Have you ever found yourself in the midst of a financial storm, hoping and praying for a life raft? Yes, we’re talking about the perfect storm–bankruptcy. Going through a bankruptcy might feel like you’re stranded in open seas amidst a never-ending storm that threatens to put you—and all your hard-earned benefits—underwater for good. Well, rest-assured because there are life rafts out there to carry you and your hard-earned social security and disability benefits to shore. It sounds too good to be true, right?

Have you ever found yourself in the midst of a financial storm, hoping and praying for a life raft? Yes, we’re talking about the perfect storm–bankruptcy. Going through a bankruptcy might feel like you’re stranded in open seas amidst a never-ending storm that threatens to put you—and all your hard-earned benefits—underwater for good. Well, rest-assured because there are life rafts out there to carry you and your hard-earned social security and disability benefits to shore. It sounds too good to be true, right?

A successful navigation to shore will require dealing with the bankruptcy code, which can be a little like untangling a web of myths, particularly when your financial stability is woven with disability benefits. Many people in such a situation fear the loss of their assets and disability benefits.

But here’s an interesting twist: what if I told you that understanding how your disability benefits could be shielded might offer not just solace but a strategic advantage? That’s right. Your disability income may very well shield you from financial calamity.

This isn’t about painting over cracks or wishing away problems. It’s about facing them head-on, understanding their roots, and working diligently towards sustainable solutions. Our approach emphasizes the importance of not just quick fixes but long-term strategies that address underlying issues. In striving for this, our goal is to build a robust base that stands firm and adapts in the face of upcoming obstacles.

Understanding Chapter 7 Bankruptcy and Permanent Disability in Texas

Tackling debt can feel like a never-ending battle, especially when you’re dealing with permanent disability. In the heart of Texas, where the spirit is as big as its vast landscapes, navigating through Chapter 7 bankruptcy has its own set of rules and considerations.

The Process of Filing for Chapter 7 Bankruptcy

Chapter 7 bankruptcy is governed by federal law: the Chapter 7 bankruptcy code. It isn’t just about filling out some paperwork. It’s a step-by-step process that requires precision and understanding. First off, you’ll need to prove that you qualify by passing the means test – it’s like checking if you really need this financial reset button. If your income is lower than the median in Texas, you’re likely good to go. Some steps you’ll want to take as you begin the process:

- Gather all your financial records; debts, assets – everything but your cowboy boots maybe.

- Credit counseling comes next – think of it as financial rehab before taking a major step.

- Then there’s filing your petition with the court – officially starting your journey towards debt relief.

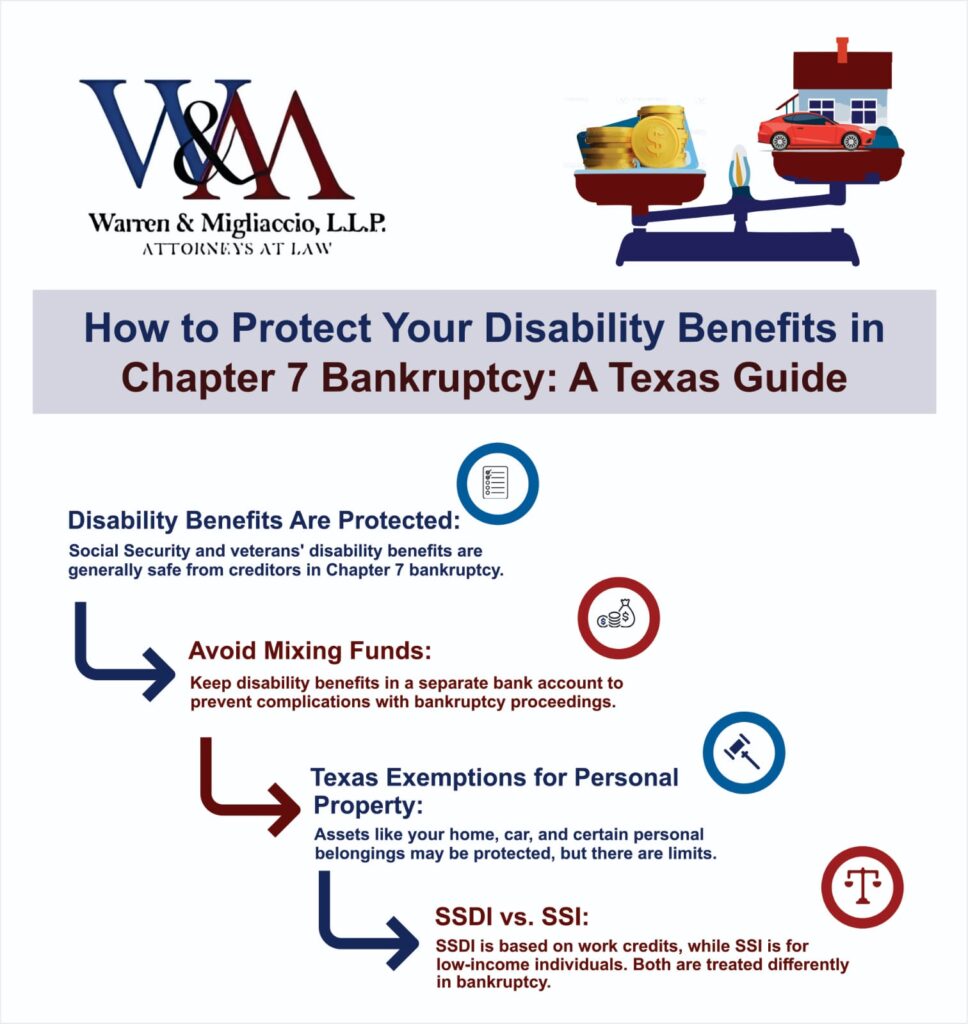

How Permanent Disability Affects Bankruptcy Proceedings

Navigating the intricacies of bankruptcy becomes even more challenging when contending with a permanent disability. But here’s some good news: certain benefits tied to disabilities are protected under Texas law. This means not all hope is lost when facing tough times financially due to health concerns beyond one’s control. Essentially, your Social Security benefits are usually off limits to creditors looking for their share during bankruptcy proceedings in Texas. Likewise, veterans’ benefits also enjoy similar protection. In essence, these protections let Texans breathe easier knowing their lifeline – their ability to cover living expenses and medical bills through disability pay – won’t be snatched away during tough times.

Key Takeaway:

Dealing with debt and disability in Texas? Chapter 7 bankruptcy could be your financial reset. Just remember to pass the means test, gather all financial records, complete credit counseling, and file your petition. But keep an eye on those protected benefits like Social Security and veterans’ benefits – they’re safe from creditors but need careful handling to avoid complications.

Navigating Social Security Disability Benefits in Bankruptcy

When life throws a curveball, and you find yourself wading through the murky waters of bankruptcy, knowing how your SSDI benefits play into this scenario is crucial. Especially if you’re in Texas, where cowboy hats are big but the heart for protecting folks’ rights is even bigger.

Protecting Your SSDI Payments

First off, let’s talk about safeguarding those Social Security Disability Insurance (SSDI) payments. In bankruptcy proceedings, these payments often get a shield against creditors. Why? Because they’re considered essential for your day-to-day living. But here’s the kicker: to keep them protected, don’t mix ’em with other funds in your bank account.

SSI vs. SSDI in Bankruptcy

A common puzzle people face is untangling Supplemental Security Income (SSI) from SSDI when filing for Chapter 7 bankruptcy. Here’s breaking it down simply:

| Social Security Disability Insurance (SSDI) |

Supplemental Security Income (SSI) |

|---|---|

|

|

So while both aim to support individuals facing disabilities, SSI and SSDI differ mainly by their eligibility criteria.

In a nutshell? Whether it’s an unexpected injury or lifelong battle with disability leading you towards Chapter 7 bankruptcy – understanding how Texas law treats these benefits can be like finding water in a desert; utterly lifesaving.

Key Takeaway:

Keep your SSDI safe in bankruptcy by giving it its own ‘room’ and keeping sharp records. Knowing the difference between SSI and SSDI is key in Texas – it’s like finding water in a desert.

Exemptions for Disability Benefits in Texas Bankruptcy Cases

If you’re wading through the murky waters of Chapter 7 bankruptcy in Texas and juggling disability benefits, there is some good news. The Lone Star State has got your back with some exemptions designed just for you. Let’s break it down.

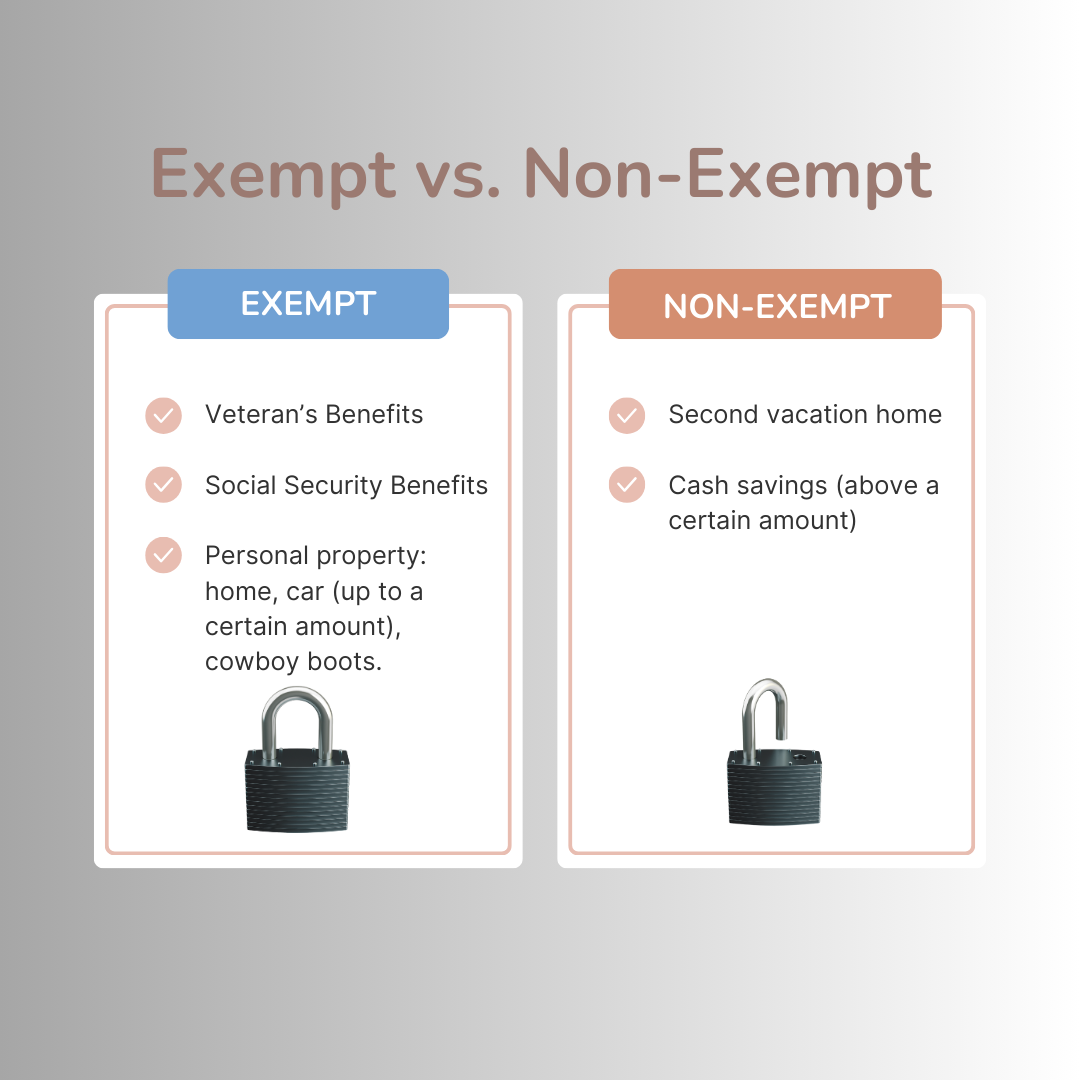

Understanding Exempt vs. Non-Exempt Assets

First off, what’s safe from creditors? In simple terms, exempt property or assets are your financial safety net that the law protects. This includes personal property like your home or car (up to a certain value) and yes, your disability payments too. On the flip side, non-exempt assets are fair game for creditors. Think cash savings above a specific limit or that second vacation home. Understanding which of your assets will be categorized as exempt is a crucial part of the bankruptcy process. In some cases, it may be relatively simple. But it’s not always simple, especially the more assets that come into play. An experienced bankruptcy attorney can offer more guidance and help you sort through your assets.

Common Mistakes to Avoid with Disability Benefits in Bankruptcy

Filing for bankruptcy can feel like navigating a minefield blindfolded. Especially when you’re juggling disability benefits on top of everything else. But, hey, let’s dodge those mines together, shall we?

Mixing Funds in Your Bank Account

Picture this: your bank account is a salad bowl. Mixing disability benefits with other funds? That’s like tossing oranges into your caesar salad. Sounds messy? It is. The mix-up makes it tough for bankruptcy trustees to tell what money comes from where. This confusion could lead them to believe you have more available cash than you actually do – which affects how much they think you can pay creditors. So use a separate bank account for your disability payments. Simple as that.

Treating all money as if it were created equal might seem easy at first glance but remember – not all greens belong in the same bowl. And while lump sum payments or regular monthly disability income might just be another deposit into your account, keeping them separate ensures they’re protected under bankruptcy laws.

Surely no one wants their safety net tangled up when seeking financial relief through bankruptcy. So, here are a couple of essential tips:

- Create and maintain a separate bank account exclusively for your disability benefit deposits.

- Avoid transferring funds between accounts unless absolutely necessary – and even then, keep meticulous records of each transaction.

This isn’t just about playing by the rules; it’s about safeguarding what’s yours so that during tough times, those lifelines remain intact. If managing multiple accounts sounds daunting – don’t worry. A little organization goes a long way towards peace of mind…and potentially smoother sailing through bankruptcy proceedings too.

Frequently Asked Questions

Will I lose my disability benefits during bankruptcy?

No. Texas law shields social security benefits, as they are essential support systems for Texans who rely upon them.

What about my personal property? Is it protected?

Personal property is generally shielded, but there are limits when it comes to things like cash savings, cars, and homes.

What should I do if I have social security benefits and want to protect them?

If you are receiving social security benefits and want to make sure there are no complications, ensure that you have a separate bank account and do not co-mingle funds.

Conclusion

Filing for bankruptcy while navigating disability benefits might feel like you’re in the midst of the perfect storm, with no way out. But as we saw, there are protections in place that should give you peace of mind.

Chapter 7 bankruptcy and permanent disability laws might seem like two opposing forces at first glance. But dig deeper, and you’ll find Texas has carved out paths designed to protect those who need it most. It’s about more than just staying afloat; it’s about understanding how these protections work hand-in-hand to safeguard your future.

We found that SSDI payments can be protected from creditors, and bankruptcy exemptions help keep certain assets safe. To avoid pitfalls, keep disability benefits separate and understand the differences between SSDI and SSI. This knowledge safeguards your assets and ensures financial stability.

Embrace the process as an opportunity for renewal. Like others who’ve turned setbacks into comebacks, you can transform your financial situation with the right guidance. Navigating bankruptcy and disability benefits isn’t just about survival—it’s about thriving. Seek support to ensure a brighter financial future.

And you don’t have to do this alone. Our lawyers are here to help. For more information, take a look around our website. You’ll find great resources to help you with your case. If you are ready to get started or wish to speak with one of our attorneys, call our law office now at (888) 584-9614 or contact us online to schedule a consultation.