Is Baxter Credit Union suing you for debt collection in Texas? If so, we understand that you may be overwhelmed or confused, especially if you do not recognize the debt or know how to protect yourself. At Warren & Migliaccio, we handle debt collection defense throughout Texas. We have helped many individuals navigate and reach favorable resolutions in credit union lawsuits. In the article below, we discuss what to know about Baxter Credit Union, why Baxter Credit Union might sue you, the next steps to take, and how an experienced attorney can help you.

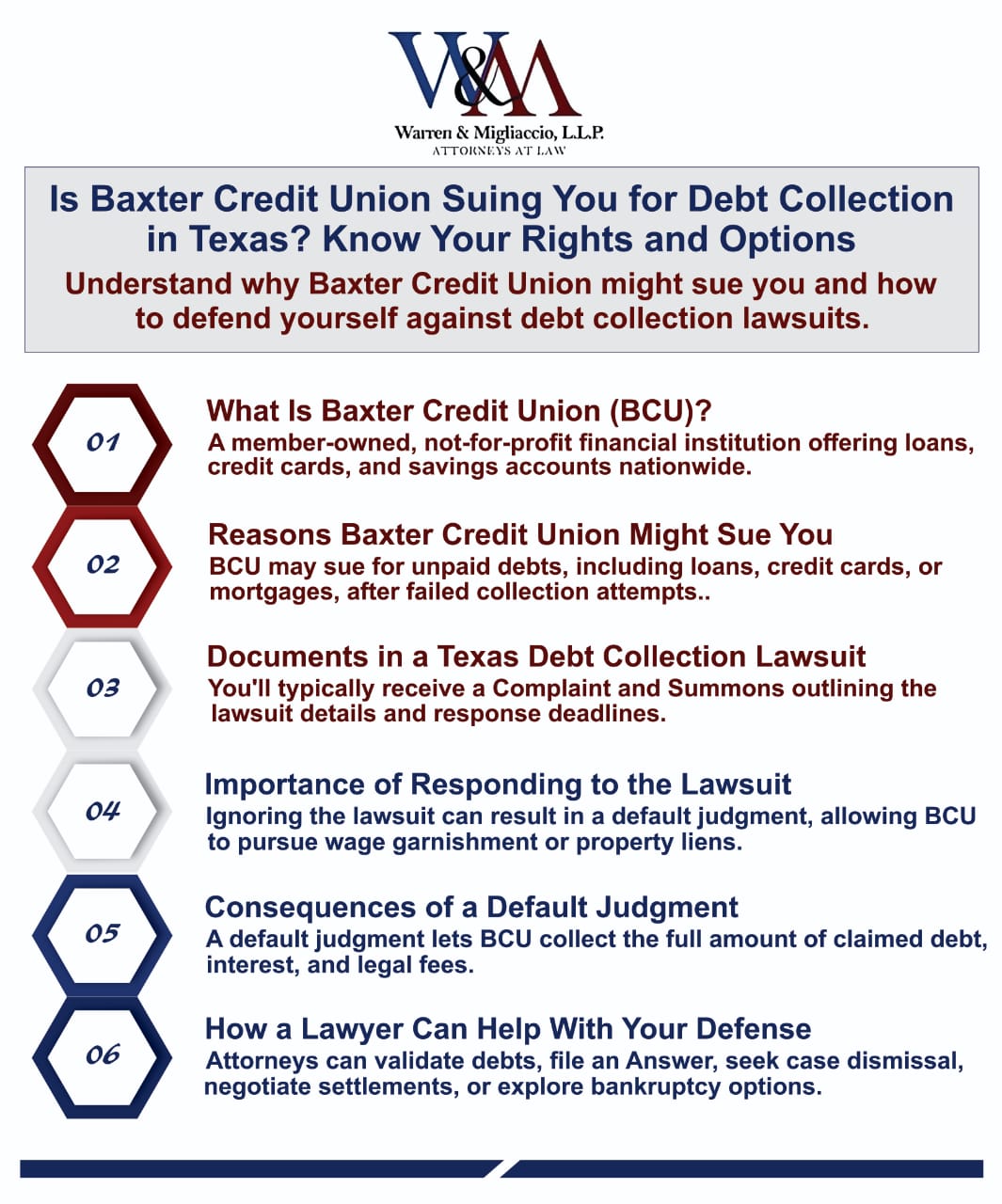

What Is Baxter Credit Union?

Baxter Credit Union, often called BCU, is a credit union headquartered in Vernon Hills, Illinois. According to its website, BCU has more than 350,000 members in the United States and Puerto Rico.

Unlike traditional for-profit banks with shareholders, a credit union is a member-owned, not-for-profit financial institution. In other words, when you open an account with Baxter Credit Union, you become a part-owner. The credit union serves its members rather than outside investors.

BCU offers members checking and savings account options, credit cards, and a wide range of loan options. For example, it offers auto, personal, student, business, and mortgage loans.

Why Would a Credit Union Sue You?

When a credit union like Baxter Credit Union initiates a debt collection lawsuit, it likely believes you owe it money that you have not repaid according to the terms of your lending agreement.

The debt collection lawsuit may relate to a credit card or loan you took out with BCU. Along with various credit cards, according to its website, BCU has many loan options, including:

- Auto loans

- RV and boat loans

- Personal loans

- Mortgages

- Home improvement loans

- Student loans

Generally, Baxter Credit Union will file a lawsuit after other collection efforts have failed. Then, it may sue for the total amount owed, plus accrued interest and fees. It may also sue for its legal fees and court costs.

BCU often works with local Texas law firms to handle its collection lawsuits in Texas. Therefore, you may receive communication from its law firm rather than from BCU. Our Texas debt collection defense lawyers often see BCU work with the following law firms:

What Are the Documents in a Texas Debt Collection Lawsuit?

Have you been served with a Baxter Credit Union lawsuit? If so, you may wonder what the documents you received mean. The documents you received should include a Complaint and Summons.

The Complaint outlines information about the lawsuit, such as why BCU is suing you, the amount it alleges you owe, and the relief it requests from the court. The Summons, on the other hand, is the official notice of the lawsuit issued by the court. It provides information about your case number, the court overseeing the case, and the deadline for your Answer.

In Texas, you have a limited time to respond to a debt collection lawsuit. Your response is called an Answer. Depending on the court handling your case, you generally have 14 to 20 days to respond. Our Texas debt collection defense lawyers discuss why you should not ignore the lawsuit below.

Why You Should Not Ignore a Baxter Credit Union Lawsuit

If you have been served with a lawsuit from Baxter Credit Union or any other creditor, you should not ignore it. Once you have been served with a debt collection lawsuit in Texas, you only have limited time to respond to the lawsuit. Failing to respond can lead to a default judgment against you.

A default judgment means the court may award BCU everything it has requested in its lawsuit without considering your side of the story. Why would it do that? Because you did not formally acknowledge the lawsuit or show up in court. A default judgment typically includes the full amount of the claimed debt, accrued interest, attorney’s fees, and court costs.

Once Baxter Credit Union obtains a judgment, it can pursue further legal action to get the money. For example, it may move to garnish your bank accounts, seize non-exempt property, or place liens on your property.

By responding to the lawsuit, you give yourself the opportunity to explore your legal options for obtaining a favorable case outcome. For example, you may have a strong defense to get BCU to drop the lawsuit or have it dismissed. You may also be able to negotiate a fair settlement or manageable payment plan, or explore debt relief options like bankruptcy.

How Our Texas Debt Collection Defense Lawyers Can Help

Dealing with a debt collection lawsuit can be overwhelming, especially if you have never faced litigation or navigated the court system. Hiring an experienced Texas debt collection defense lawyer can significantly improve your chances of obtaining a favorable case outcome.

At Warren & Migliaccio, we defend and represent individuals against debt collection lawsuits across Texas. A few of the ways we can help you with your case include:

- Helping you understand the situation you are facing

- Helping you understand your legal rights

- Reviewing and investigating the claims against you

- Drafting and filing an Answer to avoid a default judgment

- Requesting debt validation from Baxter Credit Union

- Assessing the strengths and weaknesses of the case against you

- Helping you understand your best legal options so you can make an informed decision

- Seeking case dismissal, challenging the lawsuit, negotiating a settlement, or helping you seek bankruptcy protections

You can count on our team to seek case dismissal when possible. If it is not possible, we will work toward the best possible resolution for your unique situation.

Frequently Asked Questions

FAQs Regarding Being Sued By Baxter Credit Union

Can Baxter Credit Union garnish my wages or bank accounts in Texas?

In Texas, wage garnishment for consumer debt is generally not allowed, but creditors like Baxter Credit Union may attempt to garnish your bank accounts or place liens on non-exempt property after obtaining a judgment. Responding to the lawsuit promptly can help you protect your assets and explore alternative resolutions.

How can I negotiate a settlement with Baxter Credit Union?

Negotiating a settlement typically involves working directly with Baxter Credit Union or their attorneys to agree on a reduced payoff amount or a manageable payment plan. An experienced debt collection defense lawyer can assist you in negotiating fair terms and ensuring your rights are protected throughout the process.

What should I do if I don’t recognize the debt Baxter Credit Union is suing me for?

If you don’t recognize the debt, you can request debt validation. It’s time to take action: request that Baxter Credit Union or their legal team furnish proof that the debt is authentic and attach your name to it. Consulting a debt collection defense attorney can help ensure the debt validation process is handled correctly.

Schedule a Free Consultation With Our Texas Debt Collection Defense Attorneys

At Warren & Migliaccio, we represent and defend Texans against debt collection lawsuits. We have extensive experience and success in helping individuals like you obtain favorable resolutions and put debt collection lawsuits in the past.

During a free consultation, we are happy to review your situation and help you understand your best legal options for moving forward. Call us at (888) 670-3593 or contact us online, and we will reach out to you soon to schedule a free consultation.