Many people turn to social media or dating sites to meet their potential partners due to the convenience these platforms offer. For some, the worst happens when scammers trick them into sending their hard-earned cash. There has been an upsurge of online romance scams over the past few years.

A recent report by the Federal Trade Commission indicated that victims lost more than $540 million to online romance scammers in 2021. The report is just the tip of the iceberg because things are much worse. Social media and the growing popularity of online dating apps fuel these scams, and the number of reported cases will increase in the coming years.

What are Online Dating Scams?

In a typical romance scam, two people purportedly looking for love meet online. It could be on a dating app or even on social media. One is an unsuspecting individual desperate for an emotional connection, while the other is out to scam their victim.

Online romance scammers often target widowed, divorced, older, or out-of-work individuals with financial resources such as investment accounts, inheritance, and savings. They exploit these individuals’ vulnerability to forge a deep, albeit fake emotional bond.

After building trust through incessant calls and other communication platforms, the scammers often request a significant amount of money to fix a supposed urgent issue. Thanks to the trust built over time, victims often send the money, only to realize they’ve gotten scammed when the scammers keep asking for more money before they cut off communication.

How Do Victims Get Targeted?

Anyone can fall victim to an online romance scam because perpetrators often cast their nets wide. Victims span broad demographic ranges, education levels, gender, groups, and regions. However, men and individuals aged between 60 to 69 years account for the most significant percentage of online romance scam victims.

Scammers are convincing, conniving, and creative and always take advantage of their victims’ yearning for love and affection. They prowl social media platforms and dating sites searching for potential victims while watching out for vulnerabilities they may exploit. It could be the loss of a loved one or a similar situation they can leverage to “fill” the void in their victims’ lives and build trust.

The biggest driver of online romance scams is victims’ need for an emotional connection, which is why vulnerable people are usually prime candidates. The scammers take advantage of this to talk their way into their victims’ lives and build the connection they crave. The two then become connected and inseparable, at least from the victims’ perspective, until the scammer starts to ask for money.

How to Avoid Getting Scammed

There are several red flags to watch out for to avoid falling victim to an online romance scammer. These include:

- Their profile is too good to be true

- Them being too far away

- Breaking promises to visit

- The relationship moving too fast

- Asking for more money after the initial request

- Asking for specific payment methods

Victims often get brainwashed through emotional attachment. They send the money and even provide their credit card information, knowing they’re dealing with someone they love and trust.

What To Do If You Fall Victim to a Romance Scam

Many victims feel embarrassed and ashamed upon realizing they fell for a scam. Worse still, most have an emotional attachment to their swindlers, complicating the situation further. You should not feel shameful or embarrassed about being a victim of this and it happens to a lot of people—you are the victim of a crime.

Avoid hanging your head too much and focus on recovering rather than feeling foolish. As soon as you realize your online romance is a scam, cut off all contact immediately and file a complaint with the Internet Crime Complaint Center at the FBI. This will go a long way in ensuring you receive the help you deserve.

When you report the crime, you may not always recover your money, but it can help minimize the damage. Reporting the scam to the FBI also absolves you from being complicit in the crime if the perpetrator uses your credentials to dupe another victim.

How Bankruptcy Can Help You Recover from an Online Romance Scam

Filing for bankruptcy is never an ideal situation. However, it’s one of the main options to explore if you fall victim to an online romance scam and end in financial distress. The bankruptcy attorneys at the law offices of Warren & Migliaccio can help you file for bankruptcy, saving you from further distress.

Typically, online romance scam victims take money out of their savings accounts and other tax-exempt accounts until they run out of funds. Victims may be encouraged to borrow against their homes, vehicles, and other assets to obtain more money based on the trust they have with their “online lovers. Once a victim depletes their financial assets and ruins their credit, their scammer will cut off communication.

Why Choose Bankruptcy?

After an online romance scam, there’s no better thing to do than channel your anger into protecting whatever you’re left with. Bankruptcy protects you from further financial distress by eliminating some types of debts. However, the bankruptcy process is tricky and requires the expertise of an aggressive attorney who will help you understand your options.

Since romance scams involve separating the target from family members, friends, and other associates, victims often have no one to turn to when they realize they’ve been scammed. Thankfully, our team is there to help you get through the trying moment. We’ll help you file for bankruptcy, preventing you from getting auctioned and losing whatever you’re left with.

Bankruptcy discharges unsecured debts such as credit card debts and unsecured loans. However, there’s an exception to bankruptcy discharges for debts incurred without the intent to pay, including those incurred through fraud.

The Bankruptcy Process

In most cases, bankruptcy courts consider the subjective intent to repay your debt before deciding whether the debt supposed to be incurred deceptively is dischargeable. You won’t have to stand trial and be asked whether you intend to pay your debt. Instead, “intent to pay” often gets proved through circumstantial evidence, including:

- How recent the loans/charges were.

- Your current and anticipated earnings when the loans were taken out.

- The amount you’ve repaid towards the loans.

- The unexpected change in your finances after taking out the loan.

In bankruptcy cases related to scams, creditors often check most of the required boxes, proving fraud. In your case, the court may rule that the loans you took to send to your online lover were recent and in large amounts and that your income was too low to cover the repayments. It will also be easy to prove that you made few or no payments on the loans.

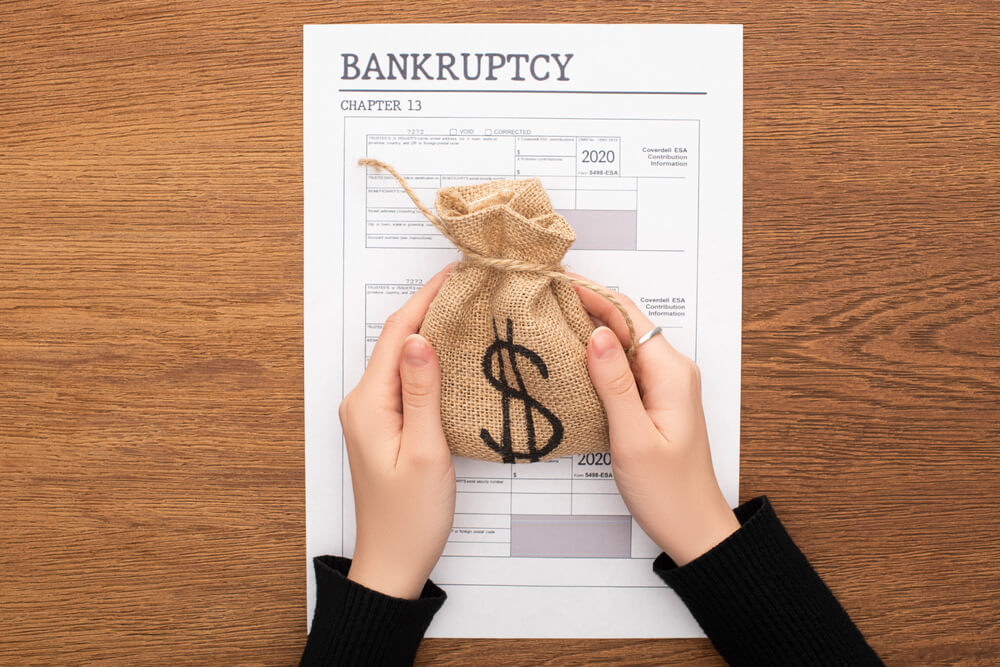

Chapter 7 vs. Chapter 13 Bankruptcy

Chapter 7 bankruptcy and Chapter 13 bankruptcy are two terms you’ll encounter after engaging our team. It’s best to understand what these bankruptcy processes mean and how you can take advantage of them to protect yourself from further financial distress.

Chapter 7 Bankruptcy

In this bankruptcy process, you will discharge unsecured debts such as unsecured loans, medical bills, and credit card debt. It also allows for the sale of your nonexempt assets and the distribution of the proceeds to your creditors. Chapter 7 bankruptcy is an excellent option if you fall behind in your repayments and can’t afford to keep up with other expenses.

Chapter 13 Bankruptcy

Also referred to as a wager’s plan, Chapter 13 bankruptcy allows you to create a repayment plan for all or part of your wages. If you select this option after losing your assets to an online romance scam, you’ll need to propose a plan outlining the repayments you’ll make to your creditors. Under this bankruptcy process, you have three to five years to pay your debts.

How Our Bankruptcy Lawyers Can Help When You Are A Victim Of Online Romance Scam

Filing for bankruptcy can help eliminate the debts arising from an online romance scam. Nonetheless, you need a skilled attorney who knows how to present your case and have it rules in your favor. The bankruptcy attorneys at Warren & Migliaccio have the expertise to prove that you got scammed into taking out your loans reasonably and honestly.

When you come to us, our team can collect the evidence needed to prove that your debts were accrued out of poor judgment and weakness and not a fraud. We believe that filing for bankruptcy isn’t the end but the start of a new chapter in your life. We’re dedicated to relieving your overwhelming financial burden and assisting you in turning over a new leaf.

Contact a Bankruptcy Attorney Today

Losing money to an online romance scam is the last thing you expect when you’re looking for a partner. However, the number of scamming incidents keeps increasing by the day. The emotional and financial drain from such incidents is often pronounced, necessitating the guidance of an experienced attorney to help you through the situation.

Filing for bankruptcy protects you financially and allows you to move on from the horrendous exploitation. So, don’t suffer under a mountain of debt when you have the team at Warren & Migliaccio to call upon for help. Contact us today for a free bankruptcy consultation to start your recovery journey.