People often think about what to put in a trust when they start planning for the future. They want to make sure their loved ones are taken care of and their assets are protected. A trust can be a powerful tool in estate planning, but figuring out what to put in a trust can sometimes feel overwhelming.

This guide helps demystify what to put in a trust, specifically a revocable living trust in Texas. It helps you understand what assets can be held in a trust, the benefits it provides, and some things to consider throughout the process.

Understanding Revocable Living Trusts in Texas

Before we dive into the details of what to put in a trust, let’s clarify what a revocable living trust actually is. Under Texas law, this type of trust is formed while you’re still alive. It allows you to maintain control of your assets, including personal property, even after they’ve been transferred into the trust.

It’s called “revocable” because, unlike certain types of irrevocable trusts, you retain the ability to change the trust terms. You can even cancel it completely during your lifetime as long as you’re mentally capable of doing so. Unlike a will, assets held within a properly funded revocable living trust avoid the sometimes costly and lengthy process of probate in Texas.

Think of probate as a kind of court process where your assets, including any generated trust income, are inventoried and then distributed to your loved ones after you’ve passed on. Probate court is public record, which may sacrifice some level of your privacy and expose your personal information. Hence, transferring ownership of certain assets into a revocable living trust while you are still living is very common. The probate process can take anywhere from a few months to years to settle.

What Assets Can You Typically Put in a Trust?

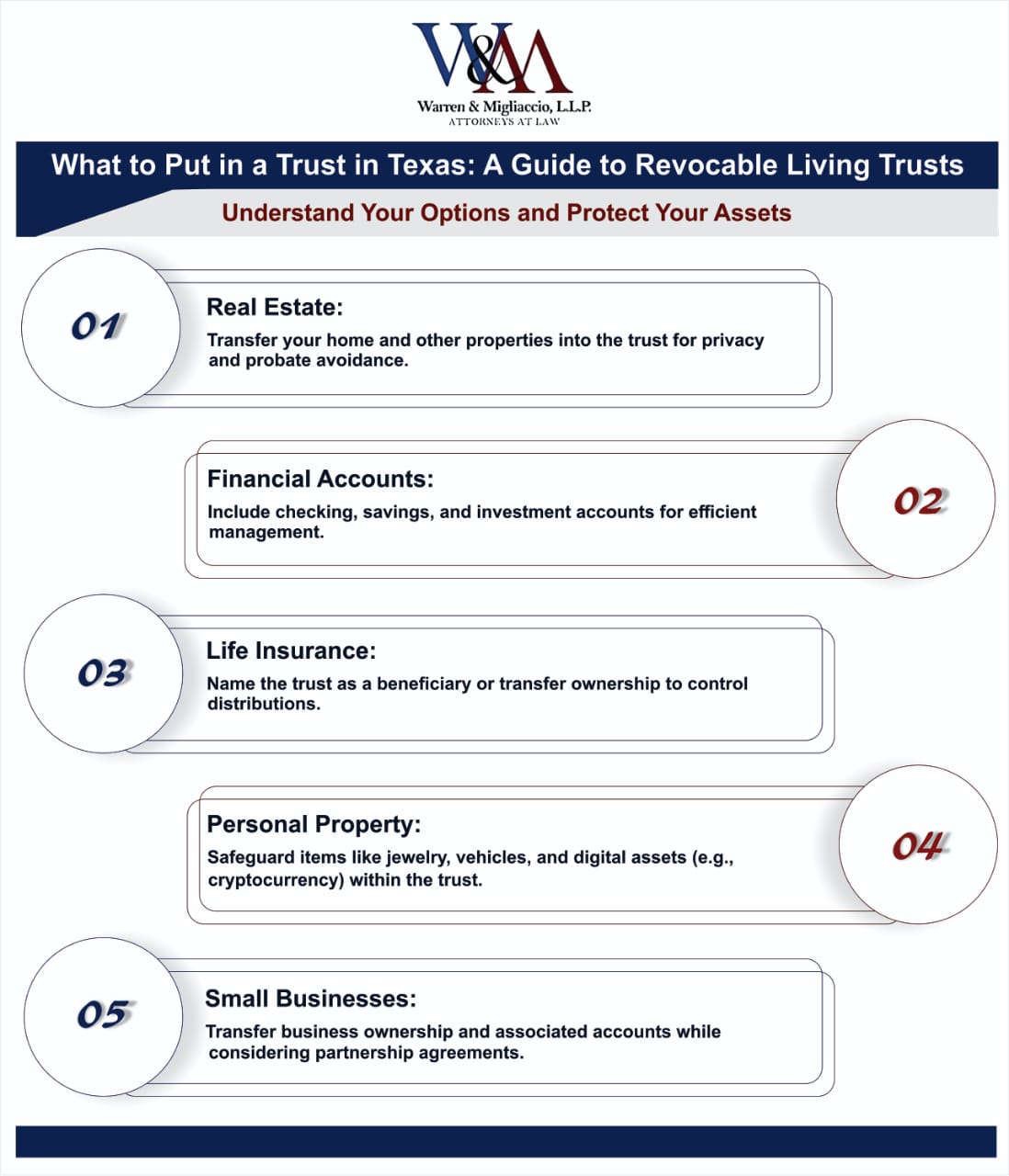

There are a range of assets that people put into revocable living trusts in Texas. Determining exactly what you choose to include is usually driven by factors like avoiding probate, minimizing taxes, or ensuring the smooth transfer of assets.

Real Estate

Your house is often your biggest asset. So, transferring your Texas homestead to your living trust is something to consider. Many folks aren’t aware that holding a Texas homestead in a trust won’t necessarily remove your protection from creditors under the Texas Property Code.

It’s worth talking with an experienced estate planning attorney to learn more about how this can work best for you.

Financial Accounts

Various types of financial accounts can be placed in a trust, including:

|

Account Type |

Details |

|---|---|

|

Bank accounts |

Checking and Savings accounts |

|

Investment accounts |

Brokerage accounts, mutual funds |

|

Stocks & bonds |

Certificates of ownership |

|

Certificates of Deposit |

CDs held at financial institutions |

Life Insurance

Life insurance proceeds can be included in a living trust in a couple of ways. The first way is by listing the trust as a beneficiary on the policy. This method offers more flexibility if you wish to keep the proceeds separate from other trust assets for a period of time after death, for example, if a beneficiary is a minor.

You can also choose to transfer ownership of the policy to your trust directly, giving you greater control over the distribution to your trust beneficiary. There may be specific tax implications depending on the dollar value of your life insurance policy. If you choose to transfer your policy directly to your trust, an estate planning lawyer can walk you through the requirements and complete the ownership transfer process for you.

Stocks, Bonds, and Other Investments

To transfer your stock certificates and bonds to your trust, they must be reissued in the trust’s name, which is a critical step in trust administration. Your financial advisor can provide insight into what assets to include in your trust and how to complete this process.

If your stocks are held by a company that uses stock transfer agents, you may need a separate legal document. The complexities of transferring these assets can be significant, so it’s often beneficial to enlist a trust and estate attorney to manage the details for you.

Personal Property

Think furniture, jewelry, vehicles, and even family photos—all can be transferred. You can also list your cryptocurrencies like Bitcoin in your trust if you own these. Clearly outlining how you want personal property handled helps prevent misunderstandings among your loved ones.

Cryptocurrency

If you happen to own cryptocurrency like Bitcoin, these digital assets can be transferred. However, the rapid rise in cryptocurrency has estate laws scrambling to catch up, especially in Texas.

Speaking with an experienced lawyer familiar with how to put Bitcoin into a trust would benefit you. It will help you ensure your ownership transfers are accurately recorded in your trust document. An estate lawyer well-versed in cryptocurrency can guide you through the process.

Small Businesses

There are many ways a small business, along with any associated business bank accounts or business credit cards, can be placed into a Texas revocable living trust. The best course of action depends largely on how your business is structured:

- Sole Proprietorships: A sole proprietor who has assets held in their name will find it’s more beneficial to transfer ownership to a trust to protect loved ones should something happen.

- Business Names: Transferring these follows the same format as the personal assets owned.

- Partnerships: In some cases, your agreement may specifically exclude you from transferring ownership to a trust, so it’s advisable to seek clarification from a professional familiar with the finer details of these agreements before proceeding.

- LLC: Generally, approval must first be granted by a majority of business owners within the company to move forward. Your lawyer can advise on how best to do this based on your particular situation and agreement.

What Assets to Avoid Putting in a Trust

Although living trusts can simplify your financial and personal asset management, some things just aren’t appropriate. For some assets, adding them to a trust could actually be more costly to you or create a greater burden for your loved ones. Carefully consider the implications before including the following:

Retirement Accounts (401(k)s, IRAs, 403(b)s)

In Texas, if you attempt to move a retirement account into a trust, you’re required to cash it out completely, which is a taxable event and is usually a poor financial strategy unless required by an advisor or court.

Instead of moving it into a living trust directly, list the trust as the beneficiary on these account types instead. That way, the trust will directly receive the proceeds according to your stated wishes while minimizing negative tax consequences.

Health Savings Accounts (HSAs)

You use an HSA in Texas to pay for specific health costs with pre-tax income, making them inherently tax-sheltered.

Like retirement accounts, avoid placing health savings accounts into a trust; instead, name the trust as the beneficiary on the policy. Directly transferring these accounts could create a tax burden or lead to a clawback by the financial institution, especially if certain time requirements must be met. In this case, a revocable living trust functions only as the beneficiary after your passing. A qualified attorney with expertise in health savings account transfers can provide you with valuable insights.

How Does a Texas Revocable Living Trust Get Funded?

Funding a trust means transferring the legal ownership of your assets from your name to the trust’s name. This isn’t just verbally saying it; you have to take tangible steps. Here are a few steps you’ll need to follow:

Real Estate: When it comes to real estate, you’ll need to collaborate with a Texas title company or a lawyer who specializes in property transfers. They can assist you in changing the deed from your personal name to the trust’s name.

Financial Accounts: For your financial accounts, local banks or financial institutions will require you to complete updated forms that designate your trust as the new account holder. If the institution has any questions, their legal team can provide guidance.

Investment Accounts: If you are transferring investment accounts, your brokerage or investment firm will typically provide forms to facilitate the ownership change for assets like stocks or bonds. If they use stock transfer agents, your legal representative may need to supply a change-of-ownership document, depending on the specific requirements involved.

Tangible Items: Tangible items can be either physically given to the trustee with clear documentation stating their possession or itemized and listed in a separate attachment to your trust document. You may also choose to include these items in your will, depending on what works best for you. Keep in mind that if tangible assets are included in your will, they will go through the probate process in Texas. It’s advisable to have your attorney carefully review any decisions related to these assets before proceeding.

Case Law Examples In Texas

Unfortunately, trusts often create legal disputes among families. While these aren’t typically reported in news articles, these disagreements often involve children fighting over a parent’s assets or disputing a step-parent’s claim to a loved one’s wealth. Business interests are a common point of contention.

In Texas, it’s common to include detailed provisions for managing family wealth after your death. This helps prevent confusion and disagreements, tailored to your unique needs and desires. Seeking guidance from qualified attorneys, such as probate or estate planning lawyers, is a great way to start this process.

Why a Lawyer’s Guidance Is Invaluable When Funding a Revocable Living Trust

After you determine what to put in a trust, you’ll need to properly fund it. You can do this by changing the titles or ownership designation to reflect the name of the trust. It’s like changing the name on a deed—you’re legally recording the trust’s ownership.

Contact an estate planning lawyer to set up a revocable living trust correctly and ensure you’re in compliance with Texas law. Each situation is different, so professional guidance is key.

FAQs About What to Put in a Trust

Should I Put All My Bank Accounts into My Trust?

No. While you technically can, if it is a regularly used account, it may become more challenging for you to manage. Imagine putting your checking account into a trust and having to jump through additional hoops each time you go to buy groceries or deposit a check.

Can I Change my Trust After it’s been Created?

Yes. One of the primary benefits of a revocable living trust is its flexibility. While you are alive and of sound mind, you can make changes, add or remove assets, or even revoke the trust altogether. This flexibility lets your estate plan evolve with your needs.

However, making these changes generally requires a formal amendment to maintain the legal integrity of your trust document.

How do I Choose a Successor Trustee?

The successor trustee is someone you trust to manage and distribute your assets. Consider their:

1. Responsibility

2. Financial knowledge.

3. Integrity to act in the best interest of your beneficiaries.

Communicate with your chosen successor trustee to ensure they are willing to take on this responsibility.

Conclusion

Deciding what to include in a trust requires planning and a clear understanding of your long-term objectives. A revocable living trust can serve as a key component of your estate plan. It helps you avoid probate, maintain privacy, and ensure a smooth transition of your assets.

To make sure your trust aligns with Texas law and meets your specific needs, it’s crucial to consult an experienced estate planning attorney. Our dedicated team at Warren & Migliaccio is here to guide you through the process, answer your questions, and help protect your legacy. Call us at (888) 584-9614 or contact us online to begin planning today.