In my role as a bankruptcy attorney here in Texas, I’ve helped many individuals dig out from under soul crushing debt. Each client brought a unique story and set of circumstances to the table but many of them also shared similar struggles and fears. Please allow me to tell you about Mr. Whirley. Perhaps you can relate to his plight.

It was a typical busy Monday morning when my phone rang. On the other end on the line was Mr. Whirley, his voice tinged with desperation and embarrassment. He was drowning in a sea of debt and needed help.

“Maybe I’ll just stop paying all my bills,” Mr. Whirely said to me. “I waste so much time thinking about which bills to pay and talking on the phone will bill collectors, I can’t even focus on earning the cash to pay them.”

“You are not alone there Mr. Whirley. I just had a similar conversation with another client and told him all about Chapter 7 bankruptcy protection,” I told him before he interrupted me.

“No way, I’m not going to be one of those people who files for bankruptcy. I’m not bankrupt, I’m just having a bad year, or two, maybe three now.” he said.

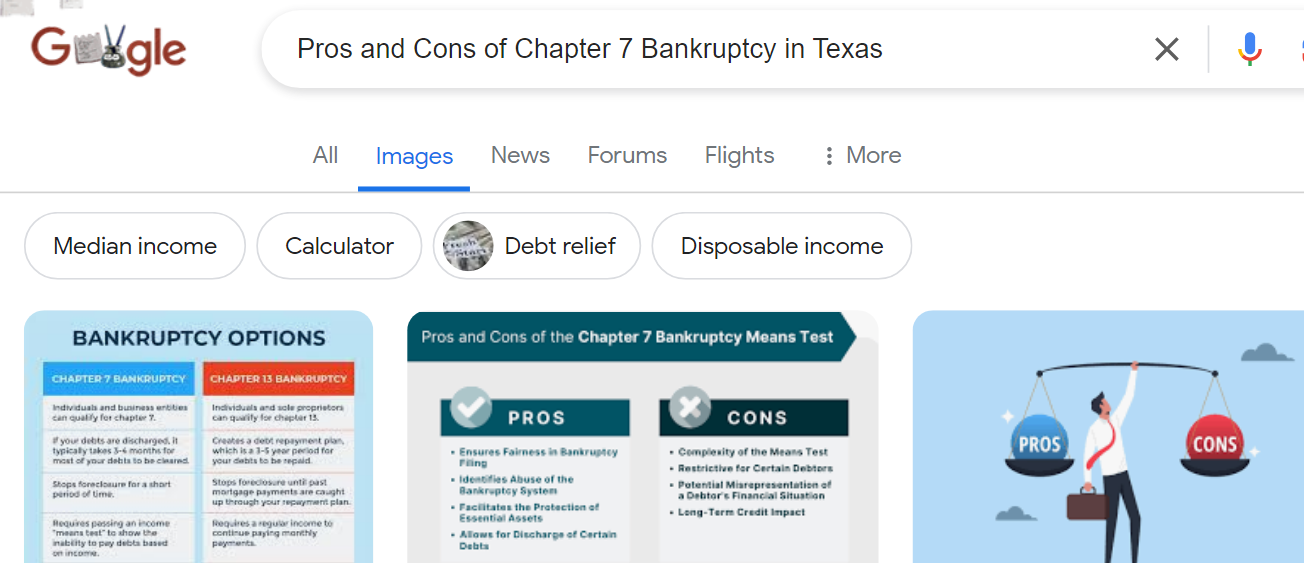

“I understand, many Americans have been having a few bad years,” I told him. But the law is there to help you get out of debt. Can we at least go over the pros and cons of filing for Chapter 7? There are some other debt relief options we can discuss too. Can you make a list with all your debts, your assets, and your projected income, and come to my office tomorrow morning at 11am for a consultation?”

“I guess so,” he said slowly. “I confess I’m really hesitant to go this bankruptcy route, it’s not how I think of myself. But yes, I’d love to know my options. Thank you Chris, I’ll see you then,”

When life throws financial hardship at you it’s easy to feel overwhelmed, hopeless, and even embarrassed like Mr. Whirley. That’s where Chapter 7 bankruptcy comes in, serving as a powerful tool that can help you hit the financial reset button and start fresh. But before you take the leap into this legal process, it’s crucial to carefully weigh the pros and cons of filing for Chapter 7.

I know firsthand how confusing and scary this experience can be. That’s why I’m here to break it down for you in plain English, so you can make the best decision for your unique situation while understanding there are so many other people dealing with similar circumstances and feelings. I won’t give you any legal jargon, or sugarcoat a tough situation. I’ll just supply the straight facts you need to know to help you evaluate your options.

Navigating Chapter 7 Bankruptcy in Texas: A Comprehensive Guide

If you’re considering filing for Chapter 7 bankruptcy in Texas, you’ve got a lot of company. It’s a common form of debt relief in the United States, and the bankruptcy process in Texas is known for its speed and efficiency. Let’s get right into the ins-and-outs of what you might be getting yourself into.

The big decision to file for bankruptcy can have long-lasting effects on your financial health. It’s not something to be taken lightly. But if you’re drowning in debt, and see no way out, it might be your path to a fresh start that can get you back on your feet.

Understanding the Basics of Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as “liquidation” bankruptcy, is designed to wipe out most of your unsecured debts, like credit card balances, medical bills, and personal loans. Secured debts, on the other hand, are backed by collateral, such as a car or home. If you can’t repay a secured debt, the creditor can seize the collateral.

So while it’s a way to hit the reset button on your finances it’s not a get-out-of-jail-free card. You’ll have to give up some of your assets, like luxury items or vacation homes, to pay off your creditors. And it’ll stay on your credit report for 10 years, which can make it harder to get loans or lines of credit in the future.

The Process of Filing for Bankruptcy in Texas

Filing for bankruptcy in Texas involves a few key steps.

First, you’ll need to complete credit counseling from an approved provider within 180 days before filing. This is to make sure you understand all your options and are making an informed decision.

Next, you’ll file a petition with the bankruptcy court, along with reports detailing your assets, debts, income, and expenses. You’ll also need to pay a filing fee, which can be paid in installments if needed. A bankruptcy trustee will be assigned to your case, and they will be responsible for overseeing the liquidation of any nonexempt assets and distributing the proceeds to your creditors. You’ll be required to attend a meeting of creditors, where the trustee will ask you questions about your finances under oath.

Legal Protections and Potential Risks

One of the biggest benefits of filing for Chapter 7 bankruptcy is the automatic stay. This legal protection means that creditors have to stop all collection actions against you, including lawsuits, bank garnishments, and harassing phone calls.

But there are also some downsides to consider. You could lose some of your assets in the liquidation process. This will depend on what assets are considered exempt under Texas law. And if the court finds that you have too much disposable income, your case could be dismissed or converted to a Chapter 13 bankruptcy proceeding, which involves a repayment plan.

The Impact of Bankruptcy on Your Financial Health

One harsh reality is that filing for bankruptcy damages your credit score. It’ll take a hit and the bankruptcy will stay on your credit report for up to 10 years. This can make it harder to get approved for loans, credit cards, or even rental applications.

But if you’re considering bankruptcy, your credit score is probably already in rough shape, so you might not be losing much by hurting a credit score that is already a problem for you. And while bankruptcy isn’t a magic wand that’ll make all your financial troubles disappear, it can give you a chance to start fresh and rebuild your credit over time.

Rebuilding Credit After Bankruptcy

The good news is that there are steps you can take to improve your credit score after bankruptcy. One method is to get a secured credit card, which requires a cash deposit but can help you establish a positive payment history.

Another key is to make all your payments on time, every time going forward. Make sure you have the money available to make the payments, then set up automatic payments or reminders so you never miss a due date. Over time, as you consistently make on-time payments and keep your balances low, you’ll start to see your credit score improve.

Exploring Debt Relief Alternatives to Bankruptcy

As beneficial as filing for bankruptcy can seem, before you jump straight into it, it’s worth exploring other debt relief options. These alternatives might not be as drastic or have as long-lasting of an impact on your credit.

Two common options are credit counseling and debt consolidation loans. Another avenue to explore is debt settlement. This involves negotiating with your creditors to try to settle your debts for less than the full amount you owe.

Credit Counseling Services

Credit counseling involves working with a certified counselor to create a plan for managing your debt. They can help you create a budget, negotiate with creditors, and even set up a debt management plan (DMP) to pay off your debts over time.

Make sure to work with a reputable, non-profit credit counseling agency. Look for one that’s accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

The Role of Debt Consolidation Loans

Another option is a debt consolidation loan. This is a type of personal loan that allows you to combine multiple debts into a single monthly payment, possibly with a lower interest rate.

The idea is that by consolidating your debts, you can simplify your payments and potentially save money on interest over time. Just be sure to shop around for the best rates and terms, while watching out for predatory lenders or scams.

The Legalities and Costs Involved in Filing for Bankruptcy

You also have to keep in mind that filing for bankruptcy has its costs. There are legal fees, filing fees, and even potential marketing fees to consider. And navigating the complexities of bankruptcy law isn’t something you want to do alone.

That’s where a bankruptcy attorney comes in. They can guide you through the process, help you understand your options, and represent you in court. But how do you choose the right one?

Choosing a Bankruptcy Attorney

When selecting a bankruptcy attorney, look for someone with experience handling Chapter 7 cases in Texas. Ask questions about their track record, communication style, and fees upfront.

You’ll also want to feel comfortable with your attorney and trust that they have your best interests in mind. Don’t be afraid to ask questions or voice concerns throughout the process.

Keep in mind that bankruptcy filings, including Chapter 7, are public records. While this might feel uncomfortable, it’s a necessary part of the process and something your attorney can help you navigate.

Life After Bankruptcy: What to Expect

So, what does life look like after bankruptcy? You’ll have to adjust to some changes and limitations, but you’ll also have a chance to start fresh and build new financial habits.

Keep in mind that while bankruptcy can eliminate many types of debt, it doesn’t erase everything. You’ll still be responsible for certain debts, like student loans, alimony, and child support.

Handling Bank Garnishments and Collection Actions Post-Bankruptcy

If you’ve been dealing with bank levies or collection actions before filing for bankruptcy, you might be wondering what happens to those after your debts are discharged.

The good news is that the automatic stay that goes into effect when you file for bankruptcy puts a stop to most collection actions, including bank garnishments. And once your debts are discharged, creditors can no longer legally pursue collection on those debts.

However, it’s important to note that you might lose some of your assets in the liquidation process of Chapter 7 bankruptcy. While Chapter 7 provides some legal protection against creditors, it doesn’t mean you get to keep everything you own.

Special Considerations for Texans Filing for Bankruptcy

While bankruptcy is governed by federal law, there are some unique considerations for Texans filing for Chapter 7. One key difference is in the exemptions allowed under Texas law.

Exemptions determine what property you get to keep in a Chapter 7 bankruptcy proceeding. And Texas is known for having some of the most generous exemptions in the country, particularly when it comes to homestead exemptions.

Exemptions and Nonexempt Assets in Texas

Under Texas law, you can exempt an unlimited amount of equity in your primary residence, as long as it’s on 10 acres or less in a city or town, or 100 acres or less in the country. This is a huge benefit for Texas homeowners filing for Chapter 7.

Other exemptions under Texas law include personal property like furniture, clothing, and vehicles up to a certain value. But anything that’s considered nonexempt property, like vacation homes, second vehicles, or valuable collections, could be liquidated to pay off creditors.

It’s important to work with a bankruptcy attorney who understands the ins-and-outs of Texas exemption laws. They can help you navigate what you can keep and what you might have to let go in a Chapter 7 bankruptcy proceeding.

Preventing Future Financial Distress

Filing for bankruptcy can feel like an opportunity to get a second chance to restart your financial life. But it’s not a decision to be made lightly, and it’s not something you want to go through more than once if you can help it.

That’s why it’s so important to focus on learning from the mistakes you made that led to your bankruptcy and prevent future financial distress. This means creating a budget, building an emergency fund, and developing healthy financial habits that will serve you well in the long run.

The Importance of Financial Education

Financial literacy and education are powerful tools for preventing financial missteps. The more you know about personal finance, budgeting, and debt management, the better equipped you’ll be to make smart financial decisions.

Consider taking a financial literacy course, reading personal finance books or blogs, or working with a financial coach or counselor. The more you learn, the more confident and empowered you’ll feel when managing your money.

The Role of Support Systems During Bankruptcy

Finally, don’t underestimate the importance of support systems during the bankruptcy process. Filing for bankruptcy can be an emotional and stressful experience. It’s not something you should go through alone.

Lean on family and friends for emotional support, and don’t be afraid to seek professional help if you need it. Many communities offer free or low-cost counseling services for those going through financial hardship.

Remember not to think of bankruptcy as a personal failing. It’s a legal tool designed to help those who are already struggling with unmanageable debt. By seeking support and taking proactive steps to rebuild your financial health, you can come out the other side stronger and more resilient.

Key Takeaway:

Chapter 7 bankruptcy in Texas can be a fresh start if you’re drowning in debt, but it comes with its share of challenges. You’ll get immediate relief from creditors, but your credit will take a hit and some assets may be lost. Before jumping in, explore other debt relief options like counseling or consolidation loans to see if there’s a less drastic path.

Conclusion

Chapter 7 bankruptcy can be a lifeline when you’re drowning in debt, but it’s not a decision to be made without balancing the many components involved. By carefully weighing the chapter 7 pros and cons, you can determine if it’s the right path for you.

With the right mindset and a solid plan, you can rebuild your credit and create a brighter financial future.

If you are ready to consider the Chapter 7 option further, don’t hesitate to reach out to a trusted bankruptcy attorney who can guide you through the process and help you make the best choice for your unique situation. For more information, take a look around our website. You’ll find great resources to help you assess if Chapter 7 is right for you. If you are ready to get started or wish to speak with one of our attorneys, call our law office now at (888) 584-9614 or contact us online to schedule a consultation.

What Happened When Mr. Whirley Came to the Office?

I met Mr Whirley in the parking lot. We started talking casually about the Mavs game the night before as we drifted inside to the office. By the time we got to the conference room, Mr. Whirley has lost any sense of embarrassment and was fully sharing his financial story. He came with his lists and we discussed the details of his situation. Then we discussed the pros and cons of Chapter 7 bankruptcy.

“You know, this bankruptcy option is sounding better and better. I thought of filing for bankruptcy as something to be ashamed of, but really it’s more of a legal method that can help me out of a situation I’m already ashamed about,” Mr. Whirley confessed to me.

“That’s a fair way to think about it. And yes, even though it might hurt your ego and credit score in the short-term, filing for Chapter 7 is your best legal option. And just knowing that there is a path forward seems to be making you feel better too,” I told him.

“I think you’re right Chris. I can see my way out of this mess and that is making me feel better. Suddenly I’m seeing financial freedom in my future,” he said. “Thank you for pointing me in the right direction.”

Before ending our conversation, I made sure to explain the next steps we would need to take to initiate his Chapter 7 bankruptcy proceeding. Mr. Whirley left our meeting with a newfound sense of hope and clarity, empowered by the knowledge that he wasn’t alone in his struggle. If you are feeling like Mr. Whirley felt, do know that with the right guidance and support, there is a road to financial recovery available for you too.

Schedule a Consultation with our Dallas Firm to help you Weigh the Pros and Cons of Filing for Chapter 7

Bankruptcy can be stressful and challenging, but you do not have to face it alone. Our team of experienced Dallas bankruptcy attorneys is ready to provide you with the guidance, support, and legal advocacy you need during these challenging times.

Whether you are trying to weigh the pros and cons of filing for Chapter 7 or navigating other bankruptcy issues, we are here to help you every step of the way. We welcome you to schedule a consultation to discuss your situation and case objectives. We can answer your legal questions and discuss how we can help you move forward. Call our law office at (888) 584-9614 or contact us online to schedule your consultation.

Leave a Reply