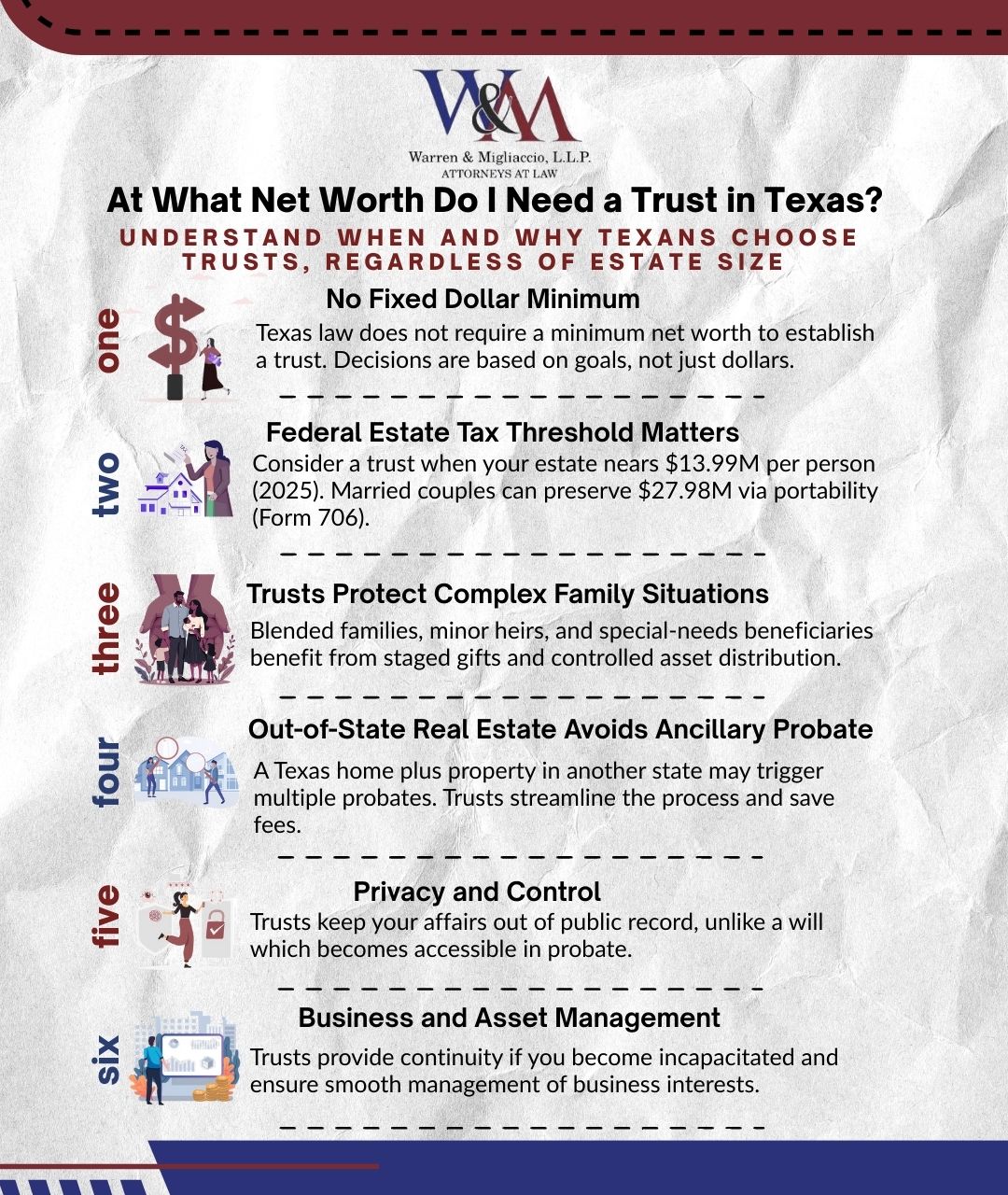

There is no fixed net worth required to create a trust in Texas. Families often establish one for privacy, blended families, special-needs heirs, or out-of-state property, and higher-value estates use trusts to save probate costs and preserve federal tax exemptions.

Quick Answer: At What Net Worth Do I Need a Trust in Texas?

Texas sets no minimum. Consider a trust as your estate nears $13.99M in 2025, or to avoid ancillary probate; married couples should file IRS Form 706 within nine months to preserve portability.

- Evaluate privacy, blended families, or special-needs heirs

- Title out-of-state real estate into the trust

- File IRS Form 706 within nine months for portability

What Net Worth Triggers a Trust in Texas? (Short Answer)

There isn’t a fixed dollar amount. Texas families choose trusts when their goals and valuable asset mix justify the costs. Even simple estates may benefit. There is no required minimum net worth for starting a trust. The decision to create a trust depends on your specific circumstances, including your personal situation and family situation, not just your net worth. Creating a trust can help you bypass probate, which is the legal process of settling your estate after your death.

The federal estate tax line matters most:

$13.99 million per person in 2025; $27.98 million for married couple with proper planning and portability (DSUE). IRS

Often, goals matter more than dollars:

- Out-of-state real estate – avoid probate in another state Texas Bar

- Privacy – keep your affairs out of public records Texas Bar

- Blended families – protect children from prior marriages, as trusts can be beneficial for individuals with complex family situations regardless of their net worth

- Minor or special-needs heirs – stage gifts and add protections

- Business interests – ensure smooth management if you’re ill

- Higher net worth – as you accumulate more money and total assets, your risk increases, making protective measures like trusts more important

Example: A $1.2M estate with an Oklahoma cabin benefits more from a trust than a $2.5M all-Texas estate. The trust avoids a second probate, which can be time-consuming and costly. Texas Bar

Net Worth Guidelines at a Glance

| Net Worth Range | Typical Recommendation | Key Considerations |

|---|---|---|

| Under $500K | Will + TOD deeds + POAs | Consider trust for privacy or out-of-state property |

| $500K – $1M | Trust becomes attractive | Multiple properties, privacy needs, family complexity |

| $1M – $3M | Trust often cost-effective | Probate savings justify setup costs |

| $3M – $5M | Add asset protection | Consider irrevocable strategies |

| $5M – $13.99M | Advanced planning needed | Estate tax planning becomes critical |

| $13.99M+ | Comprehensive strategies | Federal estate tax applies; need sophisticated tools |

How Trusts Work in Texas—Revocable vs. Irrevocable

Revocable living trust

When funded, a revocable living trust keeps affairs private and avoids probate, providing more control over the transfer of trust assets. A successor trustee steps in if you can’t act, managing and distributing the trust’s assets according to the trust agreement. It doesn’t protect assets or reduce taxes by itself. Setup costs range from $2,000-$5,000—some attorneys charge flat fees while others bill hourly. Ongoing costs may include trustee fees, legal reviews, and administrative expenses.

A trust is established through a trust agreement or trust document—a legal document outlining the terms, parties, and management instructions. When funding a trust, various assets can be transferred: real estate, business interests, and personal property.

Irrevocable trust

These trusts can remove assets from your taxable estate. When funded by others, they protect beneficiaries from creditors and can serve as asset protection trusts, particularly for high-net-worth individuals. Examples include ILITs for life insurance and charitable trusts. They can reduce or eliminate estate, gift, income, or capital gains taxes. The tax implications for irrevocable trusts can be complex—consult a tax professional for specific advice. Setup costs: $5,000-$15,000, with ongoing trustee fees and administrative expenses. Complex trusts may require investment management, a registered investment adviser, or other financial tools.

Related: What is the difference between a living trust and an irrevocable trust in Texas?

Texas spendthrift law. The Texas Property Code §112.035 protects beneficiaries but not you. A trust you control won’t shield your assets from your creditors.

Asset-Protection Reality in Texas

Texas hasn’t adopted self-settled asset protection trust laws. Don’t expect a revocable trust to protect your assets. Focus on the right tool for your goals. Texas Statutes

Case Study: Avoiding a Costly Second Probate with a Texas Trust

I met a remarried couple who owned a home in Texas, a cabin in Oklahoma, and significant retirement savings. They were anxious about family conflict and overwhelmed by the thought of handling two probates—one in Texas and another in Oklahoma—if something happened.

After reviewing their situation, I recommended a revocable living trust. We transferred the Oklahoma cabin and investment accounts into the trust, used a Texas transfer-on-death deed for their home, and created staged distributions for their adult children. We also added protections for a special-needs grandchild through a dedicated education trust.

When the husband passed away unexpectedly, his wife was able to settle everything quickly and privately. There was no second probate, no extra court fees, and no public record of their family’s finances.

The takeaway: trusts are not only for the wealthy—they are powerful tools for avoiding unnecessary costs, protecting family harmony, and ensuring assets transfer smoothly..

Takeaways at a Glance

- No minimum net worth required for a Texas trust

- Trusts avoid probate and keep estates private

- Out-of-state property often triggers trust use

- Federal estate tax exemption: $13.99M in 2025

- Married couples must file Form 706 to preserve portability

Texas Probate vs. Trust: What’s Faster, Cheaper, and More Private?

Comparison of Texas Estate Planning Options

| Option | Privacy | Speed | Cost | Best For |

|---|---|---|---|---|

| Revocable Living Trust | Private | 2–4 weeks if funded | $2,000–$5,000 setup | Multi-state assets, privacy needs |

| Independent Administration | Public record | 6–12 months | 3–5% of estate | Simple Texas-only estates |

| Muniment of Title | Public record | 30–60 days | $1,000–$3,000 | No debts, real estate only |

| TOD Deed | Deed is public | Immediate at death | $100–$500 | Single Texas property |

| Small Estate Affidavit | Public filing | 30 days | $500–$1,500 | Estates under $75,000 |

Texas advantages. We have independent administration and muniment of title. These make probate simpler than in many states. Texas Estates Code

Privacy gap. Wills become public record. Trusts stay private. Texas Bar

When trusts shine:

- Out-of-state property (avoid ancillary probate)

- Privacy needs

- Complex families

- Business interests

Practical Cost-Benefit

Compare setup and funding costs to probate expenses. A $1 million estate faces $30,000-$50,000 in probate costs. A $3,000 trust saves money and stress. Setup fees for a trust can be charged as a flat fee or hourly billing, and it’s important to consider ongoing costs such as trustee fees and other administrative expenses.

Trusts only work if funded. You must retitle accounts and property—we provide checklists and help. Beyond tax savings, trusts offer privacy, probate avoidance, asset protection, and favorable tax implications that may result in long-term savings.

Federal Estate Tax in 2025—and Why “Portability” Matters

Key numbers:

- Estate tax exemption: $13.99M per person

- Annual gift exclusion: $19,000 per recipient

- Married couples: $27.98M with portability

Establishing a trust can have significant tax implications, including potential tax benefits such as estate tax avoidance and minimizing taxes. Trusts are often used in estate planning to help reduce estate taxes, preserve wealth for heirs, and take advantage of potential tax benefits.

Establishing a trust can save much more in potential probate expenses, which can be 3% to 7% of the estate’s value. To fully understand the income taxes and other tax implications of trust planning, it is recommended to consult a tax professional or seek accounting advice.

Portability (DSUE). File Form 706 within 9 months of death. You can get a 6-month extension with Form 4768. Small estates can get late relief under Rev. Proc. 2022-32. IRS

Trusts and Tax

Revocable trusts don’t reduce estate taxes alone. For large estates, consider:

- ILITs for life insurance

- Charitable trusts for deductions

- Grantor trusts for estate freezes

- Life insurance trusts that hold life insurance proceeds and can help minimize estate taxes

These trusts can provide significant tax benefits, including reduced income taxes and estate taxes. It’s important to understand the tax implications of each trust type and consult a tax professional or seek accounting advice before making decisions.

Work with your CPA and financial advisor.

- Out-of-state property – avoid ancillary probate

- Privacy concerns – keep family and financial details out of public record

- Blended families – prevent inheritance conflicts

- Minor or special-needs heirs – protect benefits and stage distributions

- Business ownership – ensure continuity and asset protection

- Incapacity planning – smoother management than a power of attorney alone

- Complex or high-value assets – centralize management for easier oversight

Types of Trusts Texans Ask About—Plain English

Revocable living trust. Avoids probate. You keep control. A revocable trust can be changed or revoked during the lifetime of the trustmaker. Learn about more reasons you need a revocable living trust.

Irrevocable trusts. Protect assets and save taxes for large estates. Include ILITs, SLATs, and charitable trusts. There are many different trusts designed to help in different situations. Texas Trust Law

Special-needs trusts. Preserve government benefits.

Charitable trusts. Support causes and save taxes. Charitable trusts allow individuals to make gifts to charitable organizations while receiving income.

Testamentary trusts. Created by your will at death.

Texas Spendthrift Rules You Should Know

Spendthrift clauses protect beneficiaries from creditors. They don’t protect you from your own creditors. Spendthrift trusts specify how and when a beneficiary receives their inheritance, protecting it from creditors. Trusts can help you guard assets from creditors, lawsuits, divorce, or other threats. See Texas Property Code §112.035. Texas Statutes

Funding the Trust—The Critical Step

What to retitle:

- Real estate (record new deeds)

- Brokerage and bank accounts

- Business interests

- Personal property

Update beneficiaries on:

- Retirement accounts

- Life insurance

Texas tip: Consider Transfer-on-Death Deeds for Texas real estate. See Estates Code Chapter 114. Texas Statutes

Funding Checklist

✓ Deeds recorded

✓ Account titles changed

✓ POAs and HIPAA forms updated

✓ Asset list prepared

✓ Gift history tracked

Timeline: Drafting takes 1-2 weeks. Funding takes 4-6 weeks. We guide you through it all. It’s important to regularly review and update trusts due to changes in laws and personal circumstances. Maintaining a trust through ongoing administration, including regular reviews and updates, ensures it continues to meet your needs and serves its intended purpose effectively.

We serve Dallas, Fort Worth, Plano, Richardson, Garland, Frisco, McKinney, Denton, Arlington, and all of Texas. Free consultation: (888) 584-9614.

See our guide: Making and Funding a Living Trust in Texas

What Texas Courts Consider

Probate court examines:

- Clear intent in documents

- Valid execution

- Proper funding

- Fiduciary duties

Understanding the legal aspects of trust creation and administration is crucial to ensure compliance with Texas law and to avoid potential legal issues.

Thus, for probate alternatives, courts check eligibility. Muniment of title requires no unsecured debts. Texas Estates Code

Common Mistakes We See (and How to Avoid Them)

Thinking trusts protect from creditors. They don’t protect your own assets. Texas Statutes

Missing portability deadlines. File Form 706 within 9 months. Lost DSUE costs millions. IRS

Creating but not funding. Unfunded trusts don’t avoid probate. Texas Bar

Ignoring out-of-state property. This forces ancillary probate. Texas Bar

Texas Case-Law Spotlight — In re Shurley (5th Cir. 1997)

In re Shurley, 115 F.3d 333 (5th Cir. 1997) clarified Texas trust law. The court ruled creditors can only reach what the debtor contributed to a trust, not what others contributed.

Why it matters: You can’t use a self-settled trust to protect your assets. Consider irrevocable trusts or third-party funding for protection. Fifth Circuit

Frequently Asked Questions

FAQs: Need, Cost & Probate

At what net worth do I need a trust in Texas?

There’s no minimum net worth. Consider one when your estate nears the federal estate tax threshold ($13.99M per person in 2025) or when your goals justify it. Common triggers: $10 million is often mentioned as a threshold where the importance of having a trust significantly increases.

These include:

- Out-of-state real estate,

- Privacy needs,

- Blended families or minor/special-needs heirs, and

- Business continuity or incapacity planning.

How much does a living trust cost in Texas?

Typical Texas pricing: $2,000–$5,000+ for an attorney-prepared revocable trust; $5,000–$15,000+ for irrevocable strategies. Add deed recording and account-transfer costs. Compare against potential probate expenses, privacy needs, and management benefits.

Does a revocable trust avoid probate in Texas—and when is it worth it?

A properly funded revocable trust avoids probate and enhances privacy. Texas probate is simpler than in many states, but trusts shine for out-of-state property, complex family situations, and smoother incapacity planning. A properly structured trust can seamlessly manage your assets if you become incapacitated, without the need for court-appointed guardianship.

FAQs: Assets & Creditor Issues

What assets should not go into a revocable living trust?

Avoid retitling tax-advantaged accounts; use beneficiary designations instead. Common exclusions of a trust include:

- IRAs and 401(k)s

- HSAs and MSAs

- Certain right-of-survivorship or TOD accounts

Does a revocable trust protect assets from creditors in Texas?

No. Texas Property Code §112.035 protects beneficiaries, not the trust creator. Your own assets in a revocable trust remain reachable by creditors. For protection, consider liability insurance, business entities, or certain irrevocable trusts.

Will placing my Texas homestead in a trust affect my homestead exemption?

Usually no. A qualifying trust naming you as beneficiary and occupant preserves the homestead exemption. Keep the property as your principal residence and meet your appraisal district’s requirements.

FAQs: Transfers, Tax & Special Needs

How do married couples preserve both federal estate tax exemptions (portability)?

File IRS Form 706 within 9 months of the first spouse’s death (6-month extension available). This preserves portability (DSUE), allowing the survivor to combine exemptions—up to $27.98M in 2025.

Do I still need a trust if I use POD/TOD and a Transfer-on-Death Deed?

POD/TOD designations and TOD deeds transfer specific assets without probate. A trust adds centralized incapacity management, privacy, and staged distributions of your assets for heirs. Many families use both for full coverage.

Is a trust helpful for a family member with special needs in Texas?

Yes. A special needs trust can preserve SSI/Medicaid eligibility while providing for extras like therapies, education, and travel. Select the right trust type (first-party or third-party) and trustee to avoid benefit disruption.

FAQs: Practicalities & Timing

Is there a minimum net worth to set up a trust in Texas?

No. Decide based on your goals and whether the benefits outweigh setup and funding costs. Even estates under $1M can benefit for privacy, out-of-state property, or family-specific planning.

When should I consider setting up a trust?

Life events often prompt trust planning, such as:

- Marriage, divorce, or blended families

- Birth of a child or grandchild

- Acquiring real estate (especially out-of-state)

- Business formation or sale

- Health changes requiring incapacity planning

How long does Texas trust setup take?

Most trusts are completed in 2–4 weeks.

- Attorney drafts (1–2 weeks)

- Signing and notarization

- Funding—retitling assets—(2–3 weeks, varies by asset)

A trust only works if funding is completed.

Next Steps: Your Path Forward

- List your assets – property, accounts, business interests

- Define your goals – privacy, family needs, tax planning

- Call us – we’ll compare options in plain English

Related Resources:

- Texas Revocable Living Trusts—Pros, Cons, and Costs

- Muniment of Title & Independent Administration in Texas

- Special-Needs Trusts for Texas Families

Local Values, Clear Guidance

We believe in personal responsibility and putting families first. We explain complex laws in plain English and work with your CPA and financial advisor. When establishing trusts or managing wealth, it is essential to consult with financial advisors, an estate attorney, or a will and trust attorney to ensure proper trust setup, legal compliance, and effective estate planning. Our goal: protect what matters most to you. A comprehensive estate plan often includes trusts as a core component for managing and protecting assets.

Ready to Take Action?

Your journey toward a secure estate plan begins with a simple conversation. Our experienced Texas estate planning attorneys can review your situation, answer your questions, and help you understand the options that fit your goals. Call us at (888) 584-9614 or contact us online to start planning your estate today.

Sources Referenced:

- IRS – 2025 estate tax exemption, Form 706, Rev. Proc. 2022-32

- Texas Estates Code – Independent Administration, Muniment of Title, TOD Deeds

- Texas Property Code §112.035 – Spendthrift protections

- State Bar of Texas – Probate guidance and privacy information

- Fifth Circuit – In re Shurley, 115 F.3d 333 (1997)

- SmartAsset – Texas tax information

Disclaimer: This article provides general information, not legal advice. Each situation is unique. Please consult an attorney for guidance specific to your needs.