Does the executor of a will get paid in Texas? Yes. The payment an executor receives is commonly referred to as an executor fee or executor’s compensation under Texas law. Texas law entitles an executor to up to 5 % of the cash they actually receive or pay out while administering the estate—but never more than 5 % of the estate’s total fair‑market value—under Texas Estates Code § 352.002. If there is no will, or if the will does not mention executor compensation, state law governs how an executor will be paid.

Need-to-Know Highlights for This Article

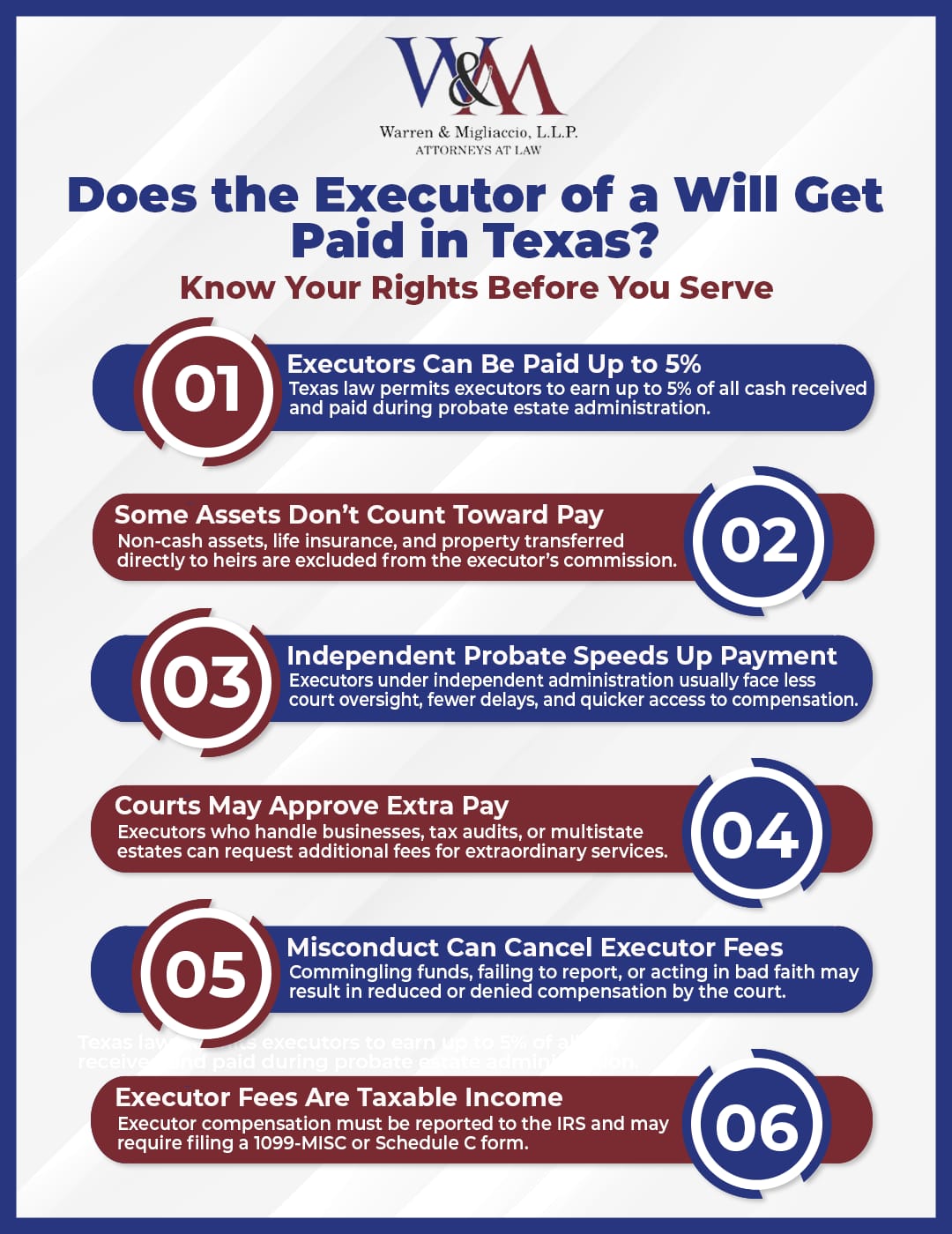

- Executors receive up to 5 % commission on cash handled, capped at 5 % of the estate’s value.

- Executors must fulfill fiduciary duties: inventory assets, pay creditors, file taxes, and distribute inheritances.

- Excluded from fees are life‑insurance proceeds, direct bequests, and non‑cash transfers.

- Courts may boost fees for extraordinary services or deny them for mismanagement.

Understanding an Executor’s Role in Texas

When a decedent (a deceased person) leaves a valid will, the probate court appoints a personal representative called an executor of an estate. The estate executor is responsible for carrying out the terms of the will and managing the estate’s assets according to legal requirements. If there is no will, or if the appointed executor cannot serve, the court may appoint an administrator to fulfill similar responsibilities.

Key duties include:

- Executor’s duties such as preparing an inventory of estate property and the estate’s assets, and determining their market value

- Likewise, notifying and paying creditors from bank accounts and other assets

- Filing final tax returns and resolving any estate tax issues

- Also, distributing remaining property to beneficiaries and closing the probate estate

The administration process involves collecting estate property, paying outstanding debts and expenses, and distributing the estate’s assets to beneficiaries in accordance with the Texas Estates Code.

Practical scenario: An independent executor manages a Plano family estate worth $450,000, pays debts, sells real estate, and delivers specific bequests to loved ones, including inheritance.

Authority signals: Texas Estates Code §§ 404.001 & 405.001 outline these executor duties and the fiduciary standard of care Texas courts expect.

Why Personal Responsibility Matters

Texas views the executor as a fiduciary—someone who must act with total honesty on behalf of the estate. When executors take shortcuts, families lose trust.

Common missteps that kill trust:

- Failing to keep receipts or mileage logs

- Mixing personal and estate bank accounts

- Delaying notices to family members and creditors

- Failing to communicate or provide updates to interested parties, such as beneficiaries and creditors

- Ignoring CPA advice on taxable income

- Paying themselves before clearing debts

Executor Compensation Under the Texas Estates Code

The 5 % “Texas Two‑Step” Rule

- 5 % of cash amounts received on behalf of the estate

- 5 % of cash amounts paid out as payments to creditors or heirs

- Never more than 5 % of the overall value of the estate

In some cases, the calculation of executor fees may also consider income earned by the estate during administration.

If the estate has multiple executors, they divide the fee according to the terms of the will or as outlined by state law. For very large estates—such as those exceeding $25 million in California—the law reduces the fee percentage to one-half of one percent for the amount above that threshold.

This formula applies in every county, whether the probate process is simple or the complexity of the estate rivals a small business.

What Doesn’t Earn a Commission

- Cash on hand or checking/savings balances

- Life insurance proceeds paid directly to a beneficiary of the estate

- Straight cash bequests named in the will

- Transfers of real property not involving cash transactions

Texas Estates Code § 352.002(b) lists these exclusions, ensuring the executor’s fee aligns with the amount of work actually performed. Executor fees are paid from estate funds and not from excluded assets.

Case Study: The “Cash Actually Received” Rule

A key Texas case, Swilley v. McClain, settled the question of whether an executor could be paid for transferring non-cash assets. The executor in the case managed the decedent’s estate, which included significant stock holdings, and wanted to take his 5% commission on the value of the decedent’s stocks, even though he transferred them directly to the heirs instead of selling them.

The court denied this request. If you are wondering whether you can appeal if a bankruptcy ruling is unfair, read more here. In its official opinion, the First Court of Appeals of Texas stated definitively:

“We hold that the five-percent commission to be paid to an executor under section 352.002 is calculated on the basis of cash actually received by the executor.”

This ruling matters because it confirms that an executor earns a fee only for money they actively manage and process—not for assets they merely transfer to beneficiaries.

When Fees Can Be Increased, Reduced, or Denied

Extraordinary Services & Court Approval (§ 352.003)

A judge may allow more than 5 % when the job goes far beyond routine and requires a significant amount of time and effort, such as:

- Running a working ranch or closely‑held corporation

- Defending the estate in a complex IRS audit

- Recovering hidden assets of the estate in another state

Grounds for Denial (§ 352.004)

- Mismanaging estate assets or commingling funds

- Self‑dealing or conflicts of interest

- Being removed as personal representative for cause

- Mishandling or failing to resolve tax disputes, which can lead to additional court scrutiny or denial of fees

Red‑flag behaviors courts punish: refusing to share accountings, overpaying attorney’s fees without approval, taking a flat fee without documentation, or neglecting to address tax disputes that complicate estate administration.

Dependent vs Independent Administration – How the Path Affects Pay

| Issue | Independent Administration | Dependent Administration |

|---|---|---|

| Court Oversight | Minimal—one initial filing | Ongoing hearings and approvals; dependent administrator is subject to more court oversight |

| Accountings | One final report | Annual, detailed accountings |

| Speed | Months | Often years |

| Fee Review | Rare unless contested | Judge reviews every request |

In Texas, the law classifies both executors and administrators as personal representatives of an estate. Whether the court appoints an administrator due to the absence of a will, or the will names an executor, both individuals carry out legal responsibilities. They manage estate assets, fulfill fiduciary duties, and may seek compensation or reimbursement as permitted under state law.

Example: In Denton County, an independent executor negotiated a higher “reasonable compensation” hourly rate because liquidating commercial real estate demanded extra expertise.

Reimbursement of Executor Expenses

Texas Estates Code § 352.051 lets executors claim reimbursement for money spent on the administration of the estate. An executor can be reimbursed for out-of-pocket expenses incurred during the administration of the estate.

Checklist—keep copies of:

- Mileage logs and fuel receipts

- Postal and certified‑mail fees

- Locksmith, appraiser, and CPA invoices

- Insurance premiums paid on estate real estate

- Funeral expenses receipts

Detailed records help justify every specific amount.

Tax & Reporting Duties for Executor Income

Executor fees are taxable income. Most Texas executors receive a 1099‑MISC; those who treat the estate work as a trade may instead file a Schedule C and pay self‑employment tax. Timing your payment in a different tax year can ease the burden, but always seek personalized legal advice and a tax professional’s guidance. Executors should also consider consulting attorneys for legal advice on complex probate or tax issues.

Beneficiary‑Executors: Balancing Family & Fiduciary Obligations

Serving as both beneficiary and executor of a will can create tension, especially when you are responsible for managing your loved one’s estate. Open communication prevents conflict.

Three scripts to keep peace:

- “Here is the court‑approved accounting; please review and ask questions.”

- “To avoid any appearance of self‑dealing, I’m hiring an outside realtor to set the sales price.”

- “Although Texas allows 5 %, I’ll accept a lower percentage of the estate to honor our loved one’s wishes.”

More Than an Honor, It’s a Job

I often tell my clients that choosing an executor is like hiring for the most important job in their estate. It’s not just an honor; it’s a demanding role.

I remember a gentleman from Prosper who came to my office to draft his will. He was set on naming his oldest son as executor, mainly out of tradition. I asked him, “Is your son the one you’d call if your plumbing burst at 2 AM? Is he organized and good with deadlines?”

He chuckled and admitted, no, that was his daughter. She was the family’s rock—a teacher who was incredibly organized, patient, and fair-minded. He realized he was about to give the toughest job to the son least equipped to handle it.

We changed the designation to his daughter. The father left my office feeling confident he had not only protected his assets, but also prevented future conflict for his children.

Some families, instead of appointing a relative, choose a trust company as executor to ensure professional management and to take advantage of their experience with estate administration.

How We Help Texas Families Navigate Executor Compensation

- Decades of probate and estate planning experience in Dallas, Collin, Denton, Rockwall, and Tarrant Counties

- Transparent fee agreements and guidance on reasonable compensation—no surprises

- Strategy sessions that consider the size of the estate, potential estate tax, and the percentage of the estate allowed for fees

- One‑on‑one support with free consultation: call (888) 584‑9614 to speak with our law firm today

We believe in personal responsibility, accountability, and always putting families first.

Frequently Asked Questions

Overview & Statutory Rules

How much does an executor get paid in Texas?

Texas executors receive up to 5% of cash they handle – 5% of money received and 5% of money paid out, but never more than 5% of the estate’s total value. For example, handling $100,000 in transactions typically means up to $5,000 in compensation under Texas Estates Code § 352.002.

Does an executor get paid in Texas?

Yes, Texas law entitles an estate executor to compensation for their services. The standard fee is 5% of cash transactions handled during estate administration. However, the testator can specify different compensation in their will, and executors can choose to waive their fees. Probate courts usually uphold the provisions of a will addressing executor payment.

What is the 5% rule for executors in Texas?

The 5% rule allows Texas executors to receive: 1. 5% of cash collected for the estate 2. 5% of cash paid to creditors and beneficiaries 3. Never exceeding 5% of the estate’s total fair market value This statutory commission is compensation for performing the executor’s duties required by law, ensuring fair payment while protecting estate assets. The amount of compensation for an executor in Texas will depend on the circumstances of the estate and the court’s assessment.

Tax & Calculation

Is executor pay taxable in Texas?

Yes, executor fees are taxable income requiring federal tax reporting. Most executors receive Form 1099-MISC and report fees as ordinary income. Those treating estate work as a business may file Schedule C and owe self-employment tax. Executor fees are considered taxable income for state and federal taxes.

How is executor compensation calculated in Texas?

Calculate executor fees by totaling: All cash received (rent, asset sales, account collections) All cash paid out (including payments for debts, taxes, distributions to creditors and beneficiaries, and other estate-related expenses) Apply 5% to this total. Verify it doesn’t exceed 5% of estate value. Example: $50,000 received + $30,000 paid (including payments to creditors and beneficiaries) = $80,000 × 5% = $4,000 fee.

Waivers, Expenses & Timing

Can an executor waive fees in Texas?

Yes, executors can waive compensation while still claiming expense reimbursement. This often happens when the executor is also a beneficiary or wants to maximize inheritance for family members. Waiving fees may also provide tax advantages in certain elder law situations.

What expenses can executors claim in Texas?

Texas executors can claim reimbursement for: Firstly, travel costs (mileage, parking, tolls) Also, administrative expenses (postage, copies, filing fees) Professional services (appraisals, accounting, repairs) Likewise, property maintenance (insurance, utilities during administration) Keep detailed receipts as the probate court requires documentation under § 352.051.

When does an executor get paid in Texas?

Executors and other personal representatives typically receive payment after court approval of the final accounting, usually 6-12 months after appointment. Independent executors may draw reasonable advances with proper documentation. Dependent administrators, as personal representatives, must wait for specific court authorization before any compensation.

Exclusions & Beneficiary-Executors

What is excluded from executor 5% commission in Texas?

Texas law excludes from the 5% calculation: Firstly, cash already in estate accounts Likewise, life insurance proceeds paid directly to beneficiaries Retirement accounts with named beneficiaries Also, property transferred by deed outside probate Only cash actively managed by the executor counts toward compensation.

Can a Texas executor who is also a beneficiary take full compensation?

Yes, serving as both executor and beneficiary doesn’t reduce compensation rights. The executor earns fees for administration work regardless of inheritance. However, many executor-beneficiaries voluntarily reduce fees to preserve more assets for all beneficiaries, especially when the testator was a close family member.

Conclusion & Next Steps

Texas law recognizes the important role executors play—and rewards those who handle estate matters with care and integrity. But navigating probate, taxes, and complex family dynamics can be overwhelming. Our experienced estate planning attorneys in Texas are here to help you manage your responsibilities with confidence. During your consultation, we’ll answer your questions, walk you through the process, and explore how we can support you. Call us at (888) 584‑9614 or contact us online to get started.

Serving Texas families statewide with clarity, accountability, and a free consultation.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Results may vary based on the specific facts of your case. Consult an attorney licensed in Texas for advice tailored to your situation.