Quick Answer: What should I do immediately if sued by LVNV Funding LLC in Texas?

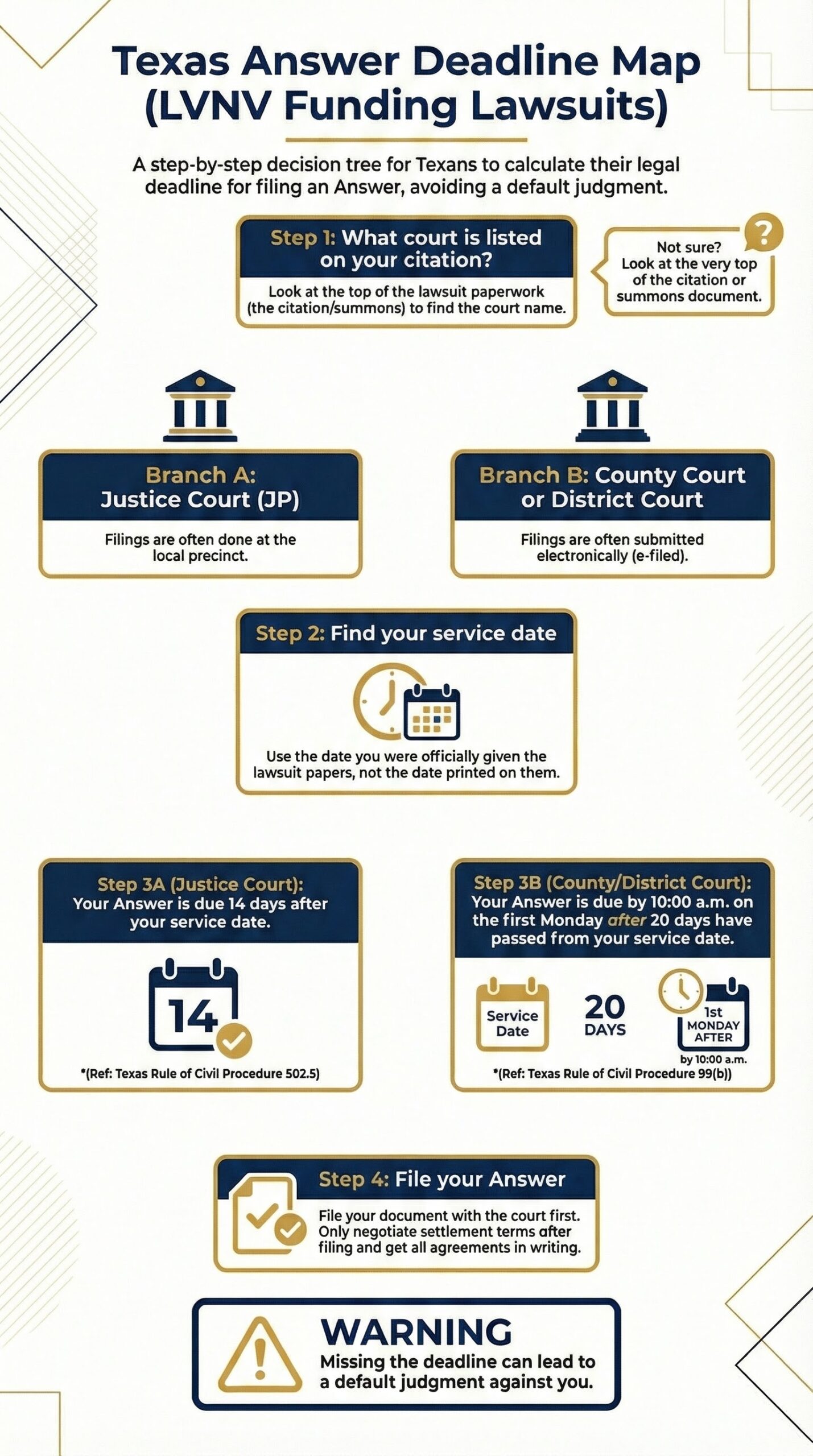

Act fast: Texas Answer deadlines are short—14 days in Justice Court (see Tex. R. Civ. P. 502.5) or the 20‑day Monday rule at 10 a.m. in county/district (see Tex. R. Civ. P. 99(b)). Texas’s four‑year statute (Tex. Civ. Prac. & Rem. Code §16.004) may bar stale claims against debt buyers. After you calculate your deadline, contact a Texas debt‑defense attorney to start building a defense and protect your bank accounts and credit.

- File your Answer (on your own or through an attorney): 14 days in JP; 20‑day Monday rule otherwise.

- Demand proof: ownership/chain of title and complete account records.

- Consult a Texas debt‑defense lawyer at Warren & Migliaccio about defenses, settlement options, and next steps.

| Court type | Typical Answer deadline | How to respond | Common LVNV proof issues |

|---|---|---|---|

| Justice Court (JP) | 14 days after service (see TRCP 502.5; check your citation) | File pro se or through counsel at the precinct; some allow e‑file, and many Texans hire a debt‑defense firm to handle this step. | Gaps in chain of title; generic affidavits; incomplete account histories |

| County/District | 20 days + next Monday at 10 a.m. (TRCP 99(b)) | E‑file an Answer—often through counsel—and consider special exceptions/discovery tailored to your case. | Missing cardmember agreement; interest/fees math; hearsay in business‑records affidavit |

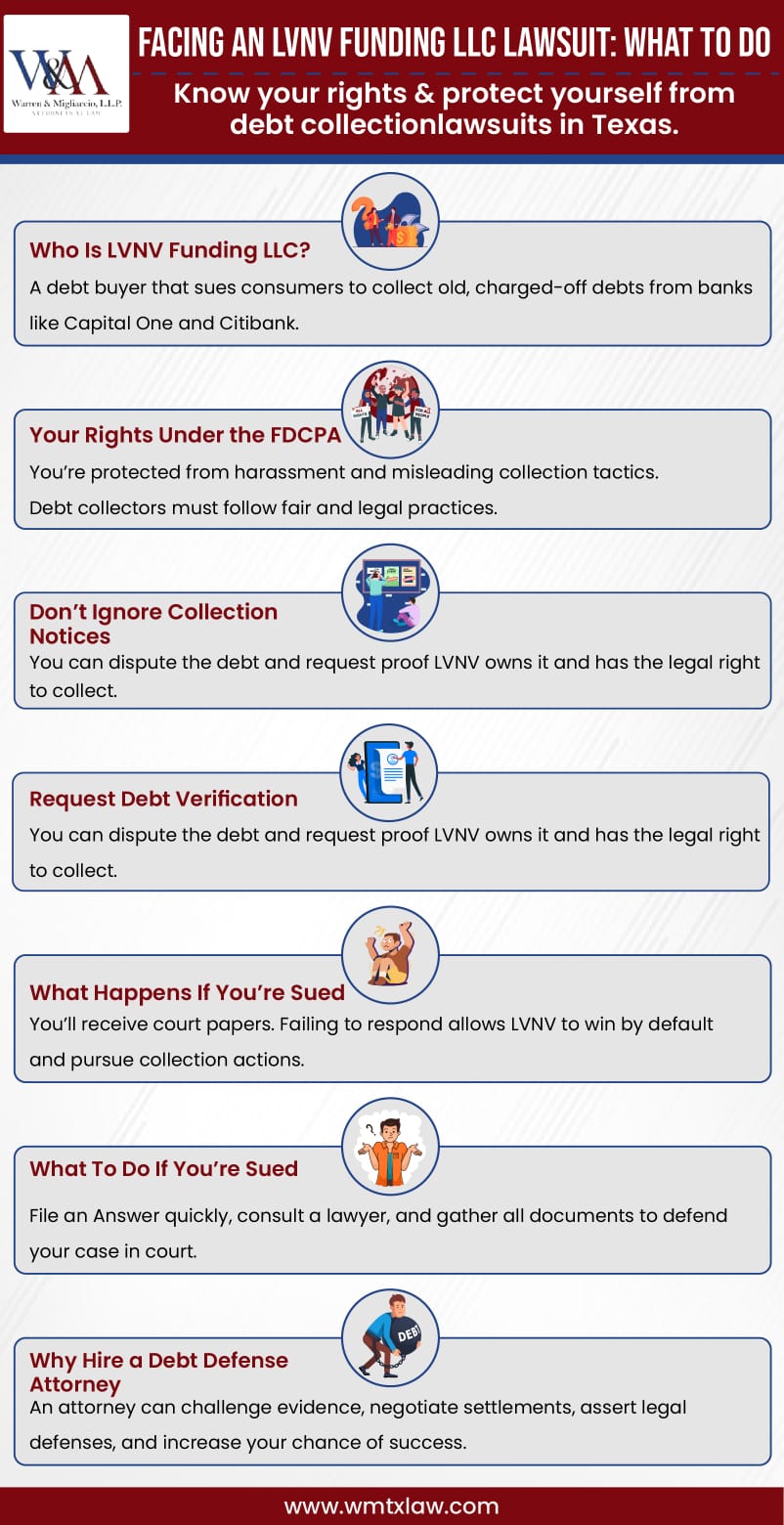

These days, it is easy to get into debt. If the debt is yours and the agreement is valid, you generally owe the money, but lawsuits can still involve disputes about who owes the debt, how much is owed, or whether the claim is too old to sue on. If that debt has turned into a lawsuit from LVNV Funding, our Texas debt‑defense firm can step in between you and the collector and help you respond.

With everything going on in the world, it might be tempting to ignore debt collection notices and phone calls. But ignoring these debt collection notices is risky. Debt collectors will often take legal debt collection action and try to get a judgment against you. This judgment cannot be ignored. Instead of going silent, you can put our legal team between you and LVNV Funding and work toward a resolution that fits your situation.

Need-to-Know Highlights

- File an Answer: 14 days in JP; 20‑day Monday rule otherwise.

- LVNV must prove ownership and accurate balance with records.

- Texas’s four‑year limitations can defeat time‑barred suits.

- Time‑barred debts: debt buyers cannot revive the claim by later payments (see §392.307(d)).

- Consult counsel at Warren & Migliaccio; negotiate only with written, post‑Answer terms.

The Fair Debt Collection Practices Act (FDCPA), a federal law, protects you from abusive debt collection practices. It makes sure debt collectors only try to collect legitimate debts. It also stops them from using misleading or unfair debt collection attempts. Our Texas consumer‑law team can evaluate whether LVNV’s conduct in your case violates these rules and pursue remedies if it does.

If you get collection notices from LVNV Funding, you might want to ignore them. But once the phone calls start, you will wish you hadn’t. Speaking with a debt‑defense attorney before things escalate can give you a clear game plan and peace of mind.

LVNV Funding, LLC is a junk debt buyer. This means they buy old debts or receivables that have been charged off. After buying a debt, they often aggressively pursue the person who owes it. Their collection efforts can feel overwhelming, which is why many Texans hire Warren & Migliaccio to deal with LVNV on their behalf.

If they cannot get the debt through phone calls, they may hire a local collection attorney. This attorney can file a lawsuit to recover the debt. When that lawsuit arrives, you need your own Texas debt‑defense lawyer advocating for you in the same courthouse.

If you receive notice that LVNV Funding, LLC is suing you, you should speak with a debt lawsuit defense attorney. If you live in Texas, the experienced attorney at Warren and Migliaccio can help you avoid a default judgment. Call us as soon as you are served so we can calculate your deadline and start protecting your rights.

📥 Download: Texas Answer Deadline + First 48 Hours Quick Guide (LVNV)

Save this mobile-friendly PDF so you can calculate your Answer deadline fast and follow the right steps before LVNV can push for a default judgment.

- Texas Answer deadline calculator

- First 48 hours step checklist

- LVNV proof and red flags

- Time-barred debt law snapshot

No email required. Instant PDF download.

Who is LVNV Funding LLC and why are they suing me?

IIf you are unfamiliar with the company’s name, you may be quite confused when you receive notice that you are being sued. Owned by Sherman Financial Group, LVNV Funding, LLC is a company that purchases debts that have been written off by original lenders. However, the account is managed by Resurgent Capital Services. This means you will likely receive letters or calls from Resurgent, not LVNV directly. If you are hearing from Resurgent, you are dealing with an LVNV account.

These debts are most often credit cards, but could also include personal loans or installment loans. There is a potential advantage with this specific debt buyer: Resurgent Capital Services typically has a policy of deleting the collection tradeline from your credit report entirely once the debt is resolved, rather than just marking it “Paid.” We can verify if your account qualifies for this deletion during settlement negotiations. Our firm regularly defends Texans in LVNV cases involving debts from creditors such as:

It is very important to file your Answer with the court listed on your citation (summons) by your deadline. In most cases, you also must send a copy of your filed Answer and other papers to LVNV’s attorney (or to LVNV if no attorney is listed). When you retain Warren & Migliaccio, our team prepares and files these responses on your behalf. Tex. R. Civ. P. 99(b); Tex. R. Civ. P. 21a; Tex. R. Civ. P. 502.5; Tex. R. Civ. P. 501.4.

After LVNV Funding buys a debt, they aggressively pursue the person who owes it with phone calls. Consumers sometimes report conduct they believe is harassing; if you experience this, keep records and speak with our firm about your options.

The Federal Trade Commission has issued rules to regulate debt collection practices. The Fair Debt Collection Practices Act (FDCPA) stops debt collectors from using false, deceptive, or misleading tactics. This law protects consumers from unfair collection efforts and opens the door for legal debt relief strategies. Our attorneys can review LVNV’s letters and calls in your case and advise whether they crossed the line.

Your Right to Dispute or Verify the Debt

Under the Fair Debt Collection Practices Act (FDCPA), you have 30 days after you receive the required written validation notice, which tells you the amount claimed and your dispute rights, to dispute the debt. If you dispute in writing within that 30‑day window, the debt collector must pause collection until it mails you verification of the debt and, if you request it in writing, the name and address of the original creditor. Our firm can prepare and send dispute and validation letters for you so you do not have to handle this alone. 15 U.S.C. § 1692g(a)–(b).

Under the FDCPA, a debt collector must send a written validation notice within five days after its initial communication (unless the required information was in the first message or you already paid). If you dispute in writing within 30 days after you receive that notice, the collector must stop collection until it mails verification of the debt. Bring any letters or notices you received from LVNV Funding to your consultation so we can review them together. 15 U.S.C. § 1692g(a)–(b).

Requesting verification helps you confirm that LVNV Funding, LLC really owns your debt. It also helps you check if the debt amount is correct. If they cannot provide the needed documents, this can strengthen your defense in state court. It may even lead to the lawsuit being dismissed. Our attorneys routinely use these documentation gaps to attack LVNV’s claims.

Always keep copies of any letters you send to dispute the debt. Also, keep any responses you get from the collector. If the collector fails to provide proper verification, you may have more defenses under federal or Texas consumer protection laws. Having an attorney review this paper trail can reveal defenses you might otherwise miss.

What To Expect If You Are Contacted By Or Sued by LVNV Funding, LLC?

If LVNV Funding contacts you, the first call typically includes a debt settlement offer—often a discounted lump-sum payment if you act quickly. Before agreeing to anything on the phone, speak with a debt‑defense attorney who is looking out for you, not the collector.

If you don’t accept, they may escalate their efforts, sometimes crossing into harassment. Expect frequent calls, including to numbers of people listed as references. They also report debts to credit bureaus like TransUnion, Experian, and Equifax. Once you hire our firm, LVNV must communicate through us, which can greatly reduce the stress on you and your family.

If LVNV Funding cannot reach you or you refuse to pay, their collection activity often escalates to filing a lawsuit, seeking a judgment to recover the debt. Debt‑buyer cases may be filed in Justice Court or county/district court, depending on the amount and circumstances. Our attorneys appear regularly in both Justice Courts and county/district courts across Texas defending consumers against LVNV.

If you don’t respond or refuse to pay, they may sue you to recover the debt. LVNV Funding files thousands of lawsuits each year, often seeking more than twice the original balance. These lawsuits aim to secure default judgments when people don’t respond in time. Hiring a debt‑defense attorney early is one of the most effective ways to avoid being another default‑judgment statistic.

In court, debt buyers are often represented by attorneys or collectors who may lack complete documentation of your debt. This can work in your favor—if you respond. Many people feel overwhelmed or embarrassed and ignore the lawsuit, but doing so can lead to an automatic judgment against you. Our firm’s job is to force LVNV to prove every element of its case or face dismissal.

If you’re considering a settlement, know your financial limits—understand your income, expenses, and debts before making an offer you can realistically afford. An experienced debt‑defense attorney can help you evaluate offers, avoid traps in settlement language, and negotiate terms you can actually keep.

If a judgment is entered, you may be able to challenge it by a post‑judgment motion in the trial court (such as a motion to set aside or motion for new trial) and/or by an appeal. The deadlines depend on the court and can be short. Tex. R. Civ. P. 329b; Tex. R. Civ. P. 505.3; Tex. R. Civ. P. 506.1; Tex. R. App. P. 26.1.

Bottom line: If LVNV Funding sues you, don’t ignore it. Responding promptly and hiring a knowledgeable attorney can make a significant difference in your outcome. The sooner you contact Warren & Migliaccio, the more options we typically have to protect you.

Weaknesses of Debt Collection Lawsuits

When collection agencies like LVNV Funding file a debt collection lawsuit, they face some challenges. These weaknesses can work in your favor. Our attorneys focus on spotting and leveraging these weaknesses to defend you.

For example, in both state and federal court, the debt collector must prove they have the legal right to collect the debt and follow all proper procedures. We hold LVNV to these proof requirements in every case.

Here are some common weaknesses in their cases:

- You might not show up in court: Debt collectors often hope you will ignore the lawsuit. If you don’t appear, they can easily get a default judgment against you.

- Old debts: Some debts LVNV buys are very old. These old debts may be too old to enforce legally because of the statute of limitations.

- Unclear ownership: The real ownership of the debt is often unclear. The chain of custody—who actually owns the debt—can be confusing or incomplete.

- Affidavits signed without full knowledge: When debts are bought in large groups, the person signing affidavits often does not know the details of each debt. They may sign hundreds of affidavits without direct knowledge of the individual accounts.

Case Study: How We Beat an LVNV Lawsuit

We recently worked with a person who was completely overwhelmed by a lawsuit from LVNV Funding. They were demanding thousands for an old credit card debt he barely recognized, and he was ready to just give up. Our advice was simple: “Let’s make them prove they actually own this debt.” We filed a response and formally demanded they produce the complete paper trail showing the chain of ownership from the original bank to them. You know what happened? They couldn’t. All LVNV had was a name on a giant spreadsheet, not the actual contracts for his specific account. Faced with having to produce real evidence in court, they quietly dismissed the lawsuit. He went from facing a judgment to owing nothing, all because we challenged them to prove their case. It shows that just because they sue doesn’t mean they can win. If you are facing an LVNV lawsuit, we can evaluate whether similar weaknesses exist in your case.

Debt collectors must follow strict procedures to avoid liability for wrongful collection actions. This is especially important when there is mistaken identity, meaning they are trying to collect from the wrong individual. Our firm can help you push back if LVNV is pursuing the wrong person or the wrong amount.

Our firm has successfully defended hundreds of Texans against lawsuits from debt buyers like LVNV Funding. In many situations, the case hinges on a simple but powerful legal challenge, as illustrated by the following example:” We would be glad to talk with you about whether a similar strategy could work in your case.

What Not To Do

Nothing. Many of the lawsuits filed by LVNV Funding go uncontested. The debt holder, unsure of what to do, often does nothing. If you are being sued by the company and you do not respond or show up in court, LVNV Funding will get the full judgment amount they asked for. Instead of freezing, reach out to our office so we can walk you through your options.

As the defendant in a debt collection lawsuit, it is very important to know your legal rights and responsibilities when you get a summons and complaint. If you don’t respond properly, you could face serious legal consequences, including a default judgment. A consultation with a debt‑defense attorney can quickly clarify what needs to happen next.

A judgment can lead to:

- Frozen or garnished bank accounts (writ of garnishment)

- Liens on non‑exempt real property (via abstract of judgment). Tex. Prop. Code § 52.001.

- Other post‑judgment collection remedies allowed by Texas law

A judgment is a public court record. The three major credit bureaus generally do not list civil judgments as a separate item on consumer credit reports, but the underlying collection account may still appear. The court’s ruling in these matters is legally binding and enforceable.

What To Do If You Are Sued by LVNV Funding, LLC

If LVNV Funding, LLC has filed a lawsuit against you, follow these important steps:

- File an Answer to the lawsuit right away. This is your first and most important step in responding to the pleadings. Our office can prepare and file your Answer for you.

- Decide if you should hire an attorney to help with your case—such as the Texas debt‑defense lawyers at Warren & Migliaccio.

Going to court shows the judge you take the matter seriously. But if you seem unprepared or confused, the judge will likely side with LVNV Funding and award them the full amount they want. Appearing with an experienced debt‑defense attorney sends a clear signal that you are prepared and defended.

You need to understand the legal proceedings to protect your rights in court. Every debt case is different, and knowing which laws apply takes experience. Some defenses are a matter of law, meaning the court will decide them without needing a full trial. We walk our clients through each step so they are never guessing about what comes next.

LVNV Funding makes a lot of money from lawsuits people don’t contest. Having a debt lawsuit attorney on your side greatly increases your chances of:

- Getting the case dismissed

- Settling the debt before going to trial court

Law Firms that sue and file lawsuits for LVNV:

Possible Consequences of a Lawsuit with LVNV Funding

When Facing an LVNV Funding LLC Lawsuit, Several Outcomes Are Possible:

-

🏆

Victory in Court

If you successfully defend against LVNV’s claim, the court may dismiss the lawsuit. No judgment will be entered against you.

-

⚖️

Defeat in Court

If LVNV wins, a judgment will be entered against you. You’ll be required to pay the debt plus any extra fees or interest.

-

🤝

Settlement Agreement

Sometimes LVNV may offer a settlement agreement. You agree to pay part of the debt, and they drop the lawsuit—often the best option to avoid a judgment if you can’t pay in full.

-

⌛

Default Judgment

If you fail to respond or miss a hearing, LVNV can win by default, resulting in a judgment against you and potential enforcement actions like bank‑account garnishment and property liens.

Ignoring a lawsuit about an outstanding debt can lead to serious problems. These include default judgments, bank‑account garnishment, property liens, and other collection activity. Our firm focuses on helping clients avoid these worst‑case outcomes.

The outcome of the lawsuit depends on the evidence both sides present. As a consumer, you have the right to make an informed decision for your best interests. You can legally question the debt’s validity and seek professional legal advice. During your consultation, we will review LVNV’s lawsuit and explain your options in plain language.

Benefits of Retaining a Debt Defense Attorney

When you retain an attorney to help you with the lawsuit against you, such as Warren & Migliaccio, the attorney can:

- Advise you of your rights.

- Help you with the preparation of your response.

- Request a dismissal of the case against you.

- Investigate your case.

- Take action if the debt collection agency is abusive towards you.

- Assert any defenses, such as the statute of limitations having expired on the debt.

- Negotiate a settlement if appropriate.

- Advise you of all of your options.

Retaining a Debt Defense Attorney Can Help You

Hiring a lawyer who focuses on debt defense offers strategic advantages. At Warren & Migliaccio, this is a core part of our practice:

- Knowledge of the law: A specialized attorney understands Texas and federal debt collection laws and can pinpoint weaknesses in LVNV Funding’s claims.

- Stronger Negotiations: Collectors often agree to more favorable settlements when they see you have legal representation.

- Procedural Guidance: An attorney ensures you meet all court deadlines and comply with local rules—avoiding costly mistakes like missing an Answer deadline.

- FDCPA Enforcement: If LVNV Funding violates consumer rights or can’t verify the debt, a lawyer helps assert those defenses.

Although many debtors handle lawsuits on their own, retaining a debt defense attorney can provide benefits that significantly boost your chances of a successful outcome. The right legal counsel often pays for itself compared to the risk of a default judgment or a higher settlement. Our clients frequently find that having our firm involved reduces stress and leads to better financial results.

Don’t let companies like LVNV Funding pressure you into paying without legal advice. At Warren & Migliaccio, our Texas debt-defense attorneys help clients evaluate lawsuits, assert defenses, and pursue the best possible outcome. If you’ve been sued or threatened with a lawsuit, you can speak with our team by calling (888) 584-9614 or contacting us online for a free consultation.

Frequently Asked Questions

Initial Steps & Consequences

What should I do if I get a lawsuit from LVNV Funding LLC?

In Texas, respond right away by filing a formal Answer before your deadline—typically 14 days in Justice Court or by 10 a.m. on the Monday after 20 days in county/district. Never ignore the lawsuit. Filing an Answer preserves defenses and helps you avoid a no‑answer default judgment (a judgment entered because no Answer was filed). Tex. R. Civ. P. 502.5; Tex. R. Civ. P. 99(b).

- Review all documents carefully; note deadlines and specific claims

- In your Answer, respond to each allegation by admitting, denying, or stating insufficient knowledge

- File your Answer with the court listed on the citation, and send a copy to the plaintiff or its attorney. Tex. R. Civ. P. 99(b); Tex. R. Civ. P. 21a; Tex. R. Civ. P. 502.5; Tex. R. Civ. P. 501.4.

- Consider affirmative defenses such as statute of limitations or lack of standing

- Gather documentation related to the debt, including payment records and correspondence

- Consult a Texas debt‑defense attorney at Warren & Migliaccio

- Continue to meet all court requirements even if negotiating

What happens if I ignore an LVNV Funding lawsuit?

Ignoring the case almost always leads to a default judgment. In Texas, wages are generally not subject to garnishment for consumer debts, but a judgment can still be enforced through bank‑account garnishment, property liens, and other remedies.

- A default judgment means you lose without presenting your side

- Judgments can include the claimed balance plus interest, court costs, and attorney’s fees

- Judgments may result in bank‑account garnishment and liens on non‑exempt property

- They can affect your credit and be difficult to undo—respond on time

Legal Defenses & Your Rights

What are my legal defenses against an LVNV Funding lawsuit?

Defenses can include statute of limitations, lack of standing/assignment proof, insufficient documentation, and FDCPA/TDCA violations. Texas courts also require proper proof under business‑records rules. A Texas debt‑defense lawyer can identify which defenses are strongest in your case.

- Statute of limitations: Texas’s period is generally four years for credit‑card debts

- Lack of standing: LVNV must prove ownership with proper documentation

- Insufficient documentation: Missing card agreement, interest/fees math, or account history

- Mistaken identity or identity theft

- Improper service

How does the statute of limitations affect my LVNV Funding debt?

In Texas, the limitations period for most consumer debts is four years (Tex. Civ. Prac. & Rem. Code §16.004). If the claim is time‑barred and LVNV is acting as a debt buyer, Texas Finance Code §392.307 prohibits filing suit or compelling arbitration—and a later payment or reaffirmation does not revive the claim.

Before limitations expire, certain activity may affect the timeline. Speak with a Texas debt‑defense lawyer to evaluate dates and documents.

To protect yourself:

- Check your account history to confirm your last payment/acknowledgment

- Bring documents to a consult to assess whether the time limit has passed

- Use limitations as a defense in your Answer where appropriate

Settlement & Getting Help

Can I settle with LVNV Funding after being sued?

Yes. Many debt‑buyer cases settle. Offers vary by facts and proof. Lump‑sum proposals are often stronger than long payment plans. Our office regularly negotiates LVNV settlements for Texas consumers.

- Keep responding to the lawsuit while negotiating

- Get any settlement in writing before paying

- Request appropriate credit‑reporting language and a filed satisfaction/dismissal

- Consider attorney‑led negotiation for better terms

Should I get an attorney for my LVNV Funding lawsuit?

Working with a debt‑defense attorney improves outcomes through knowledge of Texas procedure, evidentiary rules, and negotiation leverage. Many offer free consultations and payment plans.

- Spotting limitations/standing issues and evidentiary gaps

- Managing deadlines, filings, and discovery

- Negotiating settlements or pushing for dismissal when proof is lacking

Where can I get help for an LVNV Funding lawsuit (free consultations & payment plans)?

Many Texas consumer law firms offer free consultations for debt‑collection lawsuits. During this meeting, an attorney will review your case and potential defenses.

By talking to a lawyer early, you will learn your options, which may include:

- Fighting the lawsuit

- Negotiating a settlement

- Filing a motion to dismiss or other relief

Getting legal advice early can help you avoid serious legal consequences.