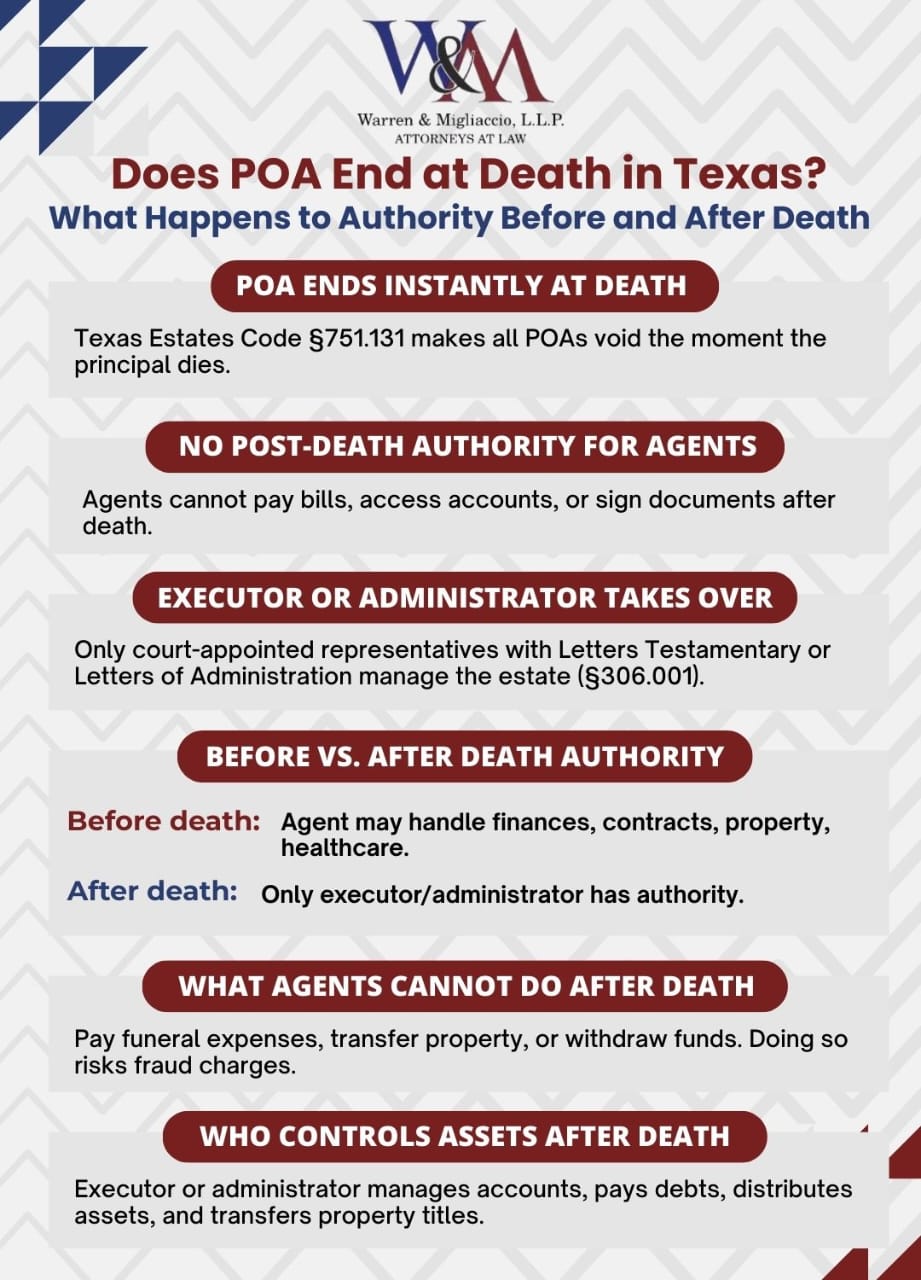

In Texas, every power of attorney—durable, general, medical, or springing—ends the instant the principal dies. Under Estates Code §751.131, an agent’s authority stops at death; afterward, only a court-appointed executor or administrator with Letters may handle the estate.

What this means for Texas families: A POA helps during life, but after death you’ll need a court-appointed personal representative to access accounts, pay bills, and transfer property. Below, we explain that handoff and how to move forward quickly.

Quick Answer: Does a Texas power of attorney end at death?

Yes. In Texas, POA authority ends at death under Estates Code §751.131 — move quickly to obtain court Letters before paying bills or accessing accounts.

- Stop using any POA immediately

- Notify banks and gather death certificates

- File for Letters Testamentary or Administration

What a Texas POA Does—and Doesn’t Do

We help Texas families understand these boundaries every day. Losing a loved one is hard enough without legal confusion. After a loved one’s death, important legal responsibilities arise, including estate administration and accessing assets, which require proper legal authority.

POA Basics in Texas

A power of attorney is a legal tool that lets your chosen agent act on your behalf while you’re alive. This creates a fiduciary duty—they must act in your best interest. Texas recognizes several types, each designed for specific situations:

- Durable POA – A durable power of attorney is a legal tool that stays valid if you become incapacitated, making it essential for planning for potential incapacity (Chapter 751). However, it terminates upon the principal’s death.

- General POA – A general power of attorney grants broad authority to your agent to handle various financial matters on your behalf, but some responsibilities remain with the principal.

- Springing POA – A springing power of attorney is a legal tool that only starts when specific conditions occur, such as when the principal is unable to act due to incapacity.

- Medical POA – For healthcare decisions under Health & Safety Code Chapter 166

Your agent can manage bank accounts, sign contracts, and handle property deals on the principal’s behalf. But this power exists only during your lifetime.

Related Guide: Power of Attorney vs Durable Power of Attorney in Texas

The Hard Stop: Death

Power of attorney does not equal post-death authority. The agent’s legal right to act under a POA ends the moment the principal passes. Texas Estates Code §751.131 makes this crystal clear. No exceptions exist—not for paying final bills, not for funeral arrangements, not for “wrapping things up.” Attempting to use a POA in such a situation can lead to legal complications and disputes over estate management.

Need-to-Know Highlights

- No one has post-death authority until the court issues Letters.

- Only court-appointed representatives can access accounts or sell property.

- Good-faith transactions before death notice may stand (§751.134).

- Beneficiary-designated assets pass outside probate and POA.

- Open probate promptly to avoid freezes, title issues, and delays.

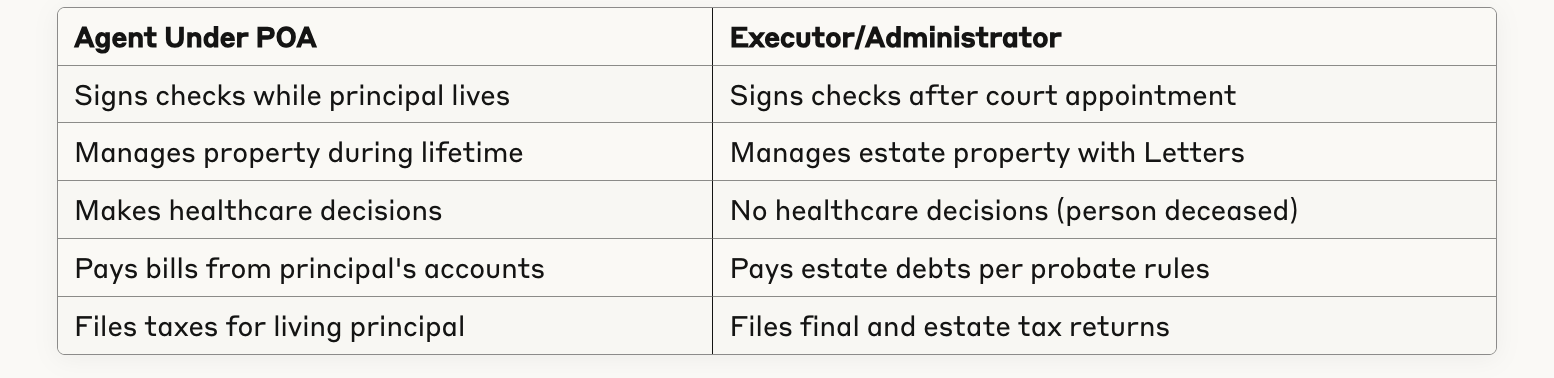

Authority Before vs. After Death

Need help understanding who has authority now? Call (888) 584-9614 for a free consultation.

Who Has Authority After Death?

When someone dies in Texas, their power of attorney becomes void. If there is no will, the court will determine how the estate is managed, often appointing a close relative or other designated person when an individual passes. We guide families through this transition from agent authority to proper estate administration.

Executor or Administrator Takes Over

After death, only a court-appointed personal representative has legal authority. This person receives either:

- Letters Testamentary – If there’s a valid will naming an executor

- Letters of Administration – If there’s no will or named executor

Texas Estates Code §306.001 governs when courts issue these documents. Independent administration, authorized by §402.002, lets executors act without constant court supervision. Most Texas wills include this provision.

Once appointed, the estate is managed by the executor or administrator, who is responsible for ensuring all assets are handled properly and in accordance with legal requirements.

The personal representative can then:

- Access the deceased’s bank accounts

- Sell or transfer property

- Pay valid debts and taxes

- Distribute assets to heirs

Practical Example: Who Pays the Bills?

Let’s say mortgage and utilities are due after your loved one passes. Here’s who can legally pay:

- Before death: The agent under a valid POA can pay bills

- After death, before probate: No one can legally access accounts

- After court appointment: Only the executor or administrator can pay

To minimize issues during this transition, it’s important to organize financial affairs in advance so bills and accounts are easier to manage.

This gap often causes stress. Banks won’t accept the POA. Bills pile up. We help families move quickly through probate to restore payment authority.

Timelines

Texas law provides a four-year window to file for probate under §301.002. But waiting causes problems:

- Banks freeze accounts

- Property titles cloud

- Creditors grow impatient

- Family tensions rise

Delays in starting the legal process can increase legal fees and make estate administration more complicated.

In North Texas courts, getting Letters typically takes:

- Dallas County: 2-4 weeks for uncontested cases

- Collin County: 3-5 weeks with current dockets

- Denton County: 2-6 weeks depending on complexity

We routinely file in these courts and know their specific requirements.

Edge Cases People Confuse With POA After Death

Several situations create confusion about post-death authority. A power of attorney (POA) is just one of several estate planning tools, and it does not provide authority after death. We clarify these distinctions for clients throughout Texas.

Medical POA Stops at Death

Medical power of attorney ends when life ends. Health & Safety Code Chapter 166 governs these documents, but they grant no post-death rights. Healthcare decisions cease because there’s no healthcare to decide.

Organ/Tissue Donation Authority

Limited post-death rights exist here. An agent under Medical POA may authorize anatomical gifts if the principal didn’t prohibit it. Health & Safety Code §692A.004 allows this narrow exception. The agent must act immediately at death.

Disposition of Remains Is a Separate Appointment

Funeral and burial decisions need an “Appointment of Agent to Control Disposition of Remains” under Health & Safety Code §711.002. This isn’t a power of attorney. Without this document, Texas law provides a priority list for who decides.

Non-Probate Transfers

These assets pass outside probate without any POA involvement:

- Payable-on-death (POD) accounts

- Transfer-on-death (TOD) securities

- Life insurance policies

- Retirement accounts with beneficiaries

- Trust assets

Named beneficiaries receive these directly. No executor or POA needed.

Small Estate Affidavit

When someone dies without a will and the estate value falls below statutory limits, heirs may use Chapter 205 procedures. This isn’t a POA workaround—it’s a simplified probate alternative requiring:

- Estate value under $75,000 (excluding homestead)

- No will exists

- 30-day waiting period

- Agreement among all heirs

What To Do Immediately (Step-by-Step)

When a loved one dies, knowing the right steps protects the estate. Consulting a law firm can provide essential guidance through the estate administration process, especially when handling complex legal matters. We walk North Texas families through this process daily.

7 Steps in the First 10 Days

- Stop using the POA immediately – Any transactions after death could create legal problems

- Notify banks and financial institutions – Include the death certificate. Keep a log of notices sent

- Secure the deceased’s property – Change locks if needed, collect mail, safeguard valuables

- Order 10-15 death certificates – You’ll need originals for banks, insurance, and court

- Locate the will and estate documents – Check safe deposit boxes, home safes, attorney offices

- Contact an estate planning attorney – Professional guidance prevents costly mistakes

- Create an asset inventory – List accounts, property, debts, and digital assets

Financial Protection Steps

- Forward mail to a secure address

- Cancel credit cards to prevent fraud

- Review automatic payments and subscriptions

- Document all estate-related expenses

- Ask banks to freeze further POA use after notice

Have questions about these steps? Our Texas estate planning attorneys serve clients statewide. Call (888) 584-9614.

How Banks/Title/Hospitals Treat POAs at Death

Financial institutions and healthcare providers follow specific protocols when someone dies. Understanding these helps avoid delays.

Good-Faith Reliance Protection (§751.134)

Texas law protects third parties who accept a POA without knowing about the principal's death. Here's the practical impact:

- If a bank processes a transaction before getting death notice, the estate may be bound by it

- This protection encourages institutions to honor valid POAs without excessive verification

- Once notified of death, they must freeze all activity immediately

For example: A bank processes an auto-payment before learning of death—that charge may stand. But after notice, further POA use must stop.

Agent Certification Language (§751.203)

Banks routinely require agents to sign certifications stating:

"The principal is not deceased and, if applicable, the principal has not revoked the power of attorney..."

This standard Texas form creates legal accountability. Falsely certifying after knowing about death could lead to criminal charges and civil liability.

Quick Answers: Micro Q&A

Q: Does a Texas POA end at death?

A: Yes—immediately at death under Estates Code §751.131.

Q: Can an agent pay bills after death?

A: No, only the court-appointed executor or administrator can pay estate bills.

Q: Does a Medical POA continue after death?

A: No, medical decision authority ends when life ends.

Q: Who signs checks after death?

A: The court-authorized personal representative with Letters Testamentary or Administration.

Q: Are organ donations allowed if not pre-authorized?

A: An agent may authorize anatomical gifts unless the principal prohibited it.

Q: Can a bank honor a POA right after death?

A: If unaware of death, good-faith actions may bind the estate under §751.134.

Q: How long to get Letters in North Texas?

A: Typically 2-6 weeks, but court schedules and case complexity affect timing.

Q: Deadline to start probate?

A: Generally within four years of death per §301.002.

Q: Is a trust better to avoid this?

A: A funded revocable living trust avoids probate and POA confusion after death. However, a comprehensive estate plan—including trusts, powers of attorney, wills, and healthcare directives—offers the most effective way to address all aspects of estate management and avoid complications.

Q: Do beneficiary accounts need probate?

A: Usually no—benefits pay directly to named beneficiaries.

Q: Can POA override a will?

A: No, POA does not override a will. POA ends at death and the will controls through probate. The will reflects the decedent's wishes and directs how the estate is distributed after death.

Q: What’s the penalty for using POA after death?

A: Potential criminal charges for fraud and civil liability to the estate.

Q: How can I avoid these issues?

A: Careful planning and legal guidance are key. Comprehensive estate planning—including a complete estate plan with wills, trusts, and powers of attorney—helps ensure your wishes are followed and reduces the risk of disputes or legal complications.

Case Study: Stopping POA Misuse the Day After Death

Problem: A daughter called us the morning after her father died. An uncle, named as agent under a power of attorney, was still moving money and paying himself. She was scared and confused because bills were due and she didn’t want to make a mistake.

Action: I explained that under Texas Estates Code §751.131, a POA ends at death. We acted fast. That day, we notified the bank’s fraud team, sent a short letter citing the statute, and provided the death certificate. We asked the bank to disable the POA, reverse pending transfers, and place a safeguard on the accounts. We also helped the family list auto-drafts and shift near-term expenses to funds that pass outside probate, like life insurance proceeds and a joint account with right of survivorship.

Result: The bank froze the POA access, reversed the last transfer, and stopped further withdrawals.

Takeaway: After death, stop using any POA, notify institutions immediately, and rely on beneficiary and survivorship designations to cover urgent expenses.

What Texas Courts Consider

North Texas probate courts see these issues regularly. We've represented families throughout Dallas, Fort Worth, and surrounding counties in these matters.

Validity of POA Actions Before Death vs. After Death

Courts examine timing carefully. Actions taken while the principal lived remain valid. Post-death actions face scrutiny. Judges consider:

- When the agent learned of death

- Whether third parties had notice

- If the agent personally benefited

- Good faith efforts to help the estate

Remedies for Unauthorized Post-Death Transfers

When agents act without authority after death, courts may order:

- Surcharge - Personal liability for losses caused

- Turnover - Return of estate property taken

- Conversion claims - Civil penalties for unauthorized use

- Contempt - For violating court orders

Independent vs. Dependent Administration Practicalities

Independent administration streamlines estate handling:

- No court approval for routine decisions

- Faster property sales

- Lower legal costs

- Greater executor flexibility

Dependent administration requires court oversight for most actions. This protects estates but increases time and expense.

Common Mistakes We've Seen

Through nearly two decades serving Texas families, we've witnessed these recurring errors:

- Using POA after learning of death "just to pay final bills"

- Withdrawing funeral costs from the deceased's account without authority

- Waiting months to order death certificates

- Missing the four-year probate deadline

- Forgetting to collect life insurance and retirement benefits

- Assuming joint accounts automatically transfer

- Not appointing a successor trustee for living trusts

- Letting family members move into estate property

- Distributing personal items before probate opens

- Signing deceased's name on tax refund checks

- Closing accounts that should stay open for estate administration

- Filing incorrect small estate affidavits

Need help avoiding these mistakes? Call (888) 584-9614 for guidance.

Texas Case Law Spotlight

Recent Texas cases reinforce when power of attorney ends at death.

Bertucci v. Watkins (2025)

In Bertucci v. Watkins, 688 S.W.3d (Tex. 2025), the Texas Supreme Court clarified fiduciary duties and POA limitations. The court emphasized that agents must cease all activity upon learning of the principal's death.

Wise v. Mitchell (2016)

The Dallas Court of Appeals case Wise v. Mitchell reviewed disputes over deeds and POA actions taken while the principal was alive. The court drew a clear line: valid lifetime acts under a POA are one thing; after death, authority shifts completely to the court-appointed personal representative.

The opinion underscores that even with broad powers during life, those powers cannot extend beyond death. Only the executor or administrator may act for the estate.

These cases show how Texas courts strictly enforce the rule that POAs end at death—no exceptions, no grace period.

Key Facts Box

Essential Texas law points about power of attorney and death:

- A Texas durable POA ends at the principal's death (Estates Code §751.131)

- After death, only the court-appointed personal representative manages the estate (§306.001)

- Banks and title companies may rely on POA in good faith if unaware of death (§751.134)

- Agent certifications commonly state "the principal is not deceased" (§751.203)

- Medical POAs govern healthcare decisions while alive, not post-death (H&S Code Ch. 166)

- An agent can sometimes authorize anatomical gifts if permitted (H&S Code §692A.004)

- You generally have 4 years to open probate (Estates Code §301.002)

- Small Estate Affidavit may be available in limited situations (Estates Code Ch. 205)

Glossary (Texas Terms)

- Agent - Person authorized to act under a power of attorney

- Attorney-in-Fact - Another term for an agent under POA

- Beneficiary Designation - Named recipient of life insurance, retirement accounts, or POD/TOD accounts

- Death Certificate - Official document proving death, needed for all estate matters

- Durable POA - Power of attorney that continues during incapacity

- Fiduciary Duty - Legal obligation to act in another's best interest

- Independent Administration - Estate administration without court supervision

- Letters Testamentary - Court document authorizing executor to act

- Medical POA - Document for healthcare decisions while alive

- Muniment of Title - Probate procedure when there's a will but no debts

- Personal Representative - Executor or administrator of an estate

- POD/TOD - Payable-on-death or transfer-on-death designation

- Probate Court - Specialized court handling estates and guardianships

- Small Estate Affidavit - Simplified procedure for estates under $75,000

- Successor Trustee - Person who manages trust after initial trustee dies

Frequently Asked Questions

FAQs - Does POA End at Death in Texas?

Does power of attorney end at death?

Yes, all powers of attorney terminate immediately when the principal dies. Texas Estates Code §751.131 mandates instant termination—no grace period exists. The agent loses all authority to act on behalf of the deceased, whether it's a durable, medical, or financial POA.

After death, a POA has zero legal effect. The former agent cannot write checks, access accounts, or sign any documents for the estate. Only an executor or administrator appointed by probate court may act. All financial and legal authority shifts to this court-appointed personal representative.

Who has authority after death?

Only a court-appointed executor (with Letters Testamentary) or administrator (with Letters of Administration) has authority after death. The former POA agent has zero post-death authority. This personal representative manages the estate, pays valid debts, and distributes assets through the probate process.

Can power of attorney pay bills after death?

No, agents cannot pay bills after the principal's death. The POA expires instantly, ending all financial authority. Banks may honor pre-death transactions processed before learning of death, but once notified, all activity stops until the court-appointed executor receives Letters Testamentary.

FAQs — POA Status at Death (Basics)

Does power of attorney end at death?

Yes, all powers of attorney terminate immediately when the principal dies. Texas Estates Code §751.131 mandates instant termination—no grace period exists. The agent loses all authority to act on behalf of the deceased, whether it's a durable, medical, or financial POA.

Power of attorney after death?

After death, a POA has zero legal effect. The former agent cannot write checks, access accounts, or sign any documents for the estate. Only an executor or administrator appointed by probate court may act. All financial and legal authority shifts to this court-appointed personal representative.

FAQs — Authority & Paying Bills After Death

Who has authority after death?

Only a court-appointed executor (with Letters Testamentary) or administrator (with Letters of Administration) has authority after death. The former POA agent has zero post-death authority. This personal representative manages the estate, pays valid debts, and distributes assets through the probate process.

Can power of attorney pay bills after death?

No, agents cannot pay bills after the principal's death. The POA expires instantly, ending all financial authority. Banks may honor pre-death transactions processed before learning of death, but once notified, all activity stops until the court-appointed executor receives Letters Testamentary.

FAQs — Effect of Death on POA & Accounts

What happens to power of attorney when someone dies?

The power of attorney document becomes void immediately at death. All agent authority over financial and medical decisions ends instantly. Estate management transfers to probate court, where an executor or administrator takes control. Banks and institutions will reject any POA presented after death.

Can power of attorney access bank accounts after death?

No, agents lose all bank account access when the principal dies. Banks freeze accounts upon death notification and require Letters Testamentary or Administration for access. Any attempted access using an expired POA could result in criminal fraud charges and civil liability.

How long is power of attorney valid after death?

Zero days—POA expires the instant the principal dies. Texas law provides no grace period for any POA type. All authority for financial transactions and legal decisions terminates immediately. Acting for the estate requires court appointment as executor or administrator through probate.

FAQs — Medical POA, Replacement & Beneficiaries

Does medical power of attorney have authority after death?

No, medical POA ends when life ends—no healthcare decisions remain. Limited exception: agents may authorize anatomical gifts if not prohibited. Funeral arrangements require a separate "Appointment of Agent to Control Disposition of Remains" document, not a medical POA.

What replaces power of attorney after death?

An executor (named in the will) or court-appointed administrator replaces the expired POA. These representatives receive Letters Testamentary or Letters of Administration from probate court. Unlike POA agents, executors have specific statutory authority to manage estate assets and pay debts.

Can power of attorney override a will?

No, POA cannot override a will after death since the POA expires immediately. During life, agents act only within granted powers. After death, the will controls through probate, and beneficiary-titled assets pay per existing designations. POA cannot change post-death outcomes.

What happens to beneficiary accounts when someone dies?

Beneficiary-designated accounts bypass probate and transfer directly to named recipients. These non-probate transfers include:

1. Life insurance policies

2. Retirement accounts (401k, IRA)

3. Payable-on-death bank accounts

4. Transfer-on-death securities

These pass outside POA or executor control.

FAQs — Legal Risk, Real Property & Probate Steps

Is using power of attorney after death illegal?

Yes, knowingly using POA after death constitutes fraud. Consequences include criminal prosecution, civil liability for estate damages, and personal responsibility for unauthorized transactions. Texas law provides zero tolerance—the prohibition is absolute and immediate upon the principal's death.

Can an agent sell the decedent's home after death?

No, only the executor or administrator may sell property after death. They need either power of sale language in the will or court approval. Any deed signed using an expired POA is voidable. Attempting such a sale could result in fraud charges.

What's the fastest way to gain legal authority for the estate?

File immediately for Letters Testamentary (if there's a will) or Letters of Administration (without a will). After court issuance, the personal representative can access accounts, pay debts, and manage assets. Most North Texas courts issue Letters within 2-6 weeks for uncontested cases.

Can an agent pay funeral expenses from deceased's accounts?

No, agents cannot access accounts after death, even for funeral costs. Family members who advance funeral expenses should keep detailed receipts. They can request reimbursement from the estate once a personal representative receives court authority through Letters Testamentary.

Related Resources

Texas Estate Planning

Estate planning attorneys in North Texas help protect your family's future through comprehensive planning. Related: Discover how proper planning prevents probate complications and family disputes.

Texas Probate & Estate Administration

Navigate the Texas probate process with experienced guidance through every step. Discover how to avoid probate in Texas.

Related: Learn timeline expectations and cost factors for Texas probate proceedings.

Supporting Resources

Statutory durable POA - Understanding Texas's standard power of attorney form Related: Download the statutory form and learn customization options for your situation.

Medical decisions and MPOA - Protecting healthcare choices during incapacity Related: Ensure your medical wishes are followed when you cannot speak.

Executor responsibilities - Complete checklist for estate administrators Related: Step-by-step guidance for fulfilling your duties as executor properly.

If there's a will and no debts - Simplified probate through muniment of title Related: Save time and money when estates have no outstanding debts.

When no will and small estate - Using affidavit procedures for modest estates Related: Qualify for simplified procedures when traditional probate isn't needed.

Transferring real property without full probate - Affidavit of heirship options Related: Transfer inherited property titles without formal estate administration.

Avoiding probate with a trust - How revocable trusts provide seamless transitions Related: Protect privacy and avoid court involvement through trust planning.

Local Court Information

Dallas County Probate Courts George L. Allen, Sr. Courts Building 600 Commerce St., 7th Floor, Dallas, TX 75202

Collin County Probate Court Russell A. Steindam Courts Building 2100 Bloomdale Rd., #12010, McKinney, TX 75071

Denton County Probate Court No. 1 3900 Morse St., Suite 100, Denton, TX 76208

Conclusion and Next Steps

Since 2006, we’ve helped North Texas families understand and prepare the right powers of attorney. Our focus is drafting clear, durable POAs and advising on what these legal instruments can—and cannot—do during life.

We do not handle probate or estate administration. If a loved one has passed away, we can explain what ends at death and what the probate process requires, then refer you to a trusted probate attorney for Letters Testamentary or Letters of Administration.

Need help right now? Our team of expert Texas estate planning attorneys can draft or update your financial and medical POA, review your existing documents for gaps, and make sure your family has the right tools in place before a crisis. Call (888) 584-9614 or contact us online for a free consultation.

This article provides educational information only and does not constitute legal advice. Past results do not guarantee future outcomes. Each situation is unique and requires personalized legal guidance. Attorney advertising.