Planning your estate in Texas can feel like a chess game, and the Lady Bird Deed might seem like the winning move.

However, this legal tool, designed to streamline property transfer, has its pitfalls.

Let’s explore why Texas residents may face challenges with a Lady Bird Deed, touching on:

- Medicaid Recovery

- Inflexibility Post-execution

- The Importance of Seeking Professional Guidance

Understanding the Lady Bird Deed in Texas

Texas homeowners favor the Lady Bird Deed, an enhanced life estate deed. Unlike traditional life estates, it lets you enjoy and control your property while alive and ensures a seamless transfer after death, avoiding probate court complexities.

While it provides advantages, it’s essential to dissect the potential disadvantages.

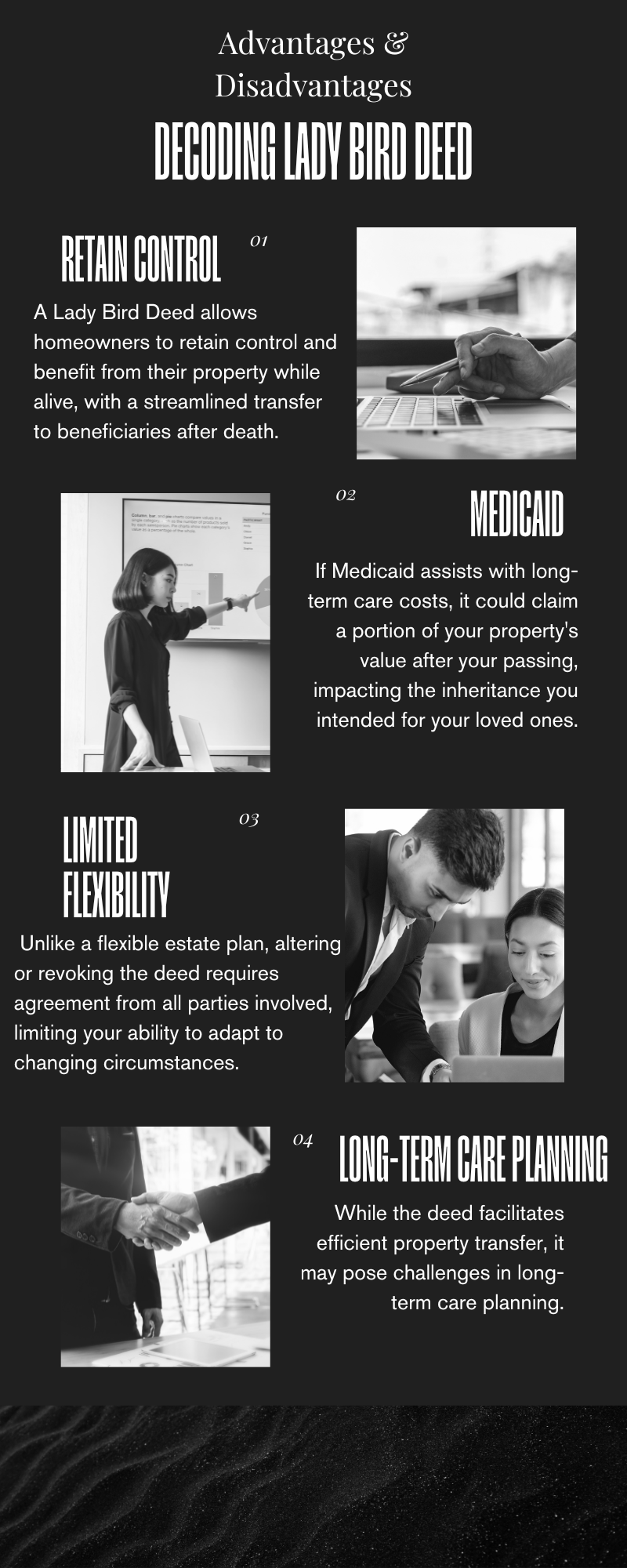

Advantages of a Lady Bird Deed: A Balancing Act

A Lady Bird Deed is akin to enjoying a breezy day while securely holding onto your favorite hat. It allows homeowners to retain full control and benefit from their property while alive, smoothly transitioning it to loved ones after death.

The magic lies in bypassing probate court, offering simplicity and efficiency in estate planning.

The Flip Side: Disadvantages of a Lady Bird Deed

While undoubtedly advantageous, Lady Bird Deeds come with potential pitfalls:

- Medicaid Estate Recovery Concerns: The smooth transfer of property outside probate takes an unexpected turn when Medicaid comes into play. If you’ve encountered Medicaid for long-term care, the Lady Bird Deed could expose your estate to recovery efforts. After your passing, Medicaid may assert its claim to recover expenses, potentially impacting the property you intended to pass on to your loved ones.

- Limited Flexibility Post-Execution: Once a Lady Bird Deed is signed, altering it becomes a complex task. Changes require agreement from all involved parties, and major adjustments are challenging. This lack of flexibility could pose difficulties in adapting to changing life circumstances.

- Long-Term Care Planning and Lady Bird Deeds: Long-term care planning adds another layer of complexity. While the Lady Bird Deed facilitates efficient property transfer, it may clash with the need for flexible options in long-term care planning. Rigid plans can become a hindrance when facing the uncertainties of future healthcare needs.

Professional Guidance in Estate Planning: Navigating the Labyrinth

Navigating these complex legal waters requires more than self-help. An estate planning attorney is not just an advisor but a skilled strategist.

They craft personalized strategies aligned with the unique nuances of your life story. This ensures that no unexpected threads unravel down the line, providing a sense of security in the face of life’s uncertainties.

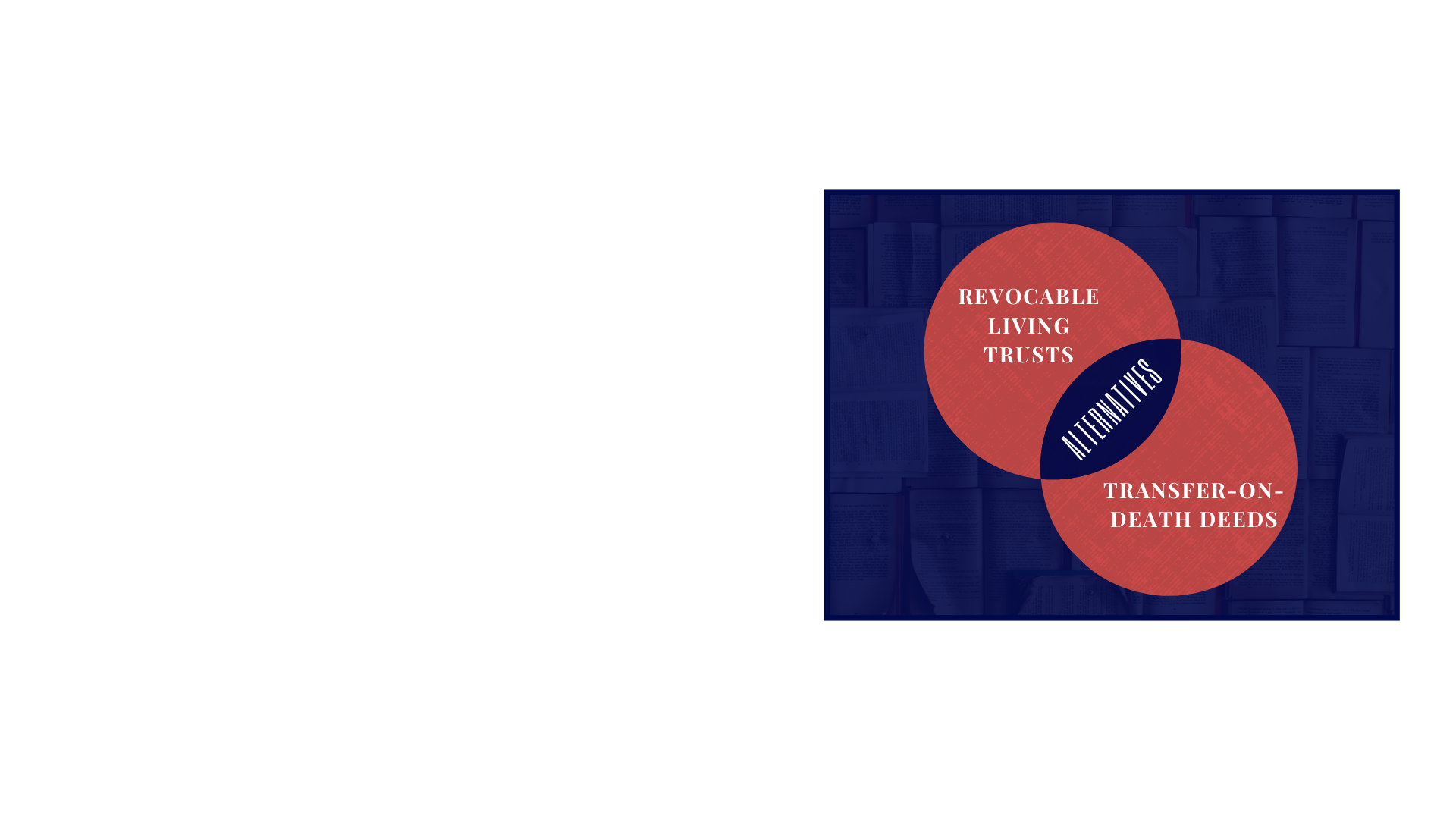

Alternatives to Consider: Revocable Living Trusts and TODDs

Instead of solely relying on a Lady Bird Deed, consider alternatives like revocable living trusts and Transfer-on-Death Deeds (TODDs). These offer flexibility, allowing adjustments as life unfolds, and offer different approaches to avoid probate:

- Revocable Living Trusts: A revocable living trust offers flexibility and control, allowing changes to your estate plan as needed. It ensures a smooth transfer of assets without the constraints of a Lady Bird Deed.

- Transfer-on-Death Deeds (TODDs): TODDs provide an alternative for bypassing probate, allowing homeowners to maintain control and make changes to their property arrangements as circumstances evolve.

Real-Life Implications: Choosing Wisely for Tomorrow

So, you’re eyeing the Lady Bird Deed — it’s like having your cake (property transfer without probate) and eating it too (keeping control during your lifetime).

But, before you sign the dotted line, let’s talk real life:

- Medicaid Roulette: Here’s the scoop: If you’ve tangled with Medicaid for long-term care, your Lady Bird Deed might trigger a showdown. Medicaid could swoop in posthumously, trying to recover expenses. Your home, meant for your loved ones, might face a bit of a tug-of-war.

- Exit Ramp Lockdown: Imagine deciding you want to shift gears after signing off on that deed. Well, it’s not as easy as changing your mind — it’s more like trying to exit a highway without a ramp. Flexibility post-execution? Not really its strong suit.

- Long-Term Care Plot Twist: Life’s unpredictable, especially health-wise. The Lady Bird Deed? It loves straightforward plans, not so much twists. If you’re eyeing long-term care, those rigid plans might clash with the healthcare unknowns.

Professional guidance isn’t just an option—it’s a necessity when navigating complex legal waters. Estate planning attorneys craft strategies tailored to individual life stories, ensuring a smooth transition for those inheriting the legacy.

Source: ClearEstate

Frequently Asked Questions

Do you pay taxes on a Lady Bird Deed in Texas?

Nope, no taxes here! Transferring property with a Lady Bird Deed gives the taxman a break, skipping the probate fuss.

What are the disadvantages of a Lady Bird Deed?

Watch out for Medicaid recovery and the lack of wiggle room post-signing – those are the drawbacks.

What is the advantage to a Lady Bird Deed in Texas?

In the Lone Star State, it’s the golden ticket to avoiding probate chaos and keeping property rights until the curtain falls.

What to do with a Lady Bird Deed after death in Texas?

Keep it simple – the home heads straight to your chosen ones without the probate hoopla. Just be sure to file that death certificate pronto.

Securing Tomorrow With Informed Decisions

Considering a Lady Bird Deed? Acknowledge the Medicaid recovery risk and potential inflexibility.

While it streamlines probate avoidance, other factors, especially in long-term care planning, need careful consideration. Ensure that your estate plan aligns with your goals and adapts to life’s uncertainties.

- Seek professional advice

- Explore alternatives

- Make decisions grounded in reality to establish a solid plan for the future

Schedule a Consultation for Personalized Guidance

Ready to set sail on your estate planning voyage or looking for insights into Lady Bird Deeds and alternatives? Our seasoned attorneys are here to offer personalized guidance tailored to your unique circumstances.

To kick things off, dial our law office at (888) 584-9614, or conveniently connect with us online to schedule a consultation. With a deep understanding of Texas property laws, our expertise ensures you navigate the legal landscape with confidence.

Your peace of mind and the seamless transfer of your legacy top our priority list. Let’s chart a course together for a future that aligns with your wishes. Reach out today, and let’s commence crafting an estate plan that stands the test of time.