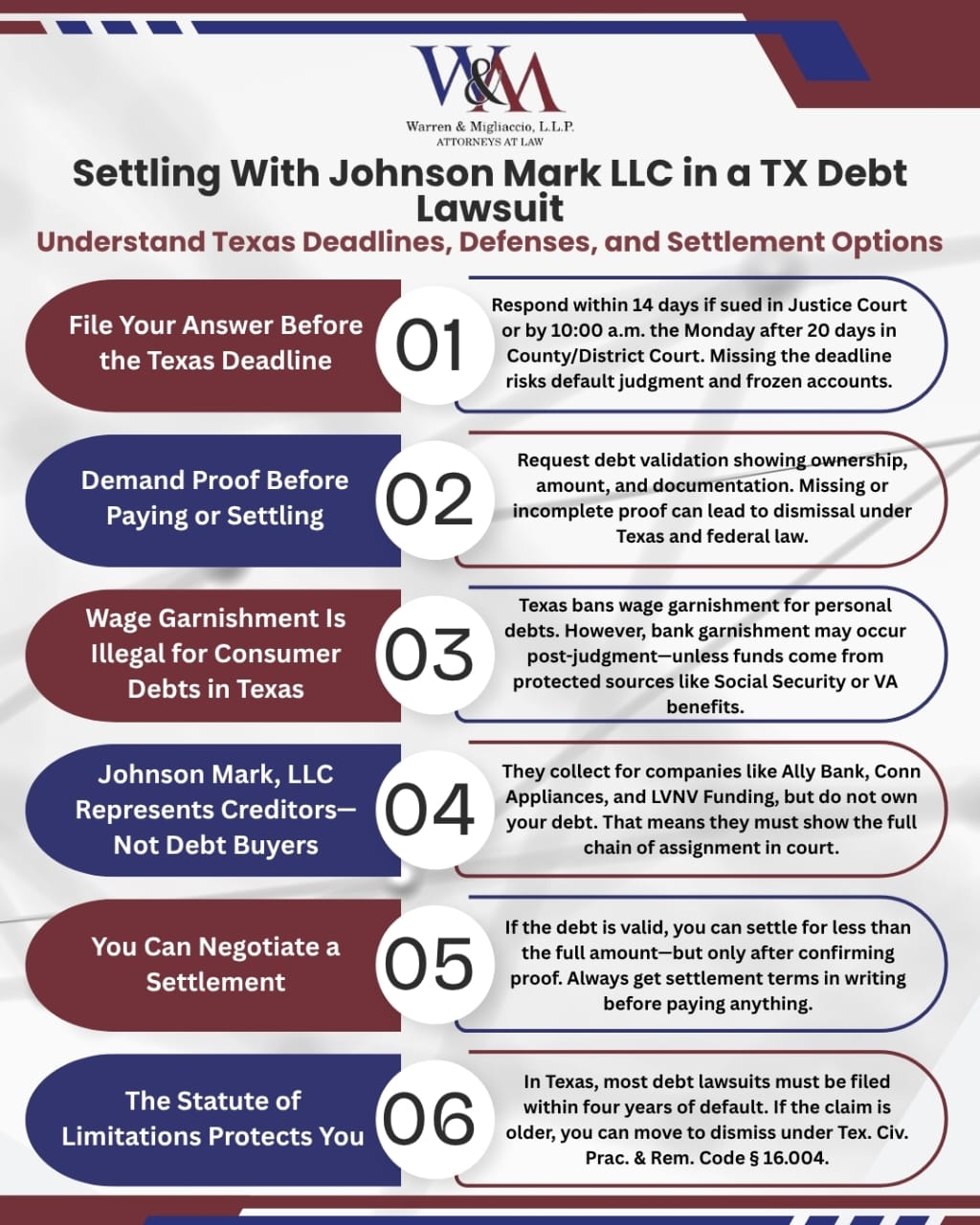

If Johnson Mark, LLC sues you in Texas, act fast: file your Answer by the Texas deadline, verify the debt and who owns it, and explore settlement or defense options to avoid default judgment and potential bank-account garnishment of non-exempt funds.

Are you currently being sued by Johnson Mark, LLC, for debt collection in Texas? We understand that you may be overwhelmed and unsure how to defend yourself. However, it is important to remember that you may have more legal options than you think for resolving the lawsuit. Below, our Texas debt collection defense lawyers discuss what to do if facing a debt collection lawsuit in Texas and your option of settling with Johnson Mark, LLC.

Quick Answer: What should I do first if Johnson Mark, LLC sues me in Texas?

Meet your Answer deadline—14 days in Justice Court (Tex. R. Civ. P. 502.5) or 10:00 a.m. on the Monday after 20 days in County/District Court (Tex. R. Civ. P. 99(b))—then request validation/records and consider settlement or defenses with a Texas debt-defense lawyer.

- File your Answer by the Texas deadline.

- Request validation proving ownership and amount.

- Negotiate written terms or prepare defenses.

| Court type | Answer deadline | How to respond | Notes |

|---|---|---|---|

| Justice Court (JP) | 14 days after service (TRCP 502.5) | File at the precinct (some allow e-file) and serve plaintiff’s counsel. | Check your citation for date/time; mind weekends/holidays. |

| County/District | 10:00 a.m. the Monday after 20 days (TRCP 99(b)) | E-file Answer; consider discovery and special exceptions. | Calendar the correct Monday to avoid default. |

Keypoints

- File your Answer by the Texas deadline to avoid default.

- Wage garnishment is barred for consumer debts; bank garnishment may follow judgment.

- Request validation to confirm ownership, amount, and documentation.

- Negotiate written settlement terms or prepare defenses.

- Contact a Texas debt-defense attorney for case strategy.

Who Is Johnson Mark LLC?

Johnson Mark, LLC is a law firm specializing in debt collection. It represents and acts on behalf of financial institutions, lending companies, and medical facilities, representing creditors in debt collection matters to recover money they allege is owed by consumers. Johnson Mark is based in Utah but represents creditors in multiple states, including Texas.

When Johnson Mark files lawsuits against consumers in Texas, it brings in Texas attorneys as local counsel. Consumers have filed complaints against Johnson Mark LLC with the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB). Johnson Mark LLC is ultimately bound by the guidelines and decisions of the creditor or financial institution they represent.

Is Johnson Mark LLC a Debt Collector?

Johnson Mark, LLC is a law firm that operates as a debt collector. However, it does not own the debts it works to obtain. Johnson Mark files debt collection lawsuits on behalf of creditors and debt buyers that are unable to collect on outstanding debts. Legal action is typically a last resort when other collection efforts have failed.

When the original creditors have exhausted their collection efforts, they often sell the debts to debt buyers or hire law firms like Johnson Mark to recover the money through litigation. Allegations against Johnson Mark LLC include contacting consumers at wrong addresses, making unauthorized calls, and improper handling of debts.

Who Does Johnson Mark LLC Collect for in Texas?

Some of the creditors and debt buyers that Johnson Mark LLC represents for Texas debt collection cases include, but are not limited to:

- Ally Bank

- Baxter Credit Union

- Conn Appliances, Inc.

- Denali Capital, LLC

- LVNV Funding, LLC

- Prestige Financial Services

What to Do if Johnson Mark Sues You for Debt Collection

Below, our Texas debt defense attorneys discuss a few steps you should take if Johnson Mark sues you for debt collection in Texas.

Texas answer deadlines are set by the Texas Rules of Civil Procedure: 14 days in Justice Court (Tex. R. Civ. P. 502.5) or by 10:00 a.m. on the Monday next after 20 days in County or District Court (Tex. R. Civ. P. 99(b)).

Before you settle with Johnson Mark LLC, make sure your agreement includes:

- Total amount and payment schedule (due dates, method, grace period).

- Dismissal with prejudice (or agreed judgment terms only if counsel approves).

- No “stipulated/consent judgment” unless advised by your attorney.

- Credit-reporting language (how the tradeline will be reported after payment).

- Fee/interest waiver terms and what happens on default.

- If a judgment already exists: release of any bank levy/garnishment after payment.

Note: If the plaintiff is acting as a debt buyer, Texas Finance Code §392.307 bars filing suit after the four-year statute of limitations (Tex. Civ. Prac. & Rem. Code §16.004), and a later payment does not revive the claim.

Do Not Ignore the Lawsuit

- Ignoring the lawsuit can lead to a default judgment against you.

- A default judgment allows Johnson Mark’s client to obtain money without proving their case.

- Ignoring phone calls from Johnson Mark LLC can also worsen your situation, so it is important to address all forms of communication.

Consult With Our Texas Debt Collection Defense Lawyers

- Schedule a consultation with our Texas debt collection defense attorneys.

- Open, proactive communication with Johnson Mark LLC and their attorneys can help facilitate negotiations and potentially resolve the debt more amicably.

- Review the claims against you during the consultation.

- Discuss next steps to protect your legal rights and resolve the lawsuit.

Answer the Lawsuit

- File a response to the lawsuit, called an Answer, to avoid a default judgment.

- Submit your Answer to the Texas court handling your case and send a copy to Johnson Mark, LLC.

- Refer to our guide on how to respond to a debt collection lawsuit for assistance.

- You may receive letters and other correspondence from Johnson Mark LLC, and it is important to respond promptly to these communications.

Work with an Experienced Attorney

- Collaborate with a Texas debt collection defense attorney to ensure your Answer protects your interests.

- Avoid mistakes and ensure you meet critical filing deadlines.

- Be aware that you have a limited time to respond, sometimes as short as 14 days.

Texas generally provides a four-year limitations period for suits on debt and open accounts (Tex. Civ. Prac. & Rem. Code § 16.004(a)(3), (c)).

Texas courts may authorize substituted electronic service—including email or social media—when traditional methods fail and the method is reasonably effective. Tex. R. Civ. P. 106(b)(2) (compiled Aug. 31, 2025).

Johnson Mark LLC may contact you through mail, so carefully review any documents you receive and ensure your rights are protected.

Can Johnson Mark, LLC Garnish My Wages?

If Johnson Mark, LLC gets a judgment against you, it may request a writ of garnishment to recover funds. However, Johnson Mark cannot garnish your wages for consumer debts.

Texas law prohibits garnishment of current wages for personal services except to enforce court-ordered child support or spousal maintenance. Tex. Const. art. XVI, § 28. Federal law separately allows certain garnishments for federal debts (e.g., IRS levies; federal student loans). 26 U.S.C. § 6331; 20 U.S.C. § 1095a. Consumers have legal protections under the Fair Debt Collection Practices Act (FDCPA), which prohibits certain practices by debt collectors.

However, Johnson Mark, LLC can try to get the money through bank garnishment. Texas permits post-judgment garnishment of bank accounts on proper grounds. Tex. Civ. Prac. & Rem. Code § 63.001. Funds traceable to federal benefits (e.g., Social Security, VA) are protected to the “protected amount.” 31 C.F.R. pt. 212; 42 U.S.C. § 407.

With a court order, your bank would freeze your accounts, and Johnson Mark could obtain the debt directly from your bank account. Once wages are deposited, they generally become funds in the account and may be subject to garnishment unless otherwise exempt.

Remember, the best defense against garnishment is to address the debt collection lawsuit head-on and not allow it to reach the judgment phase without proper defense.

What to Do if Johnson Mark Sues You for Debt Collection

Dealing with a debt collection lawsuit can be stressful and overwhelming, but settling your debt with Johnson Mark, LLC is possible. It may be in your best interest, depending on your situation. Here are some steps you should consider if you are thinking about settlement. If you are able to reach an amicable resolution with Johnson Mark LLC, it is essential to get the debt settlement agreement in writing.

Legal Steps you should Take

- Consult with a debt defense attorney. Before deciding on any course of action, consult a lawyer experienced in debt collection defense. They can help you understand your rights and provide guidance based on the specifics of your case.

- Answer the lawsuit. An attorney can also help you file an Answer to the lawsuit. Even if you plan on settling the case, you should file an Answer with the court. You want to avoid Johnson Mark obtaining a default judgment.

- Review the lawsuit thoroughly. Make sure you fully understand the claims made by Johnson Mark, LLC, and who is suing you. You have the right to request documentation to prove that Johnson Mark’s client legally owns your debt, that you owe it, and that the amount claimed is accurate.

- Determine your ability to pay. Figure out how much you can afford to pay toward the debt. Your attorney can help guide you through this process, considering your income, expenses, and other financial obligations. It is important to understand your payment options, such as whether you can make a lump-sum payment or need to arrange installment payments, to effectively resolve the debt.

- Negotiate a settlement. Before engaging in settlement negotiations, confirm that the debt is valid by requesting a debt validation letter from Johnson Mark LLC. If Johnson Mark has a strong case against you, negotiating a settlement may be the right option for you. Your attorney can negotiate with Johnson Mark to work toward a settlement amount less than the total claimed in the lawsuit. Reaching an agreement between all parties involved is crucial for a successful resolution of the debt.

You can also review our full guide about how to settle debt before going to court.

Case Study: We Challenged the Paperwork and Got the Case Dismissed

When Maria walked into our office, she was exhausted and afraid of waking up to a frozen bank account. Johnson Mark, LLC had just sued her in Texas on an old credit-card balance, and the paperwork felt overwhelming.

We slowed things down. I filed her Answer right away to avoid a default, then asked for proof: debt validation, the full chain of assignment, and itemized statements tying the balance to Maria—not just a spreadsheet.

Discovery told the real story. The documents didn’t line up: missing links in the sale of the account and gaps in the transaction history. We moved to strike the exhibits and pushed for dismissal. Before the hearing, opposing counsel agreed—case dismissed with prejudice. Maria paid nothing.

The Lesson: Don’t assume the collector can prove it. Answer on time, demand proof of ownership and amount, and use targeted discovery to expose gaps that end the case.

Frequently Asked Questions

FAQs About Texas Debt Lawsuit Basics & Enforcement

How long do I have to answer a Johnson Mark LLC debt lawsuit in Texas?

You typically have 14 days to answer in Justice Court, or until 10:00 a.m. on the Monday next after 20 days in County/District Court. File your Answer with the court and serve Johnson Mark to avoid default.

Can Johnson Mark LLC garnish my wages in Texas?

No—for consumer debts, wages generally cannot be garnished under Texas law. Exceptions include child support, spousal support, certain federal debts, and federal student loans. Avoid judgment by answering on time and defending the case.

Can Johnson Mark freeze my bank account after a judgment?

Yes, bank garnishment is possible in Texas after judgment, even though wages are protected. A writ can direct your bank to freeze non-exempt funds. Some funds are exempt by law; act quickly if your account is frozen.

FAQs About Validation & Creditor Identity

Should I request a debt validation letter from Johnson Mark?

Yes. Within 30 days of the debt collector’s first contact, you can demand validation information. Johnson Mark must pause collection until it provides verification. Ask for the amount, the current creditor, and evidence linking the debt to you. Send requests in writing.

Under the FDCPA, you have 30 days from the debt collector’s first notice to dispute and request validation; collection must pause until verification is mailed. 15 U.S.C. § 1692g; 12 C.F.R. § 1006.34.

Is Johnson Mark LLC legit or a scam?

Johnson Mark LLC is a debt-collection law firm that files suits for creditors and debt buyers. Reputation varies by office; BBB pages show mixed ratings and complaints. Treat it as legitimate litigation and respond formally.

FAQs About Timelines, Settlement & Consequences

What is the statute of limitations for credit-card debt in Texas?

Most consumer debt lawsuits in Texas have a four-year limitations period. After that, a collector can’t sue to collect, though they might still attempt to collect informally. Limitations issues can be nuanced—get legal advice.

How do I settle a Johnson Mark LLC lawsuit?

Settlements are common. Typical steps:

Verify the debt and ownership

File an Answer to avoid default

Assess budget (lump sum vs. installments)

Negotiate terms and get a written agreement

Consult counsel to avoid pitfalls.

What happens if I ignore a Johnson Mark lawsuit?

Ignoring the suit risks a default judgment, enabling bank levy and other enforcement on non-exempt assets. File an Answer and consider defenses (ownership, documentation, limitations).

FAQs About Service & Protected Funds

How will I be served in a Texas debt case?

Service may be by constable/sheriff, a court-authorized private server, or certified mail in some situations. Once served, answer within the deadline to avoid default.

Are Social Security or VA benefits protected from Johnson Mark?

Federal benefits are generally protected from commercial creditors, even after judgment, though there are exceptions for federal debts and support obligations. Keep protected funds identifiable in your account.

Contact the Texas Debt Collection Defense Attorneys of Warren & Migliaccio

At Warren & Migliaccio, our Texas debt collection defense lawyers have extensive experience and success in helping Texans resolve collection lawsuits. We handle debt collection defense cases across the state. If you are facing a Johnson Mark, LLC lawsuit in Texas, we encourage you to schedule a consultation with us to discuss your options.

Our Texas debt collection defense attorneys can review the claims against you and discuss your potential options for resolving the lawsuit. We can also discuss how we can help you ensure your debt is fully resolved through proper settlement and payment arrangements. Call us at (888) 584-9614 or contact us online, and we will reach out to you soon.