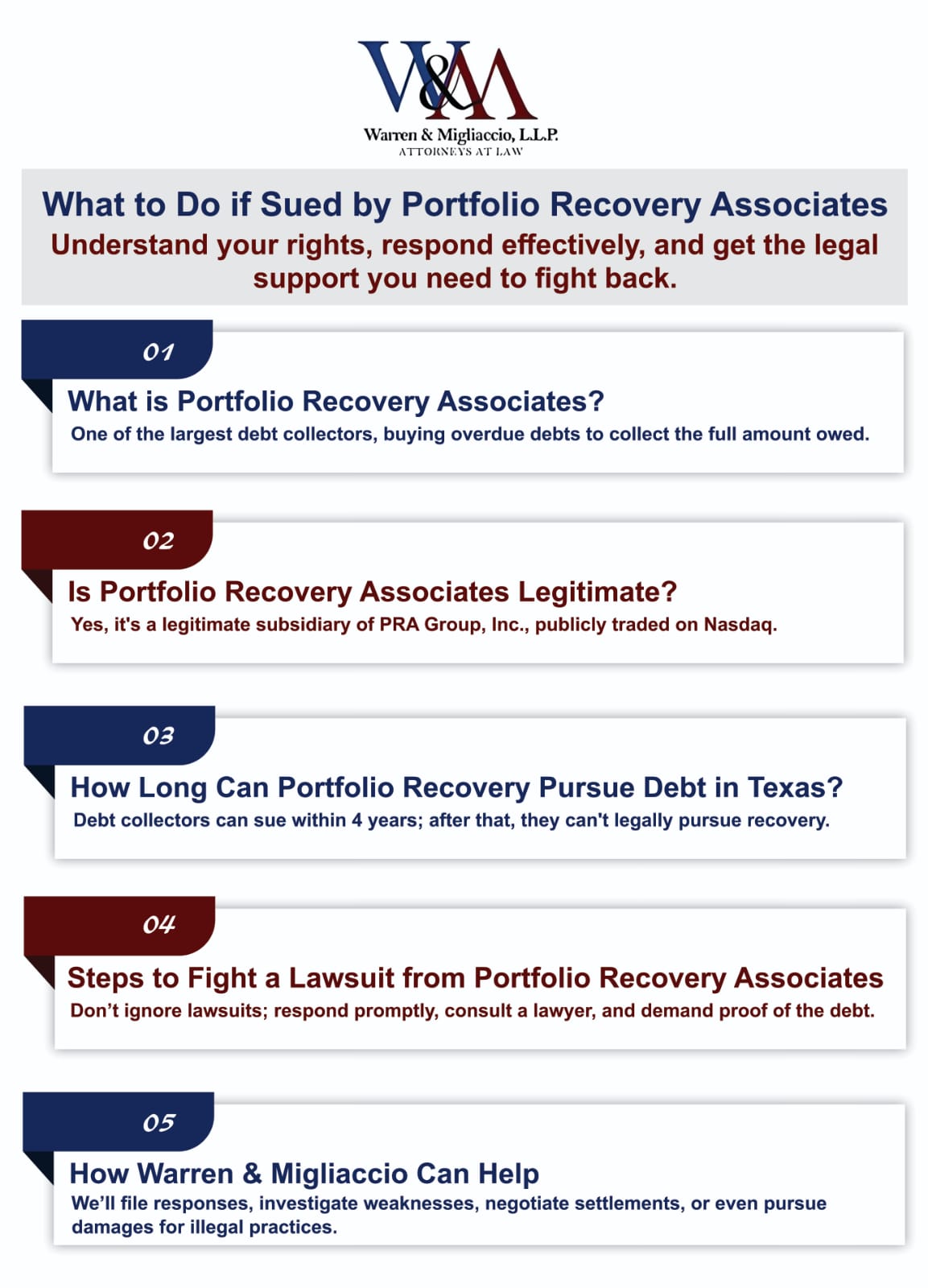

If you get sued by Portfolio Recovery Associates, LLC, you may be scared and not know how to proceed. On the other hand, you may not recognize the name and wonder if it is a scam because you have never taken out a loan through Portfolio Recovery Associates. You may not even recognize the debt it claims to own against you. Below, our North Texas debt collection defense attorneys discuss what to do if you are facing a Portfolio Recovery Associates lawsuit.

What Is Portfolio Recovery Associates, LLC?

Portfolio Recovery Associates, LLC. is one of the largest debt collectors in the United States. It often purchases unpaid and overdue debts from creditors and financial institutions at discounted prices. Then, it tries to collect the total amount of debt, usually with interest and late fees included.

![Crisis [two] coins broken, sued by portfolio recovery associates](https://media.istockphoto.com/id/94740937/photo/crisis-two.jpg?s=612x612&w=0&k=20&c=O9P5SxuTujRAU_jll8ZvBX9Io9dTmmxq_rDAMjeIXns=)

Debt collection companies must follow the Fair Debt Collection Practices Act in their collection tactics. Under the act, companies may not use aggressive or unfair tactics to collect from you. Even so, it is not uncommon for these companies to harass or threaten consumers in their efforts to collect on bad debt. In fact, the Better Business Bureau (BBB) has received more than 1,600 consumer complaints against Portfolio Recovery Associates, LLC, within the last three years.

Is Portfolio Recovery Associates Legitimate?

Yes, Portfolio Recovery Associates, LLC is a legitimate debt collection company. Its headquarters is in Norfolk, Virginia, and it is a subsidiary of PRA Group, Inc. It is a publicly traded company on Nasdaq. According to the BBB, Portfolio Recovery Associates, LLC also goes by PRA III, LLC, and Anchor Receivables Management.

Who Represents Portfolio Recovery Associates?

If Portfolio Recovery Associates, LLC is suing you, you may hear directly from its debt collection attorneys. In many Texas court cases, Rausch Sturm LLP handles its debt collection cases. If you receive communication from a law firm and do not recognize it, search for it online to learn more about it.

How Long Can a Debt Collector Pursue an Old Debt in Texas?

Each state has a statute of limitations or time limit on how long a debt collector can file a lawsuit to pursue recovery of an old debt, as defined by its state laws. In Texas, it is four years. However, this does not mean that the debt collector has to stop trying to collect from you. It means that the company cannot sue you to try to recover it. In Texas, a debt buyer must also provide written notice to consumers if the statute of limitations has expired.

How to Fight If Sued by Portfolio Recovery Associates in Texas

Are you being sued by Portfolio Recovery Associates? We recommend following these steps right away:

Follow these key steps if you’re sued by Portfolio Recovery Associates: respond promptly, consult a lawyer, and protect your rights.

1: Do Not Ignore the Lawsuit

Portfolio Recovery Associates is counting on you to ignore the lawsuit. It does not want you to respond to the suit or show up in court so that it can get a default judgment against you. The judge will likely assume you owe the debt and make a judgment in favor of Portfolio Recovery Associates without your input.

Unfortunately, if you ignore the lawsuit, you can get a default judgment against you even if you have viable defenses against the case. Portfolio Recovery Associates would be legally entitled to collect the total amount of debt from you, including interest and late penalties, which could significantly impact your net income. Depending on the type of debt, such as credit card debt, it may do so through the following ways to collect the full amount owed:

- Wage garnishment

- Garnishment against bank account

- Property lien

- Property seizure

2: Consult With a Debt Defense Lawyer as Soon as Possible

Portfolio Recovery Associates has extensive resources to collect money from you, including lawyers, and has been involved in dozens of lawsuits under federal laws. You are not required to have a lawyer on your side, but we recommend it. Having a lawyer to defend you, provide legal advice, and fight for your best interests will give you a better chance of a more favorable outcome in the case, as a lawyer is a powerful tool in navigating legal challenges. We recommend contacting our North Texas debt defense lawyers to discuss your situation.

3: Respond to the Lawsuit to Avoid a Default Judgment

It is essential that you respond to a Portfolio Recovery Associates lawsuit as soon as possible. In Texas, you may have as little as 14 days to respond. Your written response should address the allegations against you and your defenses. You should also demand proof or verification of the debt in your response.

Your experienced attorney can help you evaluate the claim’s validity, prepare and file your response, and guide you through the entire process. We can ensure your answer is filed within the appropriate time limit, defend the allegations against you, and include all required documents to strengthen your response.

How We Help Clients With Portfolio Recovery Associates Lawsuits

At Warren & Migliaccio, our debt defense lawyers have extensive experience representing clients in debt defense cases. You can count on us to help you understand your best legal options to protect you against a debt collection lawsuit.

A few examples of how we may be able to help you include but are not limited to:

- Prepare and file a response to the lawsuit. We can protect you against a default judgment due to failure to respond. We contest the allegations against our clients and demand proof of debt.

- Investigate the case. Generally, debt collection lawsuits have weaknesses. For example, the statute of limitations may have expired, you may not own the debt, or the alleged amount of debt may be incorrect. We can determine the validity of the debt by reviewing your account statements and doing proper documentation that can potentially help you win your case./span>

- Request a case dismissal. We may request that the court dismiss your case if we find that Portfolio Recovery Associates made procedural errors or the lawsuit lacks legal merit.

- Defend you in court. We can defend you and fight for your best interests within the court system. You may have legal grounds that protect your legal rights and prevent Portfolio Recovery Associates from seeking a judgment against you.

- Negotiate a settlement. If appropriate, we can help you negotiate a favorable settlement agreement below the original amount of debt or arrange a manageable payment plan.

- Pursue damages. If Portfolio Recovery Associates used illegal practices to try to collect money from you, then we can help you pursue damages against it.

Discuss Your Situation With Our Debt Collection Defense Attorneys

Are you being sued by Portfolio Recovery Associates or another debt collection company? We encourage you to schedule a free consultation with our North Texas debt defense attorneys. During consultation, we can answer your legal questions, help you understand the best option, and evaluate your individual case to determine how we can help you. Fill out our online contact form or call us at (888) 584-9614 to discuss your unique situation.