If you get sued by Capital One for credit card debt, our North Texas debt defense lawyers understand the stress and uncertainty you may be feeling. Borrowers facing a lawsuit may have concerns about the process and what steps to take next. Additionally, complaints about Capital One’s collection practices are not uncommon, with some customers citing issues such as communication problems and dispute resolution. You may wonder if it is even possible to beat a Capital One lawsuit and whether it is worth trying. At Warren & Migliaccio, we have considerable success defending individuals against large creditors and debt buyers.

We cannot emphasize enough that you may have multiple options available to resolve the Capital One lawsuit against you. However, ignoring the lawsuit hurts your options. We are happy to answer your legal questions and review your situation during a consultation. Below, we discuss what you can do if Capital One sues you and how we can help.

What is Capital One?

Capital One is one of the United States’ largest commercial banks and credit card issuers. Unlike many other big credit card companies, Capital One is known to utilize debt collection laws to pursue legal action for delinquent credit card debt. Specifically, while many credit card companies sell delinquent accounts to a collection agency that may then pursue recovery or file lawsuits, Capital One often retains ownership of defaulted debts as the original creditor and sues borrowers directly. Therefore, if Capital One suing you, it may be due to defaulted credit card debt.

Capital One uses numerous law firms to handle its credit card lawsuits in Texas. It is common to receive a notice regarding a lawsuit filed from Capital One’s lawyer rather than from Capital One. For example, law firms it commonly uses include, but are not limited to:

Capital One Is Suing Me. What Can I Do?

Case Study: Why Self-Representation Often Fails in Capital One Lawsuits

Case Study Text: In Pinzon v. Capital One Bank (USA), N.A., No. 14-21-00227-CV (Tex. App. Jul. 26, 2022), a Texas consumer lost a $11,558.87 credit card debt case while representing himself. Capital One won by using only a business records affidavit and monthly statements under the “account stated” theory. This meant they needed very little proof.

Pinzon made procedural errors and failed to keep arguments for appeal. This shows why having a professional legal representative is very important.

This case matters because it shows how Texas courts accept simple evidence from creditors. It is almost impossible for someone unprepared to win without an attorney who knows evidence rules and court procedures.

Understanding Your Response Deadlines and Options

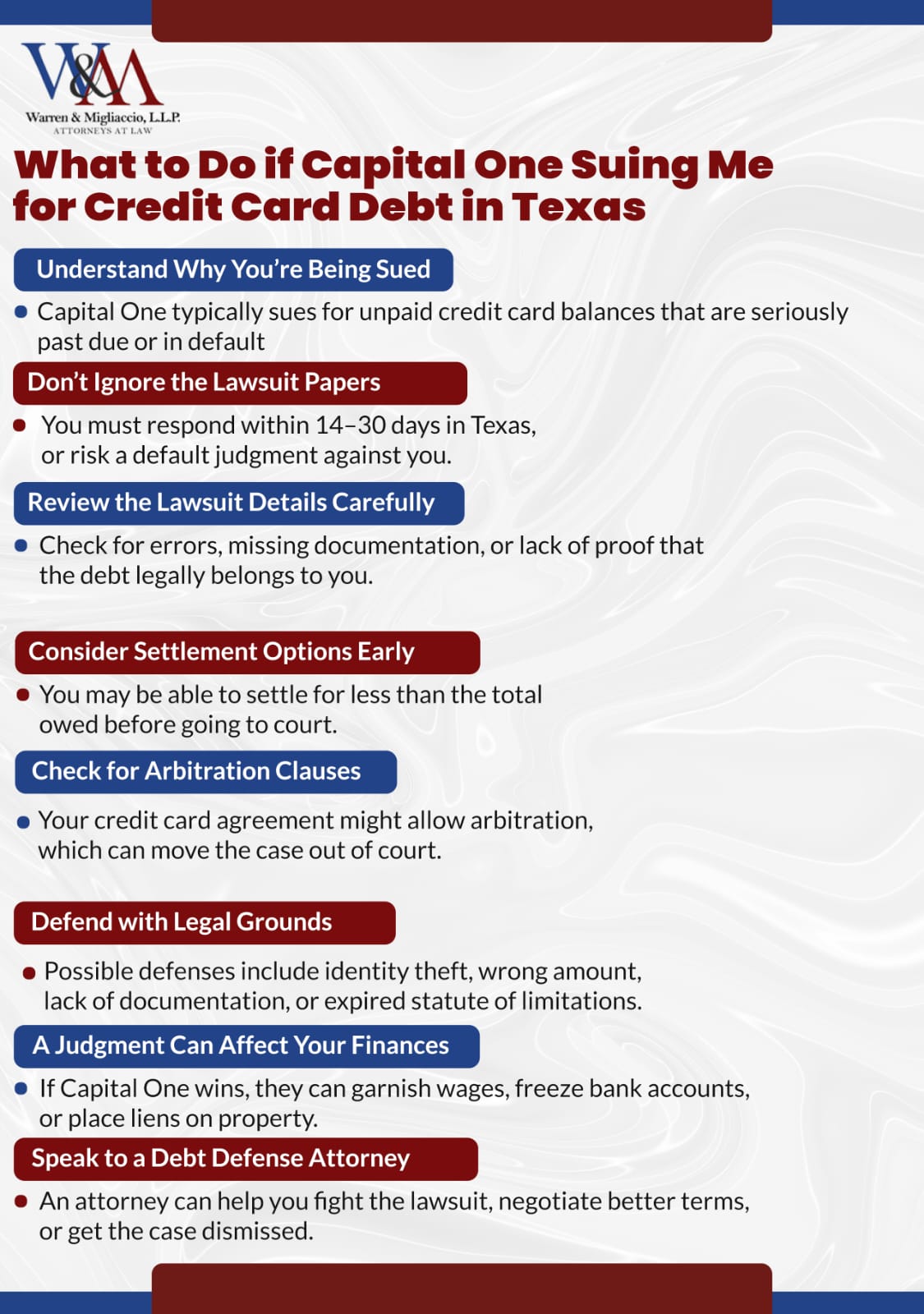

If you received a letter saying Capital One is suing you, it means you’re now in a legal dispute with them over your credit card account. Capital One takes these steps to recover past-due accounts and protect its lending practices. Many major lenders do the same when customers fall behind on payments or don’t repay their balance.

In Texas, the time you have to respond depends on the court handling your case. It could be as little as 14 days, so quick action is important. Most people have 14 to 30 days to answer a lawsuit from Capital One. A debt defense lawyer can help you file a complete and timely response within that deadline.

Failing to respond to the lawsuit could result in a default judgement or an easy win for Capital One. If the case goes to court, the judge will decide the outcome based on the evidence presented by each party. If Capital One gets a default judgment against you, it may be legally entitled to recover the money. Default judgments allow Capital One to garnish wages or freeze bank accounts. However, you may be able to resolve the lawsuit by negotiating a settlement offer or deal with Capital One.

If you lose the lawsuit or a default judgment is entered, you may be required to pay the balance owed, including any accrued interest rate and missed credit card payments. A default judgment may require you to pay the amount claimed, and once paid, the judgment is satisfied. Capital One may try to get the money from you in one or more of the following ways:

- Freezing and garnishing your bank accounts

- Putting a lien on your property

- Seizing your property

Debt repayment or settlement agreement can resolve the lawsuit and prevent further legal action.

Understanding the Lawsuit Process with Capital One

If you’ve been sued by Capital One Bank for credit card debt, it’s important to understand how the lawsuit process works and what steps you need to take. When a lawsuit is filed, you may be personally served by a process server who delivers official court documents initiating the Capital One credit card debt lawsuit against you, which will detail the amount owed, including any interest and fees that have accrued. You’ll receive official court documents outlining the claim, the total debt, and the next steps in the legal process.

You’ll receive paperwork that explains the claim, the total owed, and what happens next. You usually have a short window—often between 14 and 30 days—to respond. If you don’t respond in time, the court may issue a default judgment. That means Capital One automatically wins the case.

With a default judgment, Capital One can take stronger collection actions. This may include garnishing your bank account or, in some states, your wages.

Read all documents carefully. Make note of your court date and any deadlines to respond. Missing a deadline can lead to serious financial trouble. Talking to a debt relief lawyer is a smart step. They can explain your options, represent you in court, and help negotiate a settlement or payment plan.

Taking action quickly and getting legal advice can protect your finances and guide you toward a solution.

Working with Debt Collectors During a Capital One Lawsuit

If you’re being sued by Capital One, you may also be contacted by debt collectors or collection agencies working on behalf of the bank. These debt collectors are tasked with recovering the unpaid debt and may reach out to discuss monthly payment options, settlements, or to request information. It’s important to know your rights when dealing with debt collectors and to respond appropriately to their communications.

You have the option to negotiate a settlement, including a lump sum payment, or set up a payment plan with the debt collector, which could help you resolve the debt for less than the full amount claimed. A debt relief lawyer can assist you in communicating with debt collectors, ensuring your rights are protected throughout the debt collection process. Remember, debt collectors must follow consumer protection laws, such as the Fair Debt Collection Practices Act, which prohibits harassment and requires accurate information.

Keep detailed records of all communications and documents related to the lawsuit and any debt collection efforts. This documentation can be crucial if you need to dispute the debt or prove your case in court. By understanding your rights and options, you can better navigate the lawsuit process and work with debt collectors to reach a resolution that fits your financial situation.

Reviewing Your Capital One Credit Card Agreement for Defenses

When you’re sued by Capital One for credit card debt, one of the first steps you should take is to review your credit card agreement. This document outlines the terms and conditions of your account and can be a valuable resource for identifying possible defenses against the lawsuit. Look for any discrepancies in billing or payment information, as errors could impact the validity of Capital One’s claim.

Your credit card agreement may also contain important clauses, such as arbitration provisions or class action waivers, which could affect how your case proceeds in court. Additionally, check for any violations of consumer protection laws or regulations that might strengthen your defense. Understanding the specific terms of your agreement can help you determine if Capital One has followed proper procedures and whether you have grounds to challenge the lawsuit.

If you’re unsure how to interpret your credit card agreement or spot potential defenses, consider consulting a debt relief lawyer. An experienced attorney can review your agreement, help you navigate the lawsuit process, and work to protect your rights. By thoroughly examining your credit card agreement, you’ll be better equipped to understand your obligations and explore your options for resolving the lawsuit.

What to Expect When You Work With Our North Texas Debt Defense Attorneys

At Warren & Migliaccio, we understand the stress and concern you may feel dealing with a credit card debt lawsuit. We help clients facing difficult financial situations and looking for effective resolutions to their cases.

If you are being sued over Capital One credit card debt, you may have more legal options than you think. Our North Texas debt resolution attorneys have significant success representing Texans who have been sued by creditors and debt collectors for debt collection. Alternative debt resolution methods, such as debt consolidation loans, may also be an option for some clients to manage or refinance their debt. We encourage you to schedule a confidential consultation to discuss your unique situation. During a consultation, we can review your case and help you understand your best legal options, including the idea of exploring multiple strategies to resolve your case and ensuring that both parties agree to the terms of any settlement.

We Will Handle Your Debt Collection Defense Case to Resolution

Once you hire Warren & Migliaccio, we will represent and defend you against Capital One’s claims. Right away, you can expect that we will:

- Draft and file an answer to the lawsuit. We will begin protecting you against a default judgment by preparing and filing a response to the lawsuit with the court. This response addresses each of Capital One’s claims and asserts any appropriate legal defenses. It also places the burden of proof back on Capital One to prove that you owe the debt it alleges.

- Investigate the validity of Capital One’s claims. You can count on our attorneys to investigate the strength of Capital One’s lawsuit. In many cases, debt collection lawsuits have weaknesses due to an expired statute of limitations (old debt), lack of evidence, or inaccurate allegations. We will review the lawsuit and determine its validity. If the debt was sold, Capital One must prove it has the legal right to collect by showing a proper chain of assignment or ownership. We will also gather evidence that strengthens your defense.

From Our Case Files: A $8,000 Lesson in Texas Court

Maria called me 10 days before her Capital One trial, panicked. She had tried to defend herself by researching online, thinking she could explain her hardship to the judge.

I quickly found serious problems in Capital One’s case. They had improper documentation, no proof they owned the debt, and they violated service rules.

In court, their attorney was not ready for our challenges. The judge agreed with every objection we made. The case was dismissed with prejudice.

Maria was very relieved. She said, “I had no idea there were so many technical rules.”

This example shows why Texas courts see so many default judgments. People don’t realize that creditors must follow strict procedures. Judges will not point out these defenses for you.

Your Case Resolution Options with Warren & Migliaccio

Our North Texas debt defense lawyers will be by your side until we help you resolve your case. Every case is different, and the resolution of your case may depend on many factors surrounding your case. Potential solutions to your case may include:

- Case dismissal. If we determine major flaws in Capital One’s case, we may request a case dismissal from the court.

- Defending the lawsuit. You may have strong legal defenses against Capital One’s lawsuit. We can build a strong defense for you to fight for you and your best interests in court.

- Negotiating a settlement. Credit card companies like Capital One are often open to settling debt outside of court. Settlements benefit them by saving the time and cost of litigation. Depending on your situation, we may be able to negotiate a fair settlement for less than the amount claimed—possibly even through a small claims proceeding. You can pursue a debt settlement at any stage of the collection process. We can also work to secure payment terms that fit your financial circumstances.

- Exploring alternative debt resolution. At Warren & Migliaccio, we handle many cases beyond debt defense. We also have extensive experience in debt resolution cases, such as bankruptcy. If you believe the alleged debt is too much to handle, we can help you explore alternative debt relief options.

Discuss Your Capital One Lawsuit Options With Our North Texas Debt Defense Lawyers

Have you received a lawsuit notice from Capital One for credit card debt? You may have more legal options available to you than you think to fight it or resolve it. However, the longer you wait, the fewer options you may have. Debt collectors prefer to resolve debts without necessitating legal action. We recommend reaching out to an experienced debt resolution attorney as soon as possible.

At Warren & Migliaccio, we are happy to review the case against you and help you understand your best options to resolve it during a confidential consultation. We have extensive experience handling debt collection defense cases for our clients against debt collectors, including this debt collector: Capital One Bank. Fill out our online contact form or call our office at phone number (888) 584-9614 to request a consultation to discuss your unique situation today.

Frequently Asked Questions

FAQs About Responding to a Capital One Lawsuit in Texas

How long do I have to respond to a Capital One lawsuit in Texas?

In Texas, response deadlines are strict: 14 days from service in Justice of the Peace Court, 21 days in County Court at Law, or by 10 a.m. on the Monday following 20 days in District Court.

Texas courts rarely grant extensions without good cause. Missing these deadlines results in default judgment, allowing Capital One to:

Freeze Texas bank accounts

Place liens on Texas homestead property (with limitations)

Pursue non-exempt assets

File your Answer with the specific Texas court immediately.

What happens if I ignore a Capital One lawsuit in Texas?

Ignoring a lawsuit in Texas triggers severe consequences despite strong debtor protections:

Default judgment entered after Texas deadline (14–21 days)

Bank account garnishment: Texas allows full account seizure with judgment

Property liens: Can attach to non-homestead property in Texas

Asset seizure: Texas exemptions protect some items, but not all

10-year judgment: Renewable for another 10 years in Texas

No wage garnishment: Texas Constitution prohibits this for consumer debt

Warren & Migliaccio and other Texas debt defense firms report 90% of ignored lawsuits result in maximum collection efforts.

What happens if Capital One doesn’t appear in Texas court?

Texas courts handle no-shows differently by court level:

JP Court: Often dismisses for want of prosecution

County/District Court: May grant one reset before dismissal

Dismissal type matters: “Without prejudice” allows refiling within the Texas statute of limitations.

Under Texas Rule 165a, dismissal for want of prosecution occurs after notice.

Texas judges rarely grant default judgments to defendants. Most dismissals are “without prejudice,” meaning Capital One can refile within the 4-year limitation period. Always get the dismissal order to confirm terms.

FAQs About Settlement and Negotiation Options

How much will Capital One settle for in Texas credit card lawsuits?

Capital One typically settles Texas cases for 30% to 80% of total debt, with most North Texas settlements landing between 40% to 65%.

The amount you can afford to pay is an important factor in settlement negotiations, as proposing a realistic payment increases the chance of acceptance.

Texas-specific factors affecting settlement:

No wage garnishment in Texas gives you negotiating leverage

Texas homestead protections limit collection options

Dallas/Fort Worth courts see high volume, encouraging settlements

Texas’ 4-year statute of limitations creates urgency for older debts

Recent Texas settlements show lump sums of 45–55% commonly accepted when offered within 30 days of service.

Can I negotiate with Capital One after being served in Texas?

Yes, Texas state law encourages pre-trial settlement.

Capital One uses these Texas law firms who often negotiate:

Moss Law Firm, P.C. (Dallas-based)

Scott & Associates, P.C. (Texas offices)

Rausch Sturm (Houston operations)

Texas Rule of Civil Procedure 167 (expedited actions) applies to many Capital One cases under $100,000, creating settlement pressure.

Contact Capital One’s Texas counsel directly or through a Texas-licensed attorney. Texas courts often grant 30–45 day continuances for settlement negotiations.

FAQs About Legal Defenses and Deadlines

What is the statute of limitations for Capital One debt in Texas?

Texas enforces a 4-year statute of limitations for credit card debt under Texas Civil Practice & Remedies Code §16.004.

Key Texas-specific points:

Clock starts from last payment date or written acknowledgment

Texas courts strictly enforce this deadline if properly raised

Capital One’s Virginia choice-of-law clause may not override Texas law

Partial payments reset the Texas statute of limitations

Texas tolling rules may extend deadline if you lived out-of-state

After 4 years, debt becomes “time-barred” in Texas, though Capital One may still attempt collection. Even if a debt is time-barred, it may still appear on your credit report.

What defenses work against Capital One in Texas courts?

Texas courts recognize these defenses against Capital One:

Texas statute of limitations (4 years) – most powerful defense

Improper service under Texas Rules: Strict service requirements

Texas Rules of Evidence 902(10): Challenge business record affidavits

Standing issues: Capital One must prove ownership under Texas law

Texas usury laws: Interest rates exceeding limits (rare but possible)

Homestead exemptions: Texas Constitution protects primary residence

Texas exempt property: $60,000 personal property ($120,000 for family)

Texas judges increasingly scrutinize Capital One’s evidence, especially in JP courts.

Thus, the outcome of your case can also impact your credit scores, as settled debts or judgments may be reported and affect your creditworthiness.

FAQs About Legal Representation and Bankruptcy

Should I hire a Texas lawyer for a Capital One lawsuit?

Texas debt defense attorneys provide crucial advantages:

Local court knowledge: Each Texas county has different judges and procedures

Texas-specific defenses: Attorneys know which arguments work locally

Settlement leverage: Texas lawyers report 40–60% settlements vs 60–80% pro se

Texas legal aid: Eligible Texans can get free representation

Flat fees common: Many Texas debt lawyers charge $500–$1,500 flat fees

For small claims under $20,000 in Texas JP court, you might self-represent. For County or District Court cases, Texas attorneys are strongly recommended.

The Texas State Bar offers referrals at 1-877-984-2478.

How does bankruptcy affect a Capital One lawsuit in Texas?

Filing bankruptcy in Texas federal courts (Northern, Southern, Eastern, or Western Districts) triggers immediate protections:

Automatic stay halts pending Texas state court cases

Texas exemptions in bankruptcy are generous (homestead, personal property)

Chapter 7: Uses federal or Texas exemptions (debtor’s choice)

Chapter 13: Popular in Texas due to homestead protection

Texas bankruptcy exemptions often preserve more assets than federal exemptions. North Texas bankruptcy courts see high filing rates, making judges familiar with Capital One cases.

Bankruptcy stays on credit reports for 7–10 years but may cost less than paying full judgment in Texas.

FAQs About Garnishment and Texas Collection Laws

Can Capital One garnish wages or bank accounts in Texas?

Texas Constitution Article 16, Section 28 prohibits wage garnishment for consumer debt—period.

However, Capital One can still:

Freeze and empty Texas bank accounts (most common collection method)

Seize non-exempt property in Texas

Place liens on non-homestead real estate

Force sale of non-exempt assets

Abstract judgment to create liens on future property

Texas exemptions protect:

$60,000 personal property ($120,000 for families)

Homestead

Retirement accounts

Certain vehicles

Federal benefits receive additional protection under Texas law.