Child custody disputes are one of the most emotional and complex aspects of family law. When parents cannot agree on custody arrangements, the court will intervene to decide what is in the best interest of the child. In some cases, a parent may be considered unfit for custody. This designation is … [Read more...]

Bankruptcy and Bank Accounts

When considering filing for bankruptcy, many people have questions about how the process affects their financial assets, especially their bank accounts. Whether you’re filing for Chapter 7 or Chapter 13 bankruptcy, understanding the impact on your bank accounts is crucial. In this blog, we will … [Read more...]

How Chapter 7 Helps Amid Foreclosure

Foreclosure can be a stressful and overwhelming experience. When you fall behind on mortgage payments, your lender can take legal action to repossess your home. This is the last thing many homeowners want, but it is a reality that many face. Fortunately, there is a way to protect yourself from … [Read more...]

Challenges of Divorce with a Special Needs Child

Divorce is difficult for any family, but it can be especially challenging for parents with a special needs child. The process of separation becomes far more complex when one or both parents are responsible for the care and well-being of a child with physical, emotional, or developmental … [Read more...]

5 Tips to Help You Find the Right Dallas Divorce Lawyer

Divorce is a significant and often emotional life event. The legal process can be complex, especially when it involves property division, child custody, and financial support. Finding the right Dallas divorce lawyer can make all the difference in achieving a fair and favorable outcome. As an … [Read more...]

Co-Debtors: What it means in a Bankruptcy

When you file for bankruptcy, certain legal terms can become confusing, especially when it comes to shared debts. One such term is “co-debtor.” This anyone who shares responsibility for a debt with you. Understanding how co-debtors are treated in bankruptcy is crucial for anyone considering … [Read more...]

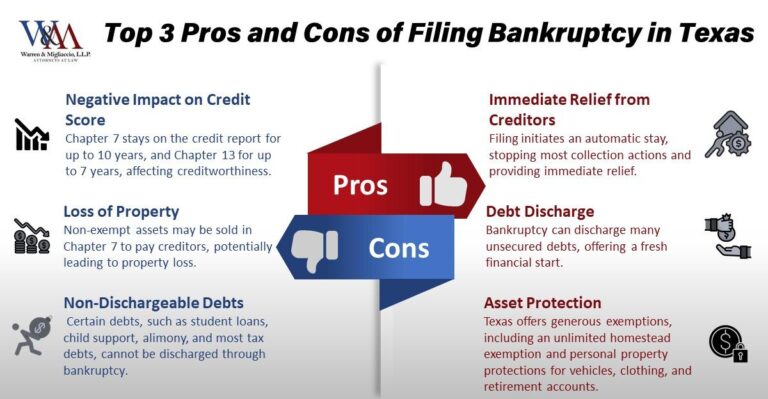

Pros and Cons of Filing Bankruptcy in Texas

In Texas, filing bankruptcy can wipe out many unsecured debts, stop most collection actions, and give you a structured path to rebuild. However, it can harm your credit, risk some non-exempt assets, and will not erase every type of debt. That’s why it’s important to evaluate all the factors … [Read more...]

Bankruptcy Filings in Texas: Hiring the Right Attorney for Your Case

This is a very significant decision. It can provide relief from overwhelming debt and give you a fresh financial start. However, it is also a complex legal process that can be difficult to navigate without professional help. For residents in Texas, hiring the right bankruptcy attorney is essential … [Read more...]

What to Do if Facing a Midland Credit Management Lawsuit in Texas

If you have received a lawsuit from Midland Credit Management (MCM) in Texas, you are not alone. Midland Credit Management is one of the largest debt collectors in the country, and it frequently files lawsuits against consumers in an attempt to collect on debts. If you find yourself facing a Midland … [Read more...]

What is Estate Planning and Why is it Important in Texas?

Estate planning in Texas provides an essential framework for organizing assets and making decisions that help protect loved ones. Without a clear plan, families face unnecessary stress and financial hurdles. Understanding how estate planning works will help you prepare for what lies ahead. Quick … [Read more...]

- « Previous Page

- 1

- …

- 22

- 23

- 24

- 25

- 26

- …

- 72

- Next Page »