If you are facing a U.S. Bank debt collection lawsuit in Texas, you may believe you have no options against a creditor as big as U.S. Bank. However, you do have legal options available to you to resolve the lawsuit in a favorable way.

At Warren & Migliaccio, we defend Texans against debt collection lawsuits, helping them obtain the best possible case results. Below, we discuss what you should know if sued by U.S. Bank for debt collection and how we can help.

What Is U.S. Bank?

U.S. Bank National Association is one of the largest financial institutions in the United States. It does business as U.S. Bank. According to the U.S. Bank website, it operates over 2,000 branches across 26 states.

Its parent company is U.S. Bancorp, publicly traded as USB and headquartered in Minneapolis, Minnesota. The bank’s current operating charter has existed since 1863, when Abraham Lincoln’s administration approved its predecessor’s First National Bank of Cincinnati charter.

U.S. Bank provides a wide range of financial products to consumers. Beyond traditional banking services, U.S. Bank also offers many types of credit card and loan options. For example, it provides:

- Credit cards

- Personal loans

- Personal lines of credit

- Home loans or mortgages

- Auto loans

- RV and boat loans

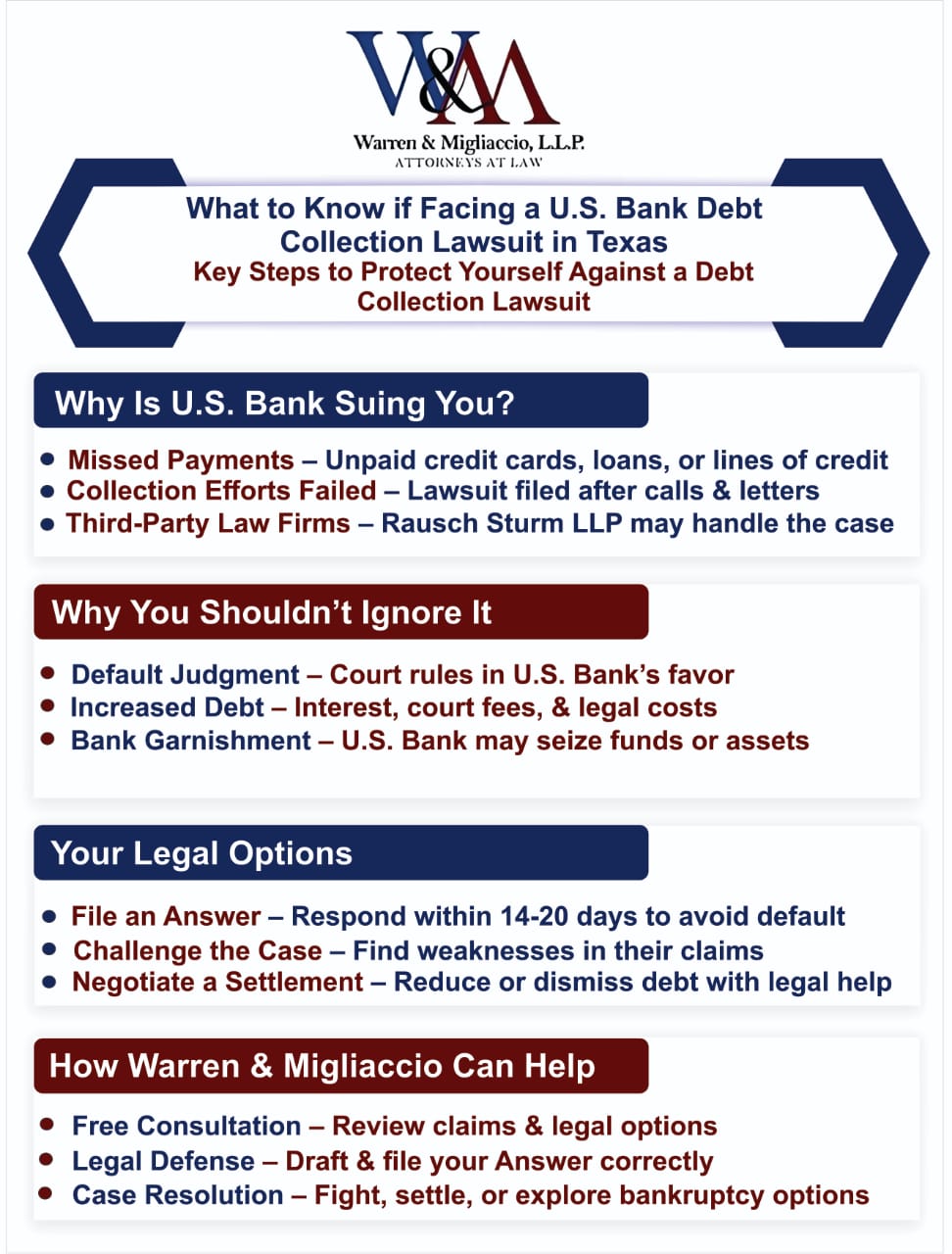

Why Is U.S. Bank Suing Me?

Is U.S. Bank suing you for debt collection in Texas? If so, you may be overwhelmed and confused about why you are being sued. You should have received a complaint and a summons when served with the lawsuit papers. The complaint will include U.S. Bank’s claims against you or why it is suing you.

Generally, however, if a creditor like U.S. Bank is suing you, then it is because it alleges you breached your contract and owe it a debt. For example, suppose a consumer stops paying their credit card bill. U.S. Bank may communicate with the consumer through phone calls or letters in an attempt to collect the outstanding debt. However, if typical collection efforts fail, then U.S. Bank may file a debt collection lawsuit against the consumer to try to recover the debt.

Debts that U.S. Bank may sue to recover include:

- Credit card debt

- Personal loan debt

- Line of credit debt

- Auto loan debt

- Home loan debt

U.S. Bank often hires debt collection law firms to handle its collection efforts. One of the law firms that handles its Texas cases is Rausch Sturm LLP. Therefore, you will likely receive communications from Rausch Sturm LLP about the alleged debt rather than directly from U.S. Bank.

Why You Should Not Ignore a U.S. Bank Debt Collection Lawsuit

There are many reasons why someone may ignore a U.S. Bank debt collection lawsuit. For example, they may not believe they have any options against a company as big as U.S. Bank, they may believe the issue will resolve on its own, or they may not recognize the debt. Our law firm understands that a debt collection lawsuit may leave you feeling overwhelmed and hopeless. However, you have legal options to resolve the lawsuit favorably. Ignoring the lawsuit takes your options away.

Failing to respond to a debt collection lawsuit can result in a default judgment against you. A default judgment means you lose the case automatically due to ignoring the lawsuit or failing to appear in court. With a default judgment, U.S. Bank is legally entitled to the money outlined in the court’s judgment.

Generally, a judgment is much greater than the original debt. A court judgment may include the claimed debt, accrued interest, court costs, and U.S. Bank’s legal fees.

After getting a judgment, U.S. Bank may take further legal action to obtain the money. For example, it may pursue bank garnishment, place liens against your property, or seize nonexempt property. In order to avoid a default judgment and give yourself time to determine your legal options, you must file a response to the lawsuit, called an Answer.

You typically only have 14 to 20 days after you were served with the lawsuit to file an Answer with the court overseeing your case. Your Answer should address the claims made against you by U.S. Bank and assert any legal defenses you may have.

We recommend working with an experienced debt defense lawyer to help you with your Answer. An attorney can review the claims against you, identify any valid defenses, and draft and file an Answer on your behalf. An attorney will ensure that your Answer is error-free, submitted on time, and follows the court’s procedures to avoid a default judgment.

How Warren & Migliaccio Can Help if Sued by U.S. Bank for Debt Collection

Warren & Migliaccio represents and defends individuals facing debt collection lawsuits from creditors and debt collectors in Texas. Our lawyers have extensive experience and success in helping individuals resolve debt lawsuits favorably. We take cases across the state.

A few ways our Texas debt collection defense lawyers can help you if sued by U.S. Bank include:

- Providing a free consultation to review the claims against you and help you understand your situation

- Drafting and filing an Answer with the court

- Investigating the allegations against you

- Identifying any weaknesses in the claims against you

- Determining your best legal options so you can make an informed decision about your case

- Helping you reach a favorable outcome for your case

The best legal strategy for your case will depend on the strength of the claims against you and your financial situation. Our team will look for weaknesses in the claims against you to move for a case dismissal, fight the case in court, or put you in an advantageous position for negotiating a settlement. Depending on your financial situation, we can also determine whether you may be a candidate for bankruptcy protection.

Schedule a Free Consultation With Our Texas Debt Defense Lawyers Today

Are you being sued by U.S. Bank for debt collection in Texas? Remember, you have legal options available to you to resolve the lawsuit. However, you must act quickly to protect yourself from a default judgment.

Do not hesitate to contact our law firm for a free consultation. We will review the claims against you, help you understand your situation, and discuss your options for moving forward. Call us today at (888) 670-3593. You can also contact us online, and we will contact you soon to schedule a free consultation.