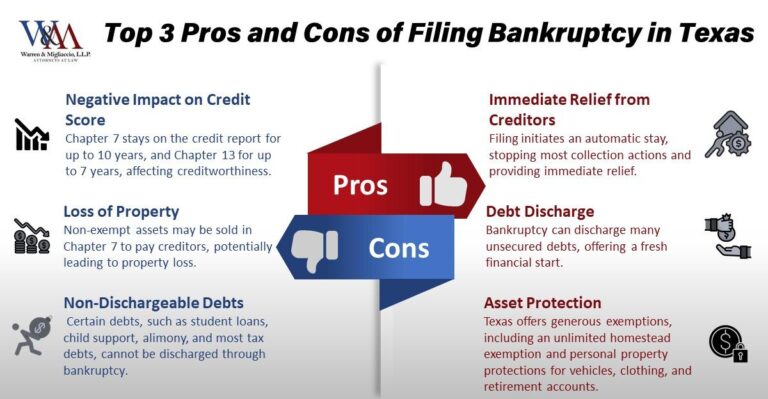

Filing for bankruptcy is one of the most challenging decisions a person can make. If you're struggling with overwhelming debt, it's important to carefully weigh the pros and cons of filing bankruptcy. Bankruptcy laws are complex and can have long-term financial and personal consequences. As a … [Read more...]

What Documents Do I Need to File for Bankruptcies In Texas?

So you’re getting ready to file for bankruptcy? You’ll need to get specific documents to make the process go smoothly. These include personal identification, financial records, and legal and property documents. This guide covers everything you need to know about “what documents do I need to file for … [Read more...]

What Is the Difference Between Chapter 7 and Chapter 13 Bankruptcy in Texas?

The two most common types of personal bankruptcy are Chapter 7 and Chapter 13. As Texas bankruptcy attorneys, a common question we receive is, "What is the difference between Chapter 7 and Chapter 13 bankruptcy in Texas?" Though both Chapter 7 and Chapter 13 bankruptcy can help you get a fresh … [Read more...]

Can I Exclude a Credit Card from Chapter 7 Bankruptcy? Here’s What You Need to Know

If you’ve ever wondered whether you could keep a credit card out of a chapter 7 bankruptcy to preserve your credit line, you’re not alone. Many people facing overwhelming debt hope to keep at least one credit card as a backup. However, can I exclude a credit card from Chapter 7 bankruptcy? The short … [Read more...]

Comparing Chapter 13 and 7 Bankruptcy in Dallas

The difference between a chapter 13 and a chapter 7 bankruptcy in Dallas comes down to whether or not the bankruptcy court rules to completely discharge your debts or to set you up with a repayment plan to repay part or all of your debts to your creditors. When you are unsure of the … [Read more...]

Spendthrift Trusts: Protecting Inheritance During Bankruptcy

Spendthrift trusts may be helpful for individuals who file for bankruptcy in Texas but who later receive an inheritance shortly after filing for bankruptcy. In many cases, it is likely that assets from an inheritance received within 180 days of filing for bankruptcy will be used to pay off … [Read more...]

Consequences of Hiding an Inheritance in Bankruptcy

Hiding inheritance in bankruptcy – or hiding any asset for that matter – is one of the bad decisions people may make when they are going through the bankruptcy process. Always follow Texas bankruptcy laws, and come to Plano bankruptcy attorneys with any questions that may arise to ensure … [Read more...]