Have you been served with a lawsuit from Troy Capital, LLC? If so, you are not alone. Debt buyers like Troy Capital, LLC file thousands of lawsuits, hoping consumers like you will ignore the lawsuit or be too overwhelmed or busy to fight back. However, a lawsuit notice is not a judgment, and you have available legal options to resolve the lawsuit and put it behind you. In the article below, we explain what to know about Troy Capital, LLC, why it may be suing you, and how to protect yourself.

At Warren & Migliaccio, our Texas debt defense lawyers represent and defend individuals and families facing debt collection lawsuits statewide. We provide a free consultation to review the claims against you and help you understand your situation. We can also discuss your potential legal options for resolving the lawsuit and how we can help you. You can call us at (888) 584 9614 or contact us online.

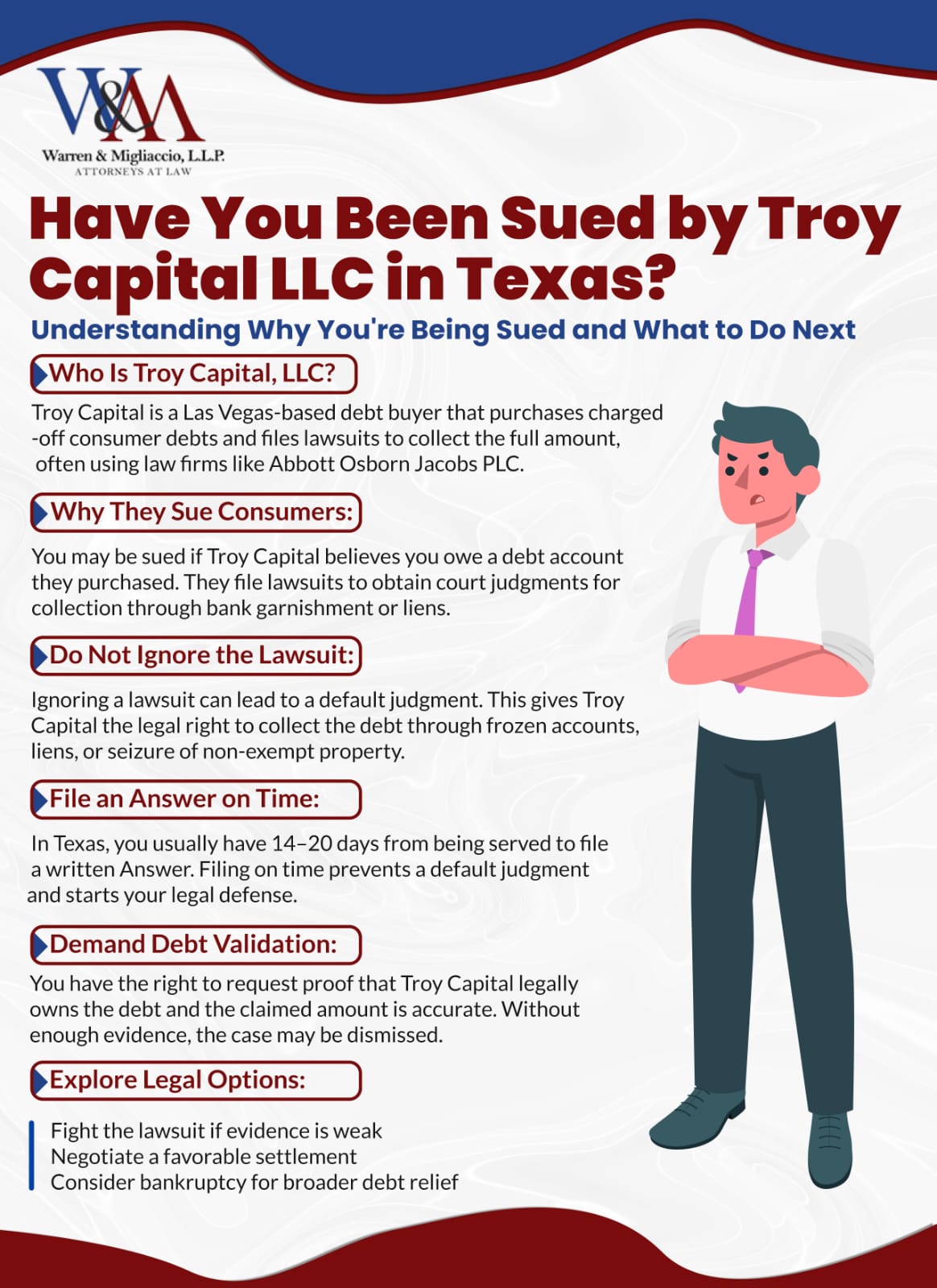

What Is Troy Capital, LLC?

Troy Capital, LLC is a debt buyer based in Las Vegas, Nevada. A debt buyer purchases charged-off accounts from original creditors, such as banks and credit card companies, at a highly discounted rate. Once it purchases this debt, it attempts to collect the total debt amount from consumers, along with accrued late fees and interest.

Why Is Troy Capital, LLC Suing Me?

If you have been sued by Troy Capital, LLC for debt collection, you may be overwhelmed and confused, especially if you have never heard of the company. Your confusion is understandable. You never opened an account with Troy Capital, LLC because it is not an original creditor.

Troy Capital, LLC buys portfolios of credit card, personal loan, and other consumer debt accounts at a fraction of their total value from creditors nationwide. Once it purchases an account, it tries to collect the full balance of the debt, plus late fees and accrued interest, from the consumer.

If Troy Capital, LLC is suing you, it is likely because it has purchased a debt account with your name on it and believes you owe it money. The company generally outsources its collection efforts to local law firms, so you will likely hear from its attorney rather than the company. It routinely works with the law firm Abbott Osborn Jacobs PLC for its Texas cases. Abbott Osborn Jacobs PLC is headquartered in West Des Moines, Iowa, but it has attorneys licensed to practice in Texas.

By filing a lawsuit, the company seeks to obtain a judgment against you. If it gets a judgment against you, it can legally pursue further collection methods like bank garnishment or property liens.

What Happens if I Ignore the Troy Capital, LLC Lawsuit?

Our Texas debt collection defense lawyers do not recommend ignoring a debt collection lawsuit. Ignoring a debt collection lawsuit can lead to serious consequences.

Troy Capital, LLC wants consumers to ignore its lawsuits, giving the company a quick path to a default judgment. A default judgment essentially means the court rules in favor of Troy Capital, LLC because you did not answer the lawsuit or appear in court. It wins by default because you did not contest the claims against you.

The court may order you to pay the full amount claimed, plus any interest, court costs, and attorneys’ fees. Then, once Troy Capital, LLC obtains a judgment, it can pursue post-judgment collection efforts to get the money. Although Texas does not allow wage garnishment for most consumer debts, Troy Capital, LLC can still pursue other methods, like:

- Freezing your bank accounts and seizing money from them

- Placing liens against your property

- Seizing non-exempt property

What to Do if Sued by Troy Capital, LLC in Texas

We recommend consulting with an experienced Texas debt defense lawyer from our firm. During a consultation, we can review the claims against you and help you understand your situation. We can also help you understand how to protect yourself from a default judgment and break down your potential legal options for resolving the lawsuit. If you decide to work with us, we will handle every step of the process, from drafting your Answer to reaching case resolution.

1. File an Answer by the Deadline

In Texas, you typically have limited time to respond to a debt collection lawsuit. Your deadline is generally 14 to 20 days from the date you were served, depending on the court handling your case. As discussed above, missing the deadline for filing an Answer can lead to a default judgment against you, meaning Troy Capital, LLC wins the case. Filing an answer prevents a default judgment and is the first critical step in defending yourself.

2. Demand Debt Validation

As the party suing, Troy Capital, LLC carries the burden of proof in the case. To win the case, it must prove the following:

- It legally owns the debt account (chain of title)

- It has the legal right to collect the debt

- You owe the debt

- The debt amount it claims is accurate

Because charged‑off accounts often change hands multiple times, debt buyers may not have enough evidence to validate the debt. You have the legal right and should demand debt validation from Troy Capital, LLC. If the company lacks sufficient evidence, it may drop the lawsuit, or you can seek a case dismissal from the court.

3. Explore Your Legal Options

The best course of action for your situation depends on many factors, such as the strength of Troy Capital, LLC’s evidence against you and your financial situation. We recommend working with an experienced Texas debt collection defense lawyer to help you determine your path forward. Generally, however, your legal options may include:

- Fighting the lawsuit. Our first goal is always to seek a dismissal when Troy Capital, LLC’s case shows obvious weaknesses, such as insufficient evidence, mistaken identity, or a time-barred lawsuit. If you cannot secure a dismissal, you may still have a strong enough defense to fight the lawsuit in court. While litigation will extend the length of the case, it may be worth it. Additionally, it could pressure Troy Capital, LLC to settle, placing you in a strong position to negotiate a favorable settlement.

- Negotiating a settlement. If Troy Capital, LLC has a strong case, you recognize the debt, or you prefer to avoid court, you may consider seeking a settlement. You may be able to pay a much lower lump-sum amount or agree on a structured payment plan.

- Seek alternative debt relief. If your debt is unmanageable beyond the Troy Capital, LLC lawsuit, seeking alternative debt relief like bankruptcy may be a viable option. Under Chapter 7, you can discharge unsecured debts from credit cards or personal loans. Under Chapter 13, you can restructure your debt into a manageable payment plan over three to five years.

FAQS

How do I respond to a Troy Capital LLC lawsuit in Texas?

1. Dispute claims you believe are inaccurate

2. Demand debt validation to require proof of ownership/amount

3. Include potential defenses like statute of limitations or identity errors

4. Be filed electronically or via certified mail before the deadline

Can Troy Capital LLC garnish my wages or bank account?

1. Freeze bank accounts via court order after judgment

2. Seize funds from non-exempt accounts (exemptions include Social Security/retirement funds)

3. Place liens on non-homestead property

What evidence does Troy Capital need to win the lawsuit?

✅ Chain of title showing legal debt ownership

✅ Signed contract/agreement with original creditor

✅ Detailed payment history and interest calculations

✅ No statute of limitations expiration (4 years in Texas)

How can I negotiate a settlement with Troy Capital?

1. Offering 30-50% of the debt as lump-sum payment

2. Requesting “payment in full” language and credit report updates

3. Using financial hardship documentation for leverage

4. Having an attorney negotiate terms to prevent revival of claims257

What if the debt is too old or I can’t pay?

1. Challenging time-barred debts (statute of limitations defense)

2. Negotiating hardship payment plans

3. Exploring bankruptcy protections (Chapter 7/13)

4. Claiming exemptions for protected income/property

How do I verify if Troy Capital legally owns my debt?

📄 Complete assignment history from original creditor

📄 Itemized principal/interest/fee breakdown

📄 Proof of your last payment date

📄 Account-opening documentation

Can Troy Capital sue for debts they can’t prove?

✉️ File a formal Answer disputing claims

⚖️ Force them to validate debt ownership/amounts

📅 Track statute of limitations expiration dates

Schedule a Free Consultation With Our Texas Debt Defense Lawyers

We understand that facing a debt collection lawsuit from Troy Capital, LLC may feel overwhelming. However, you have legal rights and options for resolving the lawsuit. Do not wait to schedule a free consultation with our experienced debt defense lawyers to discuss your situation. We can review the claims against you and help you determine a clear path forward. Call our law firm at (888) 584-9614 or fill out our online contact form, and we will contact you soon.