Imagine this: you’re grieving the loss of your spouse and dealing with their affairs. As you go through their estate plan you wonder – can a spouse change a trust after death? It’s a common question for surviving spouses, especially in Texas where laws are different. Whether it’s to adjust asset distribution or adapt to unexpected events, the ability to modify a trust after the grantor’s death is complex. Can a spouse change a trust after a spouse’s death to honor their loved one’s final wishes? Let’s find out.

Begin by locating the trust agreement and verifying whether it’s revocable or irrevocable. This sets the stage for what modifications may be allowed.

Seek guidance from a Texas estate planning or probate attorney to clarify your legal rights, especially if you’re unsure about modifying a trust.

Review all beneficiary designations and trust assets to ensure compliance with Texas law and the original trust terms.

If a successor trustee is named, confirm their responsibilities and whether they can amend the trust or only administer assets.

Explore whether amendments, restatements, or court approval might be necessary to reflect updated circumstances.

Trusts in Texas

Trusts are estate planning tools including testamentary trusts that manage and transfer assets. They offer benefits like avoiding probate and protecting trust assets. When a spouse dies, the legal impact on revocable living trusts can be significant. The surviving spouse may need to modify the trust to comply with asset distribution and legal requirements.

In Texas, the Texas Family Code governs living trusts and affects a surviving spouse’s ability to make changes after death. Different types of trusts also determine how much control a spouse has over post-death modifications. This is especially important for couples looking to protect real estate and other property.

RevocablLiving Trusts in Texas

A revocable living trust in Texas is a flexible tool during the grantor’s lifetime. The grantor has full control over the trust. They can use it for estate planning. When the grantor dies, the trust becomes an irrevocable trust. This means the surviving spouse must follow the trust terms and Texas state laws.

Key points to remember:

- The trust document and Texas community property laws determine if a spouse can change a trust after death.

- An experienced estate planning attorney can help manage a spouse’s trust after death.

- Beneficiary designations are crucial in deciding how remaining assets are distributed.

If you’re dealing with a spouse’s passing, understanding these elements is vital. It ensures the trust honors your loved one’s wishes and complies with legal requirements.

Joint Trusts and Spousal Rights

Joint trusts are a common estate planning tool for married couples. They help manage assets together and ensure a smooth transfer of control after one spouse dies. Typically, the surviving spouse becomes the sole trustee. They have the authority to manage and distribute trust assets according to the trust terms.

In Texas, joint revocable living trusts are popular because they offer flexibility and control. While both spouses are alive, they can make changes as needed. After one spouse dies, the trust remains revocable. This allows the surviving spouse to update beneficiaries and adjust distributions.

However, joint trusts can be complex. The surviving spouse’s rights may be limited by the trust agreement. That’s why couples should work with an experienced estate planning attorney. A well-drafted trust ensures a smooth transfer of assets and clearly outlines the surviving spouse’s responsibilities. Professional guidance can help avoid legal headaches and ensure the trust meets the couple’s goals.

| Aspect | Before Death | After Death |

|---|---|---|

| Control | Grantor can freely modify a revocable trust. | Trust typically becomes irrevocable, limiting changes. |

| Spousal Rights | Both spouses can agree on updates if joint trust. | Surviving spouse may need court approval or beneficiary consent. |

| Distribution | Assets remain under grantor’s direct authority. | Trust assets follow original terms, less flexible post-death. |

| Legal Process | Simple amendments or restatements possible. | Modifications often require Texas Property Code § 112.054 compliance. |

Can a Spouse Change a Trust After Death? Exploring Texas Law

Can a spouse change a trust after death? Consider the type of trust created in Texas. A standard A/B trust has different options. The “A” portion allows the survivor to control and make changes—sometimes known as the survivor’s trust.

The “B” portion or bypass trust holds the deceased spouse’s assets and has more fixed trust terms. Few changes are possible even by a surviving spouse especially with revocable living trusts. An irrevocable trust in estate planning is unchangeable as the terms of an irrevocable trust typically allow no changes. They serve wealth preservation and estate tax purposes. Control rests with appointed trustees not the spouse. The successor trustee plays a big role in managing trust assets after the grantor’s death including paying taxes and distributing assets to beneficiaries.

For a second marriage or adult children scenario or cases involving different financial situations each case demands close evaluation of how a trust works. Consult a probate attorney or estate planning professional to ensure compliance with state laws.

Successor Trustees and Their Role

A successor trustee is a person or institution appointed to manage a trust after the original trustee is unable or unwilling to do so. In the context of a joint revocable living trust, the successor trustee typically steps in to manage the trust assets after the death of one spouse.

Legal Tip

Before finalizing any trust modifications, confirm that the trust document explicitly grants the power to amend. If not, you may need court approval or beneficiary consent.

What is a Successor Trustee?

A successor trustee is responsible for administering the trust according to its terms. They make decisions about investments, distributions, and other trust-related matters.

The primary duty of a successor trustee is to act in the best interests of the beneficiaries. They must ensure that trust assets are managed and distributed according to the grantor’s wishes. This role requires a thorough understanding of the trust document. It also demands a commitment to upholding the trust’s terms and objectives.

Can a Successor Trustee Change a Trust After a Spouse Dies?

In Texas, a successor trustee may have the power to change a revocable living trust after one spouse dies. However, this depends on the trust agreement. The trust document limits the successor trustee’s authority. Any changes must follow the grantor’s original intentions.

If the trust allows amendments, the successor trustee may update the document or make other necessary changes. However, they must work with an experienced estate planning attorney. This ensures all modifications comply with Texas law and the trust’s terms.

Joint trusts and successor trustees are important in estate planning for married couples in Texas. Understanding their rights and responsibilities helps couples create a strong estate plan. This ensures a smooth asset transfer. It also honors the grantor’s wishes and provides security for the surviving spouse and beneficiaries.

Amendments, Restatements, and Decanting: Modification Options

Can a spouse change a trust after death? Sometimes. While usually unchangeable, specific conditions allow modifications to irrevocable trusts after death.

These modifications can be helpful for a spouse’s trust when specific actions need to be made. Let’s explore some options, including amendments and restatements. We’ll also examine the concept of trust “decanting.”

Amendments and Restatements: Direct Changes

Amendments are small changes to the trust that modify certain language without changing the entire instrument. Restatements replace the entire trust document with a new one that includes all changes. As the grantor (or trust creator) has control over amendments and restatements during the life of a revocable living trust, things change after the grantor passes away.

In Texas, if the trust is irrevocable, making post-death changes usually requires either unanimous consent of all beneficiaries or a court order. This is stated in Texas Property Code § 112.054 which outlines when a court can modify or terminate a trust—such as when unforeseen circumstances arise or if it further the grantor’s probable intent. Always consult with an experienced trust lawyer if you think amendments or restatements are needed.

Key Takeaway

A surviving spouse’s authority to make changes depends on the trust’s terms and state laws. Always review the original document and consult a legal professional to avoid unintended consequences.

Decanting: An Indirect Approach

Decanting, legal in some states but not Texas, involves transferring trust assets into a new trust with different terms. It allows modifications without direct changes. While not applicable in Texas, it provides an alternative perspective on modifying a trust. For instance it can help restructure trust distributions without an outright trust contest. But in Texas you’d need other legal avenues to pursue such modifications.

Protecting Your Legacy: Practical Steps

When planning your estate think beyond “can a spouse change a trust after death.” Consider your goals and choose the right type of trust with the guidance of a Texas trust attorney. Sometimes establishing a joint revocable trust or a joint revocable living trust can be a good idea for married couples seeking efficient post-death administration. But always review your trust instrument thoroughly.

| Trust Type | Spouse’s Ability to Change After Death | Benefits | Considerations |

|---|---|---|---|

| Revocable Living Trust | Generally, no, unless provisions are added or there is an agreement or court approval. This also depends on the originally-created trust document, or an amended trust later. | Flexibility, Avoids probate process, Privacy | Becomes irrevocable upon death, potentially causing unintended outcomes or difficulties with handling assets. Consider naming successor trustees for trust administration. |

| Irrevocable Trust | No, except in some specific circumstances. These documents usually can not be changed without specific steps being taken by beneficiaries and trustee or court. | Asset protection, Tax benefits | Inflexibility, seek expert advice. Successor trustee of an irrevocable trust must strictly follow original terms. |

| Joint Trust | Often, yes. After a person dies in a joint trust there are more considerations with the living person’s separate trusts, trust beneficiaries and the trust generally overall. | Simple, suitable when all assets go to surviving partner | Surviving spouse’s control can inadvertently change bequests for other beneficiaries. If undue influence is suspected, legal action might follow. |

| A/B Trust | Partial control (survivor’s trust, not bypass trust). An experienced estate planning attorney should always be involved, and we encourage clients to get such counsel. | Balances spousal inheritance with other legacies | State-specific regulations (Uniform Trust Decanting Act in some states may give increased spousal power). Hence, consulting with an experienced trust lawyer is crucial. |

Name contingent beneficiaries to avoid confusion if a beneficiary dies before you. Communicate your wishes openly and clearly to avoid ambiguity. Remember in certain cases—like a second marriage scenario or complex family trust setups—you may want to prevent conflict among adult children.

Why You Should Work With an Experienced Estate Planning Attorney

Can a spouse change a trust after death? We’ve seen that the answer depends on Texas trust laws and the type of trust. Consulting with a Texas estate planning attorney offers many benefits:

- Legal Expertise:

Attorneys know the Texas Uniform Trust Code and other state laws.

- Trust Modification Assessment:

An attorney can review the trust agreement and advise if desired changes align with Texas law including successor trustee change scenarios.

- Avoiding Potential Conflicts:

Attorneys ensure compliance and avoid disputes that could lead to a trust contest or legal issue. They also protect against claims of undue influence.

- Understanding Tax Implications:

An experienced attorney knows the tax implications of trust changes. They can advise on managing revocable trusts that may be subject to federal estate tax or irrevocable trusts with unique tax rules. Often remaining assets in a decedent’s trust must be distributed according to the trust instrument so make sure everything is done correctly for tax purposes.

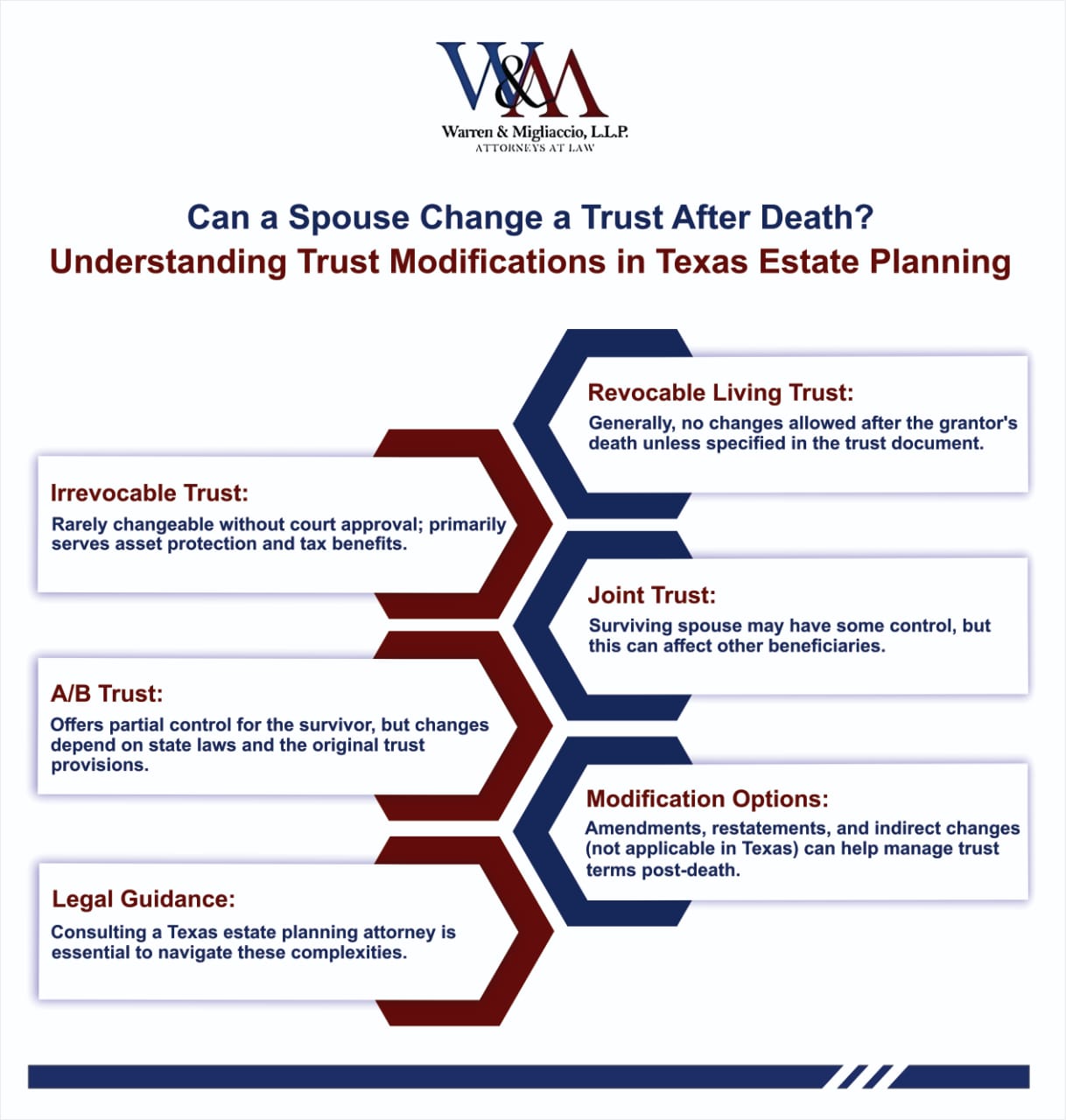

This infographic breaks down essential information for surviving spouses on whether they can change a trust after a loved one’s death, highlighting trust types, and options for modifications.

Frequently Asked Questions

Reasons and Motivations

Why might a spouse want to change a trust after death?

A surviving spouse may need to adjust a trust due to changing family circumstances or financial needs. For example, they might need to reallocate assets to cover long-term care. They may also need to provide for children from a previous marriage.

Legal Limits and Procedures

Can a bypass trust be amended after one spouse dies?

A bypass trust (the “B” portion) typically becomes irrevocable after the first spouse’s death. Minor administrative changes may be possible if the trust document allows them. However, major modifications usually require court approval. They may also need unanimous consent from the beneficiaries.

What legal steps are involved in modifying a trust post-death?

The surviving spouse or trustee must first review the trust terms and state laws. This helps determine if modifications are allowed. If changes are possible, they may pursue amendments or restatements. They may also seek court approval if beneficiaries consent. These steps often require legal documentation. They can also involve costs.

How do you contest a trust after death?

Trust disputes may arise if beneficiaries believe changes are invalid or unfair. Contesting a trust usually involves filing a legal challenge in probate court. Courts will look at whether the trust was properly executed and whether the proposed changes reflect the grantor’s intent.

Taxes and Financial Impact

Are there tax implications if a spouse changes a trust after death?

Changing a trust can affect estate or gift taxes, especially if additional assets are moved or beneficiary designations change. Get a tax professional or estate attorney to ensure any changes comply with federal and state tax laws.

Role of Legal Professionals

What role does a probate attorney play in modifying a trust?

A probate attorney helps interpret trust documents. They also explain applicable state laws and guide clients through the legal process. Their role ensures changes align with the grantor’s original intent. They also help minimize disputes among beneficiaries.

Case Studies

Case Study 1 (Real Case):

In Archer v. Anderson, 556 S.W.3d 228 (Tex. 2018) , I found that a trust instrument must be interpreted as written and that any significant changes require explicit authority in the trust or court approval. Even when questions arise about trust administration after one spouse’s death, the court said any big changes generally require permission in the trust or by the court. This case shows how tough it is for a surviving spouse to make changes post-death.

Case Study 2 (Hypothetical Scenario):

Alice and Bob created a joint revocable trust to protect their investments, real estate and trust assets. When Bob passed away, Alice wanted to change how certain assets would pass to step-children from a second marriage. Since the trust was now irrevocable, she faced legal hurdles. With the help of an estate planning law firm, she sought court approval for limited changes. This example shows how even a simple change can require legal action to comply with the original trust.

Scenarios

Scenario 1: Marital Trust

John and Maria, both 50, set up a marital trust (part of an A/B trust) to protect their children’s inheritance. When John died, Maria wants to redirect some of the trust assets to a favorite charity. She finds out the decedent’s trust is irrevocable. Only the “A” portion (the survivor’s trust) can be changed. She consults an estate planning law firm and learns about court procedures to make limited changes if all beneficiaries consent.

Scenario 2: Successor Trustee Change

Melanie is the current trustee of her late husband’s family trust. She needs a successor trustee change for better trust administration. Since the trust is irrevocable, she must follow the original trust terms or get court permission. By working with a trust protector, she can keep the trust fair and avoid a trust contest.

Case Study

In one scenario, a spouse discovered their trust required unanimous beneficiary consent for any post-death changes. Because one beneficiary objected, modifications were delayed until a court hearing resolved the dispute.

Conclusion

Navigating trust in Texas can be complex. Whether a spouse can change a trust after death depends on several factors. A qualified Texas estate attorney can guide you through these issues. He can help create effective estate plans tailored to your needs.

Proper planning allows loved ones to fulfill last wishes and reduces family conflicts. This ensures a smoother transition when a spouse or loved one passes away. Hence, providing clarity for all trust beneficiaries. Our experienced estate planning attorneys at Warren & Migliaccio are here to assist you. Call us at (888) 584-9614 or contact us online to start planning your estate today.