Most unsecured gambling debt can be discharged in a Texas bankruptcy unless a creditor proves fraud or a Bankruptcy Code presumption applies. Problems usually come from recent cash advances, last-minute charges, or false information on a credit application. The sooner you gather records and assess risk, the smoother the case tends to be.

Quick Answer

Most unsecured gambling debt can be discharged, but recent cash advances and last-minute charges can trigger fraud claims. Use these three steps to lower the odds of a creditor challenge.

-

Stop new borrowing and gambling immediately

Even “just one more time” can create problems by adding new debt right before you file.

-

Pull and save your proof before filing

Collect at least 3–6 months of bank statements, credit card statements, cash-advance history, and any casino marker paperwork so your timeline is clear.

-

Get a risk screen for fraud and presumption triggers

Recent cash advances, luxury spending, and questionable application information can decide whether the debt is easy to discharge or likely to be litigated.

What are the key facts about discharging gambling debt in a Texas bankruptcy?

If you live in Texas, most unsecured gambling debt works the same as other unsecured debt and can be wiped out. The only major exception is when a creditor proves fraud or a Bankruptcy Code presumption kicks in.

| Factor | Texas-specific rule / what to expect |

|---|---|

| Who this applies to | Texans filing Chapter 7 or Chapter 13 in the U.S. Bankruptcy Court (Northern, Southern, Eastern, or Western District of Texas) |

| Common types of debts in gambling | Credit card charges, cash advances, personal loans used to gamble, casino markers/unpaid drafts, and gambling-related checks |

| The credit counseling deadline | Must be completed within 180 days before filing (few exceptions) |

| Creditor “fraud” challenge deadline | Many nondischargeability complaints must be filed within 60 days after the first date set for the 341 meeting |

| If you’re sued in Texas before filing | In county/district court, the answer is typically due 10:00 a.m. the Monday after 20 days from service |

| What outcomes look like | Older unsecured balances are often discharged; disputes are more likely with recent, heavy spending or large cash advances |

Can I discharge gambling debt in bankruptcy in Texas, and what can go wrong? (Core Content)

Yes—most gambling debt can be discharged. However, timing and fraud allegations can turn a “simple” case into an adversary proceeding.

What counts as “gambling debt,” and why does the label matter?

“Gambling debt” usually means regular consumer bankruptcy where the money was used to gamble. What really matters is how and when you took on the debt—not whether your statement says the word ‘casino.’

Common categories I see:

- The credit card charges at casinos, racetracks, or online gaming platforms

- Cash advances and “convenience checks” used to fund gambling

- Thirdly, casino markers / unpaid drafts (a form of credit extended by the casino)

- Personal loans (including from an online lender, family, even student loans) used to borrow money and gamble

Separate unsecured debt from secured debt:

- Most gambling-related balances are unsecured (no collateral).

- If you gamble with money from a HELOC, title loan, or another secured loan, the lender’s lien stays in place. It doesn’t disappear just because you used the funds for gambling.

If you’re trying to choose between Chapter 7 and Chapter 13 bankruptcy, start with our Texas bankruptcy overview. It gives you the big picture so you can pick the right chapter for your situation.

Is gambling debt “automatically nondischargeable” because gambling is involved?

No. There is no rule that automatically makes gambling debt non-dischargeable just because you used the money to gamble.

What actually drives nondischargeability fights is whether the creditor claims the debt was obtained by:

- False pretenses / false representation / actual fraud

- Additionally, a presumption for recent luxury purchases or cash advances under the Bankruptcy Code.

In plain English: creditors often claim, ‘You borrowed money knowing you couldn’t pay it back,’ especially if you gambled a lot right before filing.

When do casinos and credit card companies challenge discharge for gambling-related debt?

Creditors challenge a bankruptcy discharge when your gambling debt seems recent or reckless. In these cases, even if you had no intention of wrongdoing, they may still raise an objection.

The three biggest triggers:

- A recent spree right before filing (timeline matters more than labels)

- Big cash advances close to filing—especially if they cross the presumption thresholds

- Misrepresentations on applications (income, job, assets, household finances)

Here’s what happens in real life:

- First, trustees and creditors look at your bank and credit card statements, plus any cash withdrawals, to figure out the timeline.

- Next, if a creditor files an adversary proceeding, i.e. a lawsuit inside your bankruptcy. You have to respond and defend yourself just like in a regular lawsuit.

Two Bankruptcy Code “red flags” clients often don’t know about:

- First, buying luxury goods or services within 90 days before filing, above a certain amount, can be presumed non-dischargeable.

- Second, taking cash advances within 70 days before filing, over the limit, can also be presumed non-dischargeable.

Those dollar thresholds adjust every three years. As of cases filed on/after April 1, 2025, the commonly cited amounts are $900 (luxury goods/services) and $1,250 (cash advances).

Bankruptcy Code Presumption Windows

Recent spending before filing can trigger creditor challenges under 11 U.S.C. § 523(a)(2)(C)

Thresholds as of April 1, 2025: $900 for luxury goods/services (90 days) and $1,250 for cash advances (70 days). These amounts adjust periodically under 11 U.S.C. § 104.

What’s the difference between Chapter 7 and Chapter 13 for gambling debt in Texas?

Chapter 7 usually gives the fastest fresh start, while Chapter 13 offers the most flexible repayment plan. However, the right choice depends on your risk profile, not just your personal preference.

| Factor | Chapter 7 (Fresh Start) | Chapter 13 (Repayment Plan) |

|---|---|---|

| Big picture | Usually the fastest fresh start if you qualify, aimed at wiping out unsecured debt through discharge. | Usually the most flexible court-supervised repayment plan for dealing with debt over time. |

| Treatment of gambling-related unsecured debt | Most unsecured balances, including gambling-related credit cards and cash advances, can be discharged, but recent activity may draw more scrutiny. | Gambling-related unsecured debts are included in the 3–5 year payment plan, and the court expects good faith and full disclosure. |

| Timeline | Discharge of gambling debts can occur relatively quickly compared to a multi-year repayment plan. | You make payments based on disposable income for 3–5 years under a court-approved plan. |

| Scrutiny & key risks | Recent transactions—especially gambling activity and cash advances—get more scrutiny, and many filers must pass the means test or income analysis. | The court focuses on good faith, full disclosure, and whether your disposable income supports the proposed repayment plan. |

| When Texans may consider it | The time when they qualify and want the fastest route to a fresh start from unsecured debt, including gambling-related balances. | When they need time to address arrears or protect assets while repaying debt over 3–5 years. |

Differentiating Chapter 7 and 13

- Chapter 7 (fresh start): Most unsecured debts can be discharged quickly. However, recent transactions get extra scrutiny, and you often must pass a means test or income analysis.

- Chapter 13 (repayment plan): You pay based on disposable income for 3–5 years. This plan can protect assets or catch up on arrears, but the court still expects full disclosure and good faith.

Chapter 7 vs. Chapter 13: Quick Decision Guide for Gambling Debt

This simplified flowchart highlights key factors — your situation may involve additional considerations

Or luxury charges over $900 (within 90 days)?

Presumption Risk

Higher chance of creditor challenge. Consider waiting or Chapter 13 to show good faith.

Consider Chapter 13

3–5 year plan demonstrates good faith and may reduce litigation risk

Texas means test?

Chapter 7 Likely

Fastest route to discharge for qualifying Texans

Chapter 13

Repay over 3–5 years based on disposable income

Important: This is a simplified overview. Other factors—Texas exemptions, asset protection, income changes, and fraud risk—can affect the best chapter choice. Get a personalized analysis before filing.

If you’re leaning toward Chapter 7, our Chapter 7 bankruptcy guide for Texans is a good next step.

Alternatives to bankruptcy in Texas: real options that can work

If presumption windows, lawsuit timing, or asset concerns make filing feel risky right now, this guide lays out Texas-specific options and when they backfire.

Quick tip: “Waiting to file” is only smart if you also have a plan to avoid default judgments and new collection pressure.

Does Texas law about “unenforceable gambling debts” change the bankruptcy analysis?

Texas public policy can affect casino markers, but that does not make you automatically safe without bankruptcy.

Some courts in Texas and the Fifth Circuit have ruled that certain gambling debts cannot be enforced, especially when the casino gave the credit.

But here’s the practical reality:

- Many people owe banks and credit card companies, not casinos.

- Debt collectors may still sue on related obligations, report the debt, or cause judgment problems.

- So, bankruptcy can still be the cleanest way to deal with significant debt across multiple unsecured creditors.

What if I’m already being sued or garnished?

Filing for bankruptcy triggers the automatic stay. This stops most collection actions, including lawsuits, phone calls, and garnishments.

Two urgent Texas points:

- If you were served with a Texas debt lawsuit, missing your answer deadline can lead to a default judgment—so don’t ignore the citation.

- If you need help responding to suit while you evaluate bankruptcy, our credit card lawsuit defense in Texas resource explains what timing mistakes to avoid.

Case Study: Building a clean timeline to avoid a fraud fight

The Problem: We met with a North Texas filer who felt embarrassed and panicked after using cash advances and casino-related charges shortly before considering bankruptcy. They had been told online that “gambling debt is never dischargeable,” and they feared a creditor would sue them inside the case.

The Action: In the Northern District of Texas (Dallas Division), our first step was building a clear transaction timeline from bank and credit card statements, then comparing it to the Bankruptcy Code’s presumption windows and common fraud allegations. We helped the client stop new borrowing, gather clean records, and choose Chapter 7 or 13 based on risk factors, not just speed. We also prepared disclosures and 341 testimony so the story stayed consistent and document-backed.

The Result: With a clean timeline and full disclosure, the case stayed on the normal track, and the client avoided a costly, drawn-out dischargeability fight over intent.

The Takeaway: If gambling activity is recent, do not file on a guess. Timing and documentation often decide whether you get a fresh start or get pulled into litigation.

What’s the step-by-step process to deal with gambling debt before and during a Texas bankruptcy?

The safest approach is to minimize any appearance of fraud and keep clear records. You should also file a case that matches your income and assets under Texas and federal rules.

1st Step: Stop new borrowing and gambling immediately

Even “just one more time” can create problems. Stopping new debt reduces the argument that you took on more gambling debt while planning to discharge it.

2nd Step: Pull and save your proof before filing

Collect at least 3–6 months of bank statements, credit card statements, cash-advance history, and any casino marker paperwork. Your bankruptcy attorney can use these documents to build a clear timeline.

What documents do I need to file for bankruptcy in Texas?

Use a full, Texas-focused checklist of the records trustees and creditors usually ask for, including what to bring to the 341 meeting.

Quick tip: The faster you can produce clean statements and pay history, the easier it is to shut down “timeline” arguments.

3rd Step: Get a risk screen for fraud and presumption triggers

Recent cash advances, luxury spending, and questionable application information can decide whether your debt is easy to discharge or likely to be litigated. If gambling was recent or large, trying to do it yourself is risky.

4th Step: Choose Chapter 7 vs. Chapter 13 based on red flags and Texas exemptions

Texas homestead and personal property exemptions can be powerful, but they depend on details like urban vs. rural location, asset values, and liens. Chapter 13 can help if you need a payment plan or more time to protect assets.

5th Step: File clean, complete schedules

Do not minimize or hide anything. Incomplete disclosures can cause bigger problems than the debt itself, including objections, dismissal, or litigation.

6th Step: Prepare for the 341 meeting like it matters

Answer honestly and consistently about income, transfers, and recent spending. These are common questions from trustees and can make or break your case.

7th Step: Act quickly if a creditor files an adversary complaint

Creditors have tight deadlines to file many complaints. You also have tight deadlines to respond. Missing either can change the outcome of your case.

If you’re struggling with a gambling problem, bankruptcy can help your financial future. But lasting debt relief usually also requires stopping gambling and getting support.

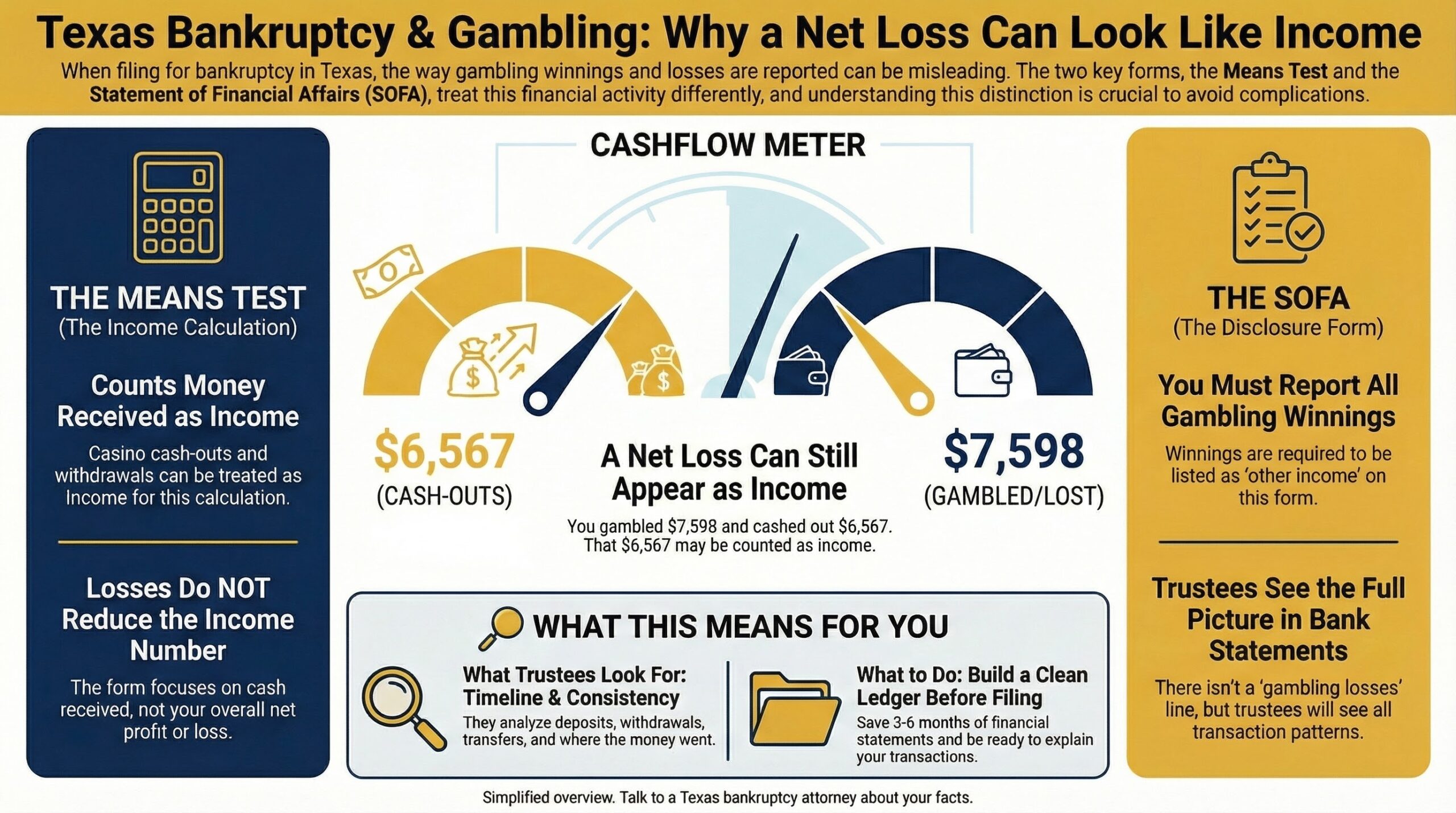

How Gambling Winnings and Losses Show Up on Bankruptcy Forms

The Means Test: Winnings Count as Income, Even If You Lost Money Overall

The Means Test looks at what money came into your hands during a set time period. This is true even if you walked away with less than you started with.

Here’s what trips people up: Bankruptcy paperwork does not work like a simple profit-and-loss statement. Your losses typically do not reduce your income on the Means Test.

Texas Chapter 7 means test: what counts as “income” and how eligibility works

Get the full Texas means-test framework (median-income step and disposable-income step), so you can see how gambling cash-outs fit into the bigger calculation.

Quick tip: If your bank deposits look “high,” you want to be ready to explain source, timing, and consistency with the forms.

What We Consistently See With Gambling Winnings on Bankruptcy Forms

People usually call us feeling embarrassed and confused when they see casino deposits on their statements. A common fear is, “I lost overall, so will the court think I’m hiding money?” In the Northern District of Texas (Dallas and Fort Worth divisions), trustees typically focus on what money came in and where it went, not just the net result.

Our first step is simple: we pull the relevant bank and credit card statements, then build a clean ledger that matches deposits, withdrawals, and transfers during the Means Test window. We also make sure the Statement of Financial Affairs tells the same story. The goal is not to argue about “math,” but to be able to answer trustee questions with records that line up.

When we do this early, the 341 meeting is usually calmer and the case is less likely to get sidetracked by follow-up requests or credibility concerns. The takeaway is straightforward: if gambling shows up in your recent financial history, clean documentation and honest disclosure protect your fresh start.

Let’s say you put $7,598 into slot machines or table games over several months. You cashed out $6,567.84. You’re clearly down more than a thousand dollars. But that $6,567.84 you cashed out? The court may still count it as income you received.

Why this matters:

- The Means Test adds up money you received, not just money you kept

- Gambling losses usually cannot be subtracted from your income calculation

- Your net loss does not change how the court views the cash you pulled out

The SOFA: Report Your Winnings and Be Ready to Explain Your Losses

The Statement of Financial Affairs asks about all your income sources. This includes “other income” beyond your paycheck. Gambling winnings belong in that section.

You won’t see a simple line item called “gambling losses” on the SOFA. But don’t let that fool you. The trustee will review your bank statements. They will see deposits and withdrawals. They will notice patterns.

If your gambling losses were large, recent, or frequent, expect questions like:

- Where did that money go?

- How much did you spend on gambling in the past year?

- Did you take on debt to fund your gambling?

The best approach is clean disclosure. Gather your records. Be ready to show your transaction history. Honest documentation matters far more than trying to argue about the math.

What Texas statutes and bankruptcy cases control discharge and gambling-debt disputes?

Federal bankruptcy law sets the main rules that apply in Texas. Texas exemption laws also matter because they determine which assets you can protect.

- 11 U.S.C. § 523(a)(2)(A) – Fraud/False Pretenses: If a creditor proves fraud, that specific debt can be ruled non-dischargeable. In other words, fraud can block discharge even if other debts are wiped out.

- 11 U.S.C. § 523(a)(2)(C) – Recent Luxury/Cash-Advance Presumptions: This section creates presumptions for certain recent luxury purchases (within 90 days) and cash advances (within 70 days) over adjusted thresholds. Therefore, timing and spending amounts can trigger challenges.

- 11 U.S.C. § 104 – Adjustments: This statute explains why dollar amounts change periodically. As a result, knowing the current thresholds is crucial when evaluating risk.

- Fed. R. Bankr. P. 4007(c) – Deadline to Sue Over Dischargeability: Many creditor challenges must be filed within 60 days after the first date set for the 341 meeting. Thus, missing this window can prevent a creditor from contesting the debt.

- In re Mercer (5th Cir.): This key Fifth Circuit case explains the standards creditors use to argue that credit-card debts were incurred by fraud. Consequently, it guides how courts view recent spending and intent.

- Carnival Leisure Industries, Ltd. v. Aubin (5th Cir.): This case addresses Texas public policy arguments around enforceability of certain gambling debts or credit arrangements. In other words, even if a debt seems unenforceable under Texas law, courts may still consider it in bankruptcy.

- Texas Property Code Exemptions: Homestead definitions (urban vs. rural acreage) and personal property caps can shape your Chapter choice and asset-protection strategy. Therefore, knowing your exemptions is essential for planning.

What common mistakes do Texans make after reading bad internet advice about gambling debt and bankruptcy?

Avoiding these mistakes is often the difference between a clean discharge and a costly fight with creditors.

1st Myth: “Gambling debt is always nondischargeable.” (Misinformation)

Many online sources claim you can’t discharge gambling debt. In Texas, the outcome depends on whether the creditor can prove fraud and whether the timing supports their claim—not on the label of the debt.

2nd Myth: “Gambling debts aren’t enforceable in Texas, so I don’t need bankruptcy.” (Incomplete)

Even if a casino marker raises Texas public-policy issues, your biggest debts usually involve a credit card company or lender. Bankruptcy may still be your best way to handle all debts at once.

3rd Myth: “Take cash advances right before filing—bankruptcy will wipe it.” (Misinformation)

Doing this can trigger a presumption fight or an adversary proceeding. It’s a risky move that can backfire.

4th Myth: “Leave gambling losses off the paperwork; they’ll never know.” (Misinformation)

Trustees and creditors can reconstruct transactions from statements. Omitting information can hurt your credibility and your case.

5th Myth: “Chapter 13 is automatically safer if there’s fraud risk.” (Incomplete)

Chapter 13 still requires good faith and full disclosure. The wrong plan can fail or lead to objections.

Frequently Asked Questions about Can Gambling Debt Be Discharged in Bankruptcy in Texas?

Discharge Basics

Can gambling debt be discharged in bankruptcy in Texas?

Yes. In Texas, most gambling-related balances are unsecured debts (credit cards, personal loans, markers) and can be discharged in Chapter 7 or treated in Chapter 13. The main exceptions are (1) a creditor proves fraud or false pretenses under 11 U.S.C. § 523(a)(2)(A), or (2) a recent-spending presumption applies under § 523(a)(2)(C).

Is gambling debt automatically nondischargeable because gambling is involved?

No. Bankruptcy law does not label a debt “nondischargeable” just because it involved gambling. What matters is intent and timing: did you borrow with no realistic intent or ability to repay, or take cash advances/last-minute charges that look deceptive? Those facts can lead to an adversary proceeding and a court ruling the specific debt nondischargeable.

Can credit card gambling charges be wiped out in Chapter 7 in Texas?

Often, yes. Chapter 7 can wipe out credit-card gambling charges the same way it wipes out other unsecured credit-card debt—unless the card issuer challenges the debt as fraud. Risk goes up when charges are recent, unusually large, tied to cash advances, or made when income was dropping. Documentation and a clean timeline help reduce disputes.

Fraud, Presumptions, and Timing Risks

What if most of my gambling debt is from cash advances taken shortly before filing?

It depends, and timing cuts both ways. Large or recent cash advances can trigger the Bankruptcy Code’s “cash advance” presumption window and invite a creditor lawsuit inside the case. Waiting longer may reduce that presumption risk, but delay can also mean lawsuits, default judgments, and growing interest. A bankruptcy attorney can review dates, amounts, and statements before you file.

What is the 90-day luxury purchase and 70-day cash advance presumption, and can it apply to gambling debt?

The Bankruptcy Code creates rebuttable presumptions for certain recent debts: “luxury goods/services” bought within 90 days and “cash advances” taken within 70 days before filing, if amounts exceed the current thresholds. As of cases filed on/after April 1, 2025, commonly cited thresholds are $900 (luxury) and $1,250 (cash advances), but they adjust periodically. Gambling-related charges can fall into these categories.

Are casino markers treated differently than credit card debt in Texas bankruptcy?

Sometimes. A casino marker is credit extended by the casino, and in Texas it may raise separate enforceability or public-policy arguments. But bankruptcy dischargeability still turns on federal rules and the facts—especially fraud allegations and recent-transaction presumptions. Also, many “gambling debt” cases involve banks or card issuers, not casinos, so you still need a full plan for all creditors.

Paperwork, Disclosure, and Chapter Strategy

How do gambling winnings and losses affect the means test and bankruptcy paperwork?

Gambling can complicate forms because “winnings” may count as income even if you lost money overall. The means test focuses on money received during the lookback period, and losses usually do not reduce that income calculation. On the Statement of Financial Affairs, report gambling income and be prepared to explain large withdrawals or transfers. Clean bank and casino records make the 341 meeting smoother.

Should I file Chapter 7 or Chapter 13 for gambling debt in Texas?

Chapter 7 is typically the fastest route to wiping out unsecured gambling-related debt, but recent gambling charges and cash advances can draw heavy scrutiny. Chapter 13 folds the debts into a 3–5 year court-approved repayment plan and emphasizes good faith and full disclosure. The right chapter depends on your income/means-test issues, Texas exemptions, asset protection goals, and any fraud or presumption red flags.

Talk With a Texas Bankruptcy Attorney About Gambling Debt and Discharge Risk

If you are considering bankruptcy after gambling-related debt, the key question is usually not “Is it dischargeable?” but whether recent cash advances, last-minute spending, or other red flags could trigger a creditor challenge. Warren & Migliaccio helps Texans evaluate whether gambling debt is likely dischargeable, identify fraud/presumption risks, and choose between Chapter 7 or Chapter 13 based on the facts—not guesswork. We offer free consultations to review your situation and explain practical next steps. Call (888) 584-9614 to speak with our attorneys or contact us online to schedule your free consultation.

Legal Authorities About Discharging Gambling Debt in Bankruptcy in Texas

- 11 U.S.C. § 523 (exceptions to discharge). Legal Information Institute

- 11 U.S.C. § 104 (bankruptcy dollar-amount adjustments). U.S. Code

- NCLC: April 1, 2025 § 523(a)(2)(C) thresholds ($900/$1,250). NCLC Digital Library

Fed. R. Bankr. P. 4007(c) (60-day deadline after first § 341 date). Legal Information Institute - 11 U.S.C. § 109(h) (credit counseling within 180 days pre-filing). Legal Information Institute

- 11 U.S.C. § 362 (automatic stay). Legal Information Institute

- Tex. R. Civ. P. 99 (answer due 10:00 a.m. Monday after 20 days). Texas Courts

- In re Mercer, 246 F.3d 391 (5th Cir. 2001). Justia Law

- Carnival Leisure Indus., Ltd. v. Aubin, 938 F.2d 624 (5th Cir. 1991); and No. 93-2878 (5th Cir. June 2, 1995). Justia Law

- Tex. Prop. Code § 41.002 (homestead definition). Texas Statutes

- Tex. Prop. Code § 42.001 (personal property exemption cap). Texas Statutes

Disclaimer: This content is for informational purposes. It does not lead to an attorney-client relationship. Consult the professional for expert legal help.