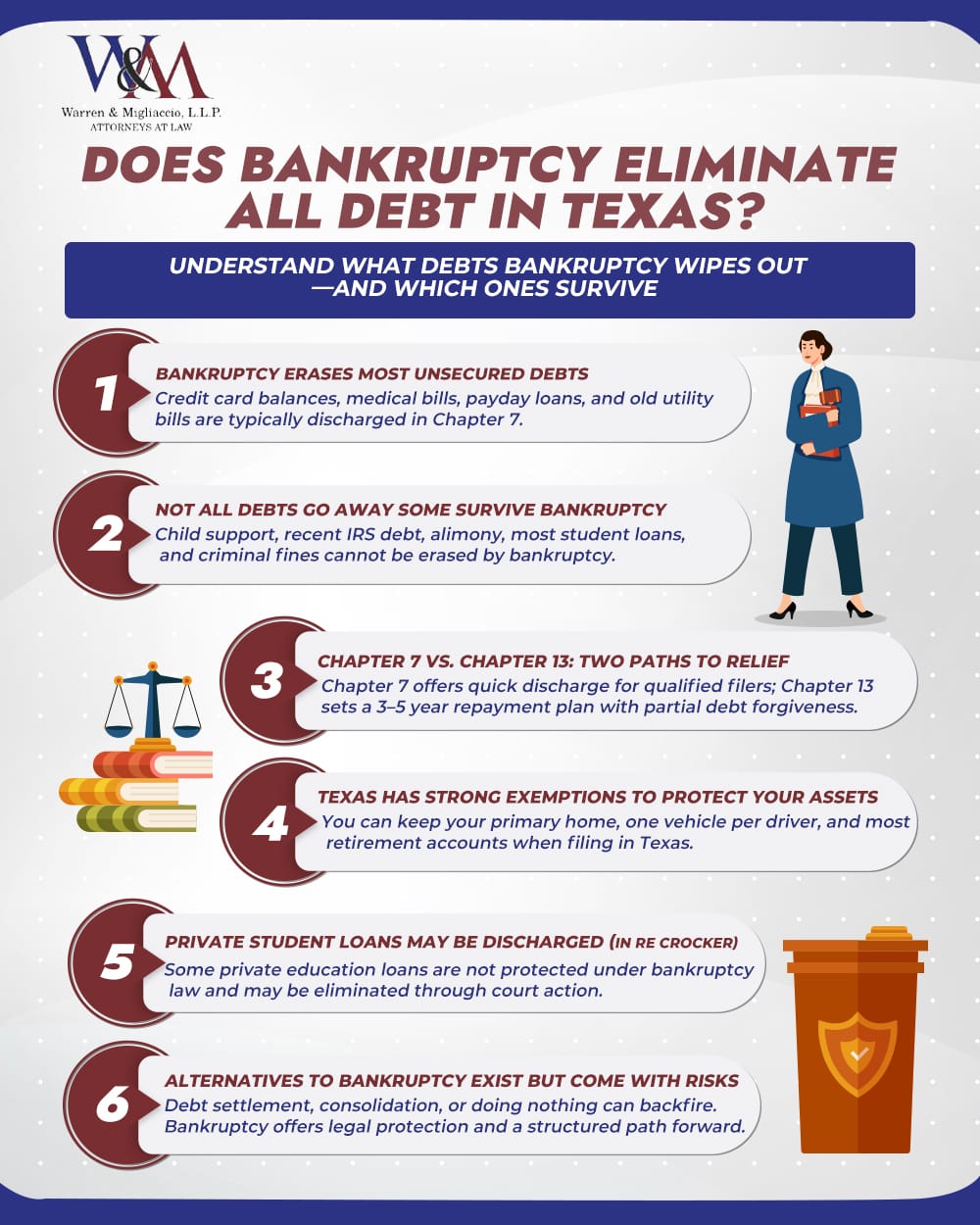

No. Bankruptcy in Texas erases most unsecured debts—credit cards, medical bills, personal loans, and deficiency balances—but priority obligations such as child support, alimony, recent income taxes, most student loans, and court fines survive. Secured liens also remain unless you surrender the collateral.

Quick Answer: What debts are (and aren’t) dischargeable in Texas bankruptcy?

No—under Texas law, bankruptcy wipes out most unsecured balances like credit cards and medical bills, but priority debts like child support, recent taxes, and most student loans remain collectible after discharge.

- Use Chapter 13 to repay priority debts over time while erasing other unsecured balances.

- Act before creditors obtain judgments, which last 10 years and complicate the process.

- Stop collection actions immediately with the automatic stay upon filing your case.

Texas-Specific Discharge & Exemptions At‑a‑Glance

- Judgments: Enforceable for 10 years; may be revived within 2 years after dormancy. CPRC §34.001, §31.006.

- Wages: Current wages generally protected from garnishment for consumer debts; exceptions include child support, spousal maintenance, and certain federal debts. Tex. Const. art. XVI, §28.

- Homestead: Unlimited equity; up to 10 urban acres and 100 (single) / 200 (family) rural acres. Prop. Code ch. 41.

- Personal property: Up to $100,000 for a family / $50,000 single adult. Prop. Code ch. 42.

Need-to-Know Highlights for This Article

- Most unsecured debts are wiped out, such as credit cards, medical bills, personal loans, and deficiency balances.

- Some debts remain collectible, including child support, alimony, recent tax debts (less than 3 years old), and most student loans.

- Chapter 13 allows repayment of priority debts while discharging unsecured balances, with repayment plans over 3–5 years.

- The automatic stay halts creditor actions immediately, offering relief from garnishments, lawsuits, and foreclosures.

- There’s an updated path to discharging federal student loans under “undue hardship” guidelines as of 2024, though proving hardship is difficult.

Bankruptcy discharge in Texas wipes out most unsecured debts—including credit card balances and medical bills—but child support, recent tax debt, alimony if you are filing bankruptcy after divorce, and most student loans still survive. In Texas, a judgment remains enforceable for 10 years. However, it can be revived within two years after it becomes dormant, so acting before enforcement or lien attempts is critical.

Overwhelming debt can make Texas families feel trapped. Fortunately, bankruptcy can erase many—but not all—debts, and Warren & Migliaccio is here to help North Texas residents understand their options and seize a free consultation for clarity. Bankruptcy halts most lawsuits, wage garnishments, and other collection actions against the debtor.

Understanding How Bankruptcy Eliminates Debt in Texas

Bankruptcy is a federal process that ends with a discharge—a court order telling creditors they can never collect certain obligations. Federal bankruptcy laws and the bankruptcy code determine which debts you can discharge. They also specify which debts remain non-dischargeable under Chapter 7 or Chapter 13 bankruptcy. When you file for bankruptcy, Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves selling off some of your assets to pay off what you can and discharging the rest of your debts. The bankruptcy process typically takes about four to six months for Chapter 7, and three to five years for Chapter 13.

Key benefits of bankruptcy filing

- Firstly, immediate automatic stay stops collection actions, wage garnishments, and foreclosure threats. Bankruptcy provides protection from collection actions as soon as a petition is filed due to the automatic stay. However, in Chapter 7 bankruptcies, the automatic stay does not protect co-signers.

- Also, the bankruptcy trustee oversees the process, including managing asset liquidation in Chapter 7 or repayment plans in Chapter 13, ensuring compliance with federal bankruptcy laws.

- Likewise, discharge provides a fresh start so families can rebuild personal finance without past mistakes. However, the bankruptcy discharge eliminates the debtor’s obligation to pay, but liens may still exist on the property.

- Additionally, creditors and debt buyers must cease collection efforts and lawsuits, but properly perfected liens generally survive discharge unless the debtor successfully avoids them in bankruptcy.

Legal foundation: 11 U.S.C. § 524 makes the discharge permanent and enforceable in every bankruptcy court.

Chapter 7 Bankruptcy in Texas: What Gets Wiped Out?

Eligibility: Most filers qualify by passing the means test, which compares household income to Texas medians. Even if income is higher, allowed expenses—like health insurance, car loans, and child‑care—can still open the door to Chapter 7 bankruptcy. Most debts incurred before filing, such as payday loans, credit card debt, and medical bills, are typically discharged in Chapter 7.

Common Unsecured Debts Discharged | Typical Balance Range |

|---|---|

Credit card debt | $2,000 – $80,000 |

Medical bills | $500 – $250,000 |

Personal loans & payday advances (including payday loans) | $300 – $20,000 |

Old utility bills and phone bills | $100 – $5,000 |

Deficiency from repossession or foreclosure | $5,000 – $60,000 |

Note: Payday loans are a type of unsecured debt that can be discharged in Chapter 7 bankruptcy.

Plano success story: A single parent earning $45,000 wiped out $45,000 in credit‑card debt and past‑due medical bills while keeping her car through Texas’s generous motor‑vehicle exemption.

Thus, after the court liquidates your assets in Chapter 7, it typically discharges the remaining balance on most unsecured debts. As a result, you receive significant debt relief.

Learn more on our Chapter 7 bankruptcy service page.

Secured Debts & Collateral Risks

- Surrender means giving back the car or house to the lender. The remaining balance becomes an unsecured debt, which bankruptcy can discharge. Also, a secured creditor with a lien on the property can still reclaim the collateral if you don’t make payments, but bankruptcy removes your personal obligation to pay the debt.

- Reaffirmation: Sign a new agreement, keep the property, and stay current on monthly payment obligations.

- Redemption: Pay the current replacement value in one lump sum (rare but powerful). Secured debts can be eliminated, but the collateral must be surrendered unless arrangements to keep the property are made. You can lose certain assets when filing for Chapter 7, as the trustee may sell nonexempt property.

If you do not reaffirm a secured debt, your personal liability is discharged; the creditor may repossess or foreclose on the collateral, but cannot collect any deficiency from you

Texas homestead exemption (Texas Property Code §§ 41.001–.002) protects unlimited equity in a primary residence located on ten urban acres or 200 rural acres for families.

Chapter 13 Reorganization: Paying Some, Discharging the Rest

When income or non exempt assets make Chapter 7 impossible, Chapter 13 bankruptcy—also known as reorganization bankruptcy—offers a structured repayment plan:

- Draft a budget‑based payment plan lasting 3–5 years.

- Make a single monthly payment to a court‑appointed trustee, who uses the payment plan to address missed payments and repay creditors, including unsecured creditors.

- Trustee distributes funds to secured debt (car loans, mortgage arrears) and priority debt (recent income tax).

- At completion, remaining unsecured debt—credit card balances, personal loans, medical bills—is discharged.

Once you complete the payment plan in Chapter 13 bankruptcy, the court discharges any remaining debt. This relieves you of any further financial obligations.

2025 Update – 11 U.S.C. § 523(a)(8)

Student Loans & Bankruptcy: The DOJ-Education Dear Colleague Letter (Aug 5, 2024) streamlines “undue hardship” reviews. As a result, Texas filers may receive faster discharges if they clearly document a long-term inability to repay.

Hot Case: Bassel v. Durand-Day, 5th Cir. 2025 — The court vacated two Chapter 13 plans that attempted to pay student loans outside the plan. It confirmed that unsecured claims, including student loans, must be addressed within the plan and during its approved term.

Tip: Use the May 15 2025 median-income tables when running the means test for cases filed in Texas on or after that date.

Example: A McKinney family cured $12,000 in mortgage arrears and stripped $30,000 in credit‑card debt while protecting their Richardson homestead.

Debts Bankruptcy Cannot Erase: The Texas Short‑List

Even the strongest bankruptcy petition leaves some obligations standing, known as nondischargeable debts. Bankruptcy does not eliminate the following debts:

Non-Dischargeable Debts in Bankruptcy

- Firstly, child support and alimony

- Also, court fines and criminal restitution

- Likewise, most tax debts, such as recent IRS tax debt (filed within three years)

- Also, federal student loans (generally nondischargeable, but may be challenged)

- Similarly, debts from fraud, embezzlement, or personal injury caused by DUI

Hence, such debts remain owed after bankruptcy and must be paid in full or through a repayment plan.

Child support obligations survive bankruptcy and must be paid in full.

Texas families may still fight federal student loan debt through an adversary proceeding, also called an undue hardship lawsuit, but the standard is demanding. You can only discharge federal student loans in bankruptcy if you meet the undue hardship standard, which is difficult to prove. To do this, you must file an adversary proceeding and demonstrate that repaying the loans would cause undue hardship.

Related Guide: Can Unemployment Overpayment Be Discharged in Chapter 7 Bankruptcy in Texas?

Case Study: Catching Up Child Support Through Chapter 13

Last year, a young father walked into my office with $60,000 in medical bills and a looming wage garnishment on $12,000 of unpaid child support. He looked exhausted, convinced bankruptcy could erase everything.

I had to pause and explain gently: “Child support keeps food on the table for your kids—Congress made it non-dischargeable.” His shoulders slumped, but then I shared the solution: Chapter 13 could transform those arrears into one manageable payment while eliminating his medical and credit card balances.

We filed that week. The automatic stay stopped the garnishment immediately, and the trustee approved a three-year plan at just $350 monthly. Eighteen months later, his support is current, collection calls have vanished, and his credit score hit 640.

What struck me most was his transformation—from defeated to determined, knowing he was providing for his kids while rebuilding. This case reinforced why I do this work: helping Texans navigate these complex realities without judgment, creating structured paths that protect children while giving parents a realistic fresh start.

If you are unsure about which path is right for your situation, we offer a free consultation to explore your legal options. If Chapter 13 bankruptcy is the best path for you, we can refer you to a trusted Chapter 13 bankruptcy attorney if needed.

Texas Case-Law Spotlight: In re Crocker, 941 F.3d 206 (5th Cir. 2019)

The case of In re Crocker held that certain private student loans did not fit the Bankruptcy Code’s definition of an educational “loan… made under a program funded in whole or in part by a nonprofit.” The Fifth Circuit allowed discharge of a bar-prep loan and a career-training loan because they were consumer credit products—not federally backed. (In re Crocker, 941 F.3d 206 (5th Cir. 2019)). We highlight Crocker because it shows Texas borrowers that “student loans” is not a single category; the type of loan and lender matters. Families who feel trapped by private education debt may still obtain meaningful debt relief. Source

Alternatives to Bankruptcy: When a Fresh Start Isn’t the Right Fit

| Strategy | Cost | Timeline | Impact on Credit Score | Key Risk |

|---|---|---|---|---|

| Debt consolidation loan | 8–18% interest rates | 2–7 years | Short-term dip | Adds liens if secured |

| Debt settlement | 15–25% of savings (fees paid to a debt settlement company) | 2–4 years | Major score drop | Lawsuits continue |

| Chapter 13 bankruptcy | Court & attorney fees rolled into plan | 3–5 years | Rebounds faster after discharge | Court oversight |

A debt management plan, often arranged through a credit counselor, is another alternative to bankruptcy. This structured plan helps organize repayment of unsecured debts over several years and can be a key step in financial recovery.

Required credit counseling is necessary before starting a debt management plan or filing for bankruptcy. This counseling helps borrowers arrange manageable repayment plans and may assist in negotiating better terms with creditors.

When collection actions escalate, consider our debt‑collection defense page before choosing a path.

Seeking financial relief through these alternatives can help you avoid bankruptcy and improve your financial health.

Related Guide: Alternatives to Bankruptcy in Texas: Real Options That Can Work

Life After Discharge: Rebuilding Credit & Protecting Your Family’s Future

Follow these steps to boost your credit report and shield your family:

Credit Rebuilding Timeline After Bankruptcy

- Month 1–3: Open a secured credit card with a $300 limit; keep usage under 10%.

- Month 4–6: Set up automatic stay–proof payment reminders and pay every bill early.

- Month 7–12: Add a credit-builder loan through your local credit union; amounts under $1,000 work best.

- Year 2: Consider a low-rate auto loan and continue on-time payments.

- Ongoing: Track progress on free credit-report sites and dispute errors.

Bankruptcy and debt relief actions will appear on your credit reports for several years, which can affect your ability to borrow and the terms you receive. Also, some debts may not be discharged in bankruptcy, so you may still owe money on nondischargeable obligations such as certain taxes, student loans, or child support.

A 2020 LendingTree study found that 56 % of borrowers had credit scores of 640 or higher one year after bankruptcy, illustrating that scores can rebound into the prime range within 12–24 months

Personal responsibility—budgeting, emergency savings, and honest conversations with your spouse—keeps that progress on track and aligns with our “families first” approach.

Free Consultation: Get Straight Answers from Experienced Texas Bankruptcy Attorneys

We hold ourselves accountable to put your family first, offering clear guidance—not sales pressure—on every type of bankruptcy case. Call (888) 584‑9614 for a free consultation or complete our secure online form. Serving Dallas, Collin, Denton, Rockwall, and Tarrant counties from our Richardson office, we stand ready to help.

Frequently Asked Questions about does bankruptcy eliminate all debt

What bankruptcy can and cannot discharge in Texas

Does bankruptcy wipe out every debt I owe in Texas?

No, bankruptcy doesn’t eliminate all debt; child support, alimony, many taxes, court fines, and most student loans generally survive.

A bankruptcy discharge is a federal court order that wipes out your personal obligation to pay eligible debts, and it is enforced through the discharge injunction. (11 U.S.C. § 524.) In a Chapter 7 case, a trustee is appointed to review your finances and can liquidate nonexempt assets to repay creditors. The part people miss is that “debt” has layers: the discharge can erase your personal liability while a valid lien on a house or car can still remain. That is why mortgage or car loan decisions (keep, surrender, or renegotiate) still matter even when discharge debt is entered.

In a Chapter 7 case, discharge typically occurs in about four to six months. In Chapter 13, you earn the discharge after completing a three-to-five-year plan.

Before you file, list every bill, lawsuit, and loan so we can sort what gets discharged and what does not.

What debts survive a bankruptcy discharge?

- Child support and alimony

- Court fines and criminal restitution

- Most federal and private student loans

- Many recent income tax debts

- Debts tied to fraud or drunk-driving injury

If you are wondering whether bankruptcy can eliminate all debt, this list is the usual reason the answer is “not completely.” A discharge stops collection on eligible obligations, but these categories are carved out by federal law and are still owed.

Student loans are the biggest surprise. Even when a loan is potentially dischargeable, the issue is usually decided in a separate lawsuit inside the bankruptcy case (often called an adversary proceeding). Some divorce-related debts can also remain due, even if the underlying credit cards or medical bills are wiped out.

The practical move is to separate “must-pay” obligations from other debts before choosing Chapter 7, Chapter 13, or an alternative. Bring your paperwork so the categories are clear on day one.

Can older income tax debt be discharged in bankruptcy?

Yes, older income tax debt can be discharged if it meets the 3-2-240 timing rules and there’s no fraud or willful evasion.

The “3-2-240” test is a quick screen: the return was due at least 3 years ago (including extensions), the return was filed at least 2 years ago, and the tax was assessed at least 240 days before your bankruptcy filing. Miss one date and the balance can stay collectible, which is why people who filed late or had an audit often get surprised.

Even when the personal obligation is discharged, a recorded tax lien can still attach to property until it is dealt with. And if you cannot qualify for Chapter 7, Chapter 13 can force a structured payment plan for priority taxes while still discharging other debts at the end.

Pull your filing dates and account transcripts first, then decide the best filing month instead of guessing.

Can bankruptcy wipe out private student loans in Texas?

Yes, some private education loans can be discharged when they are not treated as protected student-loan debt, and an adversary case is usually required.

Not every loan marketed as “for school” fits the same legal category. In the Fifth Circuit, In re Crocker is often cited for the idea that certain education-related loans can fall outside the special student-loan exception, depending on how the loan was structured and what it actually funded. (In re Crocker, 941 F.3d 206 (5th Cir. 2019).) That is why the promissory note, the program details, and the use of proceeds matter more than the label on your billing statement.

In practice, lenders fight these cases, and the burden is on the borrower to prove the loan is dischargeable or to prove undue hardship. Planning for that fight before the bankruptcy filing avoids surprise deadlines and extra expense.

Bring the loan documents to a consultation so we can spot whether this is even a realistic target.

Lawsuits, garnishment, and keeping property

Will filing bankruptcy stop a creditor lawsuit or wage garnishment in Texas?

Yes, filing usually stops lawsuits and garnishments immediately through the automatic stay, but some actions can continue or restart with court permission.

The stay kicks in the moment the bankruptcy filing hits the court, and it typically pauses collection cases, phone calls, and most attempts to collect from your property. That breathing room is often the main reason people file when a creditor lawsuit is pending.

Timing still matters in Texas. If a creditor gets a judgment first, they may try to record liens or use post-judgment collection tools before you ever get to a discharge. Texas judgments can become dormant if enforcement steps are not taken within 10 years, but they can also be revived within two years after dormancy. That reality is one reason I do not like “wait and see” when litigation is already underway.

If you have a court date coming up, gather the petition, lawsuit papers, and any judgment documents so you file with the full picture.

Can I keep my house or car if I file bankruptcy in Texas?

Yes, many people keep a home or vehicle by staying current or working out a plan, but the lender can still foreclose or repossess if payments stop.

Bankruptcy can erase your personal liability on a mortgage or car loan, yet a properly perfected lien generally survives unless it is avoided in the case. Practically, that gives you three common paths: keep and pay, surrender and walk away from the remaining balance, or sign a reaffirmation agreement that keeps the debt in place.

Texas exemptions matter. The Texas homestead exemption can protect substantial equity in a primary residence, and vehicle exemptions can protect a typical family car. (Texas Property Code §§ 41.001–.002.) If you are behind on payments, Chapter 13 is often used to catch up over three-to-five years while you keep the property.

The biggest mistake I see is reaffirming a car loan you cannot afford after the case. Bring your loan statements so we can pressure-test the payment before you commit.

Alternatives and filing without a lawyer

Is bankruptcy worth it compared to debt settlement?

Bankruptcy is best when lawsuits have started or repayment is unrealistic. Debt settlement works better when you can fund offers and tolerate ongoing collection pressure.

Settlement usually requires being behind on payments before creditors negotiate, and a creditor lawsuit can keep moving while talks drag on. Bankruptcy is different: the case begins with a court filing that can pause collection activity and ends with a court-enforced discharge order. (11 U.S.C. § 524.) The tradeoff is credit reporting. A Chapter 7 case can appear on credit reports for up to 10 years, and Chapter 13 for up to 7 years, measured from the filing date. Expect tighter screening when you apply to rent or open new bank accounts, and plan for higher-interest loans at first.

If you are comparing paths, I start with two questions: Are you already being sued, and do you have cash to fund real settlement offers? Those answers usually point to the right tool.

Can I file bankruptcy without a lawyer in Texas?

Yes, you can file without a lawyer, but you must handle every form and deadline, and mistakes can cost property or a discharge.

Federal courts allow self-represented bankruptcy filings, but the court staff and petition preparers cannot give you legal advice. That means you must choose the right chapter, claim the right exemptions, complete the required credit counseling steps, and file complete schedules that match your documents. Missing a required form or failing to show up for the trustee meeting can lead to dismissal, which puts collectors right back where they left off.

I see DIY filings work best when the case is truly simple: mostly unsecured debts, no disputed transfers, and no real question about keeping a house or a financed vehicle. Once you have secured debt, tax issues, student loans, or a pending lawsuit, the “cheap” filing can turn expensive fast.

If you are thinking about doing this yourself, at least get a legal review of your paperwork before you file.

Conclusion

Bankruptcy discharges wipe out most credit‑card debt, medical bills, personal loans, and deficiency balances, but child support, alimony, recent taxes, and many student loans remain. Choosing the right type of bankruptcy—or an alternative—depends on your unique financial situation.

We are currently not taking new Chapter 13 bankruptcy cases. However, if needed, we can refer you to a trusted Chapter 13 bankruptcy attorney. Our firm continues to offer full legal support for Chapter 7 bankruptcy filings, debt defense, and debt settlement.

Schedule a free, judgment‑free consultation with our experienced Texas bankruptcy lawyers at (888) 584‑9614. Our mission is to help North Texas families reclaim stability through accountability and a fresh start. You can also contact us online here: https://www.wmtxlaw.com/contact-us/

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Every bankruptcy case is different; consult a qualified bankruptcy attorney for personalized guidance.