A trust-based estate plan is a smart way to manage your assets during your life and make sure they go to the right people after you pass away. It includes different types of trusts, like a revocable living trust and an irrevocable trust, each with its own purpose. These trusts help you avoid probate, keep your affairs private, and stay in control of your assets. A trust-based plan also gives you more flexibility and peace of mind. In this article, we’ll break down how these plans work and why they’re a great option for many people.

Key Takeaways

- A trust-based estate plan allows assets to be managed and given out without going through probate, which ensures privacy and helps beneficiaries.

- Key components of a trust-based estate plan include a Revocable Living Trust, a Pour-Over Will, and a Durable Power of Attorney. These work together to manage assets effectively.

- Trust-based estate plans work well for many people, including those with large assets or complicated family situations. They offer control over asset distribution and care for dependents.

What is a Trust Based Estate Plan?

A trust-based estate plan is a legal method for creating to manage your assets during your lifetime and pass them on to your beneficiaries after you die. At its core, a trust is a fiduciary arrangement that lets a trustee hold and manage assets for beneficiaries. This approach is effective for handling modern challenges in estate planning, offering security and peace of mind for your loved ones.

Unlike a will-based estate plan, which is designed to navigate the probate process and only starts after your death, a trust takes effect right away. This means you can benefit from your estate plan while you are still living. There are various types of trusts, such as a revocable living trust and an irrevocable trust, each serving a specific purpose. For example, a living trust manages assets for your beneficiaries and can adjust to life changes.

One of the biggest reasons to use a trust-based estate plan is to skip the probate process. This keeps your assets private and saves time and money. It also protects your financial information from becoming public.

Trusts are a flexible part of estate planning. They can be used to set up financial care for young children or individuals with disabilities.

Trust-Based Estate Plans by the Numbers

Many high-net-worth individuals rely on trusts for estate planning. In fact, over 60% of people with assets between $3–5 million have created or plan to create trusts. An even higher 81% of those with $10 million or more have done the same (Source). These numbers show a strong trend: wealthy individuals prefer trusts to protect and manage their assets.

This growing use of trusts shows people believe in their safety and value. Trusts are especially helpful for those who want to transfer assets smoothly and guard against life’s uncertainties. By choosing trusts, high-net-worth individuals are taking smart steps to secure their future. It’s clear that trusts play a big role in today’s financial planning.

Key Components of a Trust Based Estate Plan

A trust-based estate plan includes several legal documents that help manage and pass on your assets the way you want. The main part of this plan is the Revocable Living Trust (RLT). It holds your assets while you’re alive and smoothly transfers them to your beneficiaries after you pass. You can change this trust at any time, giving you both flexibility and control.

You might also include a Qualified Personal Residence Trust (QPRT). This lets you move your home into an irrevocable trust while still living in it for a set time. It can help reduce estate taxes on your home.

Another key document is the Pour-Over Will. It acts as a backup by moving any assets not already in the trust into it after you die. This ensures all your assets are covered, even if you forgot to include some earlier.

A Durable Power of Attorney is also important. It names someone to handle your finances and legal matters if you become unable to do so. Lastly, beneficiary designations are crucial for assets like life insurance and retirement accounts. These forms decide who gets those assets, so it’s important they match your wishes.

Together, these tools create a full estate plan that protects your assets and ensures they’re passed on smoothly.

Who Should Consider a Trust Based Estate Plan?

A trust-based estate plan isn’t only for the wealthy. It can help a wide range of people and families, regardless of age or wealth. Homeowners with at least $160,000 in assets should think about creating a trust to manage their property and other assets. This is especially true in Texas, where property laws and local factors can greatly affect estate planning.

Those with larger estates, complicated family matters, or heirs who overspend may find a trust-based estate plan especially useful. Business owners can rely on a trust to plan for smooth succession and good asset management. If you have blended families or specific giving goals, like special needs beneficiaries or charitable gifts, you’ll also benefit from a trust.

In the end, a trust-based estate plan lets you decide when and how your assets are given out, matching your personal wishes and giving you peace of mind. Whether your family situation is complex or you just want to protect your assets, a trust-based estate plan offers a solid answer.

How Does a Trust Based Estate Plan Avoid Texas Probate?

Case Study: Proper Trust Execution to Avoid Disputes

In In re Estate of Denman (270 S.W.3d 639, Tex. App.—San Antonio 2008), the person who passed away set up a revocable living trust to make asset distribution easier, but family members questioned its validity. The appellate court eventually upheld the trust, showing that following legal requirements and clarifying key points can stop lengthy lawsuits and respect the grantor’s wishes. This case shows how a well-prepared and funded trust-based estate plan can save families from expensive court battles. It also proves why detailed paperwork is so important, especially under Texas probate and trust law.

One of the biggest advantages of a trust-based estate plan is the ability to avoid the Texas probate process, which can be long, costly, and public. In Texas, assets held in a trust skip the probate estate, so they can go straight to beneficiaries without the court process. This leads to faster and more efficient asset distribution.

It’s important to re-title assets in the trust’s name to truly avoid probate. That means transferring property deeds, bank accounts, and other assets to the trust. When you do this, those assets skip probate and stay off public records. A revocable living trust, especially, helps you avoid court involvement by quickly moving assets to heirs.

Trusts also allow for managing debts, taxes, and the rest of the deceased person’s affairs outside of court, which keeps things private and lowers costs tied to probate. This efficient approach to asset management ensures your estate is handled properly and quickly, just as you wish.

Privacy Benefits of a Trust Based Estate Plan

Privacy matters to many people when they plan their estate. Trust-based estate plans offer a more private choice compared to the probate process, which is ideal for those who value confidentiality. Wills go through probate and become part of public records, but trusts keep the trust’s contents and asset values known only to the beneficiaries and trustee.

A living trust stays within the family, allowing transfers of resources without public exposure. This extra level of privacy protects your financial details and helps beneficiaries avoid public conflicts or scrutiny.

Maintaining privacy in your estate matters by using a trust-based plan can give you and your family peace of mind and security.

Tax Advantages of a Trust Based Estate Plan

Trust-based estate plans bring significant tax benefits, especially for those with high net worth. When assets go into irrevocable trusts, they can be removed from your estate, cutting down on estate taxes. One example is irrevocable life insurance trusts (ILITs). They hold life insurance policies so the payouts aren’t part of your estate.

Texas doesn’t charge a state estate tax, but federal estate taxes still apply to estates above the federal limit. Strategically placing assets into trusts can reduce these taxes. For instance, a residence trust can move your home into the trust, potentially lowering estate taxes on that property.

Generation-skipping trusts (GSTs) can also pass assets to grandchildren, avoiding estate taxes on the children’s level. In short, trusts offer many ways to minimize estate taxes, helping you hold onto more of your wealth for your heirs.

Managing Assets with a Trust Based Estate Plan

A trust-based estate plan lets you keep managing your assets, giving you flexibility and control even after transferring them to the trust. You can still oversee investments while they’re in the trust. You can also decide that financial management continues after your death. This means your finances follow your wishes without needing the court process.

In a trust, the grantor remains in control of assets until a specific event like death or incapacity happens. This feature helps you adapt to changes and meet your financial goals. Having ongoing asset management gives you peace of mind, knowing your estate is handled well.

Trusts also enhance asset management while you’re living and after your death, making sure your chosen beneficiaries get their share in a clear way. This all-around approach to asset security and oversight makes trust-based estate plans powerful tools for financial planning and preserving wealth.

Protecting Minor Children and Financially Unstable Heirs

A trust-based estate plan is especially helpful for safeguarding minor children and heirs who may not manage money well. Naming guardians for minor children secures their care according to your wishes. This part of family planning goes beyond finances, giving you assurance that your children will be under the care of responsible individuals.

Trusts also outline the right ways to distribute funds to minors, ensuring their security and financial stability. For heirs who struggle with money, a revocable living trust can set specific guidelines for giving them assets. This prevents the misuse of your legacy and acts as a defense for those who might not handle sudden wealth responsibly.

Types of Trusts in a Trust Based Estate Plan

Trusts each serve a specific purpose in estate planning. You can use them alone or combine them to reach your estate goals. The most common type is the revocable living trust, which lets you transfer ownership of property into the trust and change or end it if needed. This trust avoids probate and keeps you in charge of assets.

An irrevocable trust can’t be changed or canceled once it’s made. Though that may seem strict, it often provides potential tax benefits and stronger protection from creditors.

Testamentary trusts come from a last will and start after the grantor’s death. They manage assets for beneficiaries in a structured way. Knowing the different types of testamentary trusts and how they work helps you build an estate plan suited to your specific needs and goals.

Key Parties in a Trust-Based Estate Plan

A trust-based estate plan involves several key parties who play crucial roles in the creation, management, and distribution of the trust assets. Understanding these roles is essential for effective estate planning.

| Key Party | Description |

|---|---|

| Grantor | The grantor, also known as the settlor or trustor, is the individual who creates the trust and transfers their assets into it. The grantor sets the terms of the trust and decides how the trust assets will be managed and distributed. |

| Trustee | The trustee is the person or entity responsible for managing the trust assets according to the grantor’s instructions. Trustees must act in the best interests of the beneficiaries and manage the trust assets prudently. They play a vital role in ensuring that the estate plan is executed as intended. |

| Beneficiaries | Beneficiaries are the individuals or entities who will receive the trust assets as specified by the grantor. They can include family members, friends, charities, or other organizations. The trust outlines how and when the beneficiaries will receive their inheritance. |

| Estate Planning Attorney | An estate planning attorney is a professional who assists in creating a trust-based estate plan tailored to the grantor’s unique needs and goals. They provide guidance on the creation of the trust, the selection of the trustee, and the distribution of the trust assets. Working with an experienced estate planning attorney ensures that all legal requirements are met and that the estate plan is robust and effective. |

By understanding the roles of these key parties, you can create a comprehensive and effective trust-based estate plan that meets your specific needs and goals.

How to Create a Trust-Based Estate Plan

Creating a trust-based estate plan involves several important steps. Each step ensures that your assets are managed and distributed according to your wishes, providing peace of mind and financial security for your loved ones.

| Step | Description |

|---|---|

| 1. Determine the Type of Trust | The first step is to decide which type of trust best suits your needs. Common options include revocable living trusts, which offer flexibility and control, and irrevocable trusts, which provide potential tax benefits and asset protection. Testamentary trusts, which are created after death, are another option to consider. |

| 2. Choose a Trustee | Selecting a trustee is a critical decision. The trustee will manage the trust assets and carry out the grantor’s instructions. Choose someone who is trustworthy, competent, and willing to serve. You can also appoint a professional trustee or a financial institution if preferred. |

| 3. Fund the Trust | Once the trust is created, you must transfer your assets into it. This process, known as funding the trust, involves re-titling assets such as real estate, bank accounts, and investments in the name of the trust. Properly funding the trust is essential to avoid probate and ensure that the trust operates as intended. |

| 4. Create a Trust Agreement | The trust agreement is a legal document that outlines the terms and conditions of the trust. It should include the names of the grantor, trustee, and beneficiaries, as well as detailed instructions for the distribution of the trust assets. This legal document serves as the foundation of your trust-based estate plan. |

| 5. Review and Update the Trust | Regularly reviewing and updating your trust is crucial to ensure that it continues to meet your needs and goals. Life events such as marriage, divorce, the birth of a child, or significant changes in finances may necessitate updates to your trust. Keeping your trust current ensures that it remains effective and aligned with your wishes. |

By following these steps, you can create a comprehensive trust-based estate plan that provides flexibility, control, and peace of mind.

Related: How Long Does it Take to Set up a Trust in Texas?

Role of Trustees in a Trust Based Estate Plan

Trustees play a key role in handling trust assets by following the rules set out in the trust document. They must fulfill the grantor’s wishes. They also make sure assets go where they should, based on the instructions in the trust agreement. Trustees are held to a high standard, known as fiduciary care, in all trust-related tasks.

They protect assets within the trust and make investment decisions that match the trust’s goals. They also keep complete financial records and manage any tax paperwork for the trust. Communicating with beneficiaries is important, and trustees should address questions about the trust.

The trustee’s role can change if the original trustee becomes incapacitated or passes away. This can require a new trustee. Trustees might be personally liable for decisions made about the trust. That’s why careful management and loyalty to the trust document are essential.

How to Fund a Trust Based Estate Plan

Funding a trust is a vital step in estate planning. It involves transferring ownership of your assets into the trust. This lets the trust manage them according to your plan and helps you avoid probate. To fund a trust, you must change ownership titles so the trust is the owner. Real estate, bank accounts, investments, personal items, and businesses all need to be updated.

It’s wise to list all your assets before moving them into the trust. You’ll need deeds and account statements to finish the process. For real estate, a signed and recorded deed is needed to name the trust as the new owner. For personal property, a general legal document can show that the trust is now the owner. These legal documents are crucial so everything is handled correctly.

It’s also a good idea to talk to financial institutions about their rules for transferring assets to a trust. When you properly fund your trust, you make sure it covers all your assets and manages them the way you want.

Related: How to Transfer Ownership of an LLC to a Trust

Common Misconceptions About Trust Based Estate Plans

There are some widespread myths about trust-based estate plans that may keep people from considering them. One myth is that trusts are only for people with great wealth. In reality, trusts can benefit estates of all sizes. They skip probate and offer better control over asset distribution, which helps families of many income levels.

Another common misconception is that creating a trust means losing total control over your assets. However, revocable trusts let you keep a lot of control, and you can change or revoke them at any time while you’re alive. Some folks also think trusts only come into play after death, but they can actually take effect during your lifetime and give you immediate benefits.

Importance of Estate Planning

Estate planning is a vital process that ensures your assets are distributed according to your wishes after you pass away. Here are some key reasons why estate planning is important:

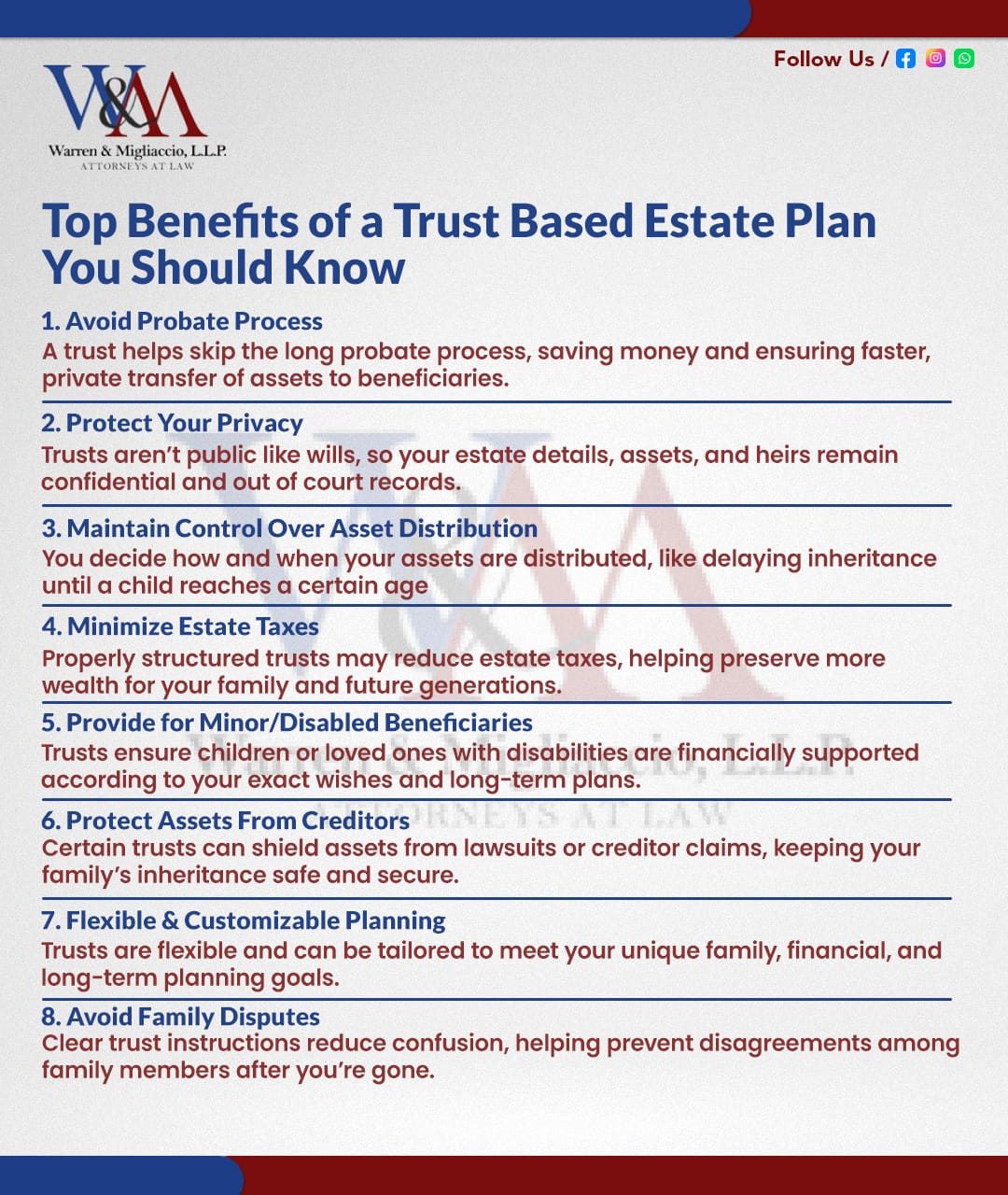

Avoid Probate: Probate is a lengthy and costly process that can be avoided with a trust-based estate plan. By transferring assets into a trust, you can ensure that they are distributed directly to your beneficiaries without the need for probate court involvement. This not only saves time and money but also keeps your financial affairs private.

Minimize Estate Taxes: A well-structured trust-based estate plan can help minimize estate taxes, allowing you to preserve more of your wealth for your heirs. By strategically placing assets into trusts, you can reduce the taxable value of your estate and take advantage of tax benefits.

Protect Assets: A trust-based estate plan can provide asset protection, shielding your assets from creditors and legal claims. This is particularly important for individuals with significant assets or those in professions with higher liability risks.

Ensure Asset Distribution: Estate planning ensures that your assets are distributed according to your wishes, rather than being subject to the laws of intestacy. This allows you to provide for your loved ones in the manner you choose, including specific bequests and charitable donations.

Provide for Minor Children: A trust-based estate plan can provide for minor children by naming guardians and setting up trusts to manage their inheritance. This ensures that your children are cared for and that their financial needs are met according to your wishes.

In summary, estate planning is essential for avoiding probate, minimizing estate taxes, protecting assets, ensuring proper asset distribution, and providing for minor children. By working with an experienced will and trust attorney, you can create a comprehensive plan that secures your legacy and provides peace of mind for you and your family.

Regular Reviews and Updates

Regularly checking and updating your trust-based estate plan makes sure it stays valid and follows your current wishes. In general, you should review it at least every three to five years, or when big life events happen, like marriage, divorce, the birth of a child, or a significant change in finances. This flexibility is key to keeping your plan effective.

Laws and rules can also change, which might affect your estate plan. So it’s important to meet with estate planning attorneys occasionally. Frequent updates help your plan keep matching your financial goals and ensure your beneficiaries get the benefits you intended.

Keeping your estate plan current is essential for protecting what you leave behind and honoring your preferences.

Frequently Asked Questions

FAQs: Estate Planning Basics

Who can benefit from estate planning, according to the text?

Everyone can benefit from estate planning, as it ensures that families are taken care of in the event of a member’s passing without a will or estate plan. This process is crucial no matter how wealthy you are.

What is a revocable living trust (RLT)?

A revocable living trust (RLT) is a legal arrangement that lets you oversee your assets during your life, while a trustee manages them and you keep control even after you pass away. This flexibility can make transferring assets to beneficiaries simpler.

What control do you retain with a revocable living trust?

With a revocable living trust, you have full control over its assets. You can handle them however you like, including buying, selling, or using property. This flexibility also means you can change the trust whenever you want while you are able.

How does a revocable living trust adapt to changing situations?

A revocable living trust is easy to update. You can add or remove assets as needed during your life, so it stays in line with your current wishes and needs.

How does a revocable living trust avoid probate in Texas?

A revocable living trust keeps legal ownership of your assets, letting them pass directly to beneficiaries without going through Texas probate courts. By changing property titles into the trust, you skip public probate and speed up distribution.Many Texans choose a living trust for its privacy benefits and to reduce court fees.It’s important to properly fund the trust by transferring deeds, bank accounts, and other financial assets into the trust’s name.

What’s the difference between a trust-based estate plan and a will in Texas?

A trust-based estate plan manages and distributes assets during your life and after death, while a will usually only takes effect once you pass away. Trusts can avoid probate, offering more privacy and faster transfers compared to a will.Wills in Texas go through probate courts, which can be time-consuming and public.A trust-based plan might also include a Pour-Over Will to catch assets not moved into the trust.

What are three advantages of a trust over a will?

1. A trust avoids probate, which speeds up asset transfers and preserves privacy.2. Trusts can manage assets if you become incapacitated.3. You can set up specific ways to give assets to certain beneficiaries, such as minors or those with financial challenges.Wills become public during probate, while trusts usually stay private.A revocable living trust also lets you make changes as your life evolves.

FAQs: Setting Up & Maintaining a Trust

How do I set up a trust-based estate plan in Texas?

To create a trust-based estate plan, draft a trust document, appoint a trustee, and fund the trust by putting assets in its name. An estate planning attorney can help ensure you meet legal requirements.Common steps include:1. Choose the Right Trust Type: Revocable vs. irrevocable.2. Appoint a Trustee: You can act as your own trustee for a revocable trust.3. Transfer Assets: Deeds, bank accounts, and other assets need to be properly moved into the trust.

When should I consider an irrevocable trust?

You might consider an irrevocable trust for stronger asset protection, possible estate tax benefits, or shielding assets from creditors if your estate is large or complicated. Once created, you usually can’t change an irrevocable trust. Yet it can add extra security for your assets.Irrevocable life insurance trusts (ILITs) remove life insurance payouts from your taxable estate.Be sure you’re comfortable giving up control before choosing an irrevocable trust.

How much does a trust-based estate plan typically cost?

Costs can range from a few hundred dollars (for DIY services) to several thousand when hiring a lawyer, based on how detailed your plan is and where you live. In Texas, most complete plans (with a living trust, pour-over will, and powers of attorney) cost between $1,500 and $5,000 or more.Prices vary with the number of trusts, property transfers, and special provisions.You might pay more for updates over time, but these keep your plan up to date.

What assets should I put into a trust to avoid probate?

Real estate, bank accounts, investments, and other valuable assets should be re-titled into the trust so they skip probate. Some accounts like retirement funds or life insurance can bypass probate if they have named beneficiaries.1. Always speak with an attorney or financial advisor before transferring assets to follow any lender or institution rules.2. Keep a clear record of trust-owned assets to make management easier.

Can I be my own trustee, and how does that work?

Yes, you can serve as trustee for your revocable living trust. You keep full control of assets just as if you owned them personally. If you become incapacitated or pass away, your successor trustee steps in to oversee asset distribution.Being your own trustee lets you buy, sell, and use trust property at will.The successor trustee takes over without a court hearing, making the change smoother.

How do taxes work for a trust-based estate plan?

A revocable trust usually uses your own Social Security number, so you report trust income on your personal tax return. An irrevocable trust often has its own tax ID and must file a separate return, which can help reduce estate taxes if set up properly.Texas doesn’t have a state estate tax, but federal estate taxes can apply if your estate surpasses federal limits.Certain trusts, like an irrevocable life insurance trust (ILIT), may exclude large insurance payouts from your taxable estate.

Can a trust help protect assets from creditors or lawsuits?

An irrevocable trust can protect assets from creditors because they’re no longer considered your personal property. However, a revocable living trust doesn’t typically guard against lawsuits or creditors, since you still control the assets.Asset protection often involves irrevocable trusts or other structures.Always talk to an attorney to comply with laws regarding fraudulent conveyance and creditor protection.

How long does the trust-based estate planning process take?

Setting up a trust-based estate plan usually takes a few weeks to a few months, depending on your assets and how quickly you finish paperwork. Delays can happen if you have multiple properties, unusual business assets, or need extra reviews.Funding the trust (moving assets into it) is often the most time-consuming part.Working with qualified professionals can speed things up.

FAQs: Family Considerations and Mistakes

What is the biggest mistake parents make when setting up a trust fund?

A common mistake is not explaining when and how children should receive trust assets. Without clear guidelines, kids might get funds too early, leading to misuse.Parents should also pick a dependable trustee or co-trustee to manage the child’s finances.They should update the trust every so often to match a child’s changing needs.

What is the disadvantage of an estate trust?

One drawback can be the initial cost and effort, including lawyer fees and ongoing management. Some irrevocable trusts also limit your power over assets once they’re placed in the trust.Not properly funding the trust can ruin its benefits by pushing assets back into probate.Annual reviews or updates may be needed to keep the trust in line with new laws or life changes. think ;longer

Summary

Trust-based estate plans offer many benefits. They help you avoid probate, protect your privacy, reduce estate taxes, and support loved ones who may need special care. By understanding the key parts and types of trusts, you can create a plan that fits your unique goals. Reviewing your plan regularly keeps it strong as your life and needs change.

In short, a trust-based estate plan is a smart and flexible way to manage your estate. It brings peace of mind and financial protection for you and your family.

Our experienced estate planning attorneys in Texas are ready to help you create a plan that fits your needs. During your consultation, we’ll go over your situation, answer your questions, and explain how we can support you. Call us at (888) 584-9614 or contact us online to start planning your estate today.