Business owners wonder, “how to transfer ownership of an LLC to a trust”? As a Texas estate planning attorney, I’ve helped many such business owners protect their assets and simplify their estate plans by transferring LLC ownership to trusts. This has become a popular move among my clients who want to avoid probate and have their business interests pass smoothly to their heirs.

Just last year I worked with a Dallas restaurant owner who owned three locations through her LLC. By transferring the LLC to her revocable living trust, we avoided probate and saved her family thousands in legal fees. And the best part? She had complete control of her business during her lifetime.

The Data Behind Succession: A Ticking Clock for Business Owners

For many business owners, planning for the future of their company feels less urgent than daily operations. But the data shows a big gap between intention and action. According to SCORE, a nonprofit resource partner of the U.S. Small Business Administration, 47% of family business owners who plan to retire in the next five years don’t have a successor. Source: SCORE, “Infographic: The Family Business—Successes and Obstacles”. Aligning succession planning with your financial goals is key to making sure your business and personal wealth objectives are met.

What is an LLC and Its Operating Agreement

What is a Limited Liability Company?

An LLC is one of the most flexible business structures out there. It shields your personal assets from business debts and offers tax advantages that corporations can’t match.

Here in Texas I see two main types:

- Single-member LLCs: You’re the only owner

- Multi-member LLCs: You share ownership with business partners

The beauty of an LLC is its simplicity. Unlike corporations with their complexity, LLCs let you run your business with minimal paperwork while still protecting your personal property.

The Importance of the LLC’s Operating Agreement

Your operating agreement is the rulebook for your LLC. Think of it as your business’s constitution.

This document spells out:

- Firstly, who owns what percentage

- Secondly, how decisions get made

- What happens when ownership changes

- Also, whether you need consent from other members for transfers

I always tell clients: if your operating agreement doesn’t address trust transfers, update it now. I’ve seen too many transfers hit roadblocks because the operating agreement required unanimous consent from all members, and one member was uncooperative.

Case Study: Why the LLC Operating Agreement Is King

The operating agreement is very important, as illustrated in the Texas Supreme Court case Spires v. Spires, 443 S.W.3d 857 (Tex. 2014). In that case, a husband attempted to transfer his LLC membership interest in a family LLC to his wife as part of a divorce settlement.

However, the LLC’s operating agreement prohibited the transfer of membership interests to non-members without the consent of all other LLC members. As a result, when the other family members (the LLC members) objected, the dispute escalated to court.

Ultimately, the Texas Supreme Court ruled that the transfer restrictions outlined in the operating agreement had to be upheld. Therefore, the wife could not become an LLC member with full membership rights because the agreement did not permit it.

This case teaches Texas business owners an important lesson: If you do not follow the transfer rules and get the required consent in your operating agreement, your transfer—even one to a trust for estate planning or asset protection—can be invalidated by the court.

Types of Trusts: Revocable Living Trust vs. Irrevocable Trust

Choosing the Right Type of Trust

The trust you choose makes a huge difference in how you’ll transfer your LLC interest. Let me break down the two main options:

Revocable Living Trust:

- Firstly, you can change or cancel it anytime

- Also, you keep full control of the LLC

- Assets avoid probate

- Lastly, no asset protection from creditors

Irrevocable Trust:

- Firstly, can’t be changed once created

- Offers strong liability protection

- May provide tax benefits

- Lastly, you give up control of the LLC

Why a Trust-Owned LLC Can Be a Good Idea

Trust ownership of your LLC brings several advantages:

- Estate tax savings: Proper planning can reduce or eliminate estate taxes

- Asset protection: Shields business assets from personal creditors

- Enhanced asset protection: Transferring an LLC to a trust offers a higher level of safeguarding assets from creditors, legal claims, and potential liabilities

- Simplified transfers: No court involvement when you pass away

- Privacy: Trust transfers stay out of public records

For family-owned businesses and rental property LLCs, trust ownership often makes perfect sense. One client with multiple rental properties saved her children months of probate delays by placing her real estate LLC in a trust. Trust ownership of an LLC is a powerful strategy for estate planning and business succession.

Pre-Transfer Considerations and Legal Advice

Business Interests and Specific Goals

Before you transfer your LLC, take stock of what you own. This includes:

- Firstly, real property held by the LLC

- Investment property

- Bank accounts

- Lastly, equipment and inventory

What are your goals:

- Retirement?

- Asset protection from lawsuits?

- Smooth business succession?

Talking to financial advisors will help ensure your business succession plan aligns with your overall financial goals.

A colleague told me about a client who rushed into transferring his construction company LLC to an irrevocable trust without considering he’d need financing for new equipment. The trust structure complicated his loan applications big time.

Gather Necessary Documents

Get these documents before you start:

- Firstly, articles of organization

- Likewise, current operating agreement

- Also, trust document

- Buy-sell agreements

- Lastly, business licenses and permits

The one step most people miss? Reviewing loan documents. Some lenders require notification or approval before ownership transfers.

Step-by-Step Guide to Transferring Ownership of an LLC to a Trust

Draft or Update the Trust Agreement

Your trust agreement must include the LLC as a trust asset. Work with your attorney to make sure the language covers:

- Firstly, the LLC’s full legal name

- Your membership interest percentage

- Also, how the trustee will manage the business

- Specific management instructions for the LLC, as outlined in the trust terms

- Lastly, instructions on how the LLC should be managed or transferred in the event of incapacity or death, so your wishes are followed correctly

The trustee has big responsibilities. They’ll need authority to:

- Vote on LLC matters

- Sign documents

- Manage distributions

- File tax returns

- Obtaining Consent of Other Members (If Applicable)

Multi-member LLCs require careful navigation. Your operating agreement likely requires consent from other members before any transfer.

Steps for smooth approval:

- Review the operating agreement’s transfer provisions

- Prepare a written consent form

- Schedule a members’ meeting

- Document the approval in meeting minutes

- Get written signatures from all members

I recently helped a tech startup where three partners needed to approve one partner’s trust transfer. Clear communication and proper documentation prevented any disputes.

Executing the Assignment of Membership Interests

The assignment document officially moves your LLC membership interest to the trust. This transfer document is used for transferring LLC membership interests and should include:

- Current owner’s name (you)

- Trust’s full legal name

- Percentage of interest transferred

- Effective date

- Signatures of all required parties

Hence, transferring LLC membership interests as part of estate planning or asset protection ensures your ownership rights are properly assigned to the trust.

In Texas, we follow the Texas Business Organizations Code for LLC transfers. The good news? Texas doesn’t require complex filings or newspaper publications like some other states.

Updating the LLC’s Official Records

Don’t forget to update your LLC’s official records:

- Firstly, file a Certificate of Amendment with the Texas Secretary of State if needed

- Update your registered agent information

- Also, revise internal membership ledgers

- Notify your LLC’s bank and update signature cards

- Lastly, update your franchise tax account with the Texas Comptroller

Texas makes this process relatively straightforward compared to many states.

Addressing Tax Implications and Liabilities

Tax considerations vary by trust type:

If you transfer your LLC into a revocable trust, you typically retain control and the LLC’s income is reported on your personal tax return. For irrevocable trusts, the LLC’s income may be taxed at the trust level or passed through to beneficiaries, depending on the trust’s structure. Always consult a tax professional to understand how the LLC’s income will be reported and taxed based on the specific trust arrangement.

Revocable Trust:

- No immediate tax changes

- You still report LLC income on your personal return

- No gift tax issues

Irrevocable Trust:

- May trigger gift tax consequences

- Trust becomes a separate taxpayer

- Potential estate tax benefits

Therefore, always consult your tax advisor. I’ve seen clients save thousands in property taxes with proper planning, while others faced unexpected tax bills from hasty transfers.

State-Specific Requirements and Legal Arrangements

Texas LLC Requirements

Texas has relatively business-friendly laws for LLC transfers. Here’s what you need to know:

- Filing requirements: File amendments with the Texas Secretary of State within 30 days

- Franchise tax: Update your Texas franchise tax account to reflect new ownership

- No publication requirement: Unlike some states, Texas doesn’t require newspaper notices

Hence, for LLCs owning Texas real estate, check county recording requirements. Some counties require additional documentation when trust ownership is involved.

Land Trust and Other Specialized Trust-Owned LLCs

Land trusts offer unique benefits for real estate holdings:

- Firstly, enhanced privacy (trustee’s name appears on deeds, not yours)

- Easier property transfers

- Lastly, simplified management of multiple properties

Proper management and administration of the trust’s assets is crucial, especially when the trust owns multiple properties, to ensure ongoing compliance and financial health.

Texas doesn’t have specific land trust statutes like some states, but we can achieve similar results using traditional trust structures. These specialized trusts require careful planning to meet specific requirements.

Updating Your Estate Plan and Avoiding Probate

Integrating Trust-Owned LLCs into Your Estate Planning

Your LLC transfer should fit seamlessly into your broader estate plan. Consider how it affects:

- Firstly, your will or pour-over will

- Power of attorney documents

- Healthcare directives

- Lastly, beneficiary designations

The goal? Create a comprehensive plan where all pieces work together. When done right, your loved ones avoid the time, expense, and stress of probate court.

Reviewing and Revising Your Trust Document

Review your trust whenever:

- You add or remove business partners

- Your successor trustee changes

- Major tax laws change

- Your personal situation shifts

I recommend annual reviews with your attorney. Small updates now prevent big problems later.

Frequently Asked Questions

FAQs About Process & Timeline

What are the steps to transfer LLC ownership to a trust?

The process typically involves 5 key steps that take 4-8 weeks to complete. Transferring LLC membership interests is a key part of transferring assets into a trust for estate planning purposes, helping to avoid probate and ensure proper management of your estate.

The basic steps are:

Firstly, review your operating agreement for transfer restrictions and consent requirements

Obtain member consent if required (usually for multi-member LLCs)

Likewise, draft an assignment of membership interest document transferring ownership

Also, amend the operating agreement to reflect the trust as new member

Finally, file state documents if required (varies by state and LLC structure)

Additional considerations include updating bank accounts, notifying the IRS if needed, and ensuring all members sign the necessary documents. States like Texas require filing an amendment if management structure changes.

How long does it take to transfer LLC to trust?

The typical timeline is 4-8 weeks for a complete LLC trust transfer.

Timeline breakdown:

Document preparation with attorney: 2-4 weeks

Member approval process (if required): 1-2 weeks

State filing processing: 1-3 weeks

Bank account updates: 1 week

Simple single-member LLC transfers can be completed in as little as 2-3 weeks, while complex multi-member transfers may take up to 12 weeks. The timeline depends on attorney availability, member cooperation, and state processing speeds.

What documents are needed to transfer LLC to trust?

You’ll need 6 essential documents to complete an LLC trust transfer.

Required documents include:

Assignment of Membership Interest Agreement – the main transfer document

Amended Operating Agreement – updating ownership records

Member Resolutions – documenting approval of transfer

Trust Documentation – proving the trust exists and trustee authority

State Filing Documents – Certificate of Formation amendments (if required)

Updated LLC Records – membership ledger and ownership certificates

Additional documents may include consent forms from other members, bank authorization forms, and IRS notification letters depending on your specific situation.

Is it a good idea to transfer ownership of your LLC to a trust?

For most business owners, yes. The benefits typically outweigh any drawbacks:

Pros:

Firstly, avoids probate

Also, provides privacy

Enables smooth succession

Finally, may offer tax advantages

Cons:

Firstly, setup costs

Also, ongoing maintenance

Likewise, potential lender restrictions

FAQs About Membership & Consent

Do I need the consent of other members for transferring my LLC ownership interests?

Usually, yes. Most multi-member LLC operating agreements require member consent for ownership transfers, and LLC owners must be involved in the consent process to ensure proper approval.

Check your operating agreement’s transfer provisions. Some require majority consent, others need unanimous approval.

Can a single-member LLC be transferred to a trust?

Yes, single-member LLCs can be transferred to trusts, often more easily than multi-member LLCs.

Single-member LLC transfers are simpler because:

Firstly, no member consent requirements

Fewer operating agreement restrictions

Similarly, streamlined documentation process

Likewise, maintained pass-through tax treatment with revocable trusts

However, single-member LLCs may have weaker asset protection in most states. Only Alaska, Delaware, Nevada, South Dakota, and Wyoming provide full charging order protection for single-member LLCs. Consider these limitations when planning your transfer.

FAQs About Taxes & Costs

What are the tax implications for transferring an LLC to an irrevocable trust vs. a revocable living trust?

Revocable trusts create no immediate tax changes. You continue reporting LLC income on your personal return.

Irrevocable trusts may trigger:

Firstly, gift tax on the transfer

Likewise, separate trust tax returns

Different tax rates

Also, potential estate tax savings

How much does it cost to transfer LLC to trust?

The total cost typically ranges from $2,000 to $7,500 depending on complexity.

Cost breakdown:

Legal fees: $1,500-$5,000

State filing fees: $25-$300

Operating agreement amendment: $500-$2,000

Trust setup (if needed): $2,000-$10,000+

Thus, single-member LLC transfers cost less (around $2,000-$3,500), while multi-member transfers with complex agreements can reach $7,500 or more. DIY options exist but risk compliance issues.

FAQs About Assets, Debt & Valuation

Can I transfer real property held by the LLC into a trust-owned LLC?

Yes, but proceed carefully.

The LLC can continue owning real estate after you transfer the LLC to your trust. However, notify your mortgage lender first. Some loans have “due on sale” clauses triggered by ownership changes.

How do I handle bank accounts and other personal property in my LLC when transferring to a trust?

Update all account titles and signature cards after the transfer.

Notify your bank of the ownership change and provide:

Firstly, trust documentation

New signature cards

Also, updated operating agreement

Likewise, board resolutions if required

Do I need a new EIN when transferring LLC to trust?

The need for a new EIN depends on the type of trust you’re using.

EIN requirements by trust type:

Revocable Living Trust: Usually NO new EIN needed (uses grantor’s SSN)

Irrevocable Trust: YES, new EIN required (separate tax entity)

Grantor Trust: NO new EIN needed

Non-Grantor Trust: YES, new EIN required

Even if no new EIN is needed, you must notify your bank and update account information. The IRS doesn’t require notification for revocable trust transfers but does for irrevocable trust transfers.

Can you transfer an LLC with debt to a trust?

Yes, you can transfer an LLC with debt to a trust, but proceed with caution.

Critical considerations:

Loan agreements: Review all debt documents for transfer restrictions

Personal guarantees: These remain your personal liability after transfer

Lender notification: Most loans require notice of ownership changes

Trust liability: The trust owns the LLC, not its debts directly

For LLCs with significant debt, consult both your attorney and lenders before transferring. Some lenders may require trust documentation or additional guarantees.

How do you value an LLC for trust transfer purposes?

Professional valuation may be needed for gift tax compliance, typically ranging from $3,000-$10,000.

Valuation methods:

Asset-based approach: Net value of LLC assets minus liabilities

Income approach: Based on projected future cash flows

Market approach: Comparable sales of similar businesses

Professional appraisal: Required for valuable LLCs or tax planning

Formal valuation is needed for:

Firstly, transfers to irrevocable trusts (potential gift tax)

Multi-member LLCs with buyout provisions

LLCs owning significant real estate

Also, estate tax planning strategies

FAQs About Risks & Legal Help

What are the risks of NOT transferring your LLC to a trust?

Failing to transfer your LLC to a trust can cost your heirs 5-10% of the business value in probate fees and cause 6-18 months of delays.

Major risks include:

Probate costs: $10,000-$50,000+ in legal fees

Business freeze: Operations may halt during court proceedings

Public exposure: Business details become public record

Family disputes: No clear succession plan

Lost tax benefits: Missed estate planning opportunities

Forced liquidation: May need to sell assets to distribute

Thus, the average probate process takes 9-18 months, during which your business may suffer irreparable harm.

Should I consult a law firm for legal advice on transferring an LLC to a trust?

Absolutely. Texas law has specific requirements, and mistakes can be costly.

An experienced attorney ensures:

Proper document preparation

Compliance with Texas requirements

Similarly, tax efficiency

Coordination with your overall estate plan

Conclusion and Next Steps

Transferring your LLC to a trust is a powerful estate planning tool. When done correctly, it protects your business interests, avoids probate, and provides peace of mind for you and your family. Most importantly, transferring your LLC to a trust ensures a smooth transition of business ownership to your heirs.

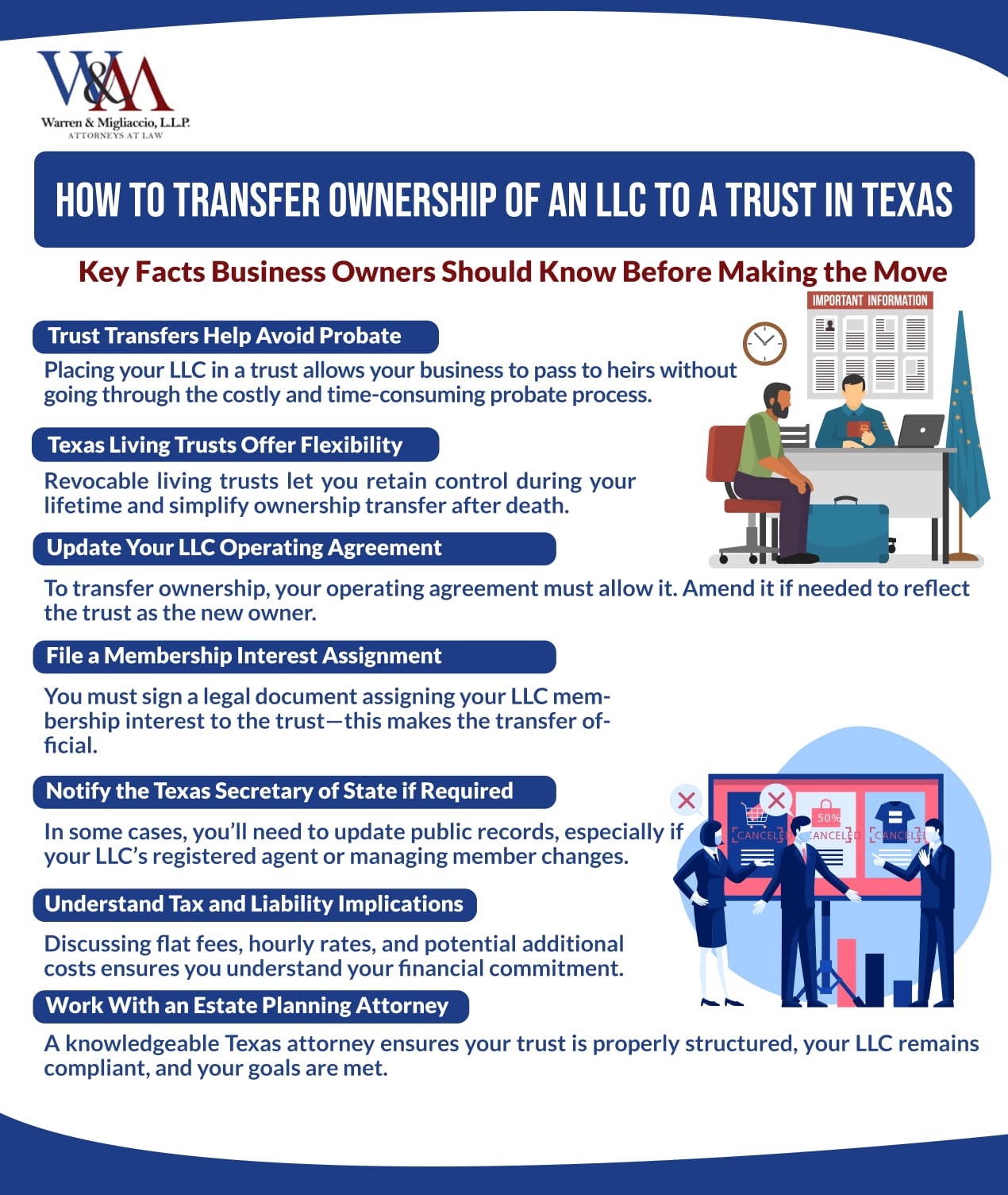

The key steps to remember:

- Firstly, choose the right type of trust for your goals

- Review and update your operating agreement

- Obtain necessary consents

- Also, execute proper transfer documents

- Update official records

- Likewise, address tax implications

Don’t let this important planning opportunity pass by. As your business interests grow and change, regularly review your estate plan to ensure it still meets your needs.

Remember, this article provides general information only and doesn’t constitute legal advice. Every situation is unique, and state laws vary. Consult with an experienced estate planning attorney to create a plan tailored to your specific circumstances.

Thinking about the future of your business? Transferring your LLC to a trust can give you peace of mind and help ensure everything you’ve built passes smoothly to the next generation. At Warren & Migliaccio, we’re here to walk you through each step—clearly, carefully, and with your goals in mind. Let’s talk about what makes the most sense for you and your family. Call us at (888) 584-9614 or reach out online to get started.