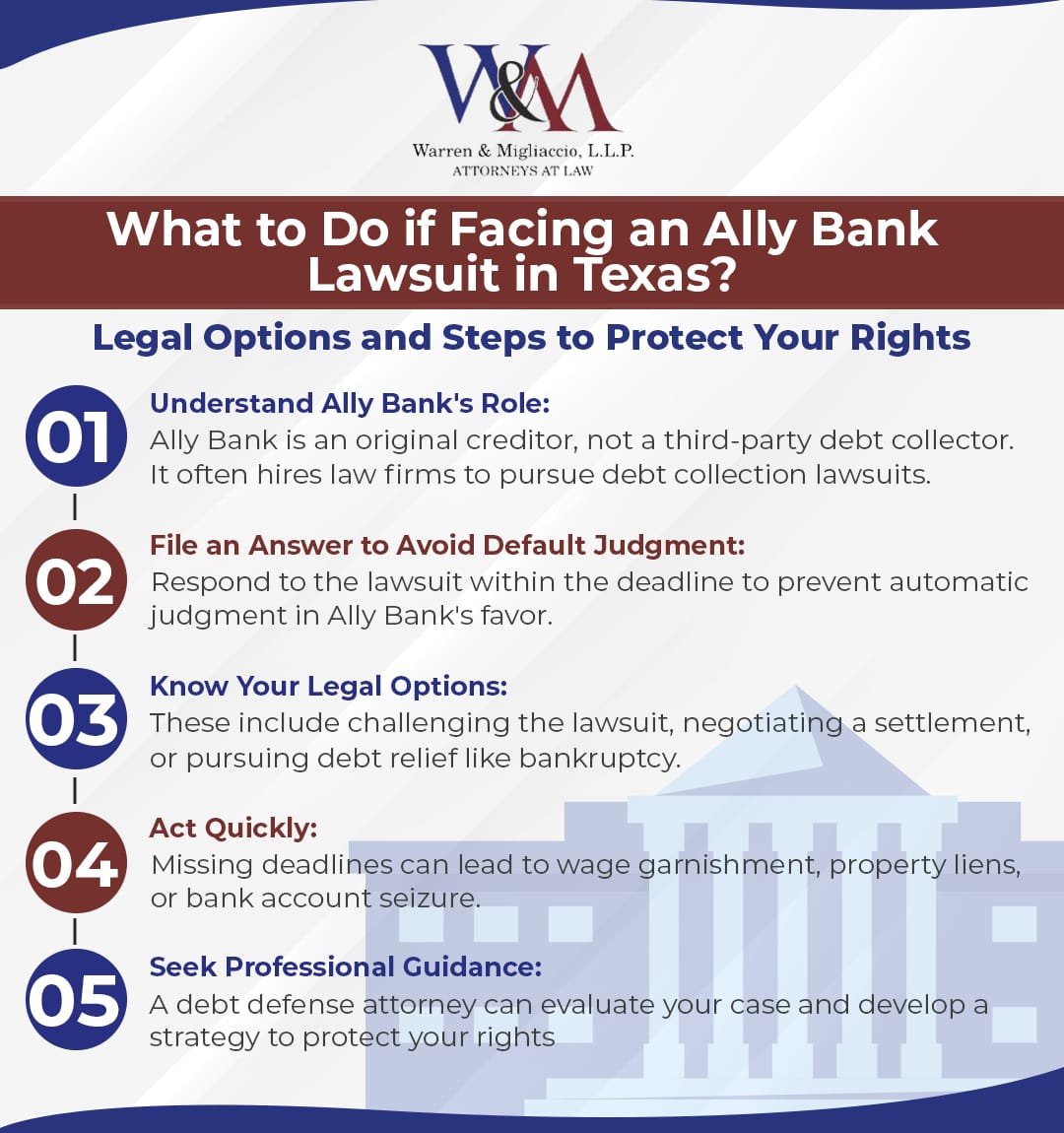

Are you being sued by Ally Bank for debt collection in Texas? Whether you recognize the debt or not, it is normal to feel overwhelmed and stressed by a lawsuit. However, you have legal options available to you to protect yourself from a default judgment and resolve the lawsuit in a favorable way. Below, our Texas debt collection defense attorneys break down what you should know about Ally Bank, why it may be suing you, and your potential legal options for resolving it.

What Is Ally Bank?

Ally Bank is an online-only bank headquartered in Sandy, Utah. It is the banking subsidiary of Ally Financial, Inc. According to its website, Ally Bank had about 11 million customers as of September 2024.

Beyond checking and savings account options, Ally Bank offers credit cards and auto loans. It also has a history of providing home loans and personal loans. However, Synchrony Bank acquired its personal lending business in March 2024. As of January 31, 2025, Ally Bank will no longer offer home loans.

Is Ally Bank a Debt Collector?

Ally Bank is an original creditor. This means that if you obtained a credit card or auto loan directly from Ally Bank, Ally Bank is the original creditor or the lender with which you first entered a contract to repay the debt.

Ally Bank will make collection efforts on its own behalf rather than on behalf of another lender. It does not collect for other companies. However, Ally Bank generally does not handle its collections past actions like phone calls and letters.

Ally Bank typically hires a debt collection law firm to handle its collection efforts for its defaulted accounts. For example, in Texas, it often works with the following law firms:

- Johnson Mark, LLC

- Quilling, Selander, Lownds, Winslett and Moser, P.C.

This means you will likely hear about the lawsuit from Ally Bank’s lawyers rather than directly from Ally Bank.

Why Is Ally Bank Suing Me?

If Ally Bank is suing you for debt collection, then it is alleging that you owe it money. For example, Ally Bank offers auto loans to consumers. If a borrower defaults on an auto loan, Ally Bank may repossess the vehicle under the loan contract and then auction it. Ally Bank may pursue the remaining balance through litigation if the sale price is less than the outstanding loan.

Additionally, Ally Bank may sue consumers for defaulted credit card debt. Before filing a lawsuit, Ally Bank may typically try collection methods like phone calls and letters. If these attempts fail, Ally Bank may move forward with litigation.

How to Respond to an Ally Bank Lawsuit

No matter how you plan to handle an Ally Bank lawsuit, you should not ignore it. Instead, you should file a response to the lawsuit, called an Answer, with the appropriate court. By filing an Answer, you protect yourself from a default judgment, which would result in automatically losing the case, and give yourself time to determine your legal options.

The paperwork you were served, a complaint and summons, should provide information about the court overseeing your case and your deadline to respond. Generally, depending on which court handles the case, you only have 14 to 20 days to respond. Missing the deadline can result in a default judgment against you.

A default judgment means Ally Bank automatically wins and can seek to collect the full amount claimed, plus any applicable interest, court costs, and legal fees. It can also seek bank garnishment, property liens, or seizure to collect its money.

We recommend contacting an experienced debt collection defense lawyer for help with your Answer. An attorney can investigate the claims against you and file a strong Answer with the court. They can determine the best legal strategy for your case and help you obtain favorable case results.

At Warren & Migliaccio, we represent and defend individuals across Texas facing debt collection and creditor lawsuits. Do not hesitate to contact us about your situation to learn how we can help you. We provide a free consultation to review the claims against you and help you understand your situation and legal options for moving forward.

What Are My Legal Options if Ally Bank Is Suing Me?

Is Ally Bank suing you for a debt? Whether for credit card debt or a defaulted auto loan, it is important to know that you have legal options. The best course of action for your case will depend on your unique situation. However, generally, your legal options for handling a debt collection lawsuit include:

Even if you owe some or all of the debt, there may be defenses that can reduce or eliminate your liability, including:

- Challenging the lawsuit. If there are serious weaknesses in Ally Bank’s case, you may be able to seek a case dismissal. Even if you cannot get the case dismissed, you may have a strong enough defense to challenge the lawsuit in court.

- Negotiating a settlement. Working toward a settlement may be in your best interest if you recognize the debt, Ally Bank has a strong case against you, or you want to avoid court. In many cases, you can settle on a lower lump-sum payment or a manageable payment plan.

- Seeking alternative debt relief such as bankruptcy. Does your debt feel impossible to handle beyond just the Ally Bank lawsuit? If so, bankruptcy may be a viable option for you to provide more comprehensive financial relief. A Texas bankruptcy attorney from our firm can help you determine whether Chapter 7 or Chapter 13 may be an option for your financial situation.

Schedule a Free Consultation With Our Texas Debt Defense Lawyers

If you are being sued by Ally Bank, remember that you have legal options to protect yourself and resolve the lawsuit. You may be able to get the case dismissed, fight it, negotiate a settlement, or pursue alternative debt relief. Do not hesitate to reach out to our Texas debt collection defense lawyers about your situation.

We provide a free consultation to review the claims against you and help you understand your situation. We can also help you understand your legal options for moving forward and resolving the lawsuit. Call our firm at (888) 584-9614 or contact us online to schedule a free consultation.