Custody lawyer cost texas: It depends on whether your child custody case stays agreed or becomes contested. Many lawyers charge about $150 to $600+ per hour and ask for a $2,500 to $10,000 retainer, but high-conflict cases can exceed $40,000 when hearings, discovery, or trial prep stack up. … [Read more...]

Can Utility Bills Be Included in Chapter 7 Bankruptcy in Texas?

Can utility bills be included in chapter 7 bankruptcy in Texas? Yes, in most cases past-due utility bills can be included and discharged, but you must keep paying future utility bills and you may have to post a new deposit to keep service on. Cable, internet, and cell phone service may not get the … [Read more...]

Do Minors Have to Pay Child Support in Texas?

Do minors have to pay child support in Texas? Yes. In Texas, a parent can be ordered to pay child support even if that parent is under 18. But minor-parent cases often need an adult next friend to help the teen parent take part in court. Key Takeaways Even if a parent is under … [Read more...]

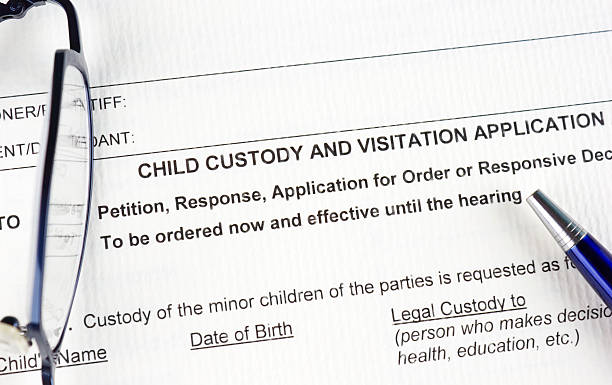

How to Register an Out-of-State Custody Order in Texas

To register an out-of-state custody order in Texas, send the appropriate Texas court: (1) a request to register, (2) two copies of the order (one certified), (3) a sworn statement the order hasn’t been modified, and (4) names and addresses of the parties (with safety exceptions). The court serves … [Read more...]

Can Gambling Debt Be Discharged in Bankruptcy in Texas?

Most unsecured gambling debt can be discharged in a Texas bankruptcy unless a creditor proves fraud or a Bankruptcy Code presumption applies. Problems usually come from recent cash advances, last-minute charges, or false information on a credit application. The sooner you gather records and assess … [Read more...]

Legal Guardian vs Power of Attorney in Texas Explained

Wondering what “legal guardian vs power of attorney in Texas” really means? A power of attorney in Texas is a private legal document. In it, a capable adult chooses an agent (attorney-in-fact) to handle financial or medical decisions. Meanwhile, a legal guardian is very different. It is a … [Read more...]

Should I Put My Home in a Trust in Texas? Pros, Cons & Your Next Steps

If you own a home in Texas and are asking, “should I put my home in a trust in Texas?”, you are really asking two things: will a trust make life easier for my family, and do I need a Texas living trust attorney to set it up correctly? In many cases, a revocable living trust can keep your homestead … [Read more...]

What Am I Entitled to in a Divorce in Texas?

Are you also questioning, what am I entitled to in a divorce in Texas? In a Texas divorce, you may be entitled to a fair share of community property (assets and debts acquired during the marriage), possible spousal maintenance, and child-related support based on your children’s needs and your … [Read more...]

How Long Does A Divorce Take In Texas With Children? Timeline & What to Expect

Key Takeaways In Texas, a divorce with children takes at least 60 days. Uncontested cases usually finish in 3–4 months, while contested custody cases often take 6–18+ months. ● Texas law imposes a mandatory 60-day waiting period after filing for divorce. … [Read more...]

Can You Get Divorce Without Your Spouse Signature in Texas? Here’s How

Can you get divorce without your spouse signature? Yes. In Texas, one spouse can end the marriage without the other’s signature. After filing and proper service, the court can finalize by default if the other spouse doesn’t respond, or after a hearing if issues are contested. A judge still decides … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 58

- Next Page »