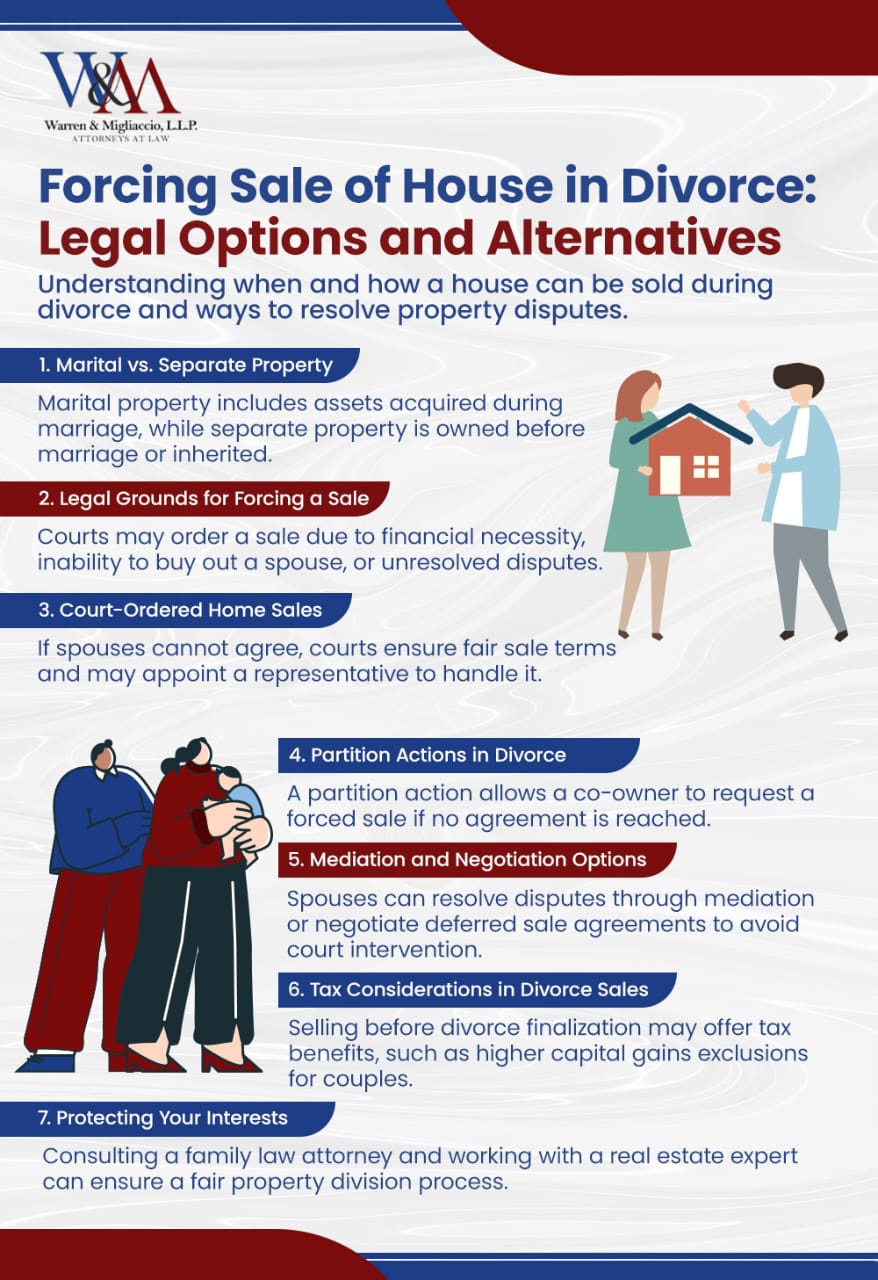

Forcing sale of house in divorce can be necessary when spouses can’t agree. This guide explains the legal grounds, court involvement and alternatives to forcing sale of house in divorce. Know your options and what to do next.

Quick Answer: Forcing Sale of a House in a Texas Divorce

In Texas divorces, a house is usually sold when neither spouse can afford to keep it, division is disputed, or the court must step in to divide community property fairly.

- Confirm whether the home is marital or separate property under Texas community property rules.

- Review legal options, including mediation, partition actions, and court-ordered or deferred sales.

- Work with your attorney and a divorce-savvy realtor to prepare, list, and divide proceeds.

Marital Property in Divorce

Knowing what’s considered marital property and marital asset is crucial when forcing a house sale during a divorce. In Texas, marital property is anything acquired during the marriage, income, real estate and personal property. This is governed by community property laws which assume most property gained during the marriage belongs to both spouses equally.

Not all assets are marital property. Separate property includes assets owned prior to marriage, inheritances and certain gifts received by one spouse. This separate property is not divisible. The line between marital and separate property can get blurry if assets mix. For example, using separate funds to remodel the marital home might make those funds marital.

Because deciding what’s marital property can be detailed, evidence is often required to prove which assets aren’t part of the marital assets. Length of the marriage, each spouse’s financial contributions and future earning capacity also impact how property is divided during divorce settlements.

Knowing these differences is key to a fair division of marital assets especially when deciding who gets the home. This is often a big issue if one spouse is more attached to the property or if children are involved.

Marital Property vs. Separate Property

| Property Type | Examples | How It’s Handled |

|---|---|---|

| Marital Property | Income earned during marriage, real estate | Divided between spouses under community property laws |

| Separate Property | Assets owned before marriage, inheritances | Remains with the individual unless commingled |

Legal Grounds to Force a House Sale

During divorce, forcing the sale of a house often depends on specific legal grounds:

Financial Necessity

If it’s too expensive to keep the family home for either spouse, the court will order a sale.

One spouse has significant financial difficulties and this makes it more likely.

Cannot Buy Out the Other

One spouse can’t afford to buy the other’s share of the home.

Without a buyout, the court will force a sale so both spouses get their fair share.

Unresolved Disputes

Spouse can’t agree on asset division or one spouse refuses to sell.

There’s enough proof of financial problems or stubbornness and the court will order a sale.

The court looks at the stability of both spouses, can they keep the property after divorce. Having a prenuptial agreement that addresses real property can help avoid disputes but many divorcing couples have to work through these issues without one.

Court Ordered Home Sales in Divorce Cases

When divorcing parties can’t agree on selling the marital home, the court intervenes. The court’s goal is a fair sale that gets the best price. The judge considers:

Cash and other property like stocks, bonds or retirement funds

Future income for both spouses

One spouse refuses to sell or fails to meet financial obligations

For example, in W.S.H. v. V.L.P., the court ordered a sale because the wife didn’t pay alimony and the court wanted to be fair. Texas courts will also order a house be sold before the divorce is final if the dispute over the property becomes intense.

If a spouse doesn’t comply with a court order, the court can appoint an attorney-in-fact to sell the house. Ultimately if divorcing couples can’t agree, the judge will make the final decision on the sale of the marital home.

Partition Actions as a Solution

A partition action is a legal tool to solve property disputes when co-owners cannot agree on how to manage or sell. Any co-owner, including a spouse, can start this process to resolve disputes.

In divorce, partition actions can be helpful for forcing sale of the home. Knowing how these actions work gives a structured path to deal with property division.

Filing a Partition Action

A partition action starts by filing a complaint or petition with the court. This document must include:

Information about all co-owners

A description of the property

The ownership percentages

This process aims to force the sale (or division) of the property when co-owners cannot agree. Properly filing includes having all necessary paperwork and evidence to back the claim. Doing so can make the difference between a smooth sale or a drawn-out legal fight.

Serving the Other Spouse

After filing a partition action, the other spouse must be notified through legal service. They have a specific timeframe to respond. Ignoring the notice or missing the deadline can lead to a default judgment, which would favor the filing spouse.

Once served, the other spouse can:

Contest the partition action

Negotiate terms

Agree to the sale

Responding on time is essential to avoid unwanted legal outcomes.

Court’s Role in Partition Actions

If a partition action moves forward, the court usually orders a partition by sale, where the property is sold and proceeds go to each co-owner. If neither side agrees, the court may name a partition commissioner to handle the sale or division.

Once the sale ends, the court reviews the results and finalizes the partition if all is in order. In equitable distribution states like Texas, a partition action is a way the court force can ensure both parties get fair treatment in property matters.

Alternatives to Forced House Sales

Partition actions and court orders aren’t the only ways to handle a marital home. Spouses can also try mediation or collaborative approaches to reach an agreement without involving the court. These methods can save time, money, and stress.

Mediation

Mediation is a voluntary process with a neutral third party who helps spouses find common ground. The mediator guides conversations, aiming for a fair outcome on property-related disputes.

Benefits: Reduced conflict, open communication, faster resolutions.

Outcome: A formal agreement that addresses property division and the sale process.

Negotiation Strategies

Strong negotiation can avoid a forced sale. For example:

Draft a Comprehensive Settlement Agreement

Lay out each spouse’s obligations, financial contributions, and future plans.

Keep everything in writing to prevent confusion later.

Explore Deferred Sale Options

Sometimes, a deferred sale arrangement is the best option if you have dependent children or unfavorable market conditions.

In this arrangement, the sale is postponed to a future date, allowing the custodial parent and children to remain in the home for a set period.

Maintain Open Communication

Discuss each person’s concerns.

Present different options to find a fair compromise.

Texas Divorce Statistics and Property Division Data

Seeing the bigger picture of Texas divorces can help those who might face the sale of their house:

Property division disputes appear in about 40% of contested divorces in Texas, and the family home is the most frequently argued asset.

[Source: https://www.txcourts.gov/statistics/annual-statistical-reports/]In high-value cases (property worth over $500,000), around 58% end in the sale of the marital home.

[Source: https://www.texasbar.com/AM/Template.cfm?Section=Family_Law_Section]Many spouses who keep the home sell it within three years (about 30%) due to financial or maintenance strains.

[Source: https://www.realtor.com/research/data/]Divorce-related home sales often recover around 94% of the home’s market value, compared to 97% for typical home sales. Emotional stress can lead to quicker, less profitable deals.

[Source: https://www.nar.realtor/research-and-statistics]

These numbers underscore why understanding your options regarding the marital home is essential in Texas divorce proceedings.

Real-World Case Study: Navigating Complex Property Division

Beard v. Beard: When Financial Realities Necessitate Home Sale

In the Texas divorce case Beard v. Beard, 49 S.W.3d 40 (Tex. App.—Waco 2001), the appellate court addressed what happens when neither spouse can afford to keep the family home after divorce.

[Source: https://casetext.com/case/beard-v-beard-65]

Background: The couple was married for 13 years and bought their home during the marriage. Both contributed to monthly mortgage payments.

Issue: Mrs. Beard wanted to stay in the home with the children, citing their need for stability. Mr. Beard argued that neither could keep up with mortgage and maintenance costs alone.

Trial Court’s Decision:

Mrs. Beard got temporary exclusive possession of the home.

Later, the court ordered the home be sold because the mortgage, taxes, and maintenance were too high.

The home’s equity was a big part of the couple’s marital assets, and both spouses needed their share to start over.

Appeals Court Ruling: Agreed with the trial court, emphasizing that while children’s stability matters, the financial strain on both spouses also matters. Forcing one spouse to handle a joint mortgage alone carries big financial risks.

After the court-ordered sale, each spouse received about $75,000 in equity. This allowed them to find housing that did not strain their finances.

A Perspective from the Trenches: Helping Clients Through Difficult Housing Decisions

When Letting Go is the Right Choice

I recall working with a client who was deeply attached to the family home. She had raised her children there for fifteen years and didn’t want to leave. However, the mortgage, taxes, and maintenance would take almost 70% of her post-divorce income.

We reviewed her budget together and realized it wasn’t realistic for her to remain. Instead, we found a smaller home in the same school district, cutting her housing costs by half. She felt relieved knowing she could stay in the area without facing constant financial pressure.

The key was balancing the emotional value with practical realities. By respecting both sides, we created a plan that protected her finances and gave her a fresh start. For many clients, selling the home can be a step toward a more secure future.

Important Reminder

Mediation and proactive planning can reframe a forced sale into an opportunity for financial rebalance.

Tax Implications of Selling Your House During Divorce

Selling a house during divorce can lead to significant tax consequences, particularly when considering capital gains tax. The IRS allows individuals to exclude up to $250,000 in gains from taxes if they meet certain rules, or up to $500,000 for married couples selling together. The home must have been the primary residence for at least two of the past five years.

Capital gains depend on the purchase price, selling costs, and any improvements to the property. Understanding capital gains tax can lead to significant tax advantages, especially for married couples compared to singles. Sometimes, it’s helpful to sell before the divorce is final so you can use the higher exclusion limit as a married couple.

Because tax regulations can vary based on the sale date, the date of separation, and the final divorce decree, it’s smart to seek guidance from both a divorce lawyer and a tax professional before deciding when to sell. Especially for divorcing couples with large home equity, these tax factors could save thousands.

Key Insight

Careful asset division during forced sales can create lasting financial stability—even in challenging divorce scenarios.

Preparing for a Court-Ordered Sale

If the court orders the sale of the home, careful preparation and good communication are vital. Try to agree on a few main issues first:

Listing Price

Use a comparative market analysis (CMA) from a real estate agent to find a fair price.

Timing

Decide when to list the home and any deadlines for accepting offers.

Expenses

Agree on repairs and staging costs to improve the home’s appeal.

Hiring a real estate agent with experience in divorce cases can help. They can offer advice on pricing, showings, and negotiation. Also, preparing the home for sale by doing necessary repairs and staging usually leads to a better sale price.

| Step | Why It’s Important | Possible Solutions |

|---|---|---|

| Set a Listing Price | Avoids undervaluing or overpricing the home | Use a CMA or hire an experienced real estate agent |

| Agree on Repairs/Staging | Helps maximize the sale price and attract potential buyers | Share costs or negotiate a fair split of expenses |

| Coordinate Showings | Ensures both spouses cooperate with viewing schedules | Keep a shared calendar for showings and open houses |

If a spouse must transfer ownership of the property, a quitclaim deed might be used. This document transfers the spouse’s share of the home equity without guaranteeing the property’s title. Knowing how and when to use this deed can prevent delays in the sale process.

Dividing Proceeds from the Sale

The main aim of dividing proceeds from the sale of the marital home is equitable distribution. This means a fair split, though not always an equal one. The court considers:

How much equity is in the home

Each spouse’s contributions (like mortgage payments or repairs)

Debts, including mortgages and selling costs

An escrow company usually handles the sale proceeds. After deducting expenses like loan payoffs and closing costs, the rest is divided according to the divorce settlement. Texas law on property division can affect how much each spouse gets from the sale.

Creating a solid settlement agreement that explains every detail helps avoid confusion. Both spouses should be clear on who pays for what and how proceeds will be split. This step is especially important for those transitioning from dual incomes to single income and looking for long-term financial stability.

Protecting Your Interests

The first step in protecting your interests during a divorce-related home sale is talking to a divorce attorney. An experienced attorney can make sure you understand how to split home sale proceeds fairly and follow all legal requirements.

Next, work with a real estate agent who has handled divorce sales before. Such agents know the unique issues divorcing couples face. If possible, keep the option to cancel your listing agreement in case things change.

It can also help not to reveal the divorce as the main reason for selling. Potential buyers might see this as a chance for lower offers if they think you must sell quickly.

Overall, a family law attorney with knowledge of property cases is vital. This is even more important when assets are complex or if one spouse has fewer financial resources.

Frequently Asked Questions

FAQs Regarding: Marital Property and Ownership

What constitutes marital property in Texas?

Marital property in Texas generally includes assets acquired during the marriage, such as income, real estate, and personal belongings. Because Texas is a community property state, both spouses typically share ownership of assets acquired after the wedding date. However, separate property—like inheritances, gifts, and items owned prior to marriage—usually remains with the original owner unless it becomes commingled. Understanding what counts as marital property is crucial for fair division in a divorce.

What happens if the marital home is in one spouse’s name only in Texas?

Even if the home is listed under one spouse’s name, Texas community property laws may still treat it as marital property if it was purchased or paid for during the marriage. Courts look at factors like when the home was acquired and how mortgage payments or improvements were financed. This means both spouses could have a claim on the home’s value, regardless of whose name appears on the title.

FAQs Regarding: Legal Grounds for Forcing a House Sale

What are the legal grounds for forcing a house sale during a divorce, and how common is it?

A forced sale usually happens if one spouse cannot buy out the other’s share, there’s a serious financial need, or ongoing disagreements make a friendly solution impossible. While Texas courts can order a sale, they prefer negotiation or mediation first. When those methods fail, the judge may decide to sell the property to ensure a fair division of assets.

Do we need a court order to sell the marital home in Texas?

If both spouses agree on selling, you can move forward without a court order. If you disagree, you’ll need one. Think of the court like a referee—stepping in only if you can’t find a fair solution on your own.

FAQs Regarding: Timelines and Post-Divorce Sales

How long does it take, or is there a time limit, for forcing the sale of a house in a divorce in Texas?

There isn’t a strict deadline, but courts usually try to wrap up property issues promptly. The timeline can vary based on court schedules, how well spouses cooperate, and how quickly the house sells. Taking action early can help avoid long legal battles and financial stress.

Can the house be forced to sell after the divorce is finalized? What if my ex refuses to sell?

Yes. If the final decree doesn’t settle all property matters or if a spouse refuses to cooperate, you can ask the court to enforce the sale. You might also file a partition action if your ex won’t budge. Courts generally discourage stalling and can enforce orders to sell.

FAQs Regarding: Rights and Occupancy

What are my rights if my spouse tries to force me to sell our home in Texas?

You can challenge a forced sale if you have a good reason, like proof you can cover the expenses on your own. However, the court can still order a sale if it seems fairer overall. Talk to a divorce attorney to see what options you have and protect your interests.

What if one spouse won’t move out? Can you be forced out of your home, or can you stay until it sells?

If a spouse refuses to leave, the court can order them to vacate so the house can be sold. In some cases, the court may let one spouse stay until the sale is complete, especially if there are children or no other living options. The judge’s goal is fairness and minimal disruption.

FAQs Regarding: Financial Aspects

How is equity in a house calculated in a Texas divorce?

Equity is your home’s market value minus mortgages, liens, or loans. Courts also check each spouse’s financial contributions, like mortgage payments or remodeling projects. Big improvements you paid for might increase your share of the proceeds.

How does the court determine the division of proceeds from a house sale?

The judge looks at the net proceeds—what’s left after loan payoffs and other costs—and weighs each spouse’s situation, including debts. While Texas aims for equitable distribution, it’s not always a 50/50 split. Detailed records and communication can help reach a fair outcome.

Who pays for repairs or improvements if the house is forced to sell in a divorce?

Both spouses usually share these costs, although the split can vary based on finances and court orders. Since repairs and improvements often raise the sale price, both can benefit. A written agreement on expenses can avoid last-minute fights.

How do I handle a mortgage when selling a home in a divorce?

Check with your lender about the payoff amount and any prepayment penalties. Decide who pays the monthly mortgage and closing costs until the sale closes. Typically, the mortgage is paid off from the sale proceeds, and remaining equity is split by the court or settlement.

Will I lose money if the house is sold in a divorce?

There’s no guarantee you’ll make a profit. If the market is slow or your equity is low, you might break even or face a loss. Still, good pricing, staging, and timing can improve your chances. Work closely with a real estate agent who has experience in divorce sales.

Who suffers most in divorce financially?

Research shows women often face a tougher financial transition, particularly if they paused their careers for childcare. However, anyone without a fair settlement or solid budget can struggle. Careful planning, legal advice, and balanced property division help protect both spouses.

Related reading: Who suffers most in divorce?

FAQs Regarding: Alternatives and Protections

Is mediation mandatory, and how can it help resolve property disputes during a divorce?

Texas courts typically encourage mediation but don’t always require it. Mediation offers a neutral setting where spouses can discuss disputes and potentially avoid forced sales. It’s often quicker, cheaper, and less emotional than a court battle.

Is it ever better to keep the house in a divorce rather than sell it in Texas?

Yes—if you have enough equity and can cover the mortgage, taxes, and upkeep on your own. Otherwise, keeping the home can become a financial burden. Weigh the emotional value against your post-divorce budget before you decide.

How can I protect my interests during a court-ordered home sale?

Hire a divorce attorney who specializes in property matters and choose a realtor with divorce experience. Avoid telling buyers you’re divorcing so they don’t assume you’re desperate. Keeping a flexible listing agreement lets you adjust if things aren’t working.

Can child custody or support issues affect whether a home is sold during divorce?

Yes. A judge might delay or alter a sale if moving would harm a child’s routine or schooling. Children’s best interests often take priority, so the court may let one spouse stay in the home longer to avoid major disruption.

Conclusion on Forcing Sale of House in Divorce in Texas

Dealing with a forced sale of a house in a Texas divorce involves:

Knowing the differences between marital and separate property

Understanding the legal grounds for forcing a sale

Recognizing the court’s role if spouses can’t agree

Mediation and negotiation are helpful alternatives that may avoid a forced sale. It’s also important to think about tax implications and to prepare carefully for a court-ordered sale to reduce stress.

Since every situation is unique, getting legal guidance can make all the difference. At Warren & Migliaccio, our experienced family and estate planning attorneys can help individuals navigate complex property division issues in Texas divorces. If you’re facing a forced sale, we can answer your questions, explain your legal options, and guide you toward the best path forward. Call us at (888) 584-9614 or contact us online to get the support you need.