Bank of America, N.A., also known as BoA or BofA, is one of the biggest banks in the United States, incorporated in North Carolina. It is also a credit card company. If you have been served with a Bank of America lawsuit, we understand that you may be stressed and uncertain about what to do now. If you do not know where to start, our North Texas debt resolution attorneys can answer your questions and help you explore your debt management options during a confidential consultation.

Below, we also highlight what you can do if you are being sued by Bank of America for credit card debt. This article will provide guidance on what to do if sued by Bank of America for credit card debt, with the disclaimer that individual cases may vary and this information should not be considered legal advice.

5 Essential Steps to Protect Yourself in Texas

-

Don’t Ignore the Lawsuit

⚠️ Over 70 % of credit-card cases end in default judgments because consumers never respond.

-

File Your Original Answer

Submit a written response within 14–28 days to stop a default judgment.

-

Raise Affirmative Defenses

Statute of limitations (4 years), identity theft, incorrect amount, improper service…

-

Explore Settlement

Bank of America often agrees to 40–60 % lump-sum or structured plans.

-

Get Legal Help

Only 1 in 10 defendants hire counsel — represented clients win or settle on far better terms.

If You Do Nothing, Bank of America Can…

- Freeze & seize your bank accounts

- Place liens on your property

- Damage your credit for up to 7 years

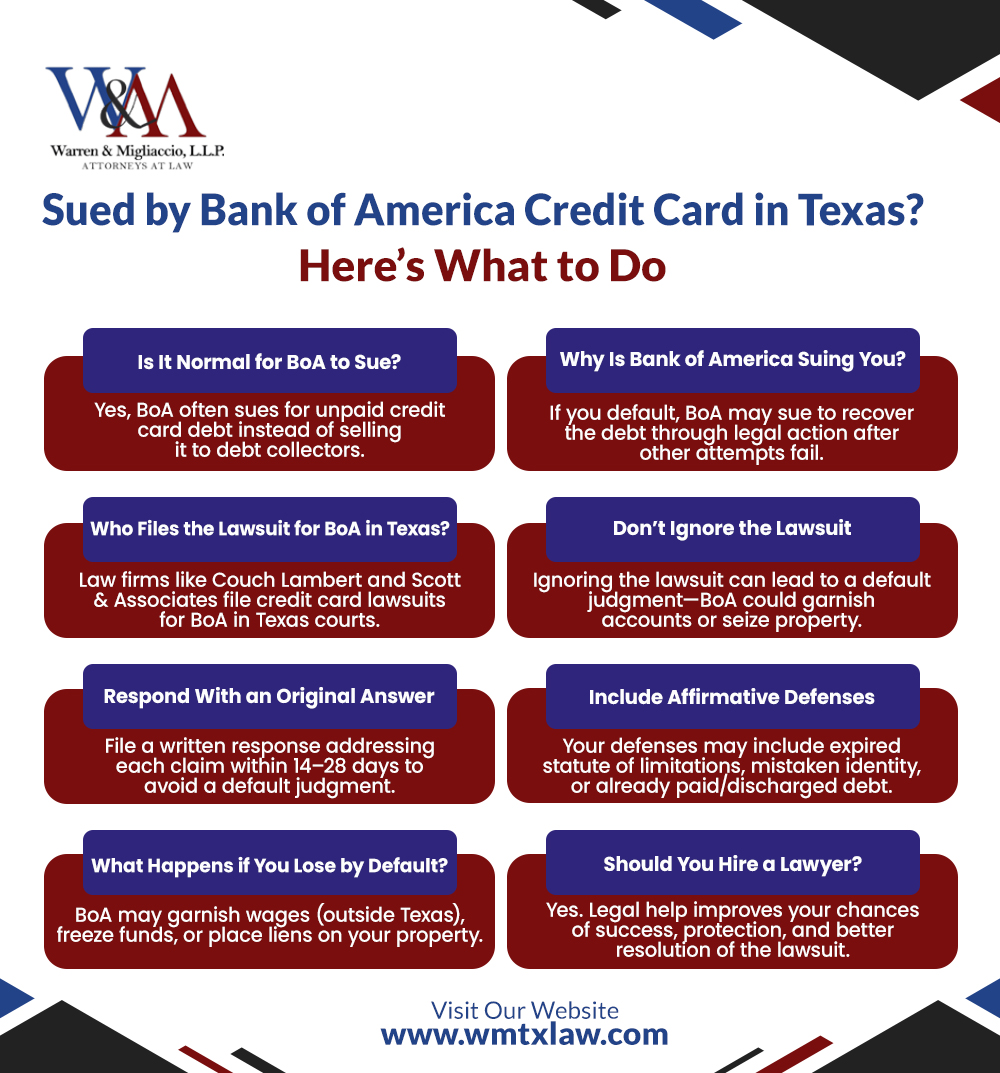

Bank of America Is Suing Me for Debt; Is That Normal?

Yes, Bank of America does sue for credit card debt. Many creditors sell old debt after a charge off to a debt buyer or collection agency for pennies on the dollar to recover some losses. Then, the debt buyer will go after the card owners who allegedly owe money. Rather than selling defaulted debt, they generally keep its defaulted accounts and do not sell its accounts to a debt collector.

Why Would Bank of America Sue You?

If you have defaulted on your credit card, Bank of America as your lender may resort to filing a legal action against you to recover the debt. If other collection efforts fail, Bank of America may attempt to recover the debt through legal action.

BOA works with multiple debt collection law firms to handle its Texas credit card lawsuits. A few firms it uses include the following:

These law firms file lawsuits all over Texas. Most cases are heard in District Courts or Justice of the Peace Courts, which are small claims courts.

Discuss Your Legal Options With a Debt Defense Attorney From Our Firm

You have legal options in a debt collection lawsuit, and our North Texas debt defense attorneys are here to help you explore them. Our experienced and dedicated lawyers can review your case and help you understand your potential options. Call us today or fill out our online contact form to request a consultation, and we will contact you soon.

How Do I Respond to Being Sued for Credit Card Debt?

Bank of America and its lawyers often expect you to ignore the lawsuit. If you don’t defend yourself, Bank of America is much more likely to win the case by default. This outcome is known as a default judgment.

If Bank of America obtains a default judgment and becomes a judgment creditor against you, it can take serious actions to collect the debt, such as:

- Garnishing your bank accounts

- Placing a lien on your property, including small business assets

- Seizing your property to recover the money owed

- Garnishing your wages (if you live outside of Texas)

- Damaging your credit score

- Gaining access to funds in your bank accounts

The good news is that you can protect yourself from a default judgment by taking action. You must file a written response, called an Original Answer, with the court that is handling your case—before the deadline. In addition, you must send a copy of this response to Bank of America’s lawyers.

Your Answer should:

- Address Bank of America’s allegations. Accept or deny each claim against you.

- Provide affirmative defenses. These are facts that can help your case. For example:

- The statute of limitations (deadline for filing the lawsuit) has expired

- You are not the cardholder or cosigner

- You have already paid or discharged the debt

Depending on your court case, your Answer may include other points. Mistakes in your response can hurt your defense and cause you to lose the case. We recommend getting help from an attorney to draft your response correctly.

You must file your Original Answer by the deadline. This deadline usually varies from 14 to 28 days depending on the court. You can find the deadline on the first pages of the lawsuit paperwork you receive.

The Data Behind Credit Card Lawsuits: What You Need to Know

Understanding data on credit card lawsuits is very important. In fact, over 70% of debt collection lawsuits end in default judgments. This means the consumer loses because they did not respond to the lawsuit. In most cases, failing to answer a Bank of America lawsuit almost always leads to losing. Therefore, responding quickly is very important.

Moreover, ignoring debts can lead to lawsuits and default judgments, which can have severe financial consequences.

In Texas, having a lawyer helps a lot. Specifically, it can improve your chances of winning or getting a better settlement. However, only about 1 in 10 people sued for debt have a lawyer. This means many people face these lawsuits alone, even though a lawyer can really help.

Taken together, these facts show that you must respond to the lawsuit. Additionally, think about getting legal help. These steps protect your rights and improve your chances when sued for unpaid credit card debt.

What if There is Already a Default Judgment Against Me?

You may have viable legal options even if there is a default judgment against you. Even if a default judgment has been issued, the debt can still be settled through negotiation as part of a broader debt relief strategy. For example, you may be able to file a motion to vacate the judgment, start a new trial, or negotiate a settlement with Bank of America. The attorneys of Warren & Migliaccio can also help you explore alternative debt resolution, such as bankruptcy. We recommend scheduling a consultation with our debt resolution attorneys to discuss your situation.

Does Bank of America Do Debt Settlement?

Credit card issuers like Bank of America often prefer to settle rather than go through the time and expense of litigation. If you believe you have a strong case, you may be able to negotiate a resolution with Bank of America instead of going to court. In many cases, you can also negotiate to repay the agreed-upon amount through a customized repayment plan with manageable monthly payments.

To make the settlement official and protect yourself legally, a formal settlement agreement is required. This document finalizes the terms and releases you from further obligations once the agreed amount is paid.

Because each case is unique, we recommend working with an experienced debt defense lawyer. They can help you determine whether negotiating a settlement is a better strategy than fighting the lawsuit in court.

Schedule a Consultation With a North Texas Debt Resolution Attorney From Our Firm

Have you been sued by Bank of America for credit card debt? At Warren & Migliaccio, our debt defense lawyers have extensive experience and success in assisting our clients with debt defense lawsuits. We work toward helping our clients reach favorable debt resolutions. We welcome you to contact us to learn more about how we can help you with your situation.

Our Texas debt defense attorneys can review Bank of America’s claims against you and determine the validity of its lawsuit. Call us at phone number (888) 584-9614 or contact us online to request a confidential consultation about your case. We can answer your legal questions and help you understand your potential options to deal with the Bank of America credit card lawsuit.

Frequently Asked Questions (FAQ)

What happens when Bank of America sues you for credit card debt?

When Bank of America sues you for credit card debt, they initiate a formal legal process to collect the unpaid debt through Bank of America’s collection practices. The original creditor will file a complaint in either a District Court or Justice of the Peace Court in your Texas county and you’ll receive court documents requiring a formal response within 14-28 days.

If you don’t respond, Bank of America can get a default judgment against you, which allows them to:

1. Firstly, freeze and seize your bank accounts

2. Secondly, place liens on your property

3. Thirdly, add attorney’s fees and court costs to your original debt amount

4. Forthly, harm your credit score with a court judgment that can stay on your credit report for up to 7 years

How do I respond to a Bank of America credit card lawsuit?

To answer a credit card debt lawsuit from Bank of America, you must file a written response (called an Original Answer) with the court before the deadline stated in your summons. This is the first step in protecting yourself from a default judgment.

Your response should:

1. Address each of Bank of America’s allegations – either admit or deny them1.

2. Include any affirmative defenses that apply to your situation (such as statute of limitations, identity theft, or prior payment)

3. Dispute any inaccuracies in the allegations made by Bank of America

4. Be filed with the court clerk before the answer deadline (14-28 days in Texas)

5. Include a copy sent to Bank of America’s attorneys

6. Be written carefully, as mistakes can hurt your case (consider getting legal advice)

Can Bank of America garnish my wages or bank accounts in Texas?

Under Texas law, Bank of America cannot garnish your wages for consumer debt, but they can freeze and seize funds in your bank accounts if they get a judgment against you. Texas has stronger consumer financial protections than many other states when it comes to wage garnishment. You should verify the legitimacy of the debt to ensure that Bank of America has the right to garnish your bank accounts.

If Bank of America wins a judgment:

1. They can put liens on your property

2. Likewise, they can levy (freeze and seize) funds in your bank accounts

3. And they cannot directly garnish your wages in Texas for credit card debt

4. Certain funds may be exempt from seizure under federal law, including Social Security benefits and veterans’ benefits

5. A debt collection agency working for Bank of America must follow the Fair Debt Collection Practices Act

What is the statute of limitations for credit card debt in Texas?

In Texas, the statute of limitations for credit card debt is four years from the date of your last payment or account activity. This time frame is set by state law and can be an important affirmative defense if Bank of America sues you after this period.

Here are some important things to know about time-barred debt:

1. First, making even a small payment can restart the four-year clock.

2. Similarly, acknowledging the debt in writing can also restart the limitations period.

3. It’s also important to note that the statute of limitations is different from how long the debt stays on your credit report, which is typically seven years.

4. If you are sued for a time-barred debt, you must raise this as an affirmative defense in your answer.

5. Finally, under federal law, debt collectors are required to disclose if they’re trying to collect a debt that is outside the statute of limitations.

What defenses can I use against a Bank of America credit card lawsuit?

If you’re sued by Bank of America for credit card debt, you may have valid legal defenses. These defenses can challenge the bank’s right to sue, the amount they claim you owe, or how the lawsuit was handled. As the plaintiff, Bank of America has the burden of proof—they must provide sufficient evidence to support their claims.

Here are some common defenses you may be able to raise:

Statute of limitations – The debt is time-barred under Texas law.

Identity theft or fraud – You didn’t open or use the account in question.

Improper service – You weren’t properly served with the lawsuit documents.

Lack of standing – Bank of America can’t prove they own the debt or have the legal right to sue you.

Payment already made or debt discharged – You’ve already paid, or the debt was wiped out in bankruptcy.

Violations of the FDCPA or CFPB rules – The bank or its collectors broke federal debt collection laws.

Each case is different, so it’s important to assess your specific situation. A debt defense lawyer can help identify which defenses apply and build a strong response to the lawsuit.

Will Bank of America negotiate or settle my credit card debt?

Yes, Bank of America frequently settles credit card debt to avoid the costs and resources involved in the legal process. Financial institutions often accept a lump-sum payment for less than the full debt amount or agree to structured monthly payments based on your financial situation. You can negotiate debt settlement at any stage of the collections process with Bank of America.

Settlement options typically include:

1. Lump-sum settlements often ranging from 40-60% of the original balance

2. Payment plans with potentially reduced interest rates

3. Agreements that stop additional late fees and penalties

4. Having a debt defense attorney negotiate on your behalf can often lead to better terms

5. Always get settlement agreements in writing before making payments

6. Even if the paid amount is less than what was owed, it should be recognized as full payment to prevent future claims for more money

7. Bank of America is known to settle for 25%-80% of the original debt depending on circumstances

What happens if I ignore a lawsuit from Bank of America?

If you ignore a lawsuit from Bank of America, the court will likely enter a default judgment against you—giving the bank significant legal power to collect the debt through various means. Ignoring unpaid bills can lead to serious consequences, including lawsuits and default judgments. This is the worst option and should be avoided. Unfortunately, about 90% of customers don’t respond to lawsuits, allowing Bank of America to win judgments easily.

Here are some of the key consequences of ignoring the lawsuit:

1. An automatic judgment for the full amount claimed, plus additional court costs and attorney’s fees

2. Legal authority for Bank of America to freeze your bank accounts

3. The ability to place liens on your real estate and personal property

4. Long-term damage to your credit score

5. Very limited options to contest the debt once a judgment has been entered

What are my options if Bank of America has already obtained a default judgment?

If Bank of America has already gotten a default judgment against you, you still have several options to address the situation, but they require prompt action. Consult with an attorney for legal advice should be your first step.

Potential post-judgment options include:

1. Filing a motion to vacate (set aside) the judgment within limited timeframes

2. Requesting a new trial based on proper legal grounds1.

3. Negotiating a post-judgment settlement with Bank of America

4. Setting up a payment plan to satisfy the judgment over time

5. Filing for bankruptcy protection if you have significant overall debt

6. Claiming exemptions for certain assets under Texas property laws

7. Collecting necessary documentation to support your case

How long does Bank of America take to sue for credit card debt?

Bank of America typically initiates lawsuits after accounts remain delinquent for 6-7 months, though the exact time frame varies. Credit card companies often begin the legal process after 180 days of missed payments.

The timeline generally follows this pattern:

1. Firstly, multiple collection attempts over several months

2. Accelerated action for larger debt amounts

3. Legal action must be filed within the four-year statute of limitations

4. The Consumer Financial Protection Bureau (CFPB) requires certain notices before legal action

Bank of America typically uses specific debt collection law firms in Texas including Couch Lambert, LLC and Scott & Associates, P.C.

How can a debt validation letter help in a Bank of America lawsuit?

A debt validation letter asking Bank of America to prove the debt is yours can be a powerful first step in your defense strategy. Under the Fair Debt Collection Practices Act, you have the right to request verification of the debt. Debt collectors must send a validation letter listing the details of the debt within five days of initial contact.

Benefits of sending a debt validation letter:

1. Forces Bank of America to provide documentation proving you owe the debt

2. Forces Bank of America to verify the legitimacy of the debt

3. May reveal errors in account information or legitimate charges

4. Must be sent within 30 days of first contact from a debt collector

5. Can help identify if the credit card company can produce the original credit card agreement

6. May reveal incorrect debt amounts, including junk fees or interest rates

Will a Bank of America lawsuit affect my credit score?

Yes, a Bank of America lawsuit will significantly impact your credit score, potentially dropping it by 100+ points and staying on your credit report for up to 7 years. The lawsuit will be a public record on your credit report making it hard to get new credit.

Credit score considerations:

The initial delinquencies leading to the lawsuit already hurt your credit score

A judgment has an even bigger impact than the lawsuit itself

Settling the debt may improve your score faster than leaving the judgment unpaid

You can request your free credit report to see how the process affects your credit

Even after the debt is paid, the lawsuit will still be on your credit report

Regularly monitor your credit reports for updates

Should I hire an attorney if sued by Bank of America?

If Bank of America sues you for credit card debt, working with an attorney is highly recommended. Legal representation can significantly improve your chances of reaching a favorable outcome. Even if you’re unsure about your next steps, a free consultation with a debt defense attorney can help you understand your rights and options.

Here are some key benefits of hiring an attorney:

A thorough review of Bank of America’s legal claims and documentation

Identification of any procedural errors or valid legal defenses

Skilled negotiation that may lead to better settlement terms

In-depth knowledge of court procedures and filing deadlines

Protection from unfair or abusive debt collection practices

Step-by-step guidance through each phase of the lawsuit

Practical tips to help you navigate the legal process with confidence

Getting legal help early on can make a big difference in the outcome of your case.