Dealing with a mortgage after a loved one passes away raises many questions. One common question is, who pays the mortgage on a house in a trust? This article addresses this concern, offering guidance on trust-owned properties, especially for those with revocable living trusts. We’ll cover Texas law, offering practical tips and resources for managing trust property.

Trusts and Real Estate: The Fundamentals

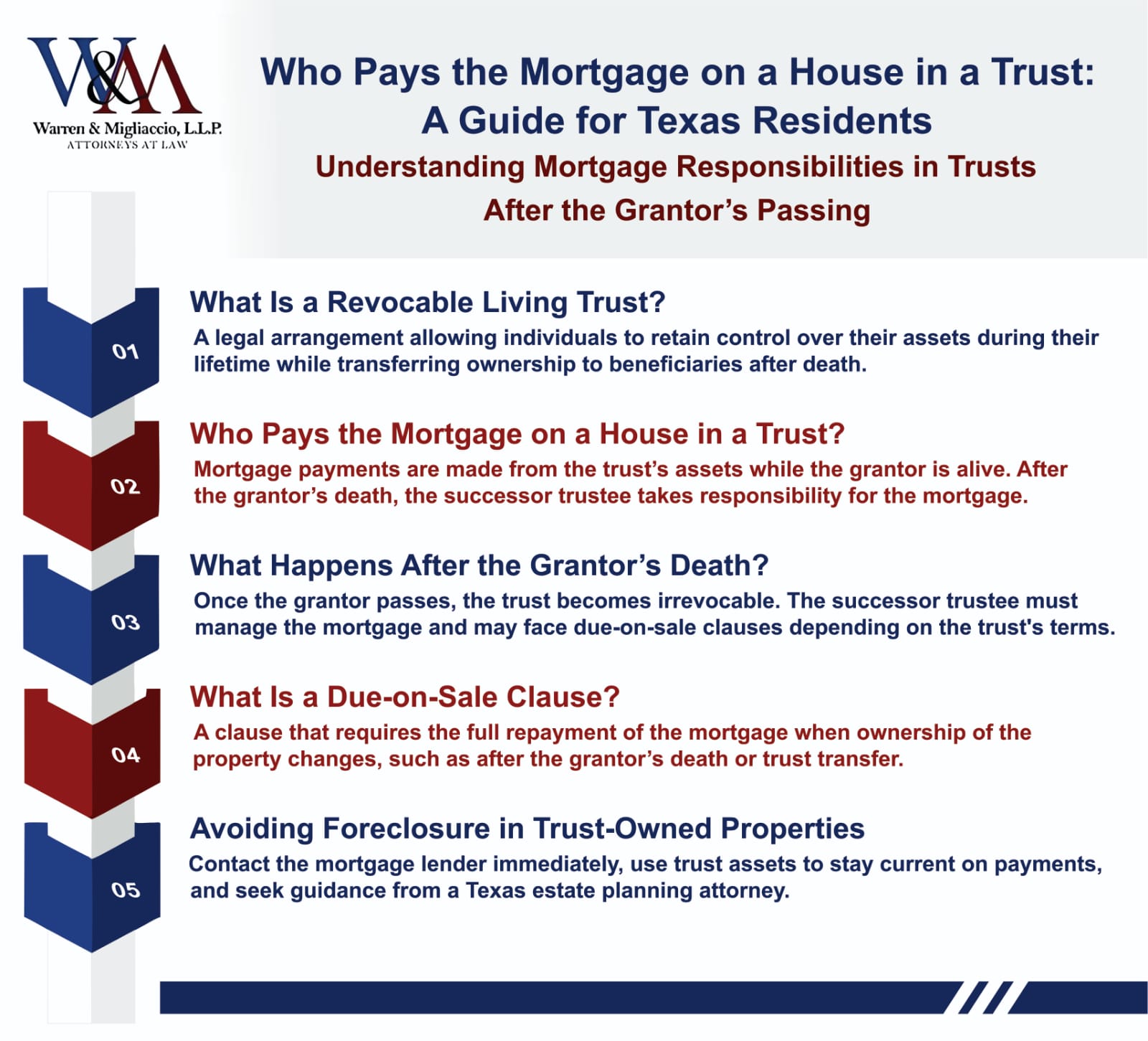

A trust is a legal instrument that allows you, the grantor, to transfer control of assets to a trustee. This trustee manages assets on behalf of the trust beneficiaries you designate. This becomes especially useful when talking about your home or other real property. Trusts can hold various types of property, making them versatile tools in estate planning.

Revocable Living Trust: What You Should Know

For many in Texas, a Revocable Living Trust offers an advantageous way to manage assets, including real estate. It allows you, as the grantor, to retain control and make changes, even revoke the trust completely, during your lifetime. But what happens when a mortgage is part of the legal arrangement? There are different types of trusts, each with varying terms and conditions that may affect how mortgage responsibilities are managed.

Who Pays the Mortgage on a House in a Trust in Texas?

When a house is in a revocable living trust in Texas, the trust handles the mortgage. Mortgage payments must be made from the trust’s assets. Because the grantor retains control and ownership in a revocable living trust, they remain liable for the mortgage.

This is helpful if the trust lacks liquid assets. You might also find information about closing costs, escrow and pricing your home. Also, obtaining a free market analysis helpful if you’re considering selling.

What Happens After the Grantor’s Death?

When the grantor of a revocable living trust dies in Texas, the trust becomes irrevocable. The successor trustee takes charge of managing the trust’s finances, including mortgages. Ownership changes can trigger due-on-sale clauses depending on the name of the trust and terms of the trust.The trust agreement specifies the rules for home ownership and management, ensuring legal compliance.

When the grantor of a revocable living trust dies in Texas, the trust becomes irrevocable. The successor trustee takes charge of managing the trust’s finances, including mortgages. Ownership changes can trigger due-on-sale clauses depending on the name of the trust and its terms. The trust agreement specifies the rules for ownership and management, ensuring legal compliance.

Unique situations may arise based on state laws or other factors. These situations often create confusion about financial responsibilities, such as who pays the mortgage, estate taxes, or debts after the grantor’s death. Property ownership and inheritance rules play a significant role, especially for assets in a trust.

Selling trust property can also become complicated, as noted by The Urban Cool Homes Team.

Avoiding Foreclosure

Successor trustees must act fast to prevent foreclosure. If you’re a successor trustee, managing the mortgage and keeping the trust financially stable is your responsibility. Here’s how to handle it:

- Contact the mortgage lender immediately.

- Use the trust’s assets to make payments on time.

Seek help from a Texas estate planning attorney to understand trust mortgages. Texas uses non-judicial foreclosure laws, so missed payments can lead to fast foreclosures.

Texas Law and Due-on-Sale Clauses

In Texas, mortgage agreements often include due-on-sale clauses. These clauses need full loan repayment when ownership changes to a new owner. Successor trustees must understand how these rules apply to irrevocable trusts. Beneficiaries inheriting mortgaged property may worry about these clauses after the grantor’s death.

Federal law, through the Garn-St. Germain Depository Institutions Act of 1982, allows exceptions. These include property transfers after death, between joint tenants, or to surviving tenants. Federal regulation 12 CFR § 191.5 explains these exceptions in detail.

Work with an estate planning attorney to navigate these rules and ensure compliance with legal requirements. Understanding these laws can protect beneficiaries and simplify property management after a grantor’s death.

Best Practices for Managing Mortgages in Texas Trusts

Managing mortgages for trust-owned properties in Texas takes planning. Follow these steps to handle it effectively:

- Know Your Role: Understand if you are the grantor, trustee, or beneficiary.

- Stay Open: Talk to the lender about changes or issues with the mortgage.

- Check Legal Documents Often: Review the trust document and financial statements with the successor trustee and beneficiaries.

- Explore Other Options: Beneficiaries needing new home loans might benefit from transferring the property back instead of using inherited loans. It is especially considered if there are property taxes to consider.

- Get Expert Advice: Contact a Texas trust attorney for guidance. They can help you understand the pros and cons of new home loans after a trust transfer and explain who pays taxes or fees when adding a mortgage to a revocable living trust.

Understanding trusts and mortgages helps you plan better. Work with an estate planning attorney to manage taxable estates and set long-term goals. Properly managing trust assets ensures legal compliance and keeps finances stable.

Benefits of Placing Your Home in a Trust

Putting your house into a trust has clear benefits, especially in Texas. It simplifies inheritance and avoids probate, saving your heirs time, stress, and probate court fees. Since probate is a matter of public record, it can drag on for months or years, but a trust skips that process.

In uncertain markets, like during the 1980s when mortgage rates hit 18%, trusts provided peace of mind. Today’s market also makes avoiding extra steps and costs through a trust valuable.

Out of 131 million U.S. homes, over 30 million have no mortgage. This shows how different financial situations affect households. Setting up a trust ensures a smoother inheritance process, even in tough times.

Seeking Professional Guidance

Managing trusts, mortgages, and Texas estate laws can feel complex. An estate planning attorney can simplify the process. They explain tax rules, answer questions, and guide you in protecting your home. With their help, you can ensure your wishes are honored and make the transition easier for your family.

FAQs About Who Pays the Mortgage on a House in a Trust

How does a mortgage work in a trust?

In a trust, the trust is the legal owner, but the mortgage terms remain. Payments are made from trust assets. The Garn-St. Germain Act protects homeowners from due-on-sale clauses when property is placed in trusts.

What are the disadvantages of putting your house in trust?

Trusts can involve costs for drafting and legal review and may limit some financial actions like refinancing. Potential negative tax impacts exist, so consult a financial expert about your finances, including managing mortgages. Trusts like revocable living trusts can provide privacy and avoid probate.

What happens to a mortgage when someone dies in a trust?

When a property owner in a Texas trust dies, the mortgage stays with the house despite ownership changes. Understanding who pays the mortgage on a house into a trust after the grantor’s death is crucial for managing trust assets.

Why do people put their mortgage in a trust?

People use trusts for several reasons, including probate avoidance, privacy within estate plans, and simplified property transfers for heirs. These trusts offer asset protection and allow grantors to keep control of their property. They may also offer tax benefits and help manage assets. Consult with a trust attorney to understand the trust type and its implications.

There can also be drawbacks, so consult legal counsel. Get pre-approved for a mortgage. Consider market trends in the central Kansas area, including Wichita and surrounding areas like Derby and Butler County, which might impact property values and your selling journey, including fees involved in property transfer.

Can I make a loan from my trust to a beneficiary?

A trust can loan money to a beneficiary if allowed by its terms. First, check the trust agreement. Ambiguity isn’t an option; the trustee must verify that the loan stays on track with the trust’s objectives. Ultimately, benefiting each individual.

Loans need clear terms: interest rates, repayment plans, and any collateral. Openness is essential when dealing with beneficiaries. It’s the best way to avoid potential conflicts. A trustee’s first order of business is to get familiar with the trust’s finances. Later, he has to gather legal insight to inform their next steps.

Few things impact your finances like tax rules do. Loans may need interest to meet IRS standards, and interest income must be reported.

Consider alternatives like distributions or a separate trust for simplicity. Good planning keeps the trust healthy while aiding the beneficiary. Always consult an estate planning lawyer for guidance.

Why Put Assets in a Revocable Living Trust?

A revocable living trust offers the benefit of revisability. It means an insurance policy against the uncertainties of life. Expect to score a windfall of positive results. When you call the shots on your assets, you get to decide how they’re handled – no annoying probate process necessary. This combo of control and confidentiality is priceless.

You can change or cancel the trust anytime. Minors get a safeguard: the strategic management of their assets ensures a more secure tomorrow. Blended families can rest easy knowing their inheritances are fairly divided.

If you become incapacitated, a successor trustee manages your assets. You’ll be free from worry, knowing your trust has your back, and that your family will be okay.

Conclusion

Deciding who pays the mortgage on a house in a trust can be overwhelming, especially under Texas law and revocable living trusts. But, with the right information and guidance, it doesn’t have to be confusing.

Remember, this is a general overview and not legal advice. Consult a qualified estate planning attorney familiar with Texas laws for personalized help. Our experienced estate planning attorneys in Texas can help you create a plan that meets your needs. Call us at phone number (888) 584-9614 or contact us online to discuss your situation and get started.