and lenders

For trusts, general warranty deeds are best. They guarantee the title for beneficiaries. If problems arise after funding, the deed protects both the trust and the beneficiaries.

Special Warranty Deed: Limited Protection

A Special Warranty Deed gives limited protection. The seller only promises there were no title issues during their ownership. They are not responsible for prior problems.

Special warranty deeds can make title insurance harder. Title companies may require more documents or higher fees because of the limited protection.

Common uses in Texas:

- Commercial property sales

- Bank or mortgage company sales

- Transfers by trusts, estates, or corporations

- Situations where the seller has limited knowledge of the property

For funding trusts, general warranty deeds usually provide better protection. Special warranty deeds may limit seller liability but can create costly problems for trust administration and beneficiaries.

Important Note: Even with a general warranty deed, title insurance is recommended and often required. The Texas Department of Insurance offers guidance at www.tdi.texas.gov/title.

Transfer on Death Deed (TODD): The Popular Probate-Avoidance Tool

The transfer on death deed (TODD) changed estate planning when Texas enacted it in 2015 under Texas Estates Code Chapter 114. Texas Estates Code §114.001. This tool lets property owners name beneficiaries who automatically receive the property when the owner dies, without probate.

Benefits and Requirements

TODDs offer several benefits, including keeping full ownership control during your lifetime. You can sell, mortgage, or change the property without the beneficiary’s consent. The deed can be revoked or updated at any time by recording a new deed or revocation with the county clerk.

For a TODD to be valid in Texas, it must:

- Be in writing with a clear legal description of the property

- Be signed by the owner in front of a notary public

- Be recorded with the county clerk before the owner’s death Texas Estates Code §114.051

- Include specific language stating the transfer of property takes effect at death

Important Limitations

TODDs have limitations you should know. After death, the property may still be used to pay certain estate debts if other assets are insufficient. Texas Estates Code §114.106

Creditors have a two-year window to make claims against the property after the owner dies. Some title companies also limit title insurance for properties transferred through TODDs, which can complicate future sales or refinancing.

TODDs work best for simple estate planning. They are ideal when the owner wants to avoid probate but does not need complex asset protection. They are especially useful for families with low debt and clear beneficiary designations.

Example: A widow wants her adult children to inherit the family home without probate. A TODD lets her keep full control while ensuring automatic transfer of real estate at death. However, if she has large medical debts, a different planning tool may be safer.

Enhanced Life Estate Deed (Lady Bird Deed): Maximum Flexibility for Asset Protection

The enhanced life estate deed, or lady bird deed, gives maximum flexibility for asset protection and avoids probate. It lets owners keep full control while transferring property automatically to beneficiaries at death. Lady Bird Deeds are recognized under Texas common law.

Unique Benefits

Lady Bird Deeds offer advantages other deeds do not:

- Protect Medicaid planning by removing the property from countable assets

- Keep the homestead exemption, maintaining property tax benefits

- Avoid probate while letting the owner sell or mortgage without beneficiary consent

- Allow the owner to change beneficiaries, revoke the deed, or sell the property without notifying heirs

Unlike Transfer on Death Deeds (TODDs), Lady Bird Deeds let the owner fully control the property while still avoiding probate. Changes can be made freely without involving beneficiaries.

Tax Advantages

Lady Bird Deeds offer tax benefits. The step-up in basis rules apply at death. This can reduce capital gains taxes if beneficiaries sell the property soon after inheriting. Avoiding probate also saves time and legal costs.

Lady Bird Deeds are not right for every family. Complex family situations, concerns about beneficiaries’ finances, or major creditor issues may require other estate planning tools. Professional guidance is highly recommended.

High-Risk Deed Options to Avoid in Estate Planning

Not all property deeds are equal, especially in estate planning. Some deed types cause more problems than they solve. Understanding these high-risk options helps you avoid costly mistakes that could put your family’s financial security at risk.

The appeal of “simple” solutions can backfire. What seems easy today can cause expensive legal battles later. Too many families learn this lesson the hard way when DIY approaches go wrong.

Quitclaim Deed: The Dangerous DIY Option

Quitclaim deeds are often misunderstood and misused. They have limited legitimate uses but are generally unsuitable for estate planning.

A quitclaim deed transfers whatever interest the grantor may have, without any warranties or guarantees about the title. The grantor does not promise they actually own the property or that the title is clear. This means the grantee could get nothing, something, or everything depending on the grantor’s actual interest.

2021 Texas Real Estate Law Change

Texas updated its treatment of quitclaim deeds in 2021. Now, a quitclaim deed recorded for four years no longer automatically blocks a later bona fide purchaser under Texas Property Code §13.001. However, title companies still act cautiously because quitclaims create title uncertainties.

Fundamental Problems

Quitclaim deeds lack protection:

- Title insurance companies often refuse coverage, making future sales difficult

- Lenders may reject these deeds, complicating financing for beneficiaries

- No guarantees about title quality or ownership validity

- No legal recourse if title problems appear

Many title companies prefer deeds with warranties over quitclaims, even with the four-year relief from the 2021 law.

A Personal Story from Real Estate Attorney Migliaccio

A few years ago, a Dallas couple wanted to leave their home to their daughter without probate. They found a form online and signed a quitclaim deed, hoping to save on attorney fees.

When the daughter tried to sell the property after the parents moved to assisted living, the title company raised issues. The quitclaim had weakened the chain of title and contained a legal description error.

We reviewed the family’s goals and rebuilt the paper trail. A correction instrument under Property Code §§5.027–5.030 fixed the legal-description error. Later, we used a properly drafted Transfer on Death Deed under Chapter 114. When the parents passed, the daughter recorded the affidavit of heirship and closed smoothly.

This case reinforced a key lesson: the right deed, drafted carefully, saves families time, money, and stress. What should have been a simple transfer became a complicated title problem that delayed the sale by months.

Common Scenarios Where Families Misuse Quitclaim Deeds

- Transferring property to avoid probate

- Adding children to titles

- Removing deceased spouses from ownership

In all these cases, other deed types provide better protection and fewer complications.

The Hidden Dangers of DIY Deed Preparation

Do-it-yourself deed preparation has grown with online legal forms and templates. But this trend creates real risks for Texas families trying to protect property.

Small mistakes can invalidate deeds and cause expensive legal problems. They exceed the cost of hiring an attorney. Common DIY errors include:

- Wrong legal descriptions

- Improper notarization

- Ignoring community property laws

- Overlooking marital rights

- Missing required language for specialized deeds

These errors can have serious financial consequences. Some families lost homestead exemptions, costing thousands in extra property taxes. Others found their DIY deeds did not transfer ownership in correct way. Hence, forcing costly probate proceedings.

Online forms often fail to meet Texas-specific rules. Texas community property laws, homestead protections, and recording requirements differ from other states. Generic forms cannot cover these details.

Spouses in community property states like Texas need special attention. Failing to address these rights can invalidate transfers or harm surviving spouses

Case studies show families spending tens of thousands to fix DIY deed mistakes. The small savings from DIY preparation often cost far more than hiring an attorney.

Specialized Deeds for Unique Situations

Beyond common estate planning deeds, Texas uses several specialized deed types for unique situations. Knowing when these deeds are needed helps ensure you use the right tool for your case.

Professional guidance is critical with specialized deeds. Their requirements and effects are more complex than standard transfers. These cases often involve multiple legal considerations that require careful coordination.

Gift Deeds and Tax Implications

Gift deeds transfer property without money, documenting it as a gift. They often include language addressing federal gift tax rules.

2025 tax note: Gifts over $19,000 per recipient must be reported using IRS Form 709, even if no tax is due under the lifetime exemption. The donor—not the recipient—reports the gift. Consult a tax professional before gifting real estate.

Gift deeds are commonly used for:

- Transfers between family members

- Charitable donations of property

- Estate planning strategies involving gifts to children or grandchildren

Deed of Trust and Mortgage-Related Transfers

In Texas, the deed of trust is central to the mortgage and foreclosure process. Unlike other states, Texas mainly uses deeds of trust to secure loans.

When a borrower defaults, the deed of trust allows non-judicial foreclosure through a trustee. This is faster than judicial foreclosure but still provides borrower protections.

A Deed in Lieu of Foreclosure lets a borrower voluntarily transfer the property to the lender. Hence, avoiding formal foreclosure and reducing credit impact.

Partition and Correction Deeds

Partition deeds divide jointly owned land so each owner gets a defined tract. Co-owners can also seek a court-ordered partition under Texas Property Code Chapter 23 if they cannot agree.

Correction instruments fix mistakes in a recorded deed, such as misspelled names, under Property Code §§5.027–5.030. Some errors require new deeds rather than affidavits, depending on their impact on ownership rights. Professional guidance determines the best solution for each title issue.

Mineral Deeds and Subsurface Rights

Mineral deeds transfer ownership of subsurface oil, gas, or mineral rights separate from surface land. In Texas, the mineral estate is dominant and can use the surface reasonably.

Property owners can sell mineral rights while keeping surface ownership, or vice versa. These deeds allow flexible management of property rights.

Sheriff’s Deeds and Court-Ordered Sales

Sheriff’s deeds are issued after judicial sales under a writ of execution or tax foreclosure. Texas law sets the process, usually through a public auction at the courthouse.

These deeds transfer only the interest the previous owner had and provide limited warranties due to the involuntary nature of the sale. They are legally valid ownership transfers. More info: http://www.txcourts.gov

Fiduciary Deeds

A fiduciary deed is signed by someone with legal authority, like an executor, administrator, or trustee, to transfer estate or trust property.

- Independent executors can sell without court approval unless restricted by a will

- Dependent administrators generally need a court order

- Trustees follow statutory powers under the Texas Property Code

The deed details the fiduciary’s authority and any court limitations.

Dedication and Cemetery Plot Deeds

Dedication deeds transfer land to a government for public use, such as streets or parks. Texas law requires proper plats and recording rules under the Local Government Code. These are common in subdivisions to transfer streets and common areas for public maintenance.

Cemetery plot deeds grant burial rights, not traditional ownership. Texas Health & Safety Code Chapter 711 governs plot and interment rights. Texas Health & Safety Code Chapter 711.

These specialized deeds define rights and rules for public use or burial purposes.

Community Property Considerations in Texas

Texas is a community property state. It means spouses equally own income and real property acquired during marriage. Property acquired during marriage is presumed community property under Texas Family Code §3.002. This affects every property deed involving married individuals.

Critical Community Property Rules

Both spouses usually must sign deeds transferring marital property. If the property is a homestead, both spouses generally must join the deed, even if only one spouse is on the title. This is required under Texas Family Code and Texas Constitution Article XVI, Section 50. Texas Constitution Art. XVI, §50

Deeds should clearly state the grantor’s marital status to prevent future disputes. A married person cannot usually transfer community property without their spouse’s signature, even if only one spouse is on the deed.

Title companies often demand marital status affidavits. They ensure clear title transfers under Texas community property rules. Failing to address these issues can void property transfers or create costly legal problems later.

Practical Tips for Community Property

- Separate property acquired before marriage has different rules; professional guidance is recommended

- State marital status in deeds to avoid future questions

- Expect title companies to request marital affidavits

- If conveying a homestead, both spouses should plan to sign

Legal Requirements and Recording Process

Valid deeds in Texas must meet key legal requirements to transfer property ownership properly.

Essential Elements of a Valid Texas Deed

A Texas deed generally needs:

- Written document signed by the grantor, with delivery and acceptance

- Adequate legal description identifying the land (not just street address)

- Granting language showing intent to transfer ownership immediately

- Notarization (acknowledgment) for recording

- Consideration is not required, but listing it can strengthen “good-faith purchaser” status

Note: Using the words “grant” or “convey” implies limited covenants under Property Code §5.023 unless expressly disclaimed.

Failing to meet these requirements can invalidate the deed and create costly problems for everyone involved.

The Recording Process

A deed is legally binding between the parties when signed, delivered, and accepted. Recording provides public notice and protects against later claims by creditors or purchasers without notice.

Recording safeguards ownership rights and establishes priority. While not required for validity between parties, it is essential for protection against bona fide purchasers.

To record a deed in Texas:

- Ensure the deed is properly executed with all required signatures and notarizations

- Take the original deed to the county clerk’s office in the property’s county

- Pay the recording fee (typically $25–$50 for the first page, plus a few dollars per additional page; varies by county)

- Receive a file-stamped copy for your records

- The clerk will scan and index the deed in the county’s official public records

Texas law makes unrecorded instruments void against certain third parties under Property Code §13.001. This is why recording immediately after closing is strongly recommended.

County procedures differ slightly, but all require proper documentation and fee payment. Many counties now offer online recording, but understanding local rules ensures proper filing.

Consequences of Failing to Record

- Loss of priority against later purchasers

- Inability to obtain title insurance

- Complications proving ownership rights

These issues may appear years later, especially when selling or refinancing property.

Comparing Texas Property Deed Types

Understanding all deed types helps you make informed decisions about property transfers. Here’s a comparison of the most common Texas deeds

| Deed Type | Level of Protection | Warranties Provided | Common Uses | Risk Level for Buyer | Key Considerations |

|---|---|---|---|---|---|

| General Warranty Deed | Maximum | Full title warranties for entire property history; grantor warrants title back to sovereignty | Standard residential sales, trust funding | Low | Best protection; title insurance still recommended |

| Special Warranty Deed | Intermediate | Limited to grantor’s ownership period only | Commercial transactions, bank sales, estate transfers | Moderate | Only covers defects arising during grantor’s ownership |

| Deed Without Warranty | Minimal | None—transfers whatever title grantor owns but disclaims warranties | Uncertain title situations, related party transfers | High | Preferred over quitclaim by some title companies |

| Quitclaim Deed | Very Low | None—transfers only “right, title, and interest” | Family transfers, clearing title clouds, divorce settlements | Very High | 2021 law provides limited relief after 4 years; title companies still cautious §13.001 |

| Transfer on Death Deed | N/A (estate planning tool) | N/A—takes effect at death | Probate avoidance, maintaining lifetime control | N/A | Must be recorded before death; property subject to certain estate debts Ch. 114 |

| Lady Bird Deed | N/A (estate planning tool) | N/A—enhanced life estate | Probate avoidance, Medicaid planning, maintaining complete control | N/A | Common-law deed; preserves lifetime control and homestead exemption |

| Gift Deed | Varies | Depends on whether warranty language included | Family gifts, charitable donations, estate planning | Varies | May trigger federal gift tax reporting; $19,000 exclusion in 2025 IRS |

| Trustee’s Deed | Limited | Limited to trustee’s authority | Trust transfers, foreclosures | Moderate to High | Authority must be verified; statutory powers under Property Code |

| Sheriff’s Deed | Minimal | Limited or none | Court-ordered sales, tax foreclosures | High | Issued after judicial sale; transfers only debtor’s interest |

| Partition Deed | N/A | N/A—divides co-owned property | Dividing jointly owned property among co-owners | N/A | Can be voluntary or court-ordered Ch. 23 |

| Correction Deed | N/A | N/A—fixes errors in prior deed | Correcting mistakes in recorded deeds | N/A | Must follow Property Code §§5.027–5.030 procedures §§5.027–5.030 |

Choosing the Right Deed: Professional Guidance is Essential

Selecting the right deed requires careful consideration of estate goals, creditor issues and tax effects. No single deed works for every case, so professional guidance is essential for the best outcome.

Key Factors in Deed Selection

Consider these critical factors when choosing your deed type:

1. Level of control you want to maintain

- Transfer on death deeds and Lady Bird deeds let you keep control during your lifetime

- Traditional warranty deeds transfer ownership immediately

- Think carefully about whether you want to give up control now or retain it until your death

2. Protection needed for your beneficiaries

- General warranty deeds offer maximum protection

- Special warranty deeds provide limited protection

- Quitclaim deeds offer no protection

3. Potential creditor issues

- Some deed types offer better creditor protection

- Estate planning strategies vary based on debt concerns

- Professional guidance essential for asset protection planning

4. Qualification for government benefits

- Lady Bird deeds may help with Medicaid planning (requires careful professional planning)

- TODDs avoid probate but don’t address Medicaid lookback

- Gift deeds can trigger Medicaid penalties if timing isn’t right

5. Existing liens or mortgages

- Most mortgages include “due on sale” clauses

- TODDs typically don’t trigger these clauses because ownership doesn’t change until death

- Check with mortgage company before executing deeds that transfer current ownership

6. Tax implications

- Different deed types trigger different tax consequences

- Property transferred during lifetime affects beneficiary’s tax basis differently than property transferred at death

- Federal estate tax rules apply for larger estates (Texas has no state estate tax)

- 2025 gift tax exclusion is $19,000 per recipient

Each consideration affects which deed type provides the best solution for your specific circumstances.

Why Professional Guidance Matters

Experienced attorneys help families avoid costly mistakes. They ensure deeds are properly selected and prepared. The cost of legal counsel is small compared to fixing problems from the wrong deed or improper execution.

Professional guidance becomes especially important when dealing with:

- Complex family situations

- Significant assets

- Potential creditor issues

- Medicaid planning needs

- Multiple property transfers

These situations need careful planning that goes beyond simple deed selection. Comprehensive asset protection strategies are often required.

Estate planning decisions can feel overwhelming, but you don’t have to face them alone. Our Texas estate planning team—Lead Counsel Verified in many practice areas—has helped thousands of families protect their homes and transfer property to beneficiaries since 2006. The peace of mind from proper planning far outweighs the cost of professional help.

Property transfer decisions are complex, and that’s why our Texas estate planning attorneys guide Texas families every day. Call us at (888) 584-9614 to schedule a free consultation at our Richardson, Dallas, or Prosper offices, or virtually anywhere in Texas. We explain your options in plain English and help you choose the deed type that best protects your family’s interests.

Frequently Asked Questions

FAQs About Types of Deeds in Texas

What deed gives me the most protection in Texas?

A general warranty deed—the standard in many residential closings—provides the broadest warranty and defense obligations from the grantor.

The seller guarantees clear title and agrees to defend against all claims, even those arising before their ownership.

Title insurance is still recommended for additional protection.

Can I use a quitclaim deed in Texas?

You can, but it’s risky. While a 2021 law change provides some relief (after four years on record, quitclaim deeds no longer automatically defeat later bona fide purchaser status under Texas Property Code §13.001), many title companies still avoid quitclaims due to the inherent title uncertainties.

Consider a deed without warranty instead for better title insurance prospects.

What’s the difference between a Lady Bird deed and a TODD?

A Lady Bird deed is a common-law enhanced life-estate deed that lets you keep complete control while naming beneficiaries.

A TODD is statutory under Estates Code Chapter 114, must be recorded before death, and the property can still be liable for certain estate debts after death.

Both avoid probate, but Lady Bird deeds may offer additional Medicaid planning advantages. Texas Estates Code Ch. 114

FAQs About Recording and Costs

Do I have to record my deed?

Recording isn’t required between the parties for validity, but it protects you against later purchasers or creditors without notice.

File with the county clerk where the property is located.

Texas law makes unrecorded instruments void against certain third parties, which is why recording is strongly recommended.

How much does it cost to record a deed in Texas?

Recording fees vary by county but typically range from $25 to $50 for the first page and a few dollars for each additional page.

Some counties charge additional fees.

Contact your county clerk’s office for exact costs.

Where do I record a deed?

With the county clerk in the county where the land lies.

Documents must meet formatting and acknowledgment rules to be accepted for recording.

FAQs About Property Ownership and Transfers

Can I add my child to my deed to avoid probate?

You can, but this strategy often creates more problems than it solves.

Adding your child to your deed means you’re giving them partial ownership now—not just after your death.

This can trigger gift tax issues, expose the property to your child’s creditors, and require your child’s signature if you want to sell the property.

A transfer on death deed usually works better for probate avoidance while maintaining your control.

How do community property rules affect deeds?

Texas presumes property acquired during marriage is community property, and both spouses must generally sign to convey a homestead.

Marital status should be clearly stated in all deed documents to avoid future disputes.

Can an executor or trustee sign the deed?

Yes, when empowered by the will, court, Estates Code, or Property Code.

Independent executors typically can sell without court approval; trustees have statutory sale powers.

The deed must specify the fiduciary’s authority and any limitations.

What happens if I execute a transfer on death deed but later sell the property?

When you sell the property, the transfer on death deed becomes irrelevant because you no longer own the property.

The beneficiary named in the transfer on death deed has no claim to the sale proceeds.

The transfer on death deed only takes effect if you still own the property when you die.

Protect Your Texas Property with the Right Deed

Property transfers are an important part of estate planning. The deed you choose affects probate, taxes, control, and your heirs’ protection. Whether you transfer property now or after your death, understanding Texas deed types helps you make smart choices. This includes the 2021 law changes for quitclaim deeds.

Since 2006, Warren & Migliaccio, L.L.P. has guided Texas families from El Paso to Houston in property transfers. As Lead Counsel Verified attorneys, we know Texas property law, current legal updates, Medicaid planning, and how to align deeds with your full estate plan.

Don’t leave property transfers to chance or online forms. Let us help you pick the right deed and handle it correctly.

Call Us—Get Clear Guidance Today

Call our law firm at (888) 584-9614 or contact us online for a free consultation. We will review your property, discuss your estate goals, and recommend the best strategy—no pressure, no obligation.

Texans can visit our Richardson, Dallas, or Prosper offices, or meet with us virtually anywhere in the state.

Service areas: Warren & Migliaccio, L.L.P. serves Texas statewide for estate planning and deed work. Bankruptcy and family law services are limited to Dallas–Fort Worth (Dallas, Collin, Denton, and Tarrant counties).

Disclaimer

This article is for informational purposes only and does not constitute legal advice. Property transfer and estate planning laws are complex and fact-specific. Consult with a qualified Texas attorney before making any property transfer decisions.