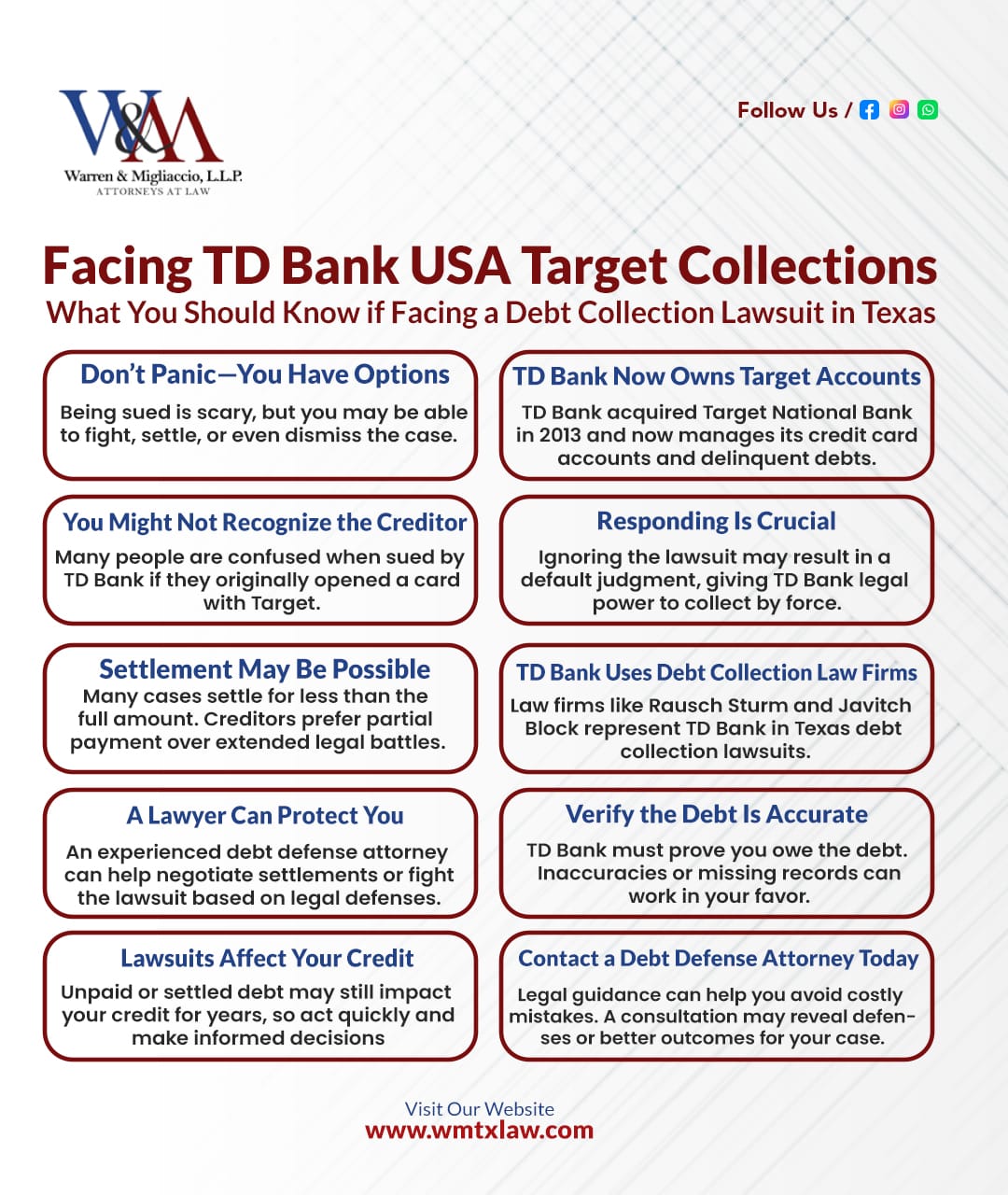

If you are being sued by TD Bank or TD Auto in a debt collection lawsuit, it is normal to feel scared and overwhelmed. You may also feel confused if you do not recognize the company. However, you may have more legal options than you think to defend yourself, reach a settlement, or even get the case dismissed.

It is important information to understand the details of the lawsuit and the rights of the individuals involved.

At Warren & Migliaccio, we defend and assist individuals facing collection lawsuits in Texas. We provide our clients with affordable legal representation to help them reach favorable resolutions to their cases. If TD Bank is suing you, contact us today to discuss potential solutions to your case.

Who Is TD Bank USA, N.A.?

TD Bank USA, N.A., a TD Bank US holding company, is a national bank headquartered in Cherry Hill, New Jersey. It is also known as TD Bank and TD. It is the United States subsidiary of the multinational banking and financial services company Toronto-Dominion Bank. Toronto-Dominion Bank has its headquarters in Toronto, Canada. Collectively, the bank and its subsidiaries are known as TD Bank Group. TD Bank collects and shares personal information, even very confidential information, for business purposes, such as processing transactions, handling balance transfers and overdraft fee as well as responding to legal investigations. The various financial products and services offered by TD Bank include credit cards, debit cards, deposit accounts, and more.

It is important to understand the type of personal information collected and shared by TD Bank.

Even though TD Bank is one of the largest commercial banks in the United States, you may have never heard of it. It is possible you never opened a account with TD, so how is it possible it is suing you?

Does your lawsuit notice list “TD Bank USA, N.A. as Successor in Interest to Target National Bank” as the plaintiff suing you? If this is the case, the original credit issuer was Target National Bank, not TD Bank. However, TD Bank acquired Target National Bank and its card portfolio in 2013. As part of this acquisition, TD Bank creates and updates customer records.

TD Bank shares personal information with Target for marketing purposes.

Who Is Target National Bank?

Target National Bank was the primary issuer of the national retailer Target’s credit cards, like the Target REDcard™. When TD Bank obtained Target National Bank, it also acquired its credit card accounts, including delinquent accounts. Now, all co-branded and private Target credit cards are through TD Bank. Therefore, if you have a Target REDcard™ credit card that you opened with Target National Bank, the creditor is TD Bank.

Even after settling debts, individuals may need to wait several years for negative items to age off their credit reports. Proactive strategies like goodwill campaigns can help improve future credit score outcomes.

TD Bank now has control over the handling of these credit card accounts, including the target card account. This includes managing customer interactions, transactions, online banking, credit card holders, eligible purchases, and the various types of information collected for marketing purposes. Customers should be aware of the options available to them, such as contacting customer service, using the TD Bank app, or calling dedicated phone numbers for assistance. TD Bank’s services offered include a range of financial products, and they apply specific rules and policies to these transactions.

Why Is TD Bank Suing Me?

When TD Bank acquired Target National Bank, it also received its delinquent credit card accounts through a transfer of accounts. It is common for creditors to file lawsuits against cardholders to try to recover outstanding debt. Certain rules and policies apply depending on the type of transaction. If you have delinquent debt on a Target credit card, TD Bank may sue you in an attempt to get the money.

Who Represents TD Bank?

Rather than manage debt collection lawsuits themselves, it is common for the financial institution to hire an experienced debt collection law firm. You likely heard from its lawyers if you received a notice that TD Bank is suing you. A couple of law firms that handle its Texas cases for debt collection matter include, but are not limited to:

If you have any questions or need assistance, calling customer service representatives can provide direct support and guidance.

These law firms exclusively pursue debts on behalf of their clients. They have substantial experience dealing with debt collection. Because of this, we recommend working with an attorney with extensive experience in defending collection lawsuits. You are more likely to get a better case result with a debt resolution attorney on your side. The CFPB investigates violations of the Fair Credit Reporting Act.

How to Settle Credit Card Debt When a Lawsuit Has Been Filed

Have you already received a summons for a debt collection lawsuit? Our North Texas debt collection defense attorneys understand that you may be stressed about the legal process and going to court. However, even if TD Bank is suing you, you may be able to negotiate a settlement before or during the litigation process. One option available is to negotiate a settlement.

Our North Texas debt collection defense attorneys know firsthand that creditors are generally open to settlement negotiations. There may be a few reasons for this, including, but not limited to, a settlement allows a creditor to:

- Save money on litigation costs

- Recover debts quicker than through a lawsuit

- Avoid the risk of losing its lawsuit

- Avoid the chance of not recovering debts due to bankruptcy

A settlement may also be the best solution for your unique situation. In many cases, we can reach favorable settlements on behalf of our clients that leave them paying less than the original amount of debt. This is because creditors prefer to recover part of the debt over nothing.

However, we recommend discussing your situation with an experienced debt defense attorney before settling with TD Bank. While a settlement may be viable for you, there may be better legal options for your unique situation. For example, you may have a strong defense that could get your case dismissed. Our attorneys can help you determine your best options during a confidential consultation.

What Not to Do if TD Bank Sues You for Debt Collection

Many people choose to ignore collection lawsuits, and unfortunately, that is the worst thing you can do to protect yourself from one. When you ignore a collection lawsuit from TD Bank or another credit card issuer, you essentially allow them to win the case without any objection. Fraudsters use various communication channels such as email, text, and phone to execute fraudulent activities. They emphasize the importance of awareness and proactive measures individuals can take to prevent becoming victims of these scams.

If you respond to the lawsuit, TD Bank will have to prove its claims with evidence, and it may not have sufficient evidence. Without a response, TD Bank does not have to prove its case and may be able to get a default judgment against you. TD Bank failed to conduct proper investigations when disputes were submitted regarding inaccuracies in reporting.

A default judgment would entitle TD Bank to the money even if it had a weak case against you. It could then get the money from you by having your bank accounts frozen and garnished, putting a lien against your property, or seizing your property to pay off the debt.

FAQS About TD Bank USA Target Collections

Why Is TD Bank Suing Me Instead of Target National Bank?

If you submitted a credit card application and opened a Target credit card when it was still through Target National Bank, TD Bank now owns that account.

This switch often causes confusion. Many people still link the debt to Target National Bank, but TD Bank now handles billing and collections.

TD Bank also shares your personal information with Target for marketing purposes. While federal law lets you limit some of this sharing, state laws may offer extra protection, including in relation to services like TD Bank mobile deposit.

Always check lawsuit details to make sure the claim is real and not from a scam or unrelated debt collector.

Can TD Bank Garnish My Wages or Bank Account in Texas?

After getting a court judgment, TD Bank may:

1. Freeze or levy your bank account

2. Place a lien on your property (if allowed by state law)

3. Texas does offer many protections for personal property, so some of your assets may be safe.

It’s important to respond to any lawsuit. If you don’t, you could face a default judgment—and lose the chance to defend yourself.

How Can I Respond to a TD Bank Credit Card Lawsuit in Texas?

Steps to take:

1. Speak with a debt defense attorney familiar with both federal and Texas law

2. Gather all relevant account documentation, including credit card statements, online statements, and any communication with TD Bank or third parties.

3. Log into your account if possible to find more details

4. Consider debt settlement or challenge the lawsuit if the evidence is weak

What Are My Options to Settle the Lawsuit?

Settlement can benefit both sides. TD Bank may get some money faster and save legal costs.

Ask about:

1. Structured payment plans

2. One-time lump-sum settlements

Before signing, read the full agreement. Look out for terms like arbitration clauses that could affect your rights.

Can TD Bank or Its Law Firm Call Me About a Target Credit Card?

If a third-party debt collector is involved, the Fair Debt Collection Practices Act (FDCPA) protects you from:

1. Harassing or repeated calls

2. Calls at odd hours

3. Contact after you’ve asked for written communication only

4, You can ask them to only contact you in writing. Just make sure you still respond to any court notices.

5. Keep records of all calls and letters. If you think they crossed the line, you may have a legal claim.

What If I Think the Lawsuit Is a Scam or I Never Opened a Target Card?

1. Look up the lawsuit in the county court’s records.

2. Call TD Bank directly using a number from their official website.

3. Visit the CFPB website to learn more or file a complaint.

If you believe this debt isn’t yours, it could be identity theft or a reporting error. In that case, contact the credit bureaus and take steps to dispute the debt.

How Long Can TD Bank Collect on Target Credit Card Debt in Texas?

After four years, TD Bank can still try to sue—but you can use the statute of limitations as a defense.

Important: If you make a payment or admit the debt in writing, it might reset the clock.

Always check your dates and timeline with an attorney if you’re unsure.

Will Settling the Lawsuit Hurt My Credit?

Yes—but not as much as ignoring it. A settlement is usually marked as “settled” rather than “paid in full.” That can lower your credit score, but it’s still better than an unpaid or charged-off account.

Over time, credit bureaus view settled accounts more positively than open collections.

What to do:

1. Get written proof of the settlement

2. Monitor your credit report to ensure it’s reported correctly

3. Settling also helps you avoid a judgment lien or more serious legal action

Schedule a Confidential Consultation With Our Texas Debt Resolution Lawyers

Is TD Bank suing you for delinquent credit card debt on a Target card you opened with Target National Bank? Our firm understands that facing a collection lawsuit and dealing with unpaid debt can be overwhelming. You don’t have to navigate this challenging situation alone.

Our experienced debt collection defense attorneys in Texas are here to help you get back on track financially. We are ready to review your case, explain your legal options, and assist you in resolving this lawsuit. During a consultation, we can discuss your unique situation and how we can help you find the best solution.

Call us at telephone number (888) 584-9614 or contact us online to start planning your next steps today.