If you’re drowning in credit card debt, you might be wondering: can credit card companies take your house? Many homeowners are facing financial difficulties and worry about losing their homes due to credit card debt. That’s a fear for many Texas homeowners, especially when bills pile up and you can’t keep up.

We’ve been helping North Texas families for nearly twenty years, so we know why this question keeps you up at night. Let’s get to the point: credit card companies cannot take your house for unpaid credit card debt.

Credit card debt is unsecured debt, it is not tied to your home or car as collateral. However, if you owe money on credit cards or other debts, it’s understandable to worry about your home. But the law has some twists, and it’s good to know exactly where you stand so you can make the best decisions for your situation.

We’ve worked with thousands of clients across Texas, and we see these questions all the time. While it’s extremely rare for a credit card company to end up with your house, there are legal processes that can lead to liens on your property in certain situations.

So, let’s break down what Texas homeowners need to know about keeping their homes safe from credit card companies.

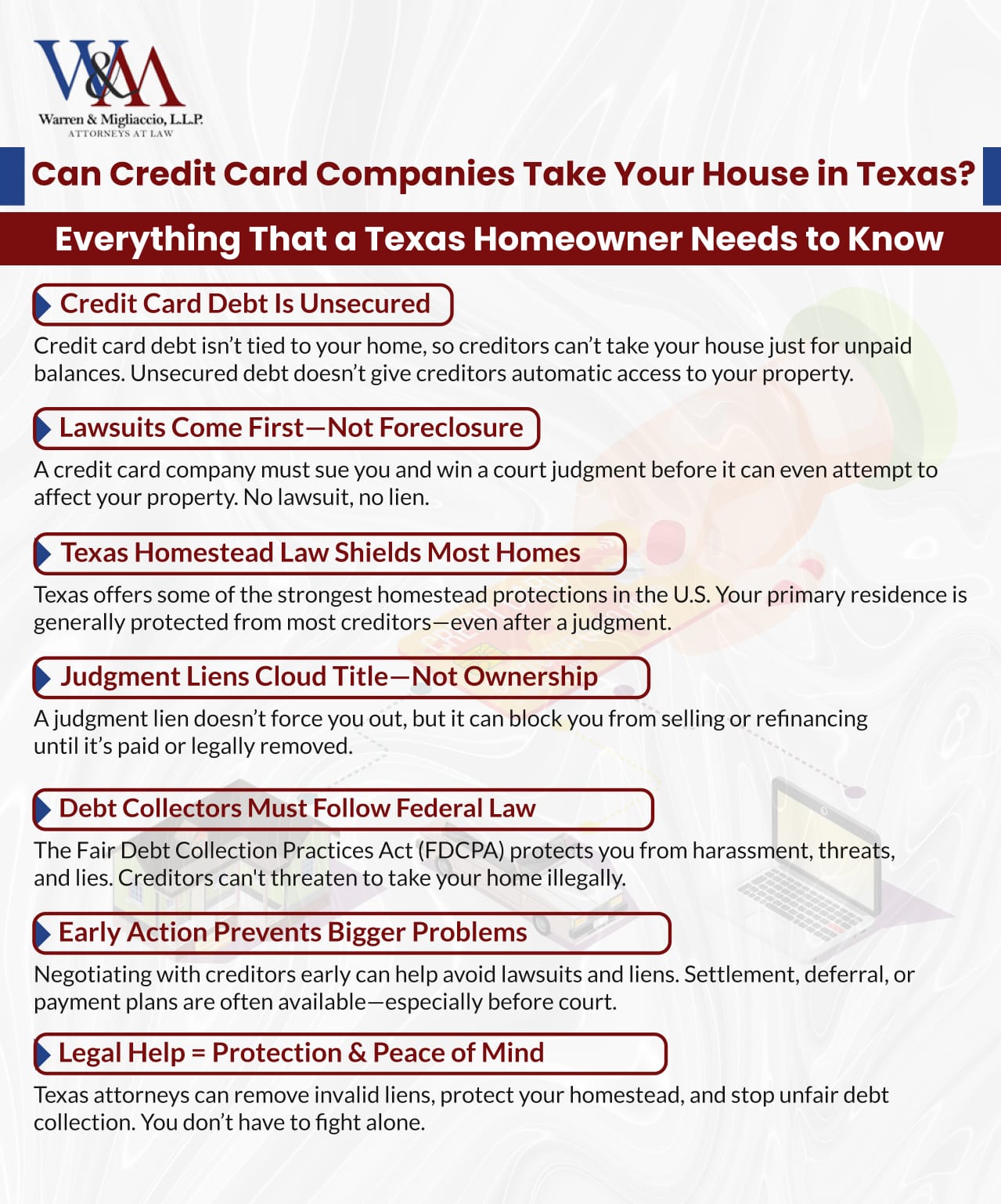

Need-to-Know Highlights for “Can Credit Card Companies Take Your House?”

- Credit card debt is unsecured, so companies must sue and win a judgment before placing a lien on your home.

- Texas homestead exemptions shield most home equity, preventing forced sales for unsecured debts like credit cards.

- Judgment liens don’t force you out but block selling or refinancing until debts and costs are paid.

- Federal and state laws ban unfair collection practices and allow you to dispute or verify debt in writing.

- Early negotiation, legal counsel, and debt management strategies can stop judgments before they threaten your home.

Secured vs. Unsecured Debt: The Foundation of Your Protection

The difference between secured and unsecured debt is what really protects your home. We explain this to clients almost every day.

Secured debt means there’s collateral—think mortgages, car loans, stuff like that. Secured debts are those that secure the lender’s interest in the property, such as a mortgage. If you default on your mortgage, your lender can go after your house and start foreclosure. That’s because the loan is tied to the property.

Unsecured debt covers credit card debt, medical bills, most personal loans, and other debts not backed by collateral. So, if you miss credit card payments, the credit card company has no automatic claim to your house. Your home is generally safer from unsecured creditors than you think.

From what we’ve seen in North Texas courts, this difference gives homeowners real protection. Credit card companies have to jump through a lot of legal hoops before they can even think about placing a lien on your property.

The Legal Process: How Credit Card Companies Can Pursue Your Home

Test Your Understanding

Credit card companies can’t just take your house, but they can go to court and, if they win, potentially get a lien on your home. Legal action is typically only pursued after you miss debt payments and unpaid debt accumulates. Knowing how this works gives you time to react and options to consider.

When a Credit Card Company Sues You

If you stop paying your credit card bills for a while, the credit card company or a debt collector might threaten to sue you, and then sue you if they do not get paid. We’ve seen this happen after a few months of missed payments, but the timeline can vary.

Here’s what usually happens:

- You get served with court papers

- You have a chance to respond and defend yourself

- The court decides if a judgment is issued; if so, you become the judgment debtor

- The process can proceed to settlement or negotiation before trial

Related: What Happens if a Debt Collector Takes You to Court?

Court Judgment

If the credit card company wins or you don’t respond, the court issues a judgment against you. That means you owe the original debt plus interest, court costs, and attorney fees. In Texas, these judgments can stick around for years.

Once a court issues a judgment, the creditor can place a judgment lien on your property. This doesn’t mean you’ll be forced to move out or sell your home immediately. Instead, the lien gives the creditor a legal claim that you must satisfy if you decide to sell or refinance your house. In most cases, homeowners must pay off the lien before they can complete a sale. During closing, the parties must settle the lien amount to clear the title for the buyer. If your home has enough equity, the creditor can collect the owed amount directly from the sale proceeds.

Texas Homestead Exemptions: Your Best Protection

Texas homestead exemptions are some of the strongest in the nation, and we talk about them with clients all the time. They’re designed to keep your home’s equity safe from most judgment creditors, including credit card companies.

How Homestead Exemptions Work

Homestead exemptions in Texas protect the equity in your main residence up to certain limits. For urban homes, it’s up to 10 acres; for rural families, it’s up to 100 acres. The key point is that creditors can’t force a sale if the protected equity covers your home’s value.

In most cases, especially with typical credit card debt, these exemptions cover you completely. For example, if you have $50,000 in equity and it’s protected by Texas law, a judgment creditor can’t force a sale to collect. This applies to your primary home where you and your family actually live.

Limitations and Exceptions

Homestead exemptions are strong, but not foolproof. Some debts can get around them:

- Property taxes or tax liens

- Mortgage debt tied to the house

- Home equity loans and some other secured debts

- Mechanics’ liens for home repairs

Credit card debt almost never fits into these exceptions, so homeowners are generally well protected from forced sales over unpaid credit card bills.

What Credit Card Companies Cannot Do Under Federal Law

The Fair Debt Collection Practices Act (FDCPA) and other federal and state laws give consumers some real rights. Federal law provides important consumer rights to protect homeowners from unfair debt collection practices. We help clients understand these protections and how to use them.

If you need help understanding your rights or dealing with debt collectors, you should seek professional assistance.

Prohibited Debt Collection Practices

Debt collectors can’t:

- Threaten to take your house without following the law

- Lie about what they can legally do

- Harass you with non-stop calls or nasty language

- Call you at work if you’ve told them not to

- Talk about your debt with family or neighbors

We see these rules broken all the time. If it happens, keep records and report it to the Consumer Financial Protection Bureau (CFPB). Sometimes you can even get damages if the collector crosses the line.

Your Rights During the Collection Process

You have the right to:

- Ask for debt verification in writing

- Dispute the debt if it’s wrong

- Negotiate a payment plan or settlement

- Get legal help at any time

- Consider bankruptcy if things get bad

Knowing your rights lets you take control instead of worrying about losing your home to credit card debt.

Judgment Liens on Homeowners

A judgment lien won’t make you leave your house right away, but it does come with strings attached. While a judgment lien does not mean you will immediately lose your home, unpaid debts increase the possibility of complications when you try to sell or refinance. The creditor gets a legal claim on your property if you try to sell or refinance.

A Word From Chris: How a “Sleeping” Lien Causes Problems Later

I often think of a couple from North Texas I met years ago. A creditor had won a judgment against them for an old credit card debt. Because of this, a lien was placed on their home. They were scared they might be forced to leave.

I explained to them that Texas has a strong homestead exemption. This means no one can force them to sell their family home. They felt a big debt relief after hearing this.

But five years later, when they wanted to retire and sell the house, the lien caused a big problem. The title company refused to close the sale because of the “cloud” on the title.

The couple worried they would have to pay the old debt. To solve this, we created a special legal affidavit. This document declared their property as their constitutionally protected homestead.

We recorded this affidavit with the county. This proved to the title company that the creditor’s lien could not be enforced against their house.

With the title cleared, the sale went through. The couple moved on to their retirement without paying that creditor a single dime.

Property Transaction Restrictions

A judgment lien means you can’t:

- Sell your house without paying off the lien

- Refinance your mortgage without dealing with the lien

- Get a home equity loan or line of credit

- Transfer ownership to someone else, even family

These restrictions can really limit your options, even if you’re still living in your home. The lien has to be paid before most real estate transactions can go through.

Credit and Financial Impact

Judgment liens hurt your credit score and make borrowing harder. Here’s what we see:

- Credit scores often drop a lot after a judgment

- Getting new loans gets tougher

- Interest rates on any approved loans go up

- Some lenders just say no if you have outstanding liens

This kind of credit damage can last 7 years or more, making it hard to get good deals on future loans.

Protecting Your Home: Proactive Strategies

Getting in early is the best way to protect your home and your finances. There are steps you can take to avoid lawsuits and judgments altogether.

If you are worried about losing your home to credit card debt, your next steps should include consulting with a financial advisor or legal professional to explore your options and create a plan to protect your property.

Early Communication and Negotiation

If you’re struggling with credit card payments, reach out to your creditors right away. Many credit card companies will work with you—sometimes offering temporary payment deferrals, lower payments, reduced interest rates, or even settlements for less than you owe. Negotiating with creditors can help you avoid legal action and protect your home. It is recommended to establish a payment plan with creditors to prevent escalation to lawsuits.

- Temporary payment deferrals

- Reduced payment plans

- Interest rate reductions

- Settlement agreements for less than the full balance

We’ve noticed creditors are more flexible before your account goes to a collection agency or ends up in court. Acting fast usually means better outcomes and less hassle down the line.

Professional Debt Management Help

You may want to get help from:

- Non-profit credit counseling agencies

- Debt negotiation attorneys

- Financial advisors who know debt management

- Bankruptcy attorneys if things are really bad

- Legal assistance, which can be crucial in defending against lawsuits, protecting your assets, and navigating court proceedings related to debt disputes

These pros can help you figure out your options and come up with a plan that fits your financial situation and goals.

If You’re Sued: Your Options

If you’ve been sued by a credit card company, don’t wait—act now. There are ways to defend yourself.

Responding to Court Papers

Don’t ignore court documents, even if you think you owe the money. If you don’t respond, the court will likely give the creditor everything they ask for. Here’s what you can do:

- Challenge the debt amount or whether it’s valid

- Ask for proof the creditor owns the debt

- Negotiate a settlement before it goes to trial

- Use legal defenses like expired statute of limitations

Working with an Attorney

An attorney can help you:

- See how strong the creditor’s case is

- Find defenses or counterclaims to help your chances of winning the lawsuit

- Negotiate better settlement terms

- Protect your homestead and other exempt assets

- Consider bankruptcy if it makes sense

Even if you owe the debt, having an attorney can make a big difference.

Removing Liens and Resolving Debt

There are ways to get rid of judgment liens and deal with your debt. In some cases, you may be able to negotiate with creditors to settle your debt for a lower amount than what you owe. The best option depends on your finances and your situation.

You should also check if you qualify for bankruptcy, as this can be a way to remove certain liens and get a fresh start.

Payment and Settlement Options

You can remove liens by:

- Paying the full judgment, including interest and costs

- Settling for less—creditors often accept less than the total

- Setting up a payment plan to pay over time and protect your property

- Disputing liens that are invalid or filed incorrectlyWe’ve seen creditors accept significantly reduced settlements, especially if collecting through a forced sale would be a hassle. Negotiation can really pay off here.

Long-term Strategies

Sometimes, waiting it out is an option:

- Judgment liens expire after a set number of years (varies by state)

- Bankruptcy can wipe out certain debts and liens

- Homestead exemptions may grow, offering more protection

- Changes in property value or life circumstances can shift things

When Credit Card Companies Rarely Pursue Home Seizure

It helps to know how credit card companies usually act when it comes to property liens. In our decades of practice, we’ve seen patterns that actually favor homeowners most of the time. Creditors may try to seize bank accounts as an alternative to pursuing a home.

Economic Factors That Protect Homeowners

Credit card companies rarely try to seize homes because:

- Legal costs often outweigh what they could recover, especially for debts under $10,000.

- Homestead exemptions shield most or all home equity in many cases.

- Time and uncertainty make other collection methods more appealing.

- Market conditions sometimes make forced sales just not worth it.

Most creditors go for wage garnishment, bank account levies or settlements instead of the hassle and expense of forcing a property sale.

Debt Thresholds and Practical Considerations

From what we’ve seen, home seizure attempts usually involve:

From what we’ve seen, home seizure attempts usually involve:

- Very large debt amounts (often $65,000 or more)

- Substantial home equity that goes beyond exemption limits

- Debtors with significant assets but not many other ways for creditors to collect

- Unusual situations where other collection methods just don’t work

Credit card companies pursuing liens typically do so for larger amounts, making it less common for smaller debts.

Texas-Specific Considerations for Homeowners

As attorneys who focus on Texas law, we get the unique protections that Texas offers homeowners dealing with credit card debt collection.

Texas Homestead Law Advantages

Case Study: When a Creditor’s Refusal to Release a Lien Becomes Costly

In Tarrant Bank v. Miller, 833 S.W.2d 666 (Tex. App.—Eastland 1992, writ denied), a bank held a judgment lien against the Millers for an old car loan and refused to release the lien when they tried to sell their homestead property in Brown County. The bank argued that since the lien was legally unenforceable against a homestead, it didn’t need to be released. The court disagreed, stating that even an unenforceable lien can create a “cloud on title” that disrupts a sale. Because the bank’s refusal to issue a partial release caused the Millers’ home sale to fail, the court ordered the bank to pay the Millers over $28,000 in damages for their financial losses, mental anguish, and attorney’s fees.

This case matters because it establishes that a creditor can be held financially liable for wrongfully refusing to release a lien on a Texas homestead, reinforcing the legal protections available to homeowners.

Texas homestead protections are some of the strongest in the country:

- Unlimited value protection for qualified homesteads (within certain acreage limits)

- Constitutional protection that can’t be bypassed without specific procedures

- Family protections that cover more than just the property owner

- Broad definitions that include mobile homes and other types of residences

Local Court Practices

In Dallas, Collin, Denton and Tarrant counties, we’ve noticed local courts often lean in favor of homeowners:

- Courts look closely at homestead exemption claims

- Judges know how important it is to protect family homes

No. Credit card debt is unsecured, so they can’t just take your home. They’d have to sue, win a court judgment and record a judgment lien. Even then, the Texas homestead exemption will almost always block a forced sale of your main residence.

Frequently Asked Questions

Liens & Judgments

Can a credit card company put a lien on my house?

Yes, but only after they sue you and win in court. They must record the judgment in county property records. This puts a lien on your home’s title, but if your home qualifies for the Texas homestead exemption, you won’t have to move or sell.

What happens before a creditor can put a lien on my house?

* You fall behind on payments.

* They sue you.

* Also, they win a court judgment.

* They record the judgment as a lien in county records.

How long does a judgment lien last in Texas?

A judgment lien stays on your property for 10 years from when it’s recorded and can be renewed for another 10 years. So, unresolved liens can be on your title or credit report for up to 20 years.

Will a judgment lien stop me from selling or refinancing my home?

Yes. Lenders and title companies will usually require all liens to be paid or released before closing. You might get higher interest rates or even a denial until the lien is cleared.

How do I get rid of a credit card judgment lien on my property?

You can:

* Pay or settle the judgment and then file a Release of Lien.

* Ask the court to declare the lien invalid if your property is a protected homestead.

* Discharge the debt in bankruptcy—sometimes this removes judgment liens.

Homestead Exemption & Protections

How does the Texas homestead exemption protect my house from creditors?

Texas law protects your primary residence—up to 10 urban acres or 100 rural acres for families—from most unsecured creditors, including credit card companies. This exemption prevents forced sale for credit card debt, no matter the value of your home.

Are there any debts that can override the Texas homestead exemption?

Yes. The exemption doesn’t protect against:

* Property tax liens

* Your mortgage or home equity loan

* Mechanic’s liens for home improvements

* Certain HOA assessments

* Court-ordered child or spousal support

Debt Collection & Lawsuits

What happens if I ignore a credit card lawsuit?

If you ignore it, the creditor gets a default judgment. That can mean:

* A judgment for the full debt plus costs

* Possible judgment lien on your property

* Damage to your credit report

* Lost chances to negotiate or defend yourself

Can a credit card company garnish my wages in Texas?

No. Texas law doesn’t allow wage garnishment for consumer debt. Creditors might try bank account levies or judgment liens instead. Federal debts, child support, and student loans are exceptions.

What personal property can a Texas judgment creditor seize?

Creditors can go after non-exempt stuff like vacation homes, boats, collectibles, or investment accounts. Basic household goods, tools of your trade, and one vehicle per licensed household member (up to certain values) are exempt.

How long does a credit card company have to sue for debt in Texas?

Credit card companies have four years from your last payment or account activity to file a lawsuit. After that, they can’t get a judgment, though collection attempts might still happen.

Bankruptcy & Property

How does bankruptcy affect my home in Texas?

Texas homestead exemptions usually protect your main home in bankruptcy. If you’re current on mortgage payments and your equity is within limits, Chapter 7 or Chapter 13 lets you keep your home. Bankruptcy can also wipe out credit card debt and get rid of some liens.

Preventive Actions & Settlements

How can I protect my home from credit card creditors?

* Know and use your Texas homestead exemption rights

* Respond quickly to lawsuits

* Try to negotiate before judgment

* Document that your property is your primary residence

* Talk to an attorney early

* Don’t use home equity loans to pay unsecured debt

Should I settle if threatened with a home lien?

Settling can clear your title and resolve the debt, but always get a written agreement releasing the lien. It’s smart to have a legal professional look over any settlement offer to make sure your rights are protected.

Take Action to Protect Your Home

Scared of losing your home to credit card debt? Honestly, that’s a common fear but the legal landscape actually gives most homeowners a lot of protection.

Credit card companies have to jump through a lot of hoops to try to take your home. In Texas, homestead exemptions add another layer of protection for your family’s residence. If you’re in financial trouble and worried about your home, don’t wait. The sooner you act, the more options you’ll have—nobody wants to wait until lawsuits or judgments are already filed.

We’ve been helping North Texas families since 2006. We know how overwhelming debt can be for homeowners.

Call our law firm at phone number (888) 584-9614 or contact us online for a free consultation. We’ll review your situation, explain your rights and help you come up with a plan to deal with your debt and protect your home.

It’s easy to get stuck in worry, but taking that first step can make a big difference.

Note: This article is for informational purposes only and does not constitute legal advice. For advice specific to your situation, please consult a qualified attorney.