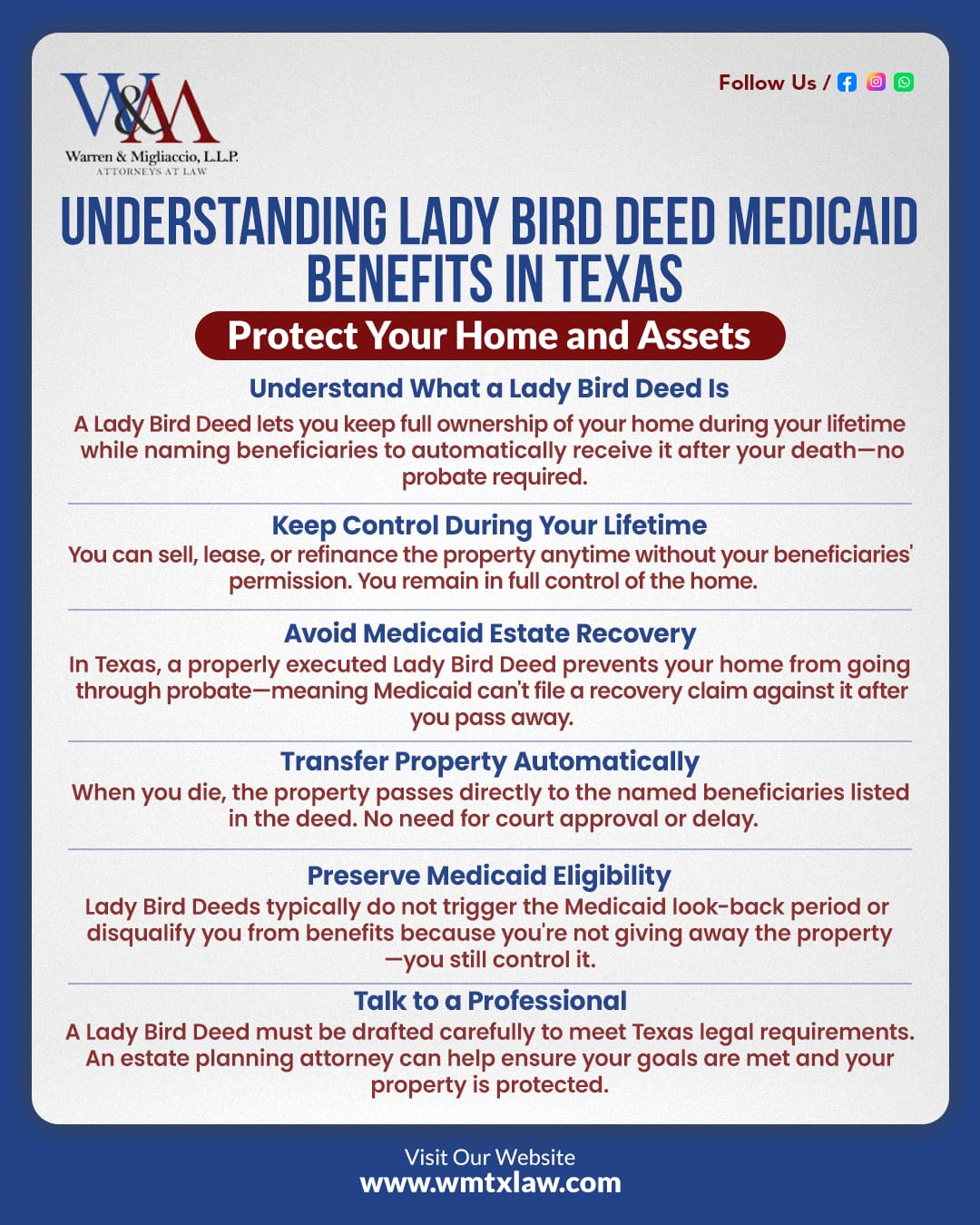

Can a lady bird deed Medicaid help protect your home from Medicaid Estate Recovery? Yes, it can. This article explains how a lady bird deed Medicaid, also called an enhanced life estate deed, lets you keep your home while staying eligible for Medicaid in Texas. You’ll learn about its main benefits, possible downsides, and how to set one up.

Key Takeaways

- A Lady Bird Deed allows a property owner to keep full control of the property. It makes sure that the property goes straight to heirs. This avoids probate and may help prevent Medicaid estate recovery problems.

- In Texas, Lady Bird Deeds receive legal recognition that protects homestead properties from Medicaid claims, helping estate planning go more smoothly.

- Creating a Lady Bird Deed requires following certain legal procedures. It’s wise to consult an elder law attorney to ensure you meet Texas requirements and fit the deed into your estate plan.

What is a Lady Bird Deed?

An enhanced life estate deed, also called a ladybird deed, is an estate planning tool that lets property owners maintain full ownership of their real property during their lifetime. It also makes sure the property skips probate and goes directly to designated beneficiaries at the owner’s death. This modern version of a traditional life estate deed is useful for transferring a primary residence smoothly after someone passes away.

Unlike a traditional life estate deed, which forces the grantor to give up rights to the property right away (leading to possible gift tax or Medicaid penalties), a lady bird deed gives the property owner greater flexibility. The owner can sell it, take out a mortgage, or even change beneficiaries without asking anyone else for permission. This power helps you avoid a lengthy probate process. Many people also use a lady bird trust as an additional way to manage properties in an estate.

Features of Lady Bird Deeds

A lady bird deed grants the property owner full control of both the ownership interest and the real property itself. After signing this deed, the owner can still sell or mortgage the property without needing the heirs’ approval. This marks a big change from a traditional life estate deed, which typically limits the owner’s freedom to manage the property.

This type of deed also lets the property pass right away at the grantor’s death, bypassing probate court. It keeps homestead exemptions and may offer tax advantages. Lady Bird Deeds are often used to protect against Medicaid estate recovery so heirs can keep the family home after the owner’s death. By clearly separating the property’s ownership during life and after death, a lady bird deed helps prevent Medicaid from claiming assets that go through probate.

Lady Bird Deed in Texas

In Texas, Lady Bird Deeds serve as a legal tool that helps people handle their estate and protect their property from problems linked to Medicaid assistance. Along with a handful of states like Florida, Michigan, Vermont, and west Virginia, Texas allows this type of deed. This means owners in Texas can shield their real property from Medicaid recovery claims while still having full control of the property.

By using a Lady Bird Deed, a Texas property owner can transfer the property to heirs right after the death of the grantor, without needing to go through probate. This fast transfer saves time, saves money, and helps protect the home from Medicaid claims once the owner dies. Also, Lady Bird Deeds help manage assets under Medicaid’s asset limit, making it simpler to keep Medicaid benefits and safeguard the estate from the Medicaid estate recovery program.

How Lady Bird Deeds Interact with Medicaid

Lady Bird Deeds help protect a person’s home from Medicaid estate recovery while also allowing them to keep their Medicaid benefits. When you use a Lady Bird Deed, you can greatly reduce or block Medicaid’s ability to claim the home after the owner’s death. This is because the deed usually does not count as a gift or penalty for Medicaid eligibility purposes. Plus, property passed through a Lady Bird Deed does not start a Medicaid penalty period since the property can be retitled without needing the remainderman’s approval.

Even though a primary residence often is not considered a countable asset for Medicaid eligibility purposes (as long as it meets equity limits), it’s still important to know the current Lady Bird Deed rules. An elder law attorney can help you avoid errors that might risk your benefits or make you ineligible for Medicaid.

Protect Your Legacy

By leveraging a Lady Bird Deed, you safeguard your home against Medicaid claims while retaining control during your lifetime.

Medicaid Estate Recovery Explained

Medicaid estate recovery programs aim to recoup some of the money paid for long-term care Medicaid from the estates of people who received Medicaid and later died. If a person used Medicaid for long-term care costs, the state may try to recover those costs from their estate. However, certain assets—like a primary home—can sometimes be protected, based on the specific rules.

A lady bird deed can be very helpful in cutting down or preventing Medicaid’s claim on a person’s property. Because it’s generally not viewed as an official transfer of the home during the owner’s lifetime, it usually doesn’t affect Medicaid eligibility requirements. In many such cases, it’s a key option for Medicaid planning. It allows property owners to pass the home to heirs without Medicaid trying to recover costs after the death of the Medicaid recipient.

The Data Behind Lady Bird Deeds and Medicaid Planning

Lady Bird Deeds have shown real benefits for protecting assets in Texas. Since the Texas Medicaid Estate Recovery Programs (MERP) started, they have gathered over $500 million worth of assets from estates (Source). This amount highlights the need for smart Texas estate planning. It reminds families that they need to protect their most valuable asset—often the family home—from Medicaid.

Moreover, Texas does not pursue estates worth less than $10,000 for MERP claims (Source). This detail offers another planning point for homeowners. The Medicaid planning process can include several legal strategies, such as Lady Bird Deeds, to preserve assets and reduce financial burdens after death. All this shows how Lady Bird Deeds are essential if you want to protect generational wealth.

Smart Asset Protection

Strategic estate planning with a Lady Bird Deed can preserve significant assets, highlighting the value of proactive legal measures.

Protecting Your Home from Medicaid Estate Recovery

Lady Bird Deeds form a strong line of defense against Medicaid estate recovery. They allow the family home to stay out of Medicaid’s reach. When a Medicaid applicant’s home is moved via a Lady Bird Deed, the property shifts to chosen heirs automatically at the owner’s death because of this special type of deed (sometimes called a death deed). This transfer often goes to a family member, which keeps the home in the family.

This setup lowers the chance that Medicaid can place a claim on the property and helps make sure the primary residence remains in the family. It’s especially important for homeowners who want to pass the house on to loved ones without worrying about state interference.

Benefits of Using Lady Bird Deeds in Medicaid Planning

Using Lady Bird Deeds in Medicaid planning brings several advantages:

- Medicaid Protection: You stay qualified for Medicaid benefits, and the deed typically doesn’t count as a transfer that affects Medicaid eligibility purposes. However, you should not rely on it solely to qualify for Medicaid, because eligibility also depends on meeting certain income and asset limits.

- Easy Transfer: The deed makes for a smooth, direct transfer of ownership of the property to heirs.

- No Probate: It helps families avoid the probate court process, which saves time and money.

- Continued Use: You keep the right to live in and control the home while you’re alive, giving peace of mind to you and your family.

Once you pass away, the designated beneficiaries usually get the property without extra fees or delays. This is a major bonus for families who wish to preserve assets for future generations.

Avoiding Probate with Lady Bird Deeds

One major advantage of a lady bird deed is that it helps you avoid the probate process. By naming designated beneficiaries to receive the property directly, the property transfers to them right after the owner’s death. This avoids the usual court-led steps that can be pricey and take a long time.

Also, transferring title with a Lady Bird Deed involves making sure there are no liens or judgments that might stop the life tenant from transferring title when they die. Skipping probate lowers the stress on family members during a tough time. Because of that, a Lady Bird Deed can be a great part of your estate plan.

Retaining Control Over Property

In Texas, homeowners can mix lady bird deed benefits with the homestead protections provided by Texas law. This creates a powerful blend that allows you to stay fully in charge of your home. You can sell it, place a mortgage on it, or make other decisions whenever you need to. With a properly signed Lady Bird Deed in Texas, you can also convey your property without facing penalties. However, the life tenant must avoid any action considered waste, which could harm the property’s value and the remainder beneficiary’s interest.

Keeping your homestead exemption can lower property taxes. As a result, choosing a Lady Bird Deed is often an effective way to protect your home while remaining financially flexible.

Tax Implications of a Lady Bird Deed

A Lady Bird Deed (enhanced life estate deed) carries important tax implications. One of its biggest advantages is that it allows the grantor to keep control of the property, avoid probate, and reduce estate taxes. When the grantor passes away, the property goes to the remainder beneficiary, and the grantor’s estate usually won’t owe estate taxes on that property.

Still, remember that if the grantor’s revocable living trust sells the property during the grantor’s life, there could be capital gains taxes. If the grantor’s estate owes federal estate taxes, the property might also be included in the taxable estate.

It’s best to talk to an elder law attorney about these tax matters. They can guide you through the rules of Lady Bird Deeds and help you shape an estate plan that meets your needs.

Role of an Elder Law Attorney

An elder law attorney is essential for creating a Lady Bird Deed that suits your needs and aims. They can help with several key tasks:

- Writing and reviewing the Lady Bird Deed so it follows state laws

- Advising on the tax effects of the deed and making sure it fits your estate plan

- Explaining the pros and cons of a Lady Bird Deed so you can decide if it’s the right choice

- Helping transfer property into the Lady Bird Deed and filing any required paperwork

- Providing guidance on keeping control of the property while avoiding probate and lowering estate taxes

Working with a skilled elder law attorney ensures your Lady Bird Deed is done correctly and that your estate plan meets your specific goals.

Expert Guidance Matters

Consulting an elder law attorney ensures your deed is executed correctly, minimizing risks and securing your family’s future.

Drawbacks and Considerations of Lady Bird Deeds

Although lady bird deeds offer many benefits, here are a few points to consider:

- Changing Beneficiaries: The property owner can change beneficiary designations at any time. This might cause disagreements among family members.

- Recognition: Not all states allow these deeds, so where you live can limit your options.

- Home Equity: A Lady Bird Deed might make it harder to tap into your home equity later. Also, title insurance companies could have special rules or extra requirements when it comes to changing remaindermen and insuring titles.

Limited Availability by State

Only a handful of states—such as Texas, Florida, Michigan, Vermont, and west Virginia—recognize lady bird deeds. If your property is in a state that doesn’t allow them, you’ll have to look for other ways to guard your assets from Medicaid recovery. States have different legal document rules for these deeds, so make sure you learn the rules in your location. Also, if a life tenant sells a home and buys a new one, the old Lady Bird Deed won’t transfer. You’d need a new lady bird deed for the new property.

Equity Access Challenges

One concern with a lady bird deed is that it might limit access to your home’s equity. After signing this deed, getting cash out of your property could become more complicated. This can be a problem if you need money for large expenses, like medical bills. Also, using a Lady Bird Deed might affect your home’s equity, which is important for financial checks tied to Medicaid eligibility.

Because of that, it’s smart to think about future plans. If you believe you’ll need to tap your home equity, consider talking to a professional to decide if a Lady Bird Deed is right for you.

Creating a Lady Bird Deed In Texas

To create a Lady Bird Deed in Texas, you must write the deed, sign it, notarize it, and then record it. This helps ensure it’s legally valid and offers full protection. It’s also important to work with a title insurance company so the deed meets all state requirements and remains insurable. By handling these steps properly, you can keep your Medicaid benefits and pass the property to your chosen heirs without delays.

Steps to Create a Lady Bird Deed In Texas

Below are the basic steps for creating a Lady Bird Deed in Texas:

- Draft the Deed: Use a suitable form that clearly describes the real property. It’s wise to detail the life tenant’s rights in the first Lady Bird Deed, such as the ability to change the remainderman.

- Sign and Notarize: Sign the deed in front of a notary. Ideally, the remainder beneficiary should also be present to understand future outcomes.

- Record the Deed: While unrecorded deeds can still be valid, filing it with your local county office provides extra legal protection and alerts the public to the transfer.

- Keep Copies Safe: Keep the deed safe, and let family members know where to find it.

Costs vary from about $30 if you do it yourself to $200–$500 if you hire a professional.

Interactive Timeline: Steps to Create a Lady Bird Deed in Texas

Draft the Deed

Use a suitable form that clearly describes the real property. It’s wise to detail the life tenant’s rights in the first Lady Bird Deed, such as the ability to change the remainderman.

Sign and Notarize

Sign the deed in front of a notary. Ideally, the remainder beneficiary should also be present to understand future outcomes.

Record the Deed

File the deed with your local county office. Recording provides extra legal protection and alerts the public to the transfer.

Keep Copies Safe

Keep the deed safe and ensure your family knows where to find it. This step is vital for safeguarding your investment and ensuring future accessibility.

Working with an Attorney in Texas

You don’t have to hire an elder law attorney, but it’s often a good idea. They know how to ensure the deed meets Texas law and fits smoothly into your estate plan. They can also help prevent mistakes that hurt your Medicaid eligibility or cause confusion about ownership interest. Elder law attorneys often take a conservative approach to drafting trusts, making sure they’re ready for future legal changes that can affect Medicaid planning.

With an experienced attorney’s guidance, you’ll follow all legal requirements and enjoy an extra layer of safety in your estate plan. This is the best way to be sure your Lady Bird Deed achieves what you want under Texas law.

Alternatives to Lady Bird Deeds for Medicaid Planning

If you’d like other options, you could try a Medicaid asset protection trust (MAPT) or see if other exemptions apply. These options can provide similar benefits and sometimes avoid certain limits of a Lady Bird Deed. A life estate holder keeps ownership and control while alive, with set rights and responsibilities for property management, changing the remainderman, and managing estate planning issues tied to Medicaid.

Medicaid Asset Protection Trusts (MAPT)

A Medicaid asset protection trust (MAPT) is one possible alternative. By placing your real property into an irrevocable trust, it may not be seen as a countable asset if you apply for long-term care Medicaid. This shields the property from Medicaid estate recovery while still giving you some control over trust assets.

In the context of Lady Bird Deeds, a life estate holder can transfer a fee simple estate without needing the remaindermen’s permission. This is crucial for understanding property rights and other legal details.

Be aware that a MAPT has to be set up well in advance due to the look-back period that can affect Medicaid eligibility. You should consult a legal professional, as these trusts can get complex.

Other Exemptions and Strategies

There are other Medicaid eligibility exemptions and approaches you can use to protect property:

- Child Caregiver Exemption: A Medicaid applicant’s home can pass to an adult child who has been the main caregiver, without causing penalties.

- Sibling Exemption: A person can give property to a sibling if certain conditions are met under federal law and if this transfer doesn’t break the look-back period.

- Joint Tenants with Right of Survivorship (JTWROS): This form of ownership can protect a home from Medicaid Estate Recovery (MERP). If one owner dies, creditors usually can’t claim the property, so it stays with the surviving owner.

By using these exemptions, property owners can protect assets even if a lady bird deed isn’t allowed or isn’t the best choice in their area.

Non-Homestead Real Estate and Lady Bird Deeds

A Lady Bird Deed can also transfer non-homestead real estate, like vacation homes or investments, to a remainder beneficiary. However, non-homestead real estate may have different tax concerns and rules than homestead property. Keep the following in mind:

- The property might face capital gains taxes if it’s sold while the grantor is alive.

- It could be part of the grantor’s taxable estate if federal estate taxes apply.

- It could be subject to certain state regulations on non-homestead property transfers.

An elder law attorney can guide you through the steps for transferring non-homestead real estate with a Lady Bird Deed and make sure it fits your broader estate plan.

Frequently Asked Questions

Lady Bird Deeds vs. Other Deeds

What is the difference between a Lady Bird Deed and a standard life estate deed?

A Lady Bird Deed (enhanced life estate deed) allows the original owner to keep full control and to sell or mortgage the real property without the future beneficiary’s consent.

A standard life estate deed usually needs the beneficiary’s approval for major decisions.

Is a Lady Bird Deed better than a Transfer on Death (TOD) Deed for Medicaid planning?

A Lady Bird Deed might give you more flexibility for avoiding Medicaid estate recovery, while a transfer-on-death deed (TOD) can be simpler but isn’t recognized in every state.

Medicaid Planning and Recovery

How does a Lady Bird Deed impact the Medicaid Estate Recovery Program after the owner’s death?

A properly signed Lady Bird Deed can keep your home out of the probate estate that Medicaid might target, because the property passes instantly to your heirs.

Does a Lady Bird Deed replace the need for a revocable living trust in Medicaid planning?

Not necessarily. A Lady Bird Deed can avoid probate court and limit Medicaid estate recovery, but a revocable living trust can:

- Hold multiple assets

- Increase privacy under a privacy policy

- Help manage long-term care costs

Taxes and Financial Considerations

Does a Lady Bird Deed affect capital gains or property taxes for heirs?

Heirs who get property through a Lady Bird Deed often benefit from a stepped-up tax basis, which can lower capital gains if they sell soon after inheriting.

Property taxes typically stay connected to homestead exemption rules, but heirs might need to apply under their own names.

Can a mortgage or lien remain on a property covered by a Lady Bird Deed in Texas?

Yes. A mortgage or lien that already exists will remain on the property.

However, title companies may require more information, and you should let your lender know about any deed change.

Geographic Validity

Are Lady Bird Deeds valid in states other than Texas and Florida?

Yes. Besides Texas and Florida, Lady Bird Deeds are recognized in Michigan, Vermont, and West Virginia.

However, federal law does not standardize them, and many states do not allow them.

Summary on Lady Bird Deed Medicaid

A lady bird deed is a useful tool for protecting your home and keeping control of it while remaining eligible for Medicaid benefits. It immediately transfers ownership of the property when you die. Hence, helps you avoid probate, and can shield the home from Medicaid recovery in Texas and a few other states.

Still, you should look into other options, like a Medicaid asset protection trust or other exemptions, in case a lady bird deed doesn’t work in your state. An elder law attorney can guide you through your options and help you avoid errors. With early planning, you can protect what may be your most valuable asset and give your family peace of mind for years to come.

If you’re unsure where to begin, our experienced estate planning attorneys in Texas are here to help. We can walk you through your options and help you create a plan that reflects your goals. Call us at (888) 584-9614 or contact us online to start planning today.