Putting a house with a mortgage into a trust can be a complex but rewarding estate planning strategy. Many homeowners consider this option to safeguard their assets and make it easier to pass their property to their heirs. However, the process can be tricky, especially when there’s an existing mortgage. To understand how to put a house in trust with a mortgage, it’s essential to know why someone would want to do this in the first place.

Understanding Trusts and Mortgages

A trust is a legal arrangement where a person (the grantor) transfers ownership of assets to a trustee. This trustee manages those assets for the benefit of designated beneficiaries. When it comes to real estate, there are two main types of trusts to consider: revocable and irrevocable. Let’s dive into the differences between them.

Revocable Living Trusts

A revocable living trust is the more flexible option. This estate planning tool allows you to maintain control of the property and change the terms of the trust. You can also remove the property from the trust if needed. This flexibility makes revocable trusts a popular choice for homeowners who want to put a house in trust with a mortgage.

Irrevocable Trusts

An irrevocable trust provides stronger asset protection, but it’s less flexible. When you put property into an irrevocable trust, you no longer control the asset. The trust terms are usually permanent, and this can protect the property from creditors. Before putting your home in an irrevocable trust, you should understand the specific requirements involved.

Mortgages and Due-on-Sale Clauses

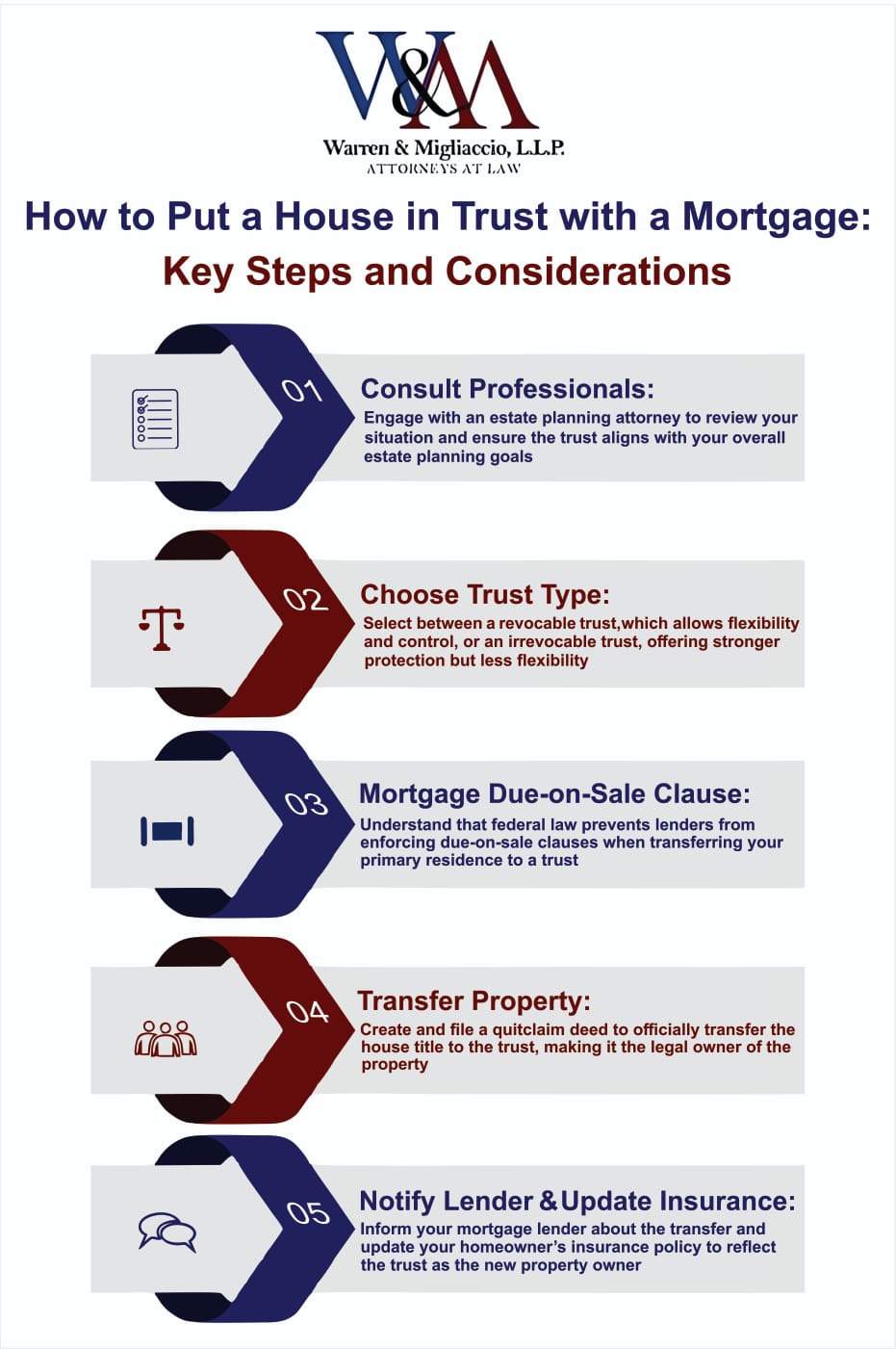

When putting a house with a mortgage into a trust, it’s essential to understand due-on-sale clauses. These clauses, typically found in mortgage agreements, let lenders demand full loan repayment if the property is sold or transferred. However, federal law offers some protection to homeowners who want to transfer their mortgaged property into a trust.

The Garn-St. Germain Depository Institutions Act of 1982 stops lenders from enforcing due-on-sale clauses in certain cases. This includes when a borrower transfers their primary residence into a living trust, as long as they remain a beneficiary of that trust.

Steps to Put a House in Trust with Mortgage

If you’ve decided that putting your house in trust with mortgage is right for your estate planning needs, here are some steps to follow. This is not legal advice, and you should always seek help from knowledgeable professionals before making legal decisions.

1. Consult with Professionals

Before making any moves, it’s crucial to consult with an estate planning attorney and a financial advisor. They can help you understand the implications of transferring your property into a trust. They will also help ensure that it aligns with your overall estate planning goals.

2. Choose the Right Type of Trust

Based on your specific situation and goals, decide whether a revocable or irrevocable trust is more appropriate. For most homeowners, a living revocable trust is the preferred option when putting a house in trust with a mortgage.

3. Create the Trust Document

Work with your attorney to draft the trust document. This legal document will outline the terms of the trust, including who the beneficiaries are and how the property should be managed. You will want to include specific details that you want to be included in your trust document.

4. Notify Your Mortgage Lender

While the Garn-St. Germain Act protects you from due-on-sale clause enforcement, it’s still a good idea to notify your mortgage lender of your intent to transfer the property into a trust. Some lenders may have specific requirements or forms to complete.

5. Transfer the Property

To officially put your house in trust with a mortgage, you’ll need to transfer the title of the property to the trust. This typically involves creating and recording a new quitclaim deed that names the trust as the property owner.

6. Update Insurance Policies

After transferring the property, make sure to update your homeowner’s insurance policy to reflect the trust as the new owner. You should review your insurance policies each year during your estate planning check-up.

Potential Benefits and Drawbacks

Understanding the pros and cons of putting a house in trust with a mortgage can help you make an informed decision. Here’s a table summarizing those:

| Benefits | Drawbacks |

|---|---|

| Avoid probate court | Potential complexity and cost |

| Maintain privacy | Limited protection from creditors (for revocable trusts) |

| Simplify property transfer to heirs | Possible difficulty refinancing |

| Potential estate tax benefits | Ongoing management responsibilities |

Common Misconceptions

When it comes to putting a house in trust with a mortgage, there are several misconceptions that homeowners should be aware of. It is important to do your own research and understand all aspects of trusts before entering into one.

Misconception 1: Transferring a Mortgaged Property to a Trust Eliminates the Mortgage

This is false. Even after transferring your property into a trust, you’re still responsible for making mortgage payments. The trust doesn’t assume the debt; it simply becomes the new owner of the property.

Misconception 2: All Trusts Offer the Same Benefits

Different types of trusts offer different benefits. For example, a revocable living trust provides flexibility but limited asset protection. An irrevocable trust offers stronger asset protection but less control.

Misconception 3: Putting a House in Trust Always Avoids Estate Taxes

While trusts can be useful tools for estate tax planning, simply transferring a property into a trust doesn’t automatically eliminate estate taxes. The tax implications depend on various factors, including the type of trust and the total value of your estate.

Alternative Options

While putting a house in trust with a mortgage can be a valuable estate planning tool, it’s not the only option available. Homeowners should also consider alternatives like Transfer-on-Death Deeds (TODDs). These alternatives may offer similar benefits with potentially less complexity.

The Role of Credit in Estate Planning

While discussing how to put a house in trust with a mortgage, it’s worth noting the broader role of credit in estate planning. Your credit history and current debts, including mortgages and credit card debt, can significantly impact your estate planning decisions.

For instance, if you’re carrying significant credit card debt, you might need to prioritize debt repayment strategies alongside your estate planning efforts. This could influence your decision on whether to put your house in trust with a mortgage or explore other options.

Conclusion

Putting a mortgaged house in a trust can benefit homeowners. It helps avoid probate and eases asset transfer. Yet, the process is complex and needs expert advice.

Understanding the steps, benefits, and myths is crucial. This helps in deciding if it’s the right strategy. It’s vital to protect assets and ensure desired distribution. Our Texas estate planning attorneys are ready to assist. They will explore options and craft a plan to meet your goals. Call us at (888) 584-9614 or reach out online to start your estate planning.