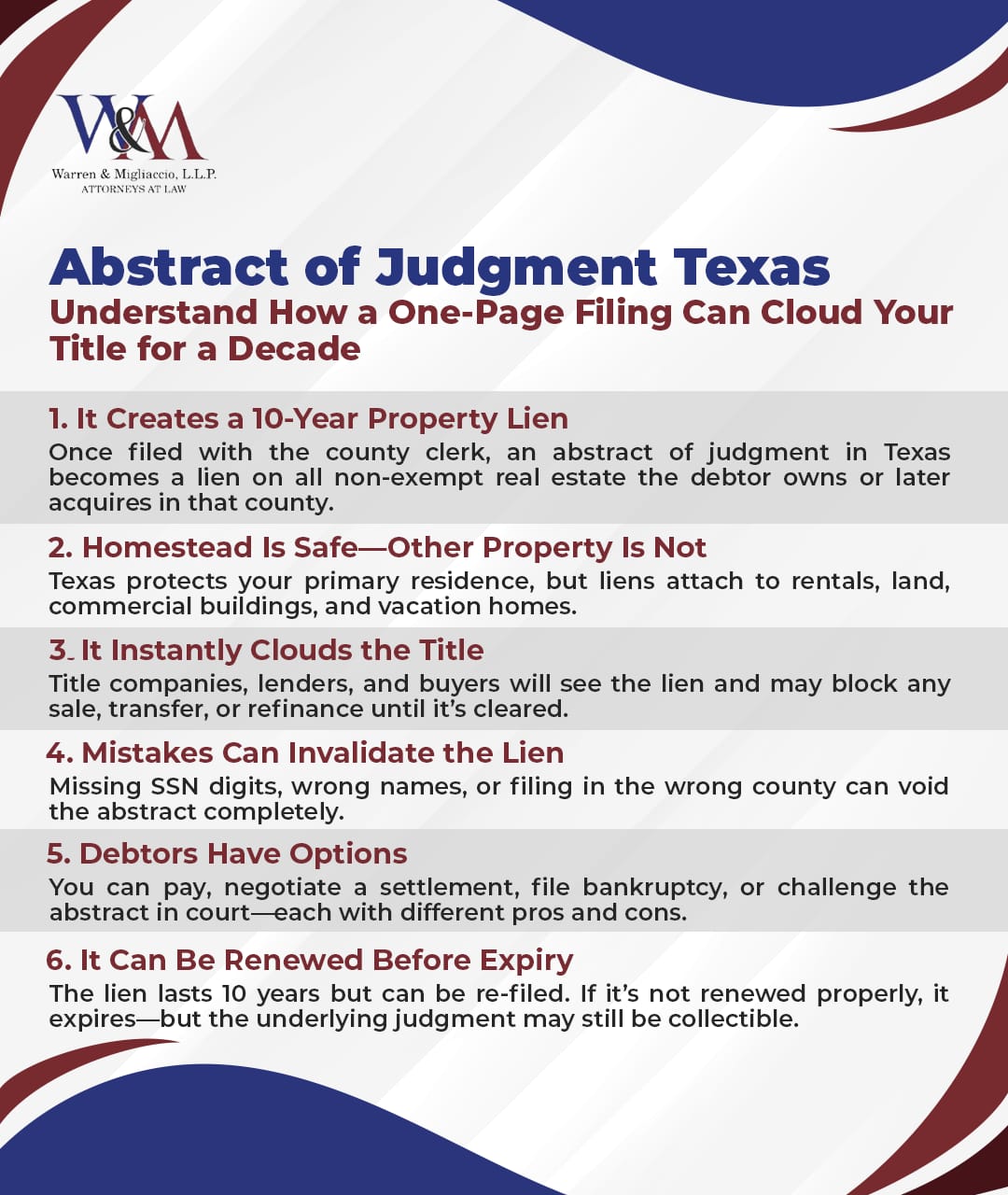

In Texas, a certified one-page abstract of judgment recorded with the county clerk immediately becomes a judgment lien on all non-exempt real property you own—or later buy—in that county. The lien usually lasts ten years and can often be renewed before it expires.

Introduction

Received notice that an abstract of judgment was just filed against you? That single sheet of paper can cloud the title to your Texas home within about 24 hours and block a sale or refinance. We defend judgment debtors throughout Texas from offices in Richardson and Plano, helping families protect homes, savings, and peace of mind. If a creditor has recorded a lien against you, our experienced Texas judgment lien attorneys are ready to review your options in a free consultation—call (888) 584-9614 today.

For help with judgment enforcement pressure, settlement negotiations, lien releases, or bankruptcy options, contact our legal team to discuss your situation and get clear next steps.

Quick Answer: What an Abstract of Judgment Does in Texas

If an abstract of judgment has been filed against you in Texas, it means a creditor has turned a court ruling into a public lien against your non-exempt real estate. The lien typically lasts 10 years and can be renewed.

Impact on You:

- Cloud on Title: It prevents you from selling or refinancing property until resolved.

- Homestead: Your primary home is generally protected from forced sale, but the lien still complicates closing.

- Solutions: You can often negotiate a partial release, settle for a lump sum, or discharge the debt in bankruptcy.

Legal Analysis by Christopher Migliaccio | Texas Bar #24053059

A Texas judgment lien attorney can often:

- Confirm whether the lien really attaches to your home or other property

- Negotiate a payoff or partial release so a sale or refinance can close

- Challenge defects in the abstract or in the judgment itself

- Use Chapter 7 or 13 bankruptcy, when appropriate, to discharge the debt and avoid the lien on exempt property

If You Were Just Sued, Your Answer Deadline Matters

The judgment that led to this lien started as a lawsuit. If you have just been served, these Texas answer deadlines apply:

| Court | Rule | Deadline to file your answer |

|---|---|---|

| Justice court (small claims) | TRCP 502.5 | By the end of the 14th day after you were served |

| County or district court | TRCP 99(b) | On or before 10:00 a.m. on the Monday after 20 days from service |

Missing these deadlines can lead to a default judgment and, later, an abstract of judgment lien. If you were just served, call us at (888) 584-9614 or visit our Texas debt lawsuit defense page to learn how we help Texans respond on time.

What Is an Abstract of Judgment in Texas?

An abstract of judgment is the certified public-record notice that turns a Texas court’s money judgment—even from a small claims case—into a real-property lien.

In Texas, a judgment lien attaches to real estate when a creditor records a properly prepared abstract of judgment in the county where the debtor owns property. Once recorded, the abstract becomes part of the county’s real property records.

The lien does not appear out of nowhere. It follows a legal process that starts when a creditor sues you, you are served, and the court signs a judgment—sometimes because the debtor never filed an answer. The abstract is the bridge between that court judgment and real-world collection efforts. It can freeze property transactions, block refinances, and create long-term pressure to pay.

Under Texas law, the abstract of judgment must be in writing and must include specific contents required by statute to ensure the judgment lien is valid and enforceable.

Required data under Tex. Prop. Code § 52.002:

- Full name of the judgment debtor

- Last three digits of the debtor’s Social Security number or Texas driver’s license number, if available

- Date of birth, if available

- Last known address of the debtor

- Total amount of the judgment, including principal, interest, court costs, and attorney’s fees

- Cause number and the court that signed the judgment

- Name and address of the judgment creditor

- Date the abstract was issued by the clerk of the court

Because county clerks index these forms in the real property records, every title company, mortgage lender, and savvy real estate buyer can see the lien almost immediately.

Why Creditors File an Abstract: Turning a Money Judgment into a Judgment Lien

Texas follows a “lien theory.” When the creditor records the abstract, it automatically attaches a judgment lien to the debtor’s non-exempt real property in that county. The judgment itself is the court’s order to pay; the abstract is official notice to the world about the creditor’s legal claim against the debtor’s property.

The defendant, also called the judgment debtor, is the person whose assets may be subject to the lien. Proper documentation of the judgment is essential for enforcement and for any later challenges.

Practical scenario: You plan to sell a Frisco rental house. Days before closing, the title examiner spots an old abstract. Until you pay, settle, avoid, or discharge the lien, the buyer’s lender may refuse to close.

Strategic Filing Considerations

Many creditors file in counties where the debtor’s family members reside, anticipating future inheritances or property transfers. Others focus on counties with active real estate markets where the debtor might purchase property in the future.

It is crucial to record the abstract of judgment in the correct Texas county (or counties) to ensure the judgment lien properly attaches to the debtor’s non-exempt real property.

This strategic approach lets creditors cast a wide net for future collection opportunities while putting pressure on the debtor to resolve the judgment.

Lien Attachment Rules for Real Property vs. Homestead

Texas homestead exemptions provide some of the nation’s strongest protections:

- Homestead property: Exempt from most judgment liens; the lien does not legally attach, but the abstract can still appear in title searches.

- Rental houses, raw land, lake lots, commercial buildings: Non-exempt; judgment liens can attach.

- Personal property—cars, furniture: Generally remains free of judgment liens.

- Personal property exemptions: Under current law, up to $50,000 for a single adult or $100,000 for a family in qualifying personal property.

As a result, the abstract creates a lien that affects non-exempt real property you own when it is recorded and property you acquire later in that county, as long as the lien remains valid. This prospective effect makes abstracts powerful collection tools.

Priority Battles: Taxes, Mortgages, and Other Liens

Priority among competing liens generally follows the rule of “first in time, first in right” unless a statute grants special priority:

- Property taxes (always first)

- Constitutional mechanic’s and materialman’s liens

- Purchase-money mortgage

- Home-equity liens

- Abstract of judgment lien

- Subsequent writs of garnishment or additional abstracts

Earlier, properly recorded liens usually win the priority race. A judgment lien may still be paid at closing, but only after senior liens are satisfied.

Texas Filing Requirements & Deadlines with the County Clerk

To record a valid abstract and create a Texas judgment lien, creditors generally follow these steps:

- Obtain a certified abstract from the issuing county or federal court clerk.

- Verify the debtor’s name, last three SSN or DL digits, and birthdate against the judgment.

- File in every Texas county where the debtor owns—or may soon buy—real estate.

- Pay the required recording fee to the county clerk.

- Confirm the recording information and index number.

- Send a copy to the debtor’s last known address, usually by mail.

How an Abstract Affects Judgment Debtors Day-to-Day

The presence of an abstract creates what real estate professionals call a “cloud on title” with far-reaching consequences:

- Mortgage refinance denials: Banks often reject applications when title searches reveal judgment liens.

- Delayed or failed home equity loans: Even exempt homestead refinances can stall while the lien is investigated.

- Driver’s license issues in some cases: Certain damage-related judgments can trigger DPS action.

- Credit score impact: Public lien records may appear in background and credit-reporting databases.

- Property value concerns: Buyers avoid properties with unresolved liens or demand price reductions.

- Estate planning complications: Heirs may face delays and extra costs when liens show up in probate.

The judgment lien lasts 10 years but may be renewed. Ignoring it can lead to unpleasant surprises at the worst time—such as when you are ready to sell a home or pass property to family.

Failure to resolve a judgment lien can also trigger additional costs, interest, and legal fees. Talking with a Texas judgment lien attorney early often gives you more and better options.

A Personal Story from Attorney Christopher Migliaccio

Recently, I met with a North Texas homeowner who had just learned about an abstract of judgment on his title days before closing. He was facing the loss of his buyer and the fear that he might never be able to sell his house. As we talked through his options, I noticed how overwhelmed he felt by the legal terms and deadlines. This reminded me why clear explanations about judgment liens matter so much. We worked together to verify homestead protections, negotiate a reduced payoff, and push the title company a detailed release timeline. What struck me most was the change in his posture once he understood there was a plan. Over my nearly 20 years practicing law, I’ve learned that good information and steady guidance lower anxiety as much as legal results. This case reinforced that judgment problems are solvable when you take action early. You are not alone.

Duration, Renewal, and Automatic Expiration under the Texas Property Code

📅 Texas Judgment Lien: 10-Year Lifecycle

Click any milestone to see what happens at each stage

Filed

Active

Period

Renewal

Deadline

Expires

Facing a judgment lien? Get a clear plan to protect your property.

📞 Free Consultation: (888) 584-9614Under Texas Property Code § 52.006, a judgment lien normally lasts ten years from the date the abstract is recorded. During a bankruptcy stay, the clock can pause. Creditors may file a new abstract in the ninth year to keep their lien alive. After ten years without renewal, the lien expires, but the money judgment itself may still be collected by other remedies.

Important timing issues that can affect the 10-year clock include:

- Bankruptcy filings that toll (pause) the expiration period

- Death of the debtor, which may extend collection time through probate

- Appeals or other court orders that delay enforcement or expiration

Debtor Options: Release, Settlement, or Bankruptcy Discharge

Texas judgment debtors usually have more than one path to deal with an abstract of judgment. The right option depends on your income, assets, and long-term plans.

Decision Tree for Judgment Debtors

1. Pay in Full

- The creditor files a release of judgment lien.

- The lien is removed from the county records.

- Clear title is restored for sales or refinances.

2. Negotiate Settlement

- Offer a lump sum that is less than the full balance.

- Request a partial release for a specific property before closing.

- Get all settlement terms in writing, including who files the release and when.

3. File Chapter 7 Bankruptcy in Texas

- Discharge the judgment debt, if eligible.

- File a motion to avoid the judgment lien on exempt property.

- Work toward a fresh financial start while protecting key assets.

4. Challenge the Abstract’s Validity

- Review for technical errors in names, numbers, or required elements.

- File a motion to declare property exempt or to invalidate the lien.

- Assert homestead protections when they apply.

5. Wait for Expiration

- Monitor the 10-year expiration date carefully.

- Watch for any renewed abstracts.

- Consider a quiet title action after expiration to clear records.

For guidance on your specific facts, call for a free consultation at (888) 584-9614. We can help you compare these options and understand how they affect your home, income, and long-term goals.

Collecting on a Judgment: Writs of Execution & Garnishment Tools

Enforcement Tools Available to Creditors

Writ of Execution

- Authorizes sheriffs or constables to seize and sell non-exempt property.

- Must follow specific procedures that protect debtor rights.

- Targets personal property and non-homestead real estate.

Bank Account Garnishment

- Reaches non-exempt funds in financial institutions.

- Requires a separate garnishment action under CPRC Chapter 63.

- Certain funds, such as Social Security or disability benefits, may be protected.

Turnover Orders

- Compel a debtor to turn over non-exempt assets.

- Are useful for business interests and other intangible assets.

- Can reach assets held by third parties, subject to court approval.

Post-Judgment Discovery

- Depositions to locate assets.

- Document requests for financial records.

- Interrogatories about property ownership and transfers.

Texas Wage Garnishment Limits

- Child support and federal taxes: allowed under specific statutes.

- Consumer debts (credit cards, medical bills): wage garnishment is generally prohibited under the Texas Constitution.

- Bank accounts: subject to garnishment orders, even if the money came from wages once deposited.

For most consumer debts, Texas law protects your paycheck from direct wage garnishment. But creditors may still try to freeze and take funds from your bank accounts after deposit, which is why understanding your rights and exemptions matters.

The Texas Uniform Fraudulent Transfer Act and other statutes allow creditors to challenge transfers made with the intent to hinder collection. At the same time, Texas exemption laws give judgment debtors important protections when used correctly.

Abstracts in Divorce & Estate Planning: Community vs. Separate Property Risk

During a Dallas County divorce, a lien against one spouse can cloud community property and stall property division. The complex interplay between Texas community property law and judgment liens can create issues such as:

- Judgments incurred during marriage may affect community property interests.

- Separate property judgments generally stay with one spouse but may still affect title searches.

- Divorce decrees should address existing liens and responsibility for payment.

- Property division becomes more complex when abstracts are in place.

In probate, an abstract can delay distribution because title companies often require a release of any judgment lien before heirs sell property. Proper planning—such as partition agreements and thoughtful estate planning—helps keep family transfers smooth.

Common Errors That Invalidate Abstracts

Experience shows that many abstracts of judgment fail because of preventable mistakes. When a creditor’s abstract is defective, the lien may not attach at all.

1. Incorrect Debtor Identification

- Missing or wrong Social Security or driver’s license digits.

- Misspelled or incomplete debtor names.

- Inaccurate addresses that do not match court records.

2. Mathematical Errors

- Miscalculated interest or fees.

- Wrong total judgment amount.

- Incorrect additions for court costs or attorney’s fees.

3. Missing Statutory Elements

- Omitted cause numbers or court names.

- Wrong jurisdiction information.

- Missing required dates or creditor information.

4. Filing Errors

- Recording in the wrong county for the debtor’s property.

- Incorrect indexing in the county’s real property records.

- Misfiled documents or incomplete recording fees.

5. Renewal Failures

- Allowing liens to expire after ten years without re-abstracting.

- Improper renewal procedures that fail to preserve priority.

- Dormant judgments that no longer support a valid lien.

Texas Case-Law Spotlight

Historic Precedent

Texas American Bank v. Southern Union Exploration, 714 S.W.2d 105 (Tex. App.—Eastland 1986). The creditor recorded an abstract that listed the wrong survey and omitted the county. The court held the legal description was fatally defective, so the lien never attached to the debtor’s land. This case shows how even “small” recording errors can strip creditors of lien rights. (View Case)

Recent Texas Appellate Trends

Texas appellate courts continue to emphasize strict compliance with abstract of judgment requirements and strong homestead protections. Courts have invalidated abstracts with faulty debtor identification and reaffirmed that constitutional homestead rights prevent forced sale of protected property, even when a valid abstract exists. These decisions remind both creditors and debtors that details matter in post-judgment collection.

Why Warren & Migliaccio Is the Call You Make Next

With nearly 20 years of experience in Texas debt and judgment matters, our Lead Counsel Verified attorneys have guided countless families through lien releases, negotiated settlements, and provided trusted bankruptcy relief. Led by Managing Partner Christopher Migliaccio, who holds a background in accountancy, our team combines practical financial insight with focused legal strategy.

We understand how stressful it is to see a lien on your home or learn that a judgment has hit the public record. Our goal is to protect what matters most—your home, your savings, and your peace of mind—while giving you a clear plan forward.

Located near Richardson High School and downtown Plano, our principal office serves as a hub for helping Texans statewide. From Houston to Amarillo and Austin to El Paso, we proudly represent judgment debtors in all 254 Texas counties by phone, video, or in-person meetings.

Ready to move forward? Call (888) 584-9614 today or click here to schedule your free case review. We’ll review your situation, discuss your options, and help you create a clear plan to address the judgment lien and protect your property.

Frequently Asked Questions

Filing & Basic Requirements

How do I file an abstract of judgment in Texas?

Obtain a certified abstract from the court clerk and file it with the county clerk’s real property records where the debtor owns property, paying fees of about $20–35 total.

The basic process is:

- (1) Request a certified abstract from the court clerk

- (2) Pay the certification fee

- (3) File the abstract with the county clerk’s real property records

- (4) Pay the recording fee

- (5) Mail a copy to the debtor’s last known address per Texas Property Code § 52.003

Filing creates an automatic lien on non-exempt real property in that county.

Source: Texas Property Code Chapter 52; guides.sll.texas.gov

What information is required on a Texas abstract of judgment?

Texas law requires the debtor’s full name, last three SSN/DL digits (if available), birthdate (if available), address, judgment amount, court information, and creditor details.

Texas Property Code § 52.003 requires: debtor’s full name, last three digits of SSN or driver’s license, birthdate, last known address, judgment amount including interest, cause number and court name, creditor’s name and address, and date of issuance.

Missing any required element can invalidate the lien. Double-check that all information matches court records exactly, as even small errors can create title problems requiring court intervention.

Source: Tex. Prop. Code § 52.003; Texas State Law Library

Can I file an abstract of judgment online in Texas?

Major Texas counties offer e-filing for abstracts, but many rural counties still require in-person or mail filing.

Online filing availability varies by county. Major counties like Harris, Dallas, and Travis offer e-filing for abstracts through clerk portals. Most rural counties still require in-person or mail filing.

Check the county clerk’s website for “e-recording” or “online real property filing” options. Online filing typically requires account setup and payment by credit card or ACH.

Source: County clerk websites; Texas Association of Counties

Discovery & Home Sale Issues

How do I check if there’s an abstract of judgment against me in Texas?

Search county clerk real property records online, order a title search, check your credit report, or search deed records in counties where you own property.

Search for abstracts by:

- (1) Checking county clerk real property records online in counties where you own property

- (2) Ordering a property title search

- (3) Reviewing your credit report for public records

- (4) Searching your name in county deed records

Many Texas counties offer free online searches through their official websites. Check multiple name variations and counties where you’ve lived or might inherit property, as creditors often file strategically.

Source: Dallas County Clerk; Harris County Clerk; Collin County Clerk

What happens if I find an abstract of judgment during a home sale?

The title company will usually require the lien to be cleared before closing through payment, settlement, bankruptcy, or legal challenge.

If an abstract appears during your home sale, the title company will require clearance before closing. If the debtor sells the property, the judgment lien lets the creditor claim a portion of the sale proceeds to satisfy the judgment.

Most homeowners start by asking the title company or county clerk for a copy of the abstract, then contacting a Texas judgment lien attorney to map out a payoff, settlement, or challenge plan. Your options include paying the full judgment for immediate release, negotiating a settlement, filing bankruptcy if eligible, or challenging the abstract’s validity in court. Even invalid abstracts can delay closings until legally removed.

Source: Texas Department of Insurance; Texas Land Title Association

Can an abstract of judgment affect my credit in Texas?

Yes, abstracts appear as public records on some credit and background reports, and they can hurt your ability to obtain new credit.

The negative mark may remain even after payment unless you ensure the creditor files a formal release. Unlike the 10-year lien duration, credit reporting often follows a seven-year schedule from the filing date under the Fair Credit Reporting Act.

Paid abstracts may show as “satisfied” but can still affect credit until the reporting period ends.

Source: 15 U.S.C. § 1681c; Consumer Financial Protection Bureau

Legal Nature & Contesting Abstracts

What’s the difference between a judgment and an abstract of judgment?

A judgment is the court’s order to pay; an abstract is the one-page filing that creates a real-property lien.

The judgment is the court’s final order requiring payment. An abstract of judgment is the one-page certified summary that creates a property lien when filed with county clerks.

The judgment alone gives the creditor the right to collect. The abstract creates an automatic lien on real property in the county of record. Think of the judgment as the legal victory and the abstract as the collection tool.

Source: Tex. Prop. Code Ch. 52; Texas Courts Guide

How do I contest an invalid abstract of judgment in Texas?

File a motion with the issuing court showing errors such as wrong identification, expired judgment, or missing requirements.

Contest an abstract by filing a motion with the court that issued the original judgment. Common grounds include:

- Incorrect debtor identification (wrong SSN digits or misspelled name)

- Expired judgment

- Discharge in bankruptcy

- Missing statutory requirements under Tex. Prop. Code § 52.003

You will need to prove the error and may need a hearing. Texas courts strictly enforce filing requirements, and even minor errors can invalidate abstracts.

Source: Texas Rules of Civil Procedure; Texas Pattern Jury Charges

What property is exempt from abstract of judgment liens in Texas?

Texas exempts homesteads, certain personal property, retirement accounts, and life insurance.

Texas law protects your homestead, personal property up to statutory limits, retirement accounts, life insurance cash values, and college savings plans under Texas Property Code Chapters 41 and 42.

A judgment lien generally attaches only to non-exempt real property like rental houses, vacant land, or commercial buildings. Even if exempt, abstracts can still appear on title searches until they are formally released.

Source: Tex. Const. Art. XVI, § 50; Tex. Prop. Code Ch. 41–42

Duration & Renewal

Does the Texas 10-year abstract of judgment rule restart if renewed?

Yes, filing a renewal abstract before expiration creates a fresh 10-year lien period.

The 10-year period starts fresh with each timely renewal filing under Texas Property Code § 52.006. Creditors who want to keep their lien must file the new abstract before the original expires.

After 10 years without renewal, the lien expires automatically, but the underlying judgment may remain collectible through other methods. Bankruptcy and appeals can pause the 10-year clock in some situations.

Source: Tex. Prop. Code § 52.006; guides.sll.texas.gov

How long does an abstract of judgment lien last in Texas?

Texas judgment liens typically last 10 years from the recording date and can be renewed before expiration.

Texas abstract of judgment liens last 10 years from the recording date under Texas Property Code § 52.006. The lien may be renewed by filing a new abstract before expiration. Bankruptcy can toll (pause) the 10-year period.

After expiration without renewal, the lien dies, but the money judgment may still be enforceable by other collection methods. Always check the recording date, not the judgment date, to calculate deadlines.

Source: Tex. Prop. Code § 52.006; guides.sll.texas.gov

Is there a cost to re-abstract after renewal?

Yes, renewal requires new filing fees plus court certification fees.

Renewal usually requires new filing fees of roughly $20–30 per county, similar to original filing costs. You must pay certification fees to the court clerk plus recording fees to each county clerk.

Creditors that hold small judgments sometimes choose not to renew liens because the renewal costs outweigh likely recovery.

Source: Local Government Code Ch. 118; County clerk fee schedules

Homestead, Bankruptcy & Out-of-State Judgments

Can an abstract attach to my homestead?

No, the Texas Constitution protects homesteads from most judgment liens, though certain debts like taxes can pierce this protection.

Texas Constitution Article XVI, Section 50 protects homesteads from abstract of judgment liens for most consumer debts. Your primary residence generally cannot be forced sold for credit cards, medical bills, or similar debts.

However, certain debts—such as property taxes, purchase money mortgages, home equity loans, and mechanic’s liens—can pierce homestead protection. The abstract may still appear on title searches, complicating refinances until it is released.

Source: Tex. Const. Art. XVI, § 50; Tex. Prop. Code § 41.001

How do I remove an old abstract before selling my house?

Remove abstracts by paying in full, negotiating settlement, filing bankruptcy, proving invalidity, or waiting for expiration.

Common options include:

- (1) Paying the debt in full for the creditor’s release

- (2) Negotiating a settlement for partial payment

- (3) Filing bankruptcy to discharge the debt, if eligible

- (4) Proving the abstract is invalid through a court motion

- (5) Waiting for 10-year expiration without renewal

- (6) Filing a quiet title action after expiration

The creditor typically must file the release with the county clerk to clear your title for sale under Texas Property Code § 52.008.

Source: Tex. Prop. Code § 52.008; Texas State Law Library

Does bankruptcy wipe out the lien or just the debt?

Bankruptcy discharges personal liability but usually requires a separate motion to remove liens from exempt property.

Chapter 7 or 13 bankruptcy can discharge your personal liability but does not automatically remove the lien from property. You must file a separate “Motion to Avoid Lien” under 11 U.S.C. § 522(f) in bankruptcy court to eliminate liens on exempt property.

Without this extra step, the lien can survive on non-exempt property even after discharge. Many debtors mistakenly believe bankruptcy alone clears title, but additional action is often required.

Source: 11 U.S.C. § 522(f); U.S. Bankruptcy Court, Northern District of Texas

What if the judgment was issued in another state — do I still get a lien in Texas?

Out-of-state judgments must be domesticated in Texas courts before creating liens through abstracts.

Out-of-state judgments must be “domesticated” in Texas before creating liens. Creditors file the foreign judgment in a Texas court under the Uniform Enforcement of Foreign Judgments Act (Texas Civil Practice & Remedies Code Chapter 35).

Once domesticated, creditors can file abstracts just like Texas judgments. The domestication process typically takes several weeks and requires proper notice to the debtor.

Source: Tex. Civ. Prac. & Rem. Code Ch. 35; guides.sll.texas.gov

Other Collection Tools & Wage Issues

What’s the difference between an abstract of judgment and other collection tools?

Abstracts create passive property liens while writs and garnishments actively seize assets.

An abstract creates a passive lien that waits for property sales or refinances. Writs of execution actively seize property through sheriff sales under Texas Rules of Civil Procedure 621–656.

Bank garnishments freeze liquid accounts. Turnover orders compel surrender of specific assets. Abstracts work best for patient creditors expecting future property transactions; other tools provide faster results but require more effort and expense.

Source: Tex. R. Civ. P. 621–656; Tex. Civ. Prac. & Rem. Code Ch. 31

Can judgment creditors take my wages in Texas?

Texas generally prohibits wage garnishment for consumer debts; only certain obligations allow wage garnishment.

Texas Constitution Article XVI, Section 28 protects current wages for most consumer debts, including credit cards, medical bills, and personal loans.

Only child support, spousal maintenance, some federal student loans, and tax debts can garnish wages. However, creditors can levy bank accounts after deposits, so it is important to understand both wage and bank-account protections.

Source: Tex. Const. Art. XVI, § 28; Tex. Civ. Prac. & Rem. Code § 63.001

Conclusion

An abstract of judgment is a small document with a big impact. It creates a public record lien, can follow your Texas real property for up to a decade, and may be renewed unless you take action. Whether you are a judgment creditor trying to enforce a court order or a judgment debtor protecting your property rights, understanding Texas abstract procedures is essential for navigating our state’s lien system.

If you face a judgment lien—or want to prevent one—call (888) 584-9614 or contact us online for a free consultation with Warren & Migliaccio. Let our Texas debt defense attorneys help safeguard your family’s future and guide you toward a clear title and a better financial path.

This article is for general informational purposes only and does not constitute legal advice. Reading it does not create an attorney-client relationship, and past results do not guarantee future outcomes. For advice about your specific situation, please speak with a licensed Texas attorney.