Once you’ve gotten your house, your business, or maybe a ranch established the way you want it, you hate to think of it being divvied up by random relatives, assorted creditors, or worse, the state, coming in to collect bills you didn’t even know you had. As an attorney, I’ve seen the spouses of former clients sobbing in probate courts. “This isn’t what he wanted!” But too late, the property is taken before the heirs even know what happened.

A Transfer on Death Deed Texas, or TOD, is a way of passing property to loved ones without going through probate. This legal document lets you retain control of your property during your life, and be certain the property goes directly to whomever you choose as your heir and beneficiary. A Transfer on Death Deed in Texas avoids the probate process, keeps your property where you want it, and gives everyone peace of mind during your lifetime.

Understanding Transfer on Death Deed in Texas

A Transfer on Death Deed (TODD) is an estate planning tool that lets you transfer real estate after death without going through probate in Texas. It’s a straightforward way to make sure your property goes to the people you choose.

The Texas Real Property Transfer on Death Act made it legal in 2015 for homeowners and landowners to pass their properties through transfer on death deeds. Now, Texans can easily leave behind homes or land without a will.

Legal Basis of TOD Deed

Chapter 114 of the Texas Estates Code contains all the rules and guidelines for making a legal transfer on death deed (TODD) in Texas. It covers everything needed to ensure your TODD is valid.

For a TODD to hold up legally, it must follow the guidelines in the Texas Estates Code. This means it must be signed, notarized, and filed with the county clerk’s office before the property owner passes away.

Purpose and Benefits of TOD Deed

People use TODDs to avoid probate for their real estate. Probate can be a long and costly court process. Transfer on death deeds let you skip it altogether for the property in the deed.

TODDs also give you more control over what happens to your real estate. You can choose exactly who you want to inherit it, and name backup beneficiaries. You can change your mind and update the deed anytime before your death.

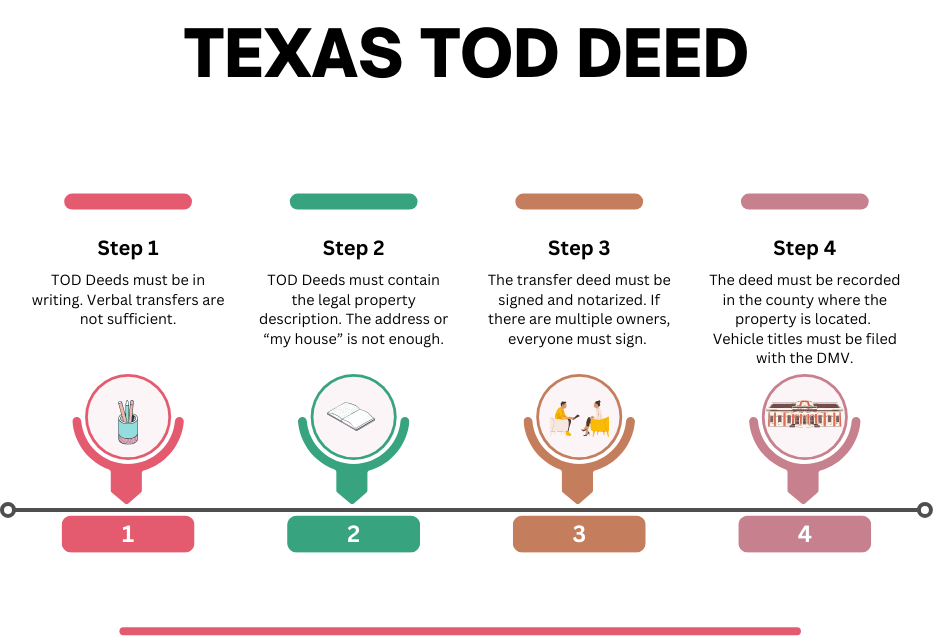

Requirements for a Valid TOD Deed in Texas

For a transfer on death deed to be valid in Texas, it must meet certain requirements. First, it must be in writing – verbal agreements or handshake deals are not sufficient.

The deed must contain the legal description of the property being transferred. This usually means the address and the lot or parcel numbers. Vague descriptions like “my house” or “the ranch” won’t suffice.

Signature and Recording Requirements

The TODD must be signed by the property owner in front of a notary public. If the property is co-owned by a married couple or other joint owners, all owners must sign the deed.

After you sign and notarize the transfer on death deed, you must record it with the county clerk’s office where the property is located. If you don’t record it correctly, the deed won’t be valid.

Process of Creating a TOD Deed in Texas

Creating a transfer on death deed in Texas is a straightforward process, but you must do it correctly. The first step is to obtain the appropriate form – you can find TODD forms in the Texas Transfer Toolkit or from legal aid services.

Once you have the form, fill it out completely and double-check that all the information is accurate. Be sure to include the full legal description of the property and the names of your chosen beneficiaries.

Signing and Filing the Deed

When the form is filled out, sign it in the presence of a notary. Notaries are available at most banks, law offices, and some shipping stores. Bring a valid photo ID with you.

After the deed is notarized, take it to the recorder’s office in the county where the property is located and file it. There will be a small filing fee, usually around $30. Once it’s filed, the deed is officially recorded and will transfer the property to your beneficiaries upon your death.

Role of Beneficiaries in TOD Deeds

A key part of a transfer on death deed is naming your beneficiaries – the people who will inherit the property. You can choose one person, multiple people, or even an organization like a charity.

It’s wise to name at least one primary beneficiary and one alternate or contingent beneficiary. That way, if something happens to your first choice, the property can still pass to someone you trust.

Rights and Responsibilities of Beneficiaries

The beneficiaries you name in a TODD have no rights to the property while you’re alive. You retain full control and can sell it, rent it out, take out a mortgage, or do anything else you want with it. The deed only takes effect after your death.

After you pass away, the beneficiaries can take ownership of the property by filing an affidavit of death with the county clerk. They’ll need a copy of your death certificate to do this. Once the affidavit is filed, the property is officially transferred to the beneficiaries without going through probate court.

Comparing TOD Deeds with Other Estate Planning Tools

In Texas, transfer on death deeds are one type of property deed to pass down property. You might also consider using a will, setting up a living trust, or creating life estate deeds like lady bird deed, although be careful with a lady bird deed.

One advantage of TODDs over wills is that they don’t have to go through probate. Property transferred by a will can get tied up in court for months or even years, but with a transfer on death deed, the beneficiaries can take ownership almost immediately.

TODDs vs. Life Estate Deeds

TODDs are similar to life estate deeds in some ways – both let you name beneficiaries to inherit the property after your death. But with a life estate deed, you give up some control over the property during your lifetime.

With a TODD, you keep full control until your death. You can revoke the deed anytime, sell the property, or do anything else with it. That flexibility is one reason many people prefer transfer on death deeds in Texas.

Potential Pitfalls and Limitations of TOD Deeds

While transfer on death deeds can be a useful tool, they’re not right for every situation. One potential issue is that TODDs don’t override claims against your estate, like Medicaid estate recovery.

If you received Medicaid benefits during your life, the state may have a claim against your estate after death. A TODD won’t prevent your property from being used to repay those expenses if your estate doesn’t have enough other assets.

Tax Implications and Creditor Claims

Don’t forget about the tax implications for your beneficiaries. If they decide to sell property transferred by a TODD, they might face capital gains taxes. Talking to a financial advisor or attorney can help clarify any potential tax consequences.

TODDs also don’t protect the property from creditor claims against the beneficiaries. If your beneficiary has significant debt or gets sued, the inherited property could be at risk. In some cases, a living trust or other tool may offer more asset protection.

Special Considerations for Joint Owners and Community Property

If you own property with someone else, like a spouse or business partner, TODDs work a bit differently. In Texas, jointly owned property can be held as separate property or community property.

With separate property, each owner can transfer their own interest with a TODD. But with community property, both spouses need to sign the deed – one spouse can’t transfer away the other’s interest.

Married Couples and TODDs

For married couples, it’s usually best to create a joint TODD that names the same beneficiaries for both spouses’ interests. That way, the whole property can transfer smoothly to the chosen heirs.

If each spouse names different beneficiaries in separate TODDs, it can create conflict and confusion after their deaths. Partitioning or even selling the property to split the interests might be a significant hassle for the beneficiaries.

Recording and Filing Requirements for TOD Deeds

To make a transfer on death deed official in Texas, you must record it with the county clerk’s office where the property is located. This involves taking the signed and notarized deed to the clerk’s office and paying a small filing fee.

The filing fee varies by county but is usually around $30. Some counties have different fees for the first page and additional pages, so check with your local clerk’s office for the exact amount.

Importance of Proper Recording

Recording the TODD is crucial – if it’s not properly recorded before your death, it won’t be valid. The beneficiaries can only take ownership if the deed is in the county’s official property records.

After you record the deed, keep a copy with your other important papers, like your will and power of attorney. Let your beneficiaries know where to find it, so they can easily handle the property transfer when the time comes.

Impact of Owner’s Death on Property Transfer

The purpose of a transfer on death deed is to quickly pass property to your beneficiaries after you die. Once the TODD is recorded, your beneficiaries simply need to file some basic paperwork to take ownership.

When you die, those who inherit from you must submit both an affidavit of death and your death certificate to the county clerk’s office. This documentation verifies your passing and puts the deed into effect.

Timing and Process for Beneficiaries

Once the affidavit and death certificate are filed, the property automatically transfers to the beneficiaries. They don’t have to go through probate court or deal with complex legal proceedings.

The exact timing depends on how quickly the beneficiaries file the paperwork, but it’s usually a matter of weeks rather than months. The property passes directly to them, and they can take possession right away.

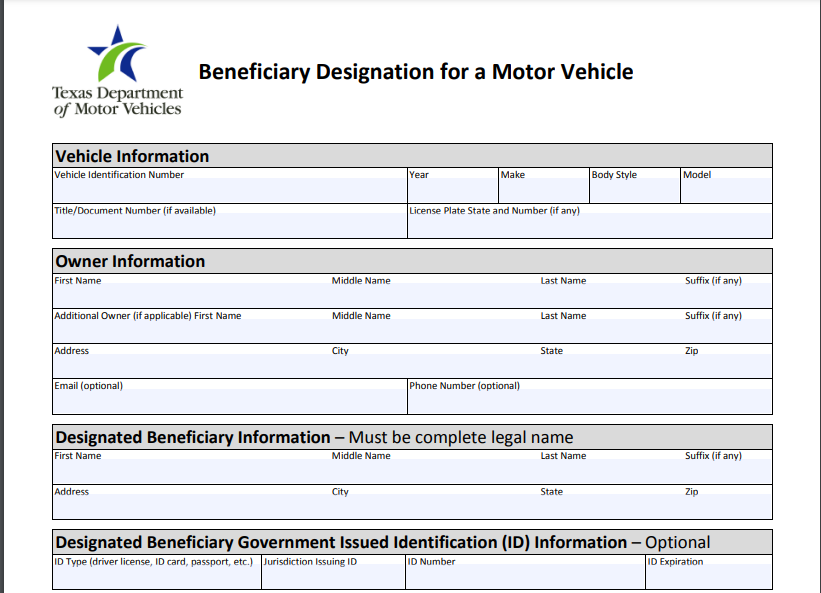

Using TOD Deeds for Motor Vehicles

In Texas, you can use a transfer on death deed not just for real estate but also for vehicles like cars, trucks, and motorcycles. The law makes it easy to pass these items directly to your heirs.

The process is similar to real estate TODDs – you fill out a form naming your chosen beneficiaries and file it with the Texas Department of Motor Vehicles (DMV). The form is called the “Beneficiary Designation for a Motor Vehicle” and it’s available on the DMV website.

Differences from Real Estate TODDs

One key difference is that motor vehicle TODDs don’t have to be notarized. You just need to sign the form and mail it or take it to your local DMV office.

Another difference is that the beneficiaries don’t have to file an affidavit of death to take ownership of the vehicle. They just need to present a copy of your death certificate and fill out a new title application to put the vehicle in their name.

Key Takeaway:

A Transfer on Death Deed (TODD) lets you transfer real estate without probate. Since 2015, Texas law has allowed TODDs under Chapter 114 of the Texas Estates Code. To be valid, a TODD must be signed, notarized, and filed with the county clerk before death.

Frequently Asked Questions

What is the problem with transfer on death deeds in Texas?

The main issue is that TOD Deeds might not protect against Medicaid estate recovery. They can also lead to disputes if improperly drafted.

How much does it cost to transfer on a death deed in Texas?

The filing fee varies by county but usually ranges from $25 to $50. Legal fees could add more.

What are the disadvantages of a transfer on death deed?

TOD Deeds don’t avoid creditors, tax issues may arise, and they might conflict with other estate plans like trusts or wills.

How do I file a transfer on death deed in Texas?

You need to complete the form accurately and record it at your local county clerk’s office. Make sure it’s properly recorded for validity.

Simplify Estate Planning with a Transfer on Death Deed – Contact Us

Transfer on Death Deed Texas – who knew such a simple document could make such a big impact? By now, you’ve seen how this powerful tool can help you avoid probate, maintain control over your property, and ensure a smooth transition for your loved ones. It’s like having a superhero cape for your estate planning needs. The process is so straightforward that you’ll wonder why you didn’t do it sooner. Whether you’re a Texan born and raised or just call the Lone Star State home, a Transfer on Death Deed is definitely worth considering. In the end, when it comes to protecting your legacy and your family’s future, every little bit helps.

For more information, visit our website. You’ll find great resources there. Ready to start or talk to an attorney? Call our law office now at (888) 584-9614 or contact us online to schedule a consultation.