Being sued for debt can be a stressful and overwhelming experience. If you have been served with a lawsuit from Westlake Services LLC, you may wonder, “Westlake Financial is suing me. What can I do?” We understand that you may be uncertain of your legal rights and the steps you need to take to protect yourself. Below, our Texas debt defense lawyers discuss what to do if facing a Westlake Financial lawsuit in Texas.

Is Westlake Financial a Real Company? Westlake Financial is a legitimate company. While it does business as Westlake Financial, its official name is Westlake Services, LLC. It is a subsidiary of the Hankey Group.

At Warren & Migliaccio, we represent and defend individuals across the state of Texas against big creditors and debt collectors. If Westlake Financial sues you for debt collection, you may have more legal options available than you think to resolve the case against you. Do not hesitate to schedule a free consultation with us. We are here to review the claims against you, answer your legal questions, and discuss your options for moving forward.

What Is Westlake Financial aka Westlake Services, LLC?

Westlake Financial is an auto finance company with headquarters in Los Angeles, California. According to its website, Westlake Financial finances auto installment contracts in over 50,000 new and used car dealerships nationwide.

While its website states it offers subprime to prime auto loans, it is known as a subprime lender. A subprime lender provides auto loans to borrowers who do not qualify for conventional loans due to low credit scores, limited credit, and other risk factors. These loans generally have higher interest rates and unfavorable loan terms than prime loans.

Beyond vehicle financing, Westlake also offers title loans through its affiliate LoanCenter. Title loans are short-term loans that require you to use your vehicle as collateral. While consumers can get funds quickly, title loans typically have high interest rates and put borrowers at risk of losing their vehicle.

Why Is Westlake Financial Suing Me?

If Westlake Financial sues you, it likely believes you have breached your loan contract. The most common reason for a lawsuit is missed payments or delinquency on your auto loan. If you fail to make your scheduled payments, Westlake Financial may attempt to recover the balance owed through litigation. However, vehicle repossession and other collection attempts generally occur before a lawsuit.

Even if Westlake Financial repossessed your vehicle and sold it, there may still be a balance on your loan. Westlake Financial may sue you to collect this remaining balance if the sale of the vehicle did not cover the total amount of the loan.

Westlake Financial often hires debt collection law firms to recover outstanding debts from borrowers. In Texas, it often hires the following law firms:

What to Do if Sued by Westlake Financial in Texas

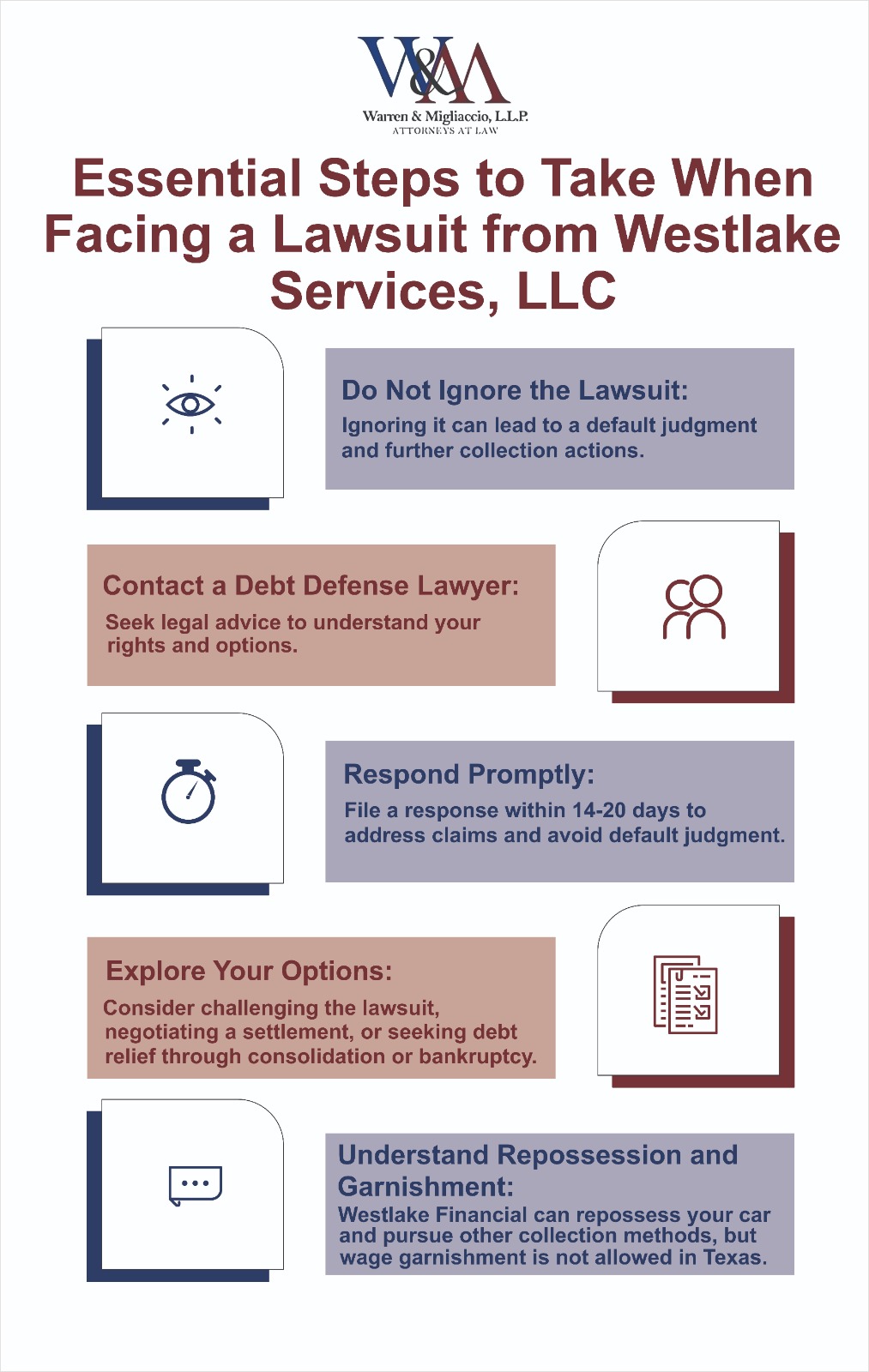

If Westlake Financial serves you with a lawsuit, you should act quickly to protect your legal rights. Our Texas debt defense lawyers recommend taking these initial steps:

- Do not ignore the lawsuit. Ignoring a lawsuit will not make it go away. Ignoring the lawsuit will likely lead to a default judgment against you, meaning Westlake Financial wins the case automatically. Once it has a default judgment against you, it can take further action against you to collect, such as bank garnishment.

- Contact a Texas debt defense lawyer. Do not wait to consult with an experienced debt defense attorney after being served with a debt collection lawsuit. For example, we have extensive experience and success defending Texans against creditors and debt collectors. We can discuss your situation, review the claims against you, and review your loan agreement to help you understand your best options for moving forward.

- Respond to the lawsuit. In Texas, you generally have 14 to 20 days to file a response to the lawsuit, depending on which court Westlake Financial filed the lawsuit. Your response should address each claim made against you and include any defenses. If you work with an attorney, they can prepare and file your response, protecting you from a default judgment and setting you up for a strong defense.

- Explore your legal options. Generally, your options for a debt collection lawsuit include challenging the lawsuit to seek dismissal, fighting it in court, negotiating a settlement, or seeking alternative debt relief through debt consolidation or bankruptcy. The best choice for you will depend on the strengths and weaknesses of Westlake Financial’s case against you and your financial situation. An attorney can investigate the case against you, evaluate your options, and help you choose the best course of action for your unique situation.

Frequently Asked Questions About Westlake Financial

Is Westlake Financial a Debt Collector?

Westlake Financial is not a debt collector. It is an auto finance company that provides loans for vehicle purchases. However, when someone misses multiple loan payments and defaults, Westlake Financial will try to collect the outstanding amount. Typically, however, Westlake Financial hires debt collection law firms to seek recovery of its money.

Can Westlake Financial Repo Your Car?

Westlake Financial can repossess your car if you default on your auto loan. If you miss payments or violate the terms of your loan agreement, it has the legal right to take back the vehicle. However, repossession typically occurs after multiple missed payments and failed collection attempts.

Can Westlake Financial Garnish Your Wages?

In Texas, wage garnishment for consumer debt, including auto loans, is prohibited. However, if Westlake Financial obtains a judgment against you in court, it may pursue other methods to collect the debt, such as freezing and garnishing your bank accounts. If you deposit your paycheck into your bank account, it is no longer safe from being garnished.

Schedule a Free Consultation With Our Texas Debt Defense Lawyers

Dealing with a Westlake Services lawsuit can be overwhelming if you take on it yourself. If Westlake Financial sues you for debt collection, our experienced Texas debt defense lawyers are here to help. We offer a free consultation to discuss your situation, review the claims against you, and help you understand your options for moving forward. Call us at (888) 584-9614 or contact us online, and we will contact you soon.