If you are unsure about which path is right for your situation, we offer a free consultation to explore your legal options. If Chapter 13 bankruptcy is the best path for you, we can refer you to a trusted Chapter 13 bankruptcy attorney if needed.

Finding a qualified bankruptcy attorney in Garland, TX is very important when you face overwhelming debt. It’s a big decision, and getting legal advice is the first step toward financial recovery. Warren & Migliaccio understands the stress that comes with financial distress. Our experienced lawyers have helped individuals in Garland, TX, for over 20 years.

As a trusted north Texas attorney and established law firm with a proven record, we assist clients in Garland, TX, and the eastern districts of Texas. We work hard to achieve successful outcomes in bankruptcy and related matters.

Likewise, we guide you through every step, answer your questions, and provide personalized legal services. We work closely with clients to help them find financial peace and effective solutions that fit their needs. This support helps you make the best decisions for your financial situation.

Our firm can help with Chapter 7 bankruptcy. We also offer personalized debt relief services for people overwhelmed with credit card debt, medical bills, or loans they cannot manage.

Through our personalized approach, clients find relief from debt and gain financial stability again.

Choosing a Bankruptcy Attorney Garland TX

While many legal professionals practice in the Garland area, selecting the right law firm with a proven record of success in bankruptcy cases is essential. This decision requires careful thought and consideration beyond a simple internet search. You’ll want to feel comfortable working with them during a stressful time.

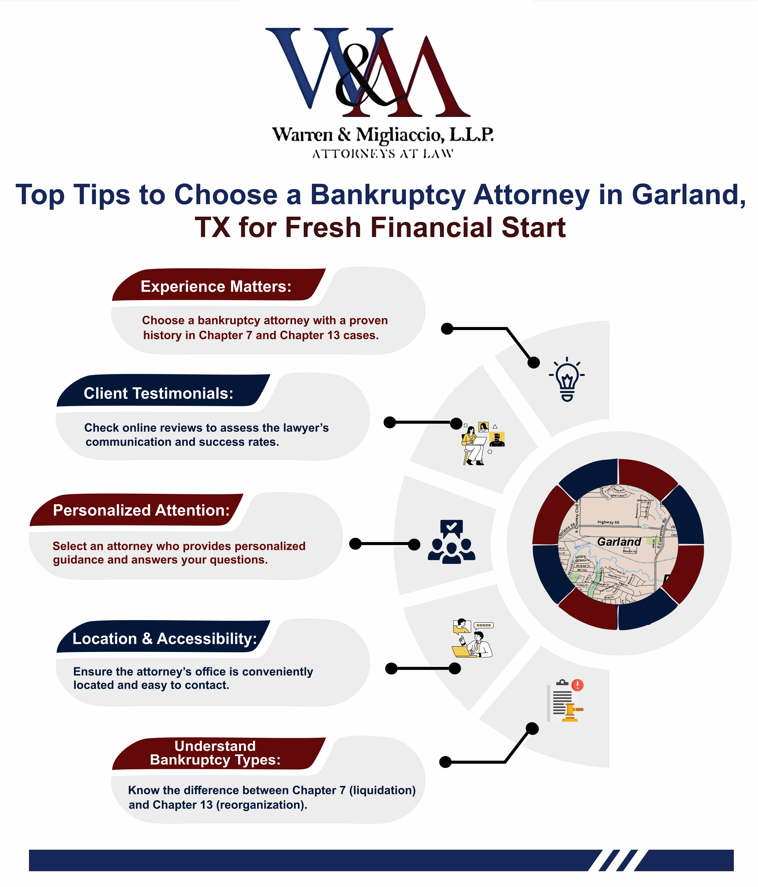

Expertise and Experience:

When looking for a bankruptcy attorney in Garland, TX, choose one with a strong history of success. Think about how long the law firm has been in business and how much experience they have handling bankruptcy cases.

Years of experience show that a firm knows how to handle complex bankruptcy law issues. For example, the bankruptcy lawyers at Warren & Migliaccio have helped many Garland residents get a fresh financial start through bankruptcy. They have been doing this for over two decades. Their dedication has earned them a reputation as knowledgeable Texas bankruptcy attorneys.

Client Testimonials and Reviews

Don’t underestimate the value of firsthand accounts. Consider reading testimonials from past clients about bankruptcy lawyers you are considering. Their feedback can give valuable insights into the lawyer’s communication style, commitment to their clients’ needs, and ability to deliver results.

Several online platforms, including Justia, FindLaw, and Google Reviews provide client reviews about super lawyers. This allows you to assess their track record. Look for reviews about how they handle bankruptcy cases, their knowledge of Texas bankruptcy law, and their experience with debt relief solutions.

Choosing the right bankruptcy attorney in Garland, TX is crucial for a successful financial recovery. This infographic highlights essential factors to consider, such as experience, client testimonials, and accessibility.

Personalized Attention

Bankruptcy is deeply personal. You want to avoid feeling like just another case file. Your bankruptcy attorney should offer personalized guidance, thoroughly explain complex legal terms, and be readily available to answer your questions and address your concerns. Many clients appreciate personalized attention from their bankruptcy attorneys throughout the legal bankruptcy process.

Warren & Migliaccio offer a free consultation. During this initial consultation, the Garland bankruptcy lawyer discusses your unique situation and explores suitable options.

Location and Accessibility

A conveniently located office is a plus when searching for any type of lawyer, especially if you’ll be meeting with them frequently to discuss your case. When considering attorneys, check if they’re conveniently located near a major highway, such as Central Expressway. You can use mapping applications on your smartphone or other touch devices to get directions.

Additionally, make sure you can contact them easily by phone or through their website. Direct contact via phone and a user-friendly website can improve a law firm’s accessibility for potential clients.

Understanding the Different Types of Bankruptcy

A key factor in choosing a bankruptcy attorney in Garland, TX is finding one specializing in a specific chapter that aligns with your needs. Understanding how bankruptcy works is essential, as it provides effective solutions to help clients resolve financial issues and regain stability. Determining whether you need to file for Chapter 7 or Chapter 13 bankruptcy will impact which bankruptcy attorney is best for you.

Chapter 13 bankruptcy allows individuals to restructure their debts, making repayment more manageable through a court-approved plan.

On the other hand, Chapter 7 bankruptcy can eliminate unsecured debt such as credit card balances and medical bills, providing significant relief for those struggling with overwhelming financial obligations.

Chapter 7:

Referred to as liquidation bankruptcy, it offers individuals a chance to liquidate non-exempt assets. This pays off creditors, providing a clean slate. Chapter 7 is particularly effective for eliminating unsecured debt, such as credit card debt and medical bills. Chapter 7 helps those of modest means who have no money left to repay debts after paying their monthly living expenses. A bankruptcy attorney will help you identify any property, like retirement accounts or your primary residence, that might be exempt.

Understanding these Texas-specific exemptions with the guidance of a lawyer can be helpful. This process, though complex, can provide much-needed debt relief for eligible filers.

Chapter 13:

Known as reorganization bankruptcy, it lets people retain their assets while following a structured repayment plan approved by a court. This is usually for those with a regular income source. Chapter 13 is an option for higher income families or sole proprietorships with certain debt limits.

Chapter 13 bankruptcy allows individuals to restructure their debts into a manageable repayment plan, making it easier to regain financial stability. It enables individuals to catch up on missed mortgage or car payments without losing property.

Texas Homestead Protection in Action

In In re Parsons, 530 B.R. 411 (Bankr. W.D. Tex. 2014), Texas debtors were able to protect their home even though they had no equity at first because of a $330,000 IRS lien. They negotiated the debt down to $140,000. This gave them $230,362 in equity. They then amended their homestead exemption claim.

The bankruptcy court ruled that Texas homestead exemptions protect the property itself. This protection is based on the property’s size, location, and use—not on how much equity is in the home.

This case shows why Texas bankruptcy law offers strong protection for Garland residents. Your primary residence is protected no matter the mortgage balances or liens. This means you can file bankruptcy without worrying about losing your home.

Navigating Texas Bankruptcy Law

Texas bankruptcy laws differ from other states. This is especially true regarding exemptions for homesteads. Understanding these nuances is where an experienced bankruptcy lawyer comes in. They offer legal expertise tailored to your specific state.

Warren & Migliaccio’s bankruptcy attorneys analyze your situation and present available legal options, giving you the best chance of regaining control of your finances. We’ve helped countless people going through situations like yours, such as:

- Wage garnishment.

- Tax debt.

- Credit card debt.

Conclusion

Finding a trustworthy bankruptcy attorney in Garland, TX doesn’t need to feel overwhelming. At Warren & Migliaccio, our experienced legal team has a deep understanding of the complex world of bankruptcy law and is dedicated to helping individuals navigate the process. We handle Chapter 7 bankruptcy filings and alternative debt relief.

Take the first step towards a fresh financial start and talk with a knowledgeable bankruptcy attorney from our firm. Whether you’re struggling with debt or seeking debt relief outside of bankruptcy, we’re here to help. Contact us today to schedule a free consultation and let us guide you through your best legal options. You can call us at (888) 584-9614 or reach out online, and we’ll schedule a consultation with you soon.

Frequently Asked Questions (FAQ)

How Much Does a Bankruptcy Attorney Cost in Garland, TX?

In Garland, TX, Chapter 7 bankruptcy attorney fees usually range from $1,777 to $2,642. For Chapter 13, fees range from $2,500 to $3,825. These amounts do not include court filing fees, which are:Firstly, $338 for Chapter 7Secondly, $313 for Chapter 13Most attorneys offer payment plans for Chapter 7, letting you pay over 3 to 6 months before filing. For Chapter 13, the attorney’s fee is often included in your 3-5 year repayment plan.In the Northern District of Texas—which covers Garland, Dallas, Plano, Mckinney and nearby cities—standard “no-look” fees for Chapter 13 are about $3,825. These fees don’t need detailed court approval.Both the Northern and Eastern Districts handle cases efficiently. Many bankruptcy lawyers also offer a free consultation to review your case and explain costs. If you hire a board-certified bankruptcy specialist, expect higher fees in exchange for more experience and service.

What Is the Difference Between Chapter 7 and Chapter 13 Bankruptcy in Texas?

Chapter 7 bankruptcy is a faster process that wipes out most unsecured debts. It usually takes 4 to 6 months. Chapter 13 bankruptcy is a repayment plan that lasts 3 to 5 years and helps you keep all your property.Here are the key differences:Timeline: Chapter 7 takes 4–6 months. Chapter 13 takes 3–5 years.Property: Chapter 7 uses state exemptions. Chapter 13 lets you keep all property while repaying.Income: Chapter 7 requires a means test. Chapter 13 requires regular income.Debt Limits: Chapter 13 has limits—$465,275 in unsecured debt and $1,395,875 in secured debt. Chapter 7 has no limits.Home Protection: Both protect your homestead under Texas exemptions.Business Needs: Business owners often choose Chapter 13 to keep their business running.Thus, Chapter 7 is better for people with low income and few assets. Chapter 13 is best if you need to stop foreclosure or catch up on car or mortgage payments. Both stop repossession and harassment from creditors.

What Property Can I Keep in Bankruptcy in Texas?

Texas bankruptcy exemptions are generous. They let you keep many important assets, including:Your home: Unlimited value on up to 10 city acres or 100 rural acres (200 for families)Vehicles: One per licensed household member, regardless of valuePersonal property: Up to $50,000 for individuals or $100,000 for familiesRetirement accounts: Fully protected (401(k), IRA, pensions)Life insurance: Cash value and annuities are protectedWages: Current wages and unpaid commissionsTools of trade: For professionals and business ownersYou can choose between Texas exemptions or federal exemptions. Most people choose Texas exemptions because they offer unlimited homestead and vehicle protection.These rules apply across Texas—from Dallas and Houston to small towns like Rockwall. Bankruptcy exemptions protect your property right away, unlike in estate planning or probate.Attorneys frequently discuss these protections during the consultation, as they’re often misunderstood even by experienced legal services providers in other practice areas.

How Long Does Chapter 7 Bankruptcy Take in Texas?

Chapter 7 bankruptcy in Texas usually takes 4 to 6 months from start to finish. Here’s the typical timeline:Filing to 341 meeting: 30–45 days341 meeting: A 10-minute meeting with the trusteeObjection period: 60 days after the 341 meetingDischarge: If no objections, discharge is issuedCase closed: About 30 days after dischargeThe automatic stay starts as soon as you file. This stops foreclosure, repossession, and debt collection. Most Chapter 7 cases move quickly unless the trustee needs more documents or assets need to be sold.Courts in the Northern and Eastern Districts of Texas handle cases from Garland, Plano, and nearby areas. These courts are known for efficient processing. Most attorneys explain this timeline during your first consultation, helping you set realistic expectations.

Do I Qualify for Chapter 7 Bankruptcy in Texas?

You qualify for Chapter 7 in Texas if your income is below the state median:Firstly, $61,460 for a single filer$79,870 for a coupleLastly, $89,842 for a family of threeIf your income is higher, you must pass the means test:Firstly, compare your average income (last 6 months) to the state median.Secondly, subtract allowed expenses (based on IRS guidelines).Calculate disposable income over 60 months.Finally, if your disposable income is under $7,475, you qualify.Other rules include:Firstly, complete credit counseling within 180 days before filingSecondly, no recent dismissals of previous bankruptcy casesOver 90% of Texans who apply qualify through income or the means test. Business owners may have additional considerations regarding business bankruptcy vs consumer bankruptcy filing.The State Bar of Texas provides resources for qualification questions and most attorneys offer a free case review to check your eligibility. Legal guidance can make the process smoother, whether you’re in Dallas, Arlington, Garland, Richardson, Fort Worth, or a smaller Texas town.