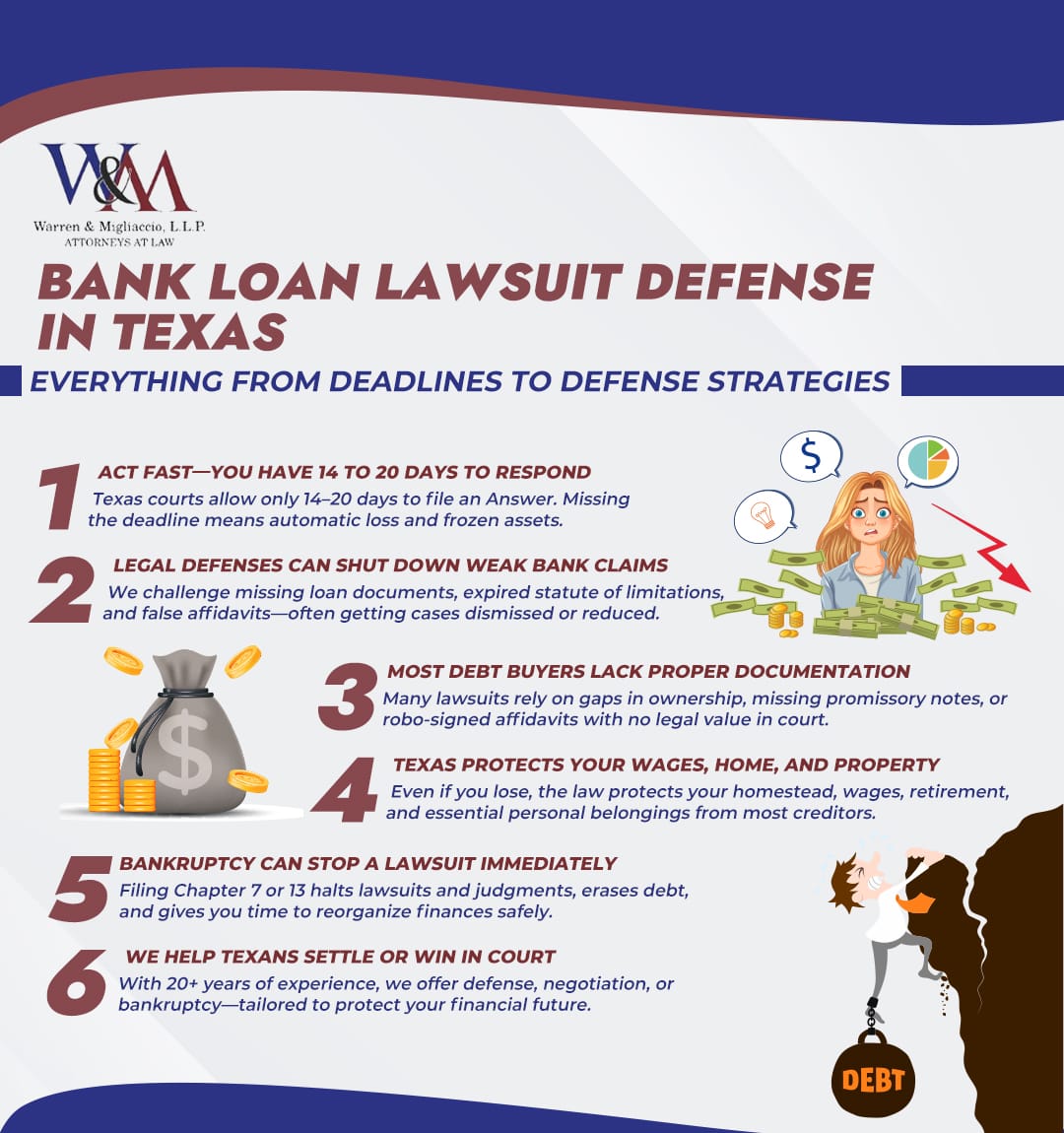

In Texas, you generally have 14 days in Justice Court or 20 days + the next Monday in County or District Court to file an Answer to a bank-loan debt lawsuit. Missing the deadline may let the lender win a default judgment, place liens on non-exempt property, and even freeze your bank accounts.

Quick Answer: How do I file an Answer to a bank-loan lawsuit in Texas?

At Warren & Migliaccio, we recommend promptly filing a precise Answer to preserve your rights and avoid default judgments.

- Determine your deadline: 14 days (Justice Court) or 20 days + next Monday (County/District).

- Draft your Answer: include case info, numbered responses, and affirmative defenses.

- File the Answer before deadline and serve opposing counsel with certificate of service.

Introduction

Served with a bank-loan lawsuit in Texas? The clock is ticking—and every day matters. Some courts give you only 14 days to act, and a default judgment can devastate your finances faster than you might imagine.

As a law firm with extensive experience in bank loan lawsuit defense, we defend clients throughout Texas, from Houston to Amarillo, with local offices in Richardson, Dallas, and Prosper to serve North Texas families. Our experienced debt defense attorneys have a proven track record of dealing with complex debt lawsuits on behalf of our clients, alleviating your stress and allowing you to focus on what matters most. We understand the stress you’re facing and are here to help protect what you’ve worked hard to build.

Why Banks Sue Texans for Unpaid Loans

Texans fall behind on all kinds of consumer debt—credit card debt, auto loans, student loans, and medical bills. When repayment stalls, banks and their collection partners move quickly to recover what they can through the court system. Aggressive tactics are often used by banks and their partners to pursue delinquent debts, which can increase pressure on consumers.

Understanding Secured vs. Unsecured Loans

The type of loan you have dramatically affects how banks can collect:

Secured loans (auto, home-equity):

- Firstly, backed by specific collateral

- Likwise, lenders can repossess or foreclose without suing

- Also, court action typically follows failed repossession attempts

- Examples: car loans, home equity lines of credit (HELOCs)

Unsecured loans (personal lines, credit card consolidations):

- Firstly, no collateral backing the debt

- Also, require court judgments to force collection

- Similarly, often sold to debt buyers after charge-off

- Examples: personal loans, credit cards, medical debt. Challenging the accuracy of the debt amount claimed is a legitimate defense under Texas law and the FDCPA, which is designed to promote fair debt collection practices and protect consumers from unethical collection efforts.

After charge-off (typically 120-180 days past due), collection agencies or debt buyers like LVNV Funding, Midland Funding, or Portfolio Recovery Associates often purchase these accounts for pennies on the dollar.

Common Lawsuit Triggers

Banks and debt buyers file suit when:

- Firstly, three or more missed payments accumulate

- Likewise, loan maturity default occurs (balloon note reaches end date without payoff)

- Also, covenant breach happens, like failing to maintain required insurance

- Similarly, transfer of the note to aggressive debt buyers who sue systematically

- Finally, statute of limitations approaches (creating urgency to file)

Texas Deadlines: Answer Before a Default Judgment Hits

Time is your enemy in Texas debt lawsuits. Missing your response deadline virtually guarantees a loss by default.

The legal process begins with service of process, which officially notifies you of the lawsuit and starts the clock for your response.

Critical Response Deadlines by Court Type

| Court Level | Response Deadline | How It’s Calculated | Citation Method |

|---|---|---|---|

| Justice Court (JP) | 14 days after service | Calendar days, including weekends | Constable or certified mail |

| County/District Court | 20 days + next Monday | If day 20 isn’t Monday, extend to following Monday | Sheriff, constable, or private server |

Quick Checklist to Draft Your Answer

Your Answer must include:

- Case information: Your name, case number, court designation

- Numbered responses: Address each allegation (admit, deny, or “insufficient knowledge”)

- Affirmative defenses: List all applicable defenses (see defense section below)

- Discovery requests: Demand production under Tex. R. Civ. P. 194.2

- Certificate of service: Proof you mailed a copy to opposing counsel

Firstly, file with the court clerk before your deadline expires—late filings are rarely accepted.

How you respond can significantly affect the results of your case. Likewise, timely and proper responses often lead to better respond results, such as avoiding default judgments and improving your legal outcome.

Case Study: Dismissing an $85K Bank Claim by Exposing Ownership Gaps

Recently, I met a small-town hardware store couple who were terrified. They’d co-signed an $85,000 bank loan to keep their family business alive, and weeks without sleep had left them overwhelmed at the thought of losing both their store and their home.

So, I immediately filed a timely Answer and launched an aggressive discovery campaign under Tex. R. Civ. P. 194.2, demanding every document that could prove the bank’s claim. As we reviewed the records, I soon uncovered that the loan had been sold twice—and, crucially, the chain of title was broken. There was no assignment linking the second and third owners.

As a result, faced with our challenge, the plaintiff agreed to dismiss the suit with prejudice and zero payment. The couple called afterward, relieved they could finally breathe again.

Takeaway: In Texas debt lawsuits, demanding unbroken proof of ownership can turn the tide. Never accept a claim at face value.

Proven Defenses to Bank Loan Lawsuits in Texas

Our nearly 20 years defending Texans has revealed consistent weaknesses in creditor lawsuits. We have extensive experience handling debt cases, including both debt lawsuits and settlement negotiations. Here are the most powerful defenses we deploy:

Lack of Standing & Missing Assignment Documentation

Banks and debt collectors must prove they own your specific debt through an unbroken chain of title. Common fatal flaws include: * Missing assignments between owners in the chain

- Undated or post-dated assignments (signed after lawsuit filed)

- Generic affidavits lacking personal knowledge of records

- Robo-signed documents with suspect signatures

- Lost original notes without proper affidavits. Standing debt buyers must prove they have the legal right to collect the debt they are suing for, and this is often among the key legal issues in court.

We aggressively challenge standing by demanding production of every link in the ownership chain.

Four-Year Statute of Limitations & “Acceleration” Date

Under Texas Civil Practice & Remedies Code §16.004, lenders have four years after a loan is accelerated to file suit. Critical dates we examine:

- Firstly, last payment date (when did you last pay anything?)

- Also, charge-off date (when did the bank write off the debt?)

- Additionally, acceleration letter date (when did they demand full payment?)

- Finally, default notice dates (formal notices of breach)

We meticulously calculate these dates because even one day past the deadline defeats the entire claim.

Arbitration Clauses & Motion Practice

Many loan contracts contain mandatory arbitration provisions that can work in your favor:

- Firstly, forces cases out of court into private arbitration

- Also, increases lender costs significantly

- Similarly, leads to favorable settlements when lenders want to avoid expense

- Also, provides leverage in negotiation

Discovery Demands That Win Cases

Through formal discovery under Rule 194.2, we demand:

- Firstly, complete payment history with all credits and debits

- Also, original promissory note with all endorsements

- Likewise, every assignment document in the chain of title

- Additionally, affidavits from employees with actual knowledge

- Similarly, call logs and recordings of collection calls

- Also, internal policies for record-keeping

- Finally, data files showing account history

Evidence Banks Must Show—And How We Knock It Out

Creditors must prove every element of their case with admissible evidence. If a debt collector is pursuing legal action, they must also meet these evidentiary requirements in court. Here’s what they need and how we attack it:

Required Evidence Elements

- Valid Contract: Original loan agreement with your signature

- Default: Proof you breached specific terms

- Damages: Accurate calculation of amount owed

- Standing: Complete chain of ownership

- Conditions Precedent: Proof they followed all contract requirements

Frequent Paperwork Mistakes We Exploit

Our experience reveals creditors commonly fail with:

- Illegible documents: Microfilmed signatures that can’t be authenticated

- Hearsay records: Business records without proper foundation

- Missing data: Spreadsheet summaries lacking underlying statements

- Break in chain: Gaps between assignments (Company A to C, skipping B)

- Wrong plaintiff: Suing in name of company that no longer owns debt

- Calculation errors: Incorrect interest, missing payments, double charges

One documentation error can sink a multimillion-dollar portfolio claim.

What Happens If You Lose? Judgments, Liens & Bank-Account Freezes

Understanding judgment consequences helps you make informed decisions about fighting or settling:

Immediate Judgment Powers

A Texas judgment allows creditors to:

- Firstly, file abstract of judgment: Creates automatic liens on all non-exempt real estate

- Likewise, levy non-exempt property: Seize vehicles, business equipment, investments

- Also, freeze bank accounts: Serve writs that lock your checking/savings

- Similarly, renew for 10 years: Judgments last a decade and can be renewed indefinitely

Texas Exemptions That Protect You

Fortunately, Texas provides strong asset protections:

- Homestead: Your primary residence is absolutely protected (Tex. Const. art. XVI, §50)

- Wages: Cannot be garnished for consumer debt (only child support/taxes)

- Retirement accounts: Most qualified plans are exempt

- Personal property: Up to $100,000 for families ($50,000 for individuals)

- Tools of trade: Equipment needed for your profession

Post-Judgment Options

If a judgment already exists, we can:

- Firstly, file motion for new trial: Within 30 days if you weren’t properly served

- Also, pursue bill of review: Up to 4 years for certain defects

- Likewise, negotiate settlement: Often 40-60% of judgment amount

- Finally, consider bankruptcy: Chapter 7 or 13 can eliminate or restructure judgment debt

Alternatives to Court: Settlement, Debt Resolution & Bankruptcy Options

Litigation isn’t always the best path. We help clients explore all options and understand the importance of knowing your legal rights before paying debts in response to a lawsuit:

- Lump-sum offers: Typically 30-60% of balance for immediate payment (note: paying may not always be the best option—seek legal advice before making any payments)

- Graduated payment plans: Start low, increase over 24-48 months

- Hardship settlements: Document financial struggles for deeper discounts

- “Pay-for-delete” agreements: Remove negative credit reporting

Many debt defense law firms in Texas offer flat fee representation, providing clients with transparent and predictable legal costs.

Settlement Strategies That Work

- Lump-sum offers: Typically 30-60% of balance for immediate payment

- Graduated payment plans: Start low, increase over 24-48 months

- Hardship settlements: Document financial struggles for deeper discounts

- “Pay-for-delete” agreements: Remove negative credit reporting

Warning: Debt resolution and credit card companies often ignore pending lawsuits. Work with an attorney who can handle both negotiation and litigation.

Bankruptcy Safety Nets

Chapter 7 Bankruptcy (North Texas/DFW residents only):

- Firstly, eliminates most unsecured debt in 3-4 months

- Similarly, stops all collection activity immediately

- Also, provides fresh financial start

- We serve Dallas, Collin, Denton, and Tarrant counties

Warren & Migliaccio is not accepting new Chapter 13 bankruptcy cases at this time. However, as an informational resource, Chapter 13 allows you to:

- Firstly, restructures debt into 3-5 year payment plan

- Secondly, saves homes from foreclosure

- Likewise, protects co-signers from collection

- Also, allows you to keep all property

A Powerful Defense: Challenging the Paper Trail

To win in court, a creditor must do more than just claim you owe money—they have to prove it with legally valid evidence. Experienced Texas debt defense lawyers play a crucial role in challenging the paper trail and defending clients in court, often exposing weaknesses in the creditor’s case. This is often where their case falls apart.

- Step 1: The Evidence Problem When a debt is sold (often multiple times), the new owner usually gets a simple data file—not the complete, original account history.

- Step 2: The Legal Hurdle Under Texas law (Rule of Evidence 803(6)), for account records to be used as evidence, they must be verified by a witness who has personal knowledge of how they were created and kept.

- Step 3: The “Debt Buyer Trap” A witness from the new debt-buying company can’t honestly testify about the original bank’s record-keeping practices. They didn’t work there and have no firsthand knowledge.

- Step 4: The Winning Objection We object to their records as inadmissible hearsay. Since the witness cannot vouch for the accuracy of another company’s records, the evidence is unreliable.

- Step 5: The Case Dismissal If the judge agrees and excludes the records, the creditor is often left with no proof. With no evidence, they have no case, which can lead to a complete dismissal.

Frequently Asked Questions

FAQs About Bank Loan Lawsuits in Texas

How long does a bank have to sue me for an unpaid loan in Texas?

Under Texas Civil Practice & Remedies Code § 16.004, a bank, debt‑buyer, or original creditor has four years from the date the loan was accelerated or from your last voluntary payment to file suit.

After that window, the claim is time‑barred, and the lender loses its right to court-ordered collection.

What happens if I ignore a bank-loan lawsuit in Texas?

Missing the Answer deadline lets the creditor win a default judgment.

That judgment authorizes:

- Property liens

- Bank-account freezes

- Post-judgment discovery

- Continued phone calls

Can a bank freeze my Texas bank account without warning?

Yes. Once a judgment is entered, the creditor can serve a writ of garnishment on your bank.

Funds are frozen immediately and remain inaccessible until:

- The court releases exempt money (e.g., Social Security)

- You resolve the judgment through payment, settlement, or bankruptcy

FAQs About Dismissal and Settlement Options

How can I get a bank-loan lawsuit dismissed in Texas?

You may file motions to dismiss when:

- No standing – the plaintiff cannot prove an unbroken chain of assignments

- Time-barred debt – the four-year limitations period has expired

- Mandatory arbitration – your contract forces disputes out of court

Do I need a debt-defense lawyer to fight a bank-loan lawsuit in Texas?

You can represent yourself, but a seasoned debt-defense lawyer understands evidentiary rules, leverages arbitration clauses, and negotiates deeper debt relief settlements.

Hiring counsel often saves more in reduced judgments or dismissed cases than the legal fee itself.

Can I settle a bank-loan lawsuit before my court date?

Usually, yes. Most lenders will accept:

- 30–60 % lump-sum settlements

- Structured plans of 12–48 months

- File an Answer first for leverage

- Get the deal in writing

- Insist on dismissal “with prejudice” once payment terms are met

FAQs About Loan Liability and Statutes

Does making even a small payment restart the four-year limitations clock?

Yes. Any voluntary payment—or written promise to pay—restarts the statute of limitations, giving the creditor four new years to sue.

Verify dates through discovery; creditors sometimes misapply payments to make an old debt look current.

Does a personal guarantee make me liable for my small-business loan?

Absolutely. A personal guarantee makes you an individual co-obligor, so the lender can sue you personally and pursue non-exempt assets if the business defaults.

All standard loan-defense strategies still apply, but liability is joint and several.

Can a bank garnish wages for loan debt in Texas?

No. Texas law bars wage garnishment for consumer and small-business loan debts.

Exceptions exist only for:

- Child support

- Taxes

- Federal student loans

How long do I have to respond to a bank-loan lawsuit in Texas courts?

You have:

- 14 days after service in Justice Court

- 20 days plus the first Monday thereafter in County or District Court

Will filing Chapter 7 bankruptcy stop a pending bank-loan lawsuit?

Yes. The moment you file, the automatic stay under 11 U.S.C. § 362 halts all collection activity, including:

- Lawsuits

- Liens

- Phone calls

- Bank levies

Your Next Step: Free Strategy Session With Our Lead Counsel Verified Attorneys

Don’t let another day pass while interest and attorney fees accumulate. Our experienced debt lawsuit defense attorneys have spent nearly 20 years defending thousands of Texans against aggressive debt collectors, and we’re ready to fight for you.

Call (888) 584-9614 now or contact us online for your free consultation—available by phone, video, or in-person at our Richardson, Dallas, or Prosper offices.

Why Choose Warren & Migliaccio?

- Proven Results: Nearly two decades defending Texas families against debt lawsuits

- Lead Counsel Verified: Recognized expertise in debt defense matters

- Statewide Service: We defend clients throughout Texas, from El Paso to Beaumont

- Flexible Options: Flat fees and payment plans available

- Free Consultation: No-pressure case evaluation to discuss your options

Related Resources:

- [What Courts Handle Debt Collection Cases in Texas?]

- How to Get a Debt Collection Lawsuit Dismissed in Texas

Serving clients across the entire state of Texas—no matter where you live, we’re here to help protect your bank accounts and your peace of mind.

Contact us today before it’s too late. Your financial future depends on taking action now.

Disclaimer: This article provides general information about Texas debt collection law and is not specific legal advice. Results may vary based on individual circumstances. For advice on your unique situation, please consult our attorneys directly. Warren & Migliaccio, L.L.P. is designated Lead Counsel Verified for debt defense matters. Attorney Christopher Migliaccio has practiced law in Texas since 2005.