In a Texas divorce, you prove separate property by rebutting the community presumption with clear and convincing evidence that tracks the asset from separate source to today through any mutations. Bank records, deeds, closing papers, and expert tracing schedules typically supply the proof courts accept.

In a Texas divorce, tracing separate property means proving—by clear and convincing evidence—that an asset came from separate funds and maintained its separate nature through any changes. This article explains how Texas courts apply tracing standards and the methods practitioners use in DFW.

Quick Answer: How do you prove separate property in a Texas divorce?

Under Texas Fam. Code §3.003’s community presumption, you must act quickly to gather records and show clear-and-convincing tracing before mediation or trial to protect separate assets.

- Gather complete bank, deed, and account records

- Apply Texas tracing methods to connect funds

- Consult a Dallas family-law attorney immediately

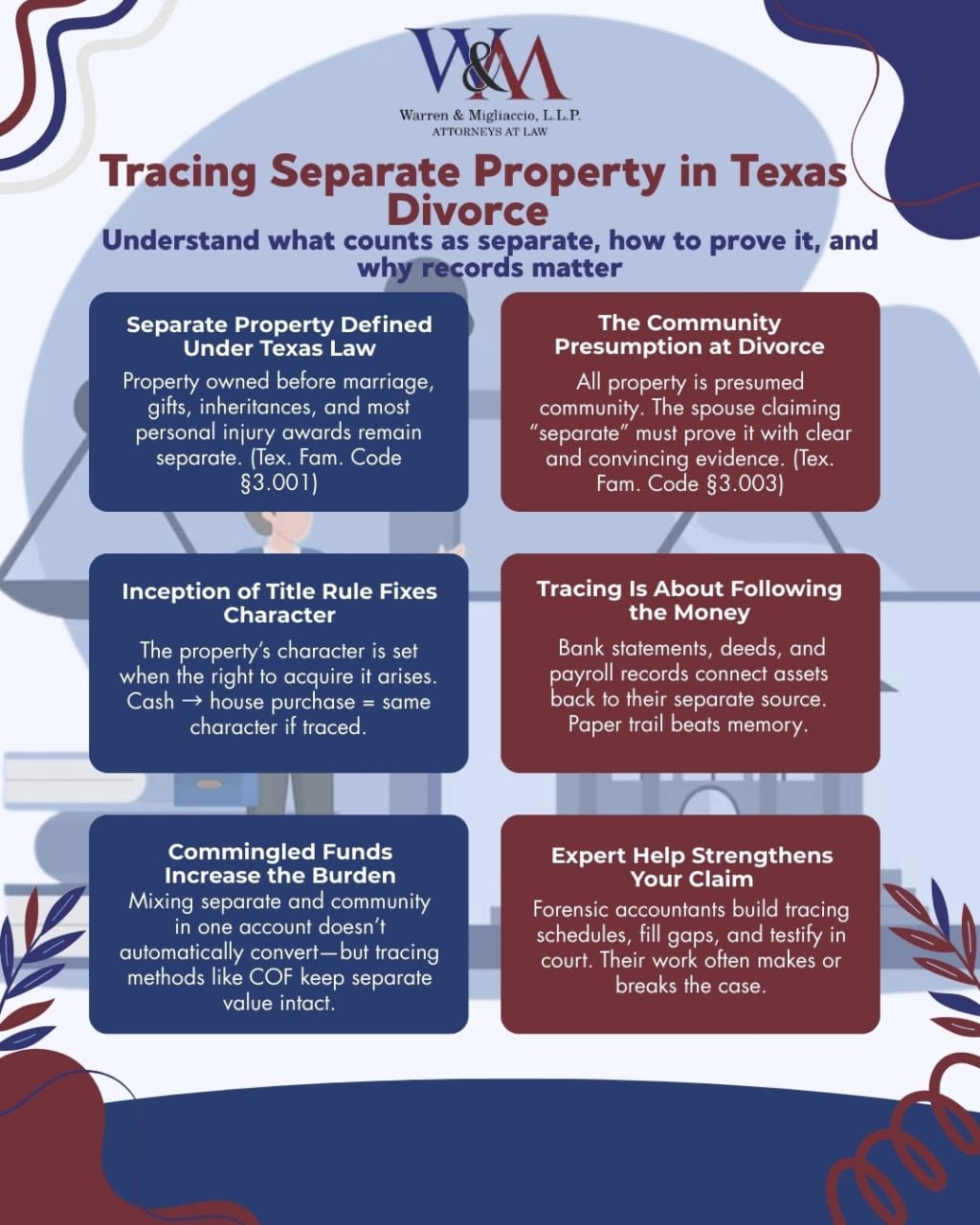

Understanding Separate Property in Texas

Texas is a community property state. This means the court must first characterize each asset and debt as either community or separate before property division occurs. As a result, the correct label directly affects who keeps what at the time of divorce. In our experience, this step often drives both strategy and settlement outcomes in DFW courts.

Moreover, understanding all aspects of property is essential in Texas family law, since these distinctions heavily impact the outcome of divorce proceedings. Consequently, family law attorneys play a key role in guiding clients through the complexities of property characterization, tracing, and valuation to help ensure a fair division.

Definitions & the Presumption

Under Texas law, separate property includes:

(1) Firstly, property owned before marriage

(2) Also, property acquired during marriage by gift, devise, or descent

(3) Moreover, most personal injury recoveries (not lost earning capacity)

Community property is, by definition, everything else acquired during marriage. In contrast, marital property includes almost all assets acquired during the marriage, while separate property remains with the original owner.

Moreover, all property possessed at divorce is presumed community unless a spouse proves separate character by clear and convincing evidence. To clarify, for an asset to be considered separate property, it must be proven as such, and the burden is on the spouse making the claim to establish that certain assets are not subject to division as community property.

Inception of Title Rule & Mutations

Texas uses the inception of title rule, meaning an asset’s character is fixed when the right to acquire it first arises. In other words, if the asset changes form (a mutation)—for example, cash used to buy real estate—the separate character still follows if you can trace it. Furthermore, even if the property has changed form or become a different property through exchanges or conversions, tracing can connect it back to the original separate property. Finally, courts rely on this rule in cases like Strong v. Garrett and in teaching materials from Baylor Law.

Key Facts Box

- Separate property: pre-marriage, gift/inheritance, personal injury (not lost wages). (Tex. Fam. Code §3.001.)

- Community presumption applies at divorce; overcome with clear and convincing proof. (Tex. Fam. Code §3.003.)

- Income from separate property is generally community unless valid agreement says otherwise. (Tex. Const. art. XVI, §15.)

- Courts divide community in a “just and right” manner, not automatic 50/50. (Tex. Fam. Code §7.001; Murff.)

- Recordation of separate property schedules is allowed but has limits on notice. (Tex. Fam. Code §3.004.)

- Retirement tracing uses normal tracing rules. (Tex. Fam. Code §3.007(c).)

- RSUs/options are apportioned by statutory formulas tied to grant and vesting. (Tex. Fam. Code §3.007(d)-(e).)

- Fraud/waste triggers a reconstituted estate remedy. (Tex. Fam. Code §7.009.)

Effective Methods for Tracing Separate Property

We’ve seen thousands of divorce cases where solid records made the difference. Tracing is about following the money—through bank accounts, withdrawals, and deposits—to link today’s asset back to separate funds. There are different methods and methods employed in the tracing process, depending on the complexity of the case.

Paper Trail Essentials

Gather these early:

- Firstly, bank/brokerage statements (monthly, complete ranges);

- Also, wire receipts, canceled checks, and payroll stubs;

- Likewise, HUD-1/Closing Disclosure and deeds for real property;

- Additionally, account opening docs for separate accounts and joint accounts;

- Moreover, QDROs or plan statements for 401(k)/IRA and retirement accounts;

- Finally, gift letters and settlement paperwork (e.g., personal injury)

It is crucial to collect all available documentary evidence to trace specific funds and support your claim of separate property. This includes gathering any documentation that can establish the origin and character of assets, especially if funds have been commingled or assets have changed form.

Paper beats memory. Texas cases emphasize documents over recollection when proving a separate property claim.

Tracing Techniques (with quick examples)

- Direct (Item) Tracing – To trace assets, match the original separate deposit to the asset purchase by connecting each and every transaction from the original source to the current asset. Example: $50,000 inheritance → same amount used to buy a car.

- Clearinghouse / Identical Sum Inference – When a unique, identical amount appears, you can infer the separate source funded the later withdrawal by tracing assets through each and every transaction.

- Minimum Sum Balance / Community-Out-First (COF) – If the account never dipped below the separate baseline, later withdrawals are presumed community funds left first. This method helps trace assets in commingled accounts.

- Pro-Rata / Value Tracing – When records are partial, apportion based on the ratio of separate to community funds at each step to trace assets accurately.

- Time-rule / statutory apportionment – For RSUs/options, use §3.007(d)-(e) grant/vesting formulas.

Expert Support

A forensic accountant can build schedules and explain methods of tracing. More importantly, their expert testimony ties monthly statements, transfers, and mutations together in a way that satisfies the clear and convincing standard Texas courts require. In addition, forensic accountants often investigate suspicions of the other spouse hiding assets or undervaluing property. As a result, they play a crucial role in establishing clear ownership of assets by tracing their origins and movement, especially when commingling has blurred ownership rights. Finally, we involve experts when accounts are dense, commingled, or span many years.

Evidence Strength Table

In divorce cases, strong evidence is crucial for proving separate property in court, as the burden of proof lies with the party claiming an asset is separate. The following table outlines the weight of different types of evidence used in this process:

| Evidence Type | Weight | Notes |

|---|---|---|

| Full monthly bank statements (complete span) | High | Best to prove source/flow; fill gaps. |

| Plan statements/QDROs for retirement | High | Pair with §3.007(c) tracing. |

| HUD-1/CD & deeds | High | Show purchase funds and title recitals. |

| Canceled checks/wires | High | Pinpoint amounts/dates. |

| Expert schedules (COF, clearinghouse) | High | Strong if tied to documents; expert testimony can help in proving separate property. |

| Reconstructed ledgers with minor gaps | Medium | Risk rises as gaps grow; documentation requirements are important for tracing. |

| Memory testimony alone | Low | Generally insufficient to rebut presumption; proving separate property requires more substantial evidence. |

Case Study: Protecting a Pre-Marriage 401(k) From Division

Problem: We met a Dallas professional who felt overwhelmed. Years after rolling a pre-marriage 401(k) into a new plan, deposits and transfers had flowed through a joint account. They worried the entire balance was now community property.

Action: We built a clear timeline, pulled complete monthly statements, and matched early payroll stubs to plan records. We applied the inception-of-title rule and Texas Family Code §3.007 to isolate the pre-marriage portion. Because the joint account never fell below the separate baseline, our community-out-first analysis supported the claim. We prepared concise tracing schedules and, as needed, engaged a forensic accountant.

Result: At mediation, the other side accepted our schedules. The client kept the pre-marriage portion as separate property, and the case settled without a hearing—bringing relief and certainty.

Takeaway: Even if funds pass through a joint account, careful records and methodical tracing can preserve separate status. Start early, save statements, and let documents—not guesses—lead the way.

Commingled Assets & Community Funds: How We Untangle Them

Depositing separate funds into a joint account does not automatically destroy the separate nature; however, it increases your burden of proof. In fact, distinguishing between separate and community property can become complex depending on the number and type of transactions, the length of the marriage, and whether assets have been commingled—all of which impact the equitable division of property in divorce. Moreover, if funds are so mixed that we can’t re-segregate them, courts may treat the asset as community. Finally, Texas cases like Tarver and McKinley illustrate how commingling and proof work in practice.

When re-segregation works: consistent bank statements, clear paper trail, and COF/minimum balance math. When it fails: missing months, irregular withdrawals, or deposits that wipe out the separate baseline. Courts warn that records gaps can sink tracing.

COF & Minimum Balance: Quick Math

- Firstly, start with $40,000 separate deposit in January.

- Also, account never falls below $40,000 for the year.

- Likewise, later withdrawals are presumed community-out-first; the $40,000 separate baseline survives.

Records Gaps Pitfalls

Even a two-month gap can break the chain. We push to get duplicates, subpoenas, or plan confirmations to fill holes because courts have rejected tracing when statements are incomplete.

Retirement, RSUs & Business Interests

Retirement Accounts (401(k), IRA)

Texas law allows retirement tracing like any other asset. The pre-marriage portion of a defined contribution plan remains separate if traced; the rest is community. Division often requires a QDRO to move funds cleanly after the decree.

Stock Options/RSUs

Section 3.007(d)-(e) sets formulas that apportion stock options and RSUs based on grant and vesting periods. We apply the fraction from the statute to separate vs. community portions and show the math in exhibits.

Businesses & Partnerships

If a spouse’s time, toil, and talent boosts the value of separate property (like a pre-marriage company), the community estate can seek reimbursement under Jensen—the separate asset stays separate, but the community may be owed value for under-compensated effort.

Related Guide: How Is an LLC Treated in a Divorce in Texas?

Burden of Proof: Clear and Convincing Evidence

By statute, property possessed at divorce is presumed community. Therefore, the spouse claiming separate property must prove it by clear and convincing evidence—a higher standard than “more likely than not.” Specifically, the spouse must demonstrate that the property belongs solely to one or both spouses as separate property, rather than community property, to avoid division. In practice, strong financial records and expert schedules are how we meet that standard. Otherwise, mischaracterization of separate property can require reversal.

Additionally, Texas appellate materials recognize that a court cannot divest a spouse of confirmed separate property; when that happens, it constitutes error (see Eggemeyer line of cases).

What Texas Courts Consider (DFW Focus)

In DFW courts (Dallas, Collin, Denton, Tarrant, Rockwall), the community estate is divided in a way that is “just and right,” rather than necessarily 50/50. For instance, judges may consider earning capacity, fault, disparity in income, health, and other Murff factors. Consequently, the role of forensic accounting becomes crucial for ensuring fair division of marital assets during divorce proceedings. In practice, we present tracing and these fairness factors together to provide a clear picture for the court.

“Just and Right” Division Factors (Examples)

- Firstly, earning capacity & education

- Also, fault in the breakup

- Similarly, disparity of assets and liabilities

- Likewise, size of each separate estate

- Also, needs of the children and child support obligations

- Finally, future needs of each spouse (housing, healthcare)

Local Court References & Addresses

- Firstly, Dallas County Family District Courts – George L. Allen Sr. Courts Building, 600 Commerce St., Dallas.

- Secondly, Collin County Courthouse – 2100 Bloomdale Rd., McKinney.

- Also, Denton County Courts Building – 1450 E. McKinney St., Denton.

- Likewise, Tarrant County, Tom Vandergriff Civil Courts Building – 100 N. Calhoun St., Fort Worth.

Common Misconceptions We’ve Seen

- Firstly, “Title in one name = separate.” Not necessarily. Texas follows inception of title, not title alone.

- Also, “Joint account destroys separate property.” Not if you can trace; use COF/minimum balance methods.

- Likewise, “Deed recitals don’t matter.” A separate-property recital can bind parties to the deed and influence characterization. Use careful drafting (or challenges) as needed.

Texas Case Law Spotlight

Murff v. Murff—“Just and Right” Factors

The Texas Supreme Court listed factors courts may weigh when dividing the community estate, and confirmed broad trial-court discretion. We tie Murff factors to our exhibits so the record supports the result.

McElwee v. McElwee—Tracing & Evidence Sufficiency

Courts expect documentary proof to overcome the presumption; mere testimony is usually not enough. We build tracing schedules around statements, wires, and ledgers.

McKinley / Tarver—Community Presumption & Tracing

These cases show that tracing must “clearly identify” the separate origin. If the evidence is too vague, the presumption controls.

Sibley v. Sibley—Community-Out-First

Practitioners cite COF presumptions from Sibley when analyzing joint accounts. We use that logic alongside account balances and dates.

Protecting Your Assets: Legal Tools & Agreements

Premarital/Marital Agreements (Partition & Conversion)

Spouses can partition or exchange property and can convert separate to community—but Texas requires specific formalities. We draft prenuptial and property agreements that meet §4.102 (partition) and §4.201–.203 (conversion) so they hold up in DFW courts.

Recordation of Separate Property

Texas allows recording a separate-property schedule in the deed records (§3.004). It can help with notice issues in real estate, but has limits. We explain when it’s worth doing.

Fraud/Waste & the Reconstituted Estate

If one spouse wastes community funds, courts can reconstitute the estate and award money judgments or unequal shares to do justice. We identify suspicious transfers and seek remedies under §7.009.

Asset Tracing Workflow (Checklist & Timeline)

We help North Texas families follow this workflow to keep evidence clean.

Six Steps to Trace Separate Property

- Firstly, inventory assets and liabilities at the time of divorce.

- Also, gather financial records (statements, deeds, payroll, tax forms).

- Likewise, build tracing schedules (COF, clearinghouse, direct).

- Additionally, analyze commingling and fill any paper trail gaps.

- Similarly, retain a forensic accountant for complex or valuation issues.

- Finally, prepare exhibits and expert testimony for mediation/trial.

(Alt text for downloadable visual: Flowchart showing tracing steps from inventory to exhibits.)

“Do I need tracing?” (Decision Tree)

- Pre-marriage source? → Yes → Have full statements? → Yes → Direct/COF tracing.

- Pre-marriage source? → Yes → Missing months? → Fill gaps (subpoenas/duplicates).

- Gift/inheritance? → Document donor and deposit → Trace forward.

- Mixed deposits? → COF/minimum balance or pro-rata, consider expert.

Download: DFW Separate Property Tracing Checklist (request during your free consultation).

Quick Answers: Micro Q&A

1. Texas divorce waiting period?

60 days after filing, with narrow exceptions for family violence cases.

2. Legal standard to prove separate property?

Clear and convincing evidence, higher than preponderance.

3. What counts as separate?

Pre-marriage assets, gifts, inheritances, and most personal injury recoveries.

4. Is title controlling?

No. The inception of title rule controls character, not title alone.

5. Can commingling ruin my claim?

Not if you can trace with reliable records and methods like COF.

6. Retirement accounts?

Pre-marriage portions can be traced; §3.007(c) applies.

7. Do increases in separate asset value stay separate?

Generally, yes; but income from separate property is community unless agreed otherwise.

8. What if a spouse wasted funds?

Court can reconstitute the estate under §7.009 and award relief.

9. Are bank statements necessary?

Yes. Statements carry more weight than memory testimony.

10. Do DFW courts divide equally?

Not automatically. The standard is “just and right,” not 50/50.

11. Are deed recitals powerful?

Yes—separate-property recitals can bind parties to the deed.

12. Do RSUs need special math?

Yes—apportion by grant/vest dates under §3.007(d)-(e).

13. Missing two months of statements?

Gaps can defeat tracing; work to fill them with subpoenas/duplicates.

14. Can we convert separate to community?

Yes—by written conversion agreement with required formalities.

15. Where are Dallas family courts?

George L. Allen Sr. Courts Building, 600 Commerce St., Dallas.

Definitions Glossary

- Community property: Property (other than separate) acquired during marriage.

- Commingled: When separate and community funds are mixed in one bank account.

- Characterization: The process of labeling assets as separate or community under the Texas Family Code.

- Clear and convincing evidence: A higher standard of proof used to overcome the presumption that property is community.

- Inception of title rule: The principle that an asset’s character is fixed when the right to acquire it first arises.

- Mutations: Changes in the form of property (e.g., cash → real estate), where the original character can follow if properly traced.

- Reimbursement: A payback claim when one marital estate benefits another, such as in Jensen.

- Reconstituted estate: The reconstructed community value after fraud, waste, or mismanagement.

- COF (community-out-first): The presumption that community funds leave an account before any separate baseline is affected.

- Tracing schedule: An exhibit showing deposits, withdrawals, and balances over time to track funds.

- QDRO: An order dividing qualifying retirement plans between spouses.

- Separate property recital: Deed language stating the separate character of property; can bind the parties.

- Disclaimer: A statement in a deed or agreement renouncing a claim—distinct from proof of characterization.

- Separate estate: One spouse’s separate property and liabilities.

- Joint account: A bank account titled to both spouses, which may require COF analysis to determine ownership.

Costs, Timelines & Your Team

Cost Snapshot (Estimates)

Item | Typical Range |

|---|---|

Forensic accountant (hourly) | $175–$450/hr |

Tracing project (simple–complex) | ~$3,000–$15,000+ |

Subpoena/records fees (per institution) | ~$100–$250 |

Certified copies/recording | ~$1–$5/page; county dependent |

QDRO prep (per plan) | ~$500–$1,500 |

Mediation (half day per party) | ~$750–$2,500 |

We provide transparent budgets during your free consultation.

Expected Timeline

- Firstly, records collection: 2–6 weeks (faster with online banking access)

- Also, expert analysis & schedules: 2–8 weeks (depends on commingling)

- Likewise, mediation/setting: Court calendars vary in Dallas, Collin, Denton, Tarrant; we target mediation once exhibits are complete.

Who Does What

- Firstly, divorce attorney: Strategy, court orders, admissions, witness prep.

- Also, paralegal: Record requests, exhibit building, organizing bank statements.

- Finally, forensic accountant: Tracing math, expert testimony, rebuttal analysis.

FAQs

Proof & Documentation

What documents do I need to prove separate property in Texas?

To prove separate property in Texas, you first need complete monthly bank statements, wire receipts, and source documents such as inheritance papers or gift letters. Moreover, courts require a clear paper trail that connects the funds from their origin all the way to the current asset.

Essential documents include:

- Bank/brokerage statements (no gaps)

- Closing disclosures and deeds

- Probate orders or trust documents

- Canceled checks and wire confirmations

- Account opening paperwork

What is clear and convincing evidence for separate property in Texas?

Clear and convincing evidence is the heightened standard required to overcome Texas’s community property presumption; moreover, it is stronger than the “preponderance of evidence” standard. In practice, this means presenting documentary proof that leaves no reasonable doubt about the separate nature of funds.

Can missing bank statements ruin my separate property claim?

Yes, even two-month gaps in statements can break your tracing chain and defeat separate property claims. Therefore, because Texas courts reject incomplete documentation, it is essential to obtain duplicates or subpoenas to fill any gaps before trial.

Do I need a forensic accountant for property tracing?

Complex cases with commingled funds often benefit from forensic accountants who create tracing schedules and provide expert testimony. Moreover, their analysis helps meet the clear and convincing evidence standard, especially when accounts are dense or timelines span many years.

Tracing Methods & Rules

Does putting separate property in a joint account make it community property?

No, depositing separate funds into a joint account does not automatically convert them to community property in Texas. However, you can preserve the separate character through tracing methods such as community-out-first analysis, provided that account records are complete.

Can separate property become community property in Texas?

Yes—separate property can only be converted by a valid written conversion agreement under the Texas Family Code. In contrast, merely depositing separate funds into a joint account does not convert them, as long as you can trace the dollars back to their separate source.

Key points:

- Requires written agreement

- Joint deposits alone don’t convert

- Keep tracing records intact

How do I trace an inheritance in a Texas divorce?

To trace an inheritance, start by gathering probate documents such as the will or court order, along with bank statements showing the deposit and fund movement. In addition, keep complete monthly statements to maintain the tracing chain from inheritance receipt through any later asset purchases.

What is the inception of title rule in Texas?

The inception of title rule fixes property character when the right to acquire it first arises. In other words, property owned before marriage stays separate even if it changes form—such as cash becoming real estate—as long as you can trace the funds.

How does the community-out-first presumption work?

In commingled accounts, community funds are generally presumed to leave first. For example, if an account holding $40,000 in separate funds never drops below $40,000, then withdrawals are presumed community, thereby preserving the $40,000 separate baseline throughout the marriage.

Property Types

Is income from separate property community property in Texas?

Yes, income from separate property (such as rent, dividends, or interest) becomes community property during marriage under Texas law. However, by contrast, appreciation of the separate asset itself remains separate. Additionally, spouses can change this rule through written partition agreements.

How do I trace a house bought during marriage?

To begin, prove the down payment came from separate funds using inheritance documents, bank statements showing transfers, and closing disclosures. In addition, [include any separate property recital in the deed] to strengthen your characterization claim.

Key evidence needed:

- Source of down payment funds

- Bank statements showing transfers

- HUD-1 or Closing Disclosure

- Deed with property recitals

How are retirement accounts divided in Texas divorce?

Pre-marriage retirement balances remain separate if properly traced; contributions during marriage are community property. Courts use statutory formulas for division and require [84†QDROs] to transfer funds after the decree.

Can cryptocurrency be traced as separate property?

Yes, cryptocurrency follows standard tracing rules by using exchange statements, wallet histories, and transaction IDs. In addition, it’s important to maintain KYC-compliant exchange records and carefully match amounts and dates to prove a separate origin without commingling.

Is property purchased during separation considered community property in Texas?

Yes. In Texas, anything you buy while still legally married, **including a house**, is usually considered community property.

Court & Divorce Outcomes

Can a judge award my separate property to my spouse?

No, Texas courts cannot divest you of confirmed separate property; in fact, doing so is reversible error. Instead, the court only divides community property, which is why proper characterization and tracing are crucial to protecting separate assets.

Does tracing affect spousal maintenance in Texas?

Indirectly, yes—strong tracing can show a larger separate estate, which in turn may potentially reduce maintenance needs. However, statutory eligibility factors still control the outcome, and additionally, parties can negotiate contractual alimony regardless of separate property holdings.

Next Steps

We’ve helped Texans protect separate property since 2006. In fact, when it comes to property division, it’s crucial that both you and your spouse understand your rights and options. Furthermore, if you’re concerned about commingled funds, retirement accounts, or real estate characterization, we’re here to help with a focused DFW strategy. To get started, begin with a free consultation—we’ll review your financial records, outline methods of tracing, and map your path forward.

Ethical Notice: This is attorney advertising. This article is for informational purposes only and does not constitute legal advice. Furthermore, no attorney-client relationship is formed until we sign an engagement agreement. To learn more, call Warren & Migliaccio, L.L.P. at (888) 584-9614 or contact us online to receive guidance from our experienced Texas divorce attorneys.