Sarah let out a frustrated sigh as she read the email. “Well, it’s official — my 341 meeting with the bankruptcy trustee is scheduled for next week.”

“Oh man, do you have to actually go to the courthouse for that?” Emily asked with a concerned look.

Sarah shook her head. “Thankfully, no. Since it’s a virtual meeting, I can just do it over a video call. No need to physically be in a courtroom.”

Emily looked relieved. “Oh good, that’s much better than having to take time off work and travel somewhere. But wait…” Her brow furrowed again. “Don’t you still have to actually attend the virtual meeting? Like it’s mandatory, right?”

“Unfortunately, yes,” Sarah confirmed. “My lawyer warned me that even though it’s not in-person, blowing off that virtual trustee meeting could put my entire bankruptcy case at risk of dismissal.”

“Yikes! Well, I’m glad you’ve got a professional keeping you on track with all these requirements,” Emily replied. “Trying to navigate virtual court and not missing any dates seems very stressful without legal help.”

Sarah nodded appreciatively. “You’re telling me. I’ve got no idea how people go through this alone…”

Navigating the complexities of Chapter 7 bankruptcy often leads to one critical question: do I have to go to court? At Warren & Migliaccio, we’re here to guide you through every step of this process.

To help ease any intimidation, we’ll simplify the required information for court appearances in bankruptcy filings.

Are you prepared to move forward? Contact us via (888) 584-9614 or arrange a consultation through our online platform.

Understanding Chapter 7 Bankruptcy and Court Appearances

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy provides a clean slate by eliminating the majority of debts. With assistance from a trustee, you may sell certain items to satisfy creditors. The process is swift and often completed within four to six months.

It is essential to comprehend the specifics before proceeding, as filing for bankruptcy ceases legal proceedings such as lawsuits and debt collections via garnishment. Nonetheless, debts associated with student loans or taxes persist despite this protective measure.

Mandatory Court Appearances Explained

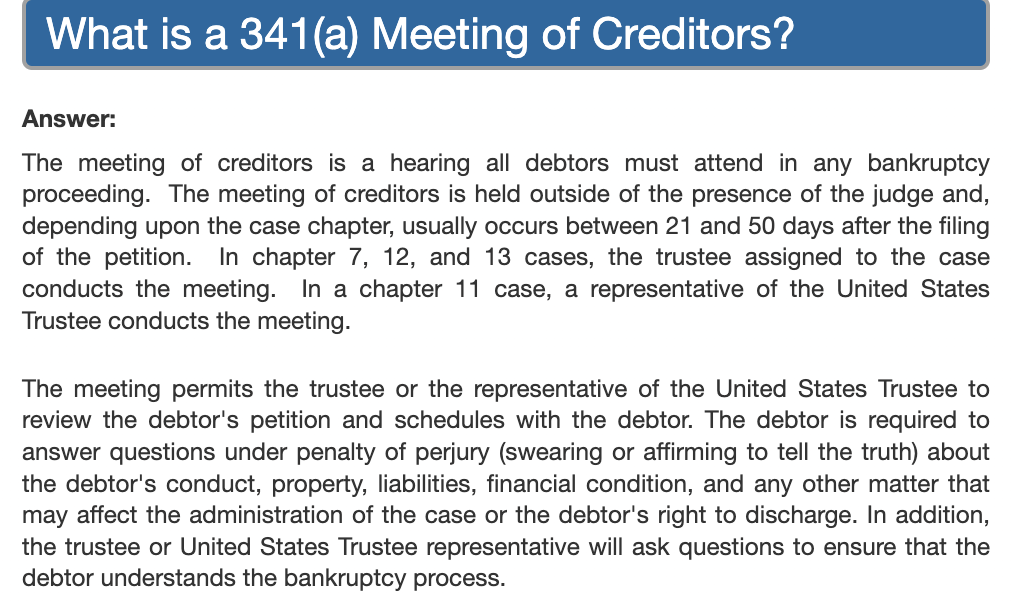

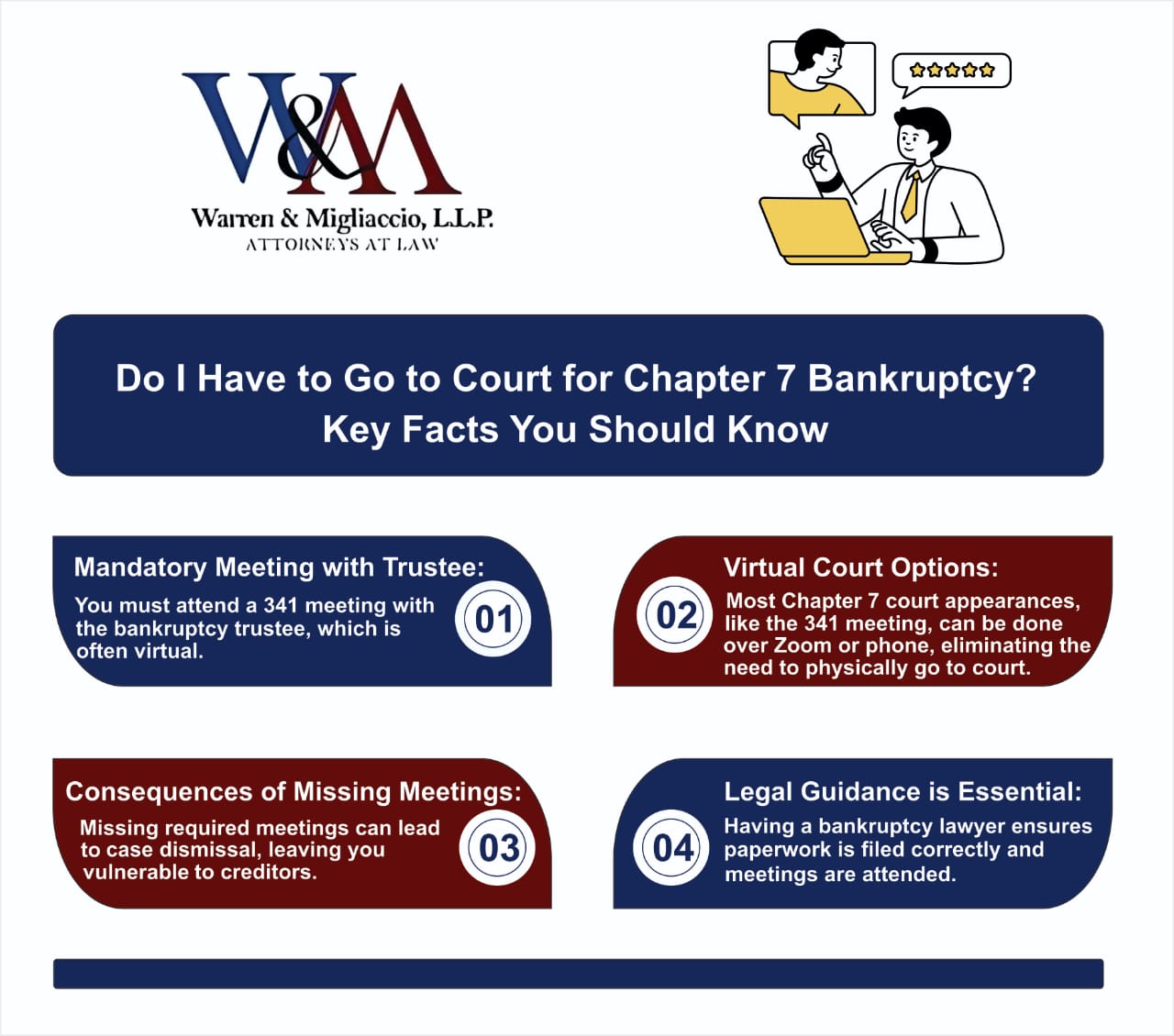

Chapter 7 Bankruptcy filings necessitate court appearances, but they do not necessarily require physical presence in the courtroom. Our area of expertise, comprising the Northern and Eastern Districts of Texas permits telephonic or Zoom conferencing for 341 meetings.

These meetings with the bankruptcy trustee allow them to review your case and ask about your financial situation. It’s crucial to attend to ensure transparency in the process and avoid penalties for inaccurately disclosing assets.

Source: https://www.canb.uscourts.gov/

The Consequences of Missing Court Dates

Missing court dates in bankruptcy is like sailing into a storm. Those appearances aren’t just formalities; they’re your compass out of debt.

In Chapter 7 Bankruptcy, skipping meetings isn’t an option. Whether it’s the 341 meeting, now over Zoom or by phone, or any other appearance, no-shows can ruin your finances.

Why?

- Missing court can lead to your case being tossed out. Without bankruptcy’s shield, creditors can hit hard — think wage garnishments and lawsuits.

- Skipping meetings sours your trustee relationship too. They oversee your case. Doubt them, and it’s trouble.

Bottom line: if you’re in bankruptcy, attend every stop. Your financial future depends on it.

Legal Guidance Through Your Bankruptcy Journey

Why You Need a Bankruptcy Lawyer

Thinking about facing bankruptcy alone? Think again. Here’s why having a bankruptcy lawyer is your best move.

Bankruptcy isn’t a stroll in the park — it’s more like a blindfolded maze run. Without a guide, you’re bound to hit walls.

That’s where we step in.

A seasoned bankruptcy attorney from Warren & Migliaccio can make sure your paperwork is spotless and on time.

No stress, no errors.

We’ll decode the legalese too, making sure you understand every twist and turn. You’re not alone in this financial storm.

But it’s not just paperwork. We’ll counsel you on smart moves to protect your assets, like leveraging exemptions to keep your stuff safe from Chapter 7 liquidation.

Facing wage garnishments or creditor lawsuits?

We’ve got your back there too.

With us, you’ll have an automatic stay on these actions, putting a pause on the chaos.

To effectively maneuver through the intricacies of bankruptcy, expertise alone is insufficient – exposure is also indispensable. This is why partnering with Warren & Migliaccio assures tranquility. Our team will oversee your journey from inception to conclusion, leaving you free to concentrate on reconstructing your monetary prospects.

Protecting Your Assets and Understanding Exemptions

Real Estate and Personal Property Exemptions

Let’s talk about protecting your assets and understanding exemptions in Chapter 7 bankruptcy.

Your home’s equity can be safeguarded by the homestead exemption, shielding it from creditors based on state rules.

Personal property exemptions cover various items like clothing, household goods, and tools of your trade. Some states even protect vehicles up to a certain value.

However, not everything is exempt. Nonexempt properties could be sold off by the bankruptcy trustee.

In districts like the Northern and Eastern Districts where we operate, there are criteria for waiving court attendance, offering relief for those managing other commitments alongside financial strains.

Understanding exemptions is crucial before diving into bankruptcy, ensuring you protect as much of your assets as possible.

Related: Can I Keep My Paid Off Car in Chapter 7?

Preparing Your Bankruptcy Petition and Schedules

At this point, you are revealing complete details of your financial position including liabilities, possessions and revenue.

Completing your petition and schedules with care is crucial when filing for Chapter 7 bankruptcy as it lays the foundation for subsequent steps.

Gathering Essential Documents

You’ll need to gather crucial paperwork, including:

- Recent tax returns

- Pay stubs

- Statements from all your credit cards

Dismissing the documentation related to loans, property deeds, vehicle titles and retirement accounts should be avoided at all costs. Although collecting these papers may appear intimidating, they are imperative for providing a thorough analysis of your financial situation.

Related: Can I Exclude a Credit Card from Chapter 7 Bankruptcy?

Navigating Credit Counseling Requirements

Before filing for Chapter 7 bankruptcy, you must undergo mandatory credit counseling within 180 days.

Approved agencies offer insights into your financial condition and explore alternatives like debt settlement strategies.

Failure to complete this session could lead to delays or dismissal of your case.

Meticulously Completing Your Forms

Attention to detail is crucial when completing your bankruptcy forms.

Legal repercussions may arise from inaccuracies, particularly in proceedings supervised by the bankruptcy trustee.

Throughout the bankruptcy process, both debtors and creditors receive fair treatment with the critical role of asset liquidation played by the trustee.

Frequently Asked Questions

What can you not do after filing Chapter 7?

Don’t take out new loans, transfer assets improperly, or skip any paperwork deadlines. Any questionable financial moves raise red flags.

How often are Chapter 7 bankruptcies denied?

With full honesty and cooperation, denials are quite rare. Filing errors or perceived dishonesty significantly raises dismissal risks.

What happens on the day you file bankruptcy?

Creditors are notified and active collections against you come to a halt once you file, triggering the automatic stay protection. However, this protection does not extend to cosigners.

Will I lose my tax refund if I file Chapter 7?

Possibly, unless your refund amount qualifies for exemption based on your state’s laws. Discuss with your lawyer upfront.

Conclusion

You may still be wondering — do I have to go to court for Chapter 7? The short answer is yes, court appearances are required. However, with modern technology, many of these proceedings can now happen virtually, easing the process.

Missing a court date can derail your plans, so avoid that at all costs. Your assets might be protected through exemptions, and filing paperwork correctly from the start saves headaches later on.

If tackling this alone seems daunting, help is here. With the right bankruptcy attorney Dallas residents rely on, you can navigate the process with confidence. Don’t wait until it feels too late; reach out now to Warren & Migliaccio to take control of your financial situation. Call us at (888) 584-9614 or contact us online to get started on your fresh financial start.