To get a debt lawsuit dismissed in Texas, you must respond by the court deadline, demand proof that the creditor owns and can enforce the debt, and raise defenses like time-barred debt, improper service, or serious errors in the lawsuit paperwork.

Are you currently facing a debt collection lawsuit in Texas? It’s normal to feel overwhelmed and uncertain, but you do have legal options. Taking the right legal steps early in the process can shift the outcome in your favor. Depending on your specific situation, you may even be able to have the lawsuit dismissed. Below, our Texas debt collection defense attorneys discuss how to get a debt lawsuit dismissed.

Quick Answer: How can I get a debt lawsuit dismissed in Texas?

In Texas, you improve your chances of getting a debt lawsuit dismissed by acting before court deadlines, forcing the creditor to prove its claim, and raising defenses like time-barred or improperly served lawsuits.

- Respond to the lawsuit by your Texas court deadline.

- Request validation and review whether the debt is time-barred.

- Talk with a Texas debt-defense lawyer about dismissal options.

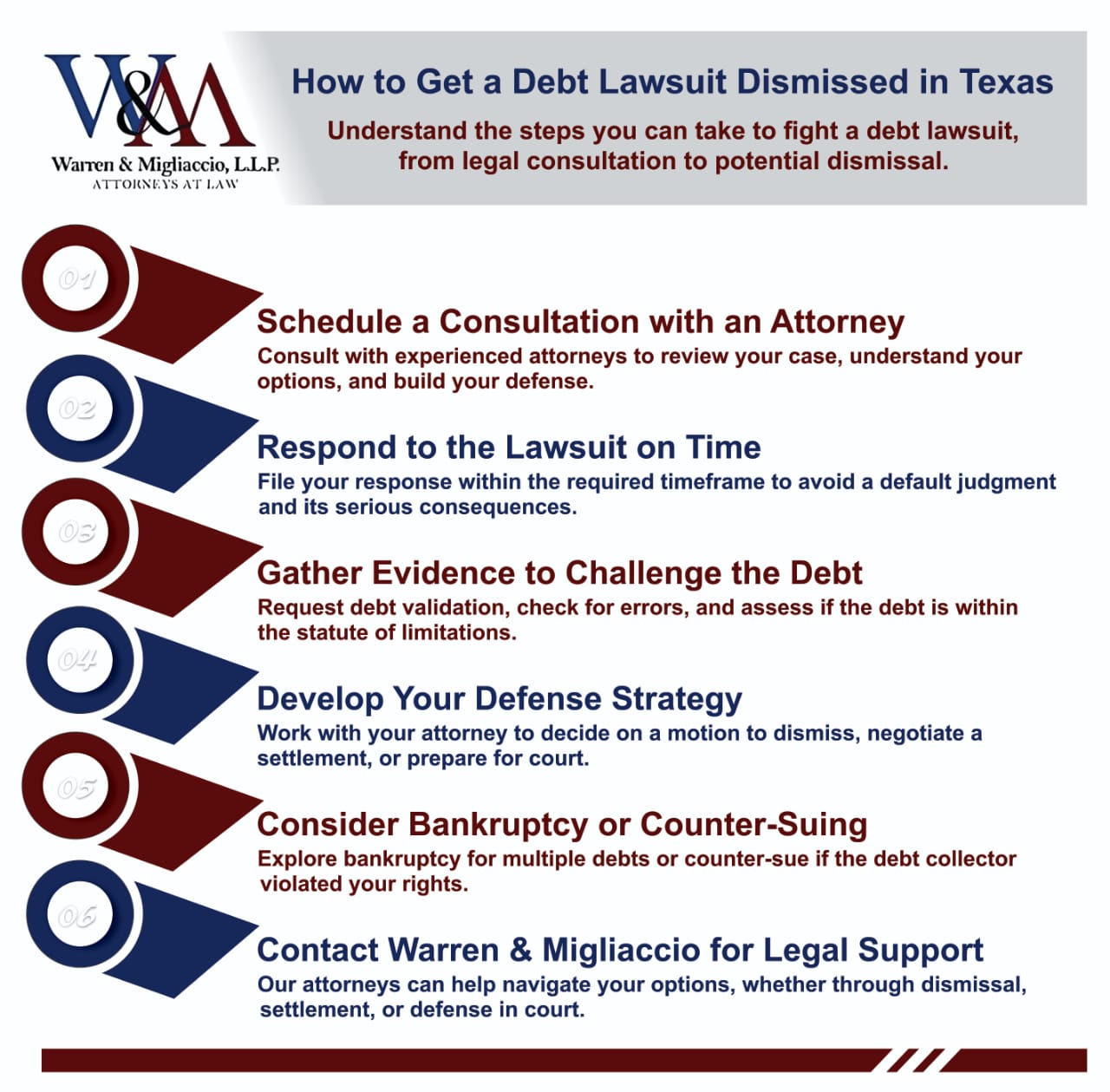

Step 1: Schedule a Consultation With a Texas Debt Defense Attorney

Regardless of whether a credit card company or a debt buyer is suing you, we recommend consulting with experienced attorneys. An attorney can help in many ways, from providing essential legal guidance to helping you understand your options. They can also advise you on the best course of action, gather evidence, and represent you through the entire case.

At Warren & Migliaccio , we represent and defend individuals like you in debt collection lawsuits throughout Texas. We have extensive experience and a successful track record in assisting our clients in resolving debt lawsuits. In some cases, we are able to get a lawsuit against our client dismissed.

If a creditor or debt collector sues you, we encourage you to contact us. During a consultation, we can review the claims against you. We will provide legal help to determine your best options for putting the lawsuit behind you. Call us at (888) 584-9614 or contact us online to schedule your consultation today.

Step 2: Answer the Lawsuit

In Texas, you have a specific amount of time to file a formal response to the lawsuit, depending on the court handling your case. Likewise, in most county and district courts, you must file an Answer on or before 10:00 a.m. on the Monday next after the expiration of 20 days after you are served. In Texas justice courts (small claims courts), your Answer is generally due by the end of the 14th day after you are served, or the next business day if that day falls on a weekend or court holiday. See Tex. R. Civ. P. 99(b), 502.5(d).

You should always answer the lawsuit within the allotted time frame and in a timely manner. You can use our guide about responding to a debt lawsuit to help you with your response and the court forms you will need. But, we recommend working with experienced debt resolution lawyers. They will protect your interests and ensure you do not make any mistakes that could hurt your case.

If you miss this deadline, the debt collector may win the court case and get a default judgment against you. A default judgment means you lose the case, and the debt collector wins, even if you do not recognize the debt and believe you do not owe it.

Tex. Civ. Prac. & Rem. Code ch. 63; Tex. Prop. Code § 42.001(a).

A default judgment can result in serious consequences, including a court order to freeze your bank account and the loss of access to your money. In Texas, most judgment creditors must obtain a writ of garnishment to reach non-exempt funds in a bank account, and exemptions protect certain wages and personal property.

In my years of helping folks with debt problems, a bank account garnishment is one of the most frustrating and difficult situations to deal with. So, if you face a debt lawsuit, ensure that you file your answer to the lawsuit.

Step 3: Collect Evidence to Support the Case Dismissal

Your first step in securing the case’s dismissal is to gather evidence that can challenge the debt collector’s claims. First, you should demand debt validation from the debt collector. Just because someone claims you owe them money does not mean they have the legal right to sue. It is common for debts to be bought and sold many times. The debt collector must prove that the debt is yours, that you owe it, and that it has the right to collect it .

You should look for any errors with the debt collector’s claim. Scrutinize the lawsuit for discrepancies, like wrong names, debt amounts, or any other legal terms that may be incorrect. For example, think about the following questions:

- Firstly, do you recognize the debt?

- Secondly, has the debt already been paid?

- Thirdly, have you already been sued for the debt?

- Also, do you actually owe the debt, or is it someone else’s debt?

- Likewise, is the amount of debt correct?

- Does the collection agency have proof that it has the right to collect it?

- Also, does the term “zombie debt” apply to the debt?

You should also seek legal advice to assess other factors that may help get the case dismissed, such as:

- Statute of limitations. In Texas, creditors and debt collectors only have a certain amount of time to pursue a debt collection lawsuit. This time limit is called a statute of limitations. For most consumer debt collection lawsuits in Texas, the limitations period is four years from when the claim accrues. Once the four-year limitations period has run, the debt is time-barred. You can assert the statute of limitations as a defense and ask the court to dismiss any lawsuit filed too late. Tex. Civ. Prac. & Rem. Code § 16.004(a)(3) (West 2024); Tex. Fin. Code § 392.307(c) (West 2024).

- Proper service. Were you properly served with the lawsuit? If you were not notified according to Texas service rules, you may be able to challenge the court’s jurisdiction or ask the court to set aside a default judgment, because defective service can render a judgment void. See Tex. R. Civ. P. 106, 108; Caldwell v. Barnes, 154 S.W.3d 93, 96–97 (Tex. 2004).

If you identify errors in the lawsuit against you, you may be able to have it dismissed.

Step 4: Decide on Your Defense Strategy on How to Get a Debt Lawsuit Dismissed

Based on the standing of the debt collector’s case, your attorney will decide on a defense strategy for your debt collection case.

For example, if you believe the lawsuit should not proceed, you can file a motion to dismiss the lawsuit. Meanwhile, you can take proactive steps in the legal process to protect your rights with the help of debt attorneys.

Another way to avoid litigation is to negotiate a settlement outside of court . You may be able to negotiate a lower debt amount than the original claimed debt through a settlement agreement with debt collector. You may also have the option to negotiate paying the settlement amount over a period of time instead of in a single payment. For example, you could settle a $10,000.00 lawsuit for $6,000.00 and then set up a payment plan to pay the $6,000 settlement over 12 months. This would allow you to pay $500.00 per month, which may help with your monthly budget.

It’s also important to understand that even if you cannot get the case dismissed, you may still be able to win the lawsuit in court. You may have strong defenses to challenge the debt collector’s claims, but you will need to wait for a court date, which can take several months or longer and make the case feel like it is dragging on.

If you have a good defense, though, the wait is often worth it. Waiting for trial with a debt collector can feel like a game of chicken—both sides may delay resolution, hoping the other will back down—creating mounting stress and uncertainty while each side tries to outlast the other in a high-stakes standoff.

Need-to-Know Highlights

- Texas courts can dismiss debt lawsuits when creditors lack proof or violate procedure.

- Missing your Answer deadline risks a default judgment against you.

- Most Texas consumer debt lawsuits must be filed within four years.

- Improper service and inaccurate balances can also support dismissal defenses.

- Consulting a Texas debt-defense lawyer helps you use these defenses effectively.

Exploring Bankruptcy

Another potential option to explore is bankruptcy, especially if collection agencies are pursuing multiple debts. When you file a bankruptcy case, an automatic stay under 11 U.S.C. § 362(a) usually stops most collection lawsuits, including many debt cases. A bankruptcy attorney from our law firm can help you determine whether you qualify for a discharge of eligible debts under 11 U.S.C. §§ 727 or 1328.

This option is especially helpful if you have other debts besides the one in the lawsuit. For example, if you have thousands of dollars in credit card balances, it may make more sense to file bankruptcy and address all of your debts in one case instead of battling each creditor individually. You may also want to consult a financial advisor to better understand how bankruptcy could affect your overall financial situation.

You may also consider counter-suing the debt collector, potentially seeking to recover attorney’s fees if the collector has violated your rights. For example, you might have grounds to sue under the federal Fair Debt Collection Practices Act (FDCPA) and the Texas Debt Collection Act if a collector uses false, misleading, or abusive tactics, and successful consumers can recover damages and attorney’s fees. See 15 U.S.C. § 1692k (2024); Tex. Fin. Code §§ 392.301–.303, 392.403 (West 2024).

Frequently Asked Questions

FAQs About Getting a Debt Lawsuit Dismissed in Texas

How can I get a debt lawsuit dismissed in Texas?

You may be able to get a debt lawsuit dismissed in Texas by showing the creditor cannot prove its claim or followed the wrong procedures. Courts may dismiss cases when the creditor lacks evidence, sues too late, serves you improperly, or files a lawsuit with serious errors.

- The debt is past the statute of limitations

- The plaintiff cannot prove it owns the debt

- The petition or amount is clearly wrong

- Service of process did not follow Texas rules

How long can a creditor sue me for a debt in Texas if it’s too old?

A creditor generally has four years from when the claim accrues to sue for most consumer debts in Texas. Once that four-year statute of limitations expires, the debt is usually considered too old to sue on, and you can ask the court to dismiss any lawsuit that is filed after the deadline.

What are the most common reasons a Texas court dismisses a debt lawsuit?

Texas courts often dismiss debt lawsuits when the creditor cannot meet its legal burden or fails to follow procedure. Common dismissal reasons include:

- The debt is past the four-year statute of limitations

- The plaintiff cannot prove it owns or correctly assigned the debt

- Major errors in the petition, parties, or amount claimed

- Serious problems with service of process or other key rules

FAQs About Deadlines and Consequences in Texas Debt Lawsuits

How long do I have to respond to a debt lawsuit in Texas?

In Texas justice courts, you typically have 14 days from the date you are served to file an Answer. In county or district court, your Answer is generally due by 10 a.m. on the Monday after 20 days have passed from service, so deadlines can arrive very quickly.

What happens if I ignore a debt lawsuit in Texas?

If you ignore a debt lawsuit in Texas, the court will likely enter a default judgment against you. A default judgment lets the creditor use strong collection tools, such as freezing bank accounts or placing liens on non-exempt property, even if you dispute the underlying debt.

How long can a creditor sue me for a debt in Texas?

For most consumer debts in Texas, a creditor has four years from when the claim accrues—often measured from the date of default—to file a lawsuit. After that four-year period, the claim is usually “time-barred,” and you can raise the statute of limitations as a defense and ask the court to dismiss the case.

FAQs About Evidence, Proof, and Service Issues

Can a debt collector sue me in Texas if they can’t prove the debt is mine?

A debt collector can file a lawsuit, but it cannot win—and may face dismissal—if it cannot prove you owe the debt and that it legally owns the account. Judges expect clear documentation of the correct balance and a chain of assignments from the original creditor.

Can a debt lawsuit in Texas be dismissed because I was not served correctly?

Improper service of process can be a strong defense in a Texas debt lawsuit. If you were not served according to Texas rules, you may ask the court to dismiss the case or set aside a default judgment that was entered without proper notice or a chance to respond.

FAQs About Outcomes, Settlement, and Legal Representation

Can creditors garnish my wages in Texas if they win a debt lawsuit?

For most consumer debts, Texas law does not allow wage garnishment, even after a judgment, because the Texas Constitution and state statutes generally exempt current wages from garnishment except for limited debts like child support or spousal maintenance. However, a creditor may still freeze money in your bank account or place liens on certain non-exempt property, so defending or resolving the lawsuit is still extremely important.

Can bankruptcy stop or dismiss a debt lawsuit in Texas?

Filing bankruptcy usually triggers an automatic stay that immediately stops most collection lawsuits, including many debt cases. If the debt is later discharged, the lawsuit is effectively resolved as part of the bankruptcy, and the creditor can no longer collect on that claim.

Can I settle a debt lawsuit instead of getting it dismissed in Texas?

Yes. Many Texas debt lawsuits end in negotiated settlements instead of outright dismissal. You may be able to reduce the total amount, set up a payment plan, or agree to pay in exchange for dismissal of the lawsuit, often avoiding a judgment on your credit record.

Do I need a lawyer to get a debt lawsuit dismissed in Texas?

You are not required to hire a lawyer, but an experienced Texas debt-defense attorney can greatly improve your chances of dismissal or a favorable settlement. A lawyer can spot defenses, challenge evidence, handle court filings, and negotiate with the creditor’s attorney for you.

Schedule a Consultation With Warren & Migliaccio Today

Facing a debt collection lawsuit in Texas is undoubtedly stressful, but you do have legal options to resolve it and put it behind you. At Warren & Migliaccio, we help individuals across Texas who are dealing with debt collection lawsuits from creditors and debt collectors.

If you’ve been sued for a debt, do not hesitate to contact us about your situation. We are happy to review the claims against you, explain how you may be able to get a credit card lawsuit dismissed in Texas, and determine how we can help.

If we cannot dismiss your case, we can still help you resolve it through other means. For example, you may have strong defenses to fight the case in court, or you may be able to negotiate a settlement for less than the original amount of debt claimed. The most important message to take from this article is that when you face a debt lawsuit, you have options. Anyone who tells you that you can only settle the lawsuit or must go to court is not giving you the full picture.

Our experienced debt defense attorney is here to help you assess your options and take the next steps with confidence. Call us at (888) 584-9614 or contact us online, and we will be in touch with you soon to schedule a free consultation.